Shine 2025 Review: Everything You Need to Know

Summary

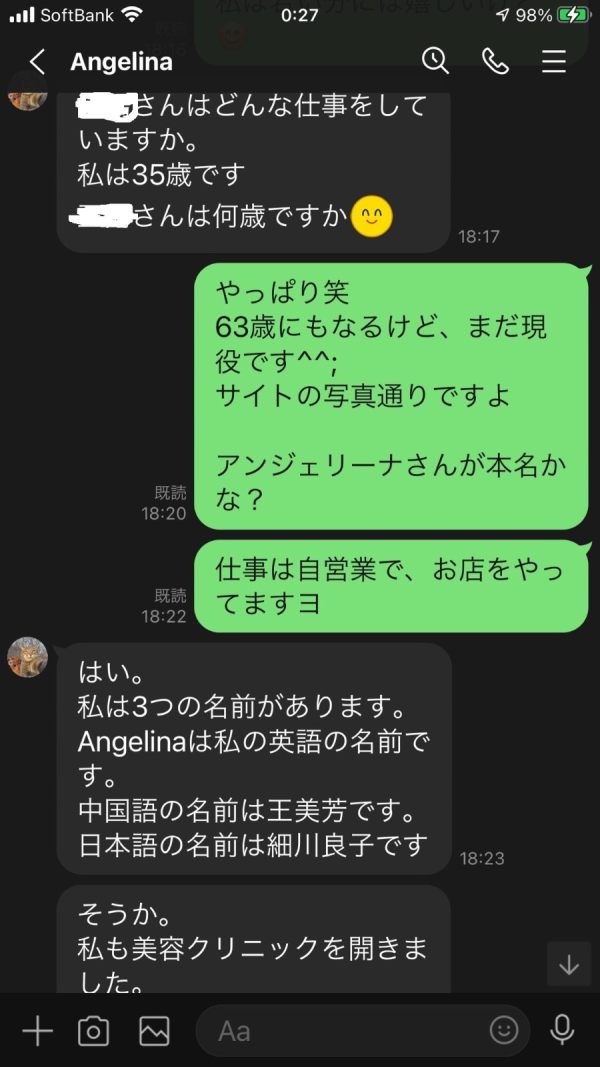

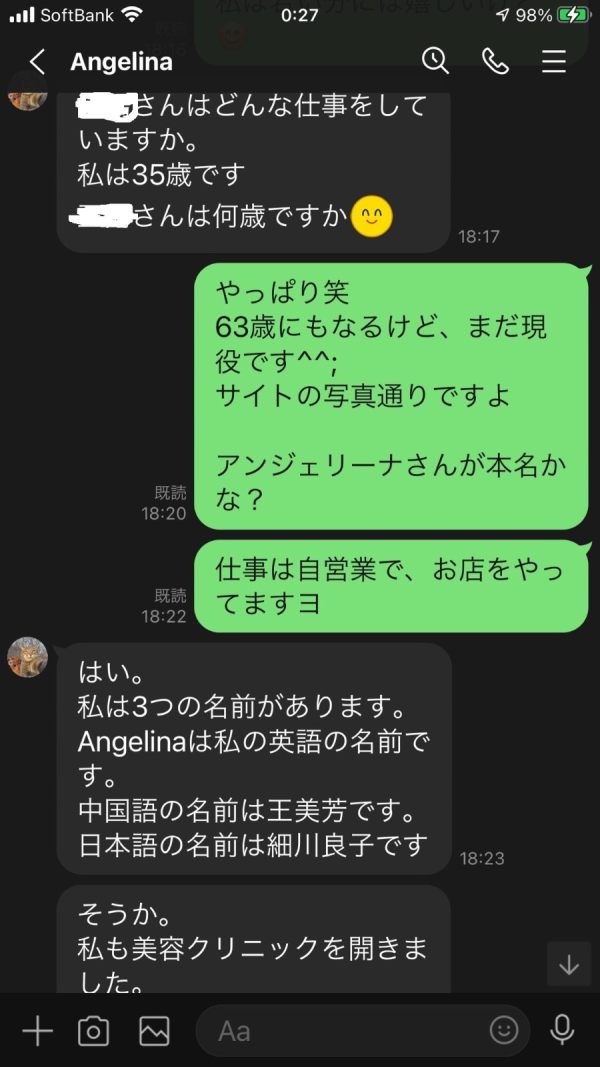

Shine Markets presents itself as a forex broker operating from the United Kingdom. The company positions itself as an accessible option for traders seeking entry into the foreign exchange market, though their track record remains unclear. This shine review examines the broker's offerings based on available information, revealing a mixed picture of opportunities and limitations that potential clients should carefully consider. The broker appears to target retail traders looking for straightforward forex trading services. However, comprehensive details about their operations remain limited in publicly available sources, which raises questions about transparency.

