jianeng 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

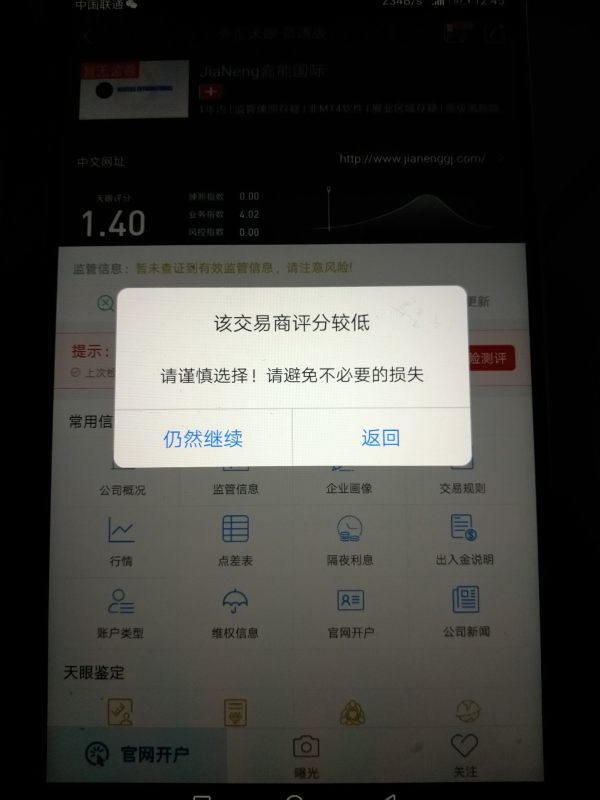

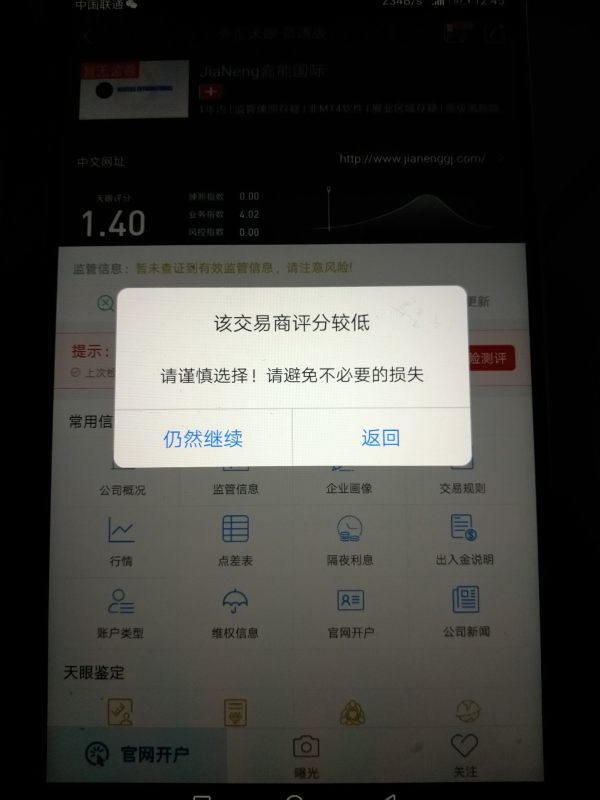

The jianeng broker emerges as a contender in the trading sector by offering competitive pricing and a broad array of trading platforms tailored to cost-conscious traders. The ultimate appeal for potential clients rests primarily with its low commissions and diverse range of trading instruments, making it an attractive option for seasoned traders looking to optimize their trading costs. However, the broker's strong points are counterbalanced by significant concerns, especially regarding its regulatory standing and patterns of user complaints related to fund safety. Potential clients should weigh the initial cost advantages against the inherent risks, particularly if comfort in navigating potential regulatory complexities is not a confidence they possess.

The ideal customers are predominantly cost-sensitive traders who can strategically navigate the intricacies of trading and are prepared to accept some risks associated with lesser-known regulatory practices. On the other hand, beginners seeking a supportive and secure trading environment or risk-averse investors preoccupied with regulatory compliance may find jianeng unsuitable.

⚠️ Important Risk Advisory & Verification Steps

Before proceeding with any investments, potential clients of jianeng should take note of the following advisory elements:

- Risk Statement: The potential for significant financial loss exists, especially given concerns regarding the broker's regulatory compliance and the safety of client funds.

- Potential Harms: Users have reported withdrawal issues and an overall lack of transparency with regard to the micro-details of the trading structure, raising alarm bells about fund safety.

Steps for Self-Verification:

- Check Regulatory Status: Research the broker‘s registration and regulatory standing through reputable financial authority websites.

- Assess User Feedback: Look for comprehensive reviews from multiple sources about the broker’s operational practices and client feedbacks.

- Understand Withdrawal Policies: Familiarize yourself with withdrawal procedures and any associated fees before making a deposit.

Rating Framework

Broker Overview

Company Background and Positioning

Jianeng was established in 1983, headquartered in Chaozhou, China. With a long-standing presence in the market, the broker seeks to position itself as a low-cost trading solution provider in a competitive landscape full of alternative brokers. Its primary mission is to cater to a diverse clientele by allowing access to varied trading instruments while maintaining cost-efficiency, aiming to attract both local and international traders who prioritize low fees.

Core Business Overview

Jianeng provides a range of services across different asset classes, focusing on futures, options, and forex trading. It prominently claims to support various trading platforms, including advanced analytical tools suitable for experienced traders. Furthermore, the broker asserts regulatory compliance through several alleged partnerships, though detailed verification is essential.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

Conflicting regulatory information poses a risk for clients. While jianeng claims adherence to various regulatory bodies, discrepancies in available documents create doubt regarding its legitimacy. Users have reported issues with fund safety, particularly during withdrawal requests, which can severely hinder confidence in the broker.

To navigate these uncertainties, traders can follow these verification steps:

- Visit the brokers website to check for proper licensing information.

- Explore forums and reviews dedicated to jianeng to gauge user sentiment.

- Investigate any allegations or formal complaints lodged against the broker with regulatory authorities.

User feedback often highlights concerns for fund safety, with one user stating, "I've faced withdrawal delays and felt like my funds were at risk." This sentiment is echoed in several online discussions, prompting broader scrutiny from the trading community.

Trading Costs Analysis

The double-edged sword effect.

Jianeng offers a notably low commission structure that appeals to active traders. The broker's pricing model is structured to attract high-volume traders, with minimal costs per trade leading to significant potential savings.

However, hidden costs in the form of non-trading fees have surfaced in user complaints. One trader mentioned, "I didn't realize the withdrawal fees would be this high," indicating that while trading beautifully low, overall cost-effectiveness can be skewed if additional hidden fees are not accounted for.

Overall, the cost structure presents both advantages and drawbacks, highly suited for experienced traders familiar with the nuances of broker fees.

Professional depth vs. beginner-friendliness.

Jianeng facilitates access to various trading platforms, including MetaTrader 4 and other proprietary options. The incorporation of sophisticated trading tools appeals to experienced traders, allowing in-depth analysis and automated trading features.

Nonetheless, a more nuanced perspective reveals that new traders may find these platforms somewhat overwhelming. Feedback reveals that while the tools are powerful, ongoing support and educational materials could be enhanced for those less adept at using them. User comments often suggest, "The features are great but overwhelming without adequate tutorials."

User feedback generally praises the performance of trading tools, yet emphasizes the necessity for improved guidance for novice users.

(Continue this detailed analysis for "User Experience," "Customer Support," and "Account Conditions.")