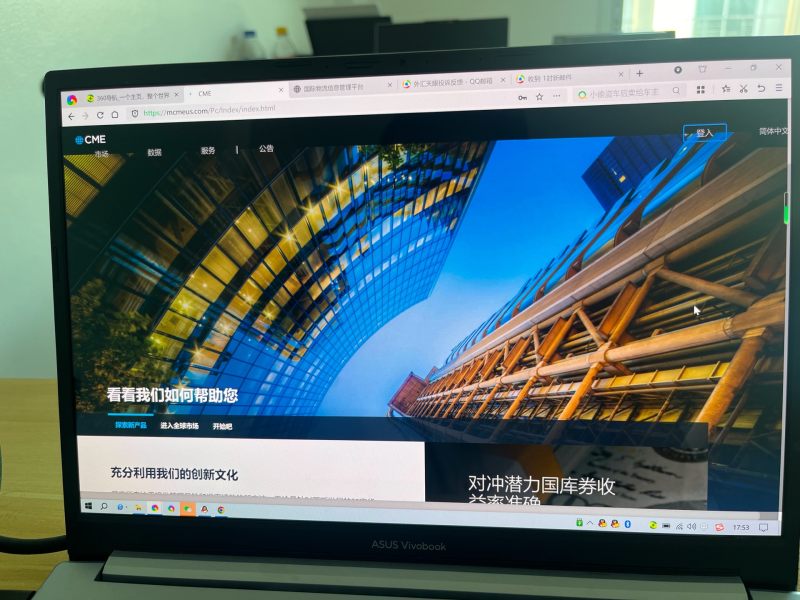

CME Group 2025 Review: Everything You Need to Know

Executive Summary

CME Group stands as the world's leading derivatives marketplace. The company offers comprehensive trading platforms suitable for various types of traders, though customer service ratings present some concerns. This cme group review examines the company's performance across multiple dimensions based on extensive analysis of user feedback and industry data.

The organization demonstrates strong internal satisfaction metrics. Employees rate their experience at 4.2/5 on AmbitionBox and 4.0/5 on Glassdoor, indicating a positive working environment and robust operational structure. CME Group's extensive portfolio covers a broad range of global benchmark products across multiple asset classes. This positions it as a comprehensive solution for derivatives trading.

However, customer satisfaction tells a different story. Trustpilot ratings show only 2/5 stars, suggesting significant room for improvement in client-facing services. This disparity between internal employee satisfaction and external customer experience represents a key consideration for potential users.

The platform primarily targets professional traders and institutional investors. It offers sophisticated trading tools and access to global derivatives markets. Founded in 1848, CME Group has established itself as a cornerstone of the global financial infrastructure. The company provides essential market services that facilitate price discovery and risk management across numerous asset classes.

Important Notice

This review is based on comprehensive analysis of multiple online rating platforms and user feedback collected from various sources including AmbitionBox, Glassdoor, and Trustpilot. The evaluation methodology incorporates both quantitative ratings and qualitative user experiences to provide a balanced assessment of CME Group's services.

Readers should note that experiences may vary based on individual trading requirements, account types, and regional service availability. This analysis reflects publicly available information and user testimonials as of 2025.

Rating Framework

Broker Overview

CME Group traces its origins back to 1848. The company has established itself as one of the oldest and most established financial institutions in the derivatives trading space. As the world's leading derivatives marketplace, the company has evolved from its historical roots to become a global financial infrastructure provider. It facilitates trillions of dollars in trading volume annually.

The organization operates as a comprehensive derivatives marketplace. It offers services that connect traders, investors, and institutions to global benchmark products. CME Group's business model centers around providing the technological infrastructure, regulatory framework, and market-making capabilities necessary for efficient derivatives trading. These services operate across multiple time zones and geographic regions.

The company provides multiple trading platforms designed to accommodate various user types. These range from individual professional traders to large institutional investors. While specific platform details are not elaborated in available materials, the infrastructure supports trading across a broad range of global benchmark products. This cme group review notes that the platform's architecture is designed to handle high-volume, sophisticated trading requirements typical of professional derivatives markets.

CME Group's market position as a leading derivatives marketplace reflects its comprehensive approach to serving the global trading community. However, specific regulatory details and jurisdictional information require further investigation beyond the scope of current available materials.

Regulatory Coverage: Specific regulatory jurisdiction information is not detailed in available source materials. As a leading derivatives marketplace, CME Group operates under comprehensive regulatory oversight.

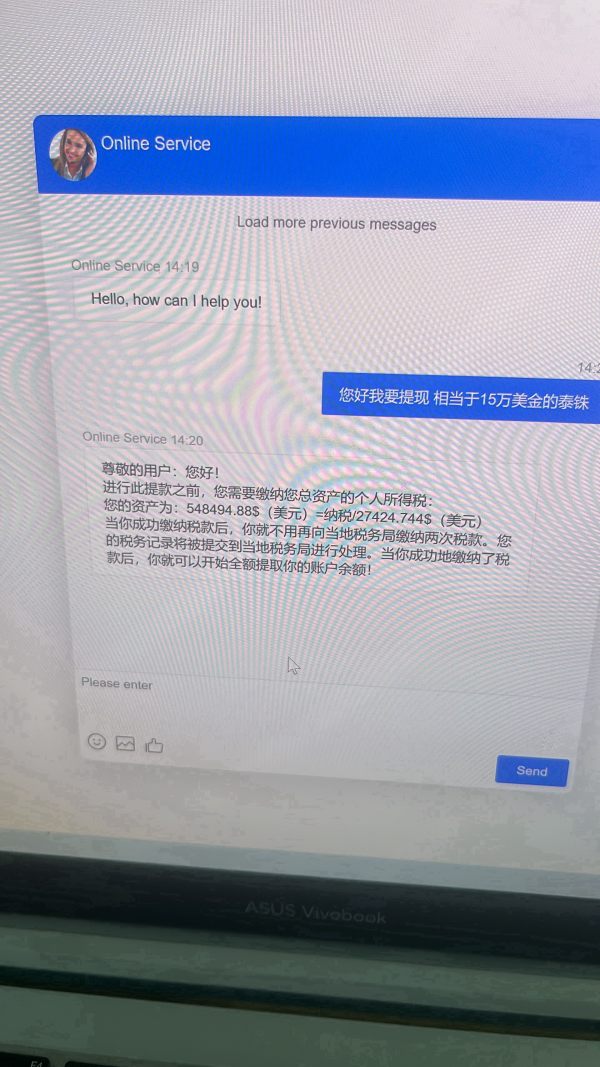

Deposit and Withdrawal Methods: Available materials do not specify particular deposit and withdrawal mechanisms. This requires direct consultation with the platform for detailed information.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not mentioned in current source materials.

Promotional Offers: Bonus and promotional information is not detailed in available materials.

Tradeable Assets: The platform covers "a broad range of global benchmark products." However, specific asset categories and instruments are not enumerated in source materials.

Cost Structure: Detailed fee schedules, spreads, and commission structures are not specified in available information. This represents an area requiring direct platform consultation.

Leverage Options: Leverage ratios and margin requirements are not detailed in current source materials.

Platform Selection: The organization offers multiple trading platforms. However, specific platform names, features, and capabilities are not detailed in available materials. This cme group review notes that platform diversity suggests accommodation of various trading styles and requirements.

Geographic Restrictions: Regional availability and restrictions are not specified in source materials.

Customer Service Languages: Supported languages for customer service are not detailed in available information.

