Profitto 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive profitto review reveals significant concerns about this forex broker's operations and legitimacy. Our extensive research from multiple industry sources shows that Profitto operates as an unregulated forex broker with widespread reports of fraudulent activities and withdrawal difficulties. The platform has been consistently flagged by various financial review sites as a scam operation. Users experience substantial difficulties in fund recovery and customer service issues.

While Profitto offers the popular MT4 trading platform compatible with Windows, OS X, iOS, and Android devices, this single positive feature is overshadowed by numerous red flags. The broker is registered in Saint Vincent and the Grenadines. This jurisdiction is known for minimal regulatory oversight, which compounds concerns about trader protection and fund security.

The platform primarily targets traders seeking high leverage opportunities and multi-platform support. However, industry experts strongly advise extreme caution when considering this broker. User feedback consistently points to withdrawal problems, poor customer service, and potential pyramid scheme characteristics that make Profitto unsuitable for serious forex trading.

Important Notice

Regional Entity Differences: Profitto is registered in Saint Vincent and the Grenadines, operating under minimal regulatory oversight. This jurisdiction lacks the stringent financial regulations found in major financial centers. It potentially exposes traders to increased risks.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, industry reports, and available public information from multiple independent sources. The assessment draws from various industry commentary and trader experiences. It provides an objective overview of Profitto's services and reputation.

Rating Overview

Broker Overview

Profitto operates as a forex brokerage firm registered in Saint Vincent and the Grenadines. Specific founding details remain unclear from available documentation. The company presents itself as a trading platform provider but lacks the transparency typically expected from legitimate financial service providers.

According to WikiBit and other industry sources, Profitto has been consistently flagged for operating without proper regulatory oversight and engaging in questionable business practices. The broker's business model appears to focus on attracting traders through promises of accessible trading platforms and competitive conditions. However, multiple independent reviews and user reports suggest that the company's actual operations diverge significantly from these initial promises.

Numerous complaints about fund withdrawal difficulties and poor service delivery continue to surface. Profitto's primary offering centers around the MetaTrader 4 platform, which supports trading across Windows, OS X, iOS, and Android operating systems. Despite this mainstream platform choice, the broker lacks the comprehensive asset offerings, regulatory compliance, and customer protection measures that characterize reputable forex brokers.

Industry analysis consistently places Profitto in the high-risk category due to its unregulated status and numerous negative user experiences reported across various review platforms.

Regulatory Status: Profitto operates from Saint Vincent and the Grenadines without oversight from major financial regulatory bodies. This jurisdiction provides minimal trader protection compared to established regulatory frameworks like FCA, ASIC, or CySEC.

