IndianXM 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive indianxm review shows a concerning picture of a forex broker that raises significant red flags for potential traders. IndianXM operates without approval from any recognized financial regulatory authority. This immediately places it in a high-risk category for traders seeking secure and reliable trading environments. Multiple independent sources have flagged this broker as a potential scam operation, with user feedback consistently highlighting serious concerns about the platform's legitimacy and operational practices.

The broker claims to offer various trading instruments and account types. It also provides 24-hour customer support primarily through email channels. However, the absence of proper regulatory oversight, combined with widespread negative user reviews and scam warnings from industry watchdogs, makes IndianXM unsuitable for traders who prioritize safety and regulatory protection. This review aims to provide traders with comprehensive information to make informed decisions about whether this broker aligns with their trading needs and risk tolerance.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various online sources. Readers should note that different regions may have varying regulatory requirements and trading conditions. These factors could affect the broker's operations and legitimacy across different jurisdictions. The assessment presented here has not been verified through direct testing or on-site verification processes.

IndianXM's lack of approval from any recognized financial regulatory authority means that traders would have limited recourse in case of disputes or issues. The information presented reflects the current available data as of 2025. Potential users should conduct their own due diligence before making any trading decisions.

Rating Framework

Broker Overview

IndianXM presents itself as a forex and CFD broker offering online trading services. Critical information about its establishment date, company background, and specific business model remains notably absent from available public sources. This lack of transparency regarding fundamental company information immediately raises concerns about the broker's legitimacy and operational history. The absence of clear corporate information makes it difficult for potential traders to assess the broker's experience, financial stability, and long-term viability in the competitive forex market.

The broker's operational structure appears to focus on forex and CFD trading instruments. Specific details about asset classes, trading conditions, and platform specifications are not clearly documented in available sources. Most concerning is IndianXM's complete absence of regulatory approval from any recognized financial authority. This represents a significant departure from industry standards and best practices. This indianxm review reveals that legitimate forex brokers typically maintain regulatory oversight from established authorities to ensure client protection and operational transparency.

Regulatory Status: IndianXM operates without approval from any recognized financial regulatory authority. This places it outside the protection frameworks that legitimate brokers provide to their clients.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not clearly documented in available public sources.

Minimum Deposit Requirements: The broker has not disclosed clear minimum deposit requirements. This makes it difficult for potential traders to understand entry-level investment expectations.

Promotional Offers: Current bonus and promotional structures are not detailed in available information. This suggests limited marketing transparency.

Trading Assets: The broker claims to offer forex and CFD trading instruments. Comprehensive asset lists and specific trading conditions remain undisclosed.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs are not transparently published. This prevents accurate cost analysis.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Selection: Specific trading platform information, including software options, mobile applications, and technical capabilities, remains unclear from current sources.

Geographic Restrictions: Regional availability and access limitations are not clearly defined in public materials.

Customer Support Languages: While 24-hour support is claimed, specific language options and regional support capabilities are not detailed.

This indianxm review highlights significant information gaps that legitimate brokers typically address transparently in their public communications and regulatory filings.

Account Conditions Analysis

The account conditions offered by IndianXM present several concerning gaps in transparency and detail. Legitimate forex brokers typically address these issues comprehensively. Available information suggests the broker offers multiple account types, though specific features, benefits, and requirements for each account tier remain undisclosed in public sources. This lack of clarity makes it impossible for potential traders to make informed decisions about which account structure might suit their trading style and capital requirements.

Minimum deposit requirements, which represent a fundamental consideration for new traders, are not clearly specified in available documentation. This absence of basic account opening information raises questions about the broker's commitment to transparency and regulatory compliance standards. Additionally, the account opening process, required documentation, and verification procedures are not detailed. This leaves potential clients uncertain about onboarding requirements and timelines.

User feedback consistently highlights poor experiences with account-related services. Specific details about account management, funding processes, and withdrawal procedures are not well-documented in available reviews. The lack of information about specialized account features, such as Islamic accounts for Muslim traders or professional account options for experienced traders, further demonstrates the broker's limited transparency in account service offerings.

