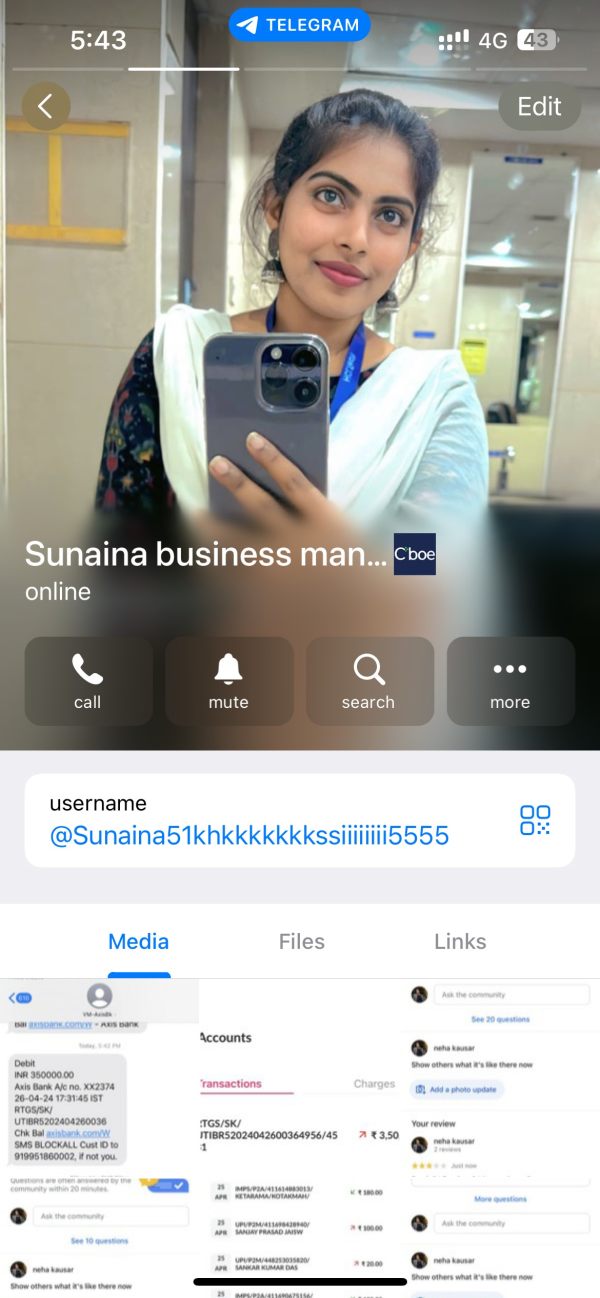

Cboe Digital 2025 Review: Everything You Need to Know

Executive Summary

This cboe digital review looks at one of the biggest changes in regulated digital asset trading. Cboe Digital works as the United States' only regulated exchange that focuses specifically on digital asset derivatives markets, offering both spot cryptocurrency trading and leveraged crypto derivatives through its complete platform system.

The exchange has a unique spot in the cryptocurrency trading world. It combines the regulatory oversight that people expect from traditional financial markets with the innovation that digital asset traders want. As part of Cboe Global Markets, Inc., the platform uses decades of derivatives market knowledge to provide institutional-grade trading infrastructure for Bitcoin and Ether futures contracts.

Key highlights include the successful launch of financially-settled margin futures contracts and the recent move of trading operations to Cboe Futures Exchange. This strategic move aims to make operations more efficient and give traders better execution capabilities.

The platform mainly targets investors who want regulated digital asset exposure. While the exchange offers strong regulatory advantages, a complete evaluation requires looking at various factors including trading conditions, user experience, and platform capabilities.

Important Notice

Regulatory Framework Differences: Cboe Digital operates as the United States' only regulated exchange for digital asset derivatives, making it unique in the global cryptocurrency trading landscape. Other places may not offer similar regulatory frameworks or oversight levels, and traders should understand that regulatory protections may vary a lot across different regions.

Review Methodology: This evaluation is based on publicly available official information, regulatory filings, and market analysis. Due to the specialized nature of Cboe Digital's operations and its focus on institutional-grade services, some traditional retail trading metrics may not apply directly to this platform's assessment framework.

