WayOne FX Review 2025: Everything You Need to Know

Summary

WayOne FX is a new forex broker that has gotten a lot of bad attention. The company lacks proper oversight and has serious transparency problems that worry many traders. Founded in 2023 and based in Saint Lucia, this wayone fx review shows a broker that works without the right legal permission, which creates big red flags for people who want to trade. The platform does offer high leverage up to 1:500 and uses the popular MT5 trading system. However, these good features are completely overshadowed by widespread warnings about possible scam activities that could hurt traders.

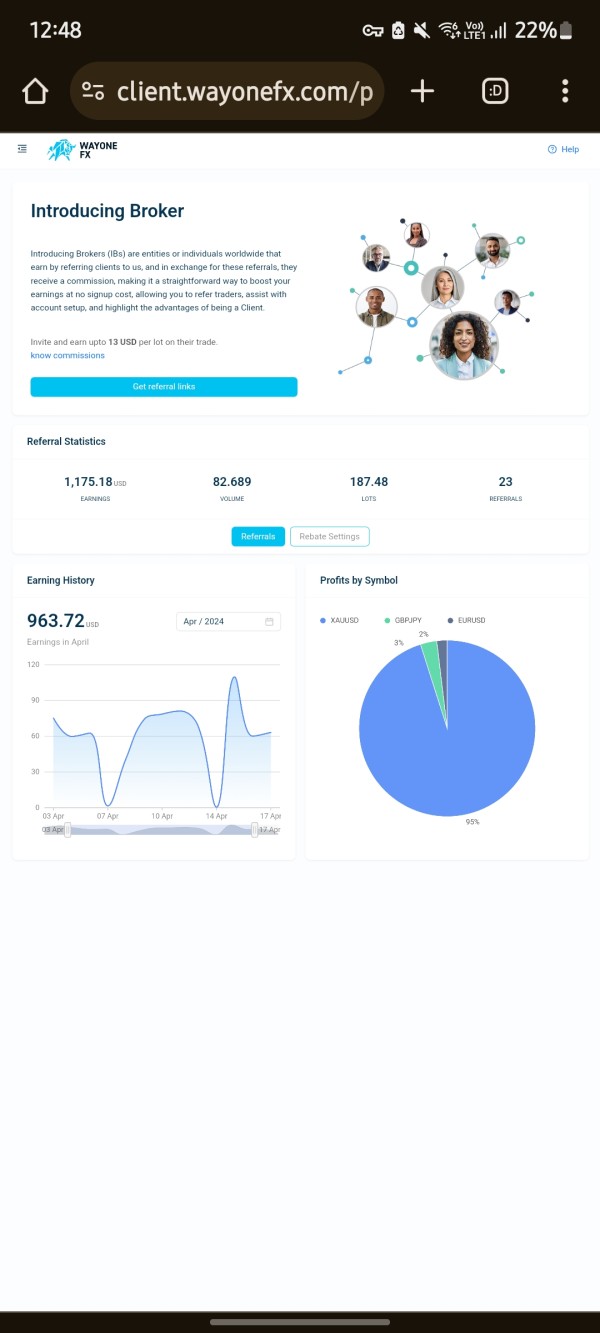

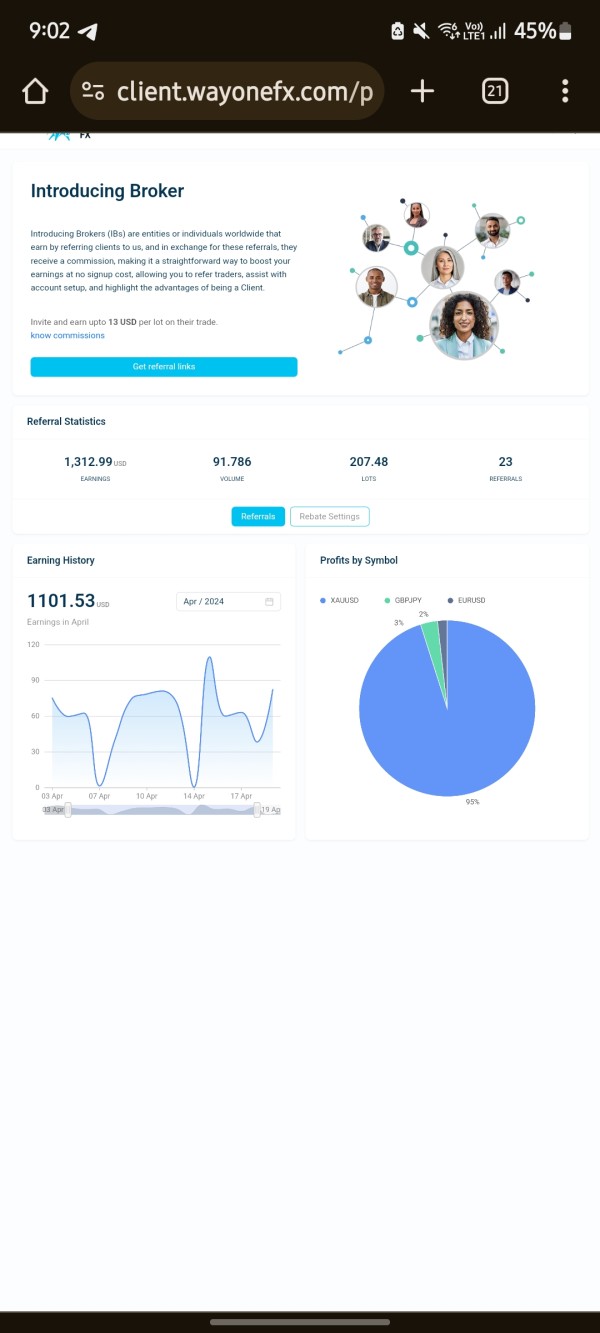

The broker focuses on retail traders who want high-leverage chances across different types of investments. These include forex, stocks, indices, precious metals, cryptocurrencies, and futures contracts. Many industry experts have warned people about WayOne FX's legitimacy, pointing to transparency problems and the lack of protection for client money. ForexMetaTrade and Cyprus Forex Trading reports say that traders should be very careful when thinking about this broker. The lack of proper oversight creates big risks for fund safety and trading security that cannot be ignored.

The broker only requires a minimum deposit of $100, which makes it easy for new traders to start. However, the overall review shows that the risks are much bigger than any possible benefits when dealing with WayOne FX.

Important Notice

This review uses information from multiple industry sources as of March 2025. WayOne FX works without clear legal permission, and the legal problems may be very different in various countries around the world. Traders need to know that the broker's services might not be legally available in certain areas. The lack of proper oversight means less protection for client funds and trading activities that could put people at risk.

The assessment in this wayone fx review comes from public information and industry reports that anyone can access. We have not directly tested or checked the platform's services ourselves, so our information comes from other sources. Many sources have raised serious concerns about possible fraudulent activities, so readers should do careful research and think about regulated alternatives before making any trading decisions.

