Trade Binance 2025 Review: Everything You Need to Know

Summary: Trade Binance has garnered mixed reviews, with users praising its low fees and wide range of cryptocurrencies. However, significant concerns regarding its regulatory status and customer service persist. Notably, the platform operates under different entities in various regions, which may affect user experience and compliance.

Note: It is crucial to understand that Trade Binance operates under multiple entities across different jurisdictions, which can impact regulatory compliance and user experience. This review aims to provide a fair and accurate assessment based on available sources.

Rating Overview

How We Rate Brokers: Our ratings are based on user feedback, expert opinions, and factual data regarding services offered.

Broker Overview

Founded in 2023, Trade Binance is a trading platform primarily focused on cryptocurrencies and forex. It operates out of the United Kingdom but lacks significant regulatory oversight, raising concerns about its legitimacy. The platform utilizes the Binance trading engine, which is known for its high liquidity and extensive asset offerings. However, it does not support popular trading platforms like MT4 or MT5.

Detailed Sections

Regulatory Geography

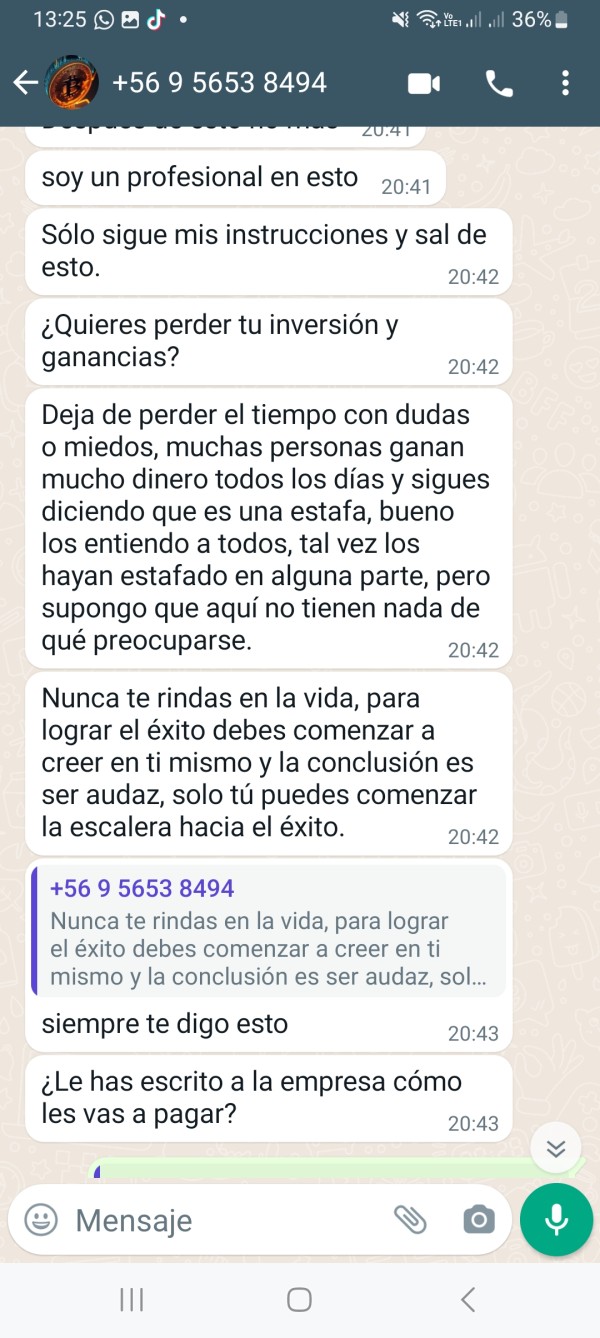

Trade Binance is not regulated by any major financial authority, which raises red flags for potential users. The absence of regulatory oversight means that users have limited recourse in case of disputes or issues with the platform. According to sources, the broker has been flagged as potentially fraudulent due to its lack of regulatory compliance (WikiFX).

