Algora Management Review 1

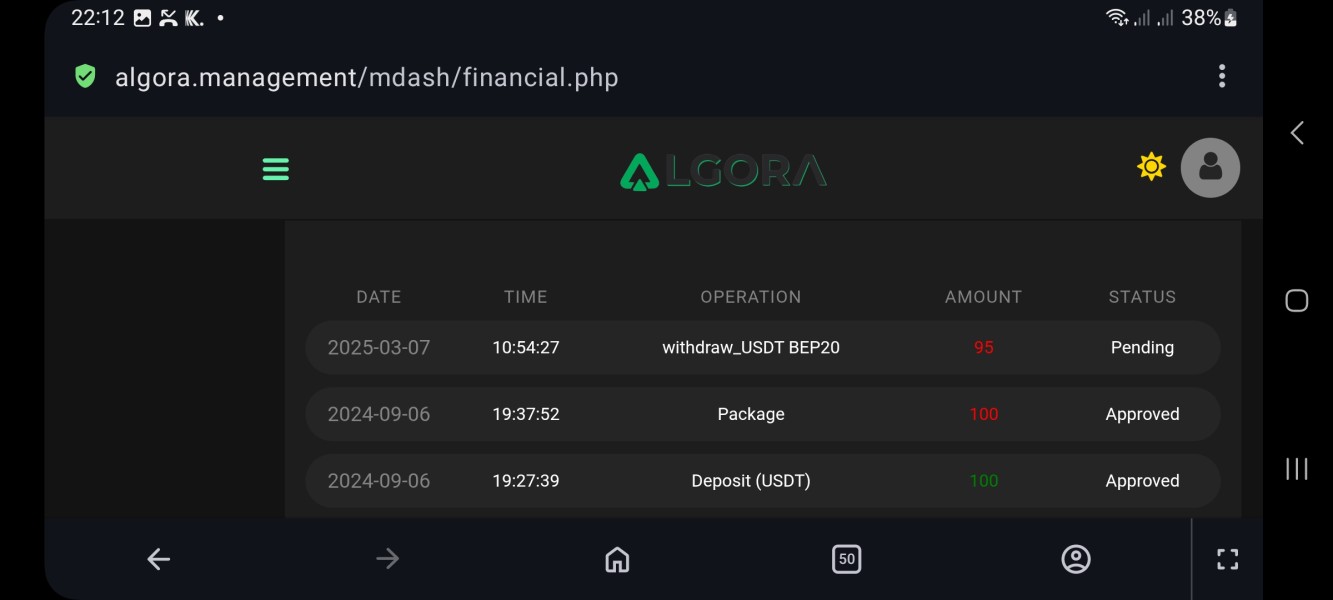

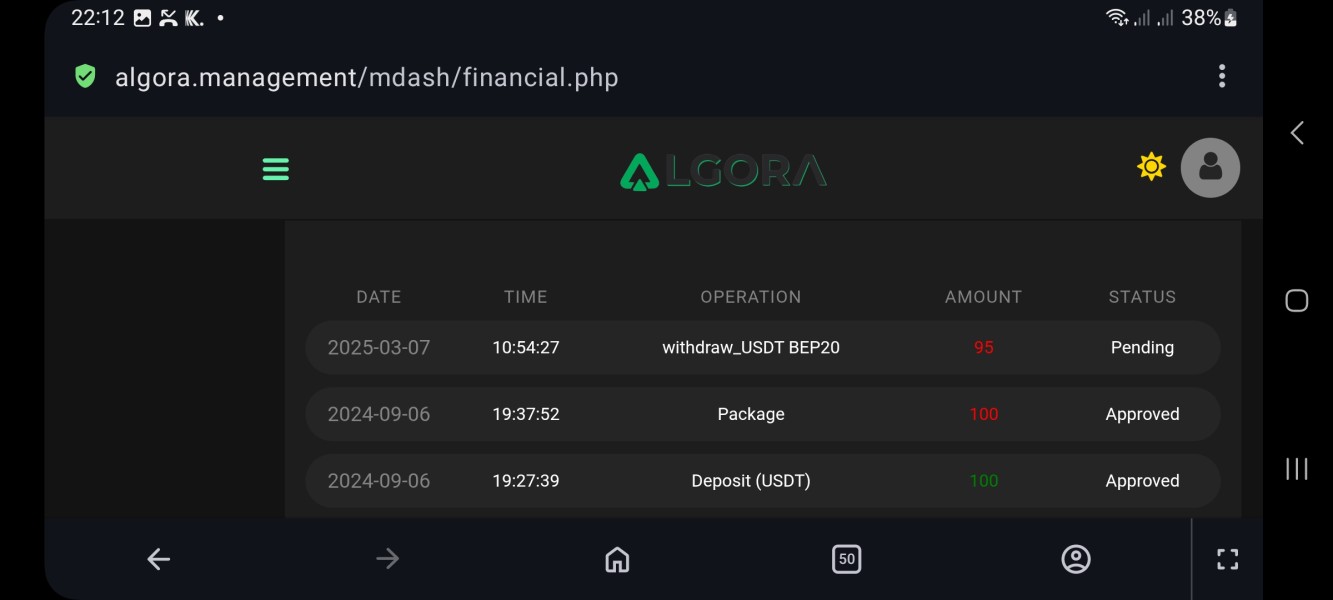

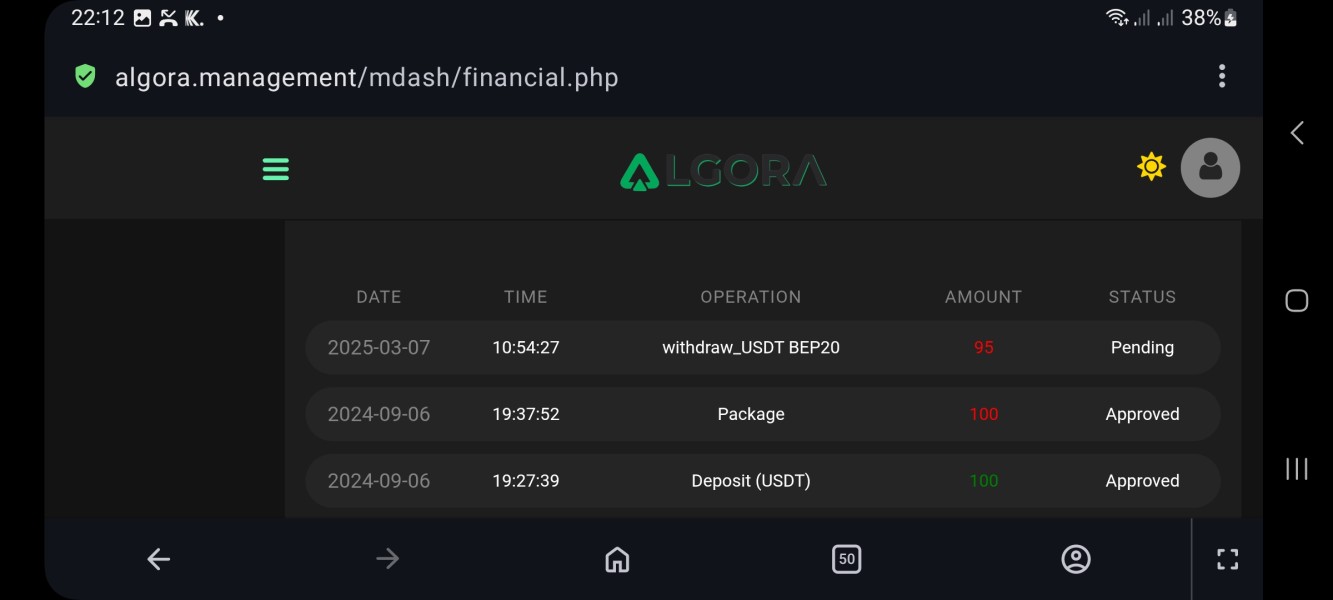

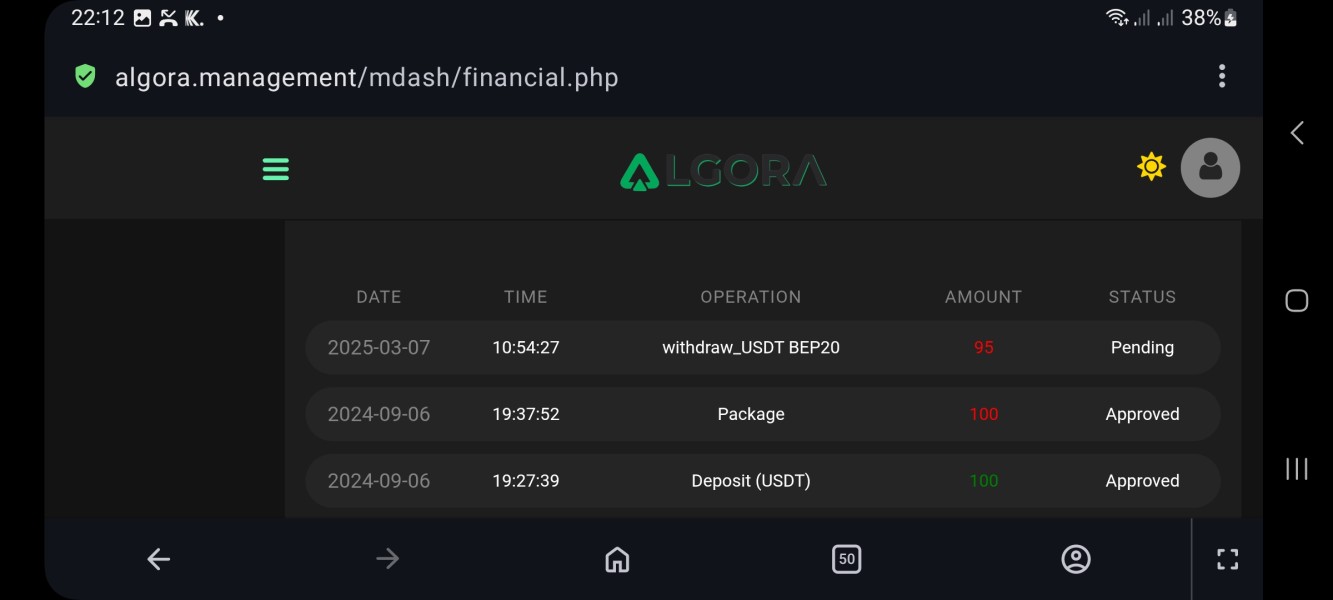

Ongoing pending withdrawal for almost 4 months (since February 2025) No feedback from company

Algora Management Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Ongoing pending withdrawal for almost 4 months (since February 2025) No feedback from company

In the rapidly evolving landscape of online trading, Algora is carving a niche by promoting innovative price action techniques that break away from traditional indicators. This approach appeals to both novice and experienced traders frustrated with conventional methodologies. However, potential users must tread carefully, as significant concerns regarding fund safety and withdrawal issues loom over the platform. As this review will illustrate, while Algora may present exciting opportunities for algorithmic trading, it also requires thorough scrutiny due to its current standing on regulatory oversight and user complaints regarding fund access. This dual nature of innovation paired with risk creates a complex decision-making landscape for prospective traders.

Caution:

How to Self-Verify Algora's Legitimacy:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 2 | Users have reported several complaints concerning fund safety and difficulty with withdrawals. |

| Trading Costs | 4 | Competitive commission structures balance potential withdrawal and hidden costs. |

| Platforms & Tools | 3 | Offers multiple platforms, but the quality of tools for analysis and charting is average. |

| User Experience | 3 | Mixed reviews regarding onboarding and ease of navigation, reflecting both strengths and weaknesses. |

| Customer Support | 2 | Numerous reports highlight slow responsiveness and inadequate support in addressing customer issues. |

