Gleneagle 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Gleneagle is an established Australian brokerage firm that has been operating for over 15 years. It offers a variety of financial services, including foreign exchange trading, managed funds, capital raising, and property loans. While Gleneagle's longevity in the market and range of services may appeal to experienced traders and investors, potential clients face turbulent waters due to its mixed regulatory credentials and a growing number of user complaints regarding fund safety.

The core narrative highlights crucial trade-offs: the broker's extensive operational history and diverse offerings on one side, and the risks associated with its questionable regulatory status and reports of fund withdrawal issues on the other. Thus, while Gleneagle may attract seasoned traders seeking varied investment solutions, it raises significant risk flags that may deter novice traders and those concerned about fund security.

⚠️ Important Risk Advisory & Verification Steps

Warning: Gleneagle poses potential risks for investors due to mixed reviews regarding its regulatory status and safety concerns regarding fund withdrawals. Understanding how to verify a broker's legitimacy is essential to protecting your financial interests.

How to Self-Verify:

- Visit Official Regulatory Websites: Always review the broker's regulatory status on official websites such as ASIC, FCA, or NFA.

- Use Trusted Broker Comparison Tools: Websites like WikiFX and PediaFX provide detailed reviews and regulatory information about various brokers.

- Check User Reviews: Research multiple user reviews across different platforms to understand the consensus on fund withdrawal and overall experience.

- Contact Customer Support: Test the responsiveness and reliability of customer support channels by reaching out with questions.

- Request Documentation: When in doubt, ask the broker for their licenses and regulatory documents to validate information.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2004 and based in Sydney, Australia, Gleneagle operates under the auspices of several licenses, including one from the Australian Securities and Investments Commission (ASIC) (license no. 337985). This long-standing presence in the financial landscape grants it a level of credibility, appealing particularly to experienced traders. The company offers a broad spectrum of financial services, striving to position itself as a multifaceted investment provider.

