Finotive Funding 2025 Review: Everything You Need to Know

Executive Summary

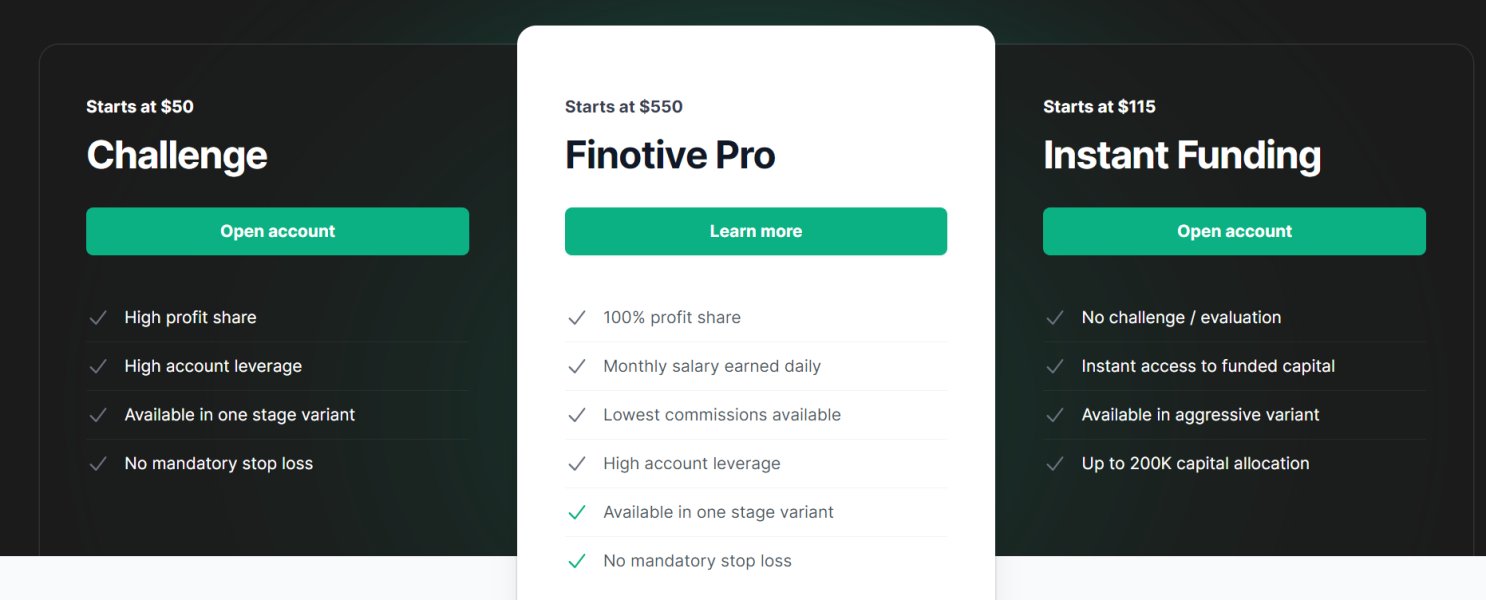

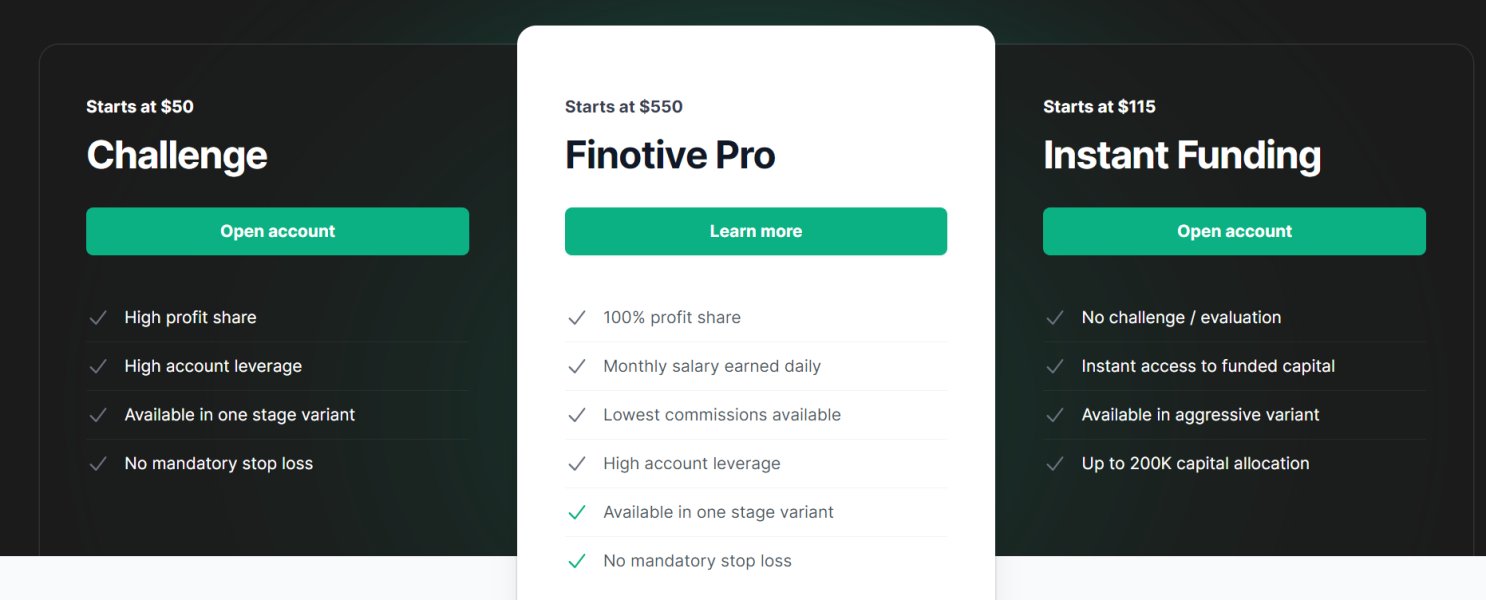

Finotive Funding is a strong proprietary trading firm. The company has built a solid position in the competitive prop trading world since it started in 2021. This finotive funding review shows a company that gives traders big funding chances with accounts up to $200,000 and profit splits as high as 95%. This makes it a good choice for both new and skilled traders who want capital support.

The firm is based in Hungary and follows rules from the Hungarian Financial Supervisory Authority. Finotive Funding stands out because it sets realistic profit targets and offers flexible trading conditions. The company only needs a $50 minimum deposit and uses the MetaTrader 5 platform for forex, commodities, and indices trading. Reports show the company focuses on individual traders and professional traders who want to use their skills with big capital amounts while keeping good profit-sharing deals.

The firm's business plan focuses on funding programs that work with different trading styles and goals. This puts the company in a position to connect skilled traders with the capital they need to reach their full potential. With 1:100 leverage and wide asset coverage, Finotive Funding wants to help the growing group of traders looking for prop trading opportunities.

Important Notice

Finotive Funding works under Hungarian Financial Supervisory Authority rules with company registration number 01-09-384153. Users should know that rules and tax effects can be very different in different countries. This review uses information from multiple sources and user feedback from 2024 to give an objective look at what the firm offers and how it performs.

