Is Morgan PRE safe?

Pros

Cons

Is Morgan Pre Safe or a Scam?

Introduction

Morgan Pre, a forex broker established in 2024, aims to provide trading services across various asset classes, including foreign exchange, commodities, and stock indices. With promises of high leverage and a diverse range of trading instruments, Morgan Pre markets itself as an appealing choice for traders looking to capitalize on market movements. However, the forex trading landscape is rife with potential pitfalls, making it crucial for traders to carefully assess the legitimacy and reliability of brokers before committing their funds. This article investigates whether Morgan Pre is a trustworthy broker or a potential scam, employing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, client safety, customer experiences, and risk assessment.

Regulatory and Legitimacy

The regulatory status of a broker is a fundamental aspect that affects its credibility. Morgan Pre claims to be regulated by several international financial authorities, including the Investment Industry Regulatory Organization of Canada (IIROC) and the National Futures Association (NFA) in the USA. However, a detailed investigation reveals discrepancies in these claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IIROC | N/A | Canada | Not Found |

| NFA | N/A | USA | Not Found |

| FinCEN | N/A | USA | Not Found |

The absence of verifiable regulatory information raises significant red flags about Morgan Pre's legitimacy. It is crucial to highlight that a brokers compliance with regulatory standards is a key indicator of its operational integrity. In this case, Morgan Pre's misleading claims about its regulatory status suggest a lack of transparency and accountability, which could potentially expose traders to high risks.

Company Background Investigation

Morgan Pre Limited, the entity behind the trading platform, is relatively new, having been established in 2024. The company is registered in New York, USA, at a prominent commercial address, which may be intended to lend credibility to its operations. However, the short history of the company raises concerns about its stability and reliability. The lack of a long-term track record makes it difficult to assess its performance over time, an essential factor for any financial institution.

Moreover, the management teams background is not well-documented, and there is limited information available regarding their professional experience in the financial services sector. Transparency in company operations and management is vital for building trust with clients. Given the scarcity of information about Morgan Pre's ownership structure and the qualifications of its management, potential clients may find it challenging to gauge the broker's reliability.

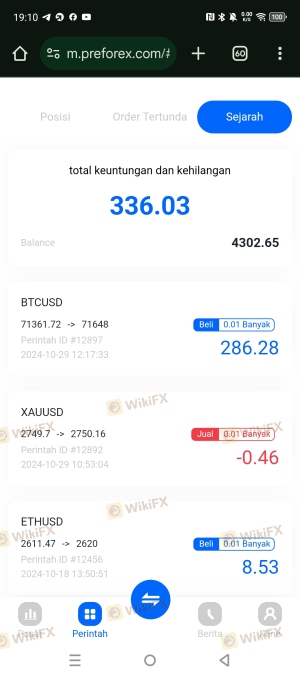

Trading Conditions Analysis

Morgan Pre offers various account types, including micro and standard accounts, with leverage as high as 1:1000. While this may attract traders seeking high returns, such excessive leverage poses significant risks, particularly for inexperienced traders.

| Fee Type | Morgan Pre | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low to Moderate |

The absence of a commission structure can be appealing, but the overall cost of trading, including spreads and overnight fees, can significantly affect profitability. Traders should be cautious of brokers that offer unusually low spreads, as these can often be a tactic to lure clients while masking hidden costs. Morgan Pre's high leverage and low deposit requirements may lead to rapid account liquidation, especially in volatile market conditions.

Client Fund Safety

The safety of client funds is paramount when evaluating any forex broker. Morgan Pre claims to implement various security measures, including fund segregation and negative balance protection. However, without legitimate regulation, the effectiveness of these measures remains questionable.

Historically, unregulated brokers have been associated with numerous financial disputes and fund mismanagement issues. The lack of a regulatory framework to oversee Morgan Pres operations raises concerns about the safety of client deposits. Traders should be aware that in the absence of proper regulation, there may be limited recourse in the event of financial mishaps or disputes.