According to multiple sources flagging IndianXM as potentially fraudulent, the indianxm review process reveals significant concerns about the broker's ability to provide reliable account services that meet industry standards and trader expectations.

IndianXM's trading tools and resources present a mixed picture. The broker claims to offer multiple trading instruments but lacks specific details about platform capabilities and analytical resources. The broker suggests availability of various trading tools, though comprehensive information about charting packages, technical indicators, automated trading support, and market analysis features remains notably absent from public documentation. This lack of detailed tool specifications makes it difficult for traders to assess whether the platform can support their analytical and execution requirements.

Research and educational resources, which legitimate brokers typically provide to support trader development and market understanding, are not clearly documented in available sources. The absence of educational materials, market analysis, trading guides, and webinar programs suggests limited commitment to trader education and support. Professional traders often require advanced analytical tools, economic calendars, and real-time market data. IndianXM's capabilities in these areas remain unclear.

User feedback regarding trading tools and platform functionality has been consistently negative. Multiple sources raise concerns about the broker's overall service quality and platform reliability. The lack of specific information about mobile trading applications, desktop platforms, and web-based trading interfaces further complicates assessment of the broker's technological capabilities.

This indianxm review indicates that while the broker claims to offer trading tools, the absence of detailed specifications and negative user feedback suggest significant limitations in the resources available to traders compared to established, regulated competitors in the forex market.

Customer Service and Support Analysis

IndianXM's customer service structure centers around 24-hour support availability. This support is primarily delivered through email communication channels. While round-the-clock availability represents a positive feature for international traders operating across different time zones, the limitation to email-based support may not meet the immediate assistance needs that active traders often require during volatile market conditions or urgent account issues.

