Bonny Markets 2025 Review: Everything You Need to Know

Executive Summary

Bonny Markets is a new player in the forex brokerage world. The company has received mixed feedback from traders who use their services. This bonny markets review shows a broker that offers some great features but also has some problems. The platform protects users from negative balances and has very fast order execution at 0 milliseconds on average, which makes it appealing to both new and experienced traders who want quick trades.

The broker focuses on forex and CFD traders who want different trading options across many types of assets like currencies, commodities, bonds, metals, energies, stocks, and indices. User feedback shows both good and bad experiences with the platform. Positive reviews talk about the trading tools and customer support being helpful. Negative experiences mostly focus on problems with withdrawing money from accounts. WikiFX data shows that Bonny Markets has received 2 positive reviews, 2 neutral reviews, and 1 exposure review from real users, which means the trading community has mixed feelings about the broker.

The platform works under rules from Mwali International Services Authority (KM MISA) and lets traders use leverage up to 1:500. This makes it a broker that serves traders who want higher leverage ratios. Even with these features, potential users should think carefully about both the good points and reported problems before they decide to use this broker.

Important Notice

Regulatory Variations: Bonny Markets works under rules from Mwali International Services Authority. Users should know that rules and legal protections can be very different in different countries. The Comoros Union regulatory environment may give different investor protections compared to major financial centers.

Review Methodology: This review uses detailed analysis of user feedback, regulatory information, platform features, and public data from multiple sources including WikiFX, FXVerify, and BrokerState. The goal is to give an objective view while knowing that individual trading experiences may be different.

Rating Overview

Broker Overview

Bonny Markets Ltd. works as an online forex and CFD trading platform that was created to give traders different investment opportunities across global financial markets. The company sees itself as a technology-focused broker that emphasizes fast execution speeds and complete asset coverage. While the exact founding date is not given in available documents, the broker has built its reputation around offering competitive trading conditions and supporting both retail and institutional clients.

The platform's business model focuses on giving access to forex and CFD trading across multiple asset classes. Bonny Markets tries to stand out through technology capabilities, especially in execution speed, and by offering a wide range of tradeable instruments. The company's approach targets traders who want variety in building their portfolios, from traditional forex pairs to commodities, bonds, and equity indices.

Available information shows that Bonny Markets uses MetaTrader 5 (MT5) as its main trading platform, giving users a familiar and strong trading environment. The broker's asset coverage includes forex pairs, CFDs on commodities, bonds, metals, energies, stocks, and indices, offering traders complete market exposure. The platform operates under regulatory oversight of Mwali International Services Authority (KM MISA), which puts it in the offshore regulatory category. This bonny markets review emphasizes how important it is for potential users to understand the regulatory implications.

Regulatory Status: Bonny Markets operates under supervision of Mwali International Services Authority (KM MISA) in the Comoros Union. This classifies it as an offshore regulated entity. This regulatory framework may offer different protections compared to tier-one regulatory jurisdictions.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. User feedback shows some challenges with withdrawal processing, especially regarding bank wire transfers.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with Bonny Markets is not specified in current available information. This represents a transparency gap for potential clients.

Promotional Offers: Available information shows that Bonny Markets does offer bonuses. Specific details about bonus structures, terms, and conditions are not explained in accessible documentation.

Available Trading Assets: The platform gives access to a complete range of instruments including spot forex, CFDs on commodities, bonds, metals, energies, stocks, and indices. This offers traders diversified market exposure across global financial instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not easily available in current documentation. The broker advertises "lowest fixed spreads" but does not provide specific numbers, making cost comparison challenging.

Leverage Options: Bonny Markets offers maximum leverage up to 1:500. Leverage availability may vary based on client jurisdiction and regulatory requirements in their location.

Platform Technology: The broker uses MetaTrader 5 (MT5) as its trading platform. This gives users advanced charting capabilities, automated trading support, and a user-friendly interface suitable for traders of varying experience levels.

Geographic Restrictions: Specific information about geographic restrictions or prohibited jurisdictions is not detailed in available documentation.

Customer Support Languages: Available documentation does not specify the languages supported by customer service teams.

This bonny markets review highlights the need for potential users to directly contact the broker for detailed information about costs, account requirements, and service specifics not covered in public documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions offered by Bonny Markets show a mixed picture. This is mainly due to limited transparency in key areas that traders typically evaluate when selecting a broker. The platform does provide access to trading with leverage up to 1:500, but the absence of clear information about account types, minimum deposit requirements, and specific trading costs creates uncertainty for potential clients.