Customer Experience and Complaints

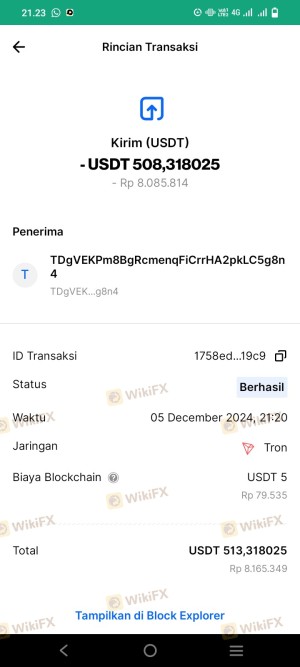

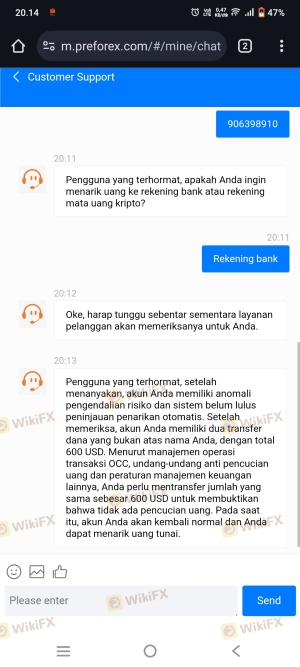

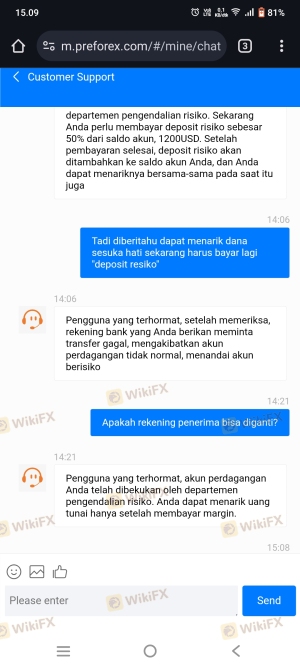

Analyzing customer feedback is crucial for understanding the reliability of a broker. Numerous reviews indicate a pattern of complaints regarding withdrawal issues and the requirement for additional deposits to access funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Denials | High | Poor |

| Account Freezing | High | Poor |

| Customer Service Issues | Medium | Average |

For instance, several users have reported that even after winning trades, they were unable to withdraw their profits without depositing additional funds. Such practices are characteristic of scam operations, leading to significant financial losses for traders. The company's lack of responsiveness to these complaints further exacerbates concerns about its legitimacy.

Platform and Trade Execution

The trading platform offered by Morgan Pre lacks support for industry-standard software such as MetaTrader 4 or 5, opting instead for a proprietary platform. This choice may hinder user experience and raise questions about the platform's reliability and security.

Order execution quality is another critical factor. Reports suggest that traders have experienced issues with slippage and order rejections, which can severely impact trading outcomes. The lack of transparency regarding order execution metrics further complicates the assessment of Morgan Pres trading environment.

Risk Assessment

Engaging with Morgan Pre carries several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No verifiable regulatory oversight |

| Financial Risk | High | High leverage increases potential losses |

| Operational Risk | Medium | Proprietary platform may lack reliability |

To mitigate these risks, traders are advised to conduct thorough due diligence, including seeking brokers with established regulatory oversight and a proven track record. Utilizing risk management strategies, such as setting stop-loss orders and limiting leverage, can also help protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Morgan Pre raises significant concerns regarding its legitimacy and safety. The lack of verifiable regulatory status, combined with troubling customer feedback and questionable trading conditions, points towards a broker that may not be safe for traders.

Potential clients should exercise extreme caution when considering Morgan Pre for their trading needs. It is advisable to opt for brokers with robust regulatory backing, transparent operations, and positive user reviews. For those seeking reliable alternatives, brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC are recommended. Ultimately, ensuring the safety of your investments should always be the top priority, and the lack of transparency and regulatory compliance at Morgan Pre should serve as a clear warning sign.

Is Morgan PRE a scam, or is it legit?

The latest exposure and evaluation content of Morgan PRE brokers.

Morgan PRE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morgan PRE latest industry rating score is 1.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.