Discovery FX 2025 Review: Everything You Need to Know

Executive Summary

Discovery FX is a forex broker registered in Samoa that started operating in 2018. This discovery fx review shows major concerns about whether the company follows proper rules and can be trusted. The broker offers good trading terms including leverage up to 1:1000 and tight spreads, especially through its nano spread accounts that users like. It supports both MT4 and MT5 trading platforms, giving traders access to forex and precious metals.

Our detailed analysis shows that Discovery FX works without proper licenses from financial regulators. This creates big questions about whether it's legitimate and if client money is protected safely. Traders who want high leverage and low costs might find the broker appealing, but the lack of oversight and mixed customer service reviews are warning signs. The minimum deposit of $200 makes it easy for regular traders to start, but potential clients should think carefully about the regulatory risks before putting money in.

Important Disclaimers

Regional Entity Differences: Discovery FX is registered in Samoa, and investors should be very careful because this area doesn't have strong regulatory oversight. The rules in Samoa give much less investor protection than major financial centers, and traders should know that standard compensation programs may not exist.

Review Methodology: This review uses detailed analysis of user feedback, market research, public company information, and industry comparisons. All assessments show conditions as of early 2025 and may change as the broker's operations develop.

Overall Rating Framework

Broker Overview

Discovery FX started in 2018 as a forex broker registered in Samoa, with its main office reportedly in Hong Kong. The company says it provides complete financial trading services, focusing mainly on forex and CFD trading for clients worldwide. Even though it's new to the market, the broker has tried to build a presence in the competitive forex industry by offering attractive trading terms and popular platform choices.

The brokerage uses a business model that focuses on competitive spreads and high leverage ratios. It targets traders who care most about cost-effective trading conditions. Discovery FX offers both MT4 and MT5 trading platforms, providing access to multiple asset types including foreign exchange pairs and precious metals. However, the company's regulatory status is a major concern because it lacks licenses from recognized financial authorities. This greatly hurts its credibility in the international forex market, and this discovery fx review aims to help traders understand both the opportunities and risks with this broker.

Regulatory Jurisdiction: Discovery FX operates under Samoa registration, which gives very little regulatory oversight compared to major financial centers. The lack of licenses from established regulators like FCA, ASIC, or CySEC represents a major compliance problem.