Rating Overview

Broker Overview

Cboe Digital stands out as a unique player in the digital asset trading world. It operates under Cboe Global Markets, Inc., a globally recognized leader in derivatives and securities exchange networks. The platform focuses only on digital asset derivatives markets, positioning itself as the bridge between traditional financial market infrastructure and the growing cryptocurrency trading landscape.

The exchange operates through a dual-entity structure with Cboe Digital Exchange, LLC and Cboe Futures Exchange, LLC. This setup enables complete coverage of both spot cryptocurrency trading and advanced derivative instruments. This structural approach allows the platform to serve different trading needs while maintaining regulatory compliance across different product categories.

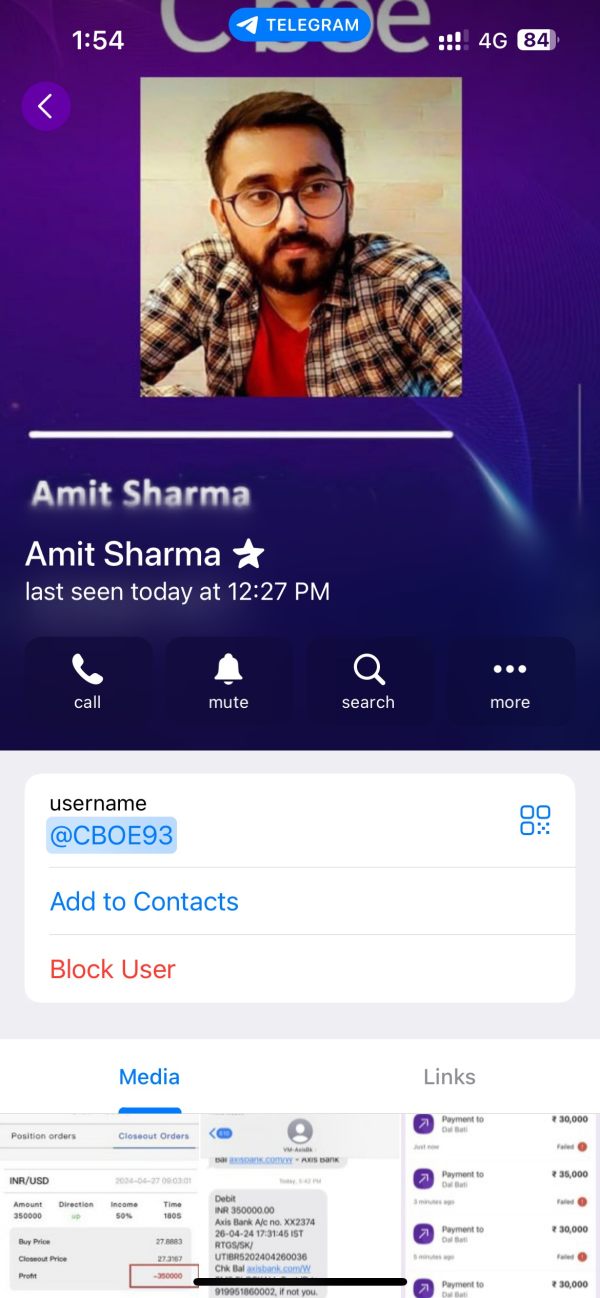

According to official announcements, Cboe Digital successfully launched trading and clearing operations for margin futures on Bitcoin and Ether in January 2024. This marked a big milestone as the first U.S. regulated exchange to offer such products. The platform's business model centers on providing institutionally-focused trading infrastructure with the regulatory certainty that traditional financial institutions require when engaging with digital assets.

The recent move of futures offerings from CDE to CFE, completed in June 2025, shows the platform's commitment to operational efficiency and technological advancement. This consolidation onto a common technology platform represents a strategic evolution designed to enhance customer experience and streamline operations across all U.S. futures products.

Regulated Jurisdiction: Cboe Digital operates as the United States' only regulated exchange for digital asset derivatives. It provides traders with the regulatory protections and oversight typically associated with traditional financial markets.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials, though institutional-grade processes are expected given the platform's regulatory status.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in available documentation. This likely reflects the platform's institutional focus where such requirements may be determined on a case-by-case basis.

Bonus and Promotions: No promotional offerings or bonus programs are mentioned in available materials. This is consistent with the platform's institutional and regulatory-focused approach.

Tradeable Assets: The platform specializes in financially-settled margin futures contracts for Bitcoin and Ether. These represent the core digital asset products most demanded by institutional investors.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in available materials. However, institutional-grade pricing models are anticipated.

