Established just ten months ago, Skyaray positions itself as a modern forex broker with advanced trading technology and a strong emphasis on user safety. Its headquarters are purportedly located in Spain, although specific operational details remain unverified due to a lack of transparency surrounding ownership. This limited disclosure raises flags for potential traders who prioritize accountability from their brokers, especially newcomers in the high-stakes forex market.

Skyaray's primary business revolves around providing access to derivatives including futures and options, catering especially to forex and commodities traders. Their trading platform, while advertised as secure, lacks clarity on regulatory oversight and licensing. Multiple claims suggest that Skyaray operates under the auspices of several financial bodies, including ASIC, FCA, and others, but concrete verification of these claims remains elusive.

The regulatory landscape surrounding Skyaray presents a problematic picture, primarily due to discrepancies in its claims of oversight from numerous authoritative bodies. Assertions of being regulated by entities such as ASIC and FCA lack sufficient verification, raising valid concerns about the broker's operational legitimacy. Users are cautioned to inquire about specific licensing and to review the credibility of any regulatory claims made by the broker.

To ascertain the trustworthiness of a broker, particularly Skyaray, users should follow these steps:

- Visit the Broker's Website: Scrutinize for any potential red flags.

- Refer to Regulatory Websites: Check NFA's BASIC database for broker verification.

- Conduct Online Searches: Look for any news or reviews regarding Skyaray.

- Consult Scam Warning Lists: Use resources like Scamadviser to check for warning signals.

- Assess User Experiences: Read personal accounts from traders on platforms sharing broker reviews.

3. Industry Reputation and Summary

Feedback from users remains varied, with many expressing concern over their funds' safety. As one user noted:

"I‘ve heard so many horror stories about trading platforms with low trust scores. I’d rather keep my money somewhere safer."

Thus, reiterating the importance of conducting thorough due diligence is crucial before engaging with Skyaray.

Trading Costs Analysis

1. Advantages in Commissions

Skyaray promotes a low-cost commission structure designed to attract new traders. With competitive fees and favorable trading conditions purportedly at lower rates than many established brokers, it is tempting for those entering the market.

2. The "Traps" of Non-Trading Fees

However, several user complaints have surfaced regarding high withdrawal fees, noted at $30, which can seriously impact profitability for active traders. Such non-transparent cost structures could deter repeat engagements.

3. Cost Structure Summary

While the apparent low commissions entice a specific segment of traders, the potential hidden fees related to trading and withdrawals must be taken into account, underscoring a double-edged sword effect in trading costs.

Skyaray shows commitment to technological advancement with support for multiple trading platforms, notably popular names like MT5. This diversity caters to various trader preferences, providing ample options for different trading styles.

The quality of tools and educational resources currently lacks comprehensive user feedback. While advertised as robust, actual experiences reveal mixed responses concerning usability and effectiveness.

User reception of the platforms highlights a divergence in experiences. As one trader remarked:

"While it has decent tools, I struggled to find the educational materials they promised."

User Experience Analysis

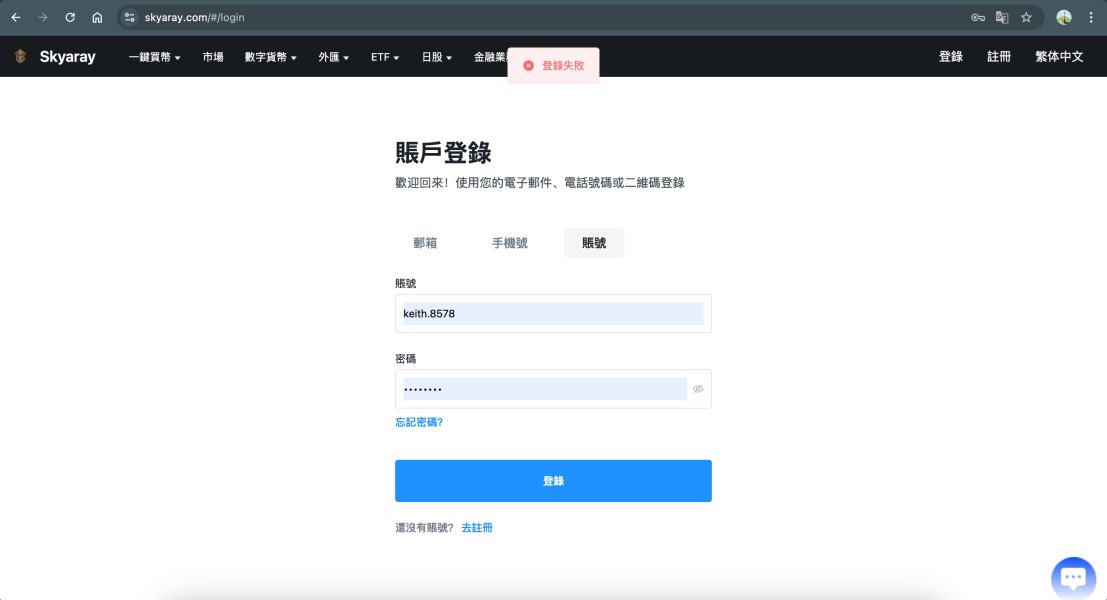

1. Onboarding Process

Users have reported a confusing onboarding process, which may complicate initial engagements. Clear instructions and straightforward sign-up methods are critical for attracting new traders.

2. Trading Experience

Once onboarded, traders have expressed frustration with fluctuating service quality while trading. Some reports highlight slippage and uncertain execution timing, leading to grumblings about trust in the platform.

3. Overall User Sentiment

Feedback largely reflects caution, as many report hesitancy in trusting a broker with such apparent incongruities surrounding its operations.

Customer Support Analysis

1. Availability of Support

Skyaray reportedly offers customer support, but the quality and responsiveness of this service remain questionable. Few direct testimonials lend credence to the claims of reliable support.

2. User Experiences

Traders frequently cite slow response times and unhelpful support staff, illustrating a significant gap in customer care. This aspect plays a pivotal role for beginner traders who need proper guidance.

3. Improvement Opportunities

Enhancing the customer support channel—both in availability and quality—could substantially boost user trust and engagement.

Account Conditions Analysis

1. Required Account Minimums

Details regarding minimum deposit requirements are sparse, leading to uncertainties that may hinder preliminary engagement with the broker.

2. Limitations and Restrictions

Users have implied the existence of restrictive conditions when it comes to account management and funding methods, which necessitate clarification.

3. Summary

A clearer outline of account conditions, including requirements and limitations, would help instill confidence and provide necessary transparency for prospective investors.

Conclusion

Skyaray presents itself as an intriguing broker with the allure of advanced trading technology and cost-effective entry points. However, the serious concerns regarding its trustworthiness, lack of transparency, and mixed user experiences create significant risk. Potential collaborators are encouraged to approach Skyaray with caution, conducting thorough research and self-verification steps before committing any capital. This broker may appeal to high-risk traders, but it ultimately serves as a cautionary tale about the fluctuating conditions in the brokerage market. Investing, especially in forex, comes with inherent risks, and due diligence is vital to safeguarding ones financial interests.