Executive Summary

This comprehensive jiasheng international review presents a detailed analysis of a forex broker that operates with significant transparency concerns. Based on available information from WikiBit and other sources, Jiasheng International appears to be a trading platform that lacks proper regulatory oversight. This raises immediate red flags for potential traders who want to protect their money. While some sources suggest the broker may offer competitive trading speeds, the absence of verified regulatory credentials creates substantial risks for client funds and trading security.

The broker's limited public information and questionable legitimacy make it unsuitable for most retail traders. This is especially true for those who want fund safety and regulatory protection. Our analysis reveals concerning gaps in essential broker characteristics including unclear account structures, unverified trading conditions, and insufficient customer protection measures. Traders considering this platform should exercise extreme caution and thoroughly verify all claims before committing any capital.

Important Notice

Due to limited verified information available about Jiasheng International's operations and regulatory status, this review is based on publicly accessible data from WikiBit and related sources. Traders should be aware that regulatory conditions and service offerings may vary significantly across different jurisdictions. The lack of clear regulatory oversight makes it difficult to verify operational claims. This evaluation reflects information available as of 2025 and should be supplemented with independent verification before making any trading decisions.

Rating Framework

Broker Overview

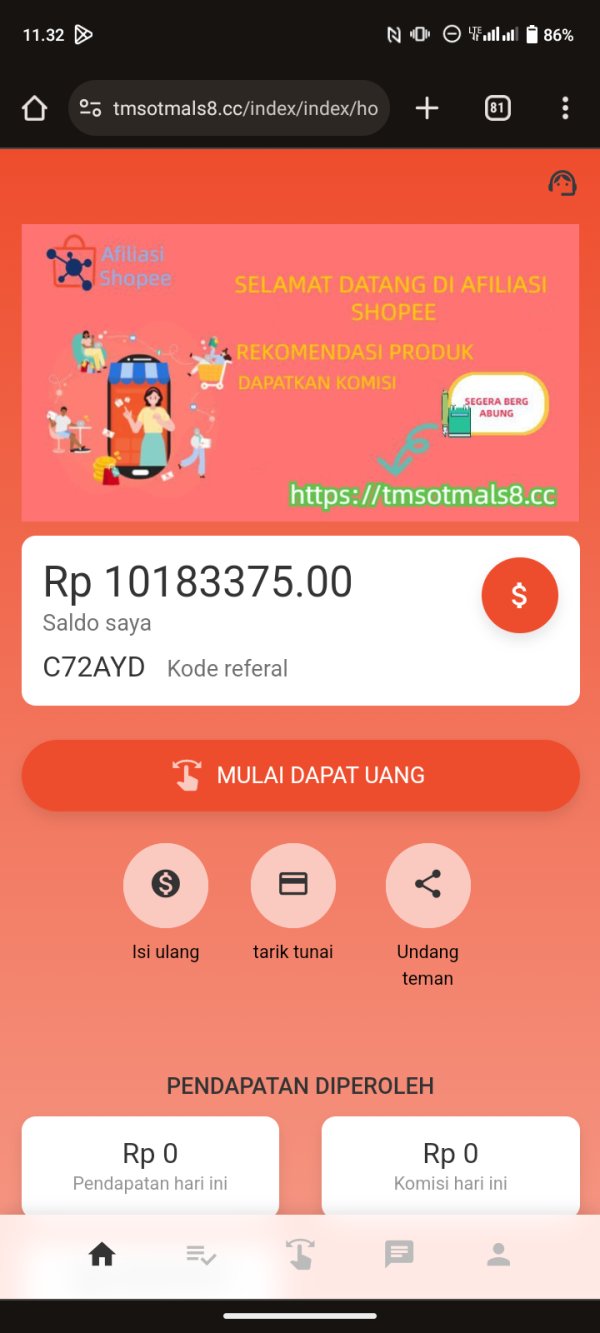

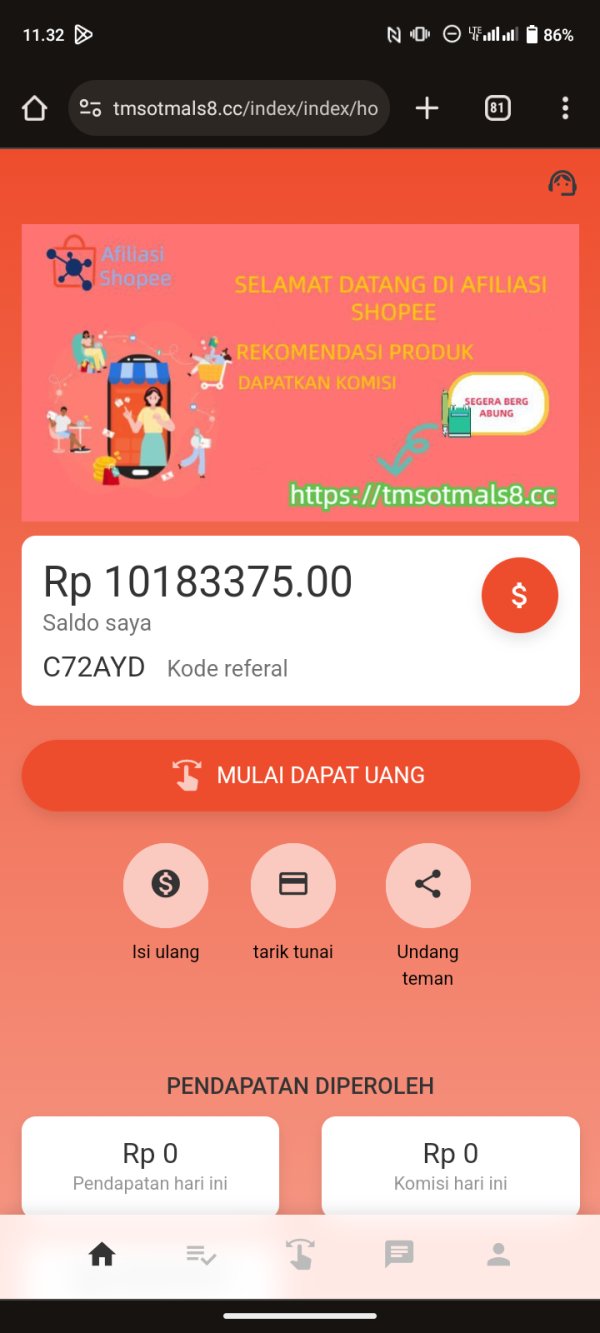

Jiasheng International presents itself as a forex and CFD trading platform. However, comprehensive details about its establishment date and corporate structure remain unclear based on available sources. According to WikiBit listings, the broker operates in the online trading space, offering access to foreign exchange markets and potentially other financial instruments. The lack of transparent corporate information and verified regulatory credentials creates significant concerns about the broker's legitimacy and operational standards.

The platform appears to target traders seeking online forex trading services. However, without proper regulatory backing, the safety of client funds remains questionable. Unlike established brokers that provide detailed company histories, regulatory compliance records, and transparent operational frameworks, jiasheng international review sources indicate limited verifiable information about the company's background, leadership, or business model. This opacity contrasts sharply with industry standards where reputable brokers maintain comprehensive public disclosures about their operations, regulatory status, and corporate governance structures.

Regulatory Status

Available information suggests Jiasheng International operates without verified regulatory oversight from recognized financial authorities. This absence of proper licensing represents a critical concern for trader protection and fund security.

