SCEX Review 1

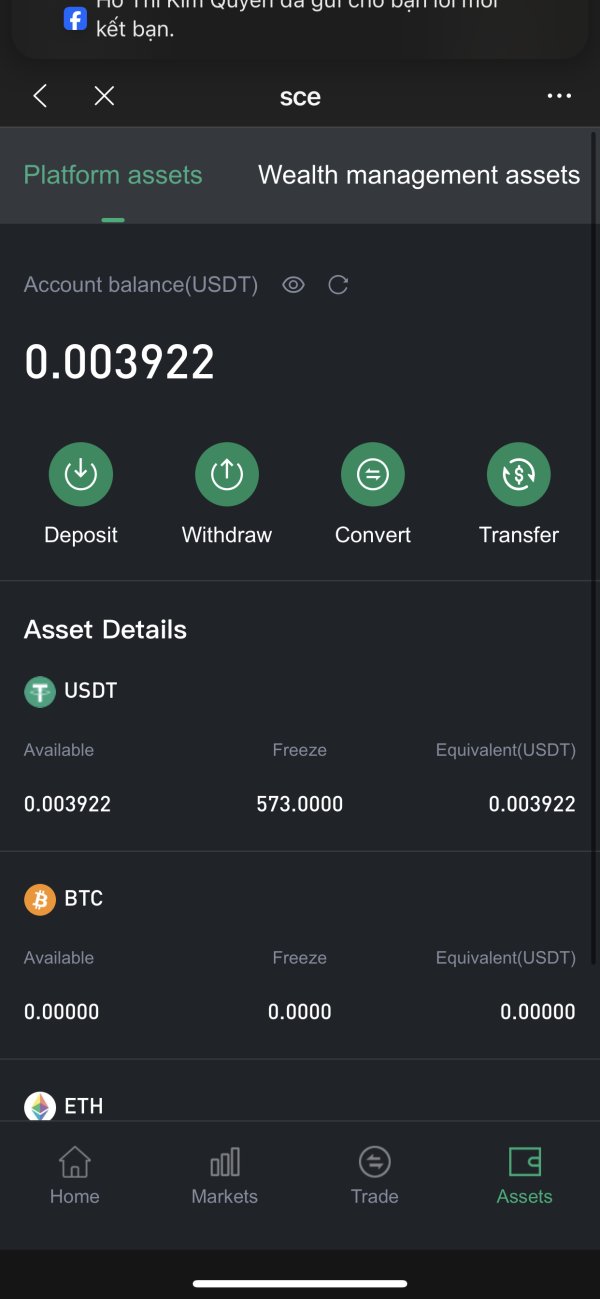

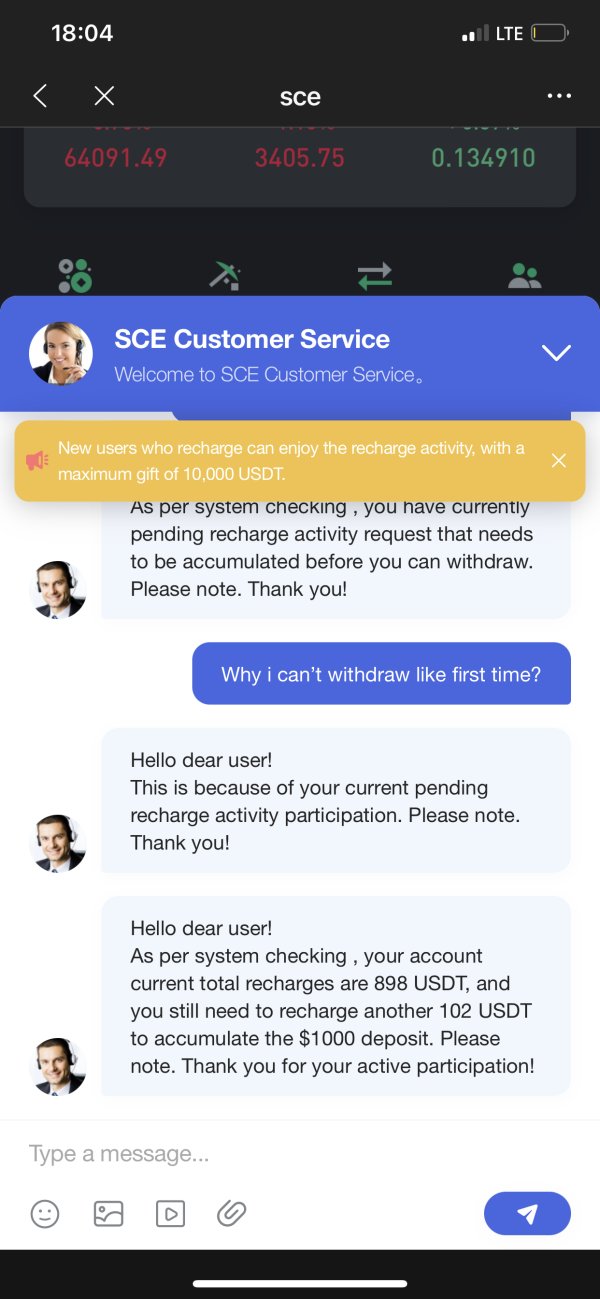

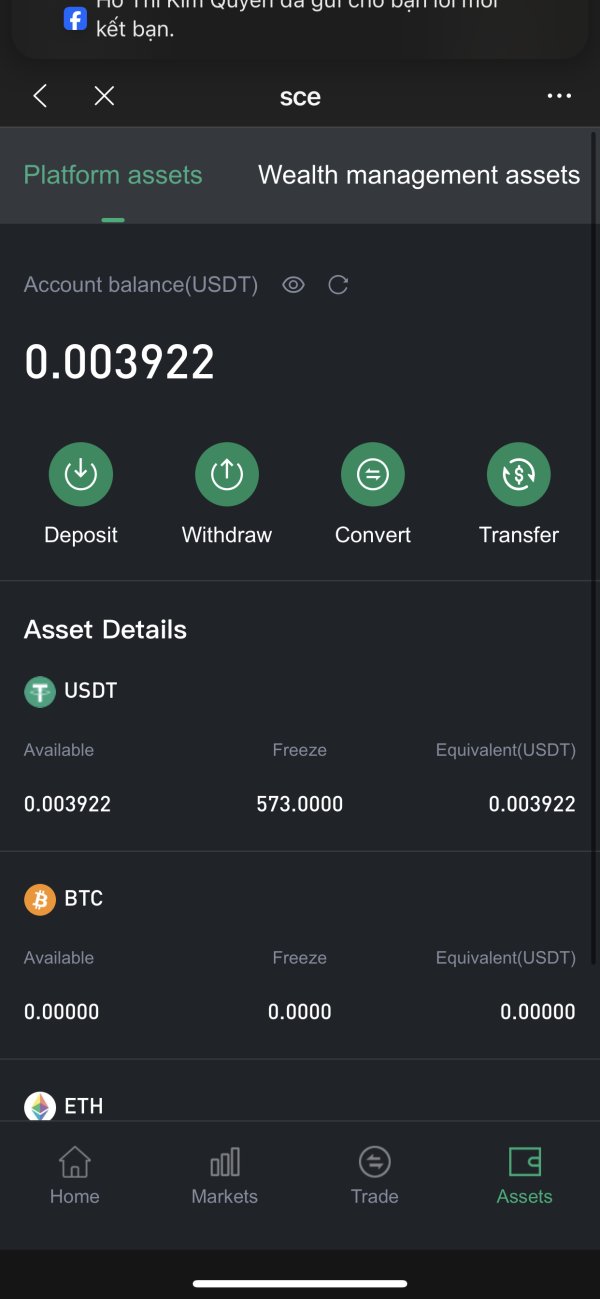

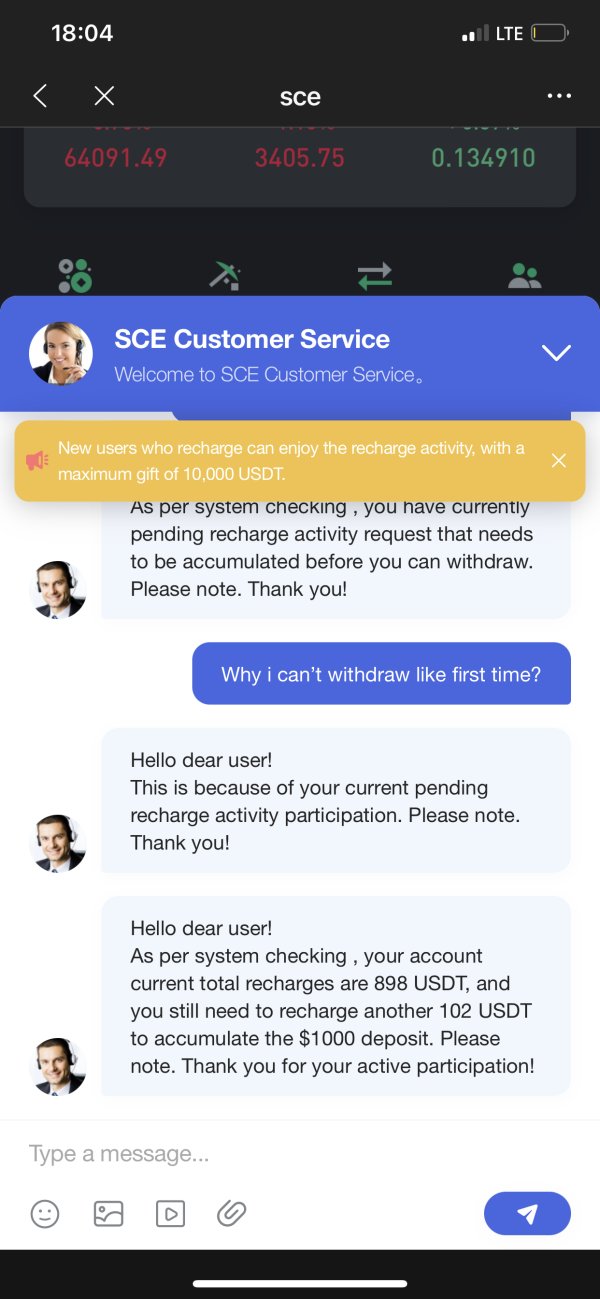