| Account Conditions | 3 | Offers various account types but creates uncertainties around deposit and withdrawal policies. |

Founded in 2020, Algora is based in Portugal and positions itself as a leading broker that harnesses unique trading strategies focused on price action without traditional indicators. It caters to a market increasingly filled with algorithmic trading options by promoting bespoke educational resources that emphasize understanding price movements. However, the lack of transparent regulatory affiliations combined with extensive user complaints significantly taints its market reputation.

Algora specializes in offering a platform for trading futures and options, leveraging proprietary techniques designed to empower both novice and skilled traders. Each course claims to enable users to capture nuances of price action trading through a lean approach, involving the open, high, low, and close of candlesticks. Despite these offerings, users have raised red flags regarding fund safety and the operational transparency of the business.

| Feature | Details |

|---|---|

| Regulation | Not clearly defined |

| Minimum Deposit | Depends on account type |

| Leverage | Variable, check official policies |

| Major Fees | Involves withdrawal fees |

Algorithmic trading platforms often operate in a grey area when it comes to regulation. In the case of Algora, the lack of transparent regulatory information raises substantial concerns. Complaints involving withdrawal issues and potential user data leaks further compound the risk.

To self-verify the legitimacy of Algora, users should consider the following steps:

"I attempted a withdrawal and it's been weeks with no response. Funds are stuck and the support is unreachable." – User Experience Summary