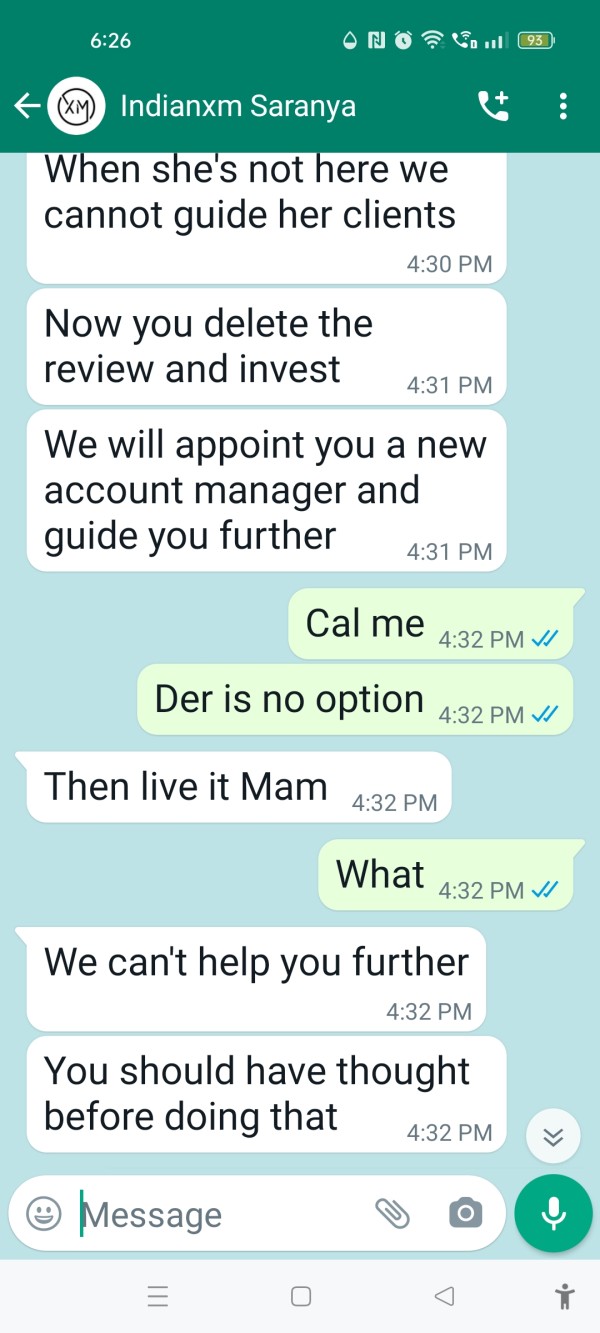

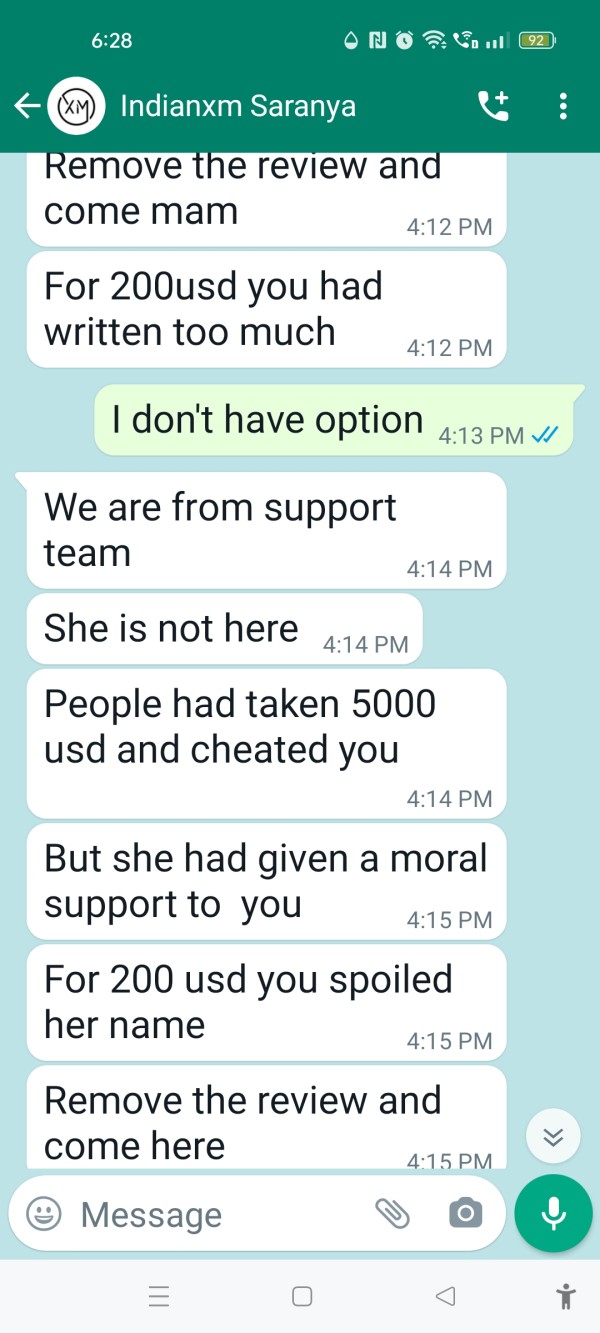

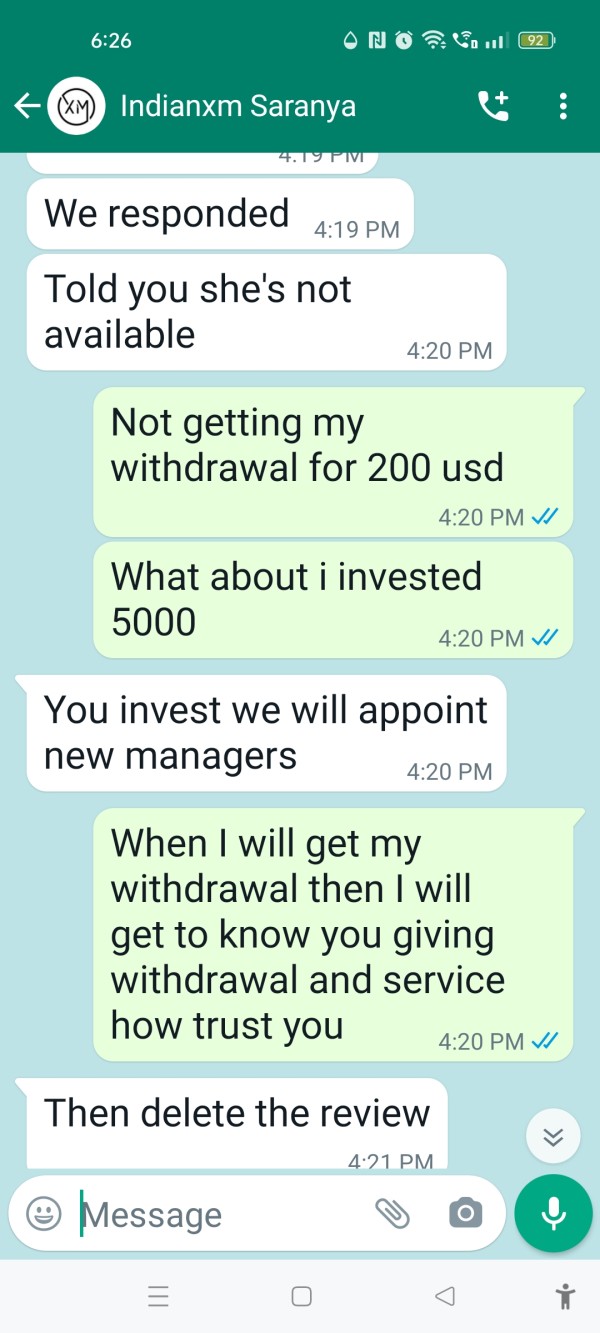

The broker's customer service quality and response time performance are not well-documented in available sources. This makes it difficult to assess the effectiveness of their support operations. Live chat, telephone support, and other immediate communication channels that many traders expect from professional forex brokers appear to be either unavailable or not prominently featured in the broker's service offerings. This limitation could significantly impact trader satisfaction, particularly for those requiring rapid assistance with technical issues or account problems.

Multiple user reviews and industry sources have expressed concerns about IndianXM's overall service quality. Specific customer service experiences and problem resolution cases are not detailed in available feedback. The absence of multilingual support information also raises questions about the broker's ability to serve international clients effectively. This particularly affects those who may not be comfortable communicating in English.

Given the widespread negative feedback and scam warnings associated with IndianXM, customer service effectiveness becomes even more critical. Traders may face difficulties resolving disputes or recovering funds without proper regulatory oversight and professional support infrastructure.

Trading Experience Analysis

The trading experience offered by IndianXM appears significantly compromised by the absence of detailed platform information and consistently poor user feedback across multiple review sources. Critical aspects of trading experience, including platform stability, execution speed, order processing quality, and system reliability, are not well-documented in available public information. This makes it impossible to assess the broker's technical capabilities against industry standards.

Platform functionality and feature completeness remain unclear. There is no specific information about trading software options, mobile application quality, or web-based platform capabilities. Professional traders typically require advanced order types, sophisticated charting tools, automated trading support, and seamless execution during high-volatility periods. IndianXM's ability to deliver these essential features is not established in available documentation.

User feedback consistently highlights negative experiences. Specific details about platform performance, execution quality, slippage rates, and technical issues are not comprehensively documented in available reviews. The absence of performance data, such as average execution speeds, uptime statistics, and order fill rates, further complicates assessment of the broker's trading environment quality.

Mobile trading capabilities, which have become essential for modern forex traders, are not clearly specified. This leaves questions about the broker's ability to support traders who need flexible, on-the-go access to their accounts. This indianxm review suggests that the overall trading experience may not meet the standards expected by serious forex traders seeking reliable, professional-grade trading environments.

Trust and Security Analysis

IndianXM's trust and security profile presents the most significant concerns identified in this comprehensive evaluation. The broker operates without approval from any recognized financial regulatory authority. This fundamentally undermines the security framework that legitimate forex brokers provide to protect client interests and funds. Regulatory oversight serves as the primary protection mechanism for traders, ensuring adherence to capital adequacy requirements, segregated client fund management, and dispute resolution procedures.

