Lakefront Futures 2025 Review: Everything You Need to Know

Executive Summary

This Lakefront Futures review gives a neutral look at a company that works with commodity hedging and managed futures services. The company operates as a middleman that helps connect investors with Commodity Trading Advisors while providing complete hedging solutions across many different types of assets. Lakefront Futures presents itself as an experienced player in the managed futures space, offering services that cover agricultural products, livestock, metals, soft commodities, currencies, interest rates, energy, and indexes.

This evaluation has limits because we lack detailed regulatory information, trading conditions, and clear operational data that we typically expect from retail futures brokers. The company seems to focus mainly on institutional-style services rather than direct retail trading, which may appeal to investors who want professional commodity hedging and managed futures guidance. Without complete regulatory disclosures and detailed trading terms, potential clients should be careful and do thorough research before using their services.

Important Notice

This review uses limited publicly available information about Lakefront Futures. The assessment may not cover all current market conditions or recent changes in the company's operations. Readers should know that complete regulatory information and detailed trading conditions were not easily available in the source materials, which affects how thorough this evaluation can be. Potential clients are strongly advised to check all information directly with the company and do independent research before making any investment decisions.

Rating Framework

Note: Scoring is not possible due to insufficient detailed information in available sources.

Broker Overview

Lakefront Futures works as a specialized financial services company that focuses on commodity hedging, trading, and managed futures services. According to available information, the company has built itself up with years of experience in helping investors handle the complex world of managed futures. Their main business model centers around matching investors with qualified Commodity Trading Advisors while at the same time helping these CTAs grow their assets under management.

The firm's approach focuses on education and guidance, especially in helping customers understand and navigate the managed futures landscape. This suggests a consultative business model rather than a traditional retail brokerage operation. Their team claims to have the necessary tools and expertise to handle hedging requirements across a complete range of asset classes.

Lakefront Futures review data shows the company covers a wide array of markets including agricultural products, livestock, metals, soft commodities, currencies, interest rates, energy, and indexes. This broad coverage suggests institutional-level capabilities, though specific trading platforms, account types, and regulatory oversight details remain unclear from available sources. The company appears to be based in Chicago, Illinois, which puts it in a major financial center known for futures trading activity.

Regulatory Status: Specific regulatory information was not clearly detailed in available source materials, which represents a significant information gap for potential clients seeking transparency about oversight and compliance.