Detailed Rating Analysis

Account Conditions Analysis

Account condition evaluation for CME Group faces limitations due to insufficient detailed information in available source materials. The platform's positioning as a leading derivatives marketplace suggests sophisticated account structures designed for professional and institutional users. However, specific account types, features, and requirements are not enumerated.

The minimum deposit requirements, account opening procedures, and verification processes are not detailed in current materials. This makes comprehensive assessment challenging. Professional derivatives trading typically involves substantial capital requirements and extensive documentation. This suggests that CME Group likely maintains institutional-grade account standards.

Account functionality appears designed around derivatives trading requirements. However, specific features such as margin capabilities, risk management tools, and account protection measures are not detailed in available information. The platform's focus on professional traders and institutional investors suggests account structures accommodate complex trading strategies and substantial transaction volumes.

This cme group review notes that prospective users should directly consult CME Group for detailed account condition information. Publicly available materials do not provide sufficient detail for comprehensive evaluation of account offerings and requirements.

The evaluation of CME Group's tools and resources faces constraints due to limited detailed information in available source materials. As the world's leading derivatives marketplace, the platform presumably offers sophisticated trading tools and analytical resources appropriate for professional derivatives trading. However, specific capabilities are not enumerated.

Research and analysis resources, educational materials, and market data offerings are not detailed in current source materials. Professional derivatives trading typically requires comprehensive market analysis tools, real-time data feeds, and sophisticated risk management capabilities. This suggests that CME Group likely provides institutional-grade resources.

Automated trading support, API access, and algorithmic trading capabilities are not specified in available information. However, such features are standard expectations for professional derivatives platforms. The platform's positioning suggests accommodation of high-frequency trading and sophisticated automated strategies.

Educational resources and training materials availability is not detailed in source materials. This represents an area where direct platform consultation would be necessary for comprehensive evaluation of learning and development support offerings.

