A&C Review 1

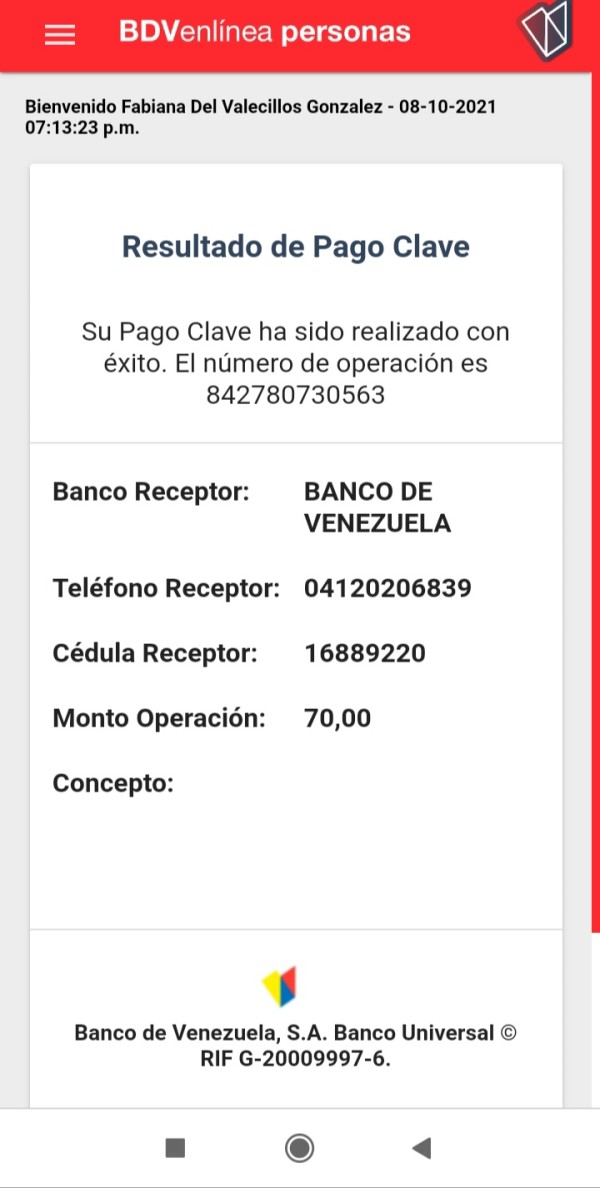

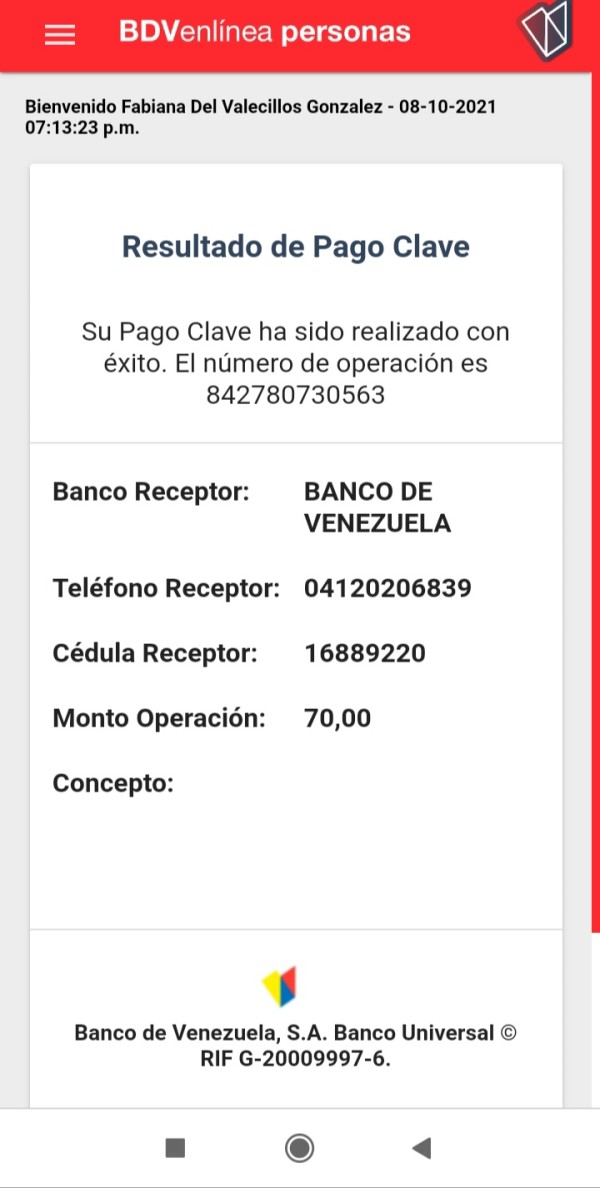

I deposited $70 and gained $300. When I wanted to withdraw, they said there was no profits in my account.

A&C Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited $70 and gained $300. When I wanted to withdraw, they said there was no profits in my account.

This comprehensive a c review examines A&C Brokerage. The company focuses mainly on insurance services rather than traditional forex trading. A&C operates from New York and offers various additional features, though these come at relatively higher price points. The company's positioning in the forex market remains unclear due to limited transparency regarding specific trading conditions, spreads, and regulatory compliance.

For potential clients seeking forex trading services, this A&C evaluation reveals significant information gaps. These gaps may concern serious traders who need detailed information to make informed decisions. While the company maintains a presence in the competitive New York financial services market, the lack of detailed trading specifications raises questions about their commitment to the forex sector. The higher pricing structure mentioned in available sources suggests this broker may target a specific demographic. However, they don't provide clear value propositions for forex traders, which makes their services less attractive. Prospective users should carefully consider whether A&C's service offerings align with their trading objectives and risk tolerance levels.

Regional Entity Differences: A&C Brokerage may operate under different regulatory frameworks across various jurisdictions. The regulatory status and compliance requirements can vary significantly between regions, potentially affecting service availability and client protections. Traders should verify the specific regulatory status applicable to their location before engaging with any A&C entity.

Review Methodology: This evaluation is based on publicly available information and market feedback. Due to limited detailed information about A&C's forex trading services, some assessments rely on general industry standards and available company data. Potential clients are advised to conduct independent due diligence and request comprehensive information directly from the broker.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific information not detailed in available materials |