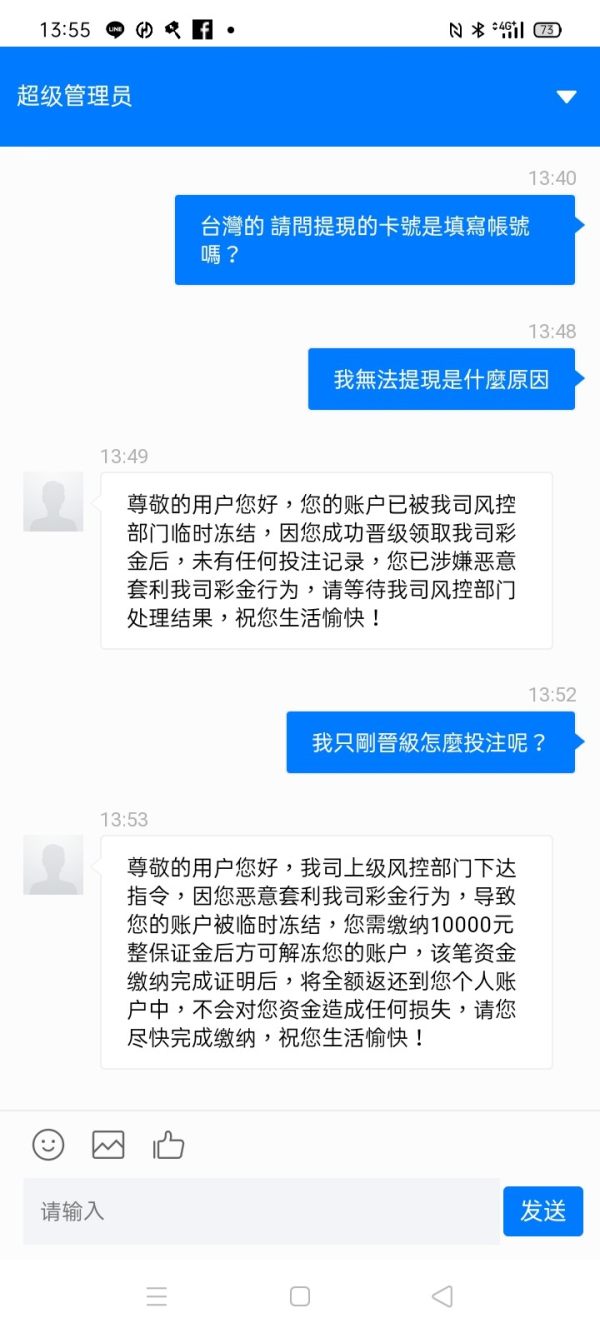

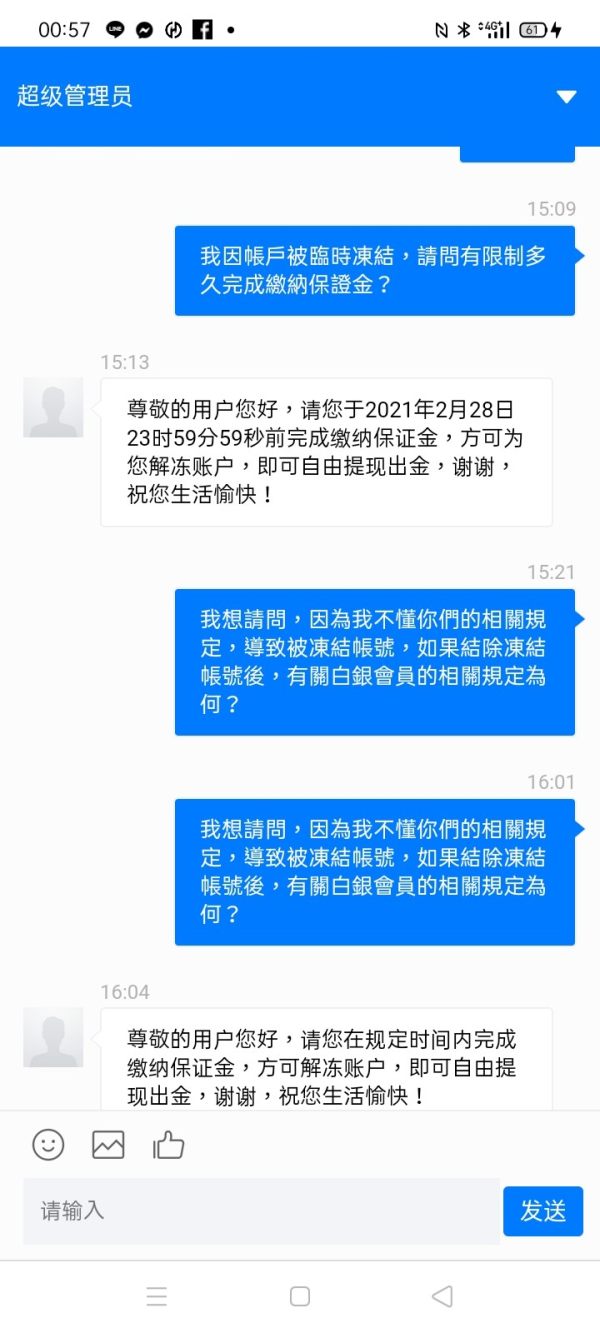

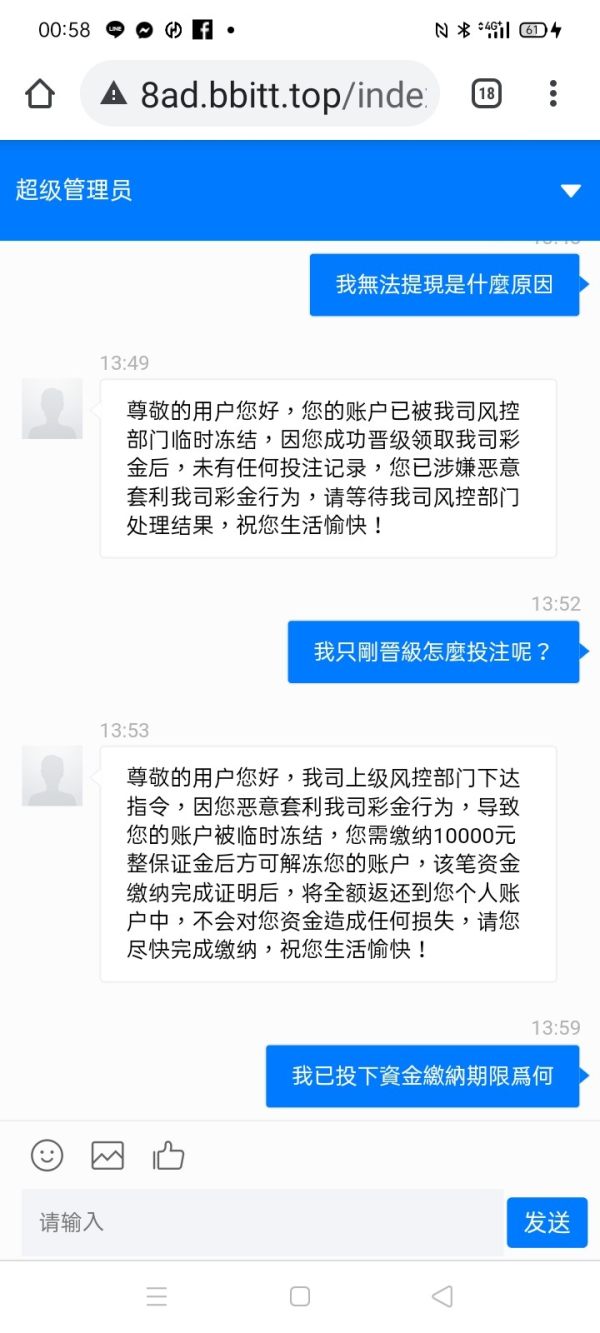

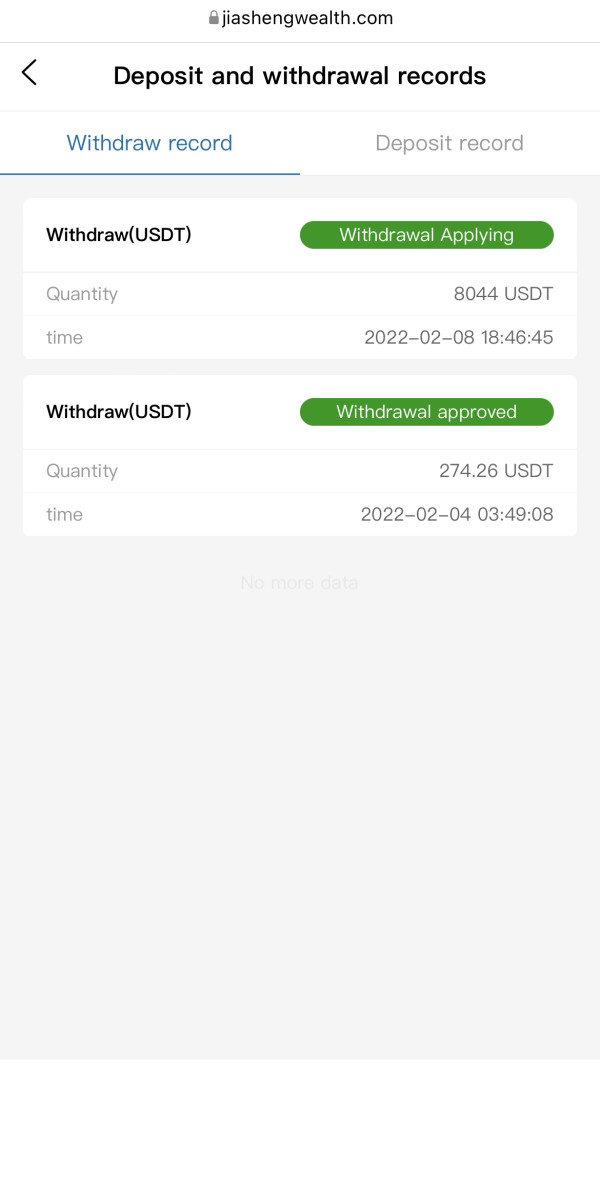

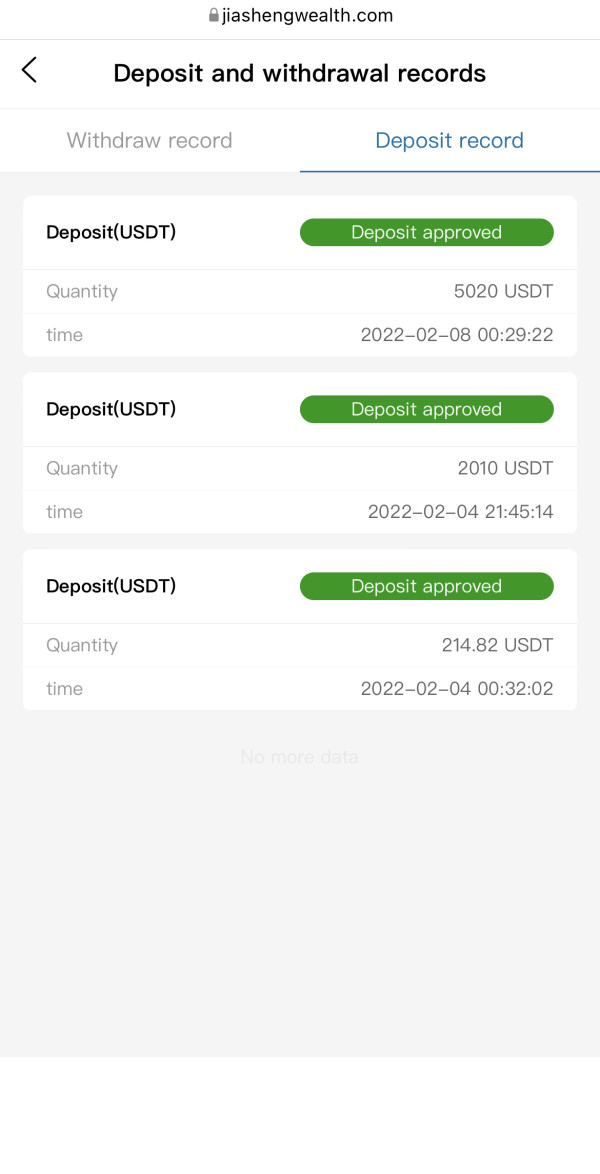

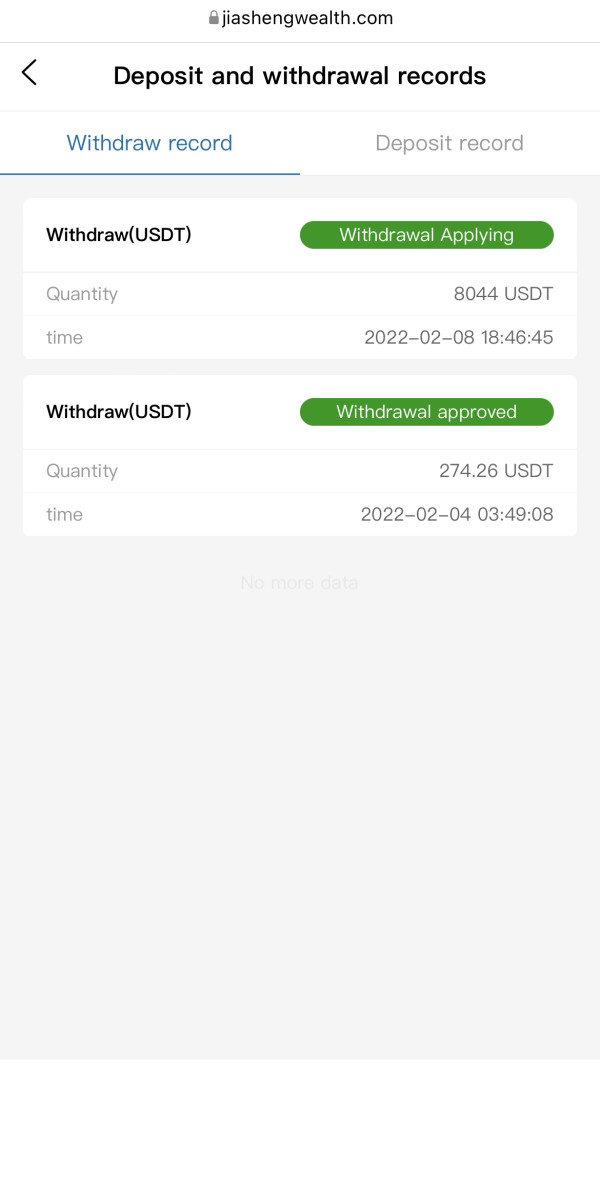

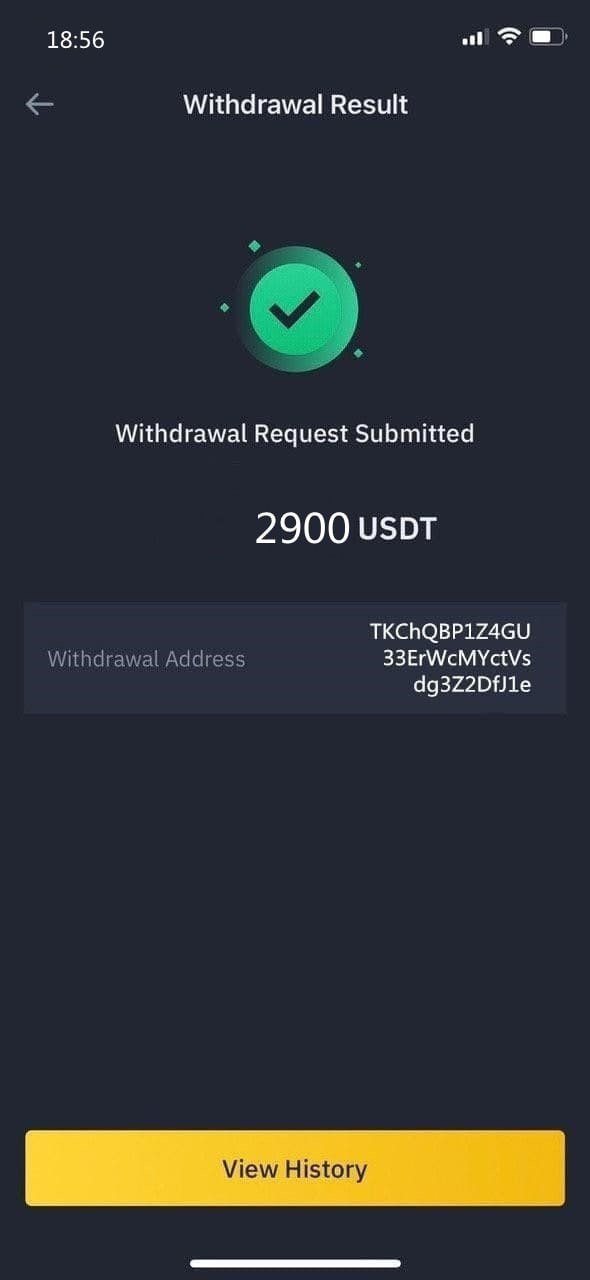

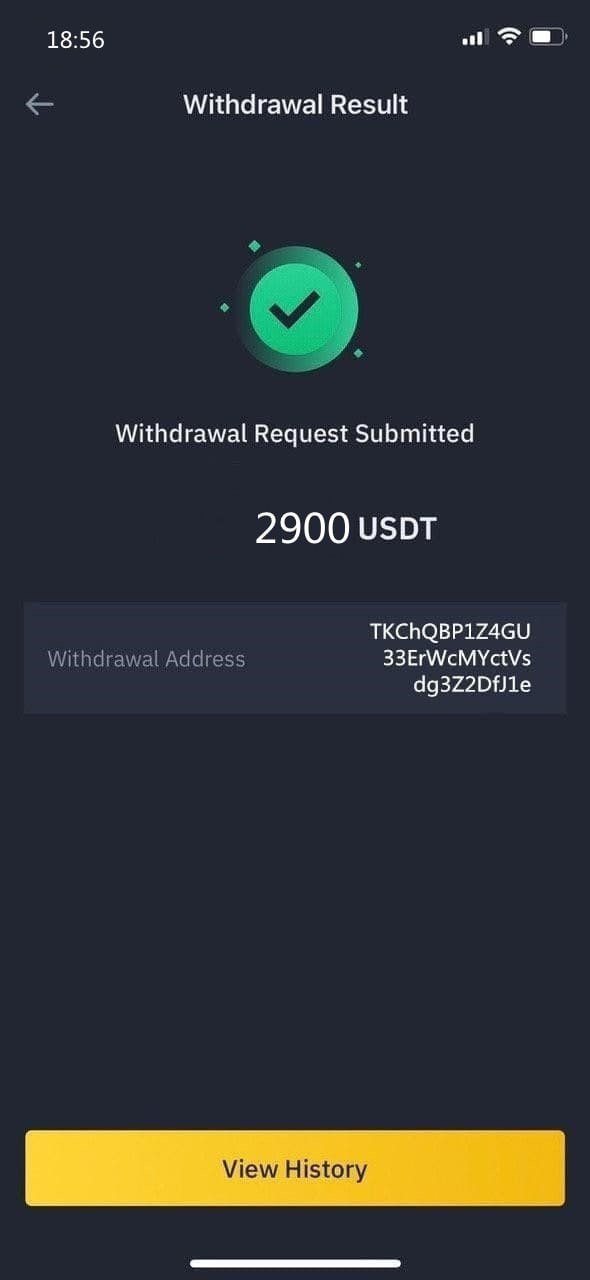

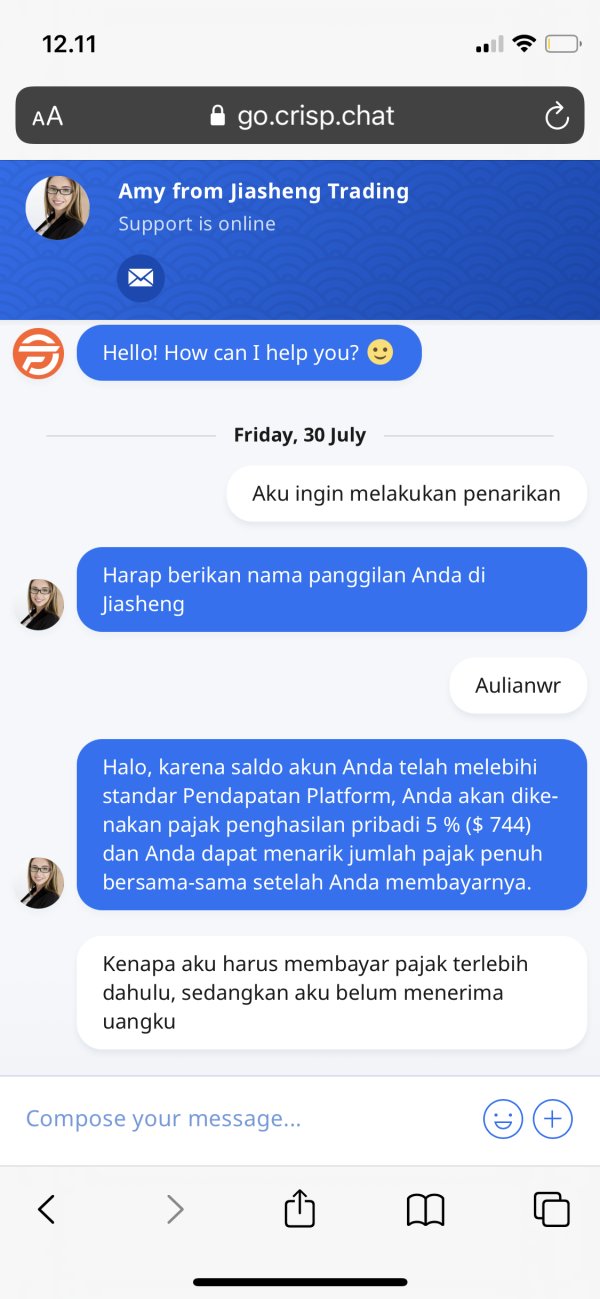

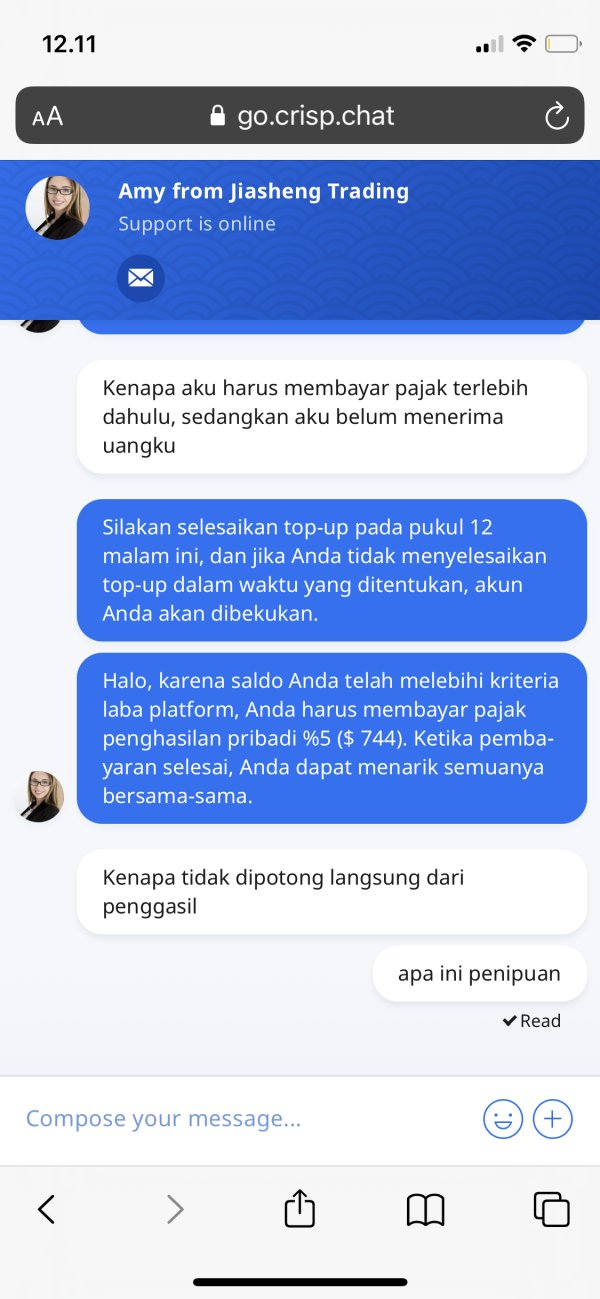

Deposit and Withdrawal Methods

