Longasia 2025 Review: Everything You Need to Know

Executive Summary

Longasia is a financial services provider established in 2012. The company specializes in forex and contract for difference markets, operating from Auckland, New Zealand for over a decade while serving international clients. This comprehensive Longasia review examines the broker's performance based on available user feedback and public information.

User feedback presents a mixed picture. The company has received 4 positive reviews and 3 neutral evaluations according to available data, but concerning reports have emerged regarding withdrawal delays with some clients experiencing significant processing times for fund withdrawals. The company operates from Level 3, 60 Cook Street, Auckland Central. Clients can reach them through phone +6082-687 445 and email support@longasiagroups.com support channels.

The broker targets traders with some understanding of forex and CFD trading. It particularly appeals to those seeking diversified trading instruments, though the lack of clear regulatory information in available sources may impact user confidence and trust levels. This review aims to provide potential clients with a comprehensive analysis of Longasia's services. We highlight both strengths and areas of concern based on available evidence and user experiences.

Important Notice

Due to the limited regulatory information available about Longasia, users in different countries and regions may face varying levels of legal protection and trading environments. The absence of clearly disclosed regulatory oversight means that trader protections may differ significantly from those offered by fully regulated brokers in major financial jurisdictions.

This review is based on user feedback analysis and publicly available information. Specific trading conditions, regulatory compliance details, and comprehensive service offerings have not been fully disclosed in available sources, so potential clients should conduct additional due diligence and request detailed information directly from the broker before making trading decisions.

Rating Framework

Broker Overview

Longasia emerged in the financial services landscape in 2012. The company established its headquarters in Auckland, New Zealand, positioning itself as a financial services provider focusing on forex and contract for difference markets while aiming to serve traders seeking exposure to these popular financial instruments. With over a decade of operation, Longasia has built a presence in the competitive online trading sector.

The company's business model centers on providing access to forex and CFD trading opportunities for global investors. Operating from New Zealand, Longasia uses its geographic position to serve clients across different time zones, though specific details about its global reach and client distribution remain limited in available sources. The broker's longevity in the market suggests some level of operational stability. This must be weighed against other factors examined in this Longasia review.

The company maintains its primary operations from Level 3, 60 Cook Street, Auckland Central. This provides a physical business address that adds to its credibility, and while the company offers forex and CFD trading services, comprehensive details about trading platforms, specific asset offerings, and regulatory compliance are not extensively detailed in publicly available information. This may concern potential clients seeking transparency.

Regulatory Status

Available sources do not provide specific information about Longasia's regulatory oversight or compliance with financial authorities. This represents a significant information gap that potential clients should address directly with the broker before engaging their services.

