Mass 2025 Review: Everything You Need to Know

Executive Summary

This mass review gives you a complete analysis of Mass Broker Services. Our evaluation shows big information gaps that make it hard to give you a full assessment. Mass appears to be a specialized service provider that focuses mainly on commercial and residential real estate transactions, as well as business buying and selling services, rather than a traditional forex or CFD broker.

The company works from Lynn, Massachusetts, United States. It positions itself in the real estate brokerage sector. However, important information about regulatory oversight, trading conditions, platform details, and standard brokerage services is not available in current documentation.

This lack of openness raises concerns for potential clients who want complete trading services. Our analysis suggests that Mass may serve real estate investors and clients with business transaction needs rather than traditional retail forex traders. The absence of standard brokerage information such as spreads, leverage ratios, trading platforms, and regulatory compliance details makes it hard to recommend this company for regular trading activities.

Important Notice

This review is based on limited data sources due to the small amount of comprehensive information about Mass Broker Services. Potential differences may exist between regional entities or service offerings that are not shown in available documentation. Our evaluation method relies on publicly accessible information, though we acknowledge significant gaps in user feedback, regulatory verification, and detailed service specifications.

Readers should be careful and do independent research before engaging with any financial service provider. This is especially important when regulatory information and trading conditions are not clearly disclosed. This review represents our assessment based on available materials and should not be considered as investment advice or a definitive recommendation.

Rating Framework

Broker Overview

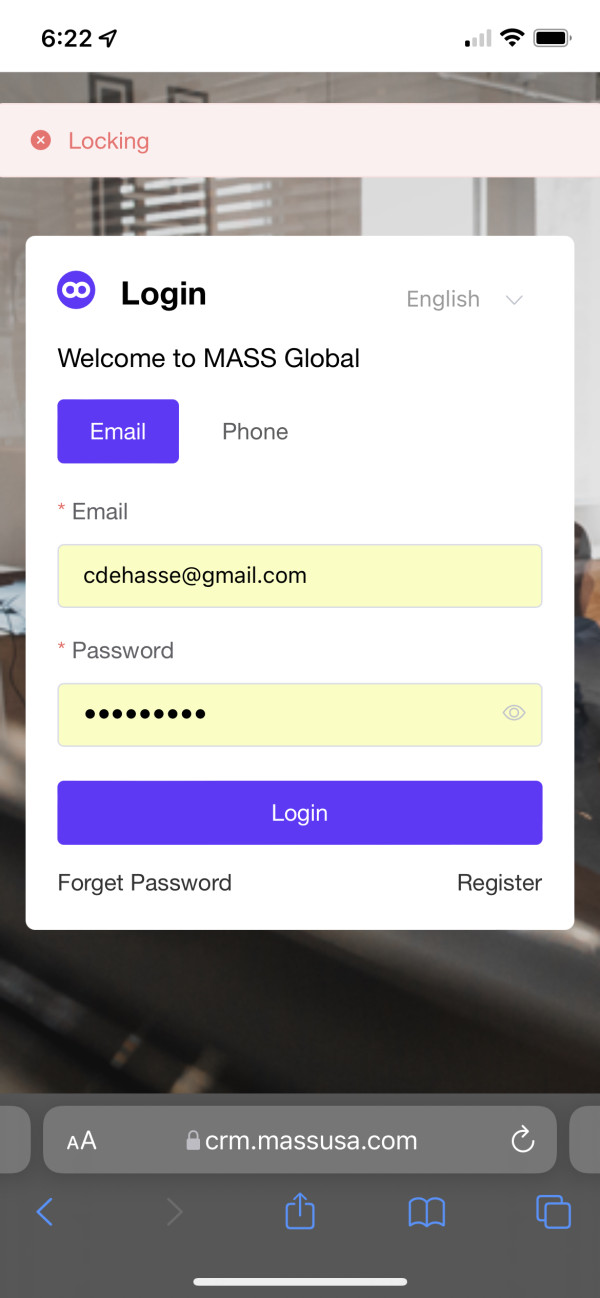

Mass Broker Services works from Lynn, Massachusetts, United States. The specific establishment date is not mentioned in available documentation. According to available information, the company positions itself as a specialized service provider that focuses on commercial and residential real estate transactions.

Their business model appears to center around helping with property purchases and investments. They also offer professional services for business sales and acquisitions. The company's approach suggests a niche focus on real estate brokerage rather than traditional financial market trading.

This positioning makes Mass different from conventional forex or CFD brokers. Their services appear tailored to property investment and business transaction help. However, the lack of detailed company background information limits our ability to provide comprehensive historical context or operational scale assessment.

Current documentation does not provide specific details about trading platforms, asset classes, and regulatory oversight. The absence of information about trading technology, available financial instruments, or regulatory compliance creates uncertainty about the company's capabilities in traditional brokerage services. This mass review highlights these information gaps as significant concerns for potential clients seeking comprehensive trading services.