| Tools and Resources | N/A | Specific information not detailed in available materials |

| Customer Service and Support | N/A | Specific information not detailed in available materials |

| Trading Experience | N/A | Specific information not detailed in available materials |

| Trust and Reliability | N/A | Specific information not detailed in available materials |

| User Experience | N/A | Specific information not detailed in available materials |

A&C Brokerage operates from New York. This positions the company within one of the world's most significant financial centers. The company's establishment date and founding details are not clearly specified in available documentation, which may concern potential clients seeking transparency about the broker's operational history. The company appears to maintain a business model that encompasses insurance services as a primary focus, with forex trading services playing an unclear secondary role.

The broker's website and public materials suggest an emphasis on additional features and services beyond basic trading functionality. However, the higher pricing structure mentioned in available sources may limit accessibility for retail traders or those seeking cost-effective trading solutions. The company's specific approach to forex market making, ECN services, or STP execution models remains undisclosed in publicly available information.

This a c review finds that the broker's platform specifications, supported trading software, and technological infrastructure details are not comprehensively documented. The absence of clear information about MetaTrader support, proprietary platform features, or mobile trading capabilities represents a significant transparency gap. Available sources do not specify the range of tradeable assets beyond general forex market participation, leaving questions about cryptocurrency, commodities, or stock CFD availability unanswered.

Regulatory Compliance: Specific information about regulatory oversight and licensing authorities is not detailed in available materials. This represents a critical information gap for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Payment processing options, supported currencies, and transaction timeframes are not specified in accessible documentation.