Traders thinking about Finotive Funding should do their own research about local legal needs and tax duties in their countries. The prop trading industry keeps changing, and rule systems may shift, which could affect how the firm operates and what services it offers in certain areas.

Rating Framework

Broker Overview

Finotive Funding Kft started in 2021 as a proprietary trading firm based in Hungary. The company has a clear goal to make trading capital access easier through new funding programs. The company has made itself a leading force in the prop trading sector by offering different funding chances that work for traders with various experience levels and risk comfort. Industry reports show that Finotive Funding has built its reputation on giving realistic profit targets combined with attractive profit-sharing deals, which sets it apart from many competitors in the crowded prop trading market.

The firm's business model works by finding skilled traders and giving them the capital they need to use their strategies well. This approach has let Finotive Funding create a helpful relationship where successful traders can access big funding while the company benefits from profitable trading activities. The company's commitment to helping trader success shows in its competitive profit splits, which can reach up to 95% for successful participants.

Finotive Funding only works through the MetaTrader 5 platform and gives traders access to many tradeable assets including major and minor forex pairs, commodities, and various indices. The firm's asset selection covers the most liquid and popular instruments in global markets, making sure traders have access to opportunities across different market sectors. Under HFSA rules, the company maintains regulatory compliance while offering leverage ratios of 1:100, balancing risk management with trading flexibility for its funded traders.