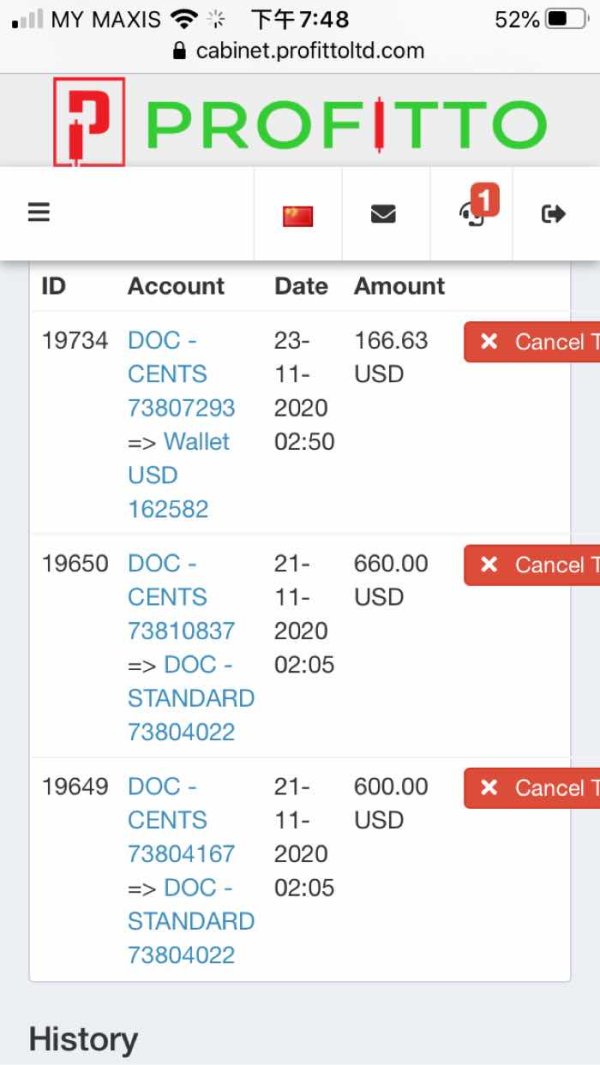

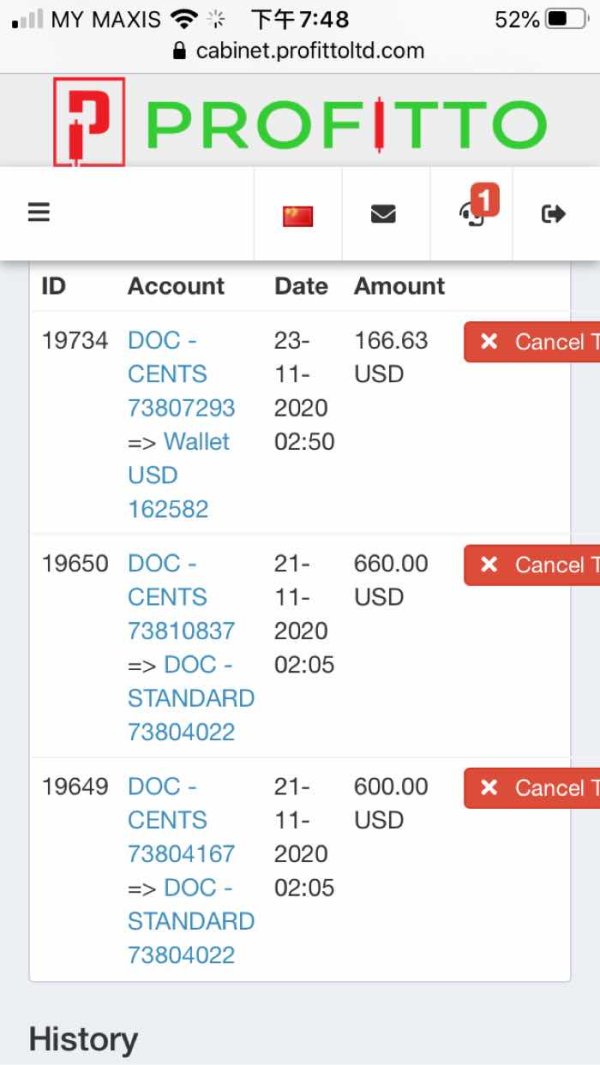

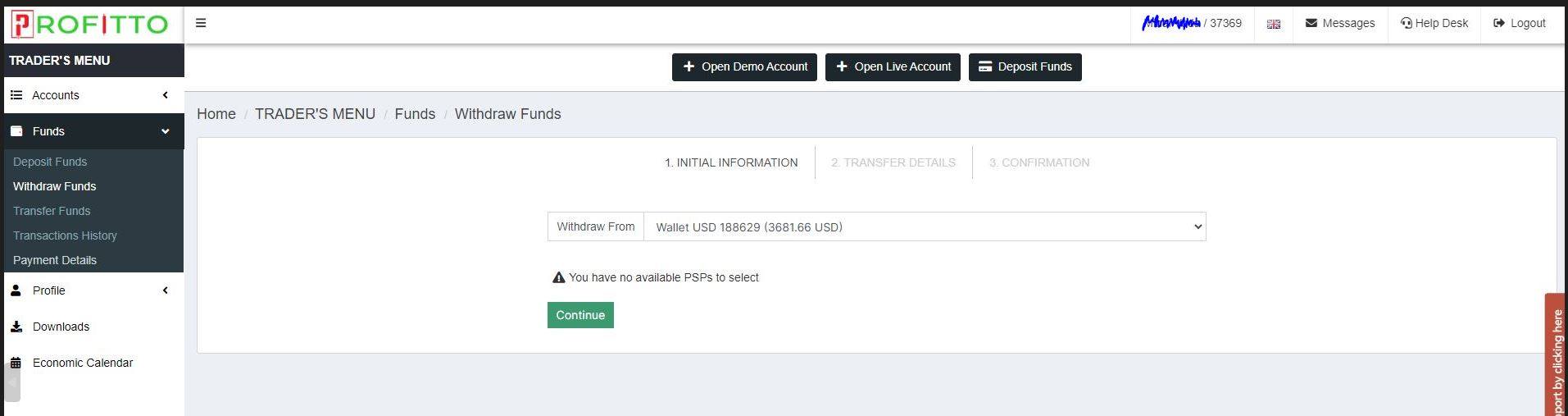

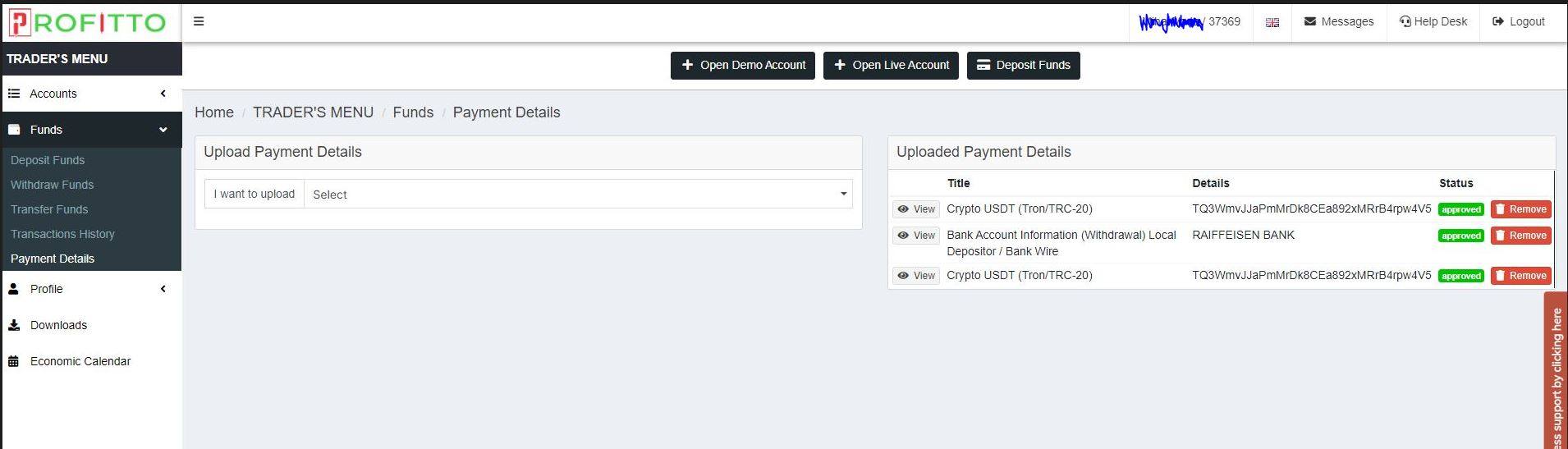

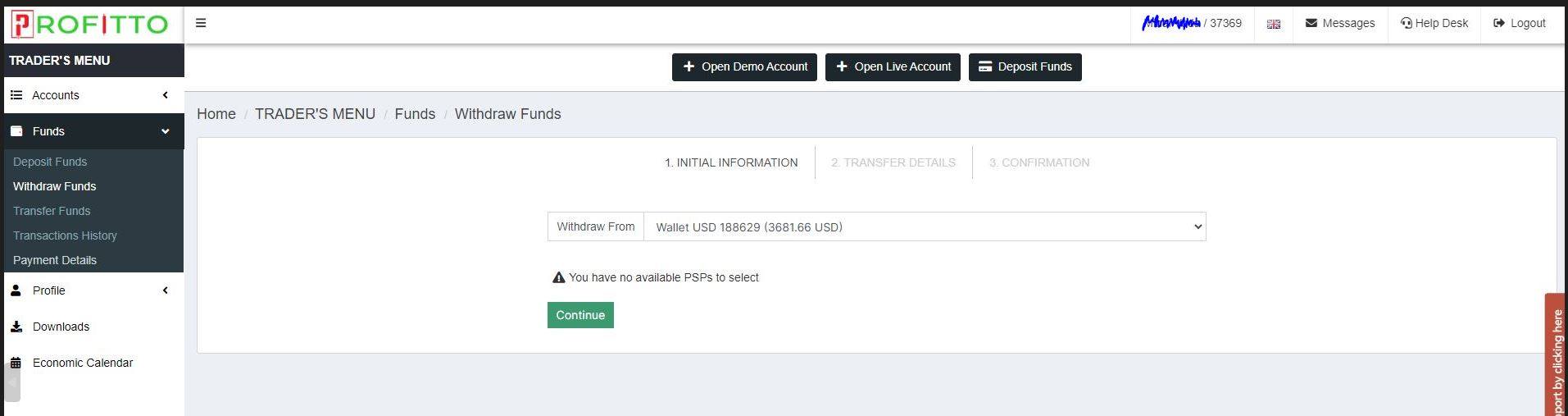

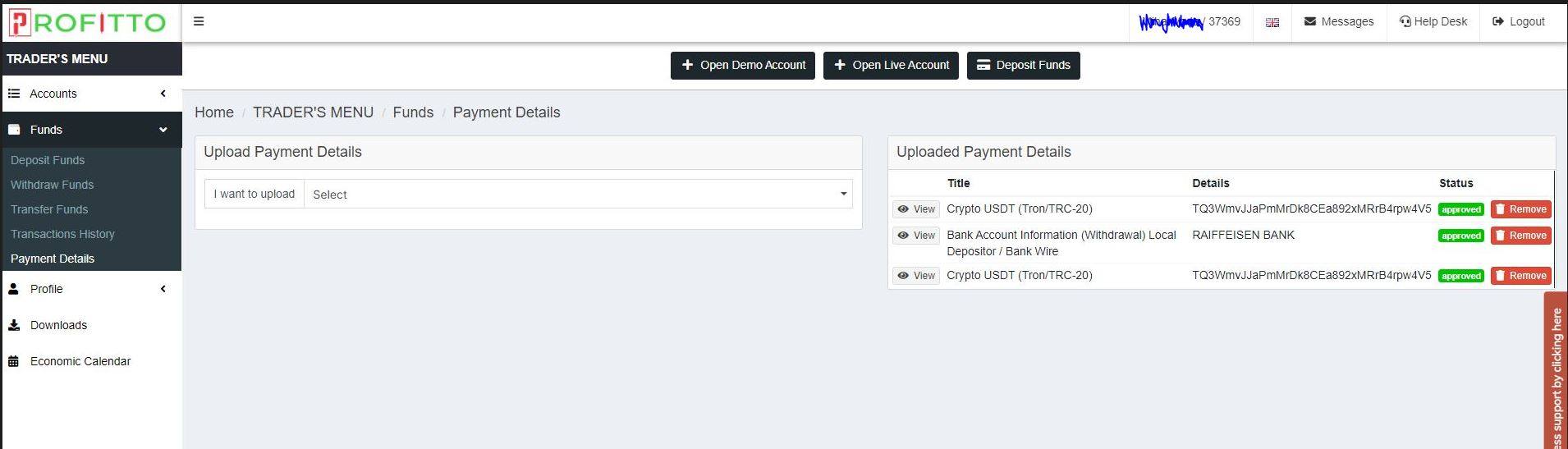

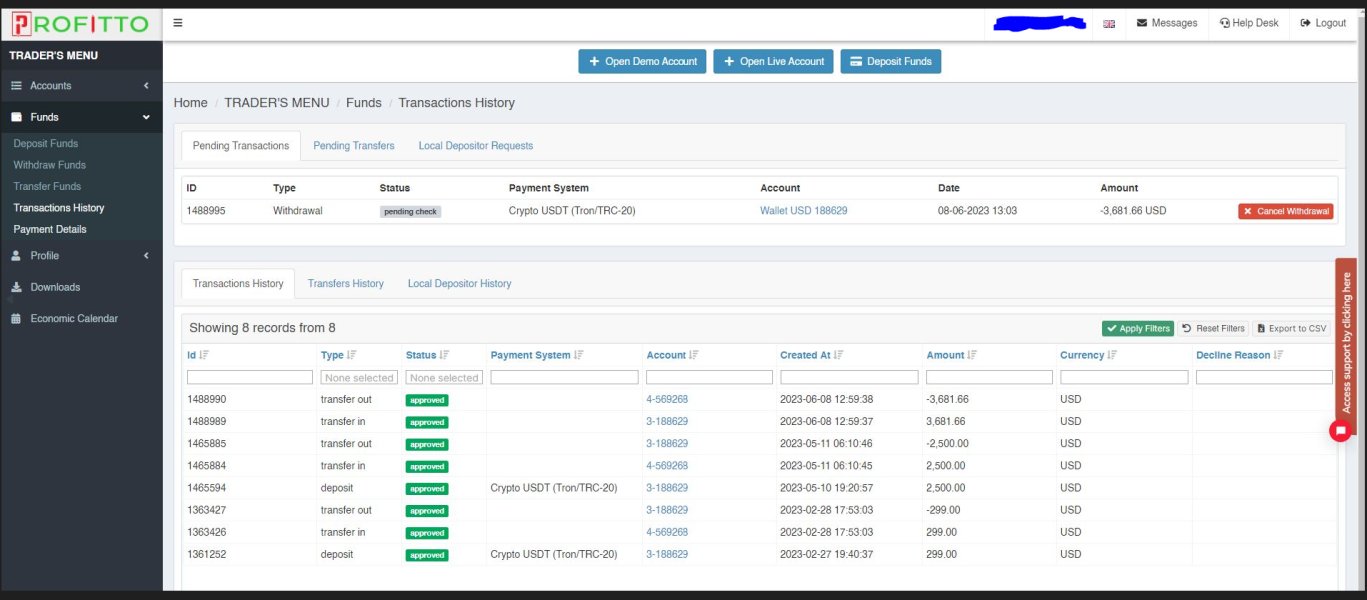

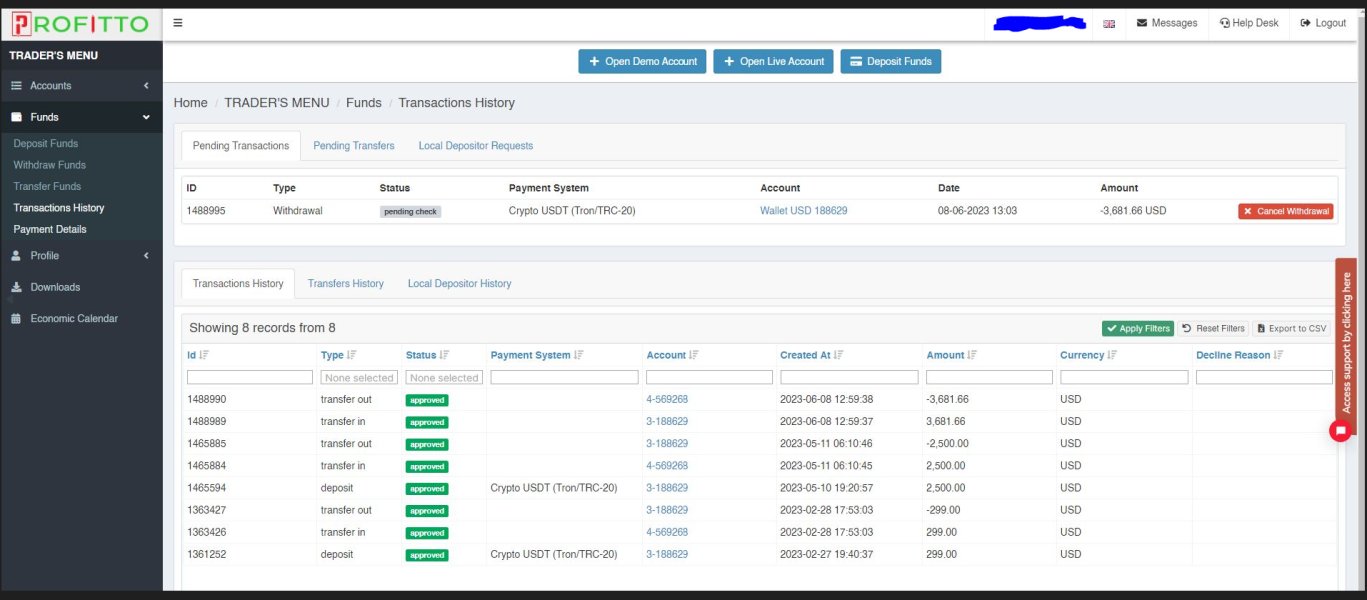

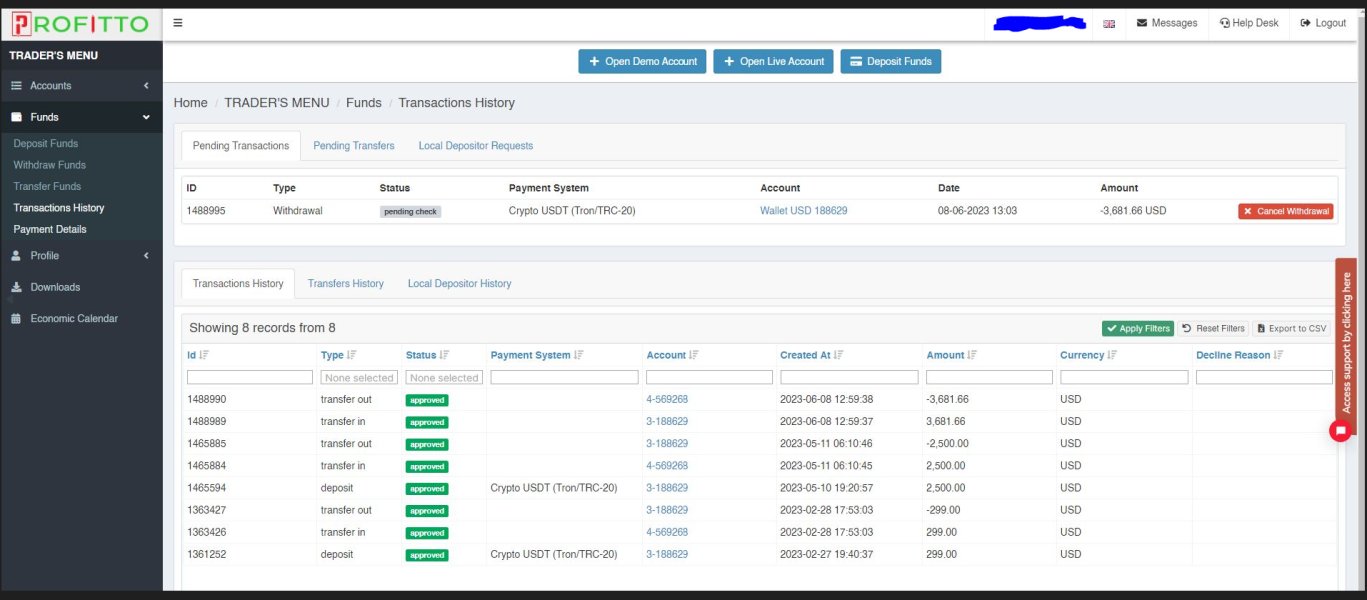

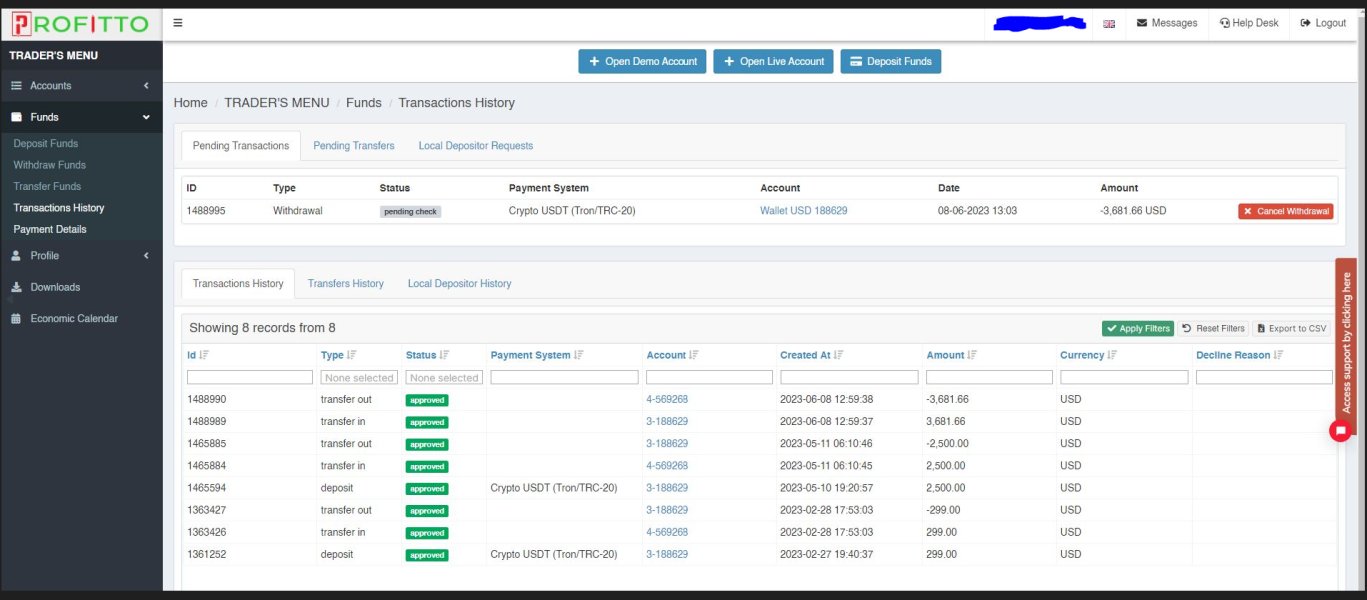

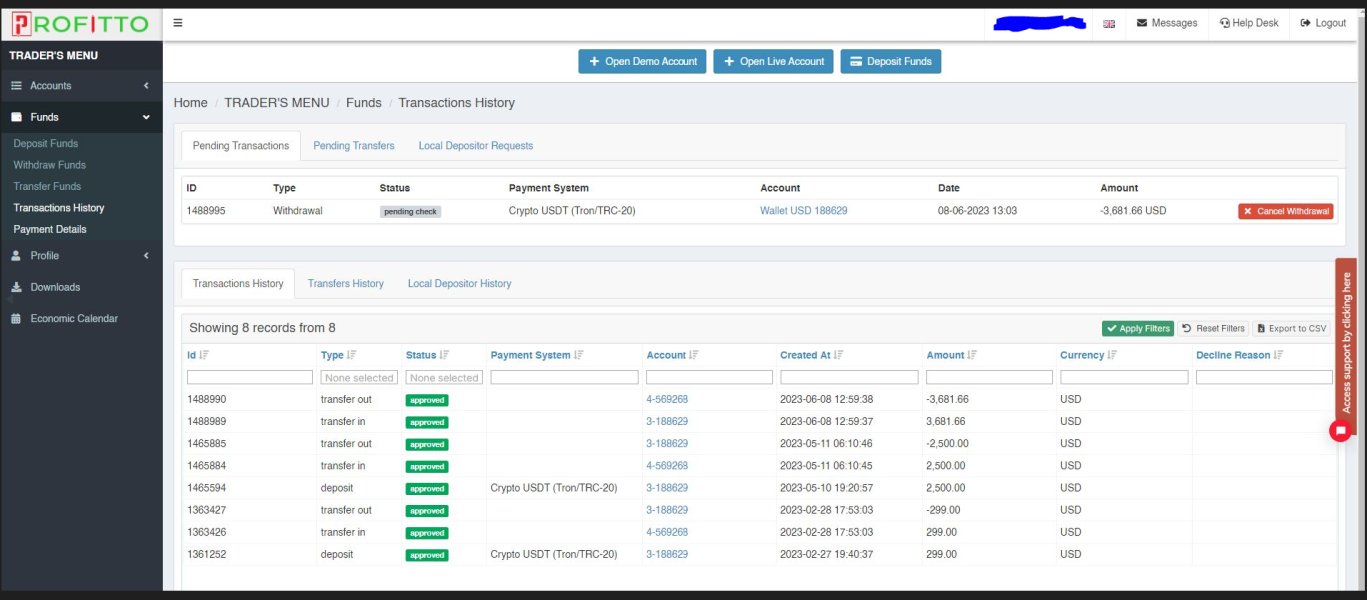

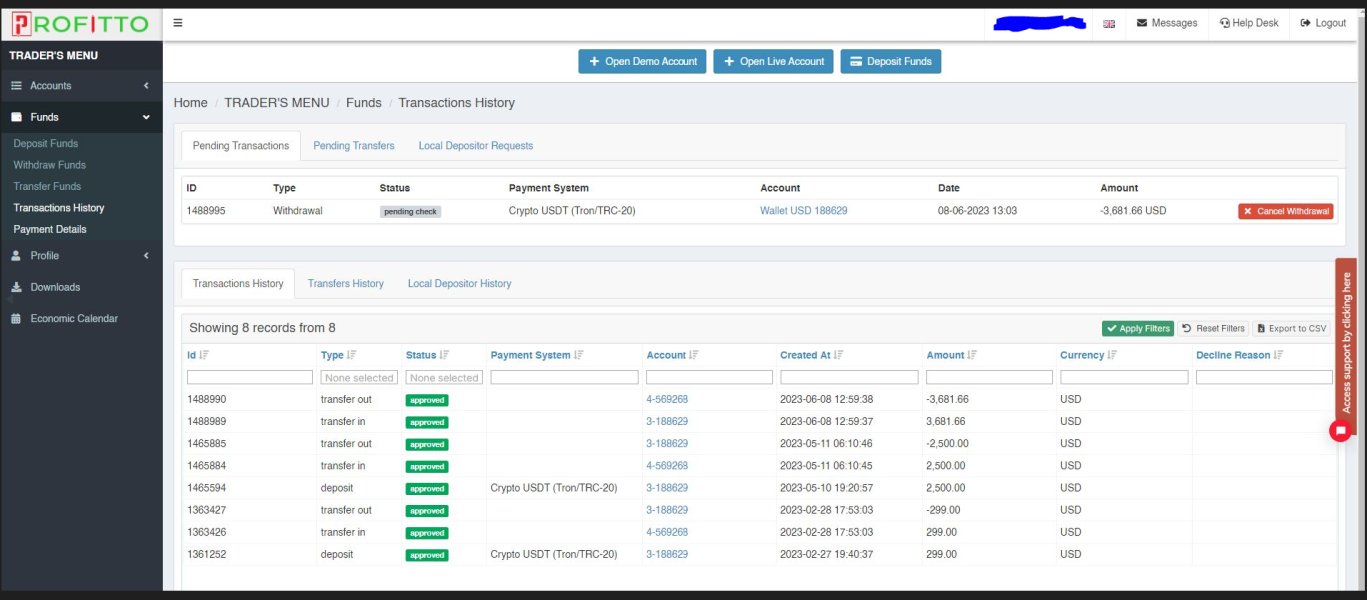

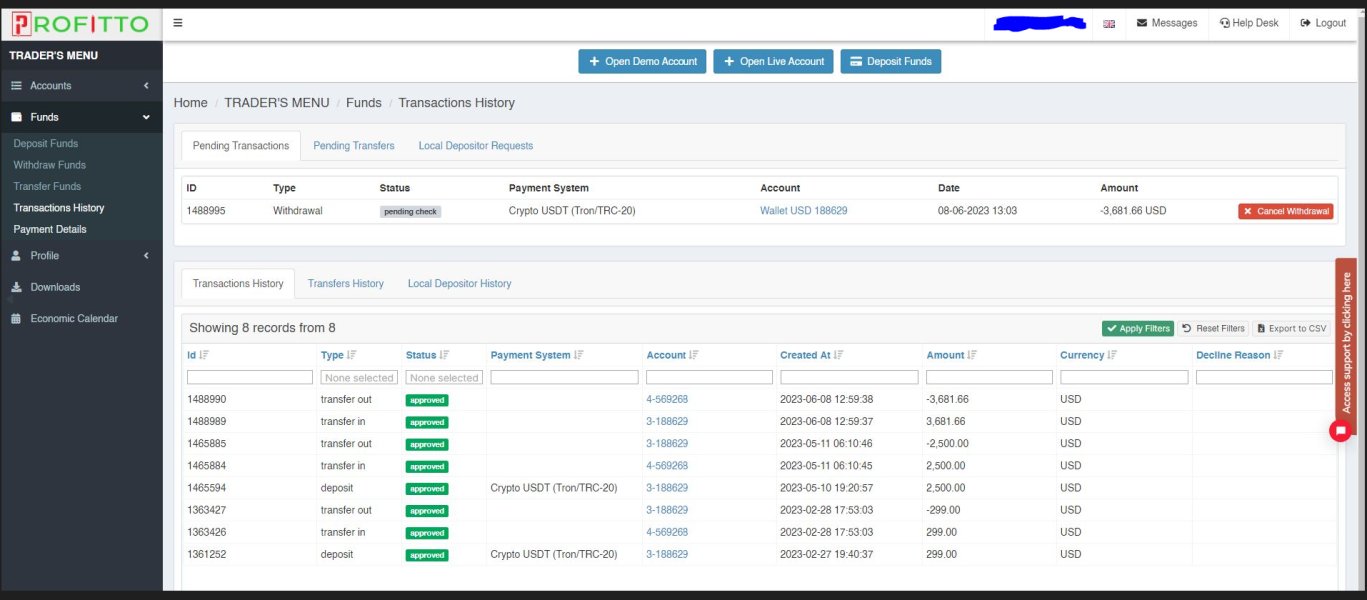

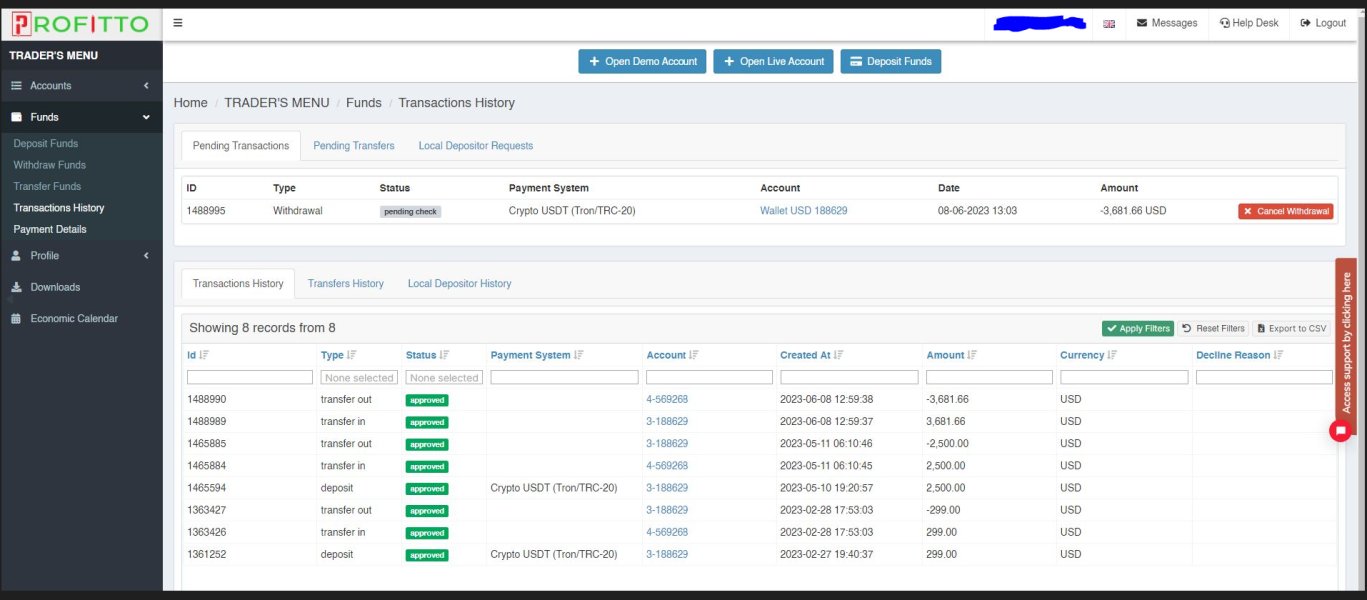

Deposit and Withdrawal Methods: Available documentation does not specify the exact payment methods supported by Profitto. User reports suggest significant difficulties with fund withdrawal processes regardless of the method used.