Deposit and Withdrawal Methods

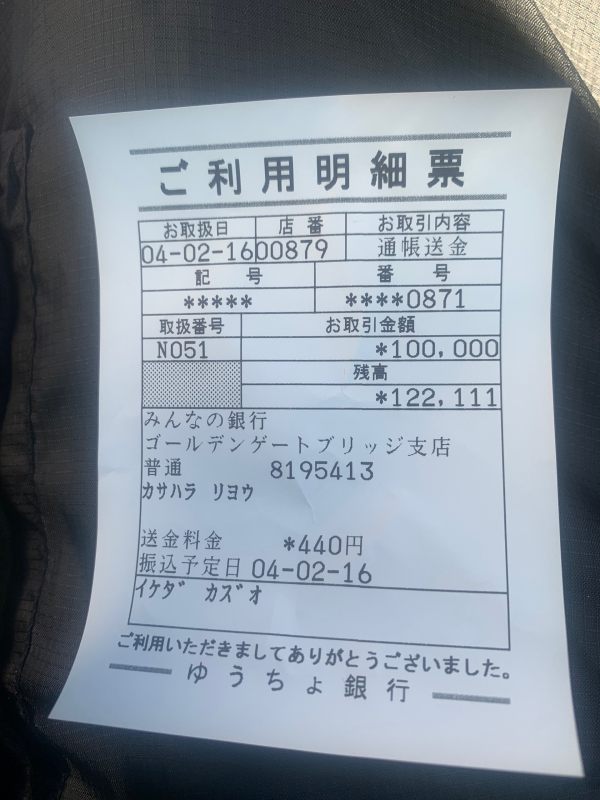

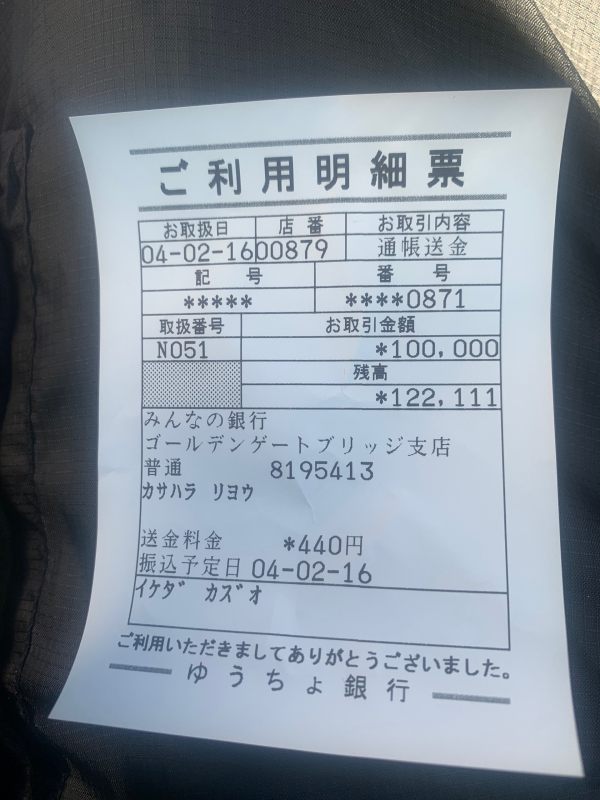

Specific information about deposit and withdrawal methods is not detailed in available sources. However, user feedback indicates concerns about withdrawal processing times. This suggests that fund withdrawal procedures may experience delays.

Minimum Deposit Requirements

Minimum deposit requirements are not specified in the available information sources reviewed for this analysis.

No specific information about promotional offers or bonus programs is mentioned in the available sources.

Tradeable Assets

Longasia provides access to forex and CFD trading markets. The broker focuses on these two primary asset classes, though specific details about the range of currency pairs, indices, commodities, or other CFD instruments available are not comprehensively detailed in available sources.

Cost Structure

Specific information about spreads, commissions, and other trading costs is not mentioned in the available sources. This makes it difficult to assess the broker's competitiveness in terms of pricing.

Leverage Ratios

Leverage ratios and maximum leverage offerings are not specified in the available information reviewed for this Longasia review.

Details about trading platforms offered by Longasia are not mentioned in the available sources.

Regional Restrictions

Information about geographical restrictions or prohibited countries is not specified in available sources.

Customer Support Languages

While contact information is available, specific language support details are not mentioned in the available sources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Longasia's account conditions faces significant limitations due to insufficient information in available sources. Account type varieties, their specific features, and associated benefits remain unclear. This makes it challenging for potential clients to understand what options may be available to them.

Minimum deposit requirements, which are crucial for trader planning, are not disclosed in the reviewed materials. This lack of transparency regarding entry-level investment requirements may deter potential clients who need to budget for their trading activities, and similarly, the account opening process, including verification procedures and timeline expectations, remains undocumented in available sources.

Special account features that many modern brokers offer, such as Islamic accounts for Sharia-compliant trading, are not mentioned. This absence of information extends to account management tools, portfolio tracking capabilities, and any tiered account structures that might provide enhanced services for higher-volume traders.

The lack of detailed account condition information represents a significant transparency gap in this Longasia review. Potential clients would need to contact the broker directly to obtain comprehensive account details. This may indicate a need for improved public disclosure of service terms and conditions.

Assessment of Longasia's trading tools and resources encounters substantial information gaps in available sources. The variety and quality of trading tools, which are essential for effective market analysis and trade execution, are not detailed in the reviewed materials.