Minimum Deposit Requirements: Entry-level funding requirements and account tier specifications are not clearly outlined in available sources.

Promotional Offers: Current bonus structures, welcome incentives, or loyalty programs are not detailed in publicly available materials.

Tradeable Assets: While forex market participation is implied, specific currency pairs, exotic options, and additional asset classes remain unspecified.

Cost Structure: Spread types, commission schedules, overnight financing rates, and additional fees are not transparently disclosed in available information.

Leverage Options: Maximum leverage ratios, margin requirements, and risk management parameters are not detailed in accessible sources.

Platform Selection: Trading software options, compatibility requirements, and platform-specific features are not comprehensively documented.

Geographic Restrictions: Service availability limitations and restricted jurisdictions are not clearly specified.

Customer Support Languages: Available communication languages and regional support options are not detailed in accessible materials.

This a c review highlights the significant information transparency challenges that potential clients may encounter when evaluating this broker's services.

The account structure and conditions offered by A&C Brokerage remain largely undefined in publicly available documentation. This lack of transparency regarding account types, minimum deposit requirements, and tier-specific benefits creates uncertainty for potential clients attempting to evaluate the broker's suitability for their trading needs. Without clear specifications about standard, premium, or professional account categories, traders cannot make informed decisions about which service level might align with their capital allocation and trading frequency.

The absence of detailed information about account opening procedures, verification requirements, and documentation standards further complicates the client onboarding assessment. Industry-standard features such as Islamic account availability, demo account access, and account currency options are not specified in available sources. This information gap is particularly concerning for international clients who require specific compliance or religious considerations in their trading arrangements.

Furthermore, the lack of clarity regarding account maintenance fees, inactivity charges, or minimum balance requirements prevents accurate cost-benefit analysis. Professional traders seeking institutional-grade account features, such as dedicated relationship management or enhanced execution priority, cannot determine whether A&C provides these services. This a c review finds that the broker's account condition transparency falls significantly below industry standards for comprehensive broker evaluation.

A&C Brokerage's trading tools and analytical resources remain inadequately documented in accessible materials. The absence of detailed information about charting packages, technical analysis indicators, and market research provisions creates significant uncertainty about the broker's commitment to trader education and decision support. Modern forex traders typically expect access to economic calendars, market sentiment indicators, and real-time news feeds, yet A&C's offerings in these areas are not clearly specified.

The availability of automated trading support, including Expert Advisor compatibility, algorithmic trading infrastructure, and API access, is not detailed in publicly available sources. This represents a critical gap for systematic traders and those employing quantitative strategies. Additionally, the broker's approach to social trading, copy trading platforms, or signal services remains undefined, limiting assessment of their innovation in trader community features.

Educational resources such as webinars, trading courses, market analysis publications, and beginner-friendly materials are not comprehensively outlined. The quality and depth of research provided by A&C's analytical team, if such services exist, cannot be evaluated based on available information. Risk management tools, including stop-loss automation, position sizing calculators, and portfolio analysis features, are not specified, leaving traders uncertain about the platform's risk control capabilities.

The customer service infrastructure and support quality provided by A&C Brokerage lacks detailed documentation in accessible sources. Critical service elements such as available contact methods, response time commitments, and support availability hours are not clearly specified. This information gap prevents potential clients from assessing whether the broker can provide adequate assistance during trading emergencies or technical difficulties.

Multilingual support capabilities, regional office locations, and local market expertise are not detailed in available materials. For international clients, understanding the broker's ability to provide native language support and culturally appropriate service approaches is essential for effective communication. The absence of this information may indicate limited global service capacity or inadequate international market focus.

Problem resolution procedures, escalation pathways, and client complaint handling processes are not transparently outlined. The broker's approach to dispute resolution, regulatory complaint procedures, and client advocacy services cannot be evaluated based on publicly available information. Additionally, the availability of dedicated account management, personalized service options, or premium support tiers for high-value clients remains unspecified, limiting assessment of service scalability.