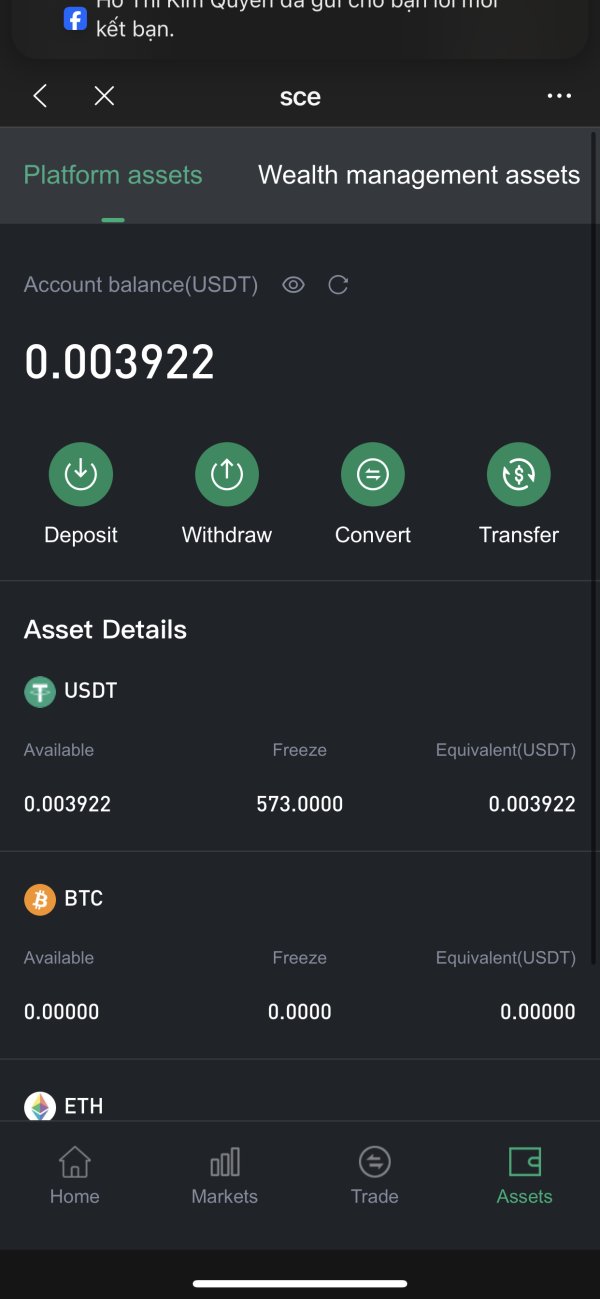

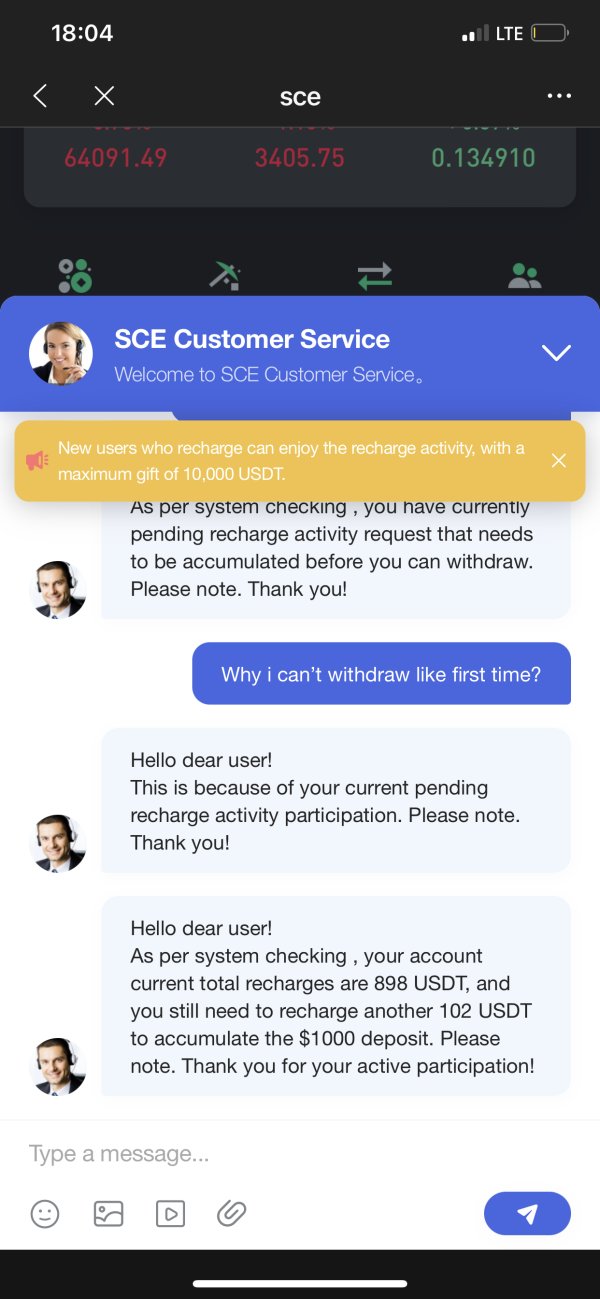

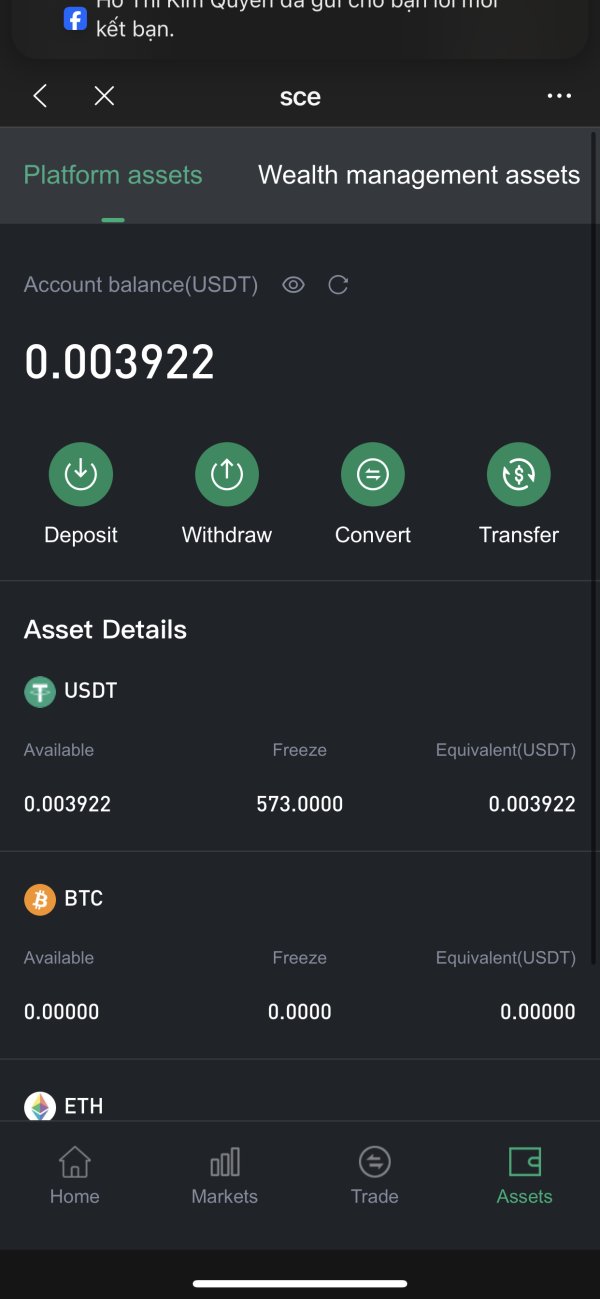

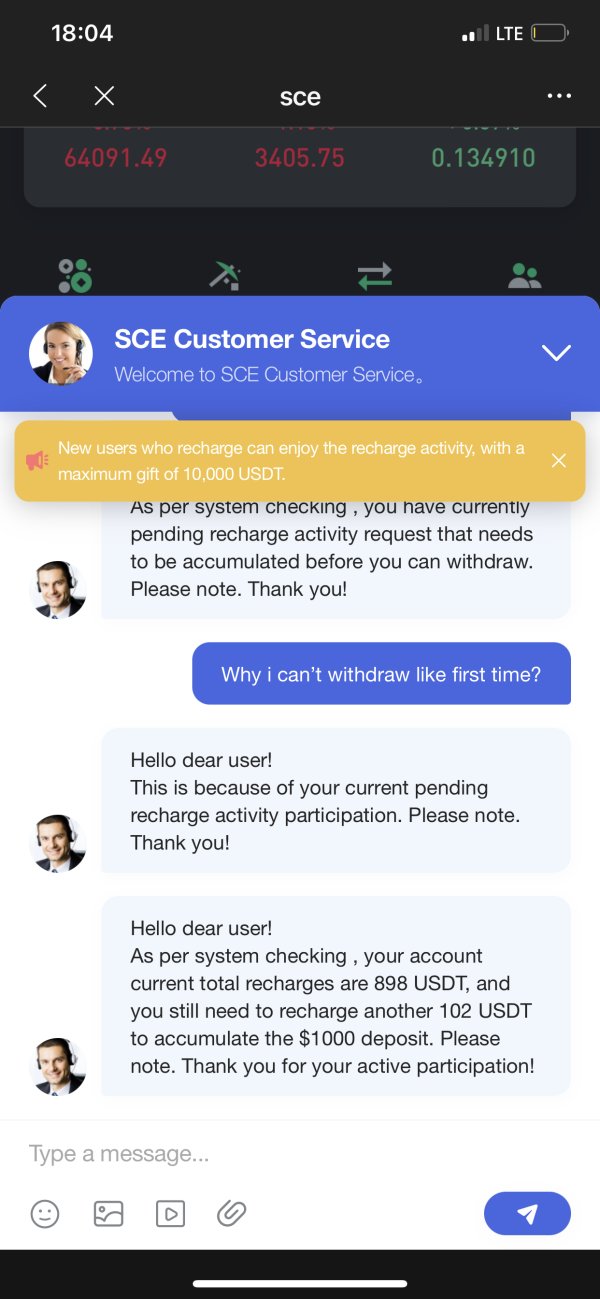

I accessed the exchange through the link and did not find a reputable address: https://h5.sourcecoinexchange.com/#/i&8E4STH. and the amount I wanted to withdraw was frozen. It requires a minimum deposit of $1000 before I can withdraw.

SCEX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I accessed the exchange through the link and did not find a reputable address: https://h5.sourcecoinexchange.com/#/i&8E4STH. and the amount I wanted to withdraw was frozen. It requires a minimum deposit of $1000 before I can withdraw.