Deposit/Withdrawal Currencies

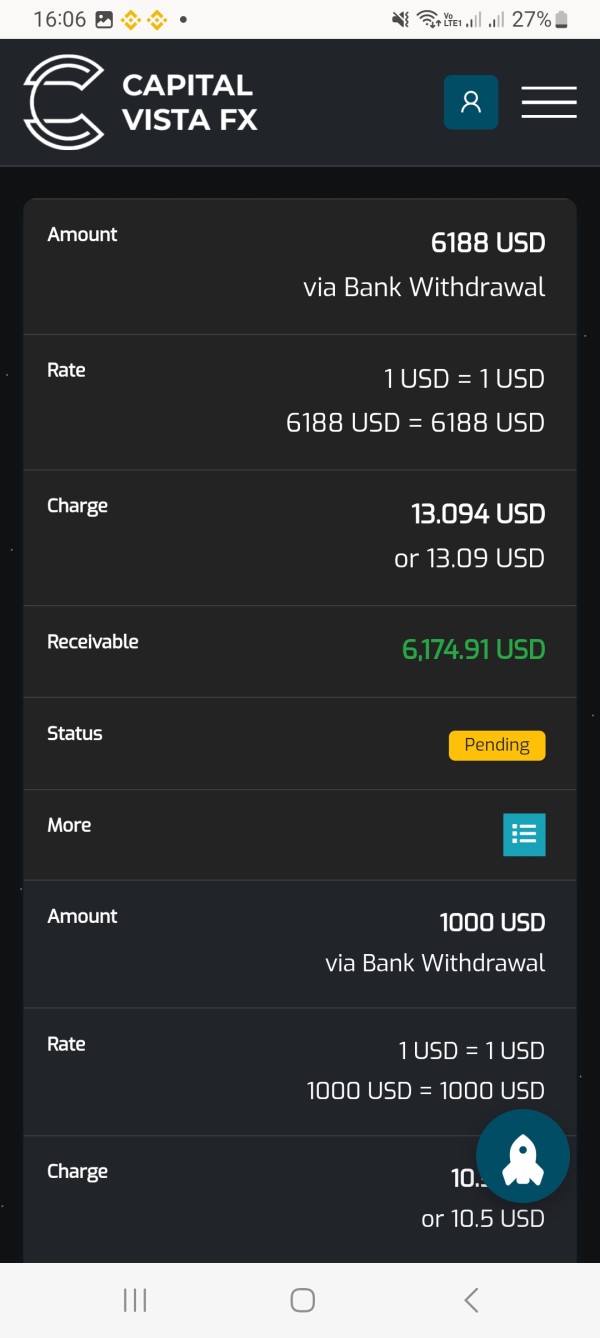

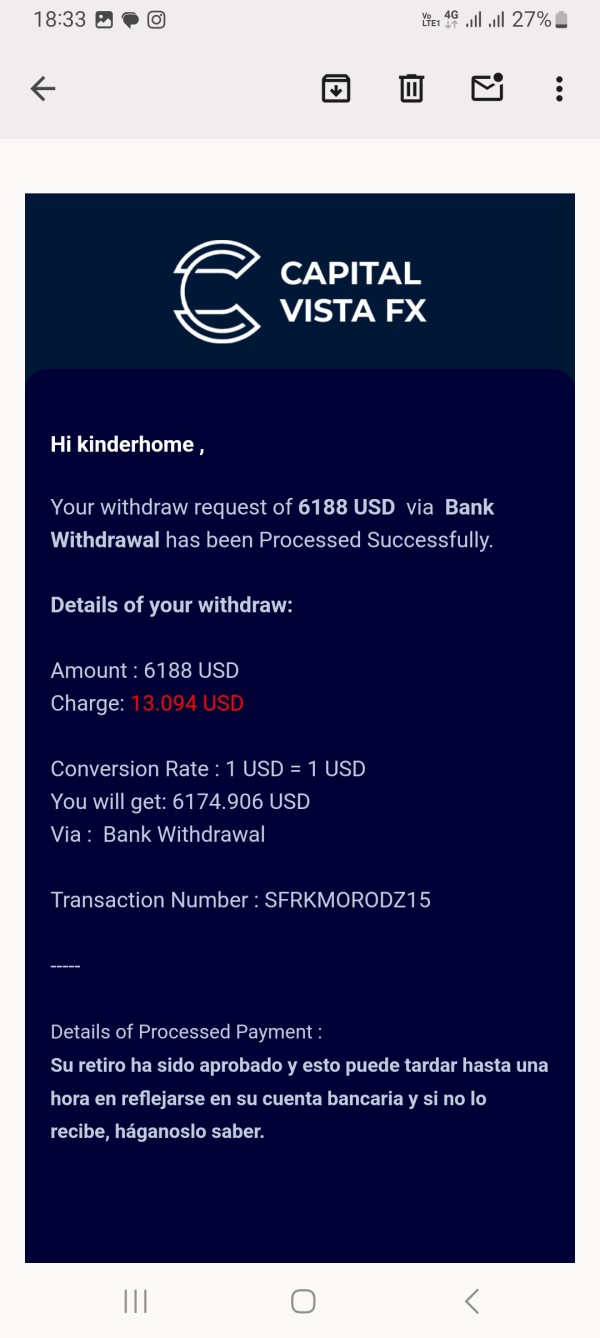

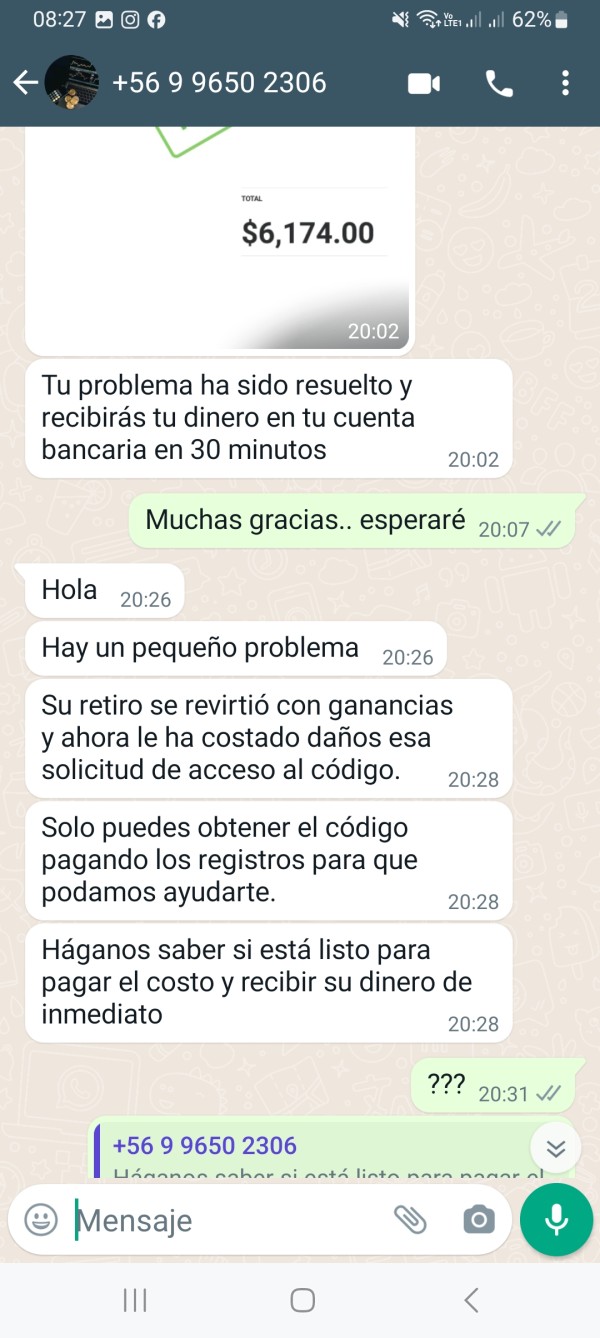

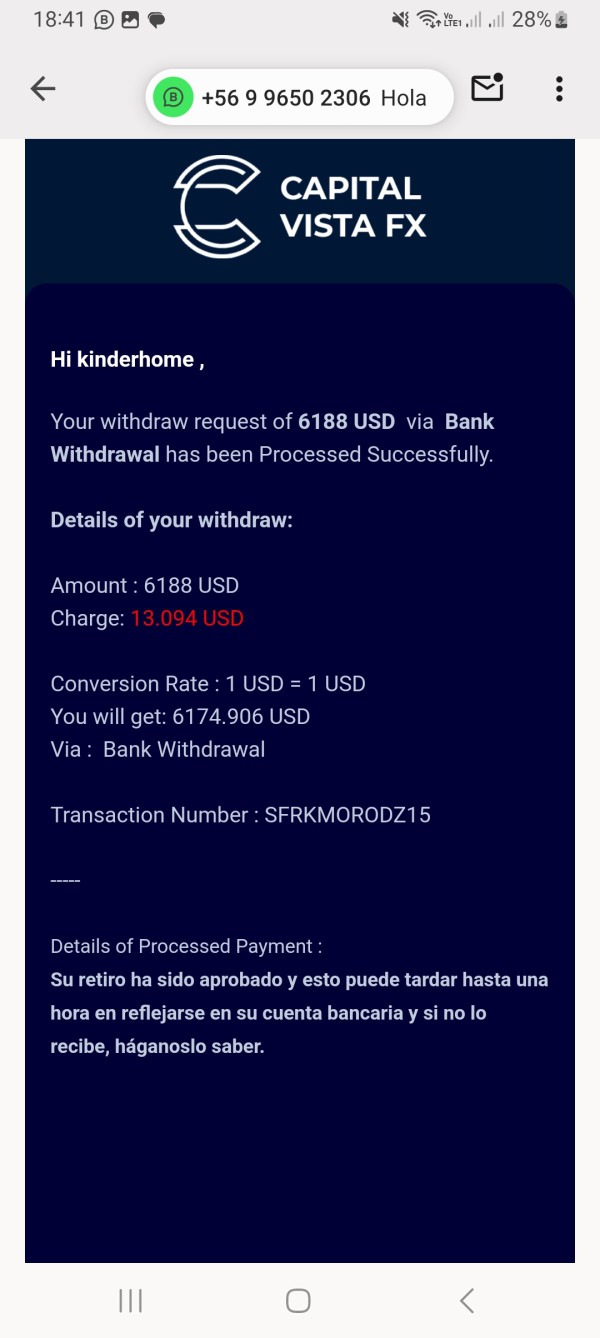

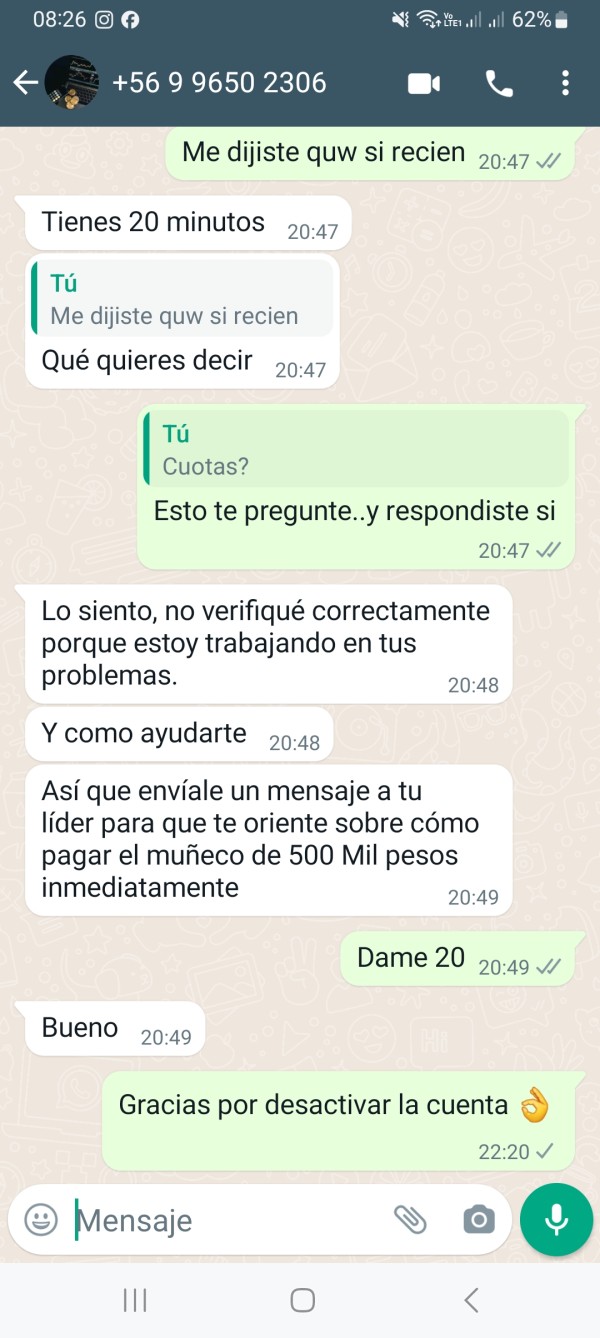

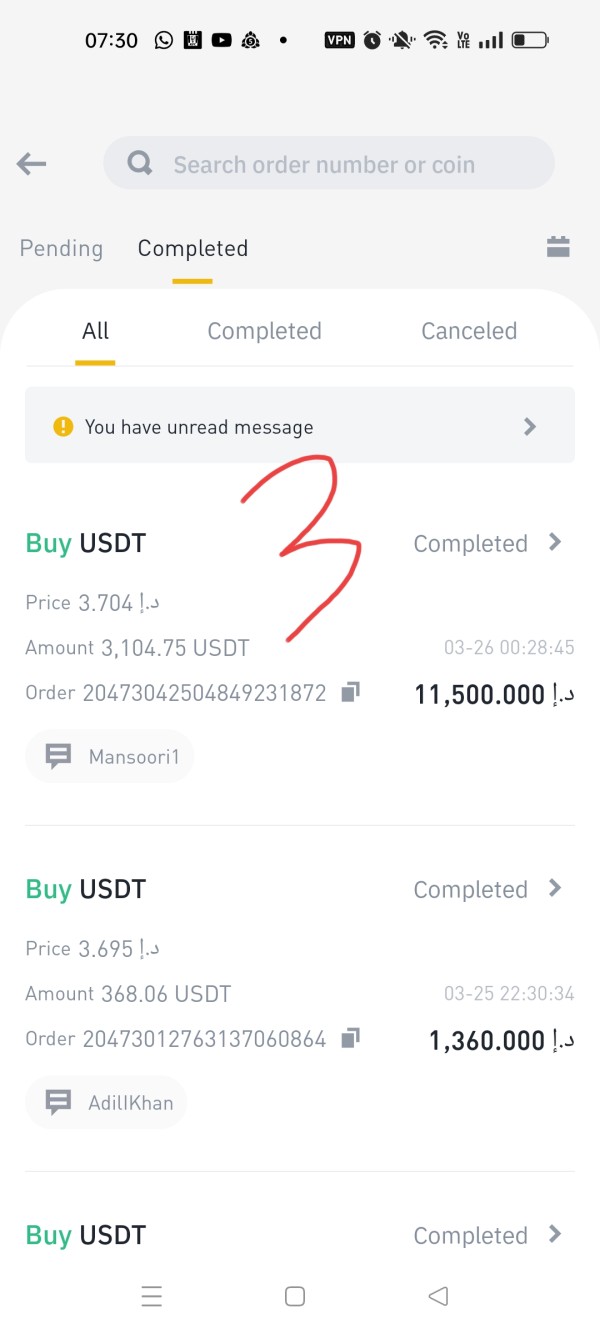

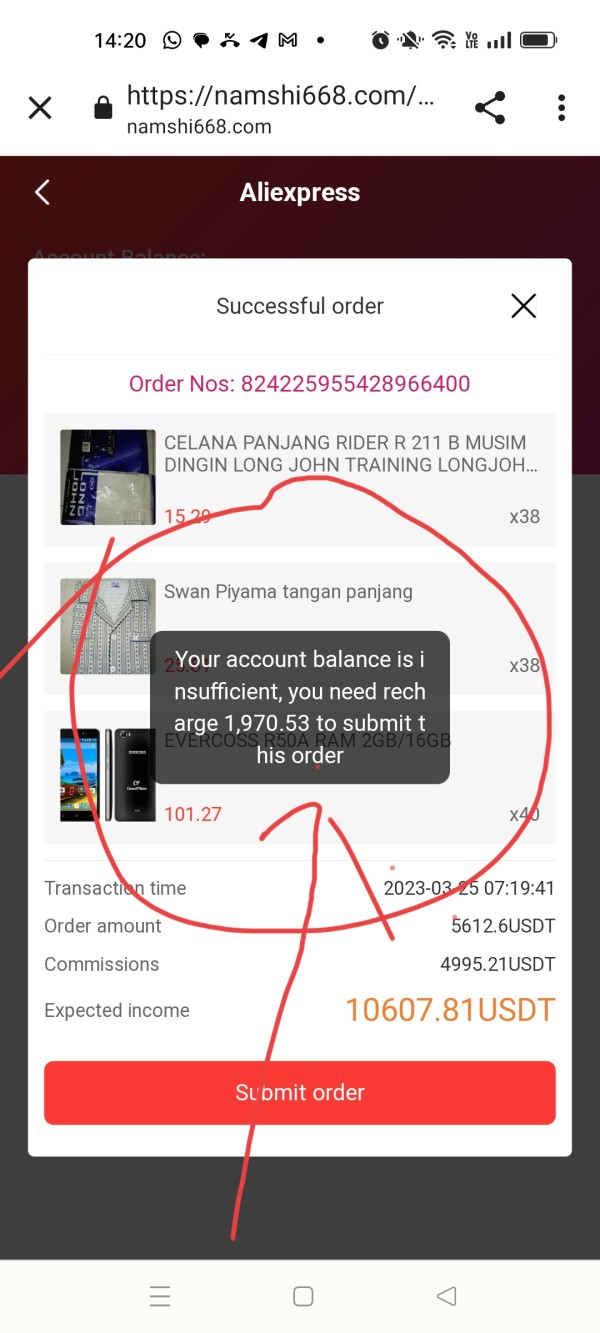

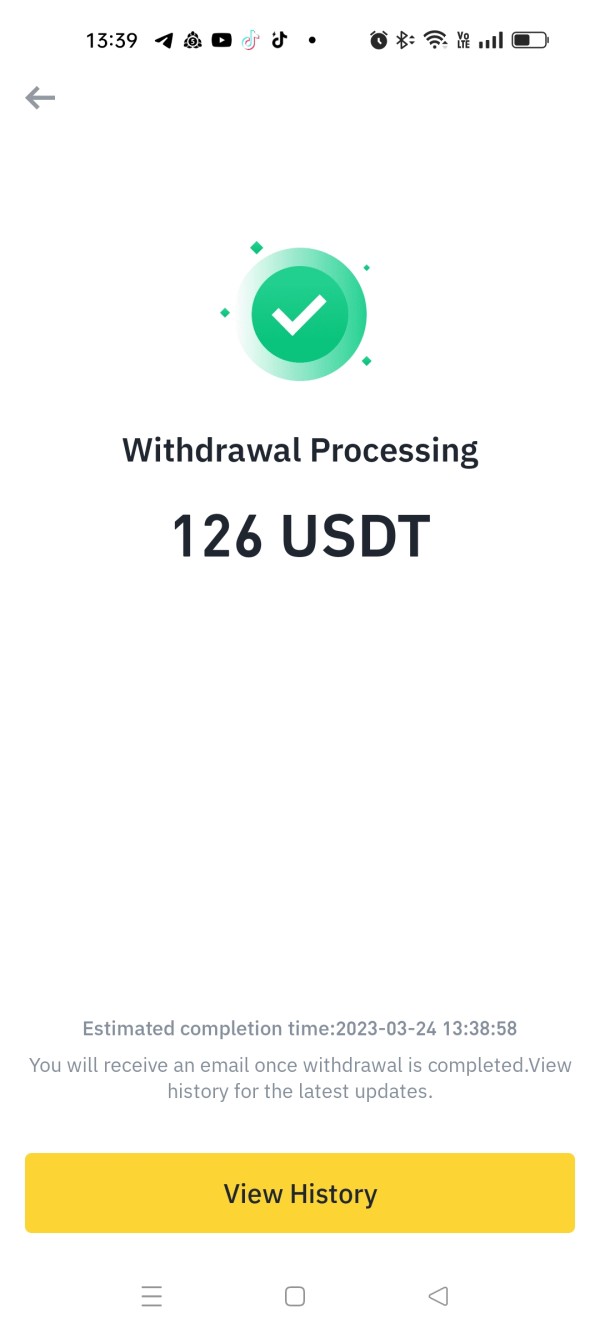

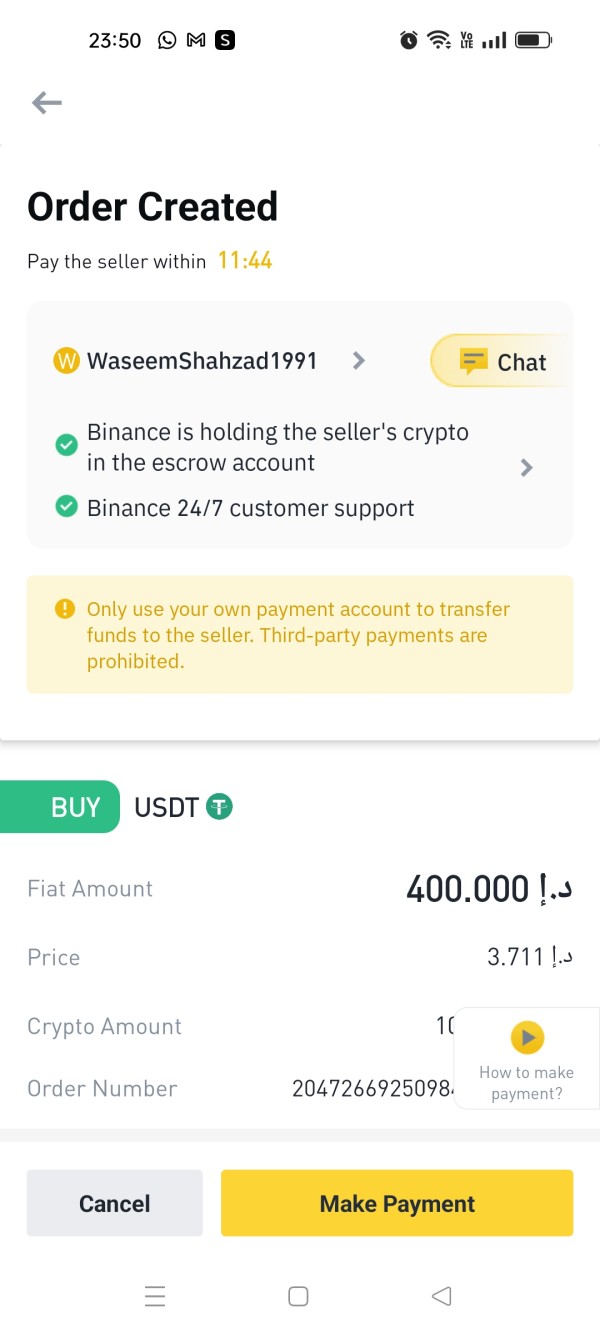

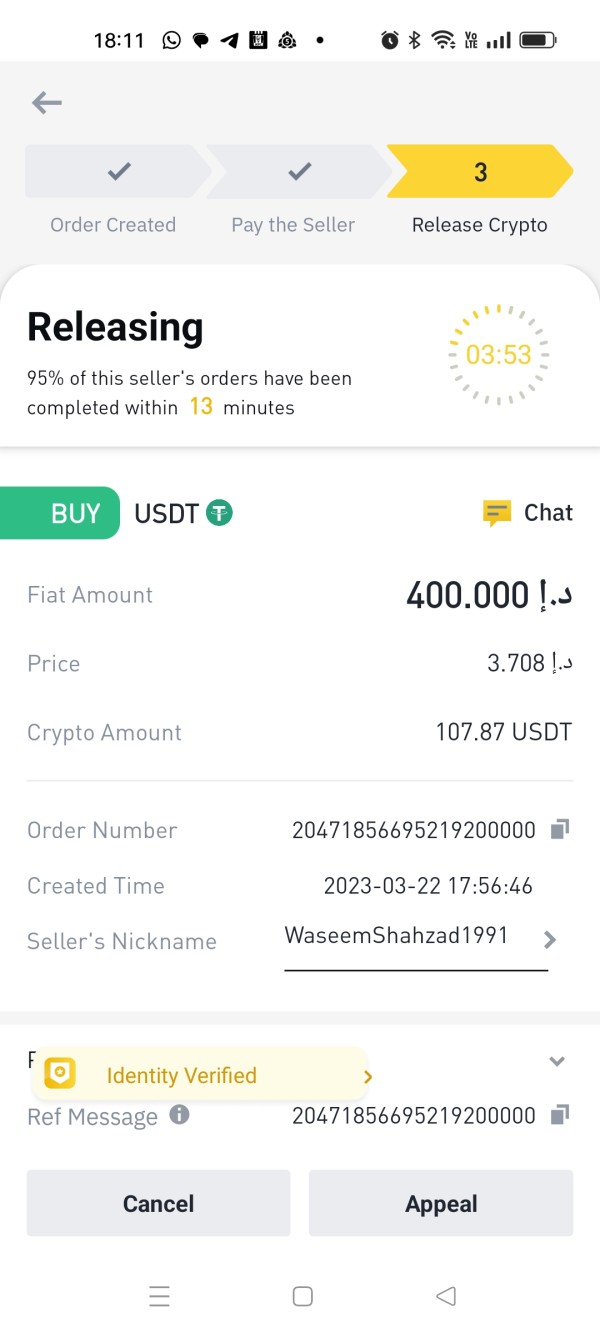

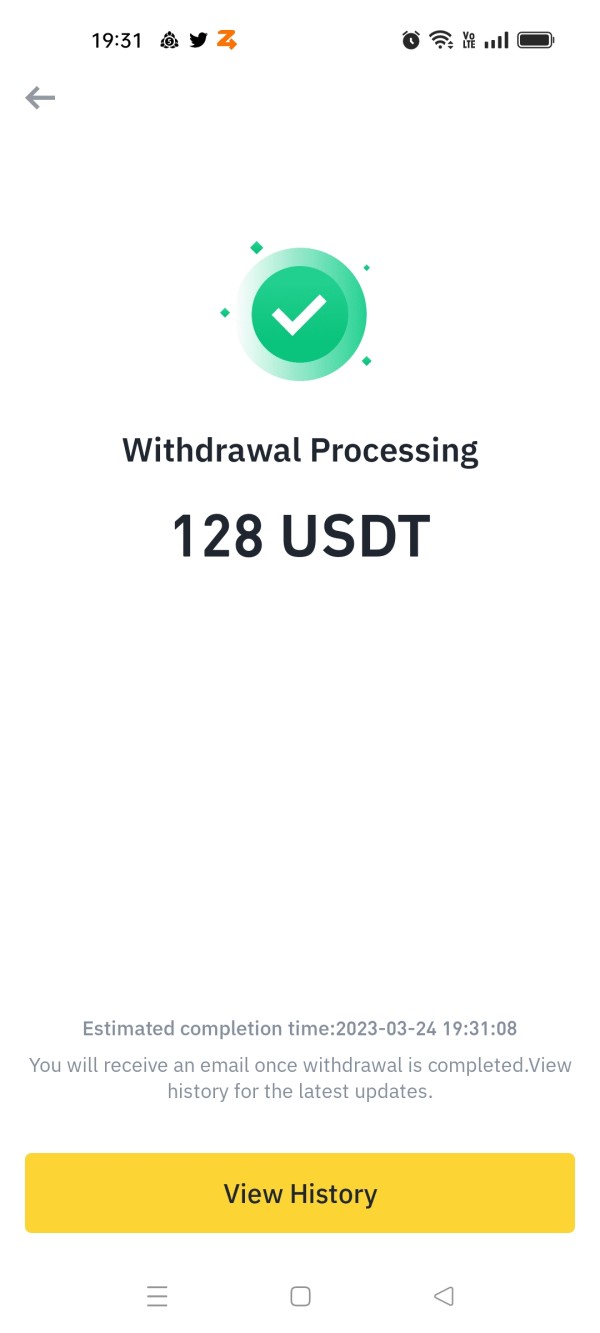