Rating Framework

Broker Overview

WayOne FX started in the forex market in 2023 as an unregulated broker based in Saint Lucia. The company says it provides forex and CFD trading services with access to multiple types of investments through the MetaTrader 5 platform. Forexexplore reports show that WayOne FX works as a market maker, giving trading services without the support of established legal frameworks that usually protect retail traders.

The broker's business plan focuses on attracting traders with competitive leverage offers and low minimum deposit requirements. However, industry experts have consistently pointed out the big transparency concerns around the company's operations that should worry potential clients. The lack of proper oversight means that WayOne FX works without the standard protections and oversight systems that regulated brokers must maintain. These include segregated client accounts, compensation schemes, and regular financial audits that protect traders.

This wayone fx review shows that while the broker offers modern trading technology and access to popular markets, the basic trust issues and regulatory gaps create big risks. Potential clients must carefully think about these problems before using the platform for their trading activities.

Regulatory Status: Multiple industry sources show that WayOne FX works without permission from recognized financial regulatory bodies. Cyprus Forex Trading reports show no evidence of licensing from major regulators such as FCA, CySEC, or ASIC, which is a major concern for trader safety.

Deposit and Withdrawal Methods: Specific information about funding methods stays limited in available documentation. The broker accepts a minimum deposit of $100, but other details about payment options are not clearly provided to potential clients.

Minimum Deposit Requirement: WayOne FX requires a minimum initial deposit of $100. This positions the broker as accessible to entry-level traders who may not have large amounts of money to start trading.