Regulatory Jurisdiction: Available documentation does not specify regulatory oversight or licensing details for Mass Broker Services. This represents a significant transparency concern for potential clients.

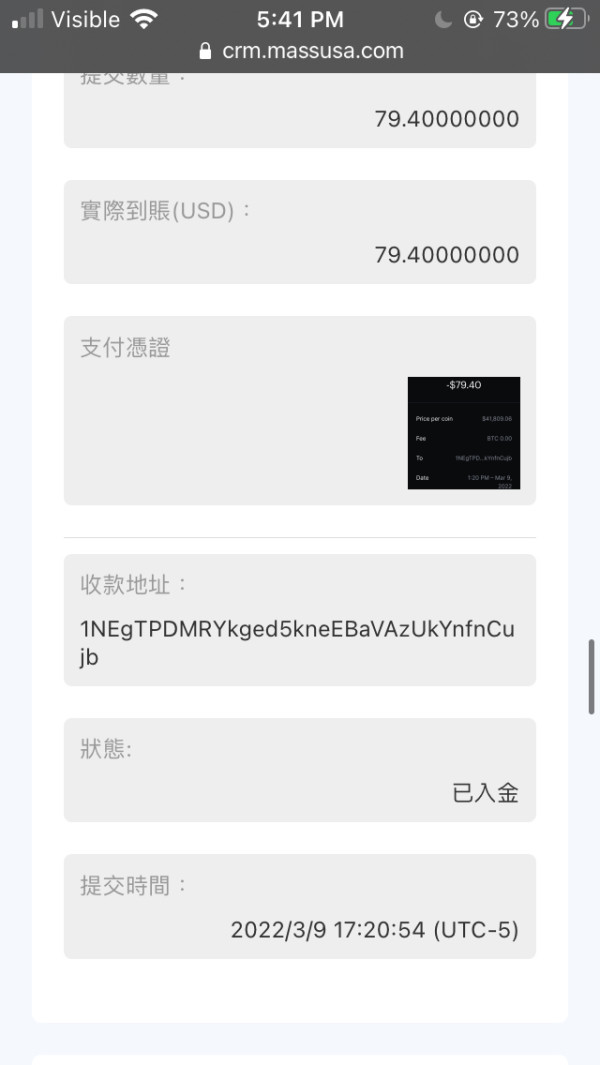

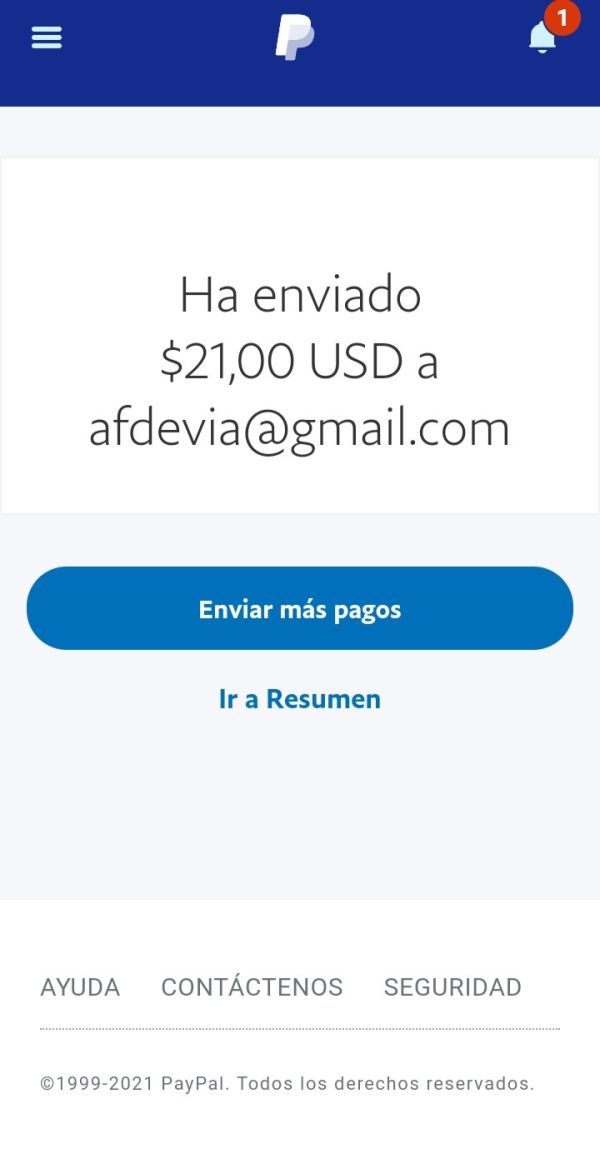

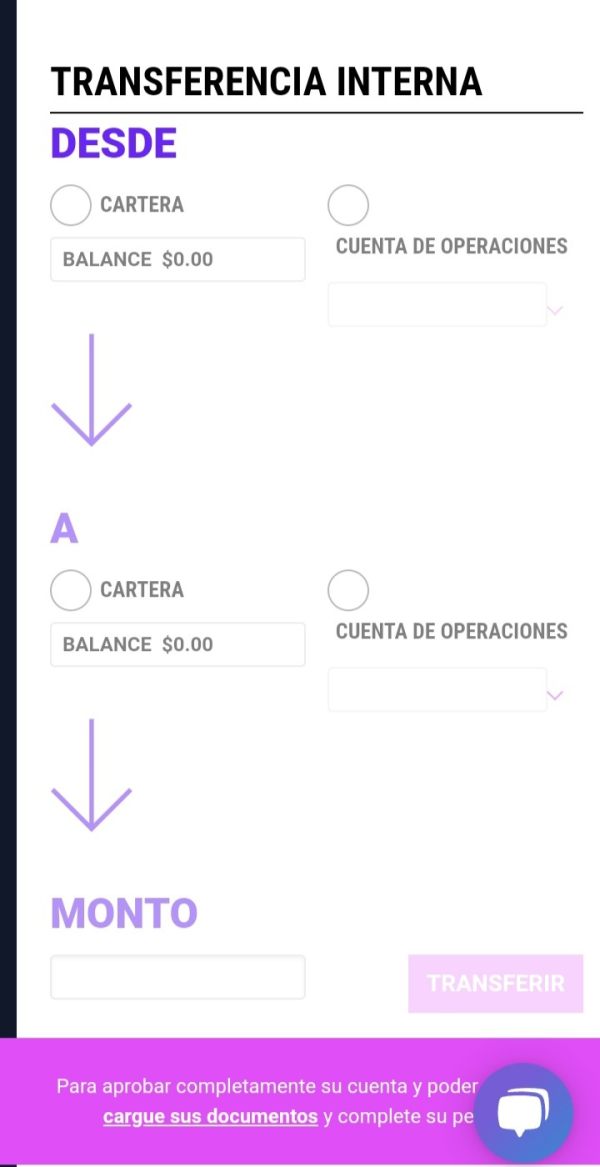

Deposit and Withdrawal Methods: Current materials do not detail available funding methods, processing times, or associated fees for client transactions.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available documentation. This makes it difficult for potential clients to assess entry requirements.

Bonus and Promotional Offers: No information regarding promotional offers, welcome bonuses, or incentive programs is available in current sources.