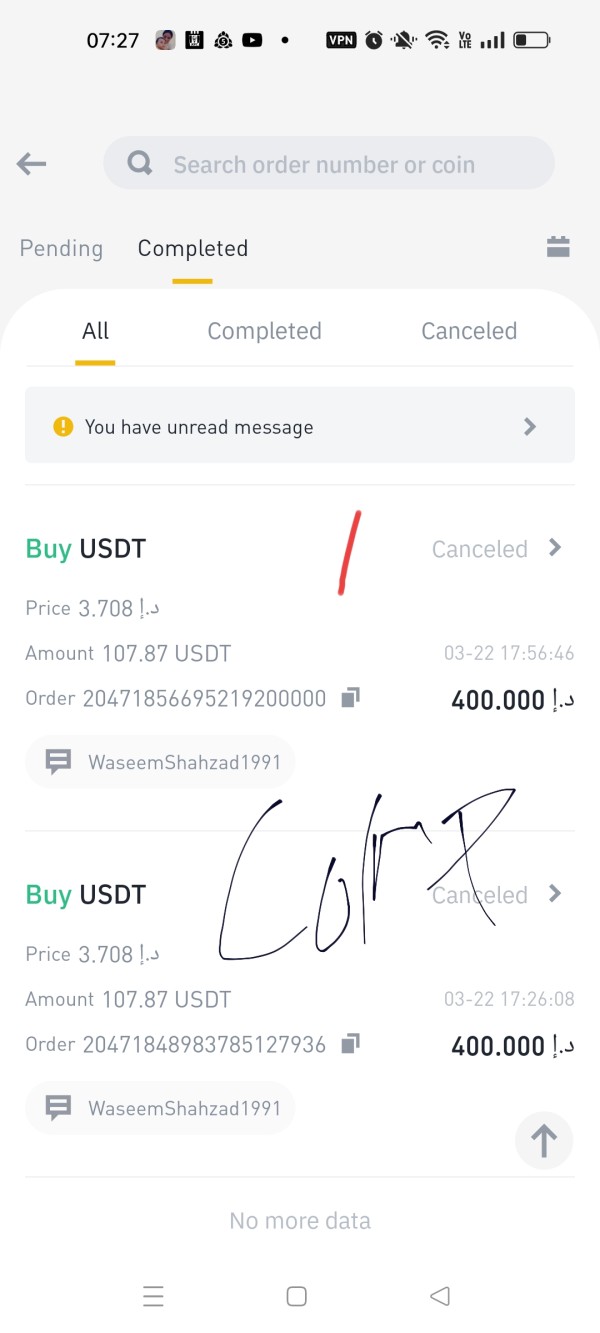

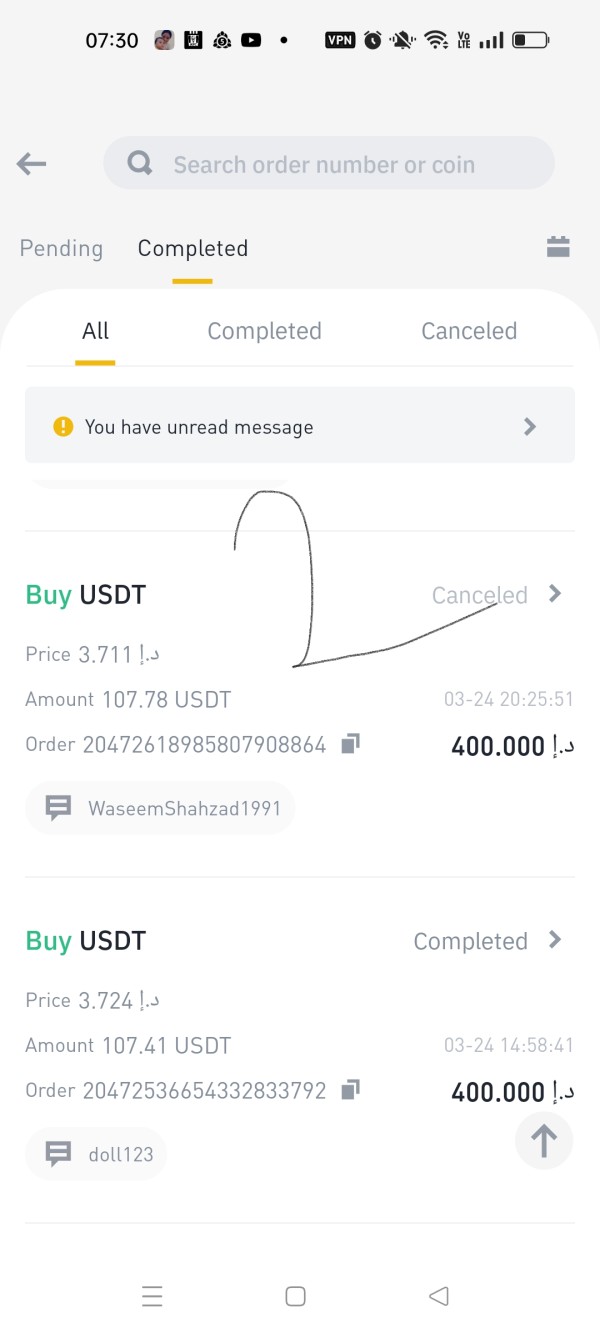

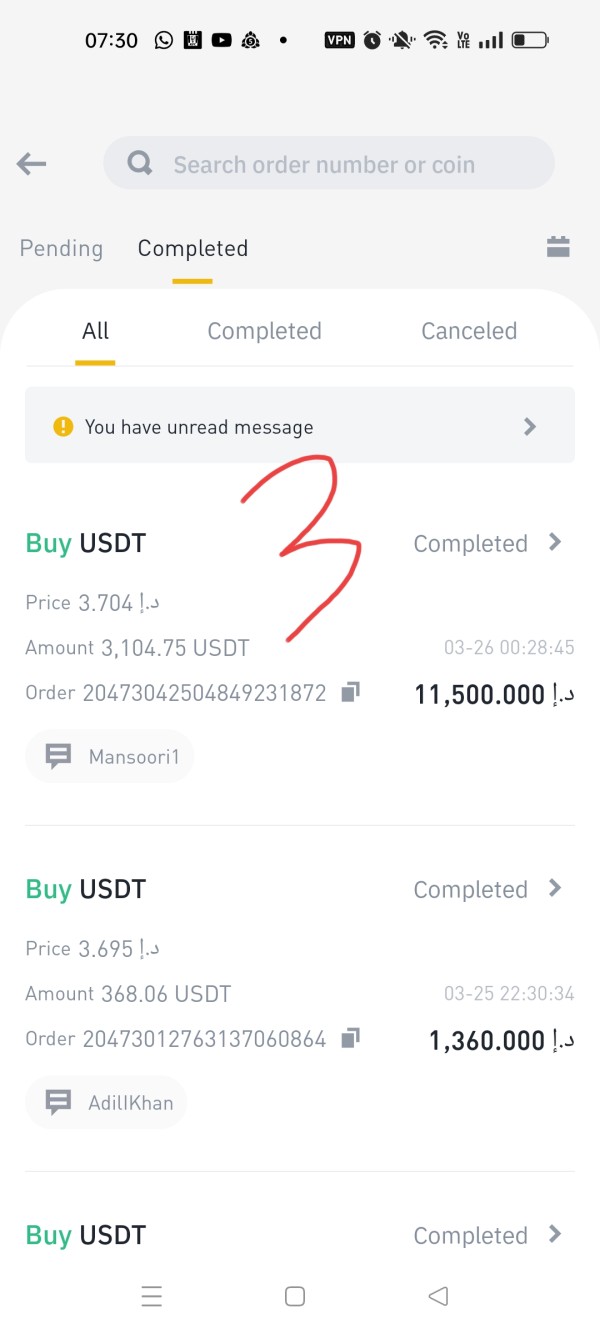

The platform supports various cryptocurrencies for deposits and withdrawals, but users have reported issues with the withdrawal process. Concerns about delayed transactions and high fees for debit card purchases have also been noted (Cyber Scam Recovery).

Minimum Deposit

The minimum deposit requirement for Trade Binance is reported to be $1,000, which is relatively