Available documentation does not detail different account tiers or specialized account features that might serve various trader segments. The lack of specific information about Islamic accounts, professional trading accounts, or beginner-friendly account options limits the ability to assess how well the broker serves diverse client needs. The account opening process and verification requirements are not clearly outlined in accessible materials.

User feedback shows some challenges with account management, particularly regarding withdrawal processes. One user review mentioned struggling with withdrawals but noted that customer support representative Becca provided assistance, suggesting that while issues may arise, the broker does attempt to address client concerns through personalized support.

The absence of clear minimum deposit information and detailed fee structures makes it difficult for traders to plan their initial investment and ongoing trading costs. This lack of transparency in account conditions significantly impacts the overall rating, as traders require clear information to make informed decisions about their broker selection.

This bonny markets review emphasizes that potential clients should directly contact the broker to get complete details about account conditions, fees, and requirements before committing to opening an account.

Bonny Markets shows strength in its trading instrument diversity. The broker offers access to forex, CFDs on commodities, bonds, metals, energies, stocks, and indices. This complete asset coverage allows traders to diversify their portfolios and access multiple markets through a single platform, which represents a significant advantage for traders seeking varied investment opportunities.

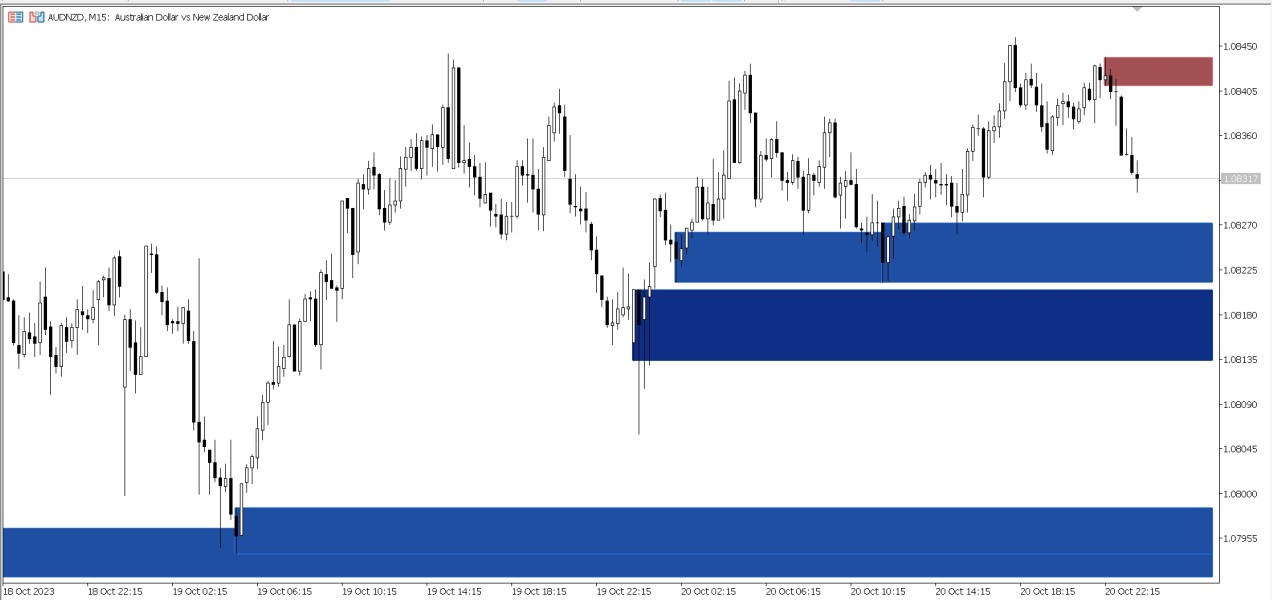

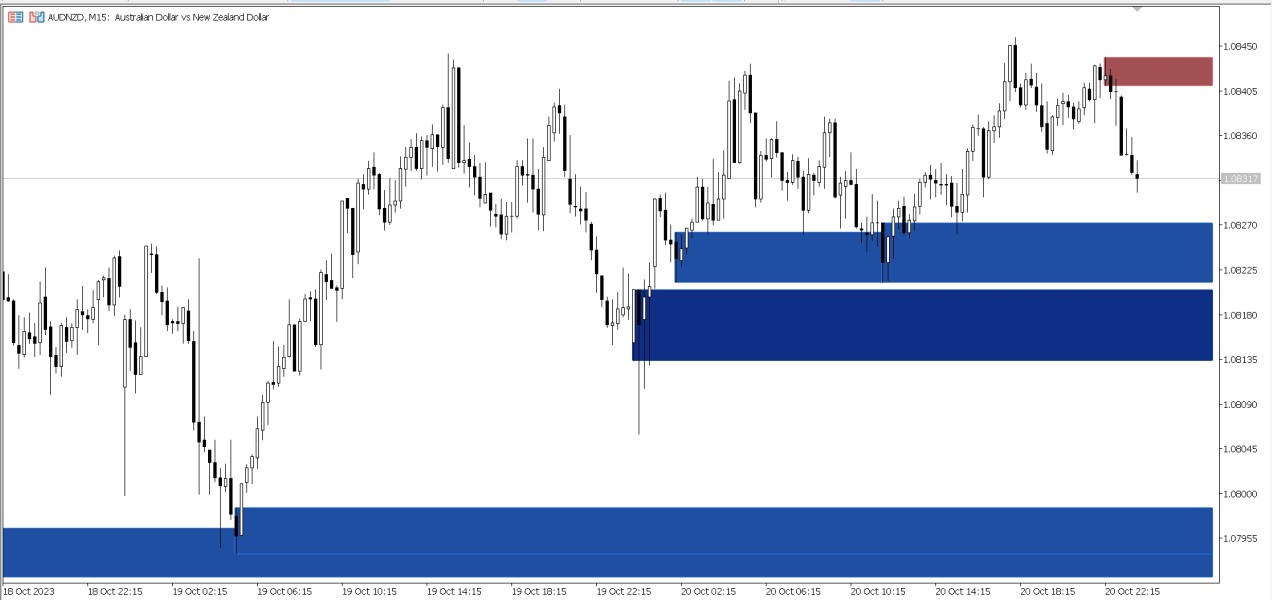

The platform's use of MetaTrader 5 (MT5) gives users robust analytical tools, advanced charting capabilities, and support for automated trading strategies. MT5's established reputation in the industry ensures that traders have access to professional-grade tools for technical analysis and trade execution. The platform's user-friendly interface accommodates both novice traders learning the markets and experienced professionals requiring sophisticated analytical capabilities.

Available documentation does not provide detailed information about additional research resources, market analysis, educational materials, or proprietary trading tools that might supplement the standard MT5 offering. Many competitive brokers enhance their platforms with daily market commentary, economic calendars, trading signals, or educational webinars, but such resources are not clearly highlighted in Bonny Markets' available information.

The broker's emphasis on execution speed, with an advertised average of 0 milliseconds, suggests technological investment in trading infrastructure. This focus on execution quality can be considered a valuable tool for active traders, particularly those employing scalping or high-frequency trading strategies where execution speed is crucial.