The trading experience provided by A&C Brokerage cannot be comprehensively evaluated due to limited platform and execution information in available sources. Critical performance metrics such as order execution speed, slippage rates, and platform stability during high-volatility periods are not documented. These factors are essential for traders seeking reliable execution environments, particularly for scalping strategies or news-based trading approaches.

Platform functionality, including order types supported, chart customization options, and interface usability, remains inadequately specified. The absence of information about mobile trading capabilities, cross-device synchronization, and offline functionality limits assessment of the broker's technological sophistication. Modern traders expect seamless experiences across desktop, web, and mobile platforms, yet A&C's capabilities in these areas are unclear.

Market access quality, including depth of book visibility, direct market access features, and institutional liquidity connectivity, is not detailed in accessible materials. The broker's approach to market making versus agency execution models cannot be determined, preventing evaluation of potential conflicts of interest. Additionally, trading environment features such as one-click trading, advanced order management, and real-time P&L tracking are not specified. This a c review finds that the overall trading experience assessment is severely limited by information transparency issues.

The trustworthiness and reliability assessment of A&C Brokerage is significantly hampered by limited regulatory and operational transparency in available sources. Specific licensing information, regulatory oversight details, and compliance certifications are not clearly documented, creating uncertainty about the broker's legal standing and client protection measures. Regulatory supervision is a cornerstone of broker reliability, and the absence of clear regulatory information raises important questions about operational legitimacy.

Client fund protection measures, including segregated account policies, deposit insurance coverage, and bankruptcy protection procedures, are not detailed in accessible materials. These safeguards are critical for client security and regulatory compliance in most jurisdictions. The broker's financial stability indicators, such as capital adequacy ratios, parent company backing, or audited financial statements, are not publicly available for evaluation.

Operational transparency regarding business practices, conflict of interest management, and client priority policies cannot be assessed based on available information. The broker's track record in handling market stress events, regulatory changes, or operational challenges is not documented. Additionally, third-party verification of services, independent audits, or industry certifications are not specified, limiting external validation of the broker's claims and capabilities.

The overall user experience provided by A&C Brokerage cannot be thoroughly evaluated due to insufficient detailed information about client interfaces and service delivery. User interface design quality, navigation efficiency, and accessibility features are not documented in available sources. Modern trading platforms require intuitive design and efficient workflow management, yet A&C's capabilities in these areas remain unclear.

Registration and account verification processes, including required documentation, approval timeframes, and digital onboarding features, are not specified. The complexity and efficiency of these procedures significantly impact initial user experience and client satisfaction. Additionally, the broker's approach to client communication, including account notifications, market alerts, and service updates, is not detailed in accessible materials.

User feedback mechanisms, client satisfaction monitoring, and service improvement processes are not transparently outlined. The availability of client portals, self-service options, and account management tools cannot be evaluated based on publicly available information. Furthermore, the broker's responsiveness to user complaints, feature requests, and service enhancement suggestions is not documented, preventing assessment of their commitment to continuous improvement.

This comprehensive a c review reveals significant transparency challenges regarding A&C Brokerage's forex trading services. While the company maintains operations in New York and offers various additional features, the lack of detailed information about trading conditions, regulatory compliance, and service specifications creates substantial uncertainty for potential clients. The higher pricing structure mentioned in available sources may not be justified without clear value propositions for forex traders.

A&C Brokerage appears most suitable for clients specifically interested in insurance services, as this seems to be their primary business focus. However, forex traders seeking transparent, well-documented trading conditions and competitive service offerings may find better alternatives in the current market. The absence of detailed platform specifications, regulatory information, and trading cost structures represents a significant disadvantage in today's competitive brokerage landscape.

The main advantages appear to be the company's New York location and diverse service offerings, while the primary disadvantages include limited forex trading transparency and potentially higher costs without corresponding value justification. Potential clients should conduct thorough due diligence and request comprehensive service documentation before making any commitment to this broker.

FX Broker Capital Trading Markets Review