Bonuses and Promotions: Current promotional offerings are not detailed in available source materials. This lack of information makes it hard for traders to understand what incentives might be available to them.

Tradeable Assets: The platform gives access to forex pairs, stocks, indices, precious metals, cryptocurrencies, and futures contracts across multiple markets. This variety could appeal to traders who want to diversify their investment portfolios across different asset types.

Cost Structure: Trading spreads begin at 1.8 pips according to available information. However, commission structures and additional fees are not clearly disclosed in source materials, which creates uncertainty about the true cost of trading.

Leverage Ratios: Maximum leverage reaches 1:500, which goes beyond regulatory limits in many jurisdictions with established retail trading protections. This high leverage can amplify both profits and losses, creating significant risks for inexperienced traders.

Platform Options: WayOne FX uses MetaTrader 5 as its primary trading platform. The system offers standard charting tools and automated trading capabilities that many traders are familiar with from other brokers.

Geographic Restrictions: Specific jurisdictional limitations are not clearly outlined in available documentation. This lack of clarity makes it difficult for potential clients to understand whether they can legally use the broker's services in their country.

Customer Support Languages: Language support details are not comprehensively covered in current source materials. This missing information could be important for international traders who need support in their native language.

This wayone fx review emphasizes that the limited transparency regarding these fundamental aspects raises additional concerns. The broker's operational standards and client protection measures appear to fall short of industry expectations for professional financial service providers.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

WayOne FX's account structure presents a mixed picture that ultimately falls short of industry standards. The broker's $100 minimum deposit requirement makes it accessible to new traders, which could be viewed as a positive feature for those starting with limited capital. However, this low barrier to entry is significantly undermined by the lack of transparency regarding account types and their specific features that traders need to understand.

The available information suggests that WayOne FX does not clearly differentiate between various account tiers. The broker also fails to provide detailed specifications about the benefits and limitations of each account type, which leaves potential clients in the dark about what they can expect. Industry reports indicate that the broker's spread structure begins at 1.8 pips, which is competitive for major currency pairs in the current market. But the absence of clear commission structures and fee schedules creates uncertainty about the true cost of trading that could surprise clients later.

According to this wayone fx review, the account opening process lacks the robust verification and documentation standards typically required by regulated brokers. This simplified approach, while potentially convenient for users who want to start quickly, raises questions about the broker's compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. These requirements are standard in the regulated financial services industry and help protect both brokers and clients from illegal activities.

The absence of specialized account features such as Islamic accounts, professional trader classifications, or institutional services further limits the broker's appeal. These missing features could be important for diverse trading communities who have specific religious or professional requirements for their trading activities. When compared to established regulated brokers that offer comprehensive account structures with clear terms and conditions, WayOne FX's offering appears underdeveloped and potentially risky for serious traders.

WayOne FX's trading tools and resources present a standard but limited offering that fails to distinguish the broker in a competitive marketplace. The platform provides access to multiple asset classes including stocks, forex, indices, precious metals, cryptocurrencies, and futures, which offers reasonable diversification opportunities for traders. This variety could appeal to traders seeking exposure to various markets without needing to open accounts with multiple brokers.

The MetaTrader 5 platform serves as the primary trading interface for all client activities. The system provides users with industry-standard charting capabilities, technical analysis tools, and automated trading support through Expert Advisors (EAs) that many traders find useful. MT5's built-in features include advanced order types, multiple timeframe analysis, and a comprehensive range of technical indicators. These tools can support both novice and experienced traders in their market analysis and decision-making processes.

However, the broker's educational and research resources appear significantly lacking based on available information from industry sources. Industry reports suggest that WayOne FX does not provide substantial market analysis, economic calendars, trading guides, or educational materials. These resources are typically expected from modern forex brokers and help traders improve their skills and market understanding over time.

The lack of proprietary trading tools, advanced risk management features, or innovative technology solutions further constrains the platform's competitiveness in the current market. These missing features could be important for traders who need sophisticated tools to manage their risk and optimize their trading strategies. When evaluated against regulated brokers that offer comprehensive research departments, daily market analysis, and extensive educational programs, WayOne FX's resource offering appears minimal. The limited resources may be insufficient for traders seeking comprehensive trading support and ongoing education to improve their trading performance.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of WayOne FX's most significant weaknesses according to multiple industry sources. These sources have raised concerns about the quality and availability of client support that could affect the overall trading experience. The limited information available about customer service channels suggests that the broker may not maintain the comprehensive support infrastructure. Professional financial service providers typically offer multiple ways for clients to get help when they need it.