According to information from various forex industry platforms, Shine Markets operates as a forex broker with headquarters in the United Kingdom. Specific regulatory information, detailed trading conditions, and comprehensive service offerings are not extensively documented in available materials, creating significant gaps in what potential clients can verify. This lack of detailed information presents challenges for potential clients seeking thorough due diligence before opening trading accounts. The absence of clear documentation makes it difficult for traders to assess whether this broker meets their specific needs and risk tolerance levels.

The broker's positioning suggests a focus on providing basic forex trading services. The absence of detailed information about trading platforms, customer support infrastructure, and regulatory compliance makes it difficult to provide a comprehensive assessment of their capabilities and reliability, which is concerning for potential clients.

Important Notice

Regional Entity Differences: Due to limited regulatory information available about Shine Markets, potential clients should conduct independent research regarding the broker's legal status and regulatory compliance in their respective jurisdictions. Different regions may have varying legal frameworks governing forex trading, and users must ensure compliance with local regulations to avoid potential legal issues.

Review Methodology: This evaluation is based on limited publicly available information from forex industry sources and databases. The assessment does not include extensive user reviews, real-time trading data, or comprehensive regulatory verification, which limits the depth of analysis possible. Potential clients should conduct additional research and due diligence before making trading decisions.

Rating Framework

Broker Overview

Shine Markets operates as a forex broker with reported headquarters in the United Kingdom, according to information found in forex industry databases. The establishment date and detailed company background information are not extensively documented in available sources, making it challenging to provide a comprehensive historical overview of the organization's development and track record.

The broker appears to focus primarily on forex trading services. The specific scope of their business model, including whether they operate as a market maker, STP broker, or ECN provider, is not clearly detailed in available documentation, which makes it difficult for traders to understand how their orders will be processed. The company's operational structure and business approach require further investigation for potential clients seeking detailed information.

From available information, Shine Markets positions itself within the retail forex trading sector. Specific details about their target market, trading philosophy, and competitive positioning are not extensively documented, leaving potential clients with limited insight into the broker's strategic approach. This shine review finds that the broker's public presence and information transparency could benefit from enhancement to better serve potential clients' research needs.

The broker's regulatory status and compliance framework represent areas where additional clarity would benefit potential clients. While the company reports UK headquarters, specific regulatory authorizations and oversight mechanisms are not clearly detailed in readily available sources, which raises questions about accountability and consumer protection.

Regulatory Regions: Specific regulatory information for Shine Markets is not detailed in available sources. The broker reports UK headquarters, but specific regulatory authorizations and compliance details require further verification from potential clients.

