Is SCEX safe?

Pros

Cons

Is SCEX Safe or Scam?

Introduction

SCEX is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a wide range of financial products, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, it has attracted both legitimate brokers and unscrupulous entities looking to exploit traders. Therefore, it is crucial for potential investors to thoroughly evaluate the credibility and safety of brokers like SCEX before committing their funds. This article aims to provide a comprehensive analysis of SCEX, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. The findings are based on a review of the top search results and credible sources related to SCEX, ensuring an objective and balanced evaluation.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its legitimacy. SCEX claims to be regulated by the Securities Commission of the Bahamas (SCB). However, upon investigation, it has been revealed that SCEX is not listed in the SCBs database, and the SCB has issued warnings against it for operating without proper authorization. This raises significant concerns regarding the broker's compliance with legal standards and investor protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SCB | N/A | Bahamas | Not Verified |

The lack of regulation from a reputable authority means that SCEX does not adhere to the strict standards set by recognized financial regulators. This absence of oversight can lead to increased risks for traders, as there are no legal protections in place to safeguard their funds. Furthermore, the SCB's warning against SCEX indicates that the broker may be operating as a scam, which further underscores the need for caution when considering this trading platform.

Company Background Investigation

SCEX operates under the name SCEX Markets Limited, with its domain registered in early 2024. The company claims to provide various trading services, but there is a notable lack of transparency regarding its ownership structure and operational history. The absence of publicly available information about the management team and their qualifications raises additional red flags.

The company's website does not provide detailed information about its founders or key personnel, which is essential for assessing the broker's credibility. A transparent company typically discloses its management team's qualifications and experience, allowing potential investors to gauge their expertise in the financial markets. Without this information, it is challenging to trust SCEX as a legitimate trading platform.

Trading Conditions Analysis

When it comes to trading conditions, SCEX offers a range of financial products with claims of competitive spreads and low commissions. However, the lack of regulatory oversight raises questions about the accuracy of these claims. Traders must be aware of any hidden fees or unfavorable trading conditions that may not be explicitly stated.

| Fee Type | SCEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 0.3 pips | 1.0 - 1.5 pips |

| Commission Model | From 7 AUD | From 5 AUD |

| Overnight Interest Range | Not Specified | 0.5 - 2.0% |

While SCEX advertises attractive trading conditions, it is essential to approach these claims with skepticism due to its unregulated status. Traders should be wary of any unexpected fees or unfavorable trading practices that could erode their profits. Comprehensive research and comparison with regulated brokers in the market are advisable to ensure that traders are not being misled.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. SCEX claims to implement measures to protect client funds, such as segregated accounts and negative balance protection. However, without regulatory oversight, the effectiveness of these measures is questionable.

Traders should be aware that the absence of regulation means there are no guarantees regarding the safety of their funds. If SCEX were to face financial difficulties or engage in fraudulent activities, clients might find it challenging to recover their investments. History has shown that unregulated brokers often lack the necessary safeguards to protect client funds, leading to significant financial losses for traders.

Customer Experience and Complaints

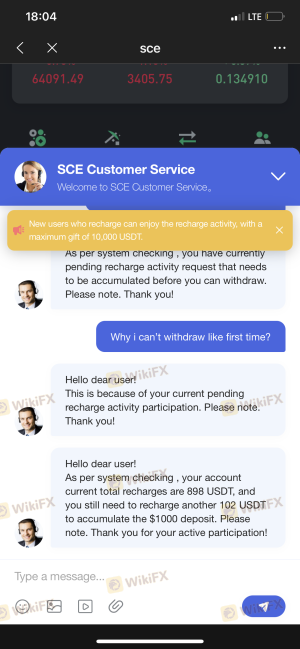

Customer feedback is a valuable indicator of a broker's reliability. Reviews and testimonials about SCEX reveal a mixed bag of experiences, with some users reporting positive interactions while others express significant concerns. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

| Trade Execution Problems | High | Poor |

Several users have reported being unable to access their funds after submitting withdrawal requests, which is a serious red flag. Additionally, the quality of customer support appears to be lacking, with many users experiencing long wait times for responses. Such issues can significantly impact a trader's experience and raise further concerns about the broker's legitimacy.

Platform and Execution Performance

The trading platform offered by SCEX is another critical aspect to consider. While the broker claims to provide a user-friendly interface and robust trading capabilities, the actual performance may vary. Reports from users indicate potential issues with order execution quality, including slippage and rejected orders.

A reliable trading platform should facilitate seamless transactions and provide traders with the tools they need to make informed decisions. However, if SCEX's platform exhibits signs of manipulation or poor performance, it could hinder traders' ability to execute trades effectively.

Risk Assessment

Using SCEX presents several risks that potential traders should consider. The absence of regulatory oversight, coupled with reported customer complaints and issues with fund safety, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation or oversight |

| Fund Safety | High | No guarantees on fund protection |

| Customer Support | Medium | Delays and poor response times |

To mitigate these risks, traders should conduct thorough research before engaging with SCEX. They may also consider starting with a small investment or exploring alternative brokers with a proven track record of regulatory compliance and positive customer experiences.

Conclusion and Recommendations

Based on the analysis presented, it is clear that SCEX raises several red flags that warrant caution. The lack of regulatory oversight, combined with customer complaints about fund withdrawals and poor support, suggests that SCEX may not be a safe trading environment.

If you are considering trading with SCEX, it is advisable to approach with extreme caution and be prepared for the potential risks involved. For traders seeking a more secure trading experience, it is recommended to explore fully regulated brokers that offer robust investor protections and transparent operations.

In conclusion, while SCEX may present itself as a viable trading option, the evidence suggests that it is fraught with risks, making it essential for traders to prioritize safety and due diligence when choosing a broker.

Is SCEX a scam, or is it legit?

The latest exposure and evaluation content of SCEX brokers.

SCEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCEX latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.