high compared to other platforms that allow for lower initial investments. This could deter new traders or those looking to test the waters before committing significant funds.

There is limited information available regarding bonuses or promotions offered by Trade Binance. The lack of competitive promotional offerings may impact its attractiveness compared to other platforms that provide incentives for new users.

Tradable Asset Classes

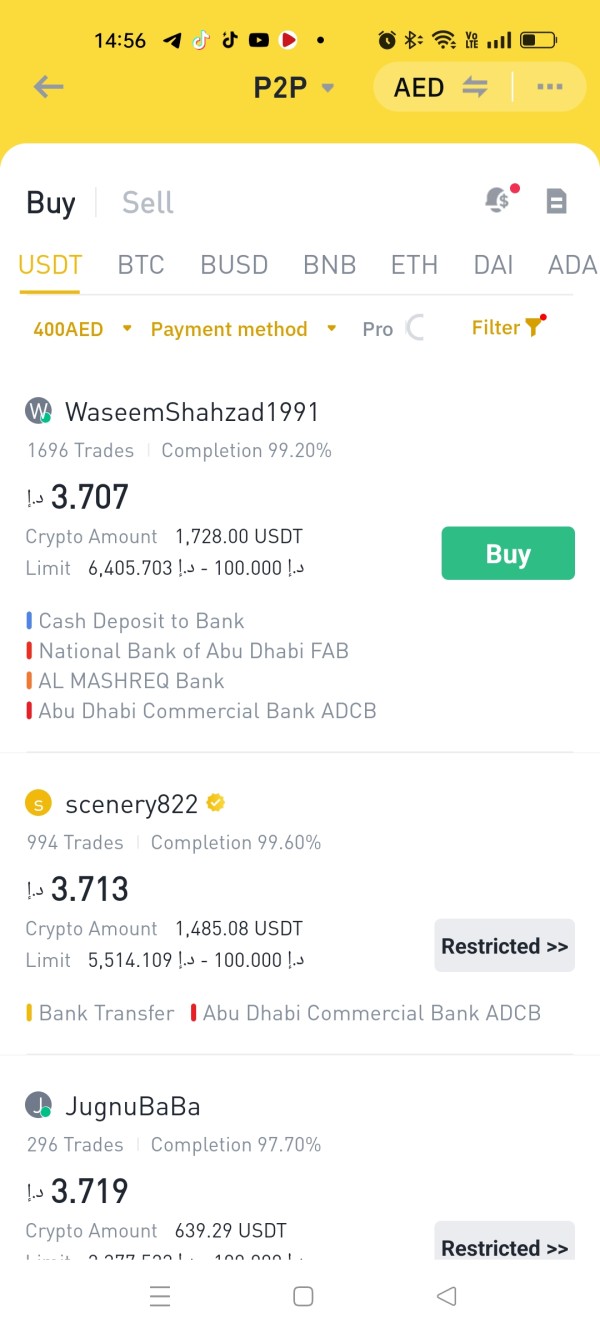

Trade Binance offers a limited selection of tradable assets, primarily focusing on cryptocurrencies and forex pairs. Unlike other exchanges that provide access to commodities, indices, or stocks, Trade Binance's offerings are relatively narrow, which could limit trading strategies for users (Investopedia).

Costs (Spreads, Fees, Commissions)

The platform's cost structure is another area of concern. While it offers low trading fees, the complexity of the fee structure can be overwhelming for newcomers. Users have reported hidden fees and high costs associated with debit card transactions, which can reach up to 4.5% (Bankrate).

Leverage

Trade Binance reportedly offers leverage up to 1:150, which can amplify both profits and losses. However, this high leverage can also pose risks, especially for inexperienced traders who may not fully understand the implications of leveraged trading.

Trade Binance primarily operates on its proprietary platform, which has received mixed reviews for its user interface. Unlike competitors that offer well-known platforms like MT4 or MT5, Trade Binance's platform may not meet the expectations of more experienced traders who prefer familiar tools.

Restricted Regions

The platform is not available in several jurisdictions, including the United States, where users are required to use the Binance US version. This limitation can significantly impact user experience and accessibility for traders in affected regions (NerdWallet).