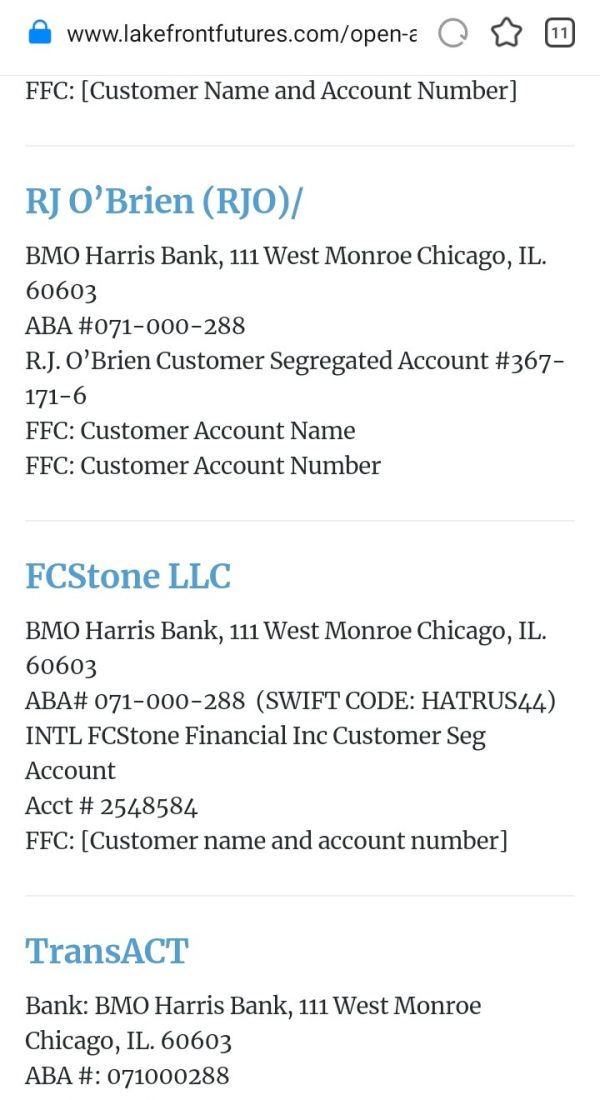

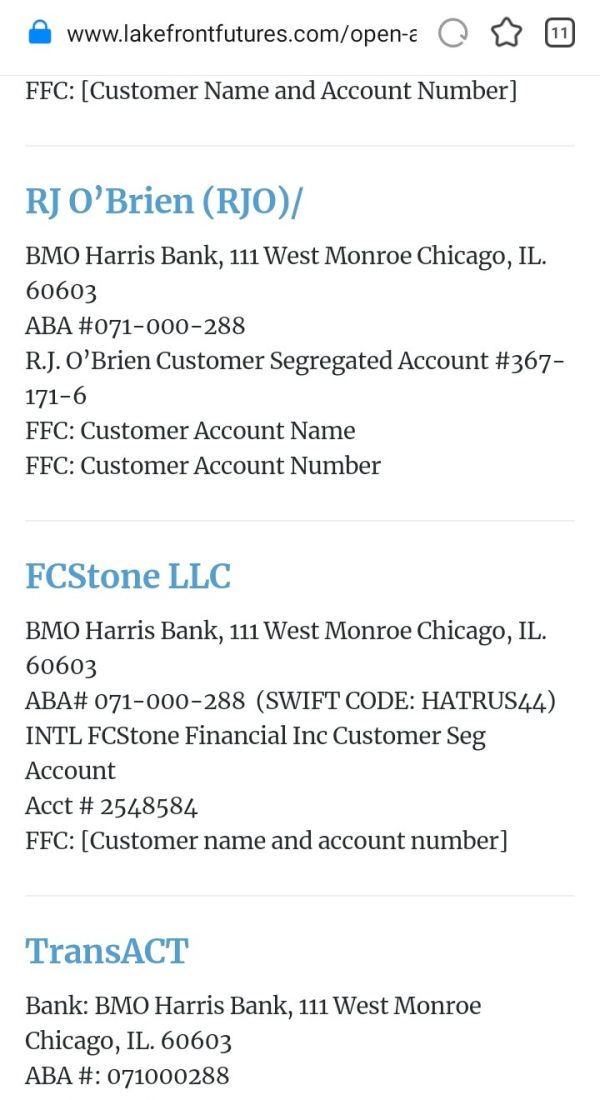

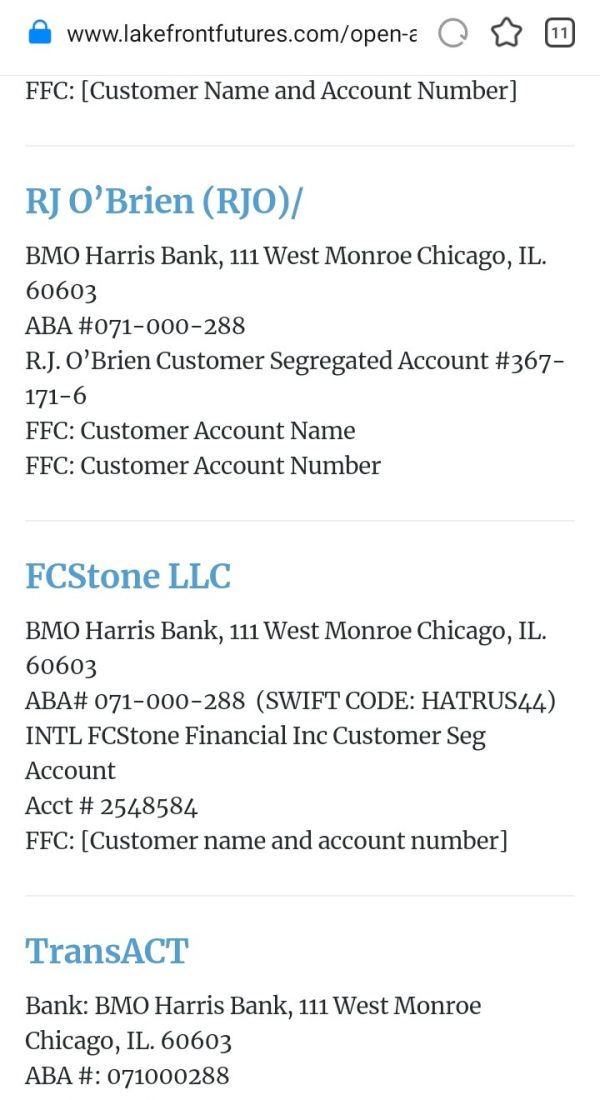

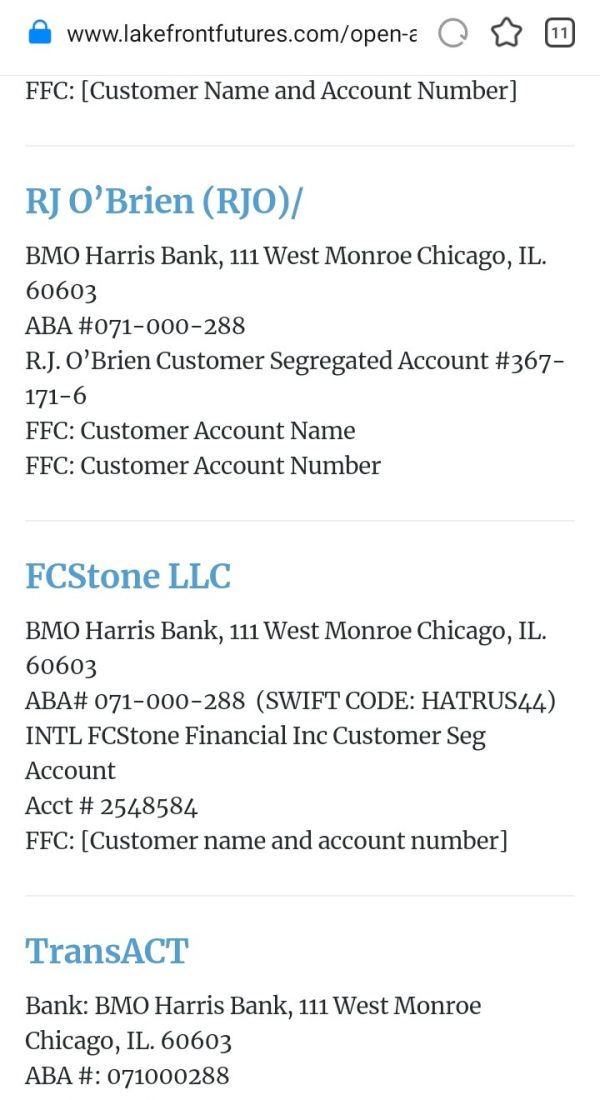

Deposit and Withdrawal Methods: Available sources do not provide specific information about funding methods, processing times, or associated fees for deposits and withdrawals.

Minimum Deposit Requirements: Minimum account funding requirements are not specified in the available information, making it difficult for potential clients to understand entry barriers.

Promotions and Bonuses: No information about promotional offers, bonuses, or special incentives was found in the source materials reviewed.