Specific details about funding options, processing times, and associated fees are not clearly disclosed in available sources. This creates uncertainty about transaction procedures.

Minimum Deposit Requirements

The broker's minimum deposit thresholds and account opening requirements are not transparently communicated in accessible materials.

Information regarding promotional offers, welcome bonuses, or trading incentives remains unclear based on current jiasheng international review materials.

Tradeable Assets

While the platform appears to focus on forex trading, the complete range of available instruments lacks detailed specification. This includes currency pairs, CFDs, and other assets.

Cost Structure

Critical pricing information including spreads, commissions, overnight fees, and other trading costs are not clearly outlined in available documentation.

Leverage Ratios

Maximum leverage offerings and risk management parameters are not specified in accessible broker information.

Details about trading platform software, mobile applications, and technological infrastructure remain unspecified.

Geographic Restrictions

Service availability across different countries and jurisdictions is not clearly defined in current materials.

Customer Support Languages

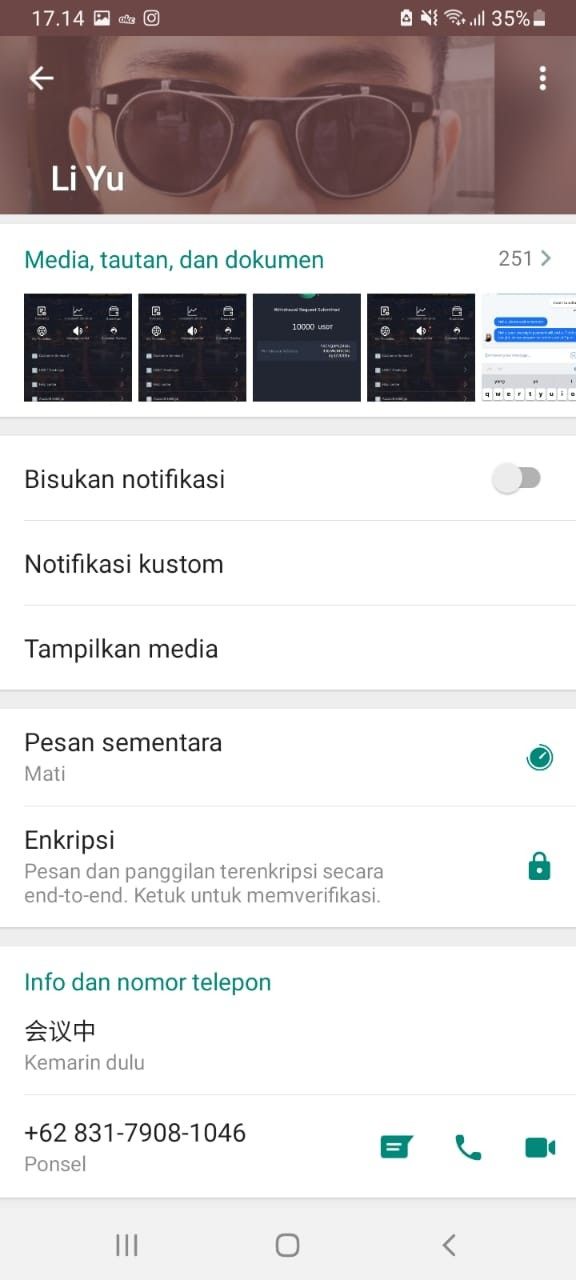

Available customer service languages and communication channels are not detailed in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