Tradeable Assets: The range of available financial instruments is not specified in available documentation. The focus appears to be on real estate rather than traditional trading assets.

Cost Structure: Details regarding spreads, commissions, overnight fees, or other trading costs are not provided in current materials. This limits cost comparison capabilities.

Leverage Ratios: Information about available leverage options is not disclosed in available documentation.

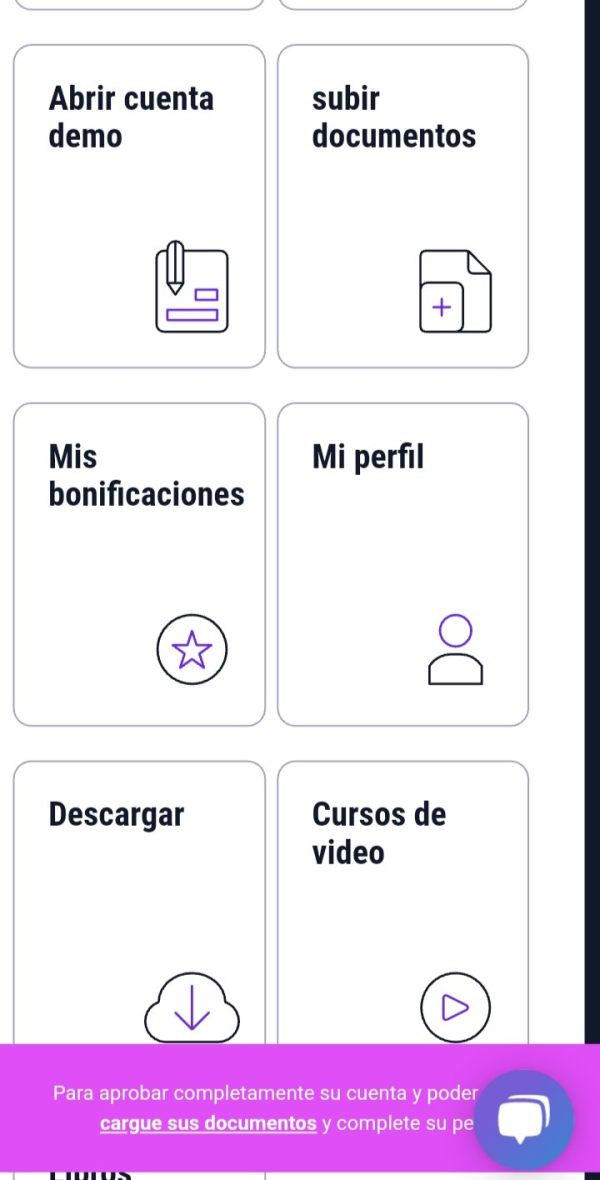

Platform Options: Specific trading platform details are not mentioned in current sources. This includes technology providers or proprietary solutions.