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly disclosed in available materials. This reflects the broker's overall lack of transparency in operational details.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in accessible documentation. This indicates limited or non-existent incentive programs for traders.

Tradeable Assets: The range of available trading instruments remains unspecified in available resources. This suggests a potentially limited selection compared to established brokers.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available. This makes it difficult for potential traders to assess the true cost of trading with Profitto.

Leverage Options: Specific leverage ratios offered by the platform are not mentioned in available documentation. This profitto review notes that high leverage claims are often used to attract inexperienced traders.

Platform Options: The broker provides access to the MetaTrader 4 trading platform across multiple operating systems including Windows, OS X, iOS, and Android devices.

Geographic Restrictions: Specific regional limitations for account opening and trading are not detailed in available materials.

Customer Support Languages: The range of languages supported by customer service teams is not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Profitto receive a poor rating due to lack of transparency and user-reported difficulties. Available information fails to specify different account types, their respective features, or minimum deposit requirements. This is concerning for potential traders seeking clear terms and conditions.

This opacity makes it impossible for traders to make informed decisions about account selection. User feedback consistently highlights problems with account management, particularly regarding fund withdrawals and account verification processes. Multiple reports suggest that traders experience unexpected difficulties when attempting to access their funds.

Some users describe prolonged delays and unresponsive customer service when seeking resolution. The absence of detailed account information on the broker's materials contrasts sharply with industry standards. Reputable brokers provide comprehensive breakdowns of account types, minimum deposits, and associated benefits.