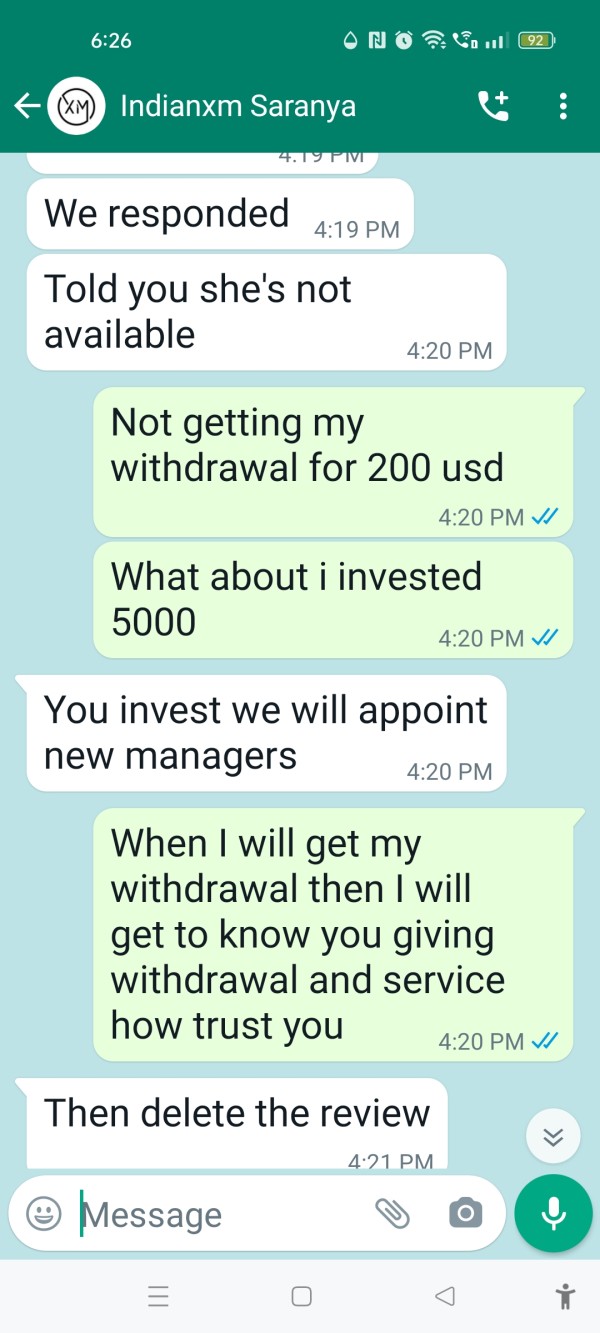

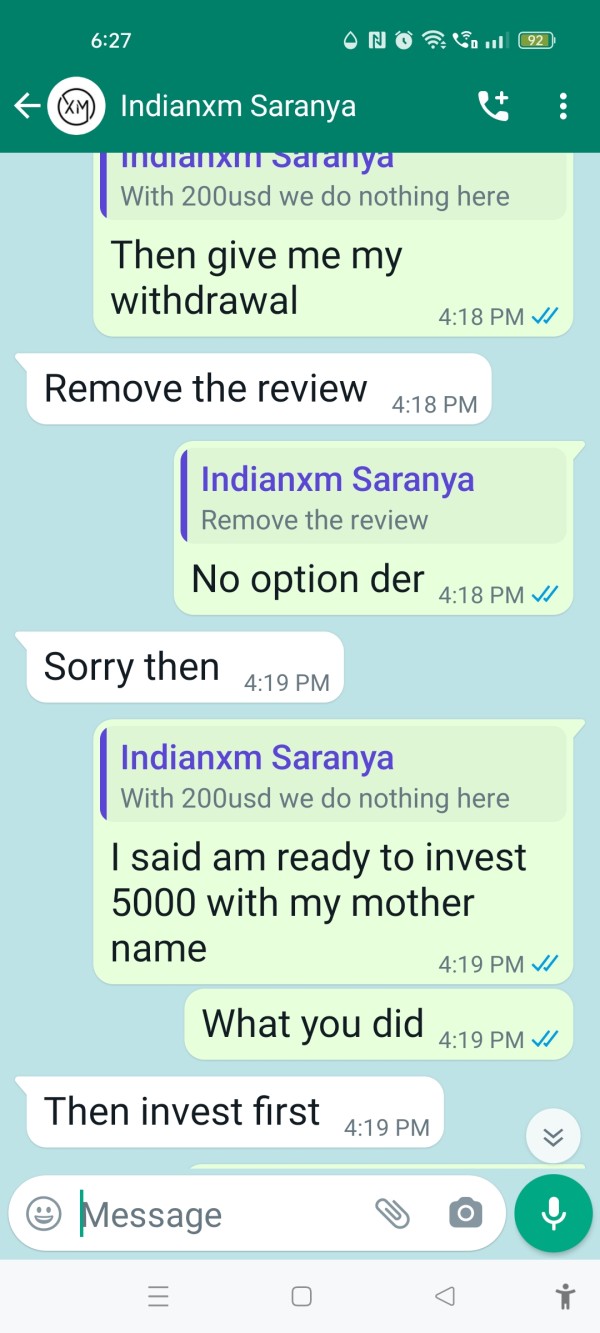