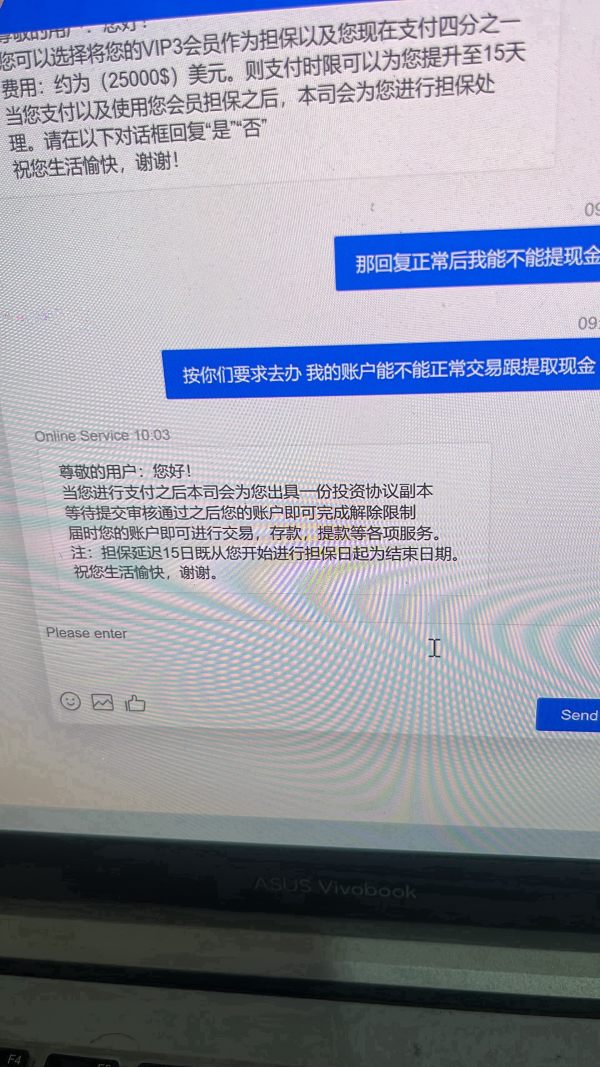

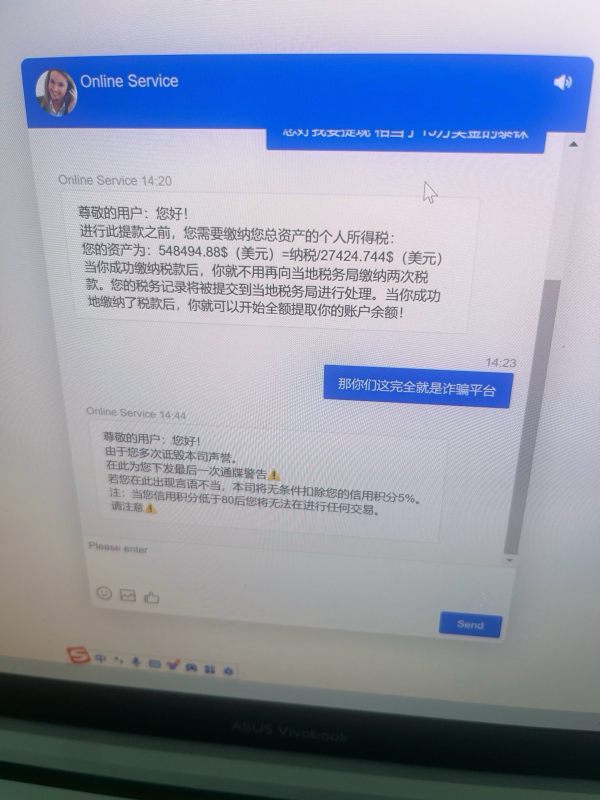

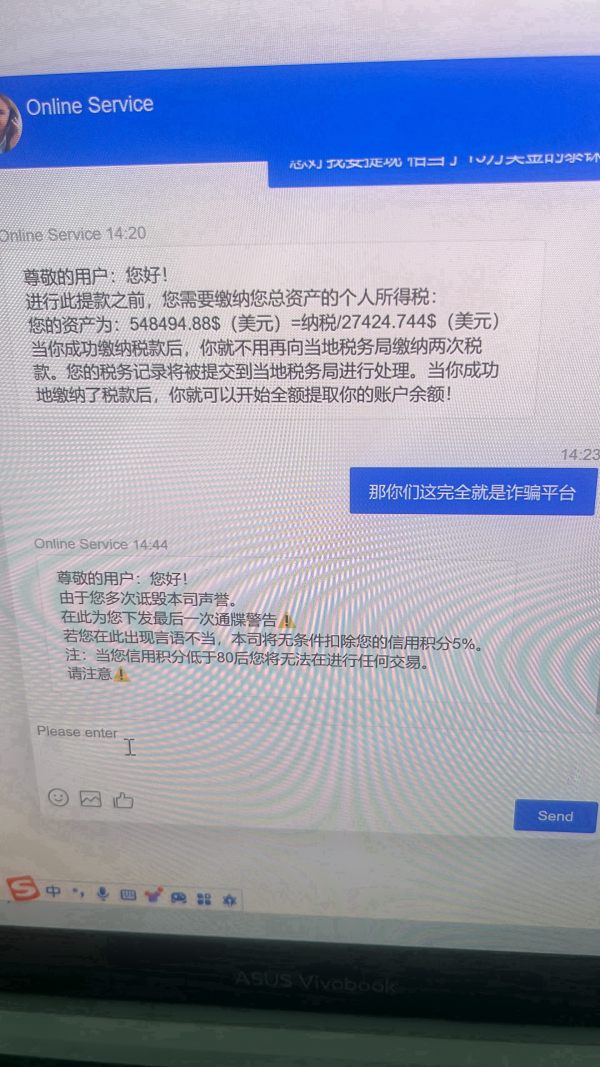

Customer Service and Support Analysis

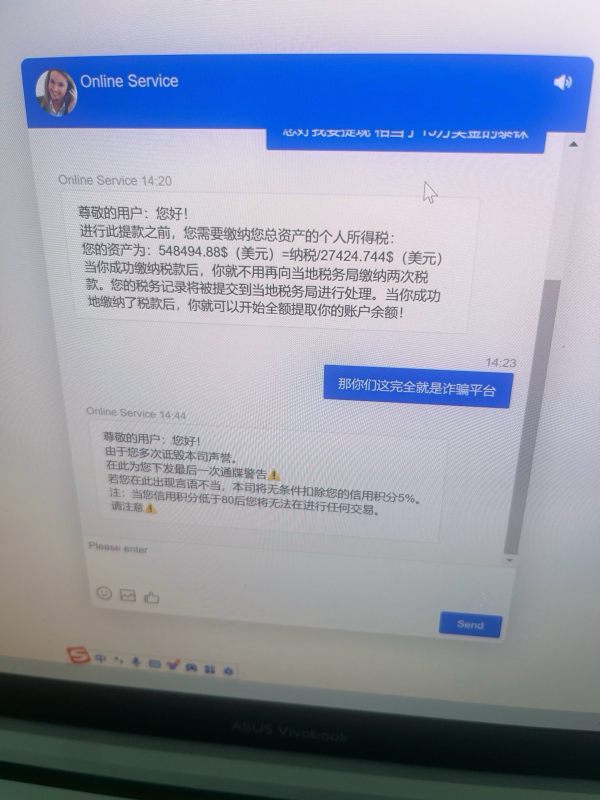

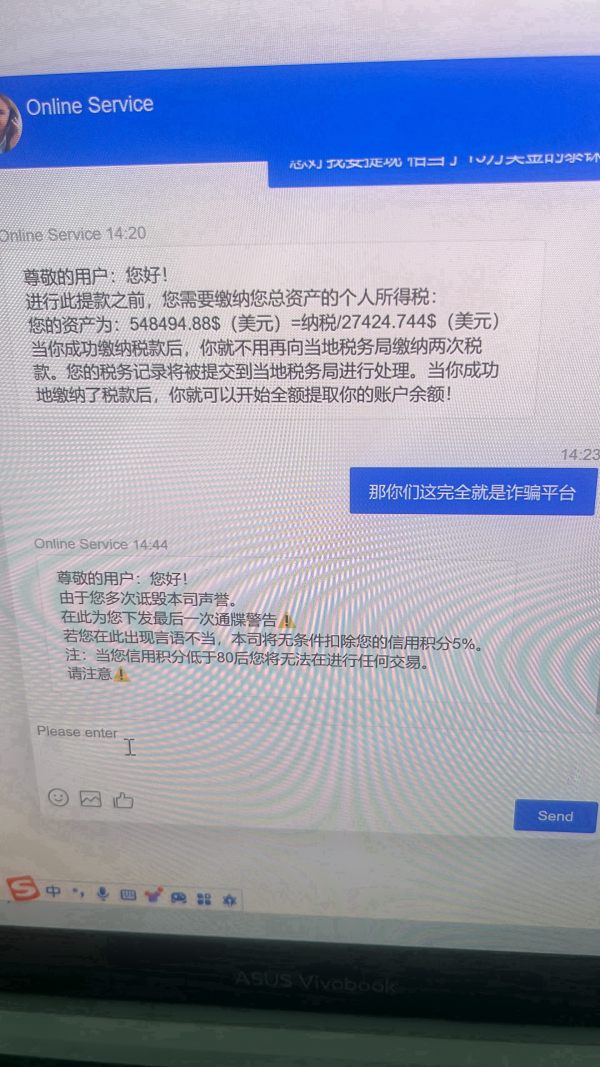

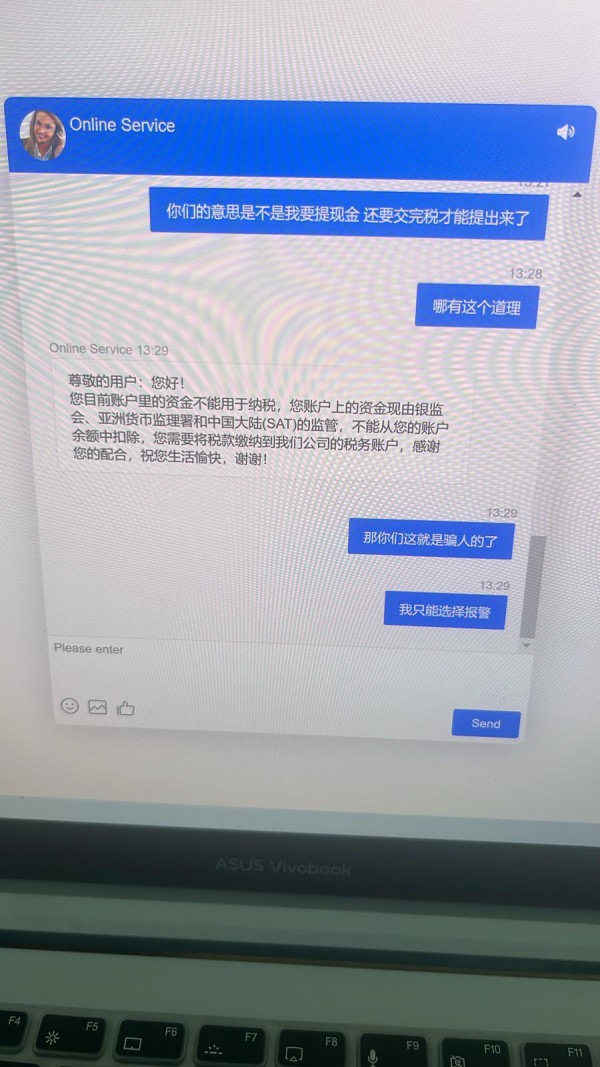

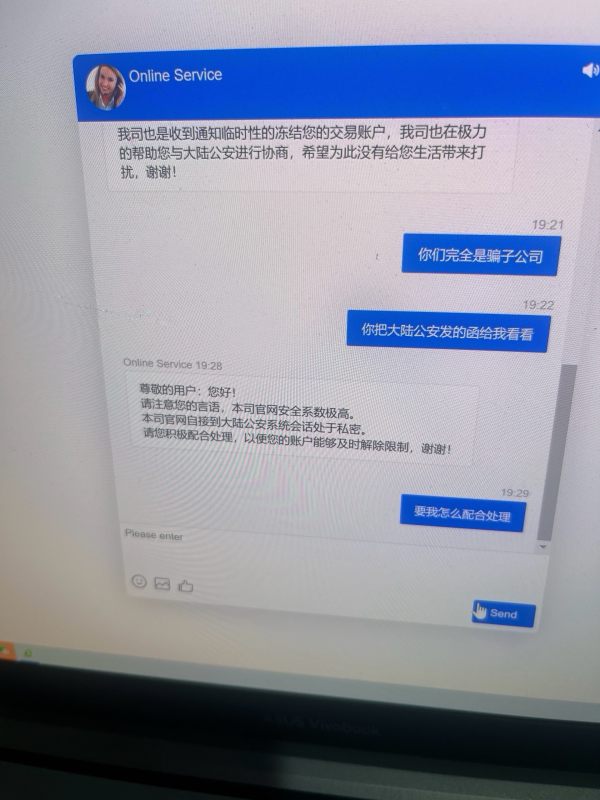

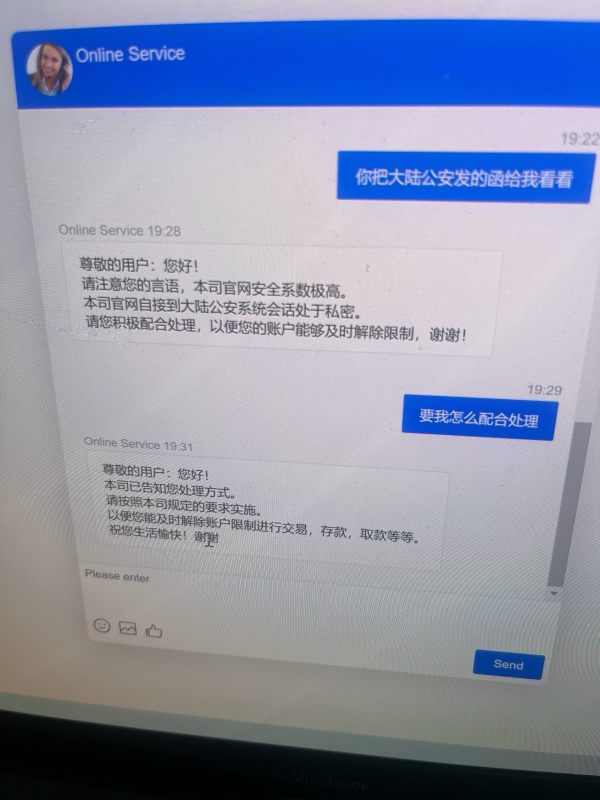

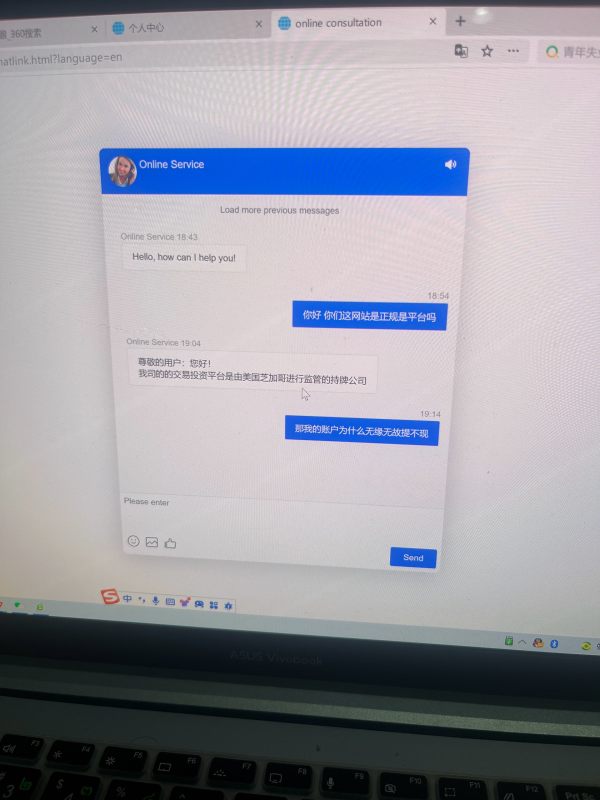

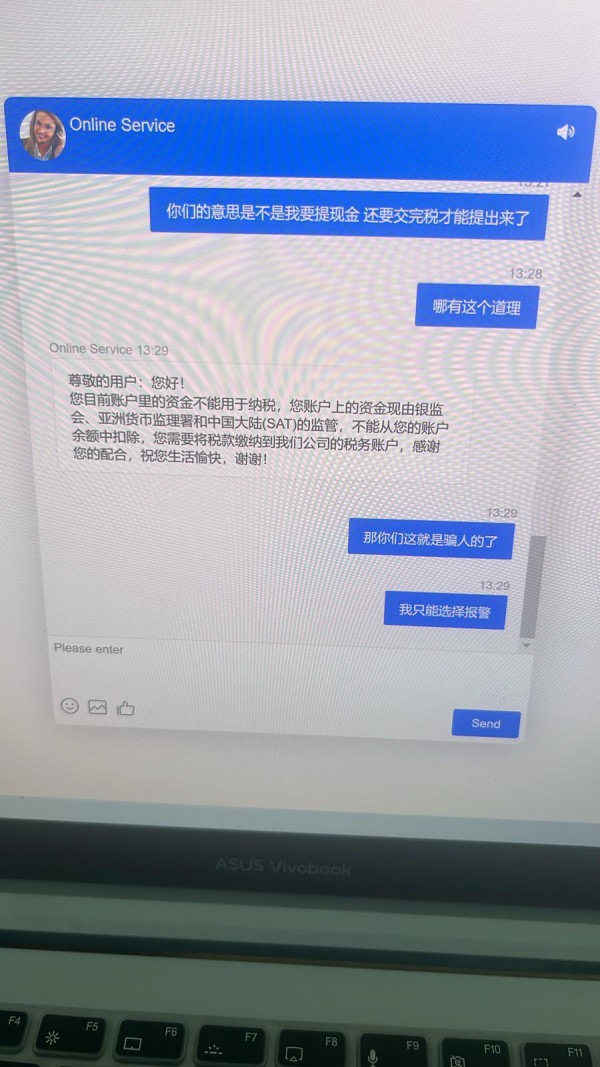

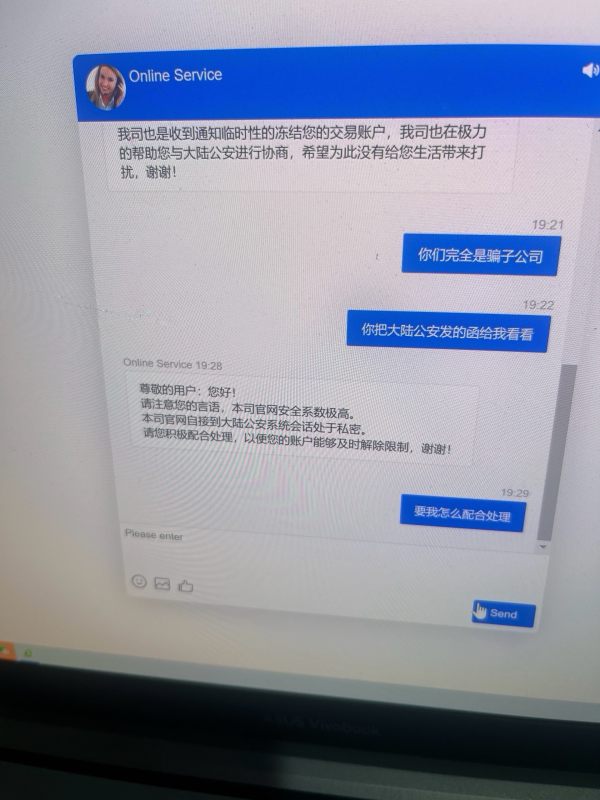

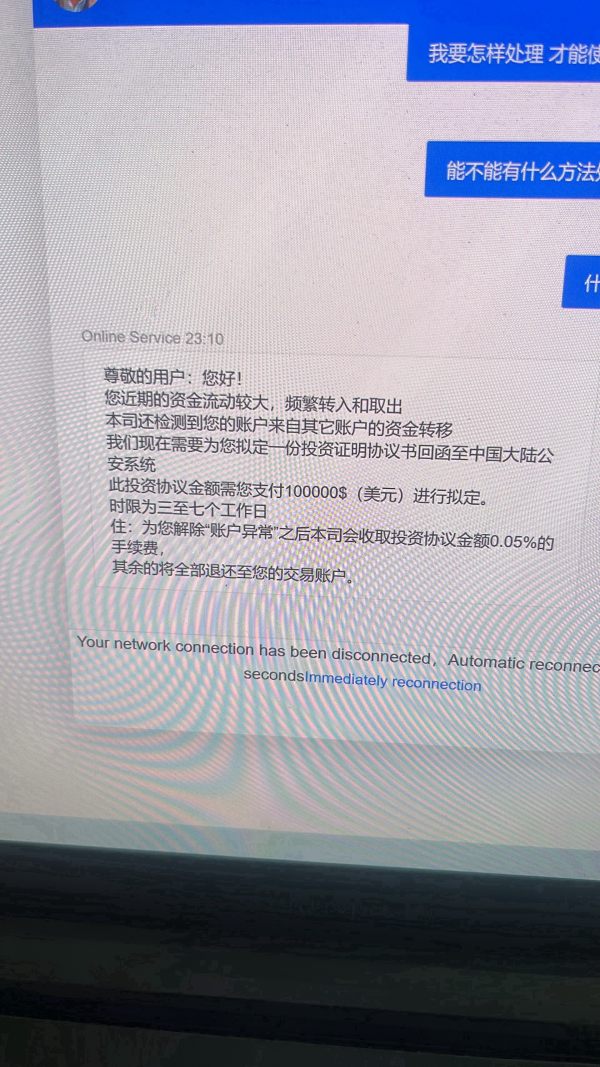

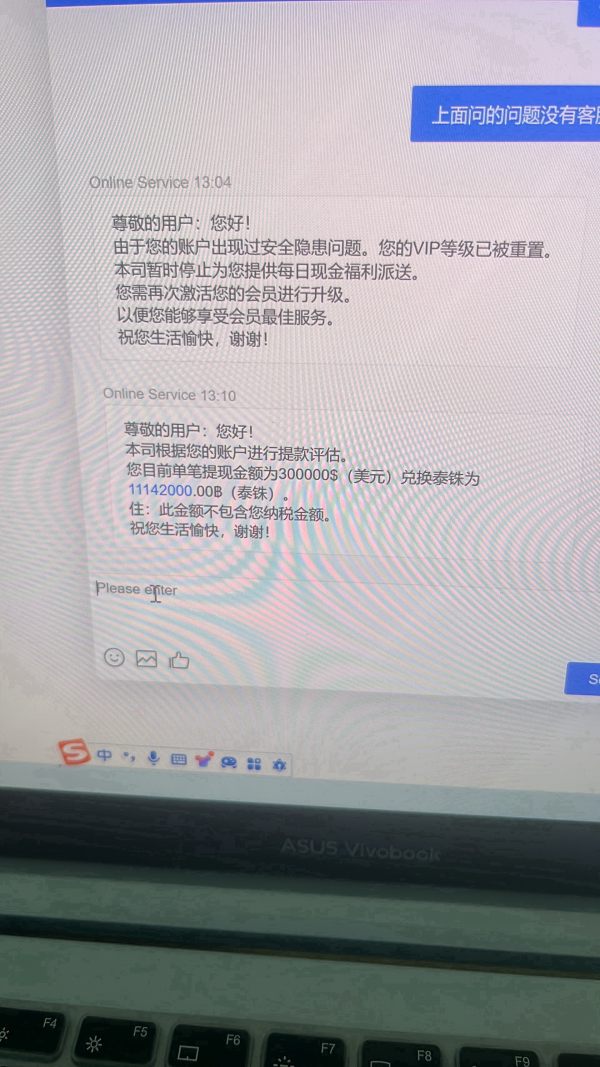