Leverage Ratios: Leverage information for futures contracts is not specified in available documentation. Though margin requirements would be expected to align with regulatory standards.

Platform Options: Trading occurs through the integrated Cboe Digital Exchange, LLC and Cboe Futures Exchange, LLC infrastructure. This is now consolidated onto a unified technology platform.

Geographic Restrictions: Specific geographic limitations are not detailed in available materials. Though U.S. regulatory compliance suggests primary focus on domestic markets.

Customer Service Languages: Customer service language options are not specified in available documentation.

This cboe digital review reveals a platform designed for sophisticated market participants seeking regulated exposure to digital asset derivatives markets.

Account Conditions Analysis

The account structure at Cboe Digital reflects its institutional focus and regulatory compliance requirements. However, specific details about account types and conditions remain limited in publicly available materials. As a regulated exchange operating under U.S. oversight, account opening procedures would necessarily involve comprehensive compliance verification processes typical of traditional financial institutions.

Given the platform's specialization in margin futures contracts for Bitcoin and Ether, account holders would need to meet sophisticated investor criteria. They must also demonstrate understanding of derivatives trading risks. The institutional nature of the platform suggests that account minimums and requirements may be substantial, reflecting the professional trader and institutional investor target market.

The migration of operations to Cboe Futures Exchange likely standardized account procedures across the platform's offerings. This potentially improved efficiency for existing account holders while maintaining regulatory compliance standards. However, specific information about account opening timelines, verification requirements, or special account features such as Islamic accounts is not detailed in available materials.

The regulatory framework provides inherent account protection through established oversight mechanisms. Though specific client fund segregation details or additional protection measures are not explicitly outlined in public documentation. This cboe digital review notes that potential users should contact the platform directly for comprehensive account condition information.

The technological infrastructure supporting Cboe Digital's operations represents a significant investment in institutional-grade trading systems. However, specific details about available tools and resources are not comprehensively detailed in available materials. The recent consolidation onto a common technology platform through the CFE migration suggests enhanced system capabilities and improved operational efficiency.

As part of Cboe Global Markets' ecosystem, the platform likely benefits from decades of derivatives market expertise and technological development. It potentially offers sophisticated order management and risk management tools typical of institutional trading environments. The focus on financially-settled margin futures indicates that professional-grade position management and margin calculation tools would be essential platform features.

Educational resources and market analysis capabilities are not specifically outlined in available documentation. Though the institutional focus suggests that users would typically possess advanced market knowledge or access to independent research resources. The platform's regulatory status implies that appropriate risk disclosure and educational materials would be provided in compliance with regulatory requirements.

Automated trading support and API connectivity details are not specified in available materials. Though institutional platforms typically provide such capabilities to accommodate professional trading strategies and system integration requirements. The technological foundation inherited from Cboe's broader exchange operations suggests robust system architecture capable of supporting sophisticated trading applications.

Customer Service and Support Analysis

Customer service and support infrastructure details are not specifically outlined in available materials. However, the institutional focus and regulatory status of Cboe Digital suggest professional-grade support capabilities. As part of Cboe Global Markets' operations, the platform would likely maintain support standards consistent with institutional expectations and regulatory requirements.

The specialized nature of margin futures trading on Bitcoin and Ether would necessitate knowledgeable support staff. These staff members must be capable of addressing complex derivatives questions and technical issues. Given the platform's regulatory compliance requirements, support procedures would likely include proper documentation and escalation processes typical of traditional financial institutions.

Response times, service quality metrics, and specific support channel availability are not detailed in available documentation. The institutional client base would typically expect dedicated support relationships and priority service levels, though specific service level agreements or support hour information is not publicly available.

Multilingual support capabilities are not specified. Though the U.S. regulatory focus suggests English-language support as the primary offering. The professional nature of the platform's target market may reduce demand for extensive multilingual support compared to retail-focused trading platforms.

Trading Experience Analysis

The trading experience on Cboe Digital centers around professionally-designed infrastructure capable of handling institutional-volume derivatives trading. However, specific performance metrics and user experience details are not comprehensively outlined in available materials. The recent migration to Cboe Futures Exchange represents a significant platform enhancement, consolidating operations onto a unified technology system designed to improve efficiency and execution quality.