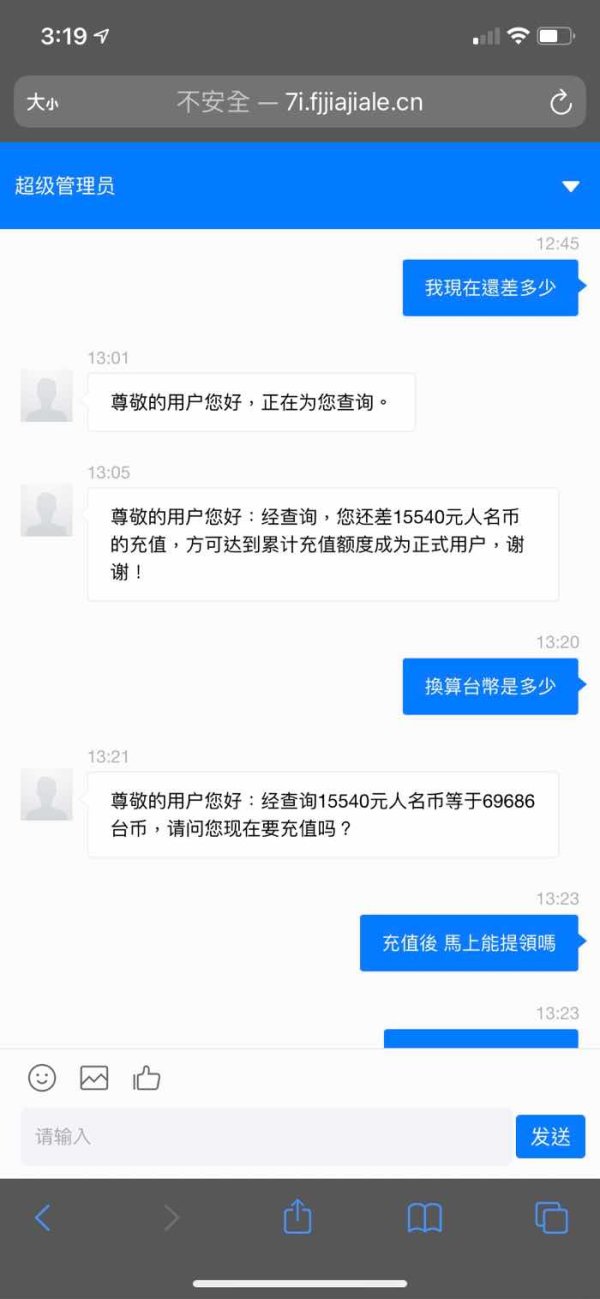

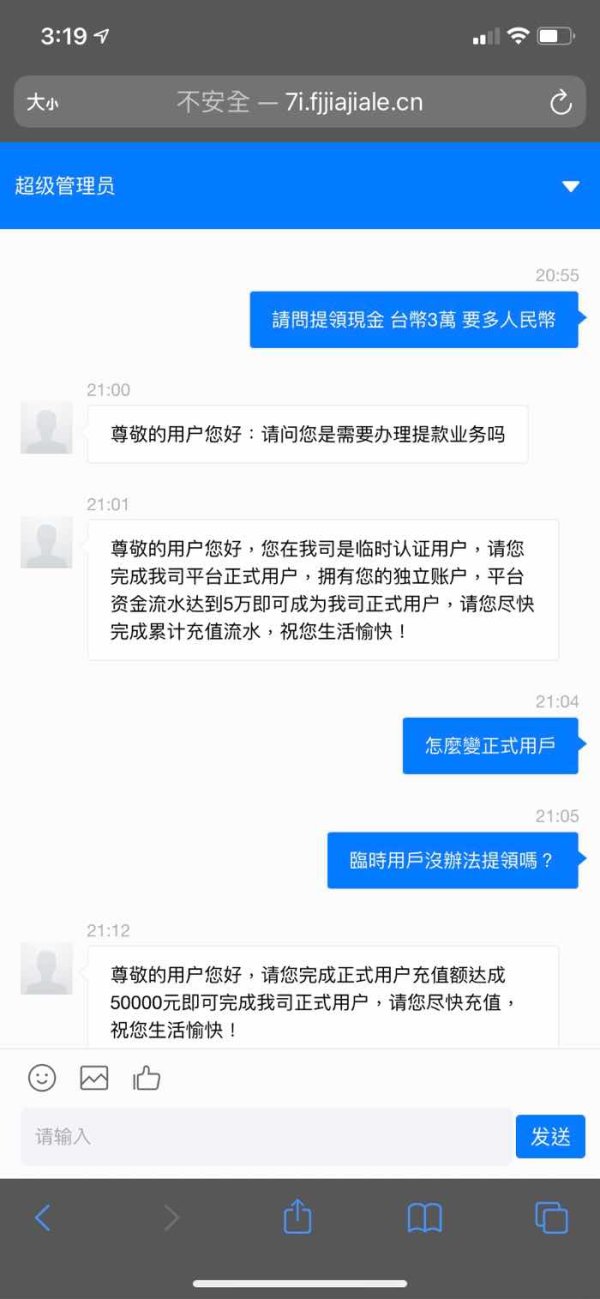

The account conditions offered by Jiasheng International receive a poor rating due to the lack of transparent information about account types, minimum deposits, and trading terms. Unlike reputable brokers that provide comprehensive account specifications including detailed fee structures, leverage options, and account features, this broker fails to deliver adequate transparency. The absence of clear account documentation makes it impossible for traders to make informed decisions about their trading setup.

Without verified information about account opening procedures, minimum balance requirements, or account maintenance fees, potential clients cannot properly evaluate the cost-effectiveness of trading with this platform. This jiasheng international review highlights that the broker's failure to provide standard account information represents a significant departure from industry best practices. Established brokers typically offer multiple account tiers with clearly defined features, costs, and benefits.

The lack of information about Islamic accounts, professional trading accounts, or institutional services further demonstrates the broker's inadequate account infrastructure compared to regulated competitors.

Jiasheng International's trading tools and educational resources receive a poor rating due to insufficient information about available analytical tools, research materials, and trader education programs. Professional forex brokers typically provide comprehensive trading platforms with advanced charting tools, technical indicators, economic calendars, and market analysis resources.

The absence of detailed information about trading tools suggests either limited platform capabilities or poor transparency in communicating available features. Successful trading often depends on access to quality research, market analysis, and educational materials. These appear to be inadequately addressed by this broker.

Without verified information about platform features, third-party tool integration, or educational content, traders cannot assess whether the broker provides the necessary resources for informed trading decisions. This deficiency places the broker at a significant disadvantage compared to established competitors that offer comprehensive trading ecosystems.

