Is Leeds Capital safe?

Pros

Cons

Is Leeds Capital Safe or Scam?

Introduction

Leeds Capital is an online forex and CFD broker that has emerged in the trading landscape since its inception in 2021. Positioned as a platform for trading foreign exchange, commodities, and cryptocurrencies, Leeds Capital claims to offer a customized trading experience. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is notorious for its volatility and the presence of unscrupulous brokers, making it imperative for traders to evaluate the legitimacy and safety of any broker they consider. This article aims to provide an objective assessment of Leeds Capital, utilizing a comprehensive investigation of its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

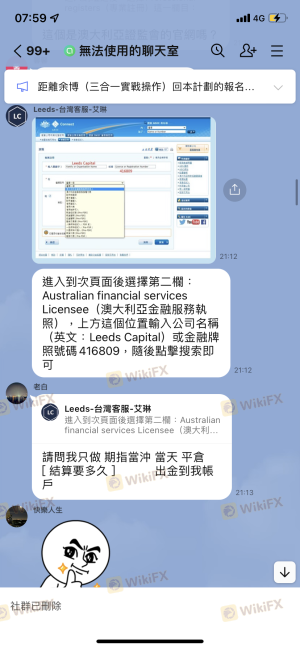

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. Leeds Capital claims to be owned by Leeds Capital Holdings Limited, which is purportedly licensed by the Australian Securities and Investments Commission (ASIC) under license number 440193. However, a closer examination reveals discrepancies in this claim. Although the license number corresponds with a registered entity, it is important to note that this entity is not authorized to offer forex services to retail clients, as per ASIC's regulations. This raises significant concerns regarding the broker's compliance and the protection of investor funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 440193 | Australia | Not Authorized for Retail Forex |

Given that Leeds Capital operates without valid regulatory oversight for retail clients, it poses a significant risk to traders. Regulatory bodies like ASIC are designed to protect investors by enforcing strict compliance standards. The absence of such oversight indicates that investors' funds may not be safeguarded under any legal framework, leading to the conclusion that Leeds Capital is not safe for trading.

Company Background Investigation

Leeds Capital's brief history raises further questions about its credibility. The company was established in 2021, which places it in the category of relatively new brokers. This youthfulness often correlates with a lack of established reputation and trustworthiness in the forex community. The ownership structure of Leeds Capital has not been transparently disclosed, which is another red flag for potential investors.

Moreover, the management team's background and expertise are not readily available on their website, leaving traders in the dark about the qualifications of those running the firm. Transparency is a crucial metric for assessing a broker's reliability, and Leeds Capital's lack of information regarding its management team diminishes its credibility.

Overall, the company's opacity regarding its ownership and management suggests a potential lack of accountability, further contributing to the perception that Leeds Capital may not be safe for traders seeking a reliable platform.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are paramount. Leeds Capital's website does not provide clear information about its fee structure or trading costs, which is concerning for potential clients. A transparent broker typically discloses spreads, commissions, and overnight interest rates, allowing traders to make informed decisions.

| Fee Type | Leeds Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The absence of detailed information about trading costs suggests a lack of transparency, which is often associated with less reputable brokers. Additionally, if a broker does not provide clear details on fees, it may be an indication of hidden charges that could arise during trading. Such practices can lead to unexpected losses, making it crucial for traders to be wary of platforms like Leeds Capital. Therefore, the lack of clarity regarding trading conditions further reinforces the idea that Leeds Capital is not safe for traders.

Customer Funds Security

The safety of customer funds is a primary concern for any trader. Leeds Capital's policies regarding fund security are not well-articulated on their website. Generally, reputable brokers implement measures such as segregated accounts, investor protection schemes, and negative balance protection to ensure the safety of their clients' funds. However, Leeds Capital does not provide sufficient information to ascertain whether such protections are in place.

In previous instances, unregulated brokers have been known to mismanage client funds, leading to significant financial losses for traders. Without clear policies on fund segregation and protection, traders are left vulnerable to potential scams or misappropriation of funds. The lack of transparency surrounding Leeds Capital's fund security measures raises serious concerns about the safety of investors' capital, leading to the conclusion that Leeds Capital may not be safe for trading.

Customer Experience and Complaints

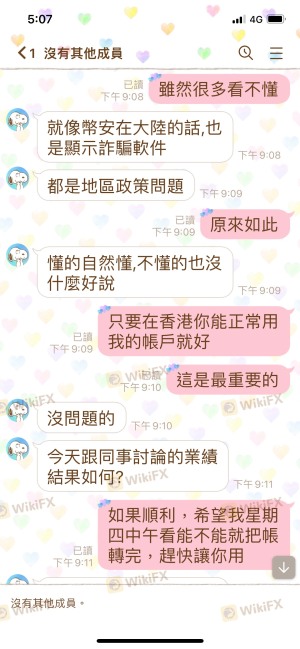

Customer feedback is an essential aspect of evaluating a broker's reliability. Reports from various review platforms indicate that Leeds Capital has received numerous complaints from clients, particularly regarding withdrawal issues. Many users have reported difficulties in processing withdrawal requests, even after meeting all necessary requirements, such as account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| Customer Support Issues | High | Poor |

The prevalence of withdrawal complaints suggests that Leeds Capital may engage in practices that hinder clients from accessing their funds, a common tactic employed by fraudulent brokers. Such experiences can lead to significant financial distress for traders and further solidify the perception that Leeds Capital is not a safe broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Leeds Capital claims to offer a proprietary trading platform, yet there is limited information available regarding its performance, stability, and user experience. Reliable brokers typically utilize well-known platforms like MetaTrader 4 or 5, which are recognized for their reliability and extensive features.

Moreover, the quality of order execution, including slippage and rejection rates, is vital for traders. If a broker's platform exhibits frequent slippage or rejections, it can significantly impact trading outcomes. However, without user reviews or detailed performance metrics, it is difficult to assess the execution quality of Leeds Capital's platform. This lack of transparency raises concerns about potential manipulation or inefficiencies, further indicating that Leeds Capital may not be safe for traders.

Risk Assessment

Engaging with any broker entails certain risks, and Leeds Capital is no exception. The combination of its unregulated status, poor customer feedback, and lack of transparency creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation for retail clients |

| Financial Risk | High | Potential mismanagement of funds |

| Operational Risk | Medium | Unclear trading conditions |

Given these risk factors, it is advisable for traders to exercise extreme caution when considering Leeds Capital as a trading option. Engaging with unregulated brokers can lead to substantial financial losses, and it is essential to prioritize safety and security in trading practices.

Conclusion and Recommendations

In conclusion, the analysis of Leeds Capital reveals significant red flags that suggest it may not be a safe broker for traders. The lack of regulatory oversight, transparency regarding trading conditions, and numerous customer complaints about withdrawal issues raise serious concerns about the broker's legitimacy.

For traders seeking reliable platforms, it is recommended to consider brokers that are regulated by reputable authorities, offer transparent trading conditions, and have a proven track record of positive customer experiences. Alternatives such as brokers regulated by ASIC, FCA, or other top-tier regulators should be prioritized to ensure the safety of investments. Ultimately, due diligence is critical in navigating the forex market, and traders should remain vigilant against the potential risks associated with platforms like Leeds Capital.

Is Leeds Capital a scam, or is it legit?

The latest exposure and evaluation content of Leeds Capital brokers.

Leeds Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Leeds Capital latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.