Tradeable Assets: The company covers agricultural products, livestock, metals, soft commodities, currencies, interest rates, energy, and indexes, indicating a comprehensive approach to commodity and futures markets.

Cost Structure: Specific information about trading fees, commissions, spreads, or other costs was not detailed in available sources, which is concerning for transparency.

Leverage Options: Leverage ratios and margin requirements are not specified in the available information.

Platform Options: Trading platform details, technology offerings, and software capabilities were not elaborated in source materials.

Geographic Restrictions: Information about which regions or countries are restricted from access was not provided in available sources.

Customer Support Languages: Specific language support options for customer service were not detailed in the materials reviewed.

This Lakefront Futures review highlights significant information gaps that potential clients should address directly with the company before proceeding.

Account Conditions Analysis

The evaluation of account conditions for Lakefront Futures is severely limited by the lack of detailed information in available sources. Traditional account analysis typically looks at account types, minimum deposits, account features, and opening procedures, but these specifics are not clearly outlined in the materials reviewed. This absence of transparent account information raises questions about the company's approach to client onboarding and service delivery.

Without clear details about account structures, it's impossible to assess whether the company offers different tiers of service, specialized accounts for various investor types, or specific features that might benefit different trading strategies. The lack of minimum deposit information also prevents potential clients from understanding the financial commitment required to begin working with the firm.

Account opening procedures, verification requirements, and documentation needs remain unclear from available sources. This opacity contrasts with industry standards where reputable brokers typically provide comprehensive account information upfront. The absence of details about Islamic accounts, corporate accounts, or other specialized offerings further limits the assessment.

For this Lakefront Futures review, the account conditions receive an incomplete evaluation due to insufficient data. Potential clients must directly contact the company to understand account structures, requirements, and features before making any commitments.

The assessment of trading tools and resources at Lakefront Futures faces significant limitations due to sparse information in available sources. While the company claims to have "the tools necessary" for comprehensive hedging across multiple asset classes, specific details about these tools, their functionality, and accessibility are not provided in the materials reviewed.

Traditional evaluation criteria for trading tools include charting capabilities, technical analysis features, research resources, and automated trading support. However, none of these elements are specifically detailed in the available information about Lakefront Futures. This lack of transparency makes it difficult for potential clients to understand what technological capabilities they would have access to.

Educational resources, which are crucial for managed futures and commodity trading, are mentioned conceptually through the company's stated mission to help clients "understand and navigate Managed Futures." However, specific educational materials, webinars, tutorials, or research publications are not detailed in the source materials.

The absence of information about third-party integrations, mobile applications, or advanced trading features further complicates the assessment. Without clear details about the technological infrastructure and support tools available to clients, potential users cannot make informed decisions about the platform's suitability for their trading needs and experience level.

Customer Service and Support Analysis

Evaluating customer service and support for Lakefront Futures proves challenging due to the limited information available in source materials. The company's emphasis on helping clients "understand and navigate Managed Futures" suggests a consultative approach to client relationships, but specific support channels, availability, and service quality metrics are not detailed in available sources.

Standard customer service evaluation typically looks at multiple contact methods, response times, support hours, and multilingual capabilities. However, these operational details are not specified in the materials reviewed for this analysis. The absence of clear customer service information raises concerns about accessibility and support quality for potential clients.

The company's business model of matching investors with CTAs and assisting in managed futures navigation implies a need for knowledgeable support staff capable of handling complex inquiries. Yet without specific information about staff qualifications, training, or expertise levels, it's impossible to assess the quality of guidance clients might receive.

Response time expectations, escalation procedures, and problem resolution processes remain unclear from available sources. This lack of transparency about support operations contrasts with industry standards where reputable firms typically provide comprehensive customer service information. The absence of user testimonials or service quality indicators further limits the ability to assess support effectiveness.