This comprehensive scex review reveals significant concerns about SCEX as a forex broker. SCEX was established in 2023 and operates from Melbourne, Australia, without any regulatory oversight, which presents substantial risks to potential investors. While the platform claims to offer over 800 tradeable instruments across forex, index CFDs, commodities, and cryptocurrencies, the lack of regulatory protection and limited market presence raise serious red flags.

The broker may attract traders seeking diverse financial instruments. However, the absence of regulatory compliance makes it unsuitable for most investors, particularly those prioritizing safety and security. According to available information from WikiBit and other review platforms, SCEX has been flagged with potential scam warnings. This makes it crucial for traders to exercise extreme caution. The platform's short operational history, combined with its unregulated status, creates an environment where investor funds lack proper protection mechanisms typically required by established financial authorities.

SCEX was established in 2023 and operates from Melbourne, Australia, without any regulatory oversight from recognized financial authorities. This unregulated status means that client funds are not protected by investor compensation schemes typically available with licensed brokers. Traders should be aware that different jurisdictions may have varying levels of access to SCEX's services. However, specific regional restrictions are not clearly detailed in available documentation.

This review is based on publicly available information from various sources including WikiBit, AlertTrade, and other financial review platforms as of late 2024. Given the limited operational history and lack of comprehensive user feedback, potential investors are strongly advised to conduct thorough due diligence before making any financial commitments with this platform.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 7/10 | Good |

| Customer Service and Support | 3/10 | Poor |

| Trading Experience | 5/10 | Average |

| Trust and Reliability | 2/10 | Very Poor |

| User Experience | 4/10 | Below Average |

SCEX entered the financial services market in 2023. The company positions itself as a multi-asset trading platform based in Melbourne, Australia. As a relatively new entrant in the competitive forex and CFD trading space, the company has attempted to establish its presence by offering a diverse range of trading instruments. However, the broker's limited operational history means it lacks the proven track record that many experienced traders seek when selecting a trading partner.

The company's business model centers around providing access to various financial markets through online trading platforms. Specific details about their proprietary technology or partnerships with established platform providers remain unclear. SCEX's rapid expansion into offering hundreds of trading instruments suggests an aggressive growth strategy. However, this approach raises questions about the depth of market expertise and risk management capabilities for a newly established firm.

The platform focuses on delivering multi-asset trading capabilities. These encompass traditional forex pairs, index CFDs covering major global markets, commodity trading opportunities, and cryptocurrency exposure. According to available information, SCEX claims to provide access to over 800 different trading instruments, which would be impressive for any broker, let alone one established recently. However, the absence of regulatory oversight means that the quality, pricing, and execution standards of these instruments cannot be independently verified through regulatory reporting requirements that licensed brokers must meet.

Regulatory Status: SCEX operates without regulation from any recognized financial authority. This creates significant risks for traders. Unlike regulated brokers who must maintain segregated client accounts and provide investor protection, SCEX's unregulated status means client funds lack these essential safeguards.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available documentation. This makes it difficult for potential traders to assess the convenience and security of funding their accounts.

Minimum Deposit Requirements: The platform has not clearly disclosed minimum deposit requirements. This is concerning as this basic information should be readily available to prospective clients.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available materials. However, this could change as the platform seeks to attract new clients.

Tradeable Assets: SCEX's primary selling point appears to be its extensive range of over 800 tradeable instruments. These span forex currency pairs, index CFDs, commodity markets, and cryptocurrency trading opportunities. However, the actual quality and competitiveness of pricing across these instruments remains unverified.

Cost Structure: Critical information about spreads, commissions, overnight financing charges, and other trading costs is not readily available in public documentation. This makes it impossible for traders to accurately assess the total cost of trading.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. This is essential information for traders planning their risk management strategies.

Platform Options: The specific trading platforms offered by SCEX are not clearly identified in available documentation. This leaves questions about whether they use established platforms like MetaTrader or proprietary solutions.

Regional Restrictions: Specific geographical limitations on SCEX's services are not detailed in available information. However, the unregulated status may affect accessibility in certain jurisdictions.

Customer Support Languages: Available customer service languages and support channels are not specified in accessible documentation.

This scex review highlights the significant information gaps that potential traders face when considering this platform.