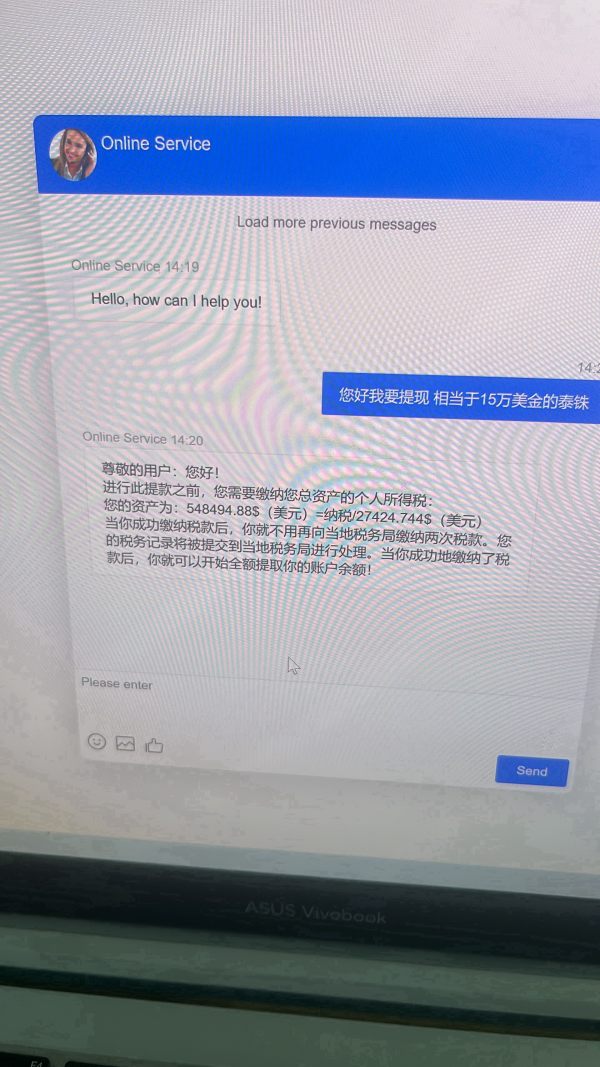

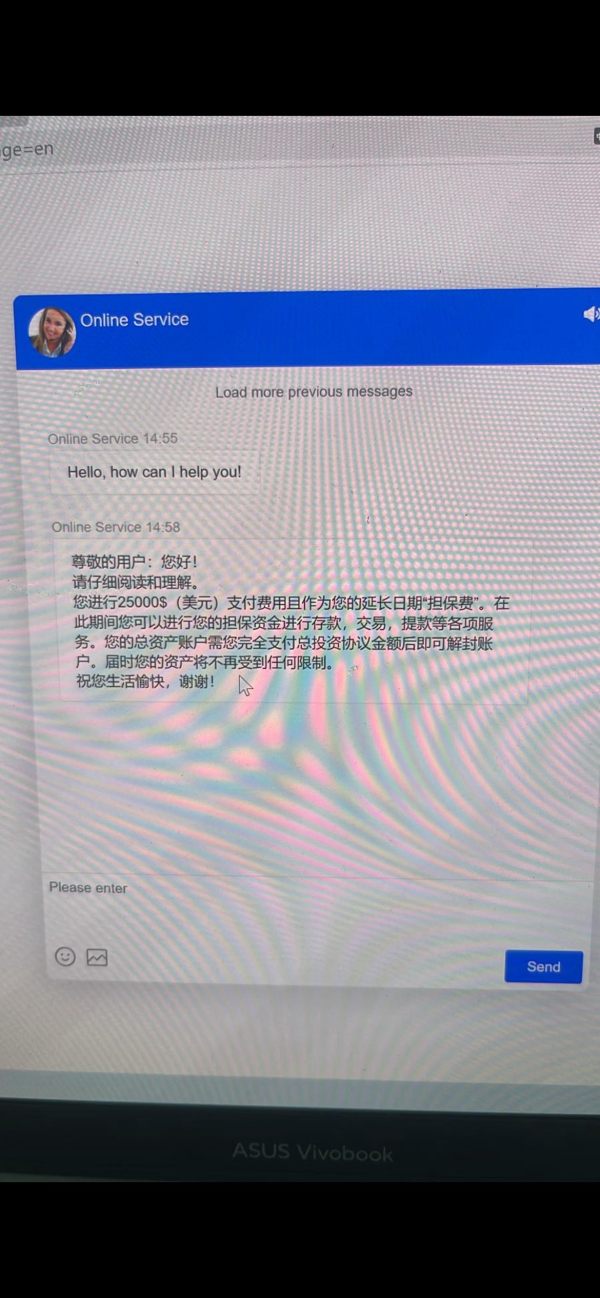

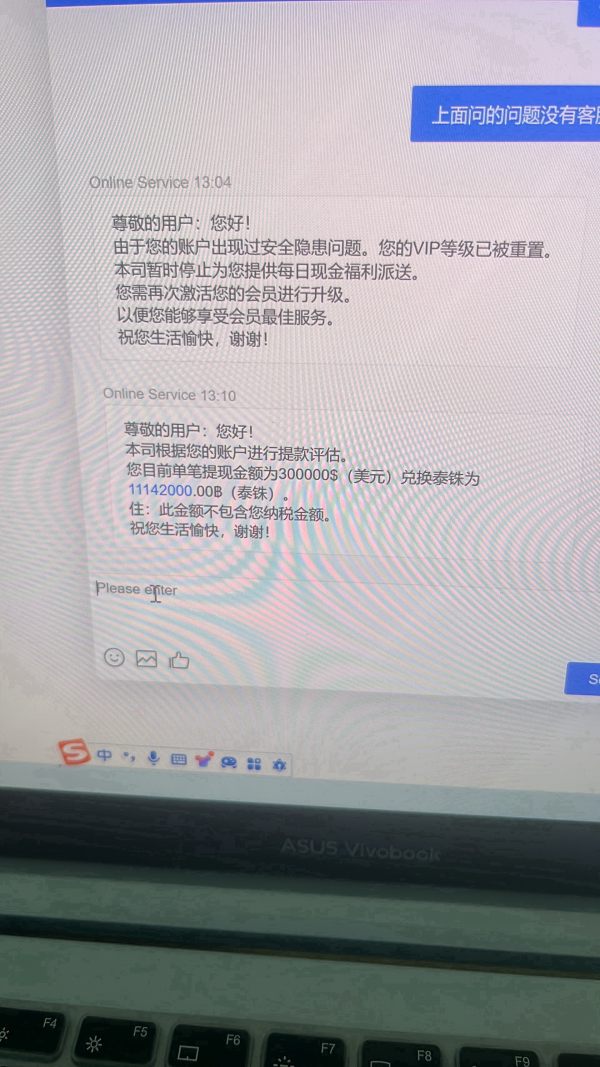

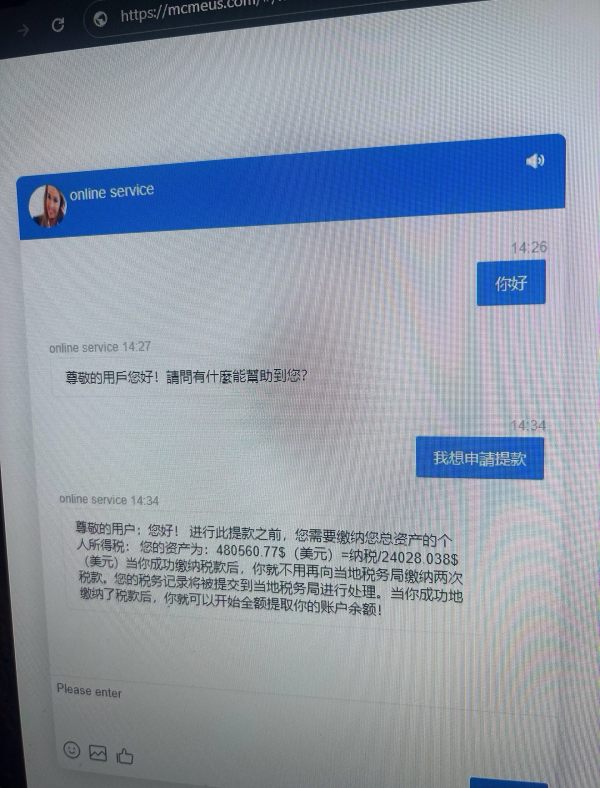

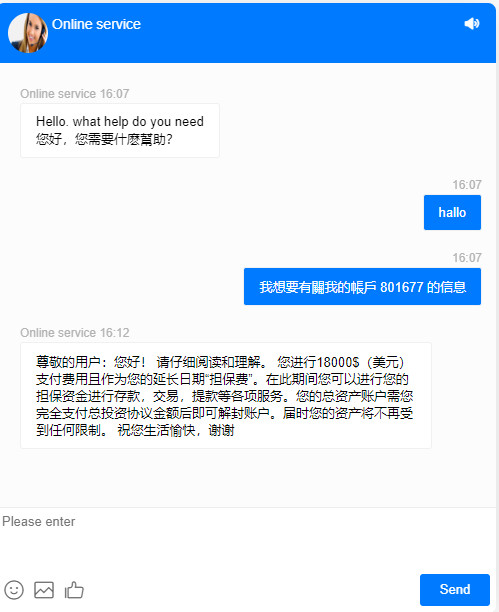

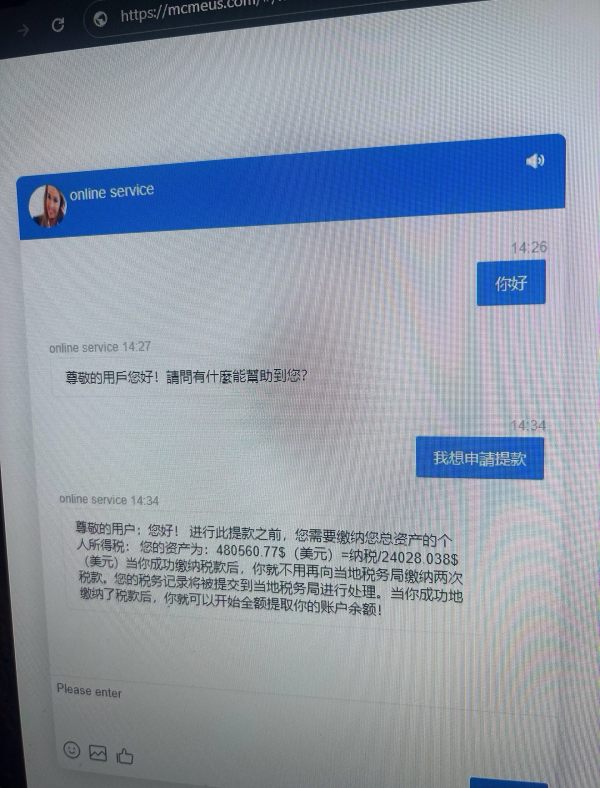

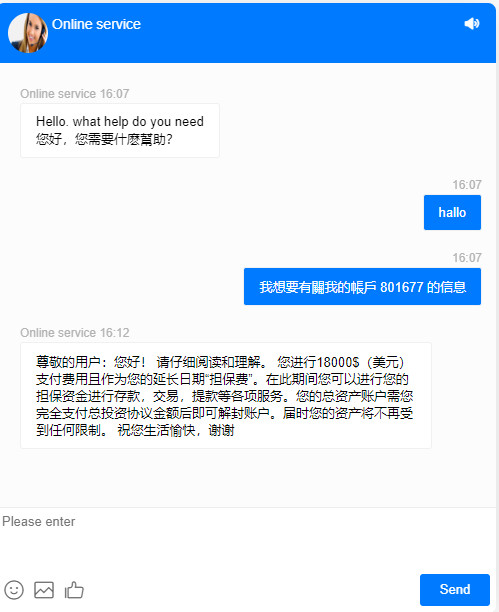

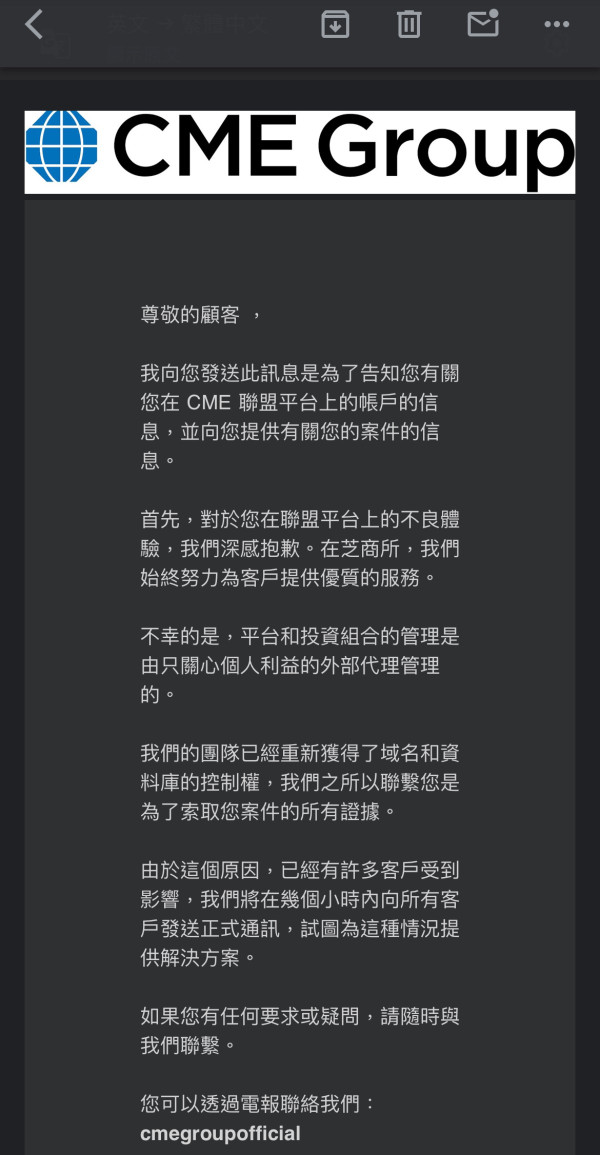

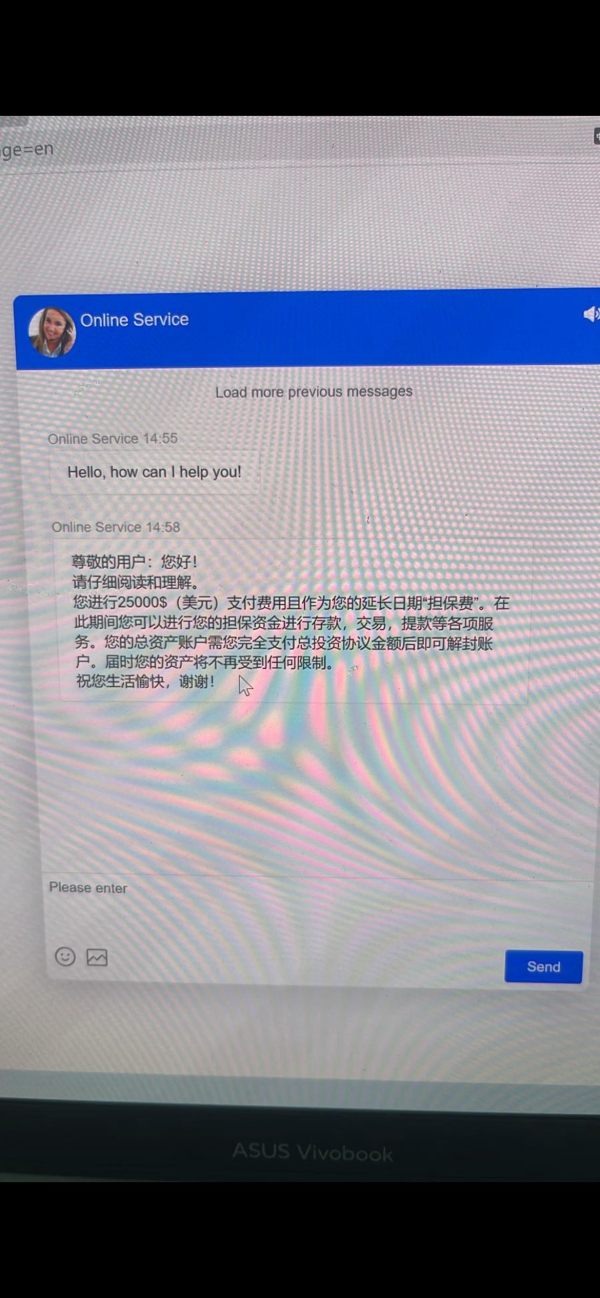

Customer service evaluation reveals concerning patterns in CME Group's client-facing operations. Trustpilot ratings of 2/5 indicate significant customer dissatisfaction with service quality, response times, or issue resolution processes. This rating suggests systematic challenges in customer support delivery that potential users should carefully consider.

The disparity between internal employee satisfaction and external customer ratings indicates potential misalignment between internal operations and customer-facing service delivery. Employee ratings range from 4.0-4.2/5 while customer ratings show only 2/5. This gap suggests that while CME Group maintains positive working conditions for employees, translation of this satisfaction into customer service excellence requires improvement.

Specific customer service channels, availability hours, and response time metrics are not detailed in available source materials. The low customer satisfaction rating suggests potential issues with accessibility, responsiveness, or problem resolution effectiveness. However, specific pain points are not enumerated in current information.

Multi-language support capabilities and regional service variations are not specified in available materials. These represent areas where direct consultation would be necessary for comprehensive service assessment.

Trading Experience Analysis

Trading experience evaluation is constrained by limited specific information in available source materials. As a leading derivatives marketplace, CME Group presumably offers robust trading infrastructure designed for professional-grade execution. However, specific performance metrics are not provided.

Platform stability, execution speed, and order processing capabilities are not detailed in current materials. Professional derivatives trading demands high-performance infrastructure with minimal latency and maximum reliability. This suggests that CME Group likely maintains institutional-grade technical standards.