Industry reports indicate that users have expressed concerns about the responsiveness and effectiveness of WayOne FX's customer support team. Many clients expect quick and helpful responses when they have problems or questions about their trading accounts. The absence of detailed information about support hours, available communication channels, and response time commitments creates uncertainty. Traders cannot be sure about the level of assistance they can expect when encountering issues or requiring guidance for their trading activities.

According to ForexMetaTrade and other industry sources cited in this review, there have been discussions within trading communities about difficulties. These discussions focus on problems reaching customer service representatives and obtaining satisfactory resolutions to trading-related inquiries that clients have submitted. These reports suggest that the broker may lack the professional customer service standards that are typically maintained by regulated financial institutions. Such standards are important for maintaining client satisfaction and resolving problems quickly and fairly.

The potential language barriers and limited multilingual support capabilities further compound these service issues for international clients. Many traders require assistance in their native languages to fully understand complex trading concepts and resolve account-related problems effectively. The absence of comprehensive FAQ sections, detailed documentation, or self-service resources means that traders are heavily dependent on direct customer service interactions. This dependence makes the reported service quality issues even more problematic for the overall user experience and client satisfaction.

Trading Experience Analysis (Score: 5/10)

The trading experience with WayOne FX presents a complex picture that combines modern platform technology with concerning operational issues. The MetaTrader 5 platform provides a familiar and functional trading environment that many traders recognize and appreciate from their experience with other brokers. The platform offers standard features such as one-click trading, multiple order types, and comprehensive charting capabilities that can help traders execute their strategies effectively.

The broker's spread structure, beginning at 1.8 pips for major currency pairs, falls within competitive ranges for the retail forex market. This pricing could be attractive to traders who are comparing costs across different brokers in the industry. The high leverage ratio of up to 1:500 may appeal to traders seeking amplified market exposure to potentially increase their profits. However, this level of leverage also significantly increases trading risks and would exceed regulatory limits in many jurisdictions with established trader protection measures.

However, the trading experience is significantly impacted by concerns about execution quality and platform reliability. These concerns stem from the broker's unregulated status and the lack of oversight that typically ensures fair trading conditions. Industry reports suggest that traders have raised questions about order execution speeds, potential slippage issues, and the overall reliability of the trading infrastructure. These problems can be particularly noticeable during volatile market conditions when fast and accurate execution becomes even more important for trading success.

According to this wayone fx review, the absence of regulatory oversight means that WayOne FX operates without the execution quality standards. The broker also lacks best execution requirements that regulated brokers must maintain to protect their clients' interests. This regulatory gap creates uncertainty about whether traders receive fair pricing and optimal order execution. Fair pricing and optimal execution are fundamental components of a satisfactory trading experience that traders should be able to expect from their broker.

The limited information about mobile trading capabilities and platform customization options further constrains the overall trading experience. These limitations can be particularly problematic for active traders who require flexible and responsive trading tools to manage their positions effectively throughout the trading day.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent WayOne FX's most critical weaknesses according to multiple industry sources. These sources have raised serious concerns about the broker's legitimacy and operational integrity that potential clients should carefully consider. The broker's unregulated status means it operates without oversight from recognized financial authorities. This lack of oversight eliminates the standard protections and accountability measures that regulated brokers must maintain to protect their clients' interests.

Industry reports from Cyprus Forex Trading and ForexMetaTrade have specifically highlighted transparency concerns about WayOne FX's operations. These reports have also issued warnings about potential fraudulent activities associated with the broker that could put client funds at risk. These warnings indicate that the broker may not meet the operational and ethical standards expected in the legitimate financial services industry. Such standards are important for maintaining client trust and ensuring fair treatment of all customers.

The absence of regulatory licensing means that WayOne FX does not maintain segregated client accounts. The broker also does not participate in compensation schemes or undergo regular financial audits that are standard requirements for regulated brokers. This regulatory gap creates substantial risks for client fund safety and provides limited recourse for traders. Traders who experience disputes or operational issues may have few options for getting help or recovering their money if problems arise.