Core Business Overview

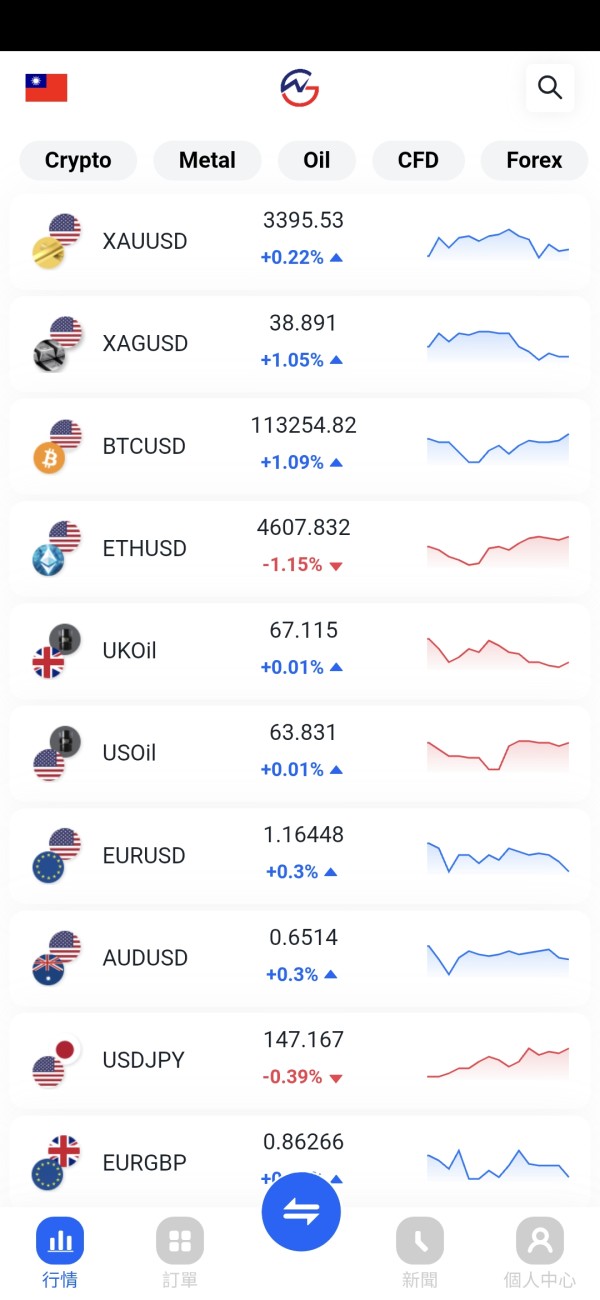

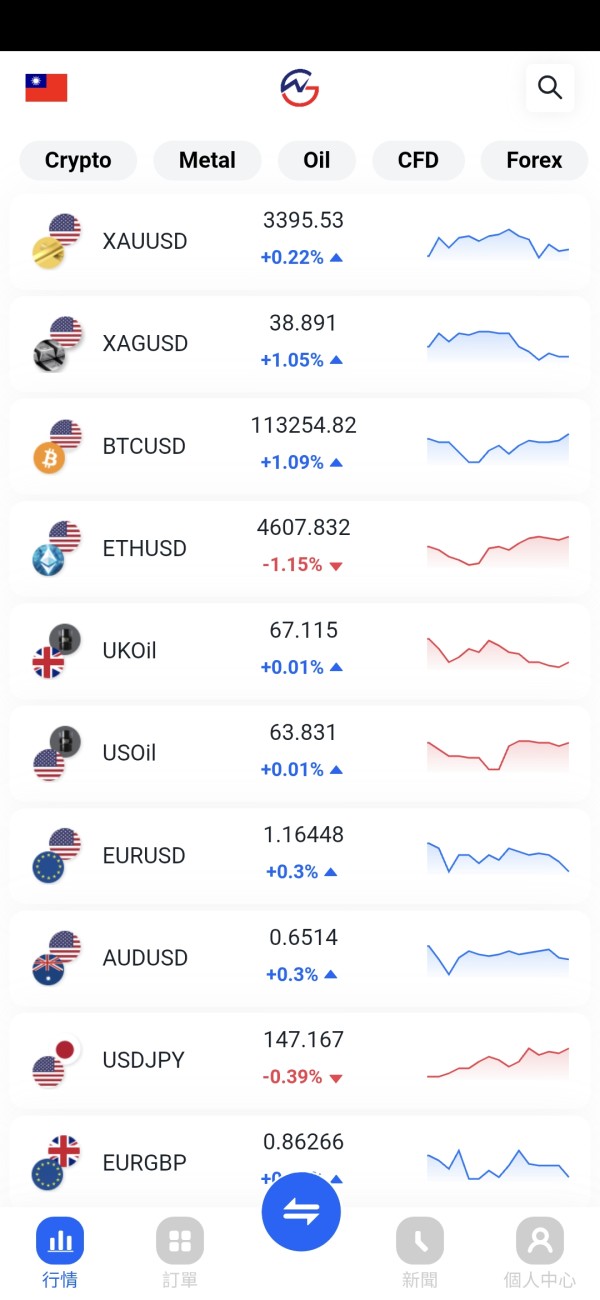

Gleneagle provides access to a variety of financial instruments, including forex, derivatives, commodities, and managed funds. Its trading platforms, primarily MT4 and MT5, cater to both trader preferences for traditional trading and algorithmic strategies. Regulatory claims are mixed, with components highlighted as "regulated" and others lacking verification, thereby raising questions about its overall legitimacy.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

"Teaching users to manage uncertainty."

Conflicting regulatory information surrounding Gleneagle raises substantial risks. User reports indicate confusion about the broker's actual regulatory status—often citing it as "regulated" yet presenting as "unverified" in other contexts. This ambiguity creates a shaky foundation for traders, necessitating thorough verification through authoritative channels.

