LME Review 1

The data does not accumulate. My investment of $1000 is not reflected in the account. This means that I cannot operate yet, and they even tell me that they are going to close their company because they are going bankrupt

LME Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The data does not accumulate. My investment of $1000 is not reflected in the account. This means that I cannot operate yet, and they even tell me that they are going to close their company because they are going bankrupt

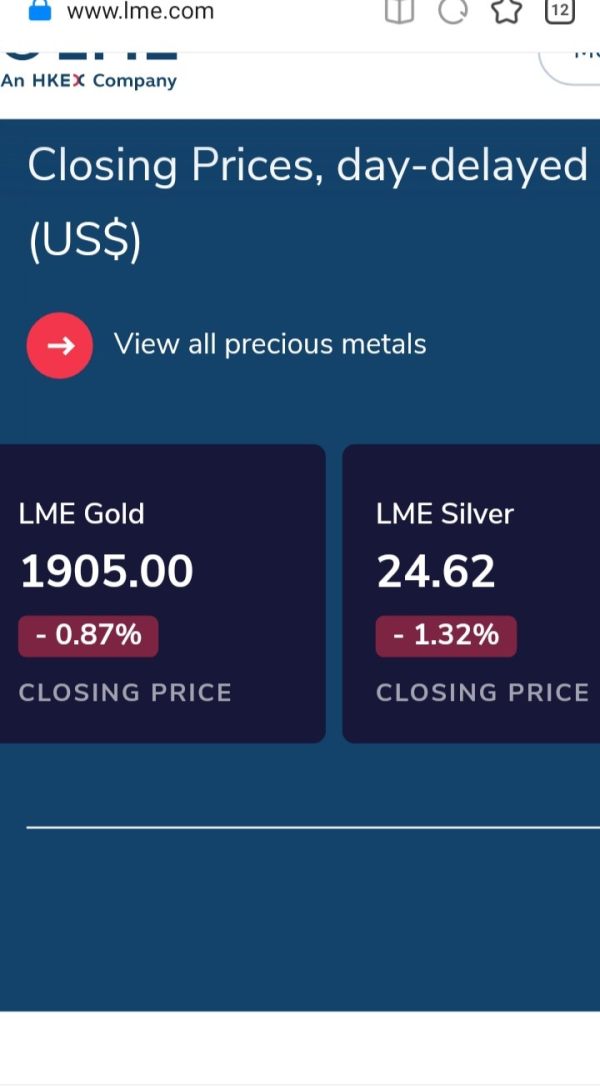

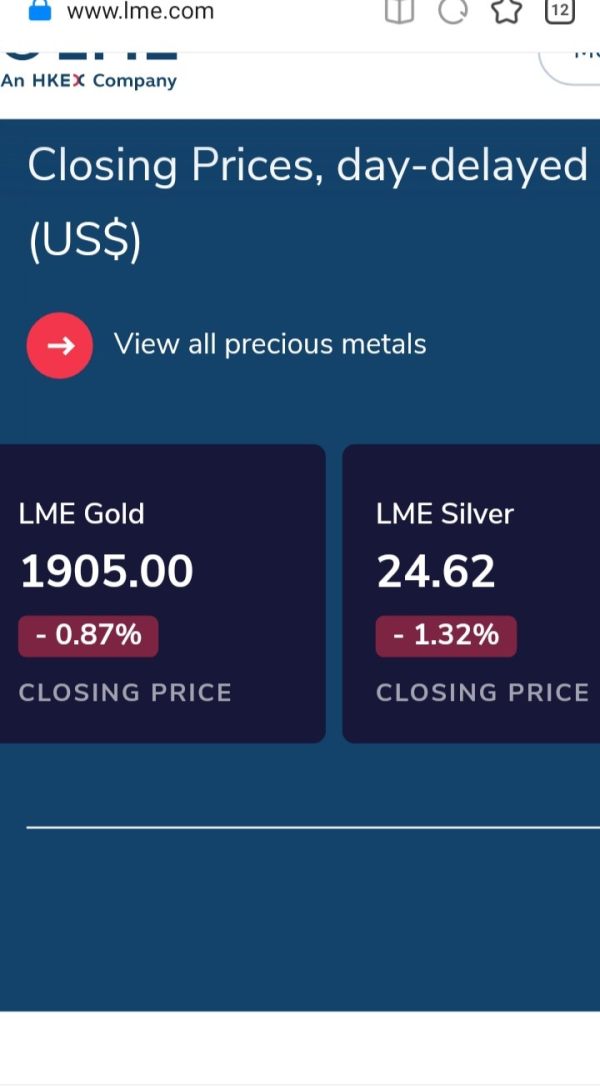