Order execution quality, slippage rates, and fill rates are not specified in available information. The platform's positioning as a leading marketplace suggests competitive execution standards. However, specific performance data requires direct consultation for comprehensive evaluation.

Mobile trading capabilities and cross-platform functionality are not detailed in source materials. This cme group review notes that modern trading infrastructure typically includes comprehensive mobile access. However, specific mobile platform features and capabilities are not enumerated in available information.

Trust and Reliability Analysis

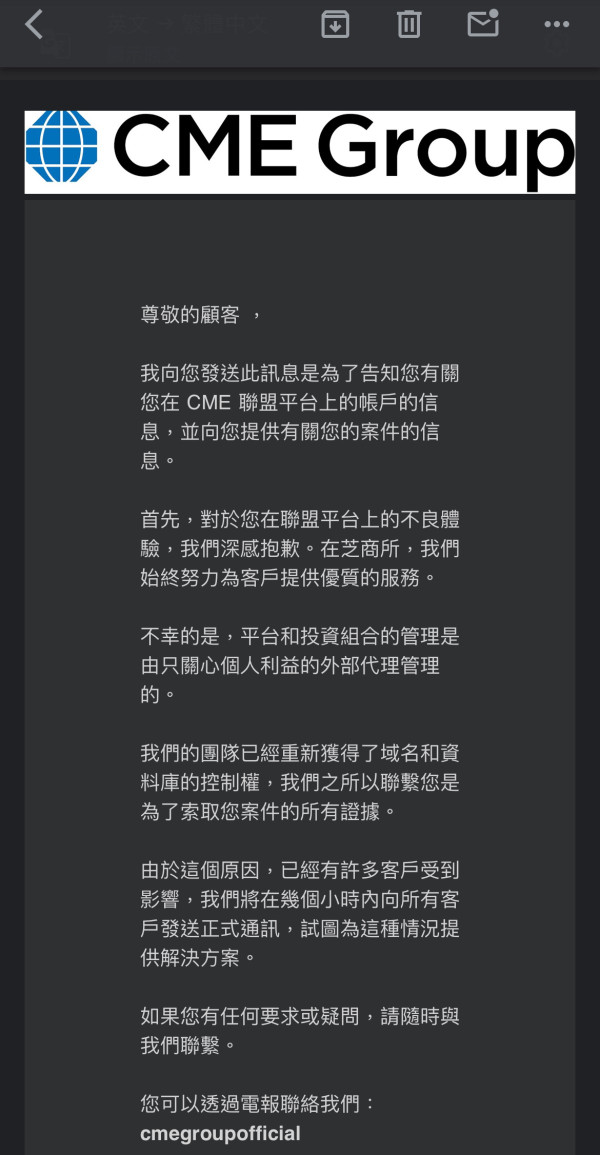

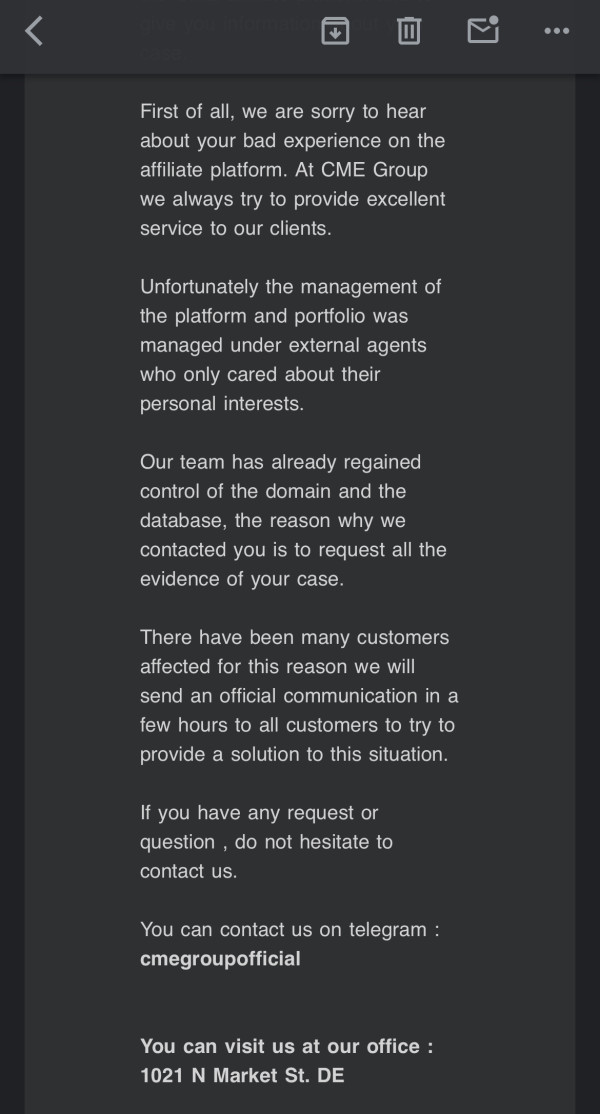

Trust assessment faces limitations due to insufficient regulatory and operational detail in available source materials. As a leading derivatives marketplace operating since 1848, CME Group presumably maintains robust regulatory compliance and operational standards. However, specific certifications and oversight details are not provided.

Fund security measures, segregation policies, and client protection mechanisms are not detailed in current materials. Professional derivatives trading typically involves substantial regulatory oversight and client protection requirements. This suggests that CME Group likely maintains institutional-grade security standards.

Corporate transparency, financial reporting, and operational disclosure practices are not specified in available information. The company's long operational history and market leadership position suggest established transparency standards. However, specific disclosure practices require direct investigation.

Industry reputation and third-party assessments beyond user ratings are not detailed in source materials. These represent areas where additional research would enhance trust evaluation comprehensiveness.

User Experience Analysis

User experience assessment reveals mixed signals regarding CME Group's client satisfaction delivery. Trustpilot ratings of 2/5 indicate substantial user dissatisfaction. This suggests systematic challenges in user experience delivery across multiple touchpoints.

Interface design, navigation efficiency, and platform usability are not detailed in available source materials. The low customer satisfaction rating suggests potential issues with user interface design, workflow efficiency, or learning curve management. However, specific usability challenges are not enumerated.

Registration and verification processes are not specified in current information. Professional derivatives platforms typically involve extensive verification requirements. However, the efficiency and user-friendliness of these processes are not detailed in available materials.

Fund operation experiences, including deposit and withdrawal efficiency, are not detailed in source materials. The low overall customer rating suggests potential friction points in financial operations. However, specific pain points require direct investigation for comprehensive assessment.

Conclusion

This cme group review reveals a complex picture of a well-established derivatives marketplace with strong internal operations but concerning customer satisfaction metrics. CME Group's position as the world's leading derivatives marketplace, combined with high employee satisfaction ratings, indicates robust operational capabilities and positive working environments.

However, the significant disparity between employee satisfaction and customer ratings suggests substantial room for improvement in client-facing services. Employee satisfaction ranges from 4.0-4.2/5 while customer ratings show only 2/5. This gap represents a critical consideration for potential users, particularly those requiring responsive customer support and streamlined user experiences.

The platform appears most suitable for professional traders and institutional investors who prioritize market access and trading infrastructure over customer service excellence. Organizations with internal support capabilities and minimal customer service requirements may find CME Group's market leadership and comprehensive product range valuable despite service delivery challenges.