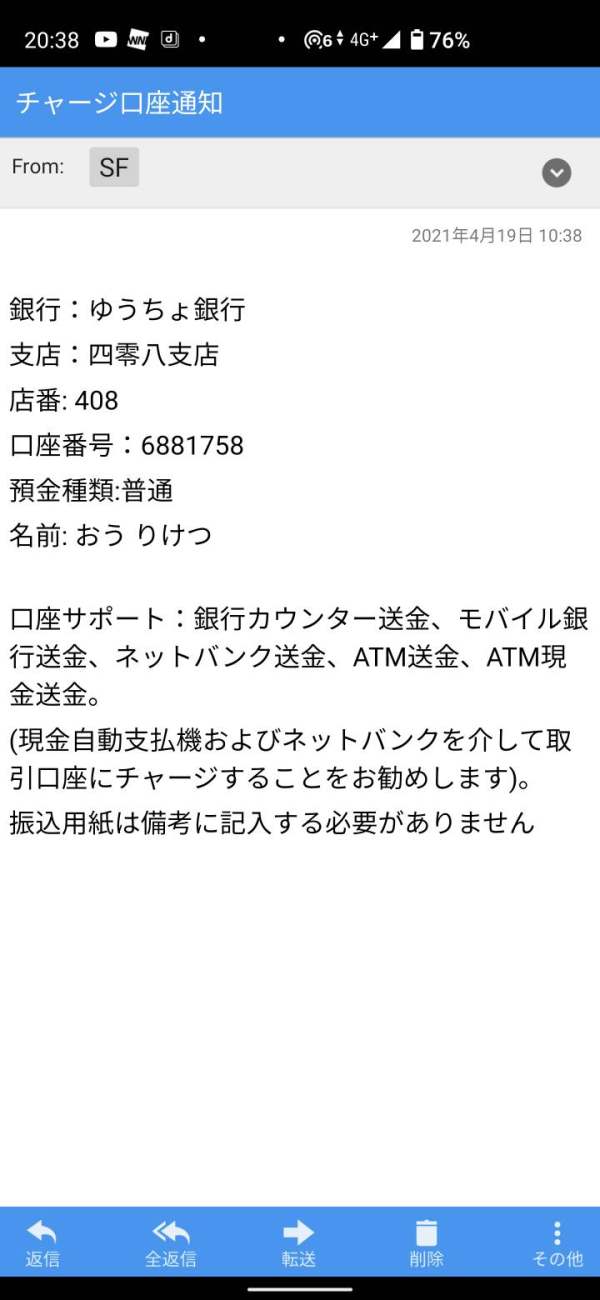

Deposit and Withdrawal Methods: Available sources do not provide detailed information about supported payment methods, processing times, or associated fees for deposits and withdrawals. This lack of transparency makes it difficult for traders to plan their funding strategies and understand the true cost of trading.

Minimum Deposit Requirements: Specific minimum deposit requirements are not clearly documented in available sources. This makes it difficult to assess accessibility for different trader segments, particularly those with limited starting capital.

Bonuses and Promotions: Information about promotional offers, welcome bonuses, or ongoing incentive programs is not available in current sources. Traders looking for additional value through promotional offerings will need to contact the broker directly for this information.

Tradeable Assets: While the broker appears to focus on forex trading, specific currency pairs, exotic options, and other tradeable instruments are not detailed in available documentation. This limits traders' ability to assess whether the broker offers the specific markets they wish to trade.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not extensively documented in available sources. This shine review notes that cost transparency is essential for trader decision-making, and the lack of clear pricing information is a significant limitation.

Leverage Ratios: Specific leverage offerings and risk management parameters are not detailed in currently available information. Traders need this information to understand their potential exposure and risk levels when trading with the broker.