Third-party industry evaluations consistently emphasize the elevated risks associated with dealing with unregulated brokers. These risks are particularly high for brokers that have attracted specific warnings from trading community watchdogs who monitor the industry for potential problems. The broker's limited operational history, combined with the serious concerns raised by industry observers, creates a trust environment. This environment falls well below the standards expected by prudent traders who want to protect their investment capital.

The lack of transparent corporate information, unclear beneficial ownership structures, and absence of published financial statements further compound the trust issues. These reliability concerns are fundamental factors that potential clients must consider when evaluating this broker for their trading activities.

User Experience Analysis (Score: 4/10)

The user experience with WayOne FX reflects the broader concerns about the broker's operational standards and transparency issues. While the MetaTrader 5 platform provides a familiar interface that many traders can navigate effectively, the overall user experience is significantly impacted by fundamental problems. The trust and reliability issues surrounding the broker create uncertainty and anxiety that can negatively affect the trading experience for clients.

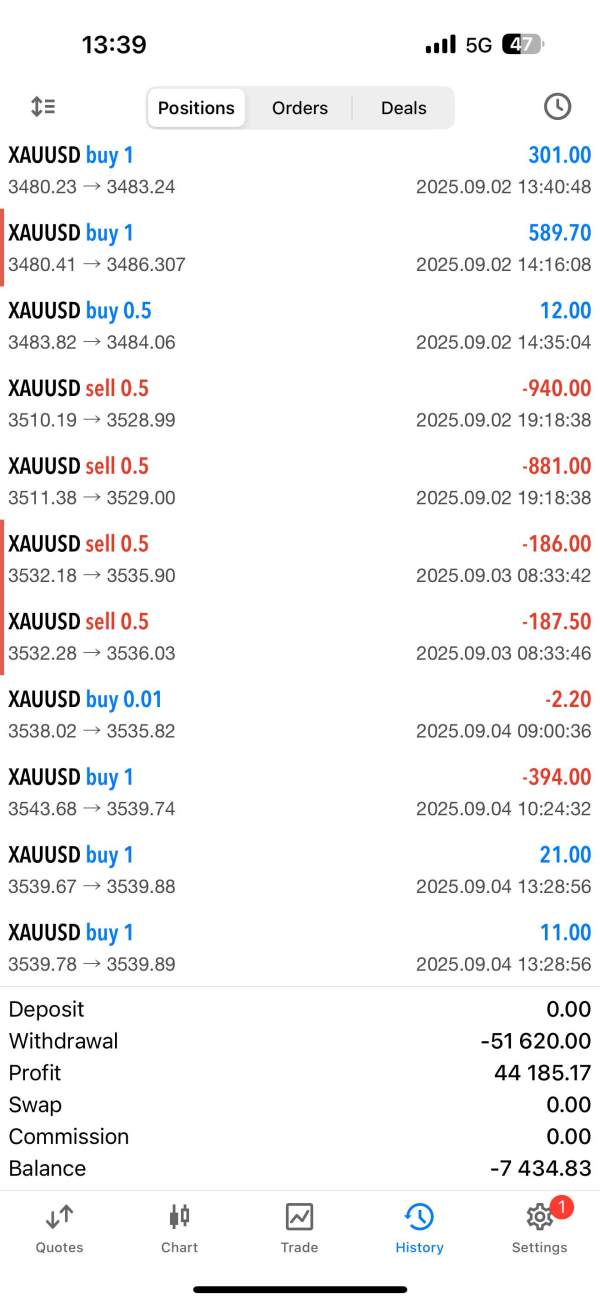

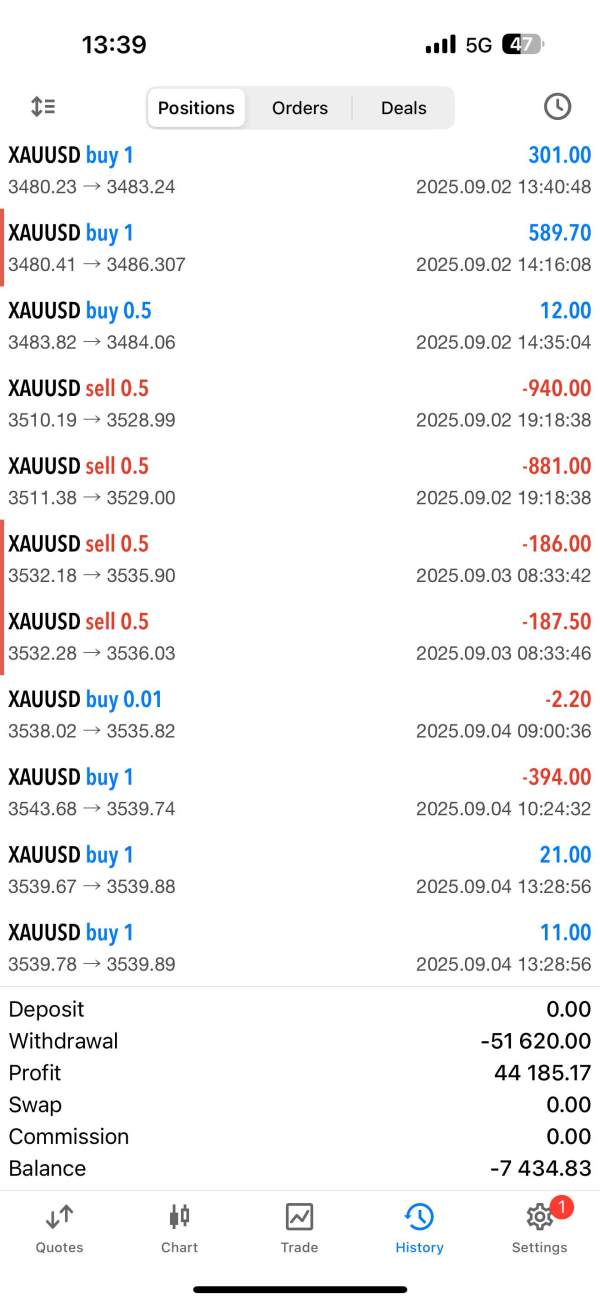

Industry discussions suggest that users have raised concerns about various aspects of the trading experience with WayOne FX. These concerns include questions about fund security, withdrawal processes, and overall platform reliability that are important for client satisfaction. The limited availability of detailed user testimonials and verified customer feedback makes it difficult to assess the true quality of the user experience. This lack of transparent feedback from real users should be a concern for potential clients who want to understand what to expect.

The broker's simplified account opening process, while potentially convenient for users who want to start trading quickly, may not provide thorough verification and security measures. Users should expect these measures from professional financial service providers who take client security seriously. This streamlined approach, combined with the lack of regulatory oversight, creates potential security vulnerabilities. These vulnerabilities could impact the user experience and put client information and funds at risk.