To assist users, here is a simple guide for self-verification using relevant regulatory databases:

- Visit the ASIC website: ASIC Register

- Enter the company name: Search for "Gleneagle Securities (Aust) Pty Ltd".

- Review regulatory status: Confirm if the broker holds a legitimate license.

- Check for warnings: Look for any recent alerts or irregularities associated with Gleneagle.

- Consult the NFAs BASIC database: Confirm licensing in relevant jurisdictions.

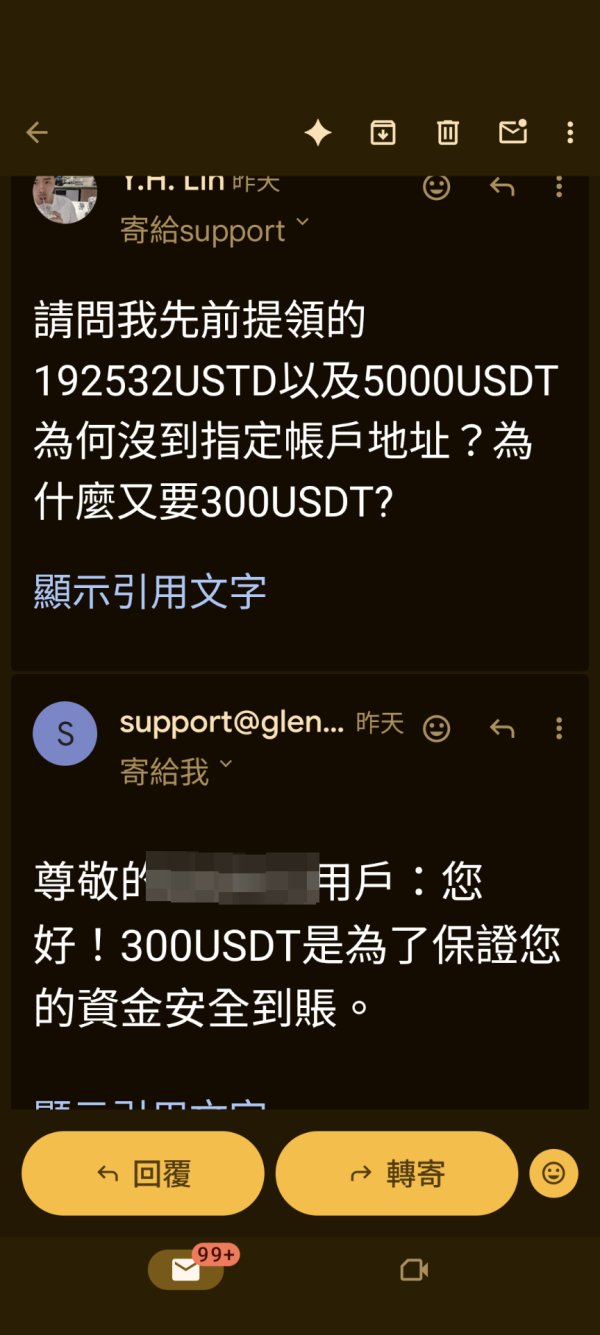

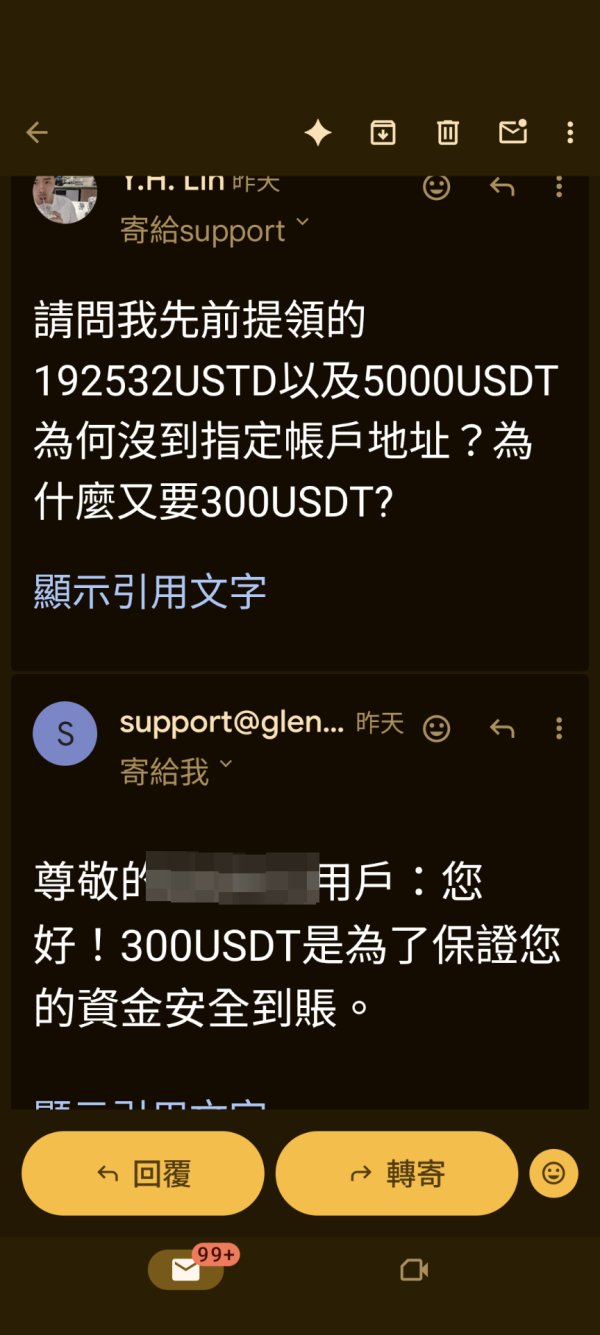

