Is Liyan Broker safe?

Business

License

Is Liyan Broker Safe or Scam?

Introduction

Liyan Broker positions itself as a prominent player in the forex market, claiming to provide traders with access to a variety of financial instruments, competitive spreads, and advanced trading platforms. However, the influx of new brokers in the financial sector has raised concerns about their legitimacy and reliability. For traders, assessing the trustworthiness of a broker is critical, as it directly impacts their investments and trading experience. The objective of this article is to rigorously evaluate Liyan Broker's safety and legitimacy through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

To achieve this, we will utilize a multi-faceted approach, drawing on data from reputable financial review sites, regulatory bodies, and user feedback. This framework will help us determine whether Liyan Broker is safe for traders or if it raises significant red flags that warrant caution.

Regulation and Legitimacy

Regulation is a fundamental aspect of any brokerage's credibility. A regulated broker operates under the oversight of a recognized financial authority, which helps ensure fair practices, transparency, and investor protection. In the case of Liyan Broker, there are several claims regarding its regulatory status, but a deeper investigation reveals a mixed picture.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Saint Vincent and the Grenadines | 2886 LLC 2023 | Saint Vincent and the Grenadines | Verified |

| Mauritius | AC 48008 | Mauritius | Verified |

| Comoros | DDC 56718 | Comoro Islands | Verified |

While Liyan Broker asserts that it holds licenses from multiple jurisdictions, including Saint Vincent and the Grenadines, Mauritius, and Comoros, the quality of regulation in these regions is often questioned. For instance, the regulatory framework in Saint Vincent and the Grenadines is less stringent compared to major financial centers like the UK or the US. This raises concerns about the level of investor protection available to clients of Liyan Broker. Furthermore, the absence of regulation from more established authorities could indicate potential risks associated with trading through this broker.

Company Background Investigation

Liyan Broker's corporate history and ownership structure are crucial in evaluating its legitimacy. The broker claims to have been operational for a relatively short period, with its domain registered only about eight months ago. This limited operational history can be a warning sign, as many fraudulent brokers often emerge and disappear quickly.

The ownership of Liyan Broker is obscured, as the identity of its owner is hidden through a privacy protection service. This lack of transparency raises questions about accountability and trustworthiness. A legitimate broker typically provides clear information about its management team, including their qualifications and experience in the financial industry. In this case, potential clients may find it challenging to ascertain the expertise of those running Liyan Broker, which is a significant concern for traders seeking a reliable partner.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to make informed decisions. Liyan Broker promotes competitive spreads and various account types, but a closer examination reveals some concerning aspects of its fee structure.

| Fee Type | Liyan Broker | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 0.8 pips | 1.0 pips |

| Commission Model | Varies | Typically flat or tiered |

| Overnight Interest Range | High (not specified) | Average (varies by broker) |

While Liyan Broker claims to offer lower spreads compared to industry averages, the lack of transparency regarding commissions and overnight interest rates is troubling. Traders should be wary of any hidden fees or unexpected costs that could erode their profits. The absence of clear information on these aspects makes it difficult to assess the overall cost of trading with Liyan Broker accurately.

Client Funds Security

The safety of client funds is paramount when evaluating a broker's reliability. Liyan Broker claims to implement several security measures to protect client deposits. However, the effectiveness of these measures is questionable, given the broker's regulatory status and transparency levels.

Liyan Broker states that it uses segregated accounts to keep client funds separate from its operational capital, which is a standard practice in the industry. Additionally, it claims to offer negative balance protection, which ensures that clients cannot lose more than their initial investment. However, the lack of independent verification of these claims raises concerns about their actual implementation.

Historically, many brokers operating without stringent regulatory oversight have faced issues related to fund security, leading to significant losses for clients. As such, traders must exercise caution and conduct thorough due diligence before entrusting their funds to Liyan Broker.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews and testimonials from actual users can provide valuable insights into the experiences of traders who have interacted with Liyan Broker. Unfortunately, the feedback regarding this broker is predominantly negative.

Common complaints include difficulties in withdrawing funds, aggressive sales tactics, and unresponsive customer support. Many users report feeling pressured to deposit more funds and experiencing significant delays in processing withdrawal requests.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Customer Support | Medium | Unresponsive |

| Aggressive Sales Tactics | High | Poor handling |

For instance, several traders have shared experiences of their accounts being blocked without explanation after attempting to withdraw their funds. Such patterns are indicative of a potentially fraudulent operation, further raising doubts about whether Liyan Broker is safe for traders.

Platform and Execution

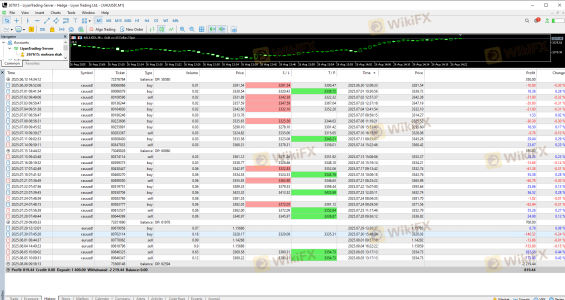

The trading platform's performance is another crucial factor in assessing a broker's reliability. Liyan Broker offers access to popular trading platforms such as MetaTrader 5 and cTrader, which are known for their advanced features and user-friendly interfaces. However, user reviews indicate mixed experiences regarding platform stability and order execution quality.

Traders have reported issues with slippage and order rejections during high-volatility market conditions. These problems can severely impact trading outcomes and suggest that Liyan Broker may not provide the level of execution quality that traders expect. Furthermore, any signs of potential platform manipulation should be taken seriously, as they can indicate unethical practices.

Risk Assessment

Using Liyan Broker presents several risks that traders should be aware of. The combination of regulatory concerns, negative customer feedback, and a lack of transparency creates a precarious trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under lax regulations |

| Fund Security Risk | High | Lack of transparency in fund protection |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should consider diversifying their investments and not committing substantial capital to Liyan Broker until further evidence of its reliability emerges. Additionally, seeking out brokers with robust regulatory oversight and positive customer reviews is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Liyan Broker raises significant concerns regarding its safety and legitimacy. The lack of regulation from reputable authorities, combined with negative customer feedback and a lack of transparency, indicates that traders should exercise extreme caution. While Liyan Broker may present itself as a viable option for forex trading, the potential risks involved outweigh the benefits.

For traders seeking a reliable and safe trading environment, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers such as IG, OANDA, or Forex.com are examples of reputable options that prioritize client safety and transparency. Ultimately, conducting thorough research and due diligence is crucial in the pursuit of a secure trading experience.

Is Liyan Broker a scam, or is it legit?

The latest exposure and evaluation content of Liyan Broker brokers.

Liyan Broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Liyan Broker latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.