User feedback generally supports the quality of available trading tools. Specific comments about additional resources or educational support are limited in available reviews.

Customer Service and Support Analysis (Score: 6/10)

Customer service quality at Bonny Markets presents a complex picture based on available user feedback and operational evidence. Specific details about customer support channels, hours of operation, and response times are not comprehensively documented, but user experiences provide insight into the service quality and support responsiveness.

One notable user review highlights both challenges and positive resolution. A trader mentioned withdrawal difficulties but praised customer support representative Becca for providing helpful assistance. This suggests that while operational issues may occur, the broker maintains support staff capable of addressing client concerns through personalized attention.

The absence of detailed information about available support channels (live chat, phone, email), multilingual support capabilities, and support hours represents a transparency gap that affects the overall service assessment. Professional forex brokers typically provide 24/5 support during market hours, but Bonny Markets' specific support availability is not clearly documented.

Response times and service quality appear to vary based on the nature of inquiries. Withdrawal-related issues receive attention though potentially require extended resolution timeframes. The broker's willingness to work with clients experiencing difficulties suggests a commitment to client retention, though the underlying operational efficiency could benefit from improvement.

The lack of comprehensive documentation about customer service protocols, escalation procedures, and service level agreements makes it challenging for potential clients to understand what level of support they can expect. This uncertainty contributes to the moderate rating in this category.

Trading Experience Analysis (Score: 8/10)

The trading experience offered by Bonny Markets shows notable strengths, particularly in execution technology and platform reliability. The broker's advertised average execution speed of 0 milliseconds represents a significant competitive advantage, especially for traders employing strategies that require rapid order processing such as scalping or high-frequency trading approaches.

The implementation of MetaTrader 5 (MT5) as the primary trading platform gives users a stable, feature-rich environment that supports various trading styles and experience levels. MT5's advanced charting capabilities, technical indicators, and automated trading support through Expert Advisors (EAs) create a comprehensive trading ecosystem suitable for both discretionary and systematic trading approaches.