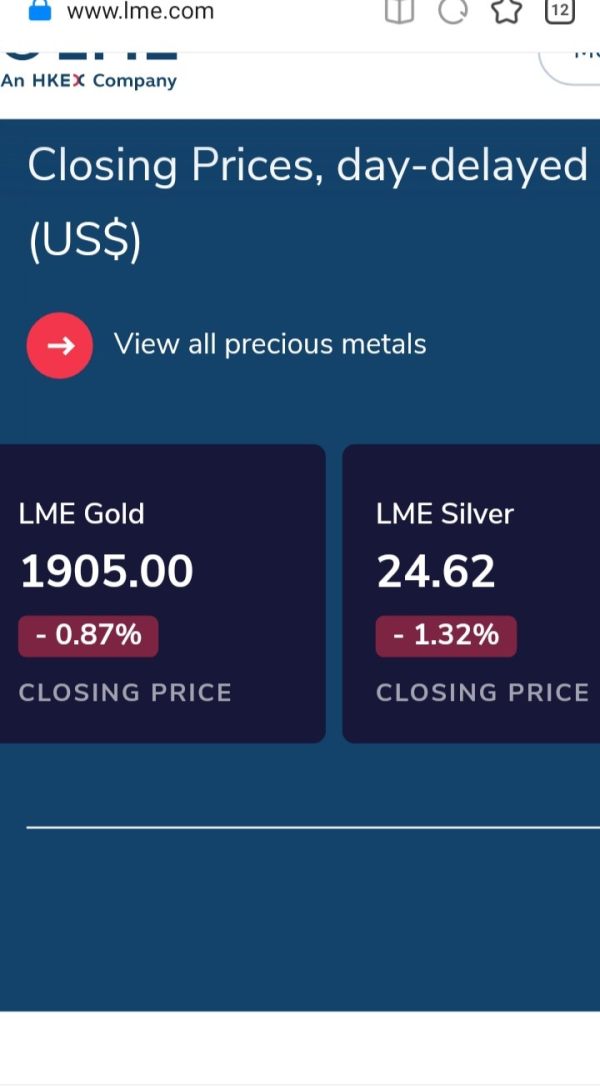

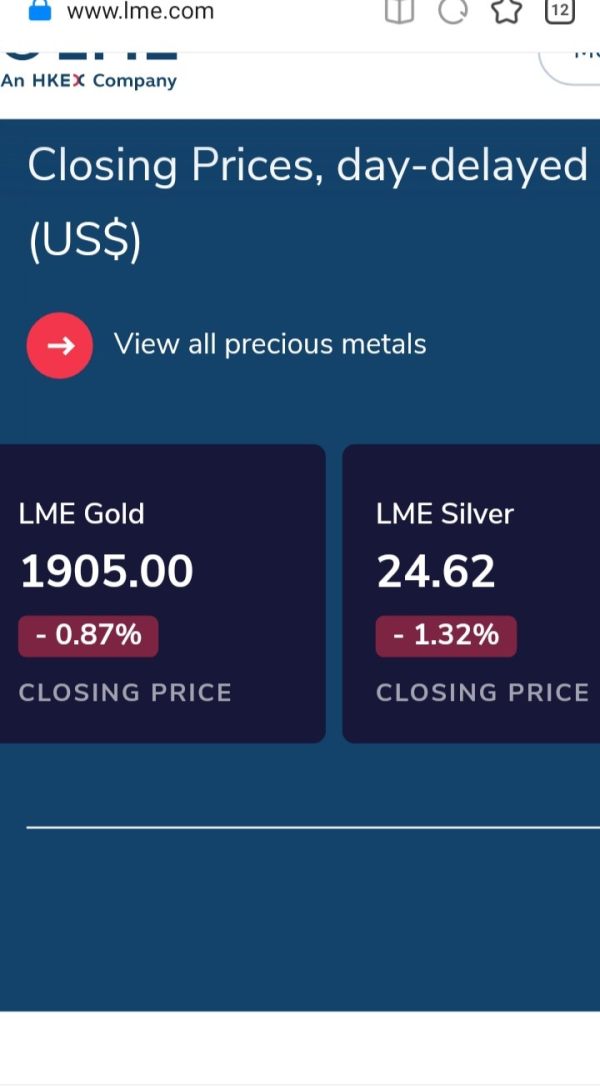

The London Metal Exchange stands as the world's top center for industrial metals trading. It offers participants 24-hour trading opportunities across global markets. This comprehensive lme review examines the exchange's position as the only dedicated metals futures marketplace globally, serving both physical industry participants and the financial community. Following the 2022 nickel market disruption, LME commissioned Oliver Wyman to conduct an independent review aimed at strengthening market rules and supervision frameworks.