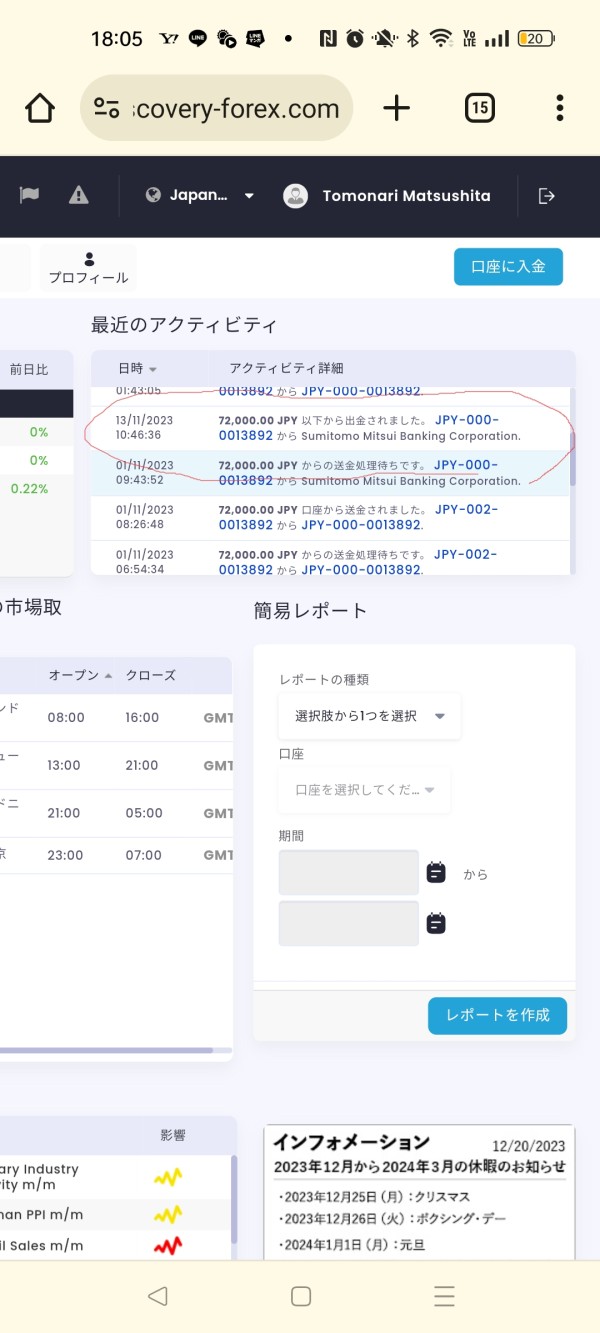

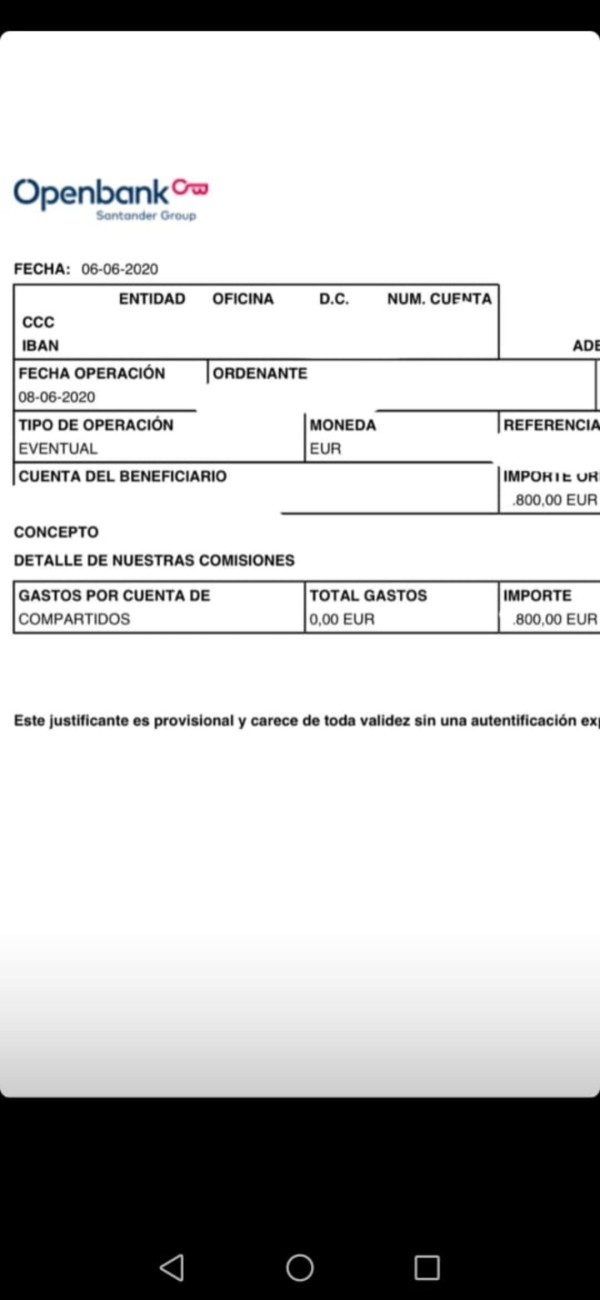

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not clearly detailed in available documents, though the broker accepts a minimum deposit of $200 for opening accounts.

Minimum Deposit Requirements: The broker requires a $200 minimum deposit, which makes it competitive for entry-level traders who want access to forex markets.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not well documented in available broker materials.

Available Trading Assets: The platform gives access to forex currency pairs and precious metals trading, though the complete asset list needs clarification from the broker directly.

Cost Structure: Discovery FX advertises competitive spreads, especially through its nano spread account option, though detailed commission schedules and fee structures need verification through direct broker contact.

Leverage Ratios: Maximum leverage reaches 1:1000, which appeals to traders seeking amplified market exposure, though such high leverage carries substantial risk.

Platform Options: Both MT4 and MT5 platforms are supported, giving traders industry-standard tools and functionality.

Geographic Restrictions: Specific country restrictions are not clearly outlined in available documentation.