The account conditions offered by SCEX present several concerns that contribute to its below-average rating in this category. The lack of detailed information about account types, minimum deposit requirements, and specific trading conditions makes it extremely difficult for potential traders to make informed decisions. Established brokers typically provide comprehensive account specifications, including various account tiers designed for different trader profiles, from beginners to institutional clients.

The absence of clear information about account opening procedures, verification requirements, and documentation needed raises additional red flags. Legitimate brokers maintain transparent onboarding processes that comply with know-your-customer and anti-money laundering requirements, even when operating in less regulated environments. SCEX's lack of detailed account information suggests either poor transparency practices or potentially incomplete service offerings.

Furthermore, the platform has not disclosed whether it offers specialized account types such as Islamic accounts for Muslim traders, demo accounts for practice trading, or institutional accounts with enhanced features. These are standard offerings in the industry, and their absence or lack of disclosure indicates limited service development. The unregulated status also means that account holders cannot benefit from investor protection schemes that would safeguard their deposits in case of broker insolvency.

Without specific information about account funding requirements, currency options, or account maintenance fees, traders cannot properly evaluate whether SCEX's account conditions align with their trading needs and financial capabilities. This scex review emphasizes the importance of complete account information for trader decision-making.

SCEX receives a relatively positive rating for tools and resources primarily due to its claimed offering of over 800 tradeable instruments across multiple asset classes. This extensive range, if accurate, would provide traders with significant diversification opportunities and access to various market sectors including forex, indices, commodities, and cryptocurrencies. The breadth of available instruments suggests that traders could potentially implement diverse trading strategies and hedge positions across different market correlations.

However, the quality assessment of these tools remains limited due to insufficient detailed information about specific instruments, their pricing competitiveness, or execution quality. While quantity is impressive, the absence of detailed specifications about spreads, minimum trade sizes, or trading hours for different instruments prevents a complete evaluation of the actual utility these tools provide to traders.

The platform's approach to offering such an extensive range of instruments as a newly established broker is ambitious. However, it raises questions about the depth of market expertise and the quality of liquidity provision across all these instruments. Established brokers typically build their instrument offerings gradually, ensuring proper risk management and competitive pricing for each addition.

Additionally, there is no available information about research tools, market analysis resources, educational materials, or trading calculators that typically accompany comprehensive trading platforms. These supplementary resources are crucial for trader success and are standard offerings among reputable brokers. The absence of information about such tools suggests either limited development in this area or poor communication of available resources.

The customer service and support capabilities of SCEX receive a poor rating due to the complete lack of available information about support channels, response times, service quality, or availability hours. This absence of basic customer service information is particularly concerning for a financial services provider where timely support can be crucial for resolving trading issues, account problems, or technical difficulties.

Established brokers typically provide multiple contact methods including live chat, telephone support, email assistance, and sometimes even social media support channels. They also clearly communicate their support hours, available languages, and expected response times for different types of inquiries. The fact that SCEX has not made this information readily available suggests either inadequate support infrastructure or poor communication practices.

The unregulated status of SCEX compounds customer service concerns because traders have no regulatory recourse if they experience poor service or unresolved disputes. Regulated brokers must maintain certain customer service standards and provide complaint resolution procedures that are overseen by financial authorities. Without such oversight, SCEX clients would have limited options for escalating unresolved issues.

Furthermore, the lack of user feedback or testimonials about customer service experiences makes it impossible to assess the actual quality of support provided. Potential traders cannot gauge whether SCEX can provide timely assistance during critical trading situations or resolve account-related issues efficiently. This uncertainty about support quality adds significant risk to the trading experience.

The trading experience evaluation for SCEX receives an average rating primarily due to insufficient information about platform performance, execution quality, and user interface design. While the broker claims to offer access to numerous trading instruments, the actual trading experience depends heavily on factors such as platform stability, order execution speed, slippage rates, and overall system reliability, none of which are documented in available materials.

The absence of information about specific trading platforms used by SCEX creates uncertainty about the technological infrastructure supporting client trading activities. Whether the broker utilizes established platforms like MetaTrader 4/5, develops proprietary solutions, or partners with third-party technology providers remains unclear. This information is crucial because platform choice significantly impacts trading functionality, charting capabilities, and overall user experience.