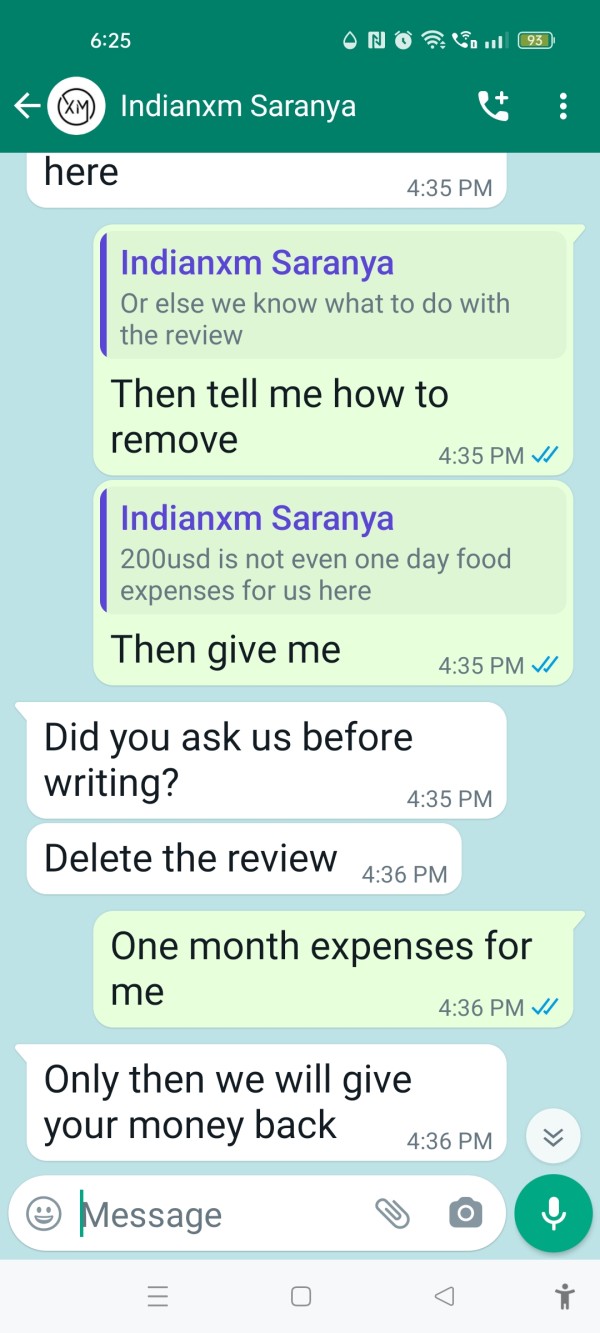