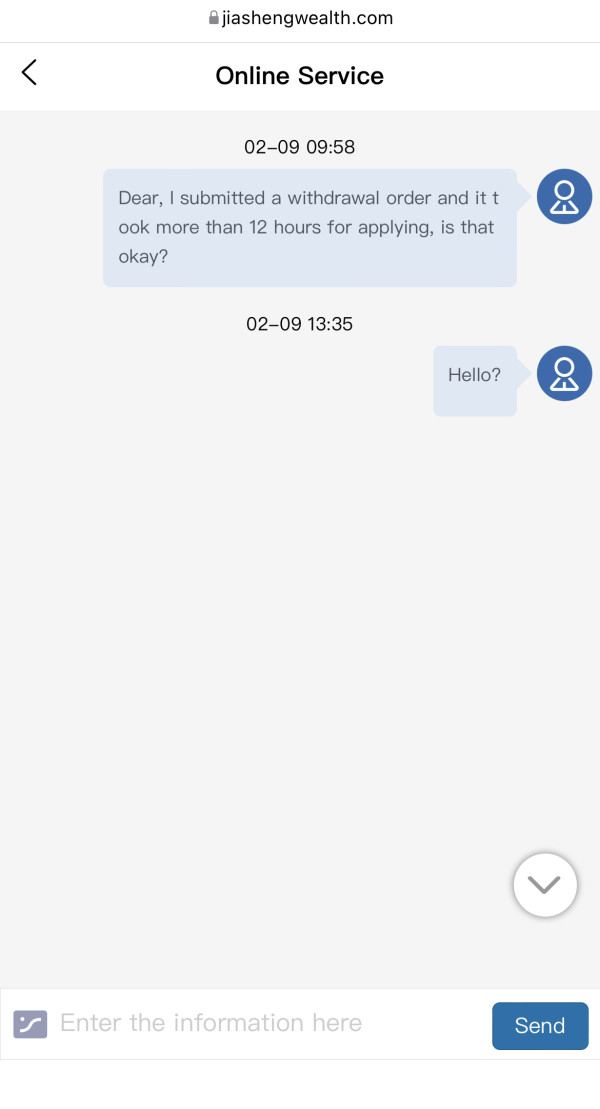

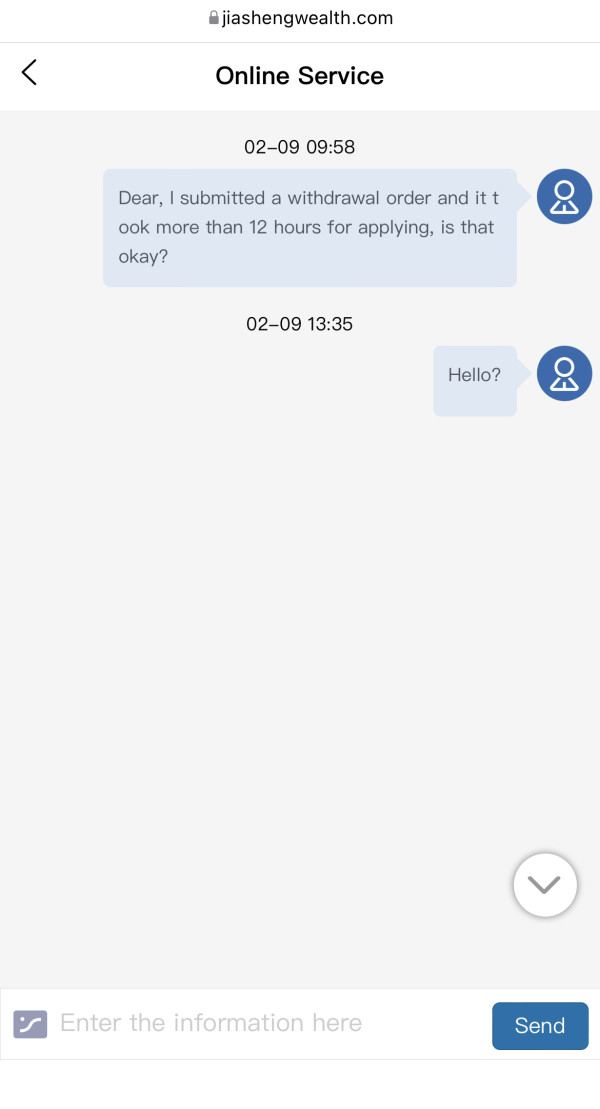

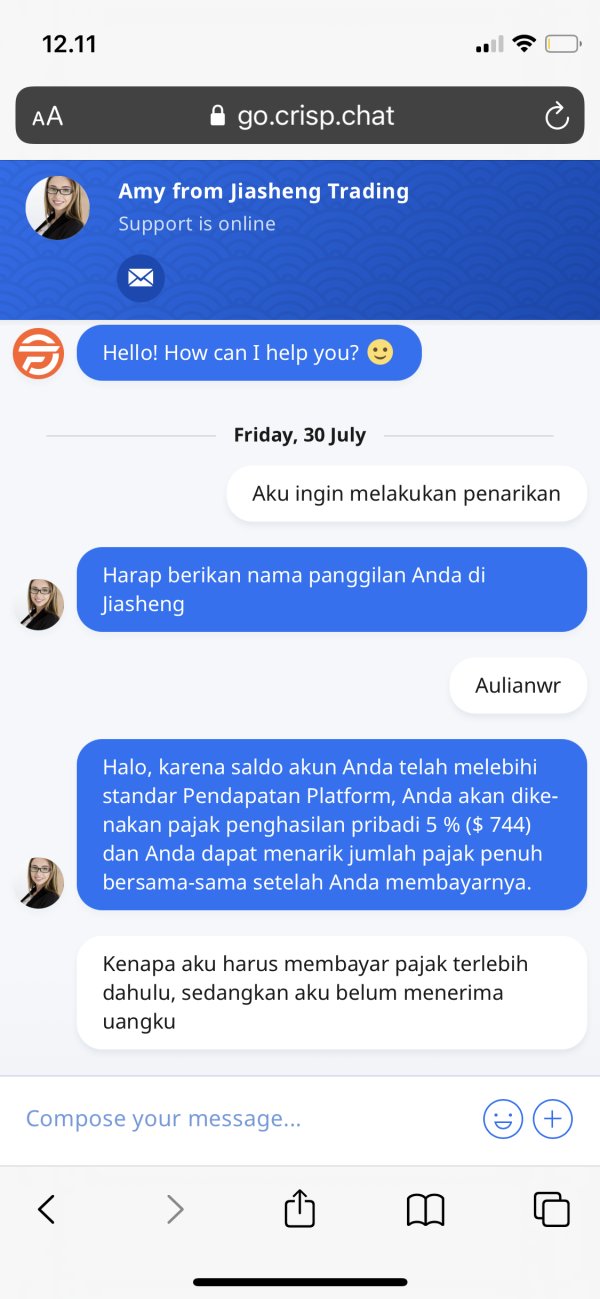

Customer Service and Support Analysis (Score: 3/10)

Customer service evaluation proves challenging due to limited information about support channels, response times, and service quality. Professional brokers typically provide multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. They also offer clearly defined operating hours and multilingual support.

The lack of transparent customer service information raises concerns about the broker's commitment to client support and problem resolution. Effective customer service is crucial in forex trading, where technical issues, account problems, or trading disputes require prompt and professional resolution.

Without verified information about support quality, response times, or available communication channels, traders cannot assess whether they will receive adequate assistance when needed. This uncertainty represents a significant risk factor for traders who may require urgent support during volatile market conditions.

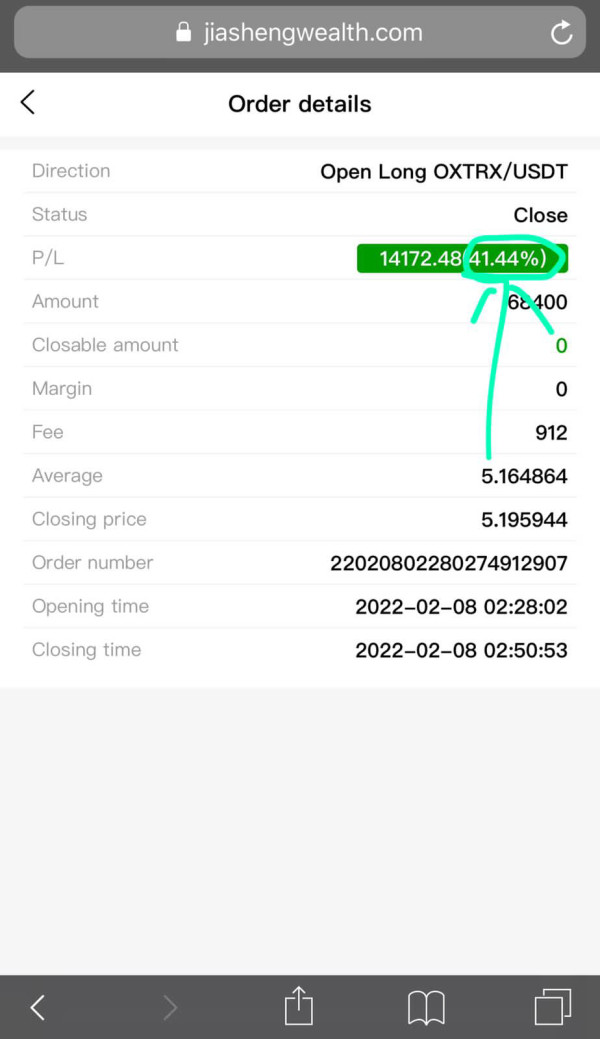

Trading Experience Analysis (Score: 4/10)

The trading experience evaluation is limited by insufficient information about platform performance, execution quality, and trading conditions. While some sources suggest competitive execution speeds, the lack of comprehensive performance data makes it difficult to verify these claims or assess overall trading quality.