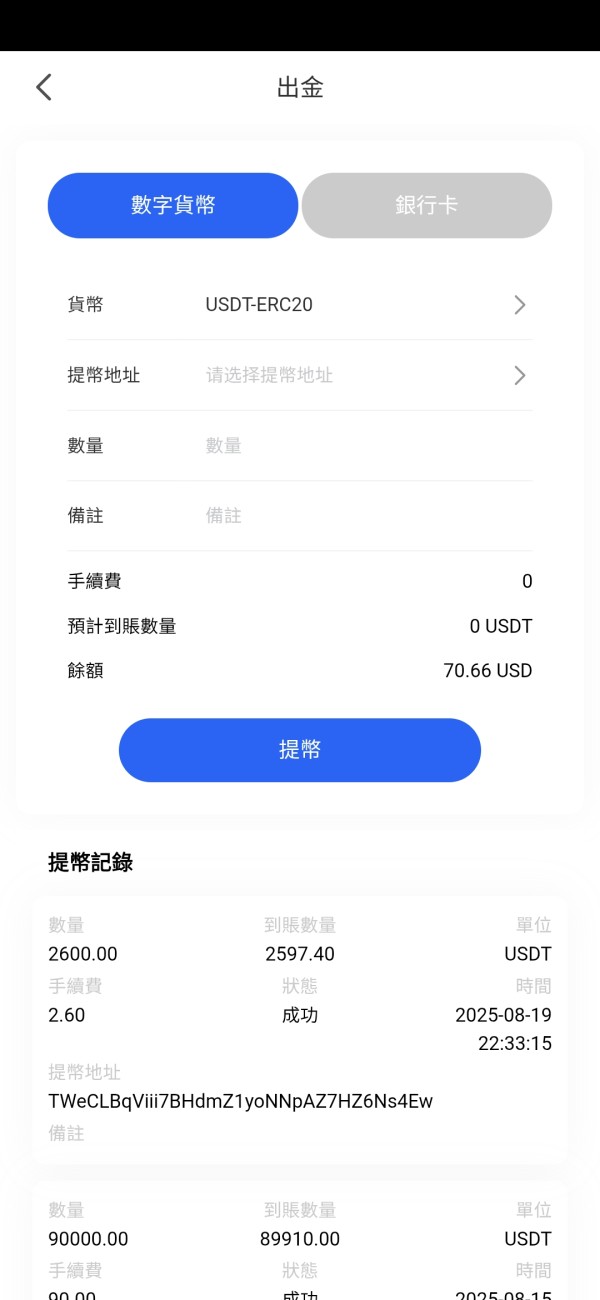

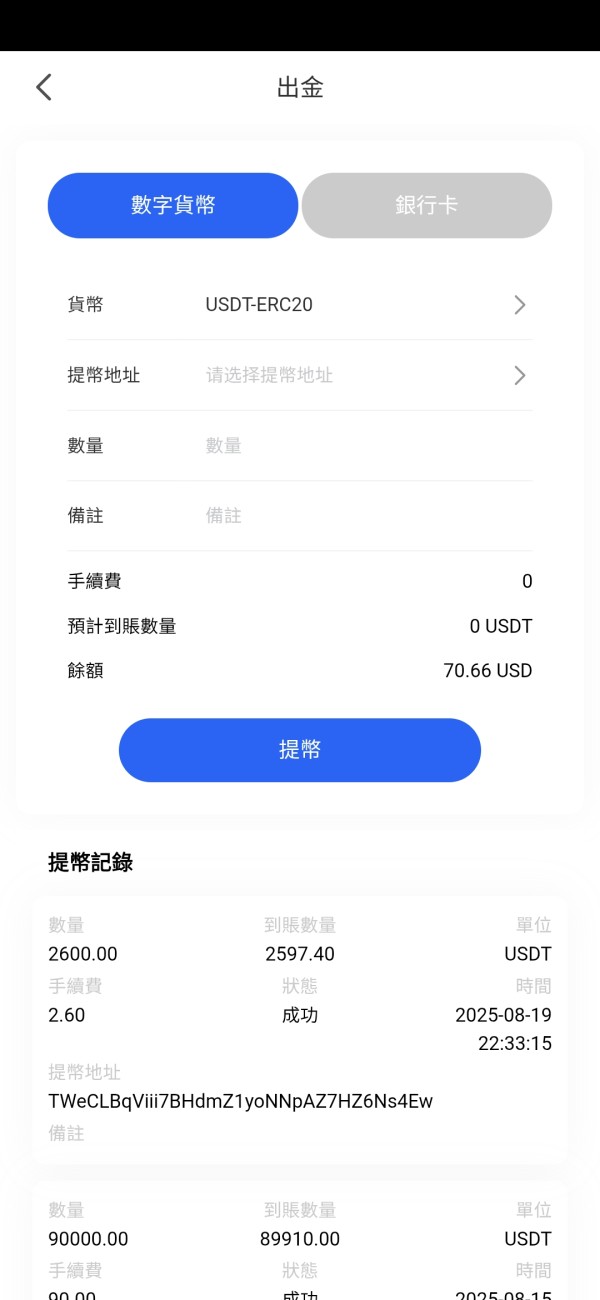

In addition, user experiences cite a lack of safety regarding funds. One user stated:

“I found it nearly impossible to withdraw my funds without significant delays, leading me to question their legitimacy.”

This further reinforces the need for potential clients to exercise due diligence.

Trading Costs Analysis

"The double-edged sword effect."

On one hand, Gleneagle offers competitive commission rates. For example, equities fees are stated at 1.1% (with a minimum of $82.50 and a maximum of $150). However, the long list of non-trading fees creates uncertainty.

Several users reported dissatisfaction with hidden withdrawal fees, with one user complaining about a $30 charge for processing withdrawals that appears burdensome, particularly for those trading smaller amounts.

Ultimately, traders need to weigh the attractive commission structure against the potential for excessive non-trading fees that can erode profitability.

"Professional depth vs. beginner-friendliness."