Customer Support Languages: Supported languages for customer service are not well detailed in current materials, and this discovery fx review emphasizes the need for clearer communication about service availability.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Discovery FX offers multiple account types including standard and nano spread options. However, the broker's documents lack complete commission information that traders need for smart decision-making. The $200 minimum deposit requirement matches industry standards for retail brokers and provides reasonable access for beginning traders, but the lack of detailed fee structures and account feature comparisons limits transparency.

The nano spread accounts have received positive user feedback, suggesting competitive pricing for active traders. Yet, the missing information about Islamic accounts, VIP tiers, or specialized trading conditions represents a big gap in account diversity. The account opening process details are not thoroughly documented, which may create uncertainty for potential clients.

When compared to established brokers, Discovery FX's account conditions appear competitive on basic metrics but lack the complete disclosure and variety typically expected from reputable firms. This discovery fx review identifies the need for better transparency in account terms and conditions to better serve trader needs.

The broker's platform offering shows strength through its support of both MT4 and MT5 trading systems. This provides traders with industry-standard tools and functionality. These platforms offer complete technical analysis capabilities, automated trading support through Expert Advisors, and signal services that improve trading efficiency, and user feedback particularly highlights how well the MT5 platform works.

However, research and analytical resources appear limited based on available information. There's no clear sign of market analysis, economic calendars, or educational materials. The lack of proprietary tools or advanced research capabilities may hurt traders who rely on complete market intelligence for decision-making.

While the core trading infrastructure receives positive user evaluation, the overall tools and resources package lacks the depth typically provided by established brokers. Better research offerings and educational content would significantly improve the broker's value for traders seeking complete market support.

Customer Service and Support Analysis (5/10)