Common user concerns identified in industry reports include difficulties with customer service interactions and questions about trading conditions. Users have also expressed uncertainties about fund withdrawal processes that are essential for accessing their money when needed. These issues suggest that the user experience may be characterized by anxiety and uncertainty rather than confidence and satisfaction. Confidence and satisfaction should define professional trading relationships between brokers and their clients.

The absence of comprehensive educational resources, detailed platform documentation, and transparent operational procedures further limits the user experience quality. These limitations are particularly problematic for newer traders who require guidance and support as they develop their trading skills. New traders also need help building their market knowledge to become successful in the competitive forex market over time.

Conclusion

This comprehensive wayone fx review reveals a broker that presents significant risks despite offering some competitive features. While WayOne FX provides high leverage ratios up to 1:500, access to the popular MT5 platform, and a low minimum deposit requirement of $100, these potential advantages are overshadowed by serious problems. The concerns about regulatory compliance, transparency, and operational legitimacy make this broker unsuitable for most traders who value safety and security.

The broker's unregulated status and the multiple industry warnings about potential fraudulent activities make it unsuitable for traders. Traders who prioritize fund safety and regulatory protection should look elsewhere for their trading needs. The lack of transparency regarding fundamental operational aspects, combined with reported customer service issues and trust concerns, creates an environment. This environment is one that prudent traders should approach with extreme caution and careful consideration of the risks involved.

WayOne FX might superficially appeal to traders seeking high-leverage opportunities and low entry barriers for starting their trading journey. However, the substantial risks associated with unregulated brokers far outweigh these potential benefits that might initially attract new traders. Serious traders should consider regulated alternatives that provide comprehensive client protections, transparent operations, and established track records. These alternatives operate in the financial services industry with proper oversight and accountability measures that protect client interests and funds.