Gleneagle supports multiple trading platforms, including MT4 and MT5, which are highly regarded for their user-friendly interfaces and advanced capabilities. Traders leverage sophisticated tools for charting and market analysis, suggesting the broker is well-suited for professional traders.

However, educational resources available for beginners remain somewhat limited, drawing criticism from novice users who may not find adequate support materials. Many reports highlight that while professional tools are abundantly available, new traders can feel overwhelmed.

One user remarked:

“While the platforms are robust, navigability could be improved for those just starting out in trading.”

User Experience Analysis

"Navigating the user journey."

Users have mixed experiences with Gleneagle's onboarding process, which, while straightforward, often leads to questions due to the lack of clarity surrounding account types and functionalities available. The interface usability of the trading platforms has generally received favorable comments among seasoned traders who appreciate the control over their trading environment.

However, reports regarding overall user satisfaction paint a less favorable picture. Multiple feedback instances describe frustrations on insufficient responsiveness from the support team, leaving users feeling unsupported when challenges arise during trading activities.

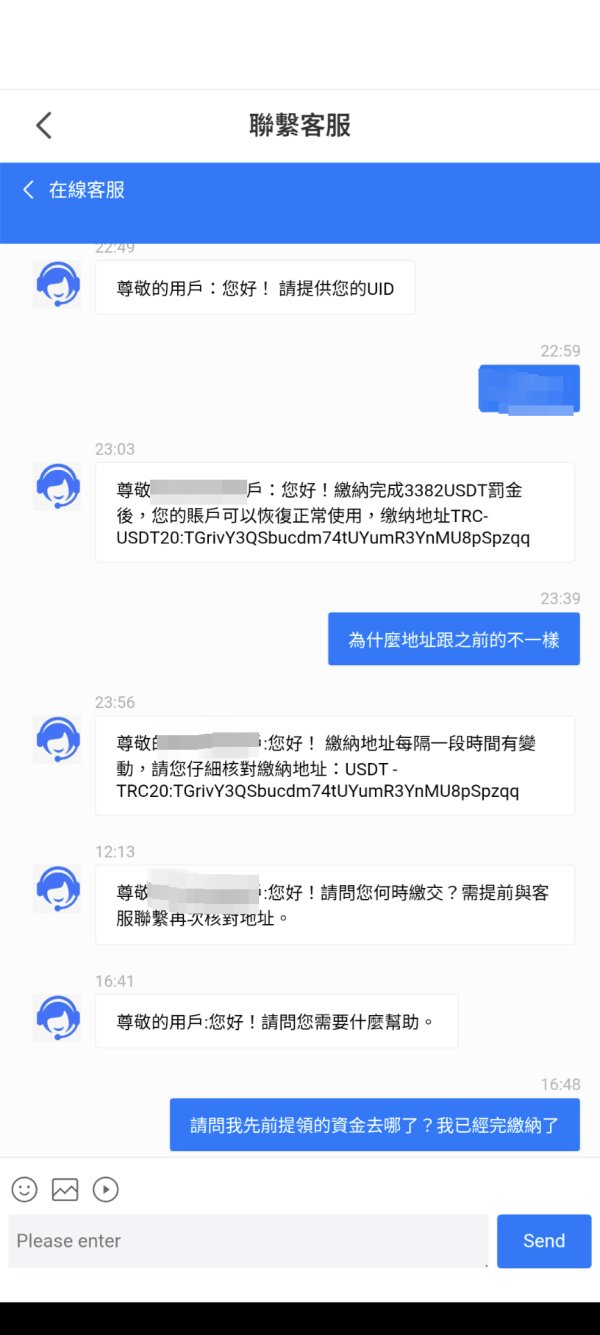

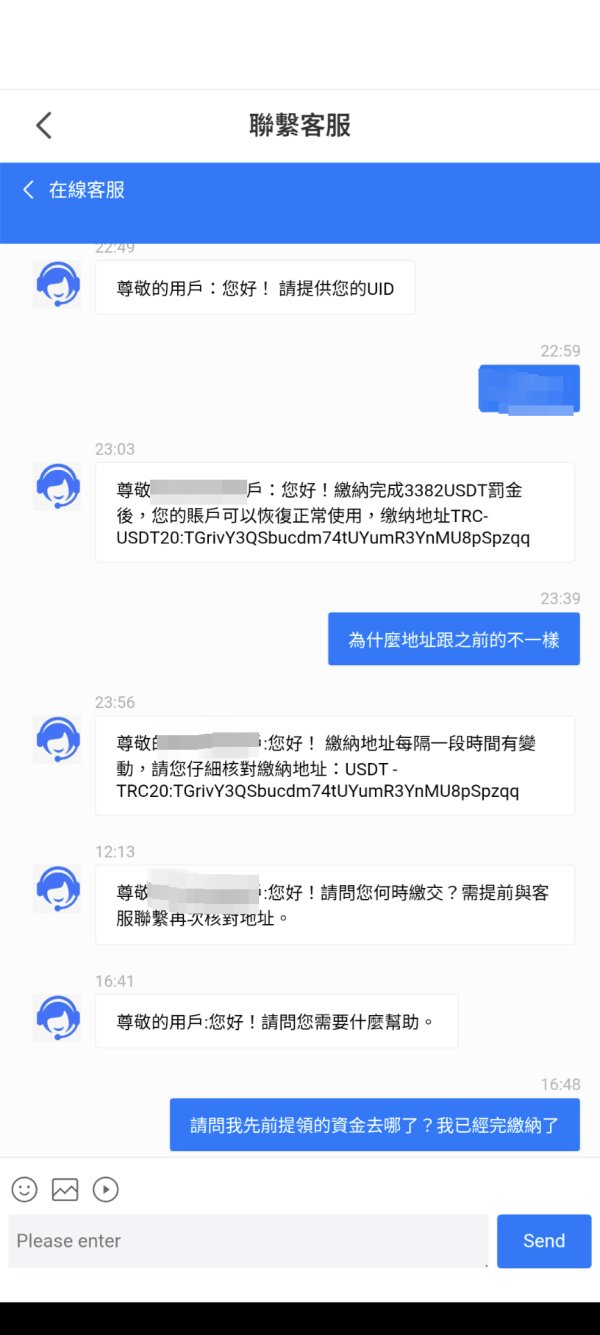

Customer Support Analysis

"Support when you need it."

Customer support options at Gleneagle are multifaceted, including phone, email, and online inquiry forms. However, user experiences suggest that response times can be notably slow, particularly in high-demand periods. Users often report feeling neglected when awaiting answers to urgent inquiries.

As one user expressed:

“I had to wait hours for a response on a critical issue, which caused significant frustration.”

Thus, while support channels are available, it is essential for potential clients to consider the timeliness and effectiveness of assistance received as a crucial factor when selecting a broker.

Account Conditions Analysis

"Flexibility versus rigidity."

Gleneagle provides limited account types, primarily suited for more experienced traders. The minimum deposit required tends to be on the higher side compared to industry standards, which can exclude beginner traders or those looking to experiment without extensive commitment.

Complaints regarding the lack of flexibility in account conditions, including minimum investments and leverage options, often surface. This rigidity can be detrimental to novice users who might prefer more adaptable setups.

Conclusion

In conclusion, Gleneagle presents a mixed bag for those considering it as a brokerage platform. While its long history and wide array of services and trading platforms may entice more experienced traders, significant risk factors such as mixed regulatory status, complaints about fund safety, and the slow responsiveness of customer support make it a potential "trap" for unsuspecting investors.

Thus, individuals looking for a reliable broker must weigh these factors carefully. Comprehensive self-verification and thorough research are vital steps in determining whether aligning with Gleneagle aligns with their investment goals and risk tolerance levels. Potential investors should evaluate alternative brokers with stronger reputations and safer operational practices.