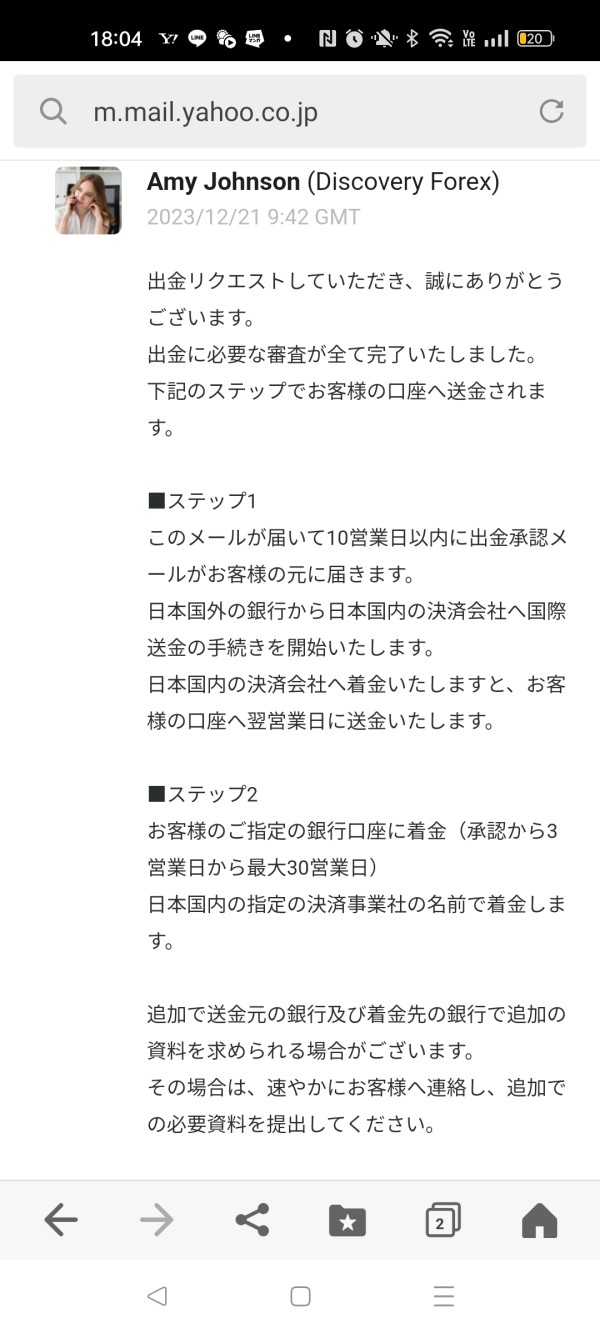

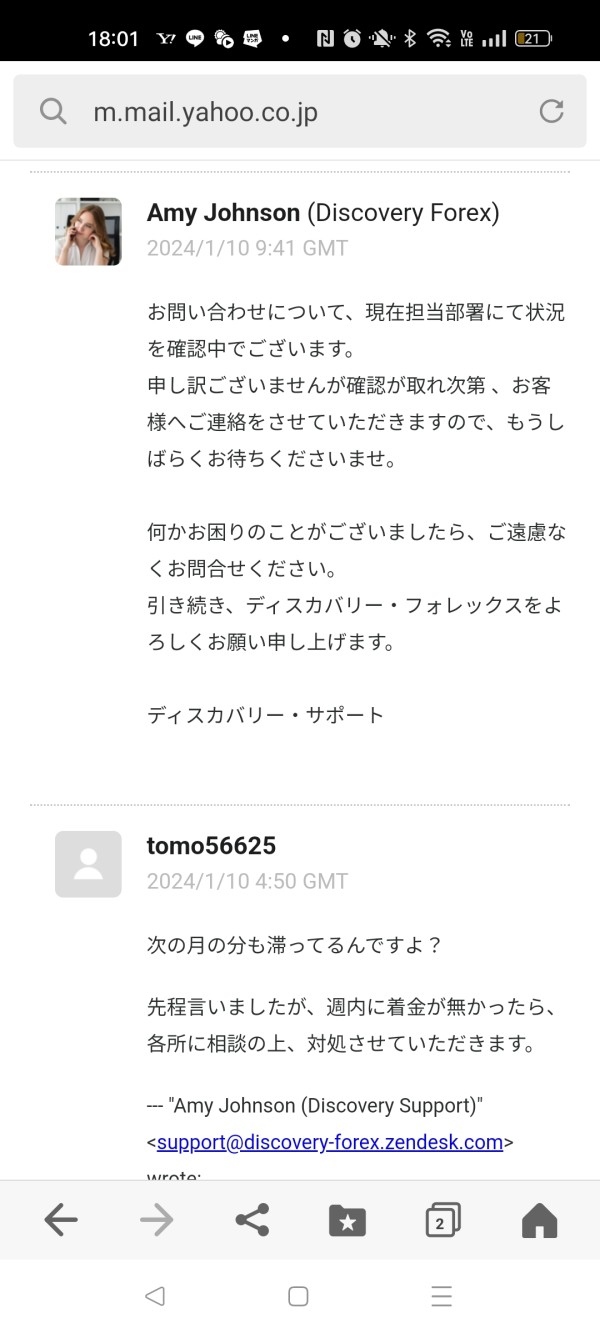

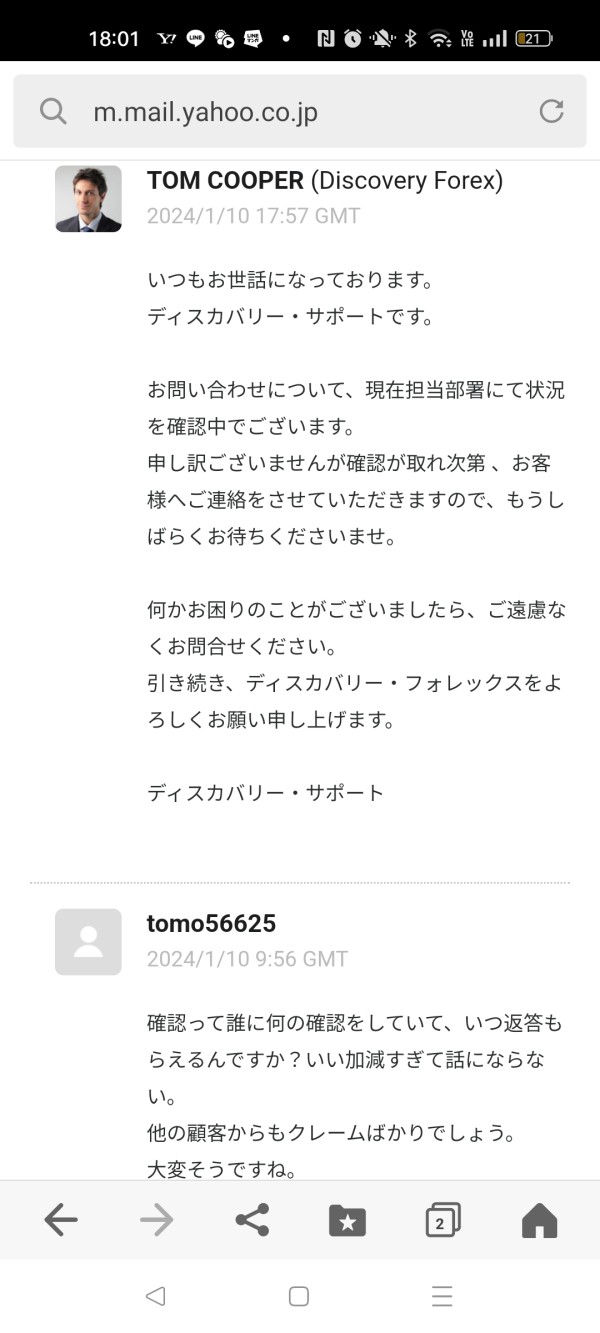

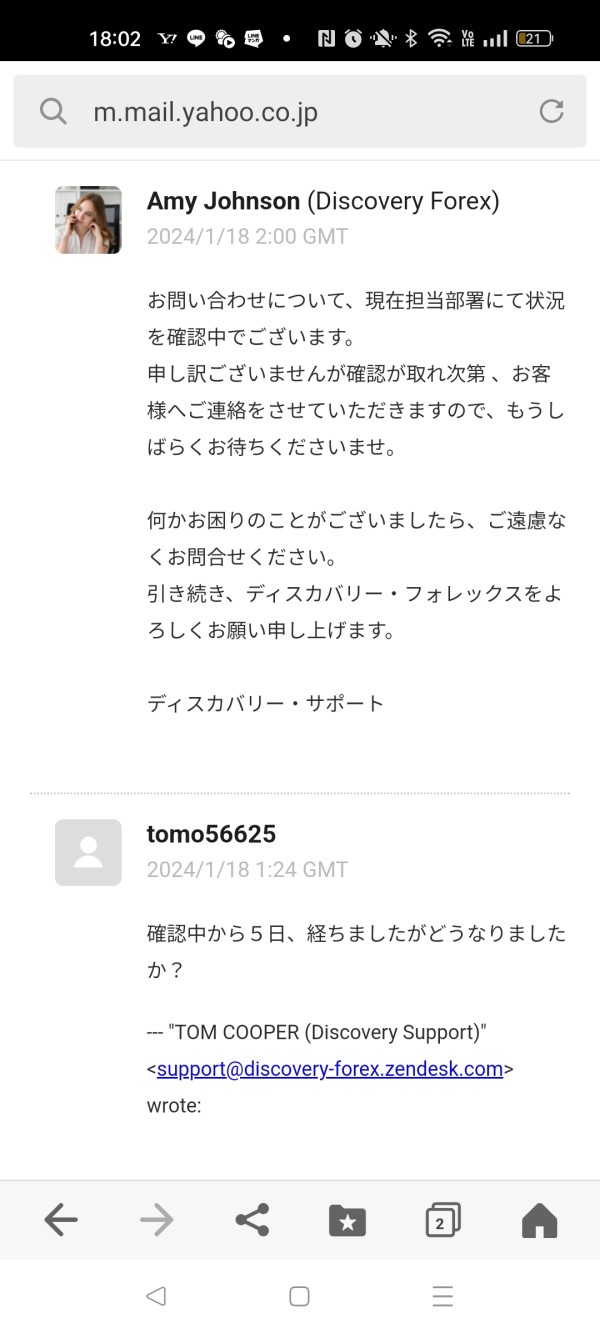

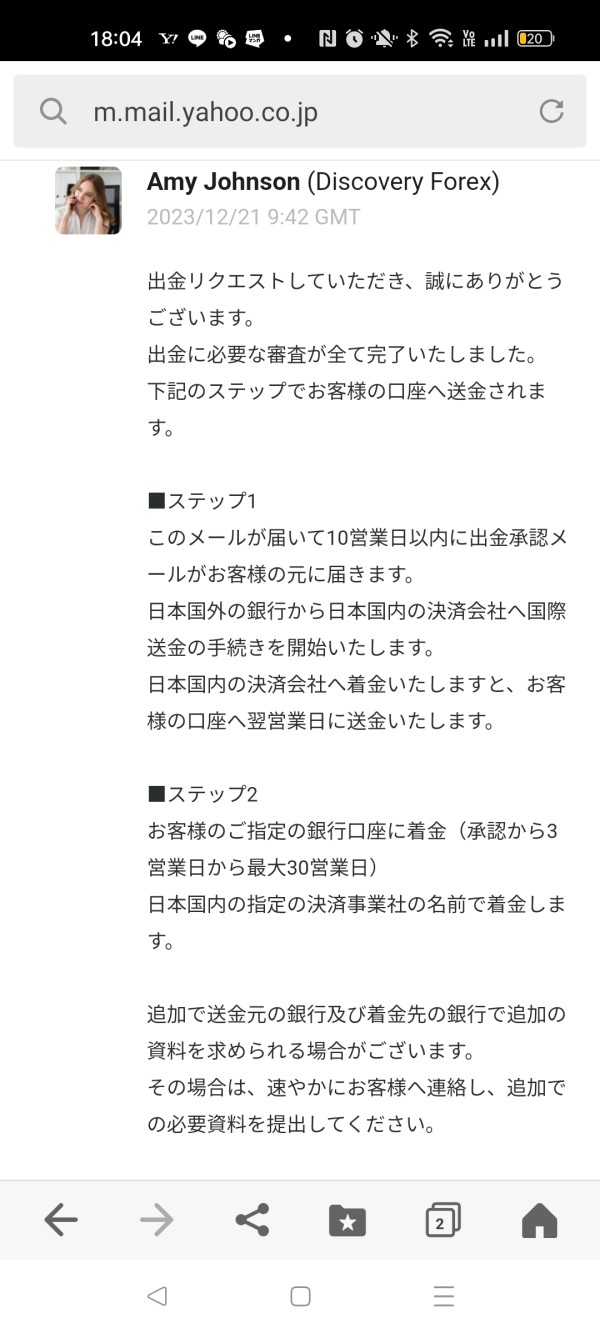

Customer service represents a notable weakness in Discovery FX's offering. Limited information is available about support channels, availability, and service quality. User feedback indicates dissatisfaction with response times and service effectiveness, raising concerns about the broker's commitment to client support.

The lack of detailed information about multilingual support, operating hours, and communication channels suggests underdeveloped customer service infrastructure. Professional forex brokers typically provide 24/5 support through multiple channels including phone, email, and live chat, but Discovery FX's capabilities in this area remain unclear.

User testimonials reveal frustrations with customer service responsiveness, which significantly impacts overall client satisfaction. The lack of documented problem resolution procedures and escalation processes further undermines confidence in the broker's support capabilities.