Available Customer Service Languages

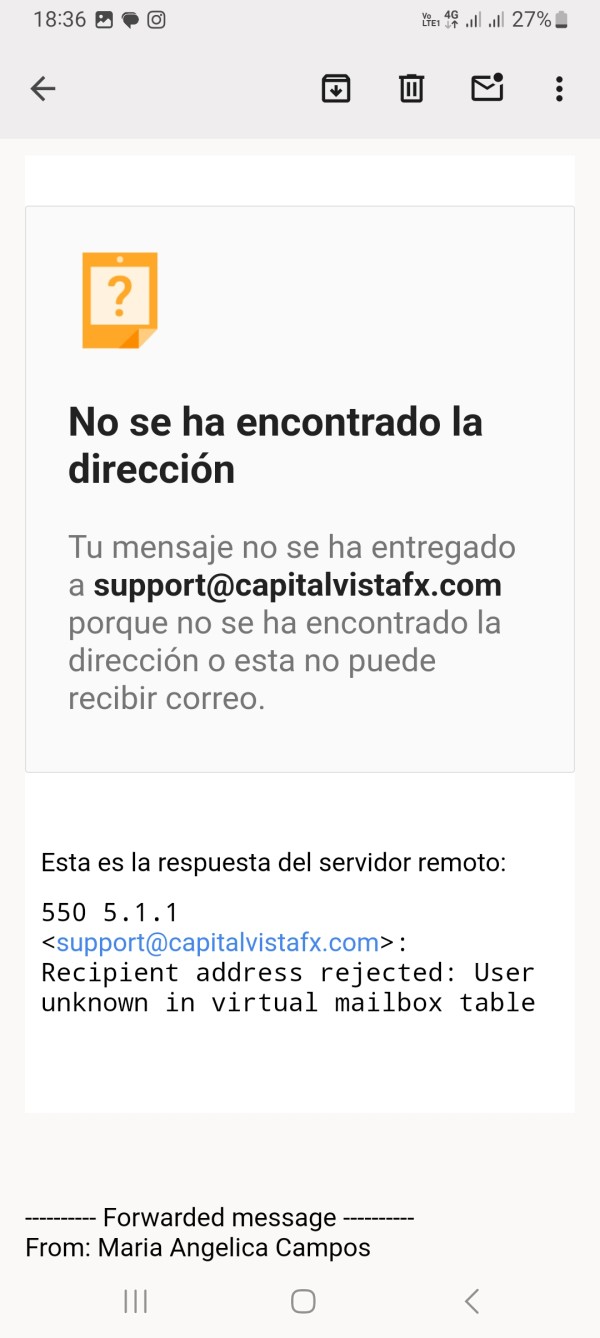

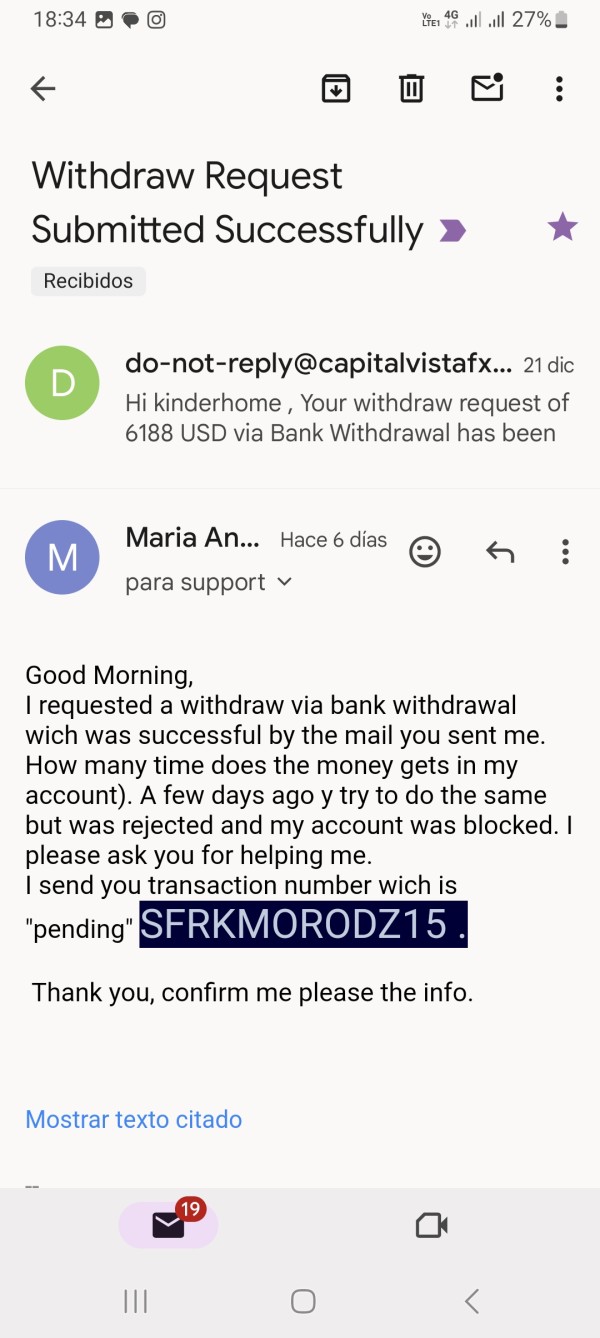

Customer service options are limited, primarily offering support through email and live chat. Users have reported slow response times and inadequate support, which can be frustrating, especially during critical trading periods (Bankrate).

Rating Overview (Revisited)

Detailed Breakdown

Account Conditions

The minimum deposit requirement of $1,000 is relatively high, which may deter new traders. Additionally, the lack of regulatory oversight raises concerns about the safety of funds.

While Trade Binance utilizes the Binance trading engine, the absence of popular trading platforms like MT4 or MT5 limits the tools available to traders. This could impact the trading experience for those who prefer established platforms.

Customer Service and Support

Customer service has been a significant pain point, with users reporting slow response times and limited support options. The lack of phone support further exacerbates the issue, leaving users reliant on email or chat (Bankrate).

Trading Experience

The trading experience is generally smooth due to the high liquidity provided by the Binance engine. However, the complexity of the fee structure and potential hidden costs can create confusion for new users.

Trustworthiness

The lack of regulation and reports of potentially fraudulent activities have negatively impacted Trade Binance's trustworthiness. Users are advised to exercise caution and consider alternative platforms with better regulatory oversight.

User Experience

User experiences have been mixed, with some praising the platform's low fees and extensive cryptocurrency offerings, while others express concerns about customer service and regulatory compliance.

Regulatory Compliance

With no valid regulatory oversight, Trade Binance operates in a legal gray area, which could pose risks for users. This lack of compliance is a significant drawback for potential investors (WikiFX).

In conclusion, while Trade Binance offers some attractive features, significant concerns regarding its regulatory status, customer service, and overall trustworthiness warrant careful consideration before investing.