Order execution quality, including factors such as slippage, requotes, and execution speed during volatile market conditions, cannot be assessed due to lack of performance data or user testimonials. These execution characteristics are fundamental to successful trading, particularly for strategies that depend on precise entry and exit timing. Without verifiable execution statistics or independent testing results, traders cannot evaluate whether SCEX provides competitive execution quality.

The mobile trading experience, which is increasingly important for modern traders, is also not documented. Most contemporary brokers provide comprehensive mobile applications that allow full trading functionality, account management, and market analysis on smartphones and tablets. The absence of information about mobile trading capabilities suggests either limited development in this area or inadequate marketing communication.

This scex review cannot provide a comprehensive assessment of trading experience due to these information limitations.

SCEX receives a very poor rating for trust and reliability, primarily due to its unregulated status and the associated risks this presents to trader funds and overall platform credibility. The absence of regulatory oversight means that SCEX operates without the stringent compliance requirements, capital adequacy standards, and operational safeguards that regulated brokers must maintain to protect client interests.

Regulatory authorities typically require licensed brokers to segregate client funds from company operational capital, maintain adequate financial reserves, submit regular financial reports, and provide investor compensation schemes. Without such regulatory framework, SCEX clients face significant risks including potential loss of funds in case of broker insolvency, lack of dispute resolution mechanisms, and absence of standardized operational practices.

The platform's establishment in 2023 means it lacks the operational track record that builds trust over time. Established brokers demonstrate reliability through years of consistent service, transparent business practices, and successful navigation of various market conditions. SCEX's short operational history provides insufficient evidence of its ability to maintain stable operations or handle challenging market situations.

According to information from review platforms including WikiBit, SCEX has been flagged with potential scam warnings, which significantly undermines trust and reliability. Such warnings, even if not definitively proven, indicate that the platform has raised concerns within the trading community and among industry watchdogs. These red flags, combined with the unregulated status, create a high-risk environment for potential traders.

The absence of transparency regarding company ownership, financial backing, or operational procedures further erodes trust. Legitimate brokers typically provide detailed information about their corporate structure, management team, and business operations to build credibility with potential clients.

The user experience assessment for SCEX yields a below-average rating due to significant information gaps about platform usability, account management procedures, and overall client interaction processes. User experience encompasses various elements including website design, account opening procedures, platform navigation, customer communication, and problem resolution efficiency, most of which remain undocumented for SCEX.

The registration and account verification process, which forms the first impression for new clients, is not detailed in available materials. Streamlined onboarding procedures with clear documentation requirements and efficient verification processes are standard expectations in modern forex trading. The absence of information about these procedures suggests either inadequate process development or poor communication of available services.

Interface design and platform usability cannot be evaluated due to lack of screenshots, user testimonials, or detailed platform descriptions. Modern trading platforms should provide intuitive navigation, comprehensive charting tools, efficient order management, and seamless integration between different platform functions. Without access to such information, potential traders cannot assess whether SCEX meets contemporary usability standards.

The funding and withdrawal experience, which significantly impacts overall user satisfaction, remains unclear due to insufficient information about supported payment methods, processing times, fees, and procedures. Efficient money management processes are crucial for positive user experience, and the lack of transparency in this area creates uncertainty for potential clients.

Additionally, there is no available user feedback or testimonials that could provide insights into actual client experiences with the platform. Independent user reviews, while sometimes biased, offer valuable perspectives on real-world platform performance and service quality that complement official broker information.

This comprehensive scex review reveals that while SCEX offers an extensive range of tradeable instruments, the platform presents significant risks that outweigh its potential benefits. The unregulated status, combined with limited operational history and insufficient transparency about key trading conditions, makes SCEX unsuitable for most traders, particularly those prioritizing safety and regulatory protection.

The broker's main advantage lies in its claimed diversity of over 800 trading instruments across multiple asset classes. This could appeal to traders seeking broad market exposure. However, this advantage is severely undermined by the lack of regulatory oversight, absence of detailed cost information, and insufficient user feedback to verify service quality.

SCEX is not recommended for novice traders or risk-averse investors who require regulatory protection and transparent operating conditions. The platform's significant information gaps and regulatory concerns make it a high-risk choice that could result in substantial financial losses for unprepared traders.

FX Broker Capital Trading Markets Review