Regulatory Status: Finotive Funding operates under the supervision of the Hungarian Financial Supervisory Authority. The company is registered as Finotive Funding Kft with company number 01-09-384153, ensuring transparency and regulatory compliance within the European Union framework.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available resources. Traders need to contact the firm directly for complete payment processing information.

Minimum Deposit Requirements: The firm sets an easy entry point with a minimum deposit of US$50. This makes it particularly attractive for new traders or those testing the platform before committing larger amounts.

Promotional Offers: Current promotional activities and bonus structures were not specifically outlined in available documentation. Potential traders should contact the firm directly for the latest promotional information.

Tradeable Assets: Finotive Funding provides access to multiple asset classes including foreign exchange pairs, commodities, and market indices. This offers diversification opportunities across different market sectors to suit various trading strategies and preferences.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not covered completely in available sources. This shows the need for direct communication with the firm for complete pricing transparency.

Leverage Ratios: The firm offers leverage up to 1:100. This provides traders with significant capital efficiency while maintaining risk management parameters consistent with regulatory requirements.

Trading Platform: Finotive Funding only uses the MetaTrader 5 platform. The platform is known for its advanced charting capabilities, automated trading support, and comprehensive market analysis tools.

Geographic Restrictions: Specific geographic limitations or restricted territories were not detailed in available information sources.

Customer Support Languages: Available customer service language options were not specified in the reviewed materials.

This complete finotive funding review highlights the firm's competitive positioning while acknowledging areas where additional information would benefit potential clients.

Account Conditions Analysis

Finotive Funding's account structure shows a well-thought approach to helping traders across different experience levels and capital needs. The firm's main offering focuses on funding accounts that can scale up to $200,000, representing a big opportunity for skilled traders to access significant capital. The $50 minimum deposit requirement stands out as particularly accessible, removing traditional barriers that might prevent talented traders from accessing prop trading opportunities.

The account opening process appears streamlined based on the firm's focus on trader accessibility, though it's not extensively detailed in available sources. The company's funding programs are designed with realistic profit targets, distinguishing them from competitors who may impose unrealistic performance requirements. This approach suggests a genuine interest in trader success rather than simply collecting evaluation fees.

Finotive Funding's profit-sharing structure represents one of its most compelling features. The splits can reach up to 95% for successful traders. This generous arrangement demonstrates confidence in their trader selection process and creates strong incentives for sustained performance. The firm's flexible approach to different trading styles indicates sophisticated risk management that doesn't unnecessarily constrain trader creativity.

However, specific details about Islamic accounts, swap-free options, or other specialized account features were not covered completely in available documentation. The absence of detailed account tier information suggests potential clients should engage directly with the firm to understand the full spectrum of available options and progression pathways within their funding programs.

The exclusive use of MetaTrader 5 as Finotive Funding's trading platform represents both a strength and a limitation. MT5's robust feature set, including advanced charting tools, multiple timeframe analysis, and automated trading capabilities, provides traders with professional-grade functionality. The platform's established reputation and widespread adoption mean most traders can quickly adapt to the environment without significant learning curves.

MetaTrader 5's built-in economic calendar, market depth display, and comprehensive technical analysis tools offer substantial value for traders developing and executing their strategies. The platform's support for Expert Advisors enables automated trading strategies, which can be particularly valuable for traders managing larger funded accounts where consistent execution becomes crucial.

However, available information does not detail specific proprietary tools, market research resources, or educational materials that Finotive Funding might provide beyond the standard MT5 offering. Many successful prop trading firms differentiate themselves through additional analytical resources, market insights, or educational content that supports trader development. The absence of detailed information about such resources in available documentation represents a potential area for improvement or clarification.

The firm's focus on multiple asset classes through MT5 provides adequate diversification opportunities. The specific range of available instruments and their trading conditions would benefit from more detailed documentation. Professional traders often require access to specific markets or instruments, and comprehensive asset information would enhance the firm's appeal to specialized trading strategies.

Customer Service and Support Analysis

Customer service quality represents a critical component of any prop trading firm's value proposition. Specific information about Finotive Funding's support infrastructure remains limited in available sources. The absence of detailed customer service information in reviewed materials suggests an area where the firm could enhance transparency and client confidence through more comprehensive documentation of their support capabilities.