Research and analysis resources, including market commentary, economic calendars, and technical analysis tools, are not mentioned in available sources. These resources are typically crucial for traders making informed decisions, and their absence from public information raises questions about the comprehensiveness of the broker's service offering.

Educational resources, which are particularly important for developing traders, are not referenced in available materials. Modern brokers often provide webinars, tutorials, market analysis, and educational content to support client development, but such offerings are not documented for Longasia.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, remains unspecified. This information gap affects traders who rely on automated strategies or seek to implement systematic trading approaches through the platform.

Customer Service and Support Analysis

Customer service evaluation reveals mixed results based on available user feedback and contact information. Longasia provides multiple contact channels, including phone support +6082-687 445 and email communication support@longasiagroups.com, indicating basic accessibility for client inquiries.

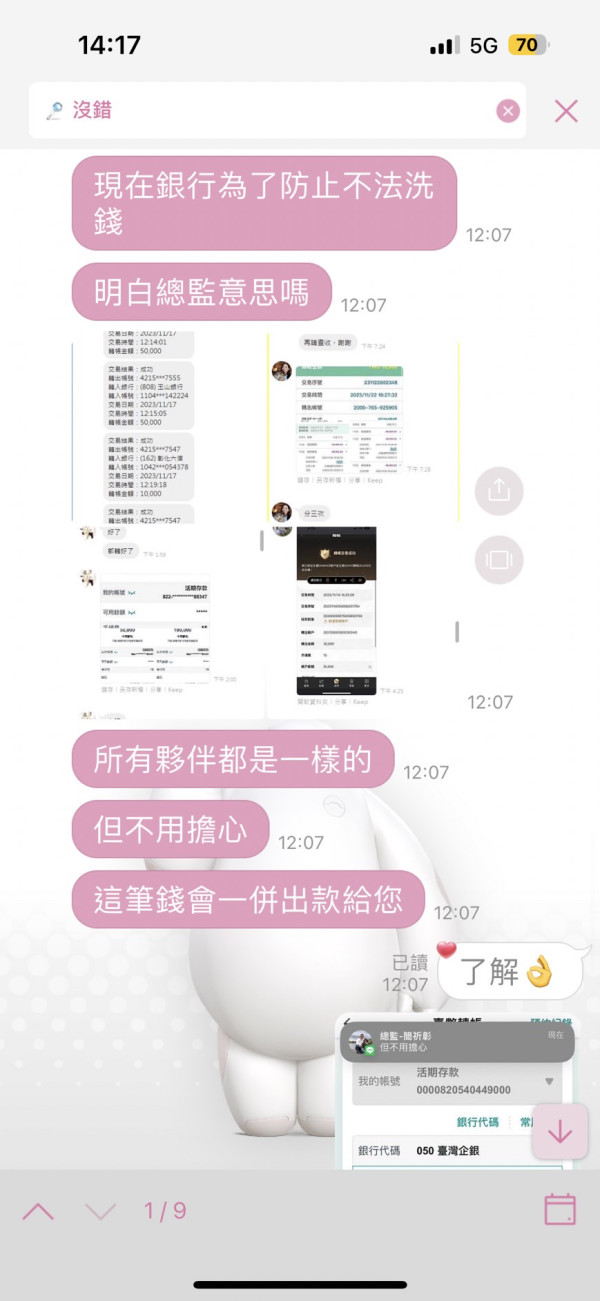

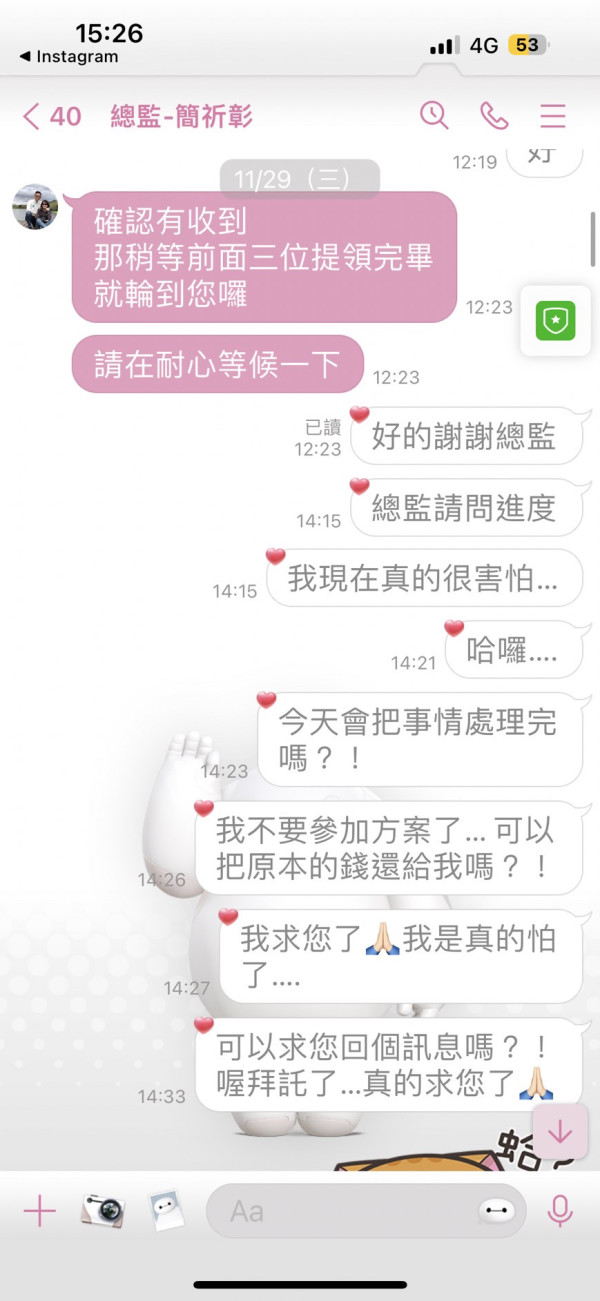

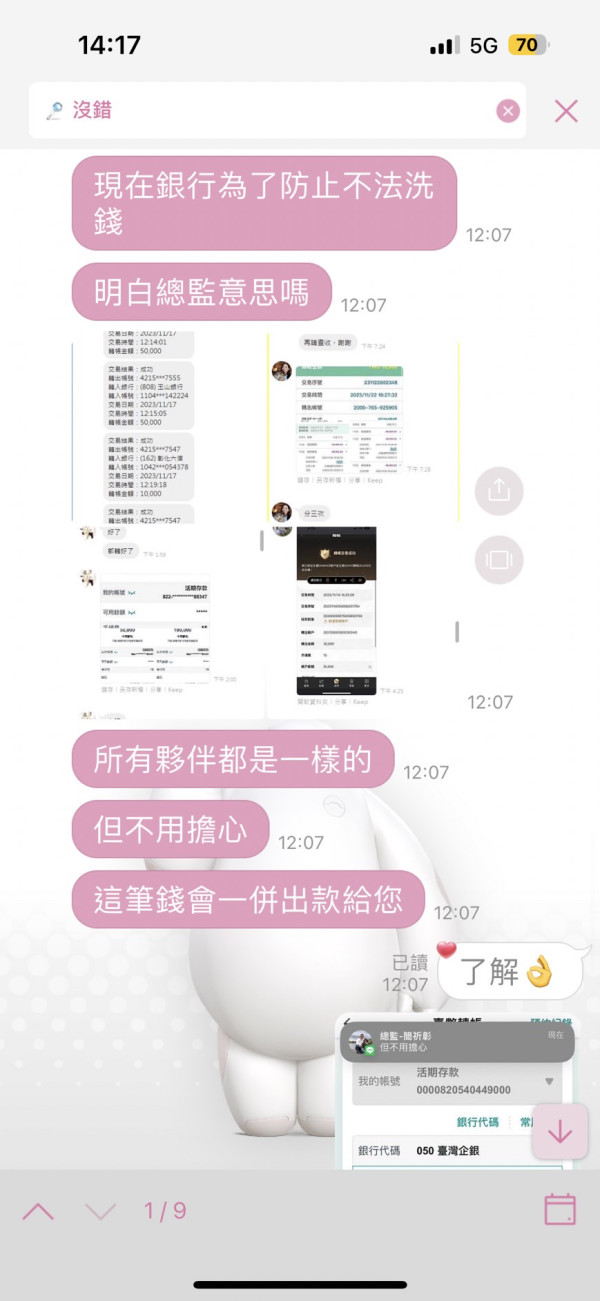

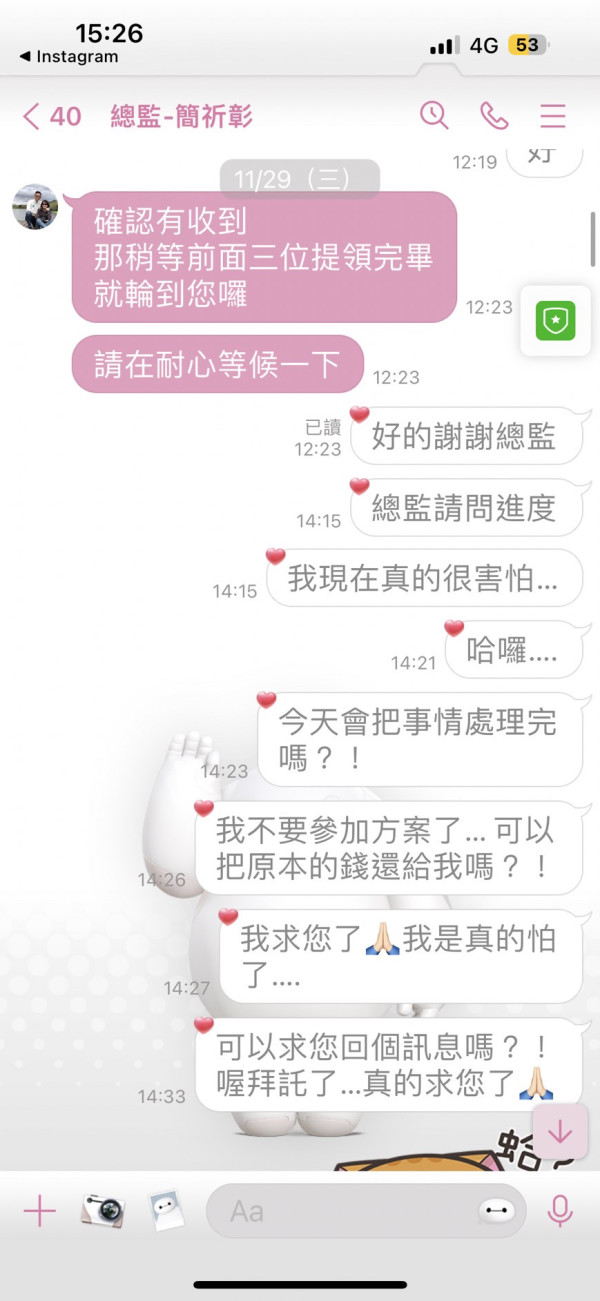

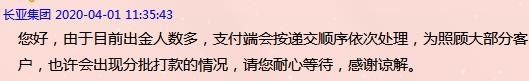

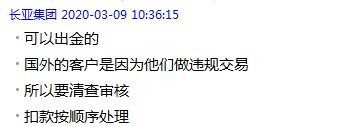

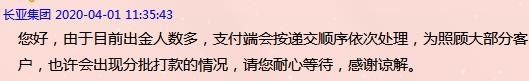

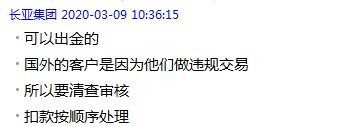

However, user feedback presents concerning patterns regarding service quality and responsiveness. Specific complaints about withdrawal delays have emerged, with one documented case showing a withdrawal request from November 27, 2023, that remained unprocessed for an extended period despite the company's stated 3-day processing timeframe.

Response time performance appears inconsistent based on available feedback. While the broker maintains communication channels, the effectiveness of problem resolution, particularly regarding financial transactions, shows room for improvement, and the withdrawal delay complaints suggest potential operational challenges that may affect overall client satisfaction.