Trading Experience Analysis

The trading experience evaluation for Lakefront Futures is constrained by the absence of detailed platform information in available sources. While the company operates in commodity hedging and managed futures, specific details about trading platforms, execution quality, and user interface design are not provided in the materials reviewed.

Traditional trading experience assessment looks at platform stability, order execution speed, interface usability, and mobile accessibility. However, these technical aspects are not detailed in the available information about Lakefront Futures. This information gap makes it difficult for potential clients to understand what their actual trading environment would look like.

The company's focus on CTA matching and managed futures suggests that direct trading may not be the primary service model, which could explain the limited platform information. However, for clients seeking hands-on trading capabilities, the lack of platform details represents a significant evaluation barrier.

Market access, order types, execution venues, and trading tools remain unspecified in source materials. Without this fundamental information, potential clients cannot assess whether the trading environment would meet their specific needs, experience level, or trading strategy requirements.

This Lakefront Futures review cannot provide a comprehensive trading experience assessment due to insufficient technical and operational details in available sources.

Trust and Safety Analysis

Trust and safety evaluation for Lakefront Futures faces significant challenges due to the absence of clear regulatory information in available sources. Regulatory oversight represents a fundamental component of broker trustworthiness, and the lack of specific regulatory details raises important questions about compliance and client protection measures.

Industry-standard trust assessment typically looks at licensing, regulatory compliance, client fund segregation, and insurance protections. However, these critical safety elements are not detailed in the materials reviewed for this analysis. The absence of regulatory transparency contrasts with established industry practices where reputable firms prominently display their regulatory status and compliance measures.

Client fund protection mechanisms, which are essential for financial services companies, are not specified in available sources. This includes information about segregated accounts, insurance coverage, and compensation schemes that protect client assets in various scenarios.

The company's years of claimed experience in the industry could indicate operational stability, but without verifiable regulatory information or third-party validations, this cannot be independently confirmed. The lack of transparent compliance information makes it difficult for potential clients to assess the safety of their potential investment.

Corporate governance, audit procedures, and financial reporting transparency also remain unclear from available sources, further complicating the trust assessment for potential clients considering the firm's services.

User Experience Analysis

User experience evaluation for Lakefront Futures is limited by the absence of detailed client feedback and platform information in available sources. While the company positions itself as experienced in managed futures and CTA matching, specific user satisfaction data, interface design details, and client journey information are not provided in the materials reviewed.

Comprehensive user experience assessment typically looks at registration processes, platform navigation, account management features, and overall client satisfaction metrics. However, these experiential elements are not detailed in available information about Lakefront Futures, making it difficult to understand the actual client experience.

The company's consultative approach to managed futures suggests a potentially personalized user experience, but without specific testimonials, case studies, or user feedback, this cannot be verified. The absence of client success stories or detailed service descriptions limits the ability to assess user satisfaction levels.

Interface design, mobile accessibility, and ease of use remain unspecified in source materials. For potential clients seeking user-friendly platforms and streamlined experiences, the lack of detailed user experience information represents a significant evaluation challenge.

Process efficiency, from initial contact through ongoing service delivery, cannot be assessed based on available information. This includes onboarding procedures, ongoing support quality, and problem resolution effectiveness, all of which are crucial components of overall user experience.

Conclusion

This Lakefront Futures review reveals a company that operates in the specialized niche of commodity hedging and managed futures services, but with significant transparency limitations that impact comprehensive evaluation. While the firm claims years of experience and broad market coverage across agricultural products, livestock, metals, currencies, energy, and other asset classes, the absence of detailed operational, regulatory, and service information raises important considerations for potential clients.

The company appears best suited for investors specifically seeking managed futures guidance and CTA matching services rather than traditional retail trading platforms. However, the lack of clear regulatory information, transparent fee structures, and detailed service terms suggests that thorough due diligence and direct communication with the company are essential before engagement. Potential clients should prioritize obtaining comprehensive regulatory, operational, and cost information directly from Lakefront Futures before making any commitments.