Trading Experience Analysis (8/10)

User feedback regarding trading experience shows notably positive responses, particularly concerning the MT5 platform's performance and spread competitiveness. Traders report satisfaction with order execution speed and spread stability, suggesting effective trading infrastructure, and the platform's technical capabilities, including advanced charting tools and technical indicators, receive favorable user evaluation.

The low spread environment, especially through nano spread accounts, appears to deliver on the broker's competitive pricing promises. Users appreciate the platform's responsiveness and the availability of sophisticated trading tools that support both manual and automated trading strategies.

However, mobile trading experience details are not well documented, and specific technical performance metrics are not readily available. Despite these information gaps, the overall trading experience feedback suggests that Discovery FX delivers competitive execution quality that meets trader expectations, and this discovery fx review recognizes the platform's technical strengths while noting areas requiring additional transparency.

Trust and Safety Analysis (3/10)

Trust and safety represent the most significant concerns in this Discovery FX evaluation. The broker's registration in Samoa without proper regulatory licensing from recognized financial authorities creates substantial credibility issues, and major regulatory bodies like the FCA, ASIC, CySEC, or similar organizations provide essential investor protections that are absent in this case.

The lack of information about client fund segregation, deposit insurance, or compensation schemes raises serious questions about financial security. User complaints regarding legitimacy concerns reflect broader market skepticism about unregulated brokers operating in offshore jurisdictions.