Platform stability and execution speed would be critical factors given the volatile nature of cryptocurrency markets and the margin requirements associated with futures trading. The institutional focus suggests that system architecture prioritizes reliability and consistent performance over retail-oriented features, though specific uptime statistics or execution speed benchmarks are not publicly available.

The consolidation of all U.S. futures products onto a common technology platform indicates significant investment in trading infrastructure. This potentially offers improved order routing, enhanced risk management capabilities, and streamlined position management tools. However, specific details about platform functionality, mobile trading capabilities, or user interface design are not detailed in available materials.

Order execution quality for Bitcoin and Ether futures would be particularly important given the 24/7 nature of cryptocurrency markets and the price sensitivity of leveraged positions. The regulatory oversight provides framework for execution quality standards, though specific metrics or performance data are not publicly disclosed.

This cboe digital review emphasizes that trading experience evaluation would benefit from direct platform testing and consultation with existing users.

Trust and Regulation Analysis

Trust and regulatory compliance represent the strongest aspects of Cboe Digital's offering. The platform operates as the United States' only regulated exchange specifically focused on digital asset derivatives. This regulatory status provides significant advantages in terms of oversight, compliance standards, and investor protection compared to unregulated cryptocurrency trading platforms.

The platform operates under comprehensive U.S. regulatory oversight. It provides institutional-grade compliance frameworks and investor protections typically associated with traditional financial markets. This regulatory foundation addresses many concerns that institutional investors have regarding cryptocurrency market participation, offering familiar compliance and oversight structures.

As part of Cboe Global Markets, Inc., the platform benefits from the parent company's established reputation and decades of experience operating regulated exchanges. This corporate backing provides additional credibility and financial stability, important factors for institutions considering digital asset exposure through derivatives products.

The successful launch and operation of financially-settled margin futures contracts demonstrates the platform's ability to navigate complex regulatory requirements while delivering innovative products. The migration to CFE further consolidates regulatory compliance under established frameworks, potentially simplifying oversight and enhancing operational efficiency.

However, specific details about fund segregation, insurance coverage, or additional protective measures beyond regulatory requirements are not detailed in available materials. The regulatory framework provides foundational trust elements, though comprehensive risk assessment would require additional due diligence.

User Experience Analysis

User experience evaluation for Cboe Digital is limited by the availability of detailed interface and usability information in public materials. The platform's institutional focus suggests that user experience prioritizes functionality, reliability, and professional-grade features over consumer-oriented design elements or simplified interfaces.

The recent migration to Cboe Futures Exchange and consolidation onto a common technology platform indicates significant investment in user experience improvements. However, specific interface enhancements or usability upgrades are not detailed. Institutional users typically prioritize system performance and feature depth over visual design, suggesting that platform development focuses on professional trader requirements.

Registration and verification processes would necessarily be comprehensive given regulatory compliance requirements. Though specific timelines or user experience elements of the onboarding process are not outlined in available materials. The institutional nature suggests that account opening may involve extensive documentation and verification procedures.

Fund operation experiences, trading interface usability, and overall user satisfaction metrics are not detailed in available documentation. The specialized nature of the platform's offerings and target market may limit the availability of general user feedback compared to retail-focused trading platforms.

Overall user experience assessment would require direct platform evaluation and consultation with existing users to provide comprehensive insights into interface design, functionality, and satisfaction levels.

Conclusion

This cboe digital review reveals a specialized trading platform that occupies a unique position in the digital asset trading landscape as the United States' only regulated exchange focused on cryptocurrency derivatives. The platform's strength lies in its regulatory compliance, institutional-grade infrastructure, and the backing of Cboe Global Markets' established expertise in derivatives markets.

The platform is particularly well-suited for institutional investors, professional traders, and sophisticated individuals seeking regulated exposure to Bitcoin and Ether through futures contracts. The recent consolidation of operations onto Cboe Futures Exchange represents a positive development for operational efficiency and technological capabilities.

However, the evaluation is limited by the lack of detailed information regarding account conditions, user experience, trading costs, and customer service capabilities. The institutional focus and regulatory compliance provide strong foundational elements, but comprehensive assessment would require additional research into operational details and user feedback.

Potential users interested in regulated digital asset derivatives trading should consider Cboe Digital as a primary option while conducting thorough due diligence regarding specific trading requirements, costs, and platform capabilities that align with their investment objectives.