Geographic Restrictions: Regional availability and potential restrictions are not clearly outlined in available materials.

Customer Support Languages: Supported languages for client communication are not specified in current documentation. The US location suggests English language support.

This mass review emphasizes that the lack of detailed information in these critical areas significantly impacts our ability to provide comprehensive guidance to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Mass Broker Services proves challenging due to the absence of specific information in available documentation. Traditional brokerage account types, such as standard, premium, or VIP tiers, are not described in current materials. This lack of transparency regarding account structures makes it impossible to assess the variety and features of available options.

Minimum deposit requirements remain undisclosed. These requirements are crucial for potential clients to understand entry barriers. Without this information, traders cannot effectively plan their initial investment or compare Mass with other brokerage options.

The account opening process is not detailed in available sources. This includes required documentation, verification procedures, and approval timeframes. Specialized account features, such as Islamic accounts for Sharia-compliant trading or managed account options, are not mentioned in current documentation.

This absence of information extends to account benefits. Such benefits might include dedicated support levels, educational resources, or exclusive trading tools that could differentiate various account tiers. The lack of comprehensive account condition information in this mass review represents a significant transparency gap that potential clients should consider when evaluating their options.

Professional traders typically require detailed understanding of account structures before committing to any brokerage relationship.

Available documentation does not provide specific details about trading tools and resources offered by Mass Broker Services. Traditional brokerage tools such as technical analysis indicators, charting packages, or automated trading support are not described in current materials. This absence of information makes it impossible to assess the technological capabilities available to potential clients.

Research and analysis resources are not detailed in available sources. These resources are essential for informed trading decisions. Professional traders typically expect access to market analysis, economic calendars, news feeds, and expert commentary, but such offerings are not specified in current documentation.

Educational resources are not mentioned in available materials. These include webinars, tutorials, market guides, or trading courses. These resources are particularly important for newer traders seeking to develop their skills and market understanding.

Automated trading support is not addressed in current documentation. This includes Expert Advisor compatibility, algorithmic trading tools, or copy trading features. The absence of information about these advanced trading features limits our ability to assess Mass's suitability for sophisticated trading strategies.