Professional traders, particularly those managing significant funded accounts, require reliable and knowledgeable support for both technical issues and account-related inquiries. The complexity of prop trading arrangements often generates questions about performance metrics, withdrawal procedures, and account progression that demand expert-level support responses.

Industry standards typically include multiple communication channels such as live chat, email support, and phone assistance. These often come with extended hours to accommodate global trading schedules. The availability of multilingual support can also be crucial for international traders, though specific language capabilities were not detailed in available information.

Response times, support quality, and problem resolution effectiveness represent key metrics that potential clients would benefit from understanding before committing to a funding program. The prop trading industry's competitive nature means that superior customer service can become a significant differentiating factor, making this information gap particularly notable for traders evaluating their options.

Trading Experience Analysis

The trading experience with Finotive Funding centers around the MetaTrader 5 platform. This provides a stable and feature-rich environment for executing trading strategies. While specific performance metrics such as execution speeds, slippage rates, or server uptime were not detailed in available sources, MT5's generally robust infrastructure suggests a professional trading environment.

Order execution quality represents a crucial factor for prop traders, particularly when managing larger funded accounts where execution inefficiencies can significantly impact performance. The absence of specific data regarding fill rates, requotes, or execution speeds in available documentation leaves important questions unanswered for performance-oriented traders.

Platform stability during high-volatility periods becomes particularly critical for funded traders who may face performance constraints. This includes major news events or market openings. Professional-grade infrastructure should maintain consistent performance regardless of market conditions, though specific reliability metrics were not available in reviewed sources.

The mobile trading experience through MT5's mobile applications can be essential for traders who need to monitor or adjust positions while away from their primary trading setups. However, specific information about mobile functionality optimization or any proprietary mobile solutions was not detailed in available materials.

This finotive funding review indicates that while the fundamental trading infrastructure appears solid through MT5, more detailed performance metrics and user experience data would enhance transparency. This would help traders make informed decisions about the platform's suitability for their specific trading requirements.

Trust and Reliability Analysis

Finotive Funding's regulatory status under the Hungarian Financial Supervisory Authority provides a solid foundation for trust and reliability. The HFSA operates within the European Union regulatory framework, offering meaningful oversight and consumer protection standards. The firm's registration number 01-09-384153 provides transparency and enables verification of their regulatory standing.

The company's establishment in 2021 means it operates as a relatively new entity in the prop trading space. This presents both opportunities and considerations for potential clients. While newer firms may offer innovative approaches and competitive terms, they lack the extensive track record that longer-established companies can provide. This factor requires careful consideration by traders evaluating long-term partnerships.

Regulatory compliance within the EU framework typically includes requirements for client fund segregation, financial reporting standards, and operational transparency. However, specific details about Finotive Funding's fund protection measures, insurance coverage, or financial strength were not covered completely in available sources. These factors represent crucial considerations for traders entrusting significant time and effort to building funded trading careers.

The absence of detailed information about company management, financial backing, or industry awards in available documentation represents an area where enhanced transparency could strengthen client confidence. Professional traders often prefer working with firms that provide comprehensive information about their operational structure and financial stability.

User Experience Analysis

User experience evaluation for Finotive Funding faces limitations due to insufficient detailed feedback and interface information in available sources. The overall user journey, from initial application through funding achievement and ongoing account management, represents a critical factor in prop trading success, yet comprehensive user experience data remains limited.