Company transparency is notably limited, with insufficient disclosure about management, ownership structure, and operational procedures. The absence of regulatory oversight means that standard industry protections and dispute resolution mechanisms may not be available to clients, significantly elevating investment risk.

User Experience Analysis (6/10)

Overall user satisfaction presents a mixed picture, with positive feedback about spreads and platform functionality balanced against concerns about regulatory status and customer service quality. The MT5 platform interface receives praise for user-friendliness and functionality, suggesting effective platform implementation.

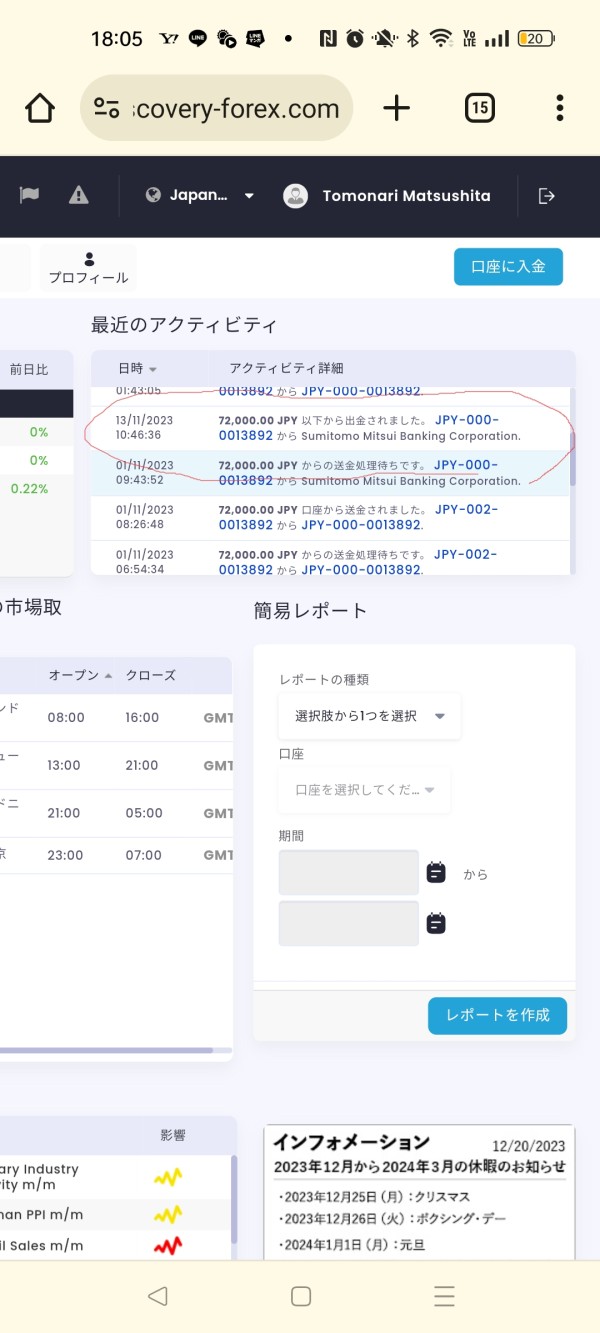

However, feedback regarding deposit and withdrawal convenience varies significantly among users, indicating inconsistent operational procedures. The registration and verification processes are not clearly documented, potentially creating uncertainty for new clients.

Common user complaints center on legitimacy concerns and customer service responsiveness, reflecting broader trust issues. The broker appears to attract traders seeking high leverage and competitive costs, but retention may be challenged by operational and regulatory concerns, and enhanced transparency and improved customer service would significantly benefit overall user experience.

Conclusion

Discovery FX demonstrates competitive trading conditions and platform capabilities, particularly through its MT5 implementation and competitive spread offerings. The broker's high leverage options and low minimum deposit requirements appeal to traders seeking cost-effective market access, but significant regulatory concerns and trust issues substantially impact its overall attractiveness.

The broker best suits experienced traders who prioritize trading conditions over regulatory protection and understand the risks associated with unregulated brokers. New traders should exercise extreme caution given the lack of investor protections typically provided by regulated entities.

Key advantages include competitive spreads, high leverage, and effective platform implementation, while major disadvantages encompass regulatory absence, limited customer service quality, and transparency concerns. Potential clients must carefully weigh these factors against their individual risk tolerance and trading requirements.