Advantages in Commissions: Algora offers a competitive commission structure appealing to traders looking to minimize costs. The platform markets low trading fees, which can enhance profit margins for active traders.

Traps of Non-Trading Fees: However, users have reported significant hidden fees:

"I had to pay a $30 fee to withdraw my funds. This was unexpected, and it really adds up." – User Feedback

This inconsistency in communication can become problematic, especially for high-frequency traders.

Algora provides multiple trading platforms, including MT5 and NinjaTrader, aimed at both professionals and beginners. However, the quality of charting tools, educational resources, and analytics offered tends to be average, possibly limiting advanced users seeking robust technical analysis capabilities.

New users generally experience an average onboarding process; however, feedback indicates a fragmented trading experience. While the platform's capabilities can initially appear robust, execution speed and interface usability have faced scrutiny. Many users have noted the complexity of navigating trading tools effectively.

Customer support represents a significant pain point for users engaging with Algora. The general sentiment reveals:

Algora supports a variety of account types tailored to diverse trader needs. However, user feedback indicates considerable variability concerning minimum deposit requirements and withdrawal conditions.

In conclusion, while Algora offers innovative trading techniques appealing to a modern-day trading audience, prospective users should carefully weigh these against considerable withdrawal risks and customer service complaints. It remains imperative for potential traders to remain cautious, engaging only after due diligence and self-verification procedures.

FX Broker Capital Trading Markets Review