Multilingual support capabilities are not specified in available sources, which may limit accessibility for international clients. Additionally, customer service hours and availability across different time zones remain undocumented. This makes it difficult for potential clients to understand when support will be accessible.

Trading Experience Analysis

Evaluation of the trading experience at Longasia faces significant information limitations in available sources. Platform stability and execution speed, which are fundamental to successful trading operations, are not documented through user feedback or technical specifications in the reviewed materials.

Order execution quality, including fill rates, slippage characteristics, and rejection rates, remains unspecified. These factors are crucial for traders, particularly those employing short-term strategies or trading during volatile market conditions, and the absence of such information makes it difficult to assess the broker's technical capabilities.

Platform functionality completeness, including charting capabilities, order types, and analytical tools, is not detailed in available sources. Modern trading platforms typically offer comprehensive feature sets, but Longasia's specific platform capabilities are not publicly documented in the reviewed materials.

Mobile trading experience, which has become increasingly important for active traders, is not mentioned in available sources. This includes mobile app availability, functionality, and user interface quality, and the lack of mobile trading information may concern traders who require on-the-go market access.

This Longasia review finds insufficient publicly available information to thoroughly assess the trading experience. This highlights the need for greater transparency in technical specifications and user experience documentation.

Trust and Reliability Analysis

Trust and reliability assessment reveals significant concerns due to limited transparency in key areas. The absence of clearly disclosed regulatory information in available sources represents a major trust factor that potential clients must consider carefully.

Regulatory oversight provides crucial protection for traders, including fund segregation requirements, compensation schemes, and operational standards. The lack of specific regulatory details in available sources suggests that clients may not have access to traditional regulatory protections available with fully licensed brokers in major jurisdictions.

Fund security measures, including client money segregation, bank partnerships, and insurance coverage, are not detailed in available sources. This information gap is particularly concerning given user reports of withdrawal delays, which may indicate operational or liquidity challenges.

Company transparency regarding ownership, financial statements, and business operations appears limited based on available public information. While the company provides a physical address in Auckland, comprehensive corporate disclosure that would enhance trust and credibility is not readily available.

Negative event handling, particularly the withdrawal delay complaints, suggests potential weaknesses in operational management and client communication. The documented case of extended withdrawal processing times raises questions about the company's financial management and client service priorities.

User Experience Analysis

User experience evaluation based on available feedback shows a mixed picture with both positive elements and areas of concern. Overall user satisfaction appears moderate, with 4 positive reviews and 3 neutral evaluations providing a balanced but limited sample of client experiences.

Interface design and usability details are not mentioned in available sources, making it difficult to assess the quality of user interaction with the broker's platforms and services. Modern trading environments require intuitive interfaces and efficient navigation, but these aspects remain undocumented.

Registration and verification processes are not detailed in available sources, though these procedures significantly impact initial user experience. Streamlined onboarding processes are essential for user satisfaction, but Longasia's approach to client acquisition and verification remains unclear.

Fund operation experience shows concerning patterns based on user feedback. Withdrawal delays represent a significant negative impact on user experience, with documented cases showing processing times exceeding stated timeframes, and this issue directly affects client confidence and satisfaction with the service.

Common user complaints center primarily on withdrawal processing delays, which appears to be a recurring theme rather than isolated incidents. The consistency of this complaint type suggests systematic issues that may require operational improvements to enhance overall user experience.

Conclusion

This comprehensive Longasia review reveals a broker with over a decade of operational history but significant transparency challenges that potential clients should carefully consider. While the company offers forex and CFD trading services from its New Zealand base, the lack of detailed regulatory information and documented withdrawal processing issues present notable concerns.

The broker appears most suitable for experienced traders who understand forex and CFD markets and can conduct thorough due diligence independently. However, traders seeking comprehensive regulatory protection and transparent operational procedures may find better alternatives in the competitive broker landscape.

Key advantages include the company's operational longevity and diversified trading product focus on forex and CFDs. However, significant disadvantages include the absence of clear regulatory oversight information, documented withdrawal delay issues, and limited transparency regarding trading conditions and service specifications, so potential clients should request detailed information directly from the broker and carefully evaluate these factors against their individual trading requirements and risk tolerance.