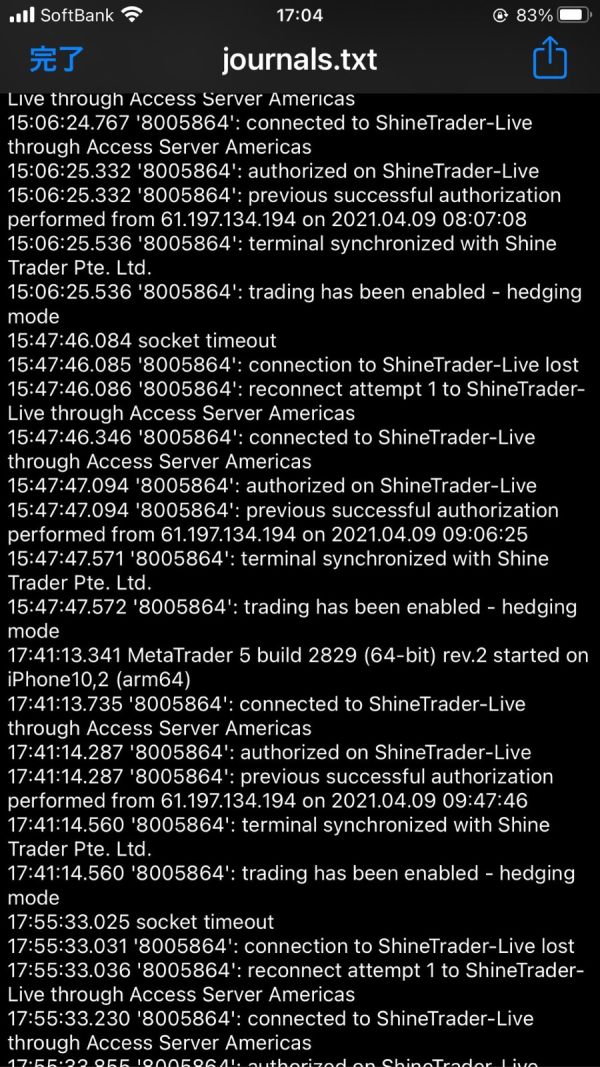

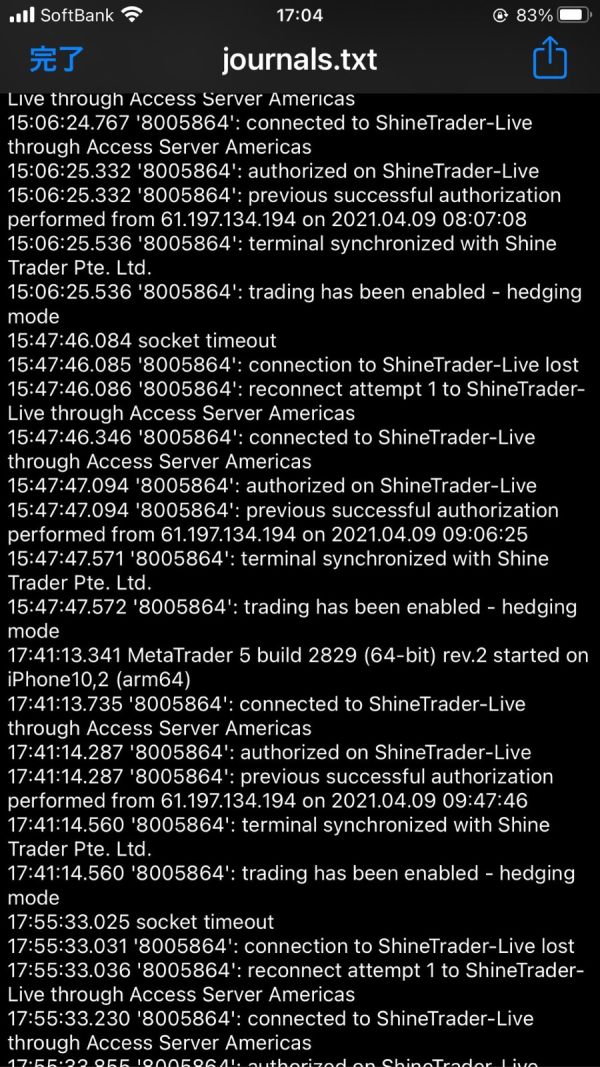

Platform Options: Information about trading platforms, mobile applications, and technical analysis tools is not comprehensively documented. Modern traders expect detailed platform specifications to assess whether the technology meets their trading requirements.

Regional Restrictions: Specific information about geographic limitations or restricted territories is not available in current sources. Potential clients should verify their eligibility before attempting to open accounts.

Customer Service Languages: Supported languages for customer service are not detailed in available documentation. International traders need to understand what language support is available before committing to a broker.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Shine Markets' account conditions faces significant limitations due to sparse publicly available information. Available sources do not provide detailed descriptions of account types, minimum balance requirements, or specific features offered to different trader segments, which makes it impossible to assess value propositions for various client categories. This lack of transparency makes it challenging for potential clients to assess whether the broker's offerings align with their trading needs and financial capabilities.

Without comprehensive information about account tiers, special features, or differentiated services, this shine review cannot provide detailed analysis of the broker's competitive positioning in terms of account conditions. The absence of clear information about Islamic accounts, professional trader options, or beginner-friendly features represents a significant gap in available documentation that affects traders with specific requirements.

Account opening procedures, verification requirements, and onboarding processes are not detailed in available sources. This information gap makes it difficult for potential clients to understand the practical aspects of establishing a trading relationship with the broker, including time requirements and documentation needs. The lack of detailed account condition information contributes to the moderate rating assigned to this category.