Customer Service and Support Analysis

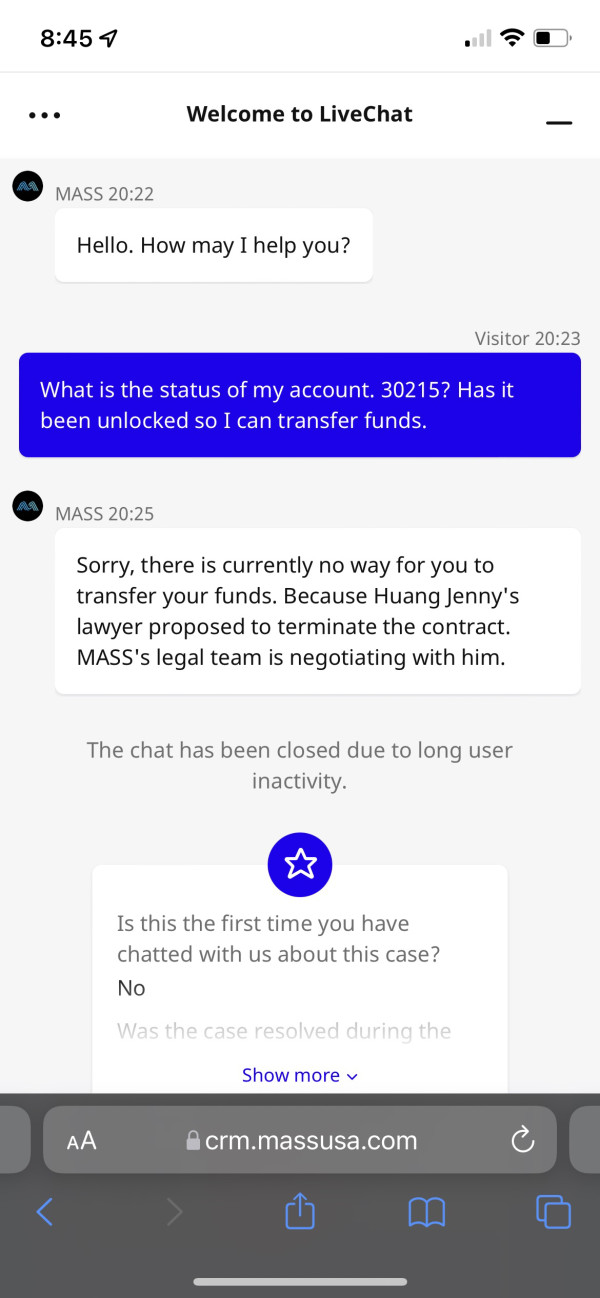

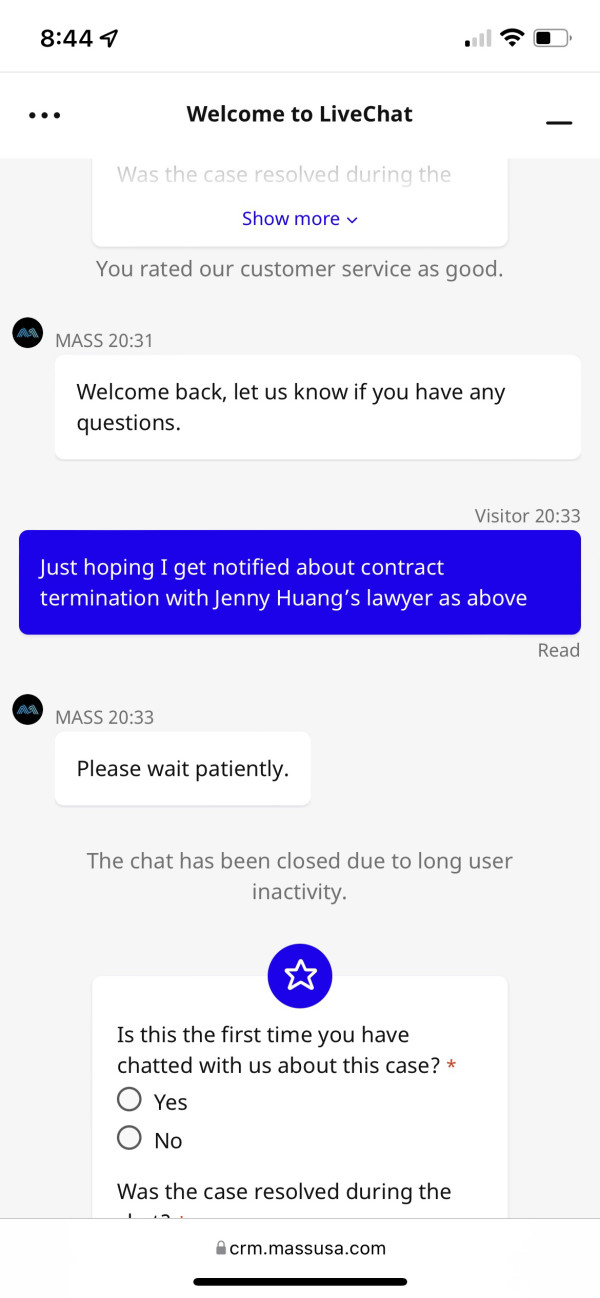

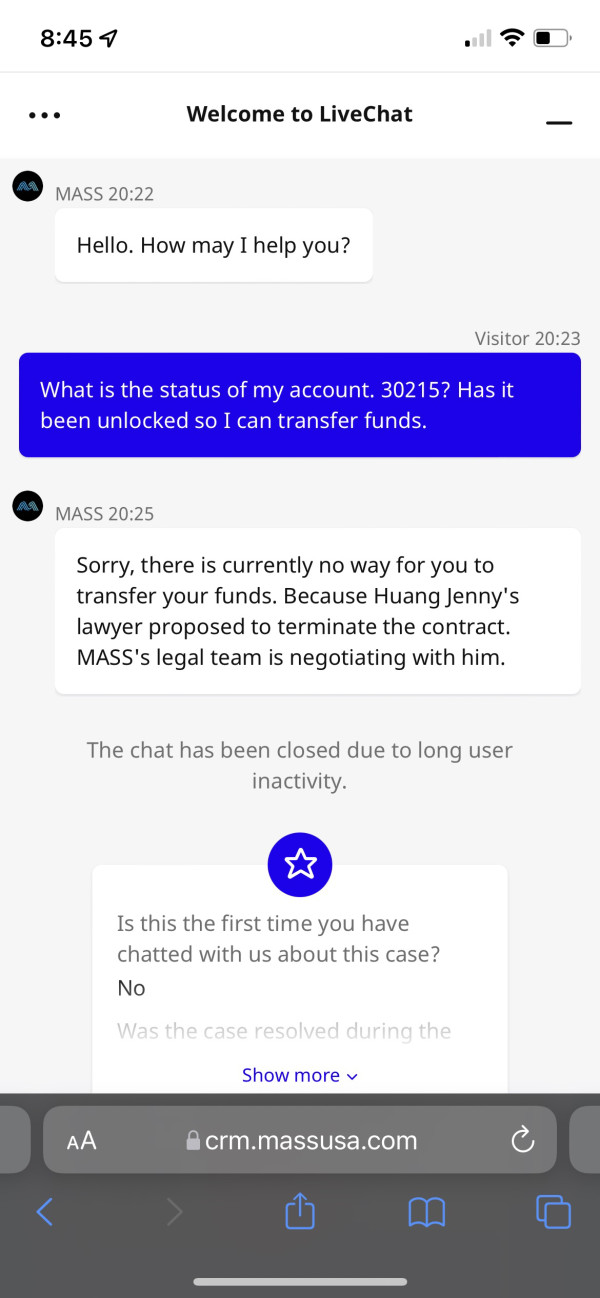

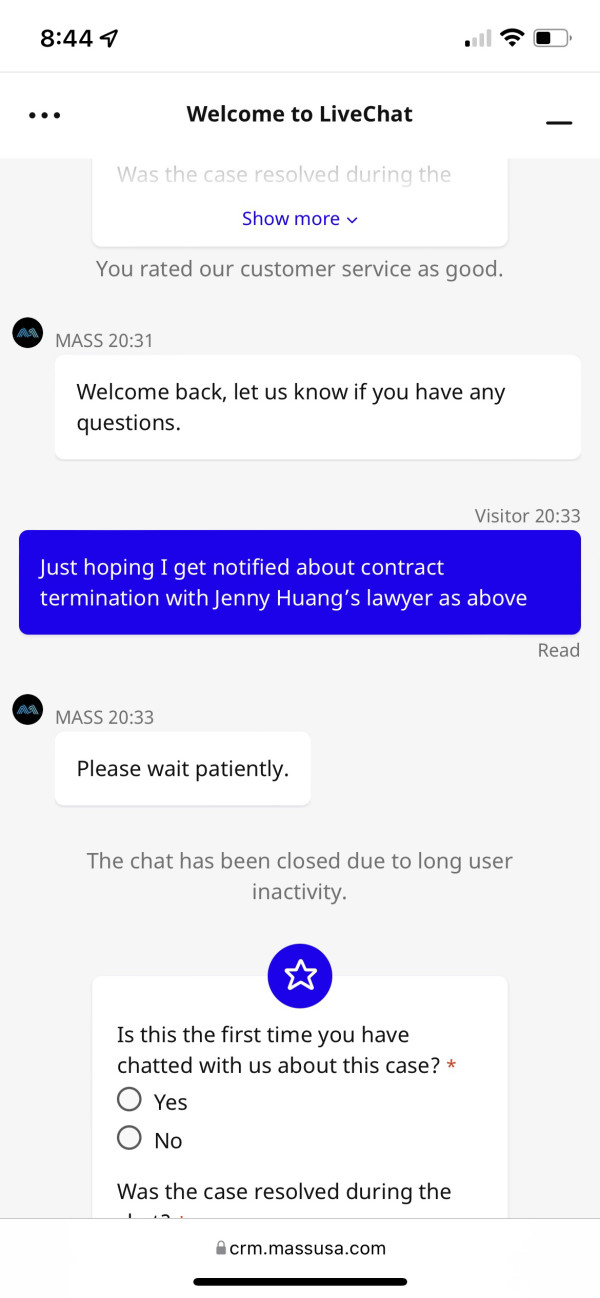

Customer service and support capabilities for Mass Broker Services are not detailed in available documentation. Essential information such as available contact channels remains unspecified in current materials. This includes phone support, live chat, email assistance, or ticketing systems.

Response times for different inquiry types are not disclosed in available sources. These times are crucial for traders needing timely assistance. Professional trading often requires immediate support for technical issues or urgent account matters, making response time guarantees an important consideration.

Service quality indicators are not provided in current documentation. Such indicators include support team expertise, problem resolution rates, or customer satisfaction metrics. Without this information, potential clients cannot assess the reliability and effectiveness of available support services.

Multilingual support capabilities are not specified in available materials. These capabilities are important for international clients. While the Massachusetts location suggests English language support, additional language options remain unclear.

Operating hours for customer support services are not detailed in current sources. This makes it difficult for potential clients to understand when assistance will be available. This information gap in our mass review highlights the need for greater transparency in support service specifications.

Trading Experience Analysis

The trading experience offered by Mass Broker Services cannot be comprehensively evaluated due to limited information in available documentation. Platform stability and execution speed are not addressed in current materials. These factors are critical for successful trading.

Professional traders require reliable technology infrastructure to execute their strategies effectively. Order execution quality is not detailed in available sources. This includes fill rates, slippage statistics, and execution speed metrics.

These technical performance indicators are essential for traders to assess whether a broker can meet their execution requirements. Platform functionality remains unspecified in current documentation. This includes order types, risk management tools, or advanced trading features.

The absence of this information makes it impossible to determine whether Mass can support sophisticated trading strategies or professional requirements. Mobile trading capabilities are not described in available materials. These capabilities are increasingly important for active traders.

Modern traders expect seamless mobile access to their accounts and trading tools, but such offerings are not detailed in current sources. The overall trading environment is not comprehensively covered in available documentation. This includes market access, pricing transparency, and trade confirmation processes.