User feedback generally supports positive trading experiences, with particular appreciation for the platform's speed and reliability. The negative balance protection feature adds an important safety element, protecting traders from account balances falling below zero during volatile market conditions, which is particularly valuable for traders utilizing higher leverage ratios.

The platform's user-friendly interface design accommodates traders with varying experience levels, from beginners learning market navigation to experienced professionals requiring advanced functionality. Specific information about mobile trading applications, platform customization options, and advanced order types is not detailed in available documentation.

While execution speed and platform stability receive positive recognition, the overall trading environment assessment is somewhat limited by the lack of detailed information about spreads, slippage rates, and requote frequency during volatile market periods. This bonny markets review notes that execution quality extends beyond speed to include consistency and fairness in order processing.

Trustworthiness Analysis (Score: 6/10)

The trustworthiness assessment of Bonny Markets reveals a complex picture influenced by regulatory status, user feedback, and operational transparency. The broker operates under the regulation of Mwali International Services Authority (KM MISA) in the Comoros Union, which places it in the offshore regulatory category. While this provides some regulatory oversight, it may offer different investor protections compared to tier-one regulatory jurisdictions such as the FCA, ASIC, or CySEC.

User feedback presents mixed signals regarding trustworthiness. Positive reviews highlight helpful customer support and satisfactory trading experiences, while negative feedback focuses primarily on withdrawal processing difficulties. The balance between positive and negative reviews (2 positive, 2 neutral, 1 exposure according to WikiFX data) suggests that experiences vary significantly among users.

The reported withdrawal difficulties represent a significant concern for trust assessment, as reliable and timely fund access is fundamental to broker credibility. The documented customer support efforts to resolve such issues indicate that the broker does not ignore client concerns, though operational efficiency in payment processing may need improvement.

Transparency regarding company information, detailed fee structures, and operational procedures is limited in publicly available documentation. Professional brokers typically provide comprehensive disclosure about their operations, regulatory status, and business practices, and the relative lack of such information affects the overall trust assessment.

The absence of detailed information about client fund segregation, deposit protection schemes, and financial reporting further impacts the trustworthiness evaluation. While negative balance protection is offered, broader financial security measures are not clearly documented.

User Experience Analysis (Score: 6/10)

The overall user experience with Bonny Markets reflects a platform with notable strengths offset by operational challenges that affect client satisfaction. The user-friendly interface design, particularly through the MT5 platform, receives positive recognition for accommodating traders across different experience levels and providing intuitive navigation for both market analysis and trade execution.

User satisfaction appears mixed based on available feedback, with experiences varying significantly depending on the specific aspects of platform interaction. Traders generally appreciate the fast execution speeds and comprehensive asset availability, which contribute positively to the daily trading experience. The platform's design philosophy appears to prioritize accessibility for beginners while maintaining the sophisticated functionality required by experienced traders.

The user experience is notably impacted by operational challenges, particularly regarding withdrawal processes. User feedback indicates that while the trading experience itself may be satisfactory, the back-office operations can create frustration and concern among clients. The need for customer support intervention to resolve withdrawal issues suggests systemic challenges that affect overall user satisfaction.

The registration and account verification processes are not detailed in available documentation, making it difficult to assess the onboarding experience for new clients. Streamlined account opening and verification procedures are increasingly important for user satisfaction in the competitive brokerage landscape.

Common user complaints center around withdrawal processing rather than trading functionality, suggesting that while the core trading platform performs adequately, the operational infrastructure may require enhancement. The platform would benefit from improved transparency regarding processing timeframes, clearer communication about operational procedures, and enhanced efficiency in payment processing systems.

Conclusion

This comprehensive bonny markets review reveals a broker with distinct advantages in trading technology and asset diversity, balanced against operational challenges that affect overall client experience. Bonny Markets shows strength in execution speed and platform functionality, making it potentially suitable for active traders prioritizing fast order processing and comprehensive market access.

The platform appears most appropriate for experienced forex and CFD traders who value technological capabilities and can navigate potential operational challenges. It may also suit beginners attracted to the user-friendly interface and negative balance protection. Traders prioritizing seamless withdrawal processes and comprehensive transparency may find better alternatives in the market.

The main advantages include exceptional execution speeds, comprehensive asset coverage, and negative balance protection. The primary concerns center around withdrawal processing difficulties, limited operational transparency, and offshore regulatory status. Potential users should carefully weigh these factors against their individual trading priorities and risk tolerance before making a commitment.