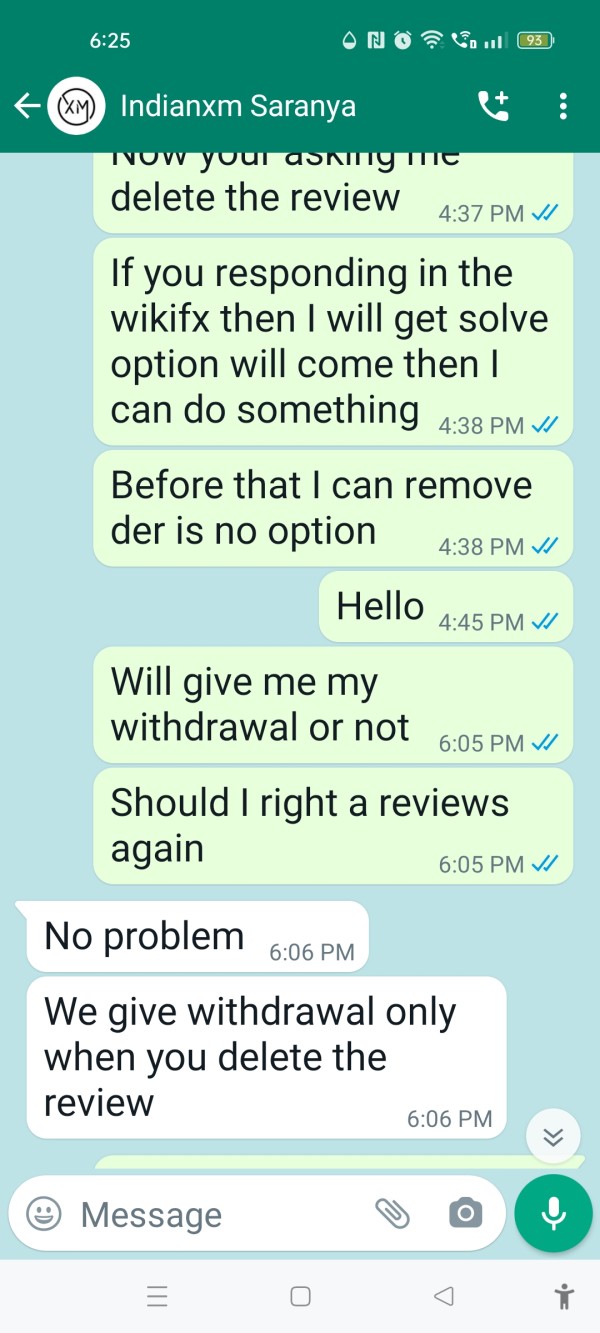

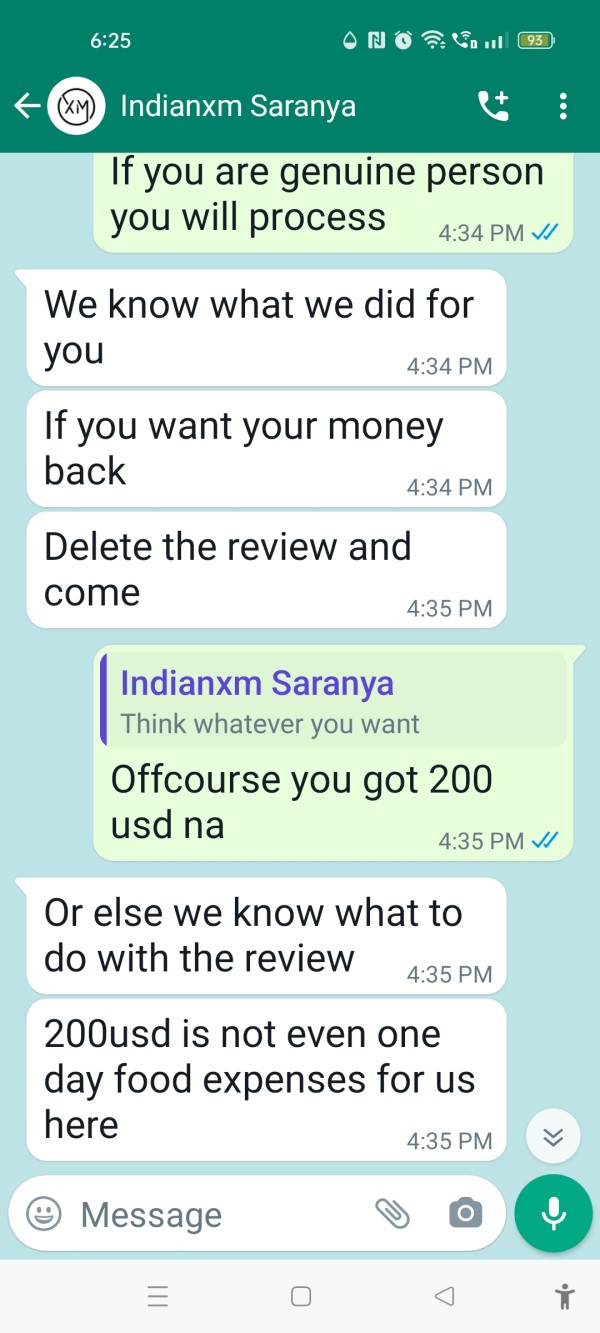