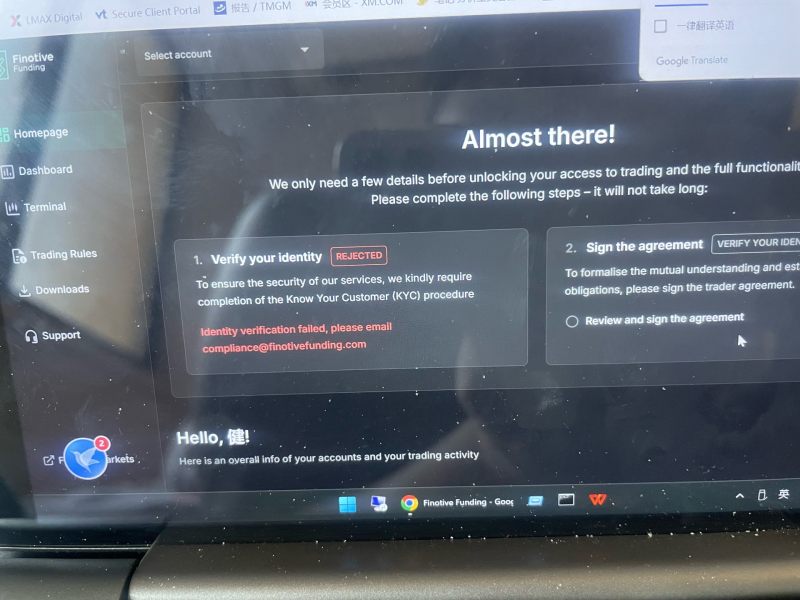

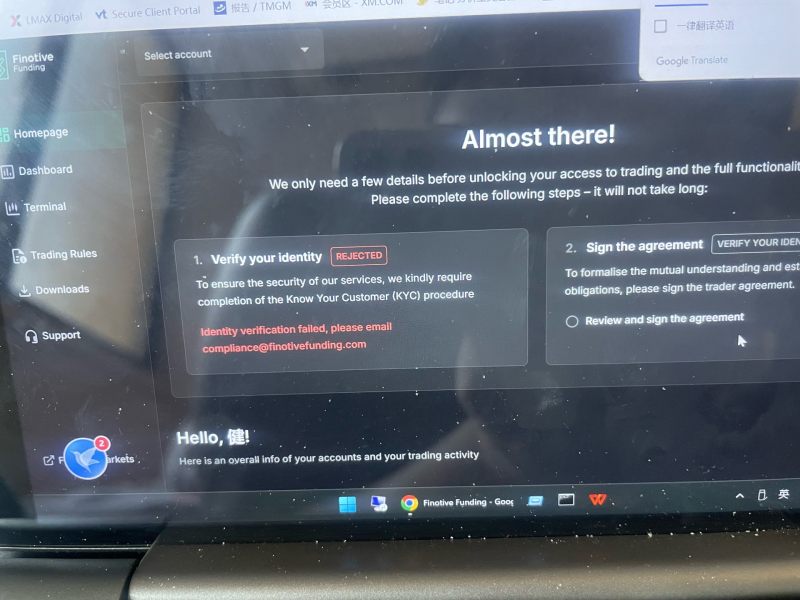

The registration and verification process efficiency can significantly impact trader satisfaction. This is particularly true in an industry where traders may evaluate multiple firms simultaneously. Streamlined onboarding procedures that respect both regulatory requirements and user convenience typically indicate sophisticated operational systems.

Platform interface design and navigation ease, while primarily determined by MetaTrader 5's standard interface, may include customizations or additional tools that enhance the user experience. However, specific information about interface modifications or proprietary additions was not available in reviewed materials.

Fund management and withdrawal processes represent particularly crucial user experience elements for prop trading firms. Traders need clear understanding of performance tracking, withdrawal procedures, and account progression pathways. The absence of detailed user feedback about these critical processes in available sources suggests an area where enhanced documentation could benefit potential clients.

The balance between user feedback regarding positive experiences and common complaints would provide valuable insights for prospective traders. Such comprehensive feedback analysis was not available in the reviewed materials. This information gap represents an opportunity for improved transparency and user guidance.

Conclusion

Finotive Funding presents itself as a competitive option in the prop trading landscape. The firm offers substantial funding opportunities with attractive profit-sharing arrangements that can reach up to 95%. The firm's low $50 minimum deposit requirement and access to accounts up to $200,000 create an accessible yet scalable opportunity for traders across different experience levels. The HFSA regulation provides a solid regulatory foundation, while the MetaTrader 5 platform offers professional-grade trading infrastructure.

The firm appears particularly well-suited for traders seeking capital backing with realistic performance targets and generous profit splits. Both novice traders attracted by the low entry requirements and experienced professionals seeking substantial funding could find value in Finotive Funding's offerings. However, potential clients should note that comprehensive information about customer service quality, detailed trading experience metrics, and user interface specifics remains limited in available sources.

The primary advantages include competitive funding terms, regulatory oversight, and accessible entry requirements. The main limitations center around insufficient documentation of customer support capabilities and detailed user experience metrics. Prospective traders should conduct direct inquiries to address these information gaps before making final decisions about their prop trading partnerships.