Professional trading requires reliable platform performance, consistent execution, minimal slippage, and stable connectivity. Without verified information about these critical factors, traders cannot assess whether the platform meets professional trading standards. The absence of detailed trading condition specifications creates uncertainty about spread consistency, execution reliability, and order processing quality.

This jiasheng international review indicates that while execution speed claims exist, the overall trading experience cannot be properly evaluated. This is due to insufficient verified information about platform capabilities, stability, and performance metrics.

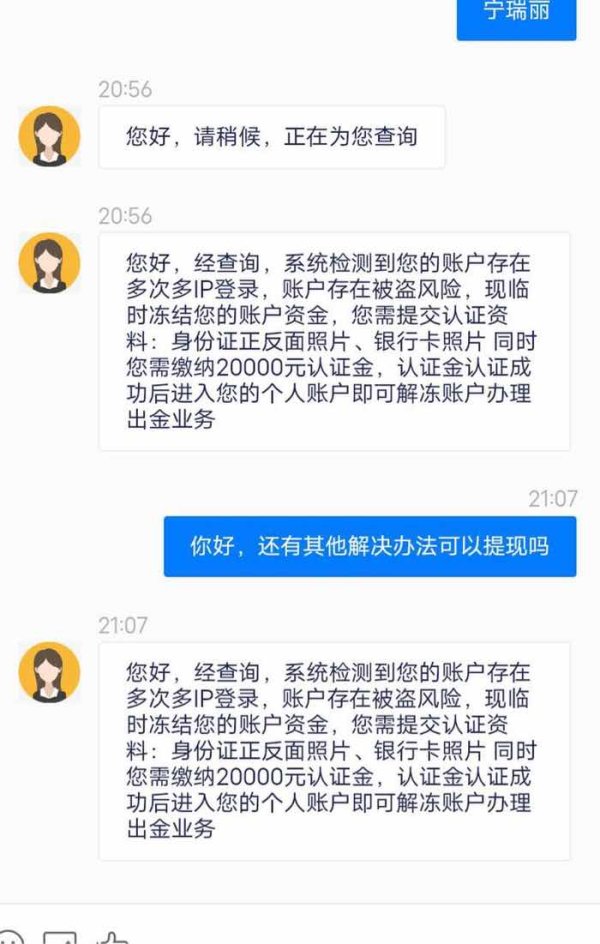

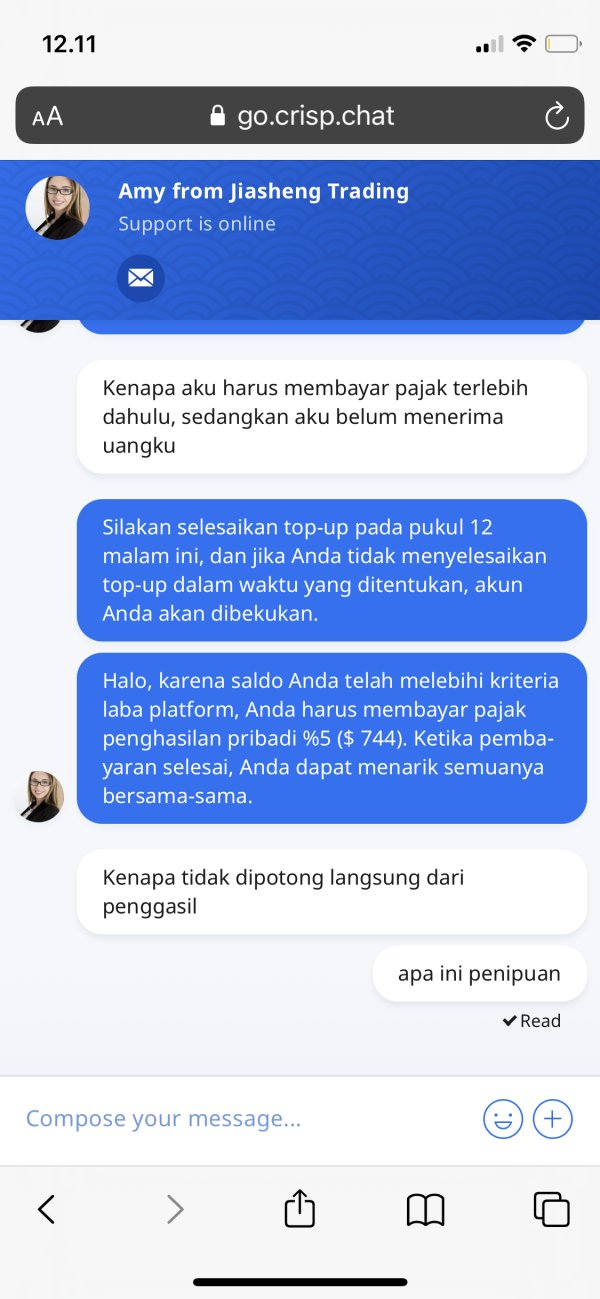

Trustworthiness Analysis (Score: 1/10)

Trustworthiness receives the lowest possible rating due to the apparent absence of regulatory oversight and limited transparency about corporate structure and operations. Regulatory compliance represents the foundation of broker trustworthiness, providing essential protections including segregated client funds, dispute resolution mechanisms, and operational oversight.

The lack of verified regulatory credentials creates substantial risks for client fund security and legal recourse. Reputable brokers maintain licenses from recognized authorities such as the FCA, CySEC, ASIC, or other established regulators. These authorities enforce strict operational standards and client protection measures.

Without proper regulatory backing, traders face significant risks including potential fund loss, limited legal protection, and inadequate dispute resolution options. This fundamental lack of regulatory compliance makes the broker unsuitable for traders prioritizing fund security and operational transparency.

User Experience Analysis (Score: 3/10)

User experience evaluation is hampered by limited verified user feedback and insufficient information about platform usability, account management processes, and overall client satisfaction. Professional brokers typically maintain comprehensive user interfaces, streamlined account opening procedures, and intuitive trading platforms that enhance the overall client experience.

The lack of detailed information about platform design, mobile trading capabilities, and user interface quality makes it difficult to assess whether the broker provides a satisfactory user experience. Additionally, without comprehensive user reviews and feedback, potential clients cannot gauge real-world satisfaction levels or identify common user concerns.

The limited transparency about user experience factors suggests either inadequate platform development or poor communication about available features. Both of these represent significant disadvantages in the competitive forex brokerage market.

Conclusion

This jiasheng international review reveals a broker that fails to meet basic industry standards for transparency, regulatory compliance, and client protection. The absence of verified regulatory oversight represents a critical flaw that makes this broker unsuitable for most retail traders. While some performance claims exist, the lack of comprehensive verification and regulatory backing creates unacceptable risks for client funds and trading security.

Traders seeking reliable forex trading services should prioritize regulated brokers that provide transparent operations, verified credentials, and comprehensive client protections. The significant information gaps and regulatory concerns identified in this analysis suggest that potential clients should exercise extreme caution. They should consider well-established alternatives with proven track records and proper regulatory oversight.