This mass review emphasizes that these information gaps significantly impact our ability to assess the practical trading experience.

Trust and Regulation Analysis

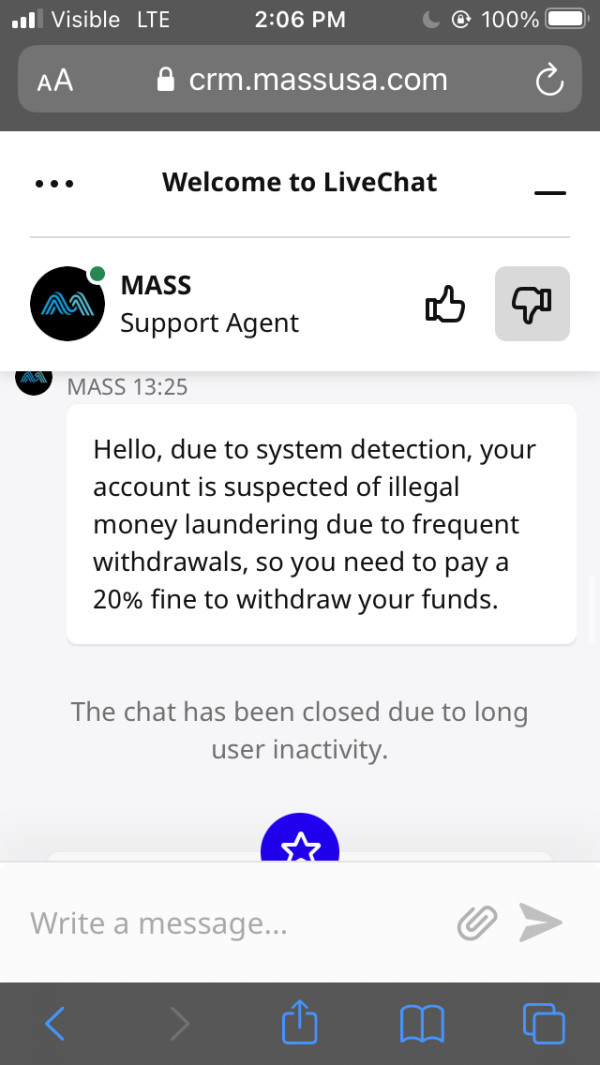

Regulatory compliance and trust factors for Mass Broker Services present significant concerns due to the absence of specific information in available documentation. Regulatory licensing details are not disclosed in current materials. These details are fundamental for establishing broker credibility.

Professional traders typically require clear regulatory oversight as a prerequisite for account opening. Fund security measures are not detailed in available sources. Such measures include segregated client accounts, deposit protection schemes, or insurance coverage.

These protections are essential for client confidence and are standard requirements in regulated jurisdictions. Company transparency is not comprehensively addressed in current documentation. This includes ownership structure, financial reporting, or operational disclosures.

This lack of transparency raises questions about corporate governance and accountability standards. Industry reputation indicators are not mentioned in available materials. Such indicators include awards, certifications, or professional memberships.

These credentials often serve as third-party validation of service quality and operational standards. The handling of negative events or disputes is not addressed in current sources. This includes complaint resolution procedures or regulatory actions.

This information gap in our mass review represents a significant concern for potential clients seeking trustworthy service providers.

User Experience Analysis

User experience evaluation for Mass Broker Services is limited by the absence of specific feedback and interface information in available documentation. Overall user satisfaction metrics are not provided in current materials. These metrics would indicate client contentment with services.

Interface design and usability aspects are not detailed in available sources. This includes platform navigation, visual design, or accessibility features. Modern traders expect intuitive and efficient user interfaces that support their trading activities.