This lack of transparency in profitto review materials serves as a significant red flag for potential traders. Compared to regulated brokers who must maintain clear account terms and conditions, Profitto's opaque approach to account management suggests either poor business practices or deliberate obfuscation of unfavorable terms. These practices might deter potential clients from opening accounts.

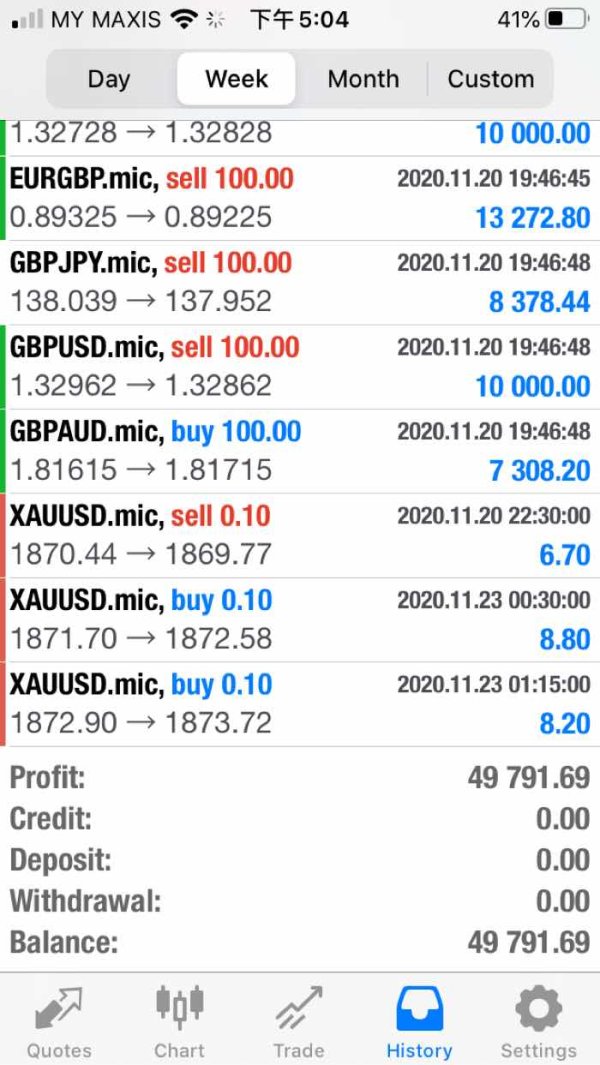

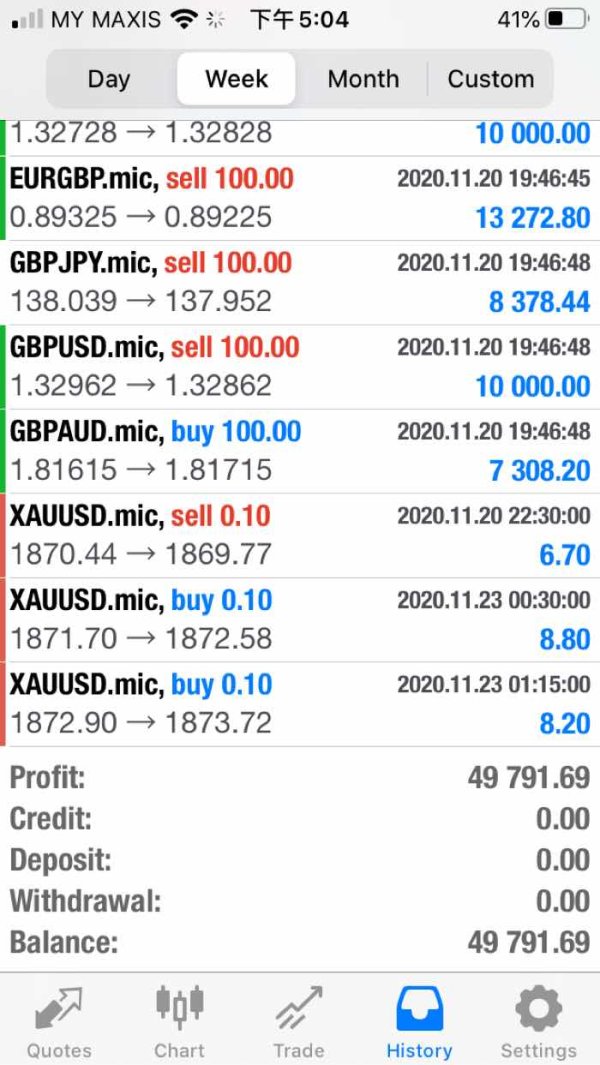

Profitto's tools and resources receive a below-average rating primarily based on the limited information available about their offerings. While the broker provides access to the MetaTrader 4 platform, which is an industry-standard trading interface, the absence of additional trading tools and resources significantly limits its appeal to serious traders.