Available information about Shine Markets' trading tools and educational resources is extremely limited. Current sources do not provide details about market analysis tools, economic calendars, trading signals, or educational materials that might be available to clients, leaving potential traders without crucial information about value-added services. This absence of information about value-added services makes it difficult to assess the broker's commitment to supporting trader development and success.

The lack of detailed information about research capabilities, market commentary, or analytical resources suggests either limited offerings in this area or insufficient public communication about available services. Modern forex traders typically expect comprehensive analytical tools and educational support, making this information gap particularly significant for traders who rely on broker-provided resources.

Technical analysis tools, charting capabilities, and automated trading support are not documented in available sources. The absence of information about API access, algorithmic trading support, or advanced order types further limits the assessment of the broker's technological capabilities and trader support infrastructure, which is crucial for advanced traders.

Customer Service and Support Analysis

Customer service information for Shine Markets is notably absent from available sources. Details about support channels, availability hours, response times, and service quality are not documented in current materials, making it impossible to evaluate this critical aspect of broker selection. This information gap makes it impossible to assess the broker's commitment to client support and problem resolution capabilities.

The absence of information about multilingual support, regional service teams, or specialized support for different account types represents a significant limitation in evaluating the broker's service infrastructure. Modern forex brokers typically emphasize customer service quality as a competitive differentiator, making this information gap particularly relevant for traders who value responsive support.

Without documented information about support ticket systems, live chat availability, phone support, or educational webinars, potential clients cannot adequately assess whether the broker's service model aligns with their support expectations and requirements. This lack of transparency in customer service capabilities is concerning for traders who may need assistance with technical or account-related issues.

Trading Experience Analysis

The evaluation of trading experience with Shine Markets faces substantial limitations due to insufficient information about platform capabilities, execution quality, and user interface design. Available sources do not provide details about trading platform options, mobile applications, or user experience features that would typically influence trader satisfaction, making it difficult to assess the practical trading environment.

Order execution quality, slippage rates, and platform stability information are not documented in available sources. These technical performance metrics are crucial for traders evaluating potential brokers, and their absence makes it difficult to assess the broker's operational capabilities and reliability during market volatility. This shine review notes that trading experience evaluation requires comprehensive technical performance data.

Information about platform customization options, advanced order types, and trading automation capabilities is not available in current sources. The lack of detailed technical specifications and user experience descriptions limits the ability to provide meaningful analysis of the broker's trading environment quality, which is essential for traders with specific technical requirements.

