Regarding the legitimacy of Longasia forex brokers, it provides ICDX, MAS and WikiBit, .

Is Longasia safe?

Pros

Cons

Is Longasia markets regulated?

The regulatory license is the strongest proof.

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

A-Longasia Liquidity Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

LONG ASIA CAPITAL PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.longasiacapital.comExpiration Time:

--Address of Licensed Institution:

1 KIM SENG PROMENADE #15-02 GREAT WORLD CITY EAST TOWER 237994Phone Number of Licensed Institution:

65-6235 2160Licensed Institution Certified Documents:

Is Longasia Safe or a Scam?

Introduction

Longasia is a forex brokerage that positions itself as a global trading platform, offering a variety of financial instruments including forex, CFDs, commodities, and cryptocurrencies. Established in 2017, it claims to cater to both retail and institutional traders. However, the online trading environment is fraught with risks, making it imperative for traders to conduct thorough due diligence before engaging with any broker. Evaluating the legitimacy and safety of a broker like Longasia involves examining its regulatory status, company background, trading conditions, customer experiences, and security measures. This article aims to provide an objective analysis of Longasia, drawing on multiple sources to assess whether it is safe for trading or if it exhibits characteristics typical of a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant factors influencing its credibility. Longasia claims to operate under various licenses, but scrutiny reveals inconsistencies and potential red flags. The following table summarizes the regulatory information available for Longasia:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Service Providers Register (FSPR) | 241165 | Singapore | Revoked |

| Monetary Authority of Singapore (MAS) | N/A | Singapore | No valid license |

| Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) | N/A | Canada | Regulated |

The absence of a valid license from recognized authorities such as the MAS raises concerns about the broker's legitimacy. Furthermore, the revocation of its FSPR license indicates a lack of compliance with regulatory standards. This lack of oversight can expose traders to significant risks, as unregulated brokers are not obligated to adhere to the same standards of transparency and security that regulated entities must follow.

Company Background Investigation

Longasia's corporate history reveals a complex structure that raises questions about its ownership and operational integrity. The company is reported to be based in Singapore but claims affiliations with entities in New Zealand and Indonesia. The management teams background is also crucial in assessing its legitimacy. However, information regarding the team's qualifications and experience is sparse, leading to concerns about transparency.

The broker's website presents a professional image, but the lack of detailed information about its management and ownership structure is disconcerting. Transparency in a broker's operations is essential for building trust with clients; without it, potential investors may feel apprehensive about the safety of their funds. This lack of clarity further complicates the question of whether Longasia is safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by Longasia is vital for evaluating its overall cost structure and potential hidden fees. The broker promotes competitive spreads and flexible leverage options, but the absence of clarity around fees may be a cause for concern. The following table outlines the core trading costs associated with Longasia:

| Fee Type | Longasia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.0 - 1.2 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies significantly |

While Longasia offers attractive leverage of up to 1:200, traders should be cautious as high leverage can amplify both profits and losses. The spread for major currency pairs is higher than the industry average, which could indicate that trading costs may be inflated compared to other brokers. The lack of transparency regarding commissions and overnight interest fees is a significant red flag, suggesting that traders may encounter unexpected costs.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. Longasia claims to implement various measures to protect client funds, including segregated accounts and risk management protocols. However, the effectiveness of these measures is questionable given its regulatory status. The lack of a valid license means that there are no mandatory requirements for fund protection, which could leave traders vulnerable.

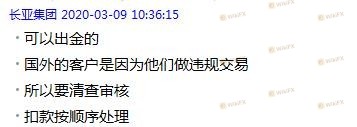

Moreover, there have been numerous complaints regarding withdrawal issues, indicating that clients have struggled to access their funds. Historical data reveals that many users have reported being unable to withdraw their money, raising serious concerns about the brokers operational integrity. This situation underscores the importance of assessing whether Longasia is safe for trading.

Customer Experience and Complaints

Customer feedback is crucial in evaluating the reliability of any broker. Longasia has received a significant number of negative reviews, particularly concerning withdrawal difficulties. The following table summarizes the main types of complaints received from users:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor or no response |

| Lack of Customer Support | Medium | Slow or ineffective |

| Misleading Information | High | No clarification provided |

Many traders have reported waiting months for their withdrawal requests to be processed, while others claim their accounts were blocked without explanation. These complaints highlight a concerning pattern that suggests Longasia may not prioritize customer service or transparency. Such issues are critical indicators of whether Longasia is safe for trading.

Platform and Trade Execution

Longasia offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, the performance of the platform, including order execution speed and reliability, is essential for a positive trading experience. Reports from users indicate that there may be issues with slippage and order rejections, which could hinder effective trading.

The quality of trade execution is a critical factor for traders, as delays or rejections can lead to significant losses. If Longasia shows signs of manipulating trades or failing to execute orders as promised, it raises further suspicion about its operations and safety.

Risk Assessment

Using Longasia involves various risks that potential traders should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation and revoked licenses. |

| Financial Risk | High | Inconsistent trading conditions and withdrawal issues. |

| Operational Risk | Medium | Complaints about customer service and platform reliability. |

Traders are advised to approach Longasia with caution, considering the high-risk levels associated with its operations. Implementing risk management strategies, such as setting strict limits on investment and only trading with funds that one can afford to lose, is crucial for mitigating potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Longasia presents several red flags that warrant caution. Its lack of valid regulation, numerous customer complaints, and questionable operational practices raise significant concerns about its legitimacy. Therefore, it cannot be confidently stated that Longasia is safe for trading.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternatives that are well-regulated and have positive reputations in the industry. Brokers such as FXCM, IG, and OANDA are recommended as safer options, providing robust regulatory frameworks and better customer support.

Ultimately, the decision to trade with Longasia should be approached with careful consideration of the risks involved. Traders must prioritize their financial security and be vigilant in selecting a broker that aligns with their trading needs and risk tolerance.

Is Longasia a scam, or is it legit?

The latest exposure and evaluation content of Longasia brokers.

Longasia Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Longasia latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.