LME's unique positioning in the commodities landscape makes it an essential venue for traders seeking exposure to industrial metals markets. The exchange brings together diverse participants including producers, consumers, and financial institutions, creating a robust marketplace where price discovery occurs continuously. However, recent market events have highlighted the need for enhanced regulatory oversight and risk management protocols.

The exchange primarily serves sophisticated institutional participants and professional traders who require access to metals futures contracts. While LME maintains its status as a global standard-setter for metals trading, potential users should carefully evaluate the exchange's evolving regulatory environment and operational changes following the independent review recommendations.

This lme review focuses on LME as a commodities exchange operating primarily in international markets. Users should understand that as a specialized metals exchange, LME operates under different regulatory frameworks compared to traditional forex brokers. Cross-jurisdictional trading rules and regulatory requirements may vary significantly depending on the user's location and the specific LME member or broker through which they access the market.

This evaluation is based on publicly available information about LME's operations, market structure, and recent developments including the independent review process. The assessment reflects the exchange's current status and may not capture all operational nuances or recent changes to trading protocols.

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available sources |

| Tools and Resources | 8/10 | 24-hour trading opportunities with comprehensive metals coverage |

| Customer Service | N/A | Customer service specifics not detailed in available sources |

| Trading Experience | 7/10 | Established global trading center with continuous market access |

| Trust and Regulation | 6/10 | Independent review indicates areas requiring enhanced supervision |

| User Experience | N/A | User experience details not specified in available sources |

The London Metal Exchange represents a cornerstone institution in global commodities trading. It is headquartered in London and serves as the world's central hub for industrial metals transactions. According to available information, LME operates as a specialized exchange bringing together participants from the physical metals industry alongside financial community members, creating what the exchange describes as "a vital, robust and regulated market where there is always a buyer or seller."

LME's business model centers exclusively on metals futures trading. This distinguishes it from diversified exchanges that offer multiple asset classes. The exchange facilitates continuous price discovery and risk transfer opportunities, operating 24 hours a day to accommodate global market participants across different time zones. This operational model has established LME as the global standard-setter for metals pricing and trading protocols.

The exchange underwent significant scrutiny following market disruptions in 2022, particularly related to nickel trading. In response, LME selected Oliver Wyman to conduct an independent review of its market rules and supervision frameworks. This review process demonstrates the exchange's commitment to addressing operational challenges while maintaining its position as the premier metals trading venue globally.

Regulatory Framework: Specific regulatory authority information is not detailed in available sources. However, LME operates under UK-based oversight as a London-headquartered exchange.

Deposit and Withdrawal Methods: Available sources do not specify particular deposit and withdrawal mechanisms, as these typically vary by LME member firm or broker.

Minimum Deposit Requirements: Minimum deposit information is not detailed in available sources. It would depend on individual member firm requirements.

Promotional Offers: No specific bonus or promotional information is mentioned in available sources regarding LME operations.

Tradeable Assets: LME specializes exclusively in industrial metals futures contracts. It maintains its focus as the world's only dedicated metals futures exchange.

Cost Structure: Specific fee and cost information is not detailed in available sources. Trading costs typically depend on the member firm or broker used to access LME markets.

Leverage Ratios: Leverage information is not specified in available sources. It would vary based on individual member firm policies and regulatory requirements.

Platform Options: Specific trading platform details are not mentioned in available sources. However, LME operates through its member network and various trading protocols.

Geographic Restrictions: Regional limitation details are not specified in available sources.

Customer Support Languages: Language support information is not detailed in available sources.

This lme review highlights the specialized nature of LME as an institutional-focused metals exchange. Many operational details depend on the specific member firm or broker used to access the market.

Account condition evaluation for LME presents unique challenges. The exchange operates through a member-based structure rather than offering direct retail accounts. Available sources do not detail specific account types, minimum deposit requirements, or account opening procedures, as these elements are typically managed by individual LME member firms or authorized brokers.