Trust and Safety Analysis

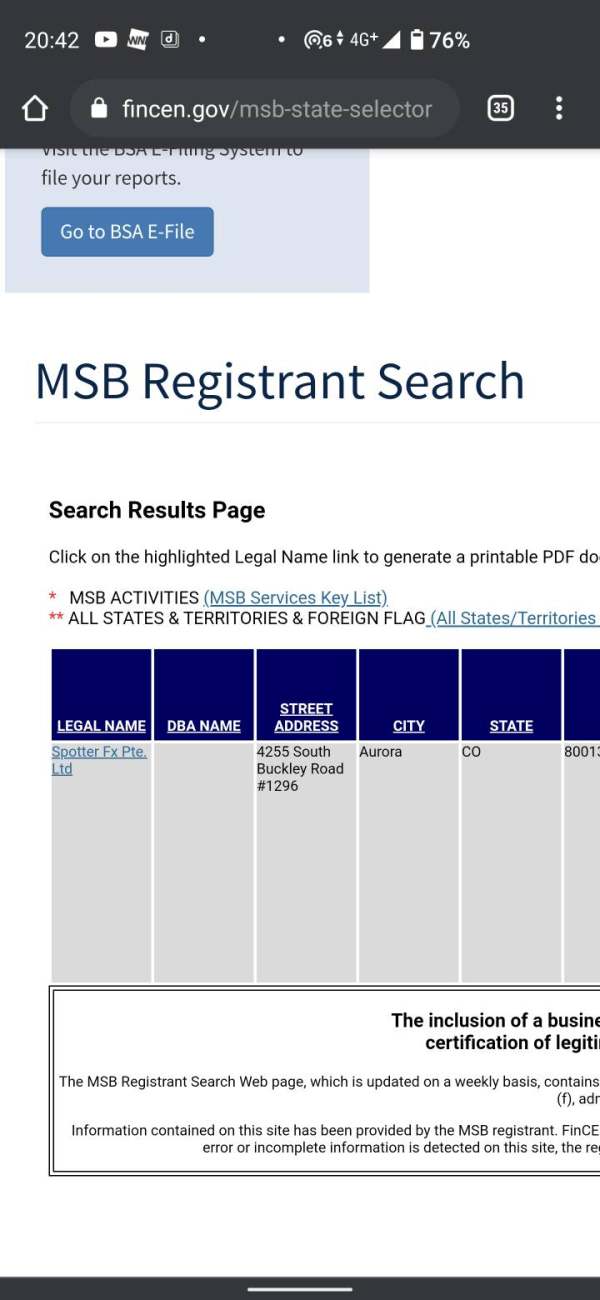

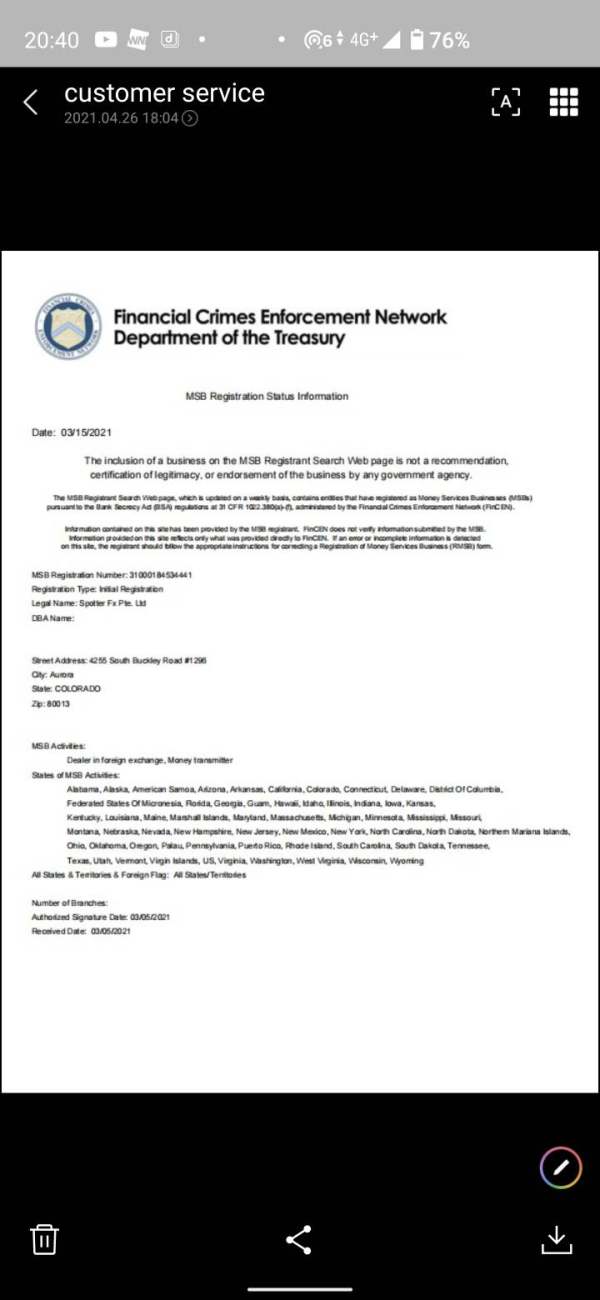

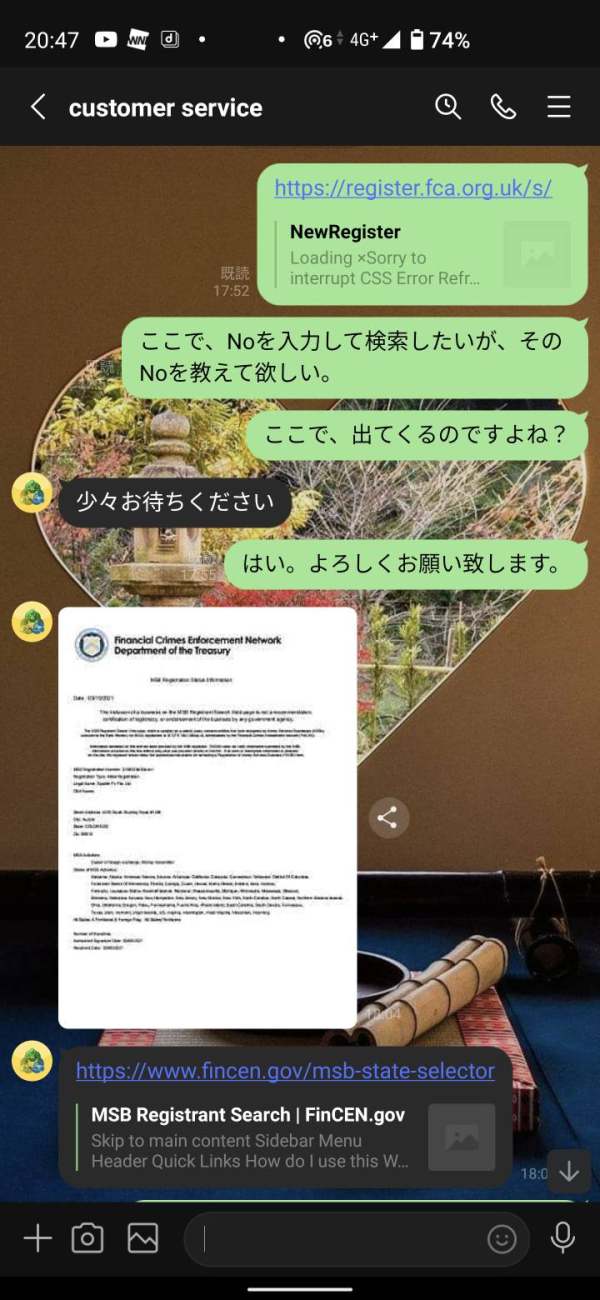

Trust and safety evaluation for Shine Markets encounters significant challenges due to limited regulatory and compliance information in available sources. While the broker reports UK headquarters, specific regulatory authorizations, compliance frameworks, and safety measures are not detailed in current documentation, raising questions about oversight and consumer protection.

Client fund protection mechanisms, segregated account policies, and insurance coverage details are not documented in available sources. These safety features are fundamental considerations for forex traders, and their absence from public information represents a significant gap in transparency that could affect client confidence.

The broker's regulatory history, compliance record, and any regulatory actions or sanctions are not detailed in available materials. Without comprehensive regulatory verification and safety protocol documentation, potential clients face challenges in conducting thorough due diligence regarding the broker's trustworthiness and regulatory standing, which is crucial for risk assessment.

User Experience Analysis

User experience evaluation for Shine Markets is severely limited by the absence of comprehensive user feedback and experience data in available sources. Current materials do not include detailed user reviews, satisfaction surveys, or community feedback that would typically inform user experience assessment, leaving potential clients without peer insights.

Interface design quality, registration process efficiency, and overall platform usability are not documented in available sources. The absence of user testimonials, case studies, or experience reports makes it difficult to assess real-world user satisfaction with the broker's services and platform capabilities, which is valuable information for decision-making.

Common user concerns, frequently reported issues, and broker responsiveness to user feedback are not detailed in current information sources. This lack of user-centric information limits the ability to provide meaningful analysis of the practical user experience with Shine Markets' services and platforms, making it difficult for potential clients to understand what to expect.

Conclusion

This shine review reveals that Shine Markets operates with limited publicly available information, making comprehensive evaluation challenging for potential clients. While the broker reports UK headquarters and positions itself in the forex trading sector, the absence of detailed information about regulatory compliance, trading conditions, and service offerings represents significant transparency gaps that potential clients should carefully consider before making any commitments.

The broker may be suitable for traders who prioritize basic forex trading access, though the limited information available makes it difficult to recommend specific user types or trading scenarios. Potential clients should conduct extensive additional research and due diligence before considering this broker for their trading activities, including direct contact with the company to obtain missing information.

The main limitations identified include insufficient regulatory information, lack of detailed trading condition documentation, and minimal transparency about service offerings and customer support infrastructure. These factors contribute to the moderate overall assessment and suggest that potential clients should explore alternatives with more comprehensive public information and regulatory clarity before making final decisions.