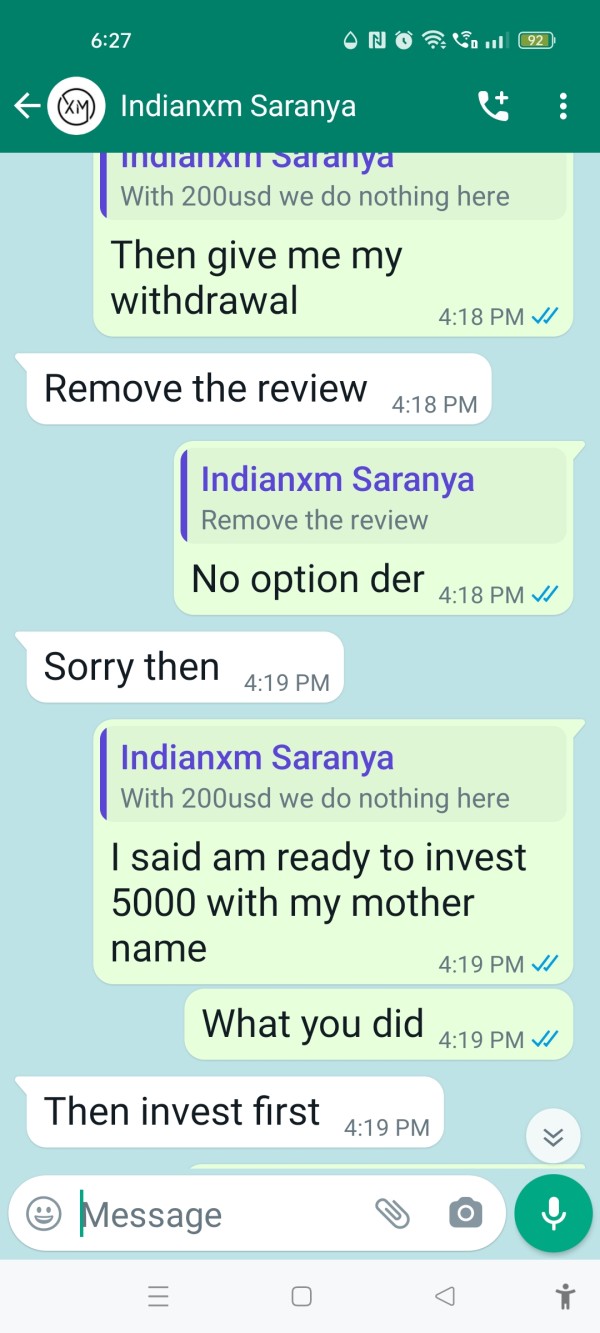