The institutional nature of LME means that account conditions vary significantly depending on the member firm through which traders access the exchange. Professional participants may have different requirements compared to smaller institutional clients, but specific details about account tiers or special account features are not available in current sources.

The absence of detailed account condition information in this lme review reflects LME's role as an exchange infrastructure rather than a direct service provider to end users. Potential participants should contact authorized LME members or brokers for specific account requirements and conditions.

LME's tools and resources center on its core strength as a 24-hour metals trading venue. It provides continuous market access across global time zones. The exchange offers comprehensive coverage of industrial metals futures, establishing itself as the definitive price discovery mechanism for the metals industry globally.

The exchange's resource framework includes educational initiatives and market information services. However, specific details about trading tools, research capabilities, or analytical resources are not detailed in available sources. LME Week and various educational programs suggest the exchange maintains educational resources for market participants.

While automated trading support and specific technical tools are not detailed in available sources, LME's institutional focus implies sophisticated trading infrastructure designed for professional participants. The exchange's role in bringing together physical industry participants and financial community members suggests comprehensive market data and analysis capabilities, though specific tool details require further investigation through member firms.

Customer service evaluation for LME requires understanding its unique operational model. It serves as an exchange serving institutional participants through member firms. Available sources do not specify customer service channels, response times, or support quality metrics, as these services are typically provided by individual member firms rather than the exchange directly.

The exchange's institutional focus suggests that customer support operates through established member relationships and professional service channels. However, specific information about service availability, multilingual support, or customer service hours is not detailed in current sources.

Problem resolution and customer service quality would typically depend on the specific LME member or broker through which participants access the market. This structure means that customer service experiences may vary significantly based on the chosen access route to LME markets.

LME's trading experience centers on its established position as the global center for industrial metals trading. It offers continuous market access and robust price discovery mechanisms. The exchange's 24-hour operation provides flexibility for international participants, though specific platform stability and execution quality metrics are not detailed in available sources.

The exchange operates through multiple trading protocols including traditional ring trading and electronic systems. However, specific platform functionality and mobile trading capabilities are not specified in current sources. LME's institutional focus suggests sophisticated trading infrastructure designed for professional participants with complex trading requirements.

Market depth and liquidity benefit from LME's role in bringing together diverse participants from physical industry and financial sectors. However, specific technical performance data, execution speed metrics, or detailed platform features require additional investigation through authorized member firms. This lme review indicates strong institutional trading infrastructure, though retail-focused features may be limited.

Trust and regulatory assessment for LME reveals both strengths and areas of concern based on recent market developments. The exchange's long-standing position as a global metals trading center provides foundational credibility, though the 2022 independent review process highlights areas requiring enhanced supervision and regulatory oversight.

LME's selection of Oliver Wyman to conduct an independent review demonstrates transparency in addressing market disruptions and operational challenges. This review process, initiated following significant market events, indicates the exchange's commitment to strengthening market rules and supervision frameworks.

However, the need for independent review also suggests previous regulatory or operational gaps that required external assessment. While specific regulatory authority details are not provided in available sources, the review process indicates ongoing efforts to enhance trust and regulatory compliance. The exchange's response to market challenges will likely influence future trust assessments.

User experience evaluation for LME faces limitations due to the institutional nature of the exchange. There is also a lack of specific user feedback in available sources. The exchange's focus on professional participants suggests sophisticated user interfaces and workflows designed for institutional requirements rather than retail user experience optimization.

Interface design, registration processes, and fund operation experiences would typically be managed through member firms rather than directly by LME. This structure means user experiences may vary significantly based on the chosen member firm or broker for market access.

Available sources do not provide user satisfaction data, common user complaints, or specific user experience feedback. The exchange's educational initiatives and market information services suggest attention to user needs, though specific user experience metrics require additional research through member firm channels and user communities.

This comprehensive lme review reveals LME's position as a specialized institutional exchange with significant market influence in global metals trading. However, transparency limitations exist across many operational aspects. The exchange's 24-hour trading opportunities and role as the global metals pricing center represent clear advantages for professional participants seeking metals market exposure.

LME appears most suitable for institutional participants, professional traders, and sophisticated investors requiring access to industrial metals futures markets. The exchange's member-based structure means individual experiences will largely depend on the chosen access route through authorized member firms.

Key advantages include global market access, continuous trading opportunities, and established market leadership in metals pricing. Primary limitations involve transparency gaps regarding operational details, the need for enhanced supervision as indicated by the independent review, and the institutional focus that may limit accessibility for smaller participants.

FX Broker Capital Trading Markets Review