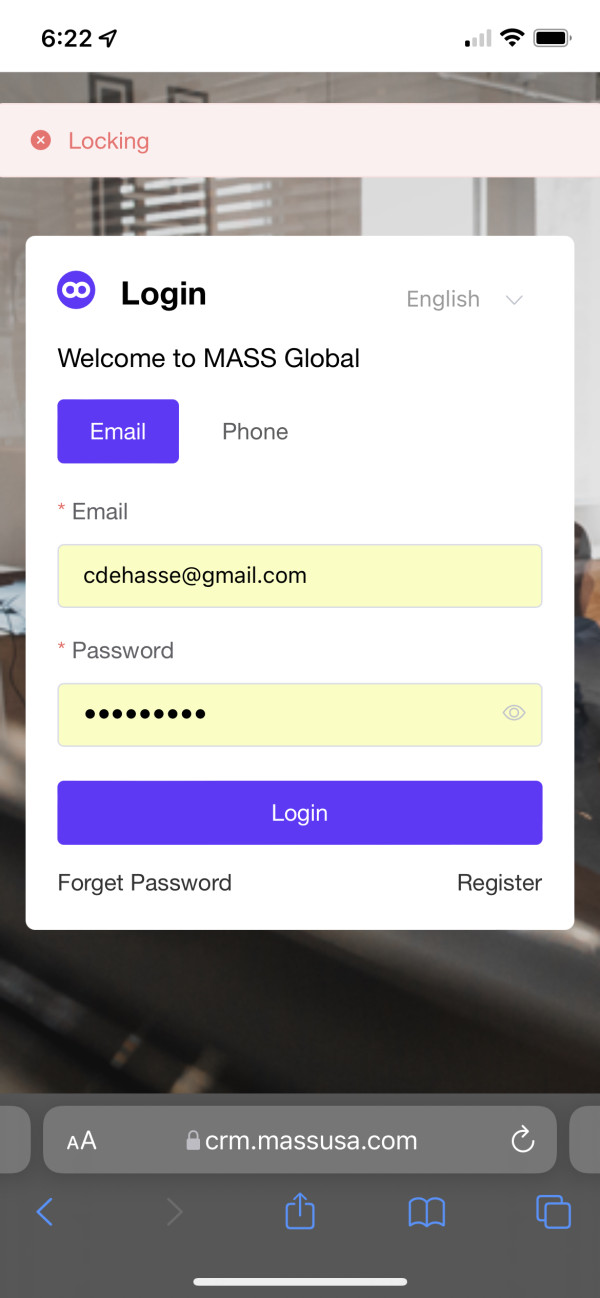

Registration and verification processes are not described in current documentation. These processes form the initial user experience. Streamlined onboarding procedures are important for positive first impressions and efficient account activation.

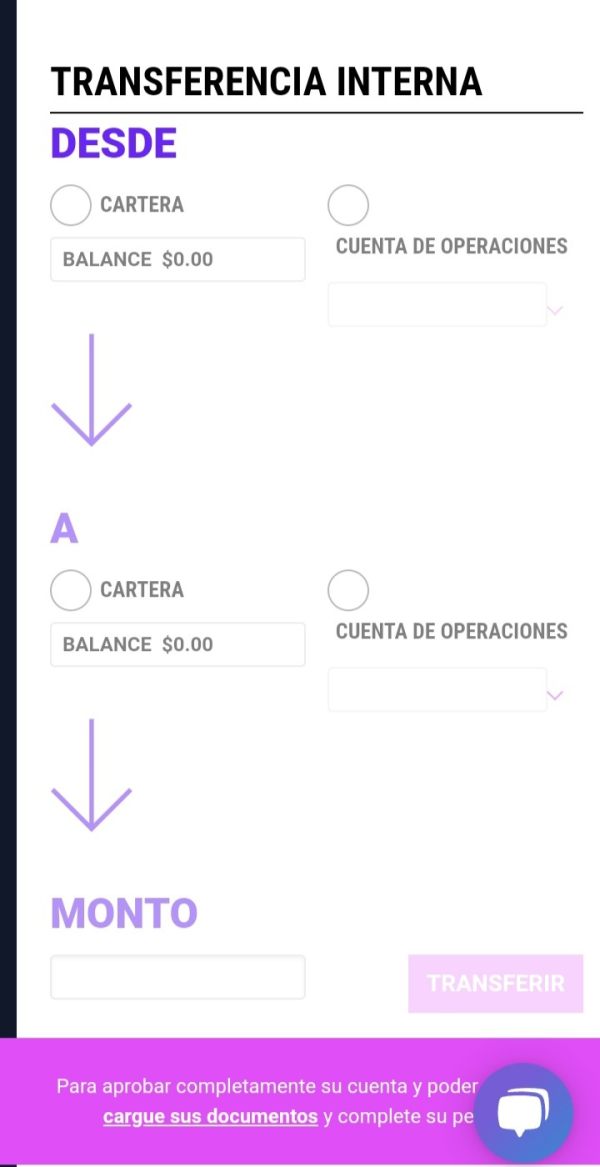

Fund operation experiences are not detailed in available materials. This includes deposit and withdrawal processes. Smooth financial transactions are essential for maintaining positive client relationships and operational efficiency.

Common user complaints or satisfaction areas are not documented in current sources. This prevents identification of potential service strengths or weaknesses. This absence of user feedback represents a significant limitation in our assessment capabilities.

Conclusion

This mass review reveals significant information gaps that prevent a comprehensive evaluation of Mass Broker Services. The limited available documentation suggests a focus on real estate brokerage rather than traditional financial market trading. This may explain the absence of standard trading information.

Mass may offer relevant expertise for real estate investors seeking property transaction services based on their stated business focus. However, traders looking for conventional forex or CFD services will find insufficient information to make informed decisions about account opening or service suitability. The primary weakness identified is the lack of transparency regarding regulatory oversight, trading conditions, and service specifications that are standard in the financial services industry.

Until more comprehensive information becomes available, potential clients should exercise caution and seek additional verification before engaging with this service provider.