The MT4 platform itself offers basic charting capabilities, technical indicators, and automated trading support through Expert Advisors. However, user feedback suggests that even this standard platform may not function optimally within Profitto's infrastructure. Some traders report connectivity issues and platform instability.

Educational resources appear to be minimal or non-existent based on available documentation. Reputable brokers typically provide extensive educational materials, market analysis, and research tools to support trader development. Profitto seems to lack these essential resources that help traders make informed decisions.

The absence of proprietary trading tools, market research, or analytical resources places Profitto at a significant disadvantage compared to established brokers. These brokers invest heavily in providing comprehensive trading support to their clients.

Customer Service and Support Analysis (2/10)

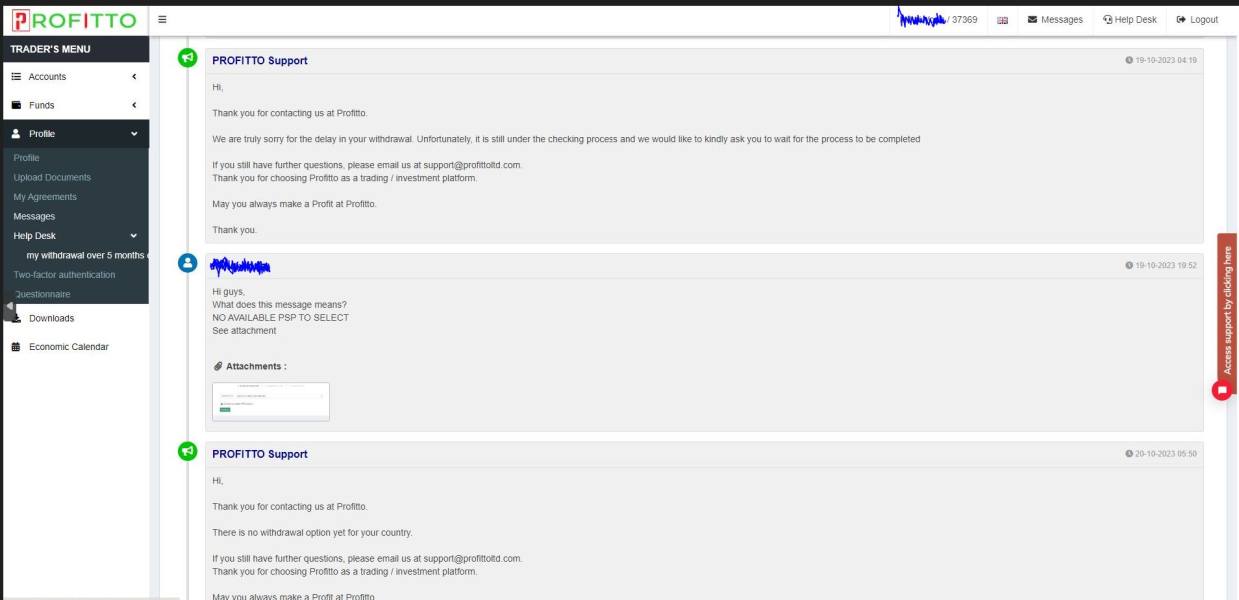

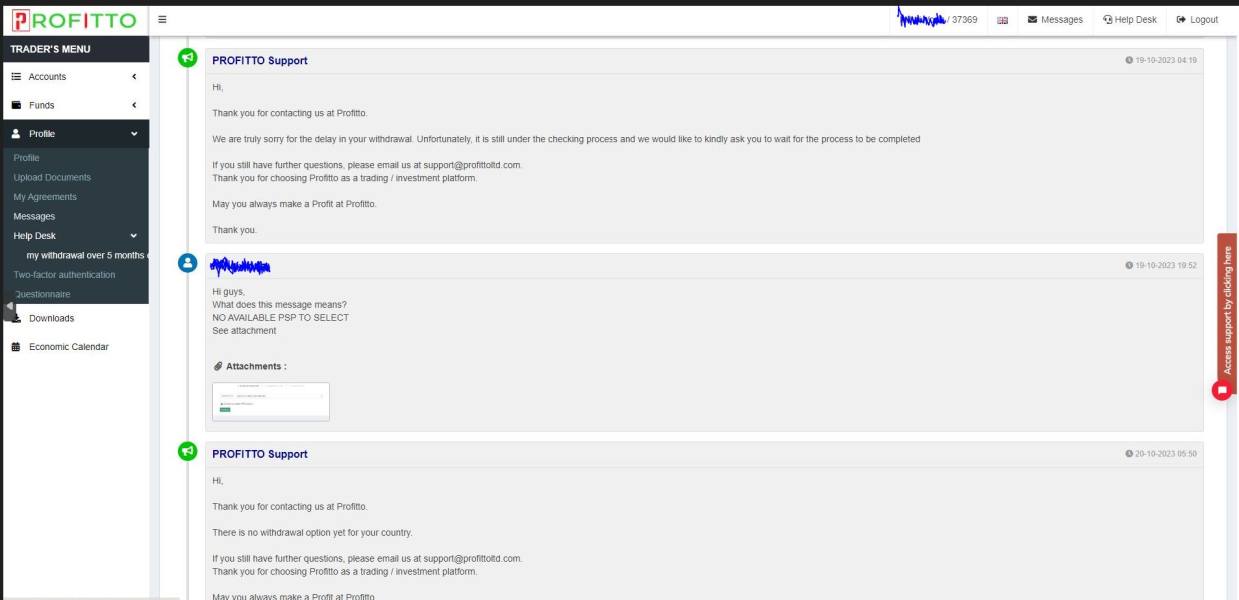

Customer service represents one of Profitto's most significant weaknesses. User reports consistently highlight poor responsiveness and inadequate problem resolution. Available feedback suggests that traders experience substantial difficulties when attempting to contact customer support.

Many report delayed responses or complete lack of communication. The specific customer service channels available through Profitto are not clearly documented, which itself indicates poor service infrastructure. Reputable brokers typically provide multiple contact methods including phone, email, live chat, and comprehensive FAQ sections.

Profitto appears to lack this basic service framework. User complaints frequently center on withdrawal-related issues where customer service fails to provide adequate assistance or resolution. Multiple reports describe situations where traders cannot access their funds and receive no meaningful support from the broker's customer service team.

The absence of detailed customer service information, including operating hours and supported languages, further demonstrates the broker's inadequate approach to client support. This suggests that trader assistance is not a priority for the organization.

Trading Experience Analysis (3/10)

The trading experience with Profitto receives a poor rating based on user feedback highlighting significant operational issues. While the broker offers the familiar MT4 platform, user reports suggest that the actual trading environment suffers from various technical and operational problems. These negatively impact the trading experience.

Platform stability appears to be a recurring issue, with some users reporting connectivity problems and execution delays that can significantly impact trading outcomes. These technical issues are particularly problematic in forex trading where timing and reliability are crucial for successful trade execution. Order execution quality has been questioned by users, though specific performance data is not available in the documentation.

The lack of transparent execution statistics or performance metrics makes it difficult for traders to assess the quality of trade execution they can expect. The overall profitto review feedback suggests that traders experience frustration with various aspects of the trading environment. This ranges from technical platform issues to broader operational problems that interfere with normal trading activities and fund management.

Trust and Safety Analysis (1/10)

Trust and safety represent Profitto's most critical weakness. The broker receives the lowest possible rating in this essential category. The company operates without regulation from recognized financial authorities, which eliminates the protective measures that regulated brokers must provide to their clients.

Multiple industry sources, including WikiBit, have flagged Profitto as a scam operation, indicating serious concerns about the broker's legitimacy and business practices. This designation reflects substantial evidence of fraudulent behavior and suggests that traders face significant risks when dealing with this broker. The lack of regulatory oversight means that Profitto is not subject to capital adequacy requirements, client fund segregation rules, or other protective measures that safeguard trader interests.

This regulatory absence creates an environment where trader funds and interests lack basic protections. Third-party evaluations consistently place Profitto in high-risk categories, with warnings about potential fraud and fund recovery difficulties. The consensus among industry observers is that this broker should be avoided due to substantial safety and legitimacy concerns.

User Experience Analysis (2/10)

Overall user satisfaction with Profitto is extremely poor. The vast majority of available feedback is negative. Users consistently report disappointing experiences across multiple aspects of the broker's services, from account management to customer support and fund withdrawal processes.

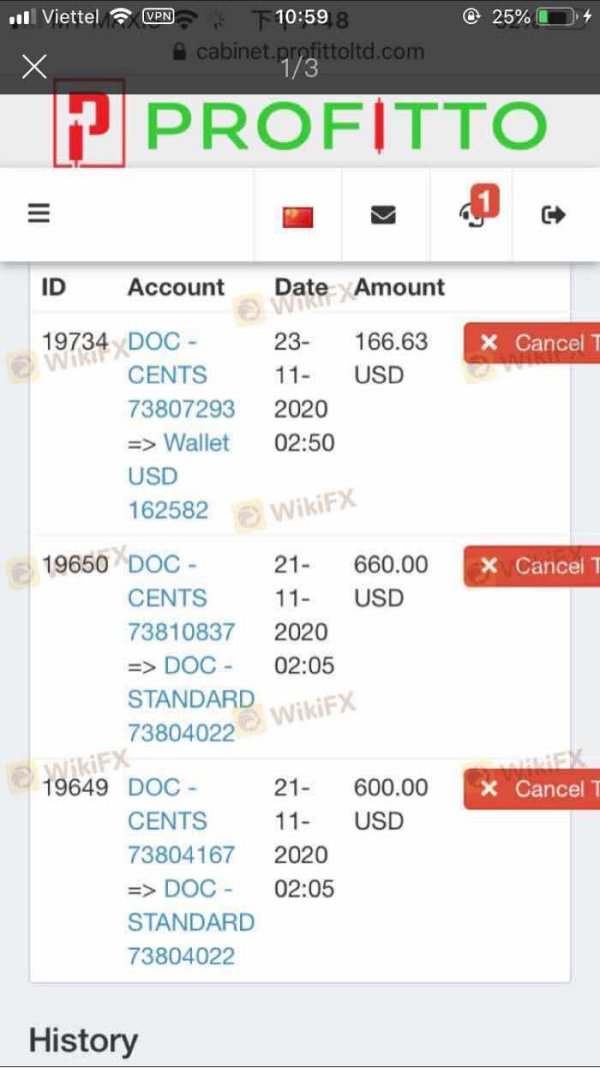

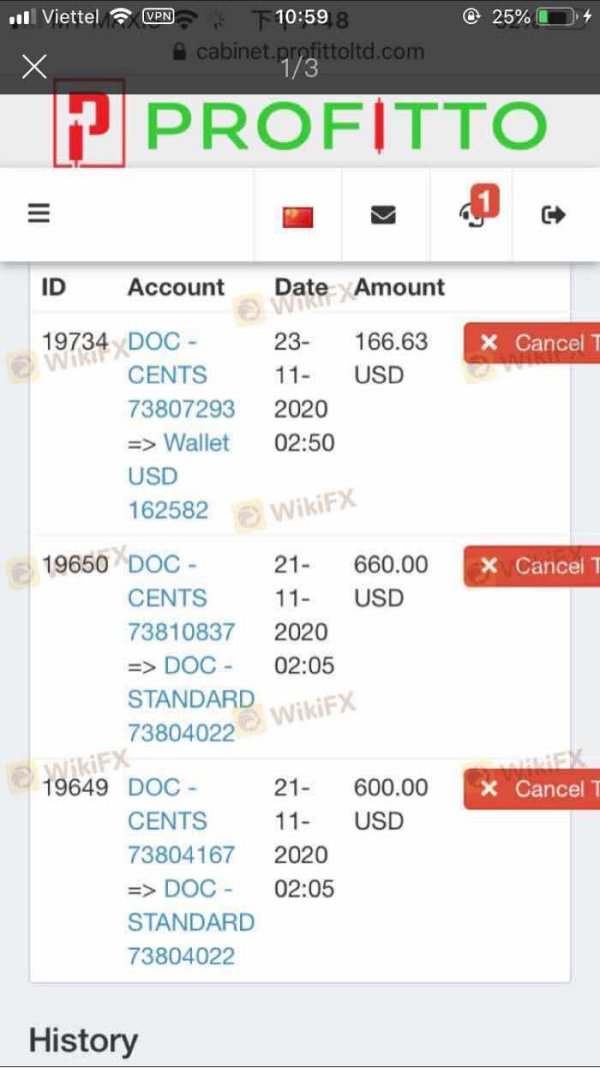

The registration and account verification processes are not well-documented, but user feedback suggests that these initial steps may be designed to appear straightforward while concealing later difficulties with fund access and account management. Fund management represents the most significant user complaint, with widespread reports of withdrawal difficulties and delayed or denied fund access. These issues appear to be systematic rather than isolated incidents, suggesting fundamental problems with the broker's business model and operations.

Common user complaints include unresponsive customer service, withdrawal delays, and lack of transparency in fee structures and terms. The overwhelming negative feedback pattern indicates that Profitto fails to meet basic expectations for forex broker services and user experience.

Conclusion

This comprehensive profitto review reveals a broker that falls significantly short of industry standards and poses substantial risks to traders. With an overall poor performance across all evaluation criteria, Profitto demonstrates numerous red flags that should concern any potential user. The combination of unregulated status, widespread scam allegations, and consistent user complaints about withdrawal difficulties creates a risk profile that makes this broker unsuitable for serious forex trading.

The broker is particularly inappropriate for risk-averse traders or those seeking reliable, transparent trading conditions. The lack of regulatory oversight, combined with systematic user complaints and industry warnings, suggests that traders should seek alternative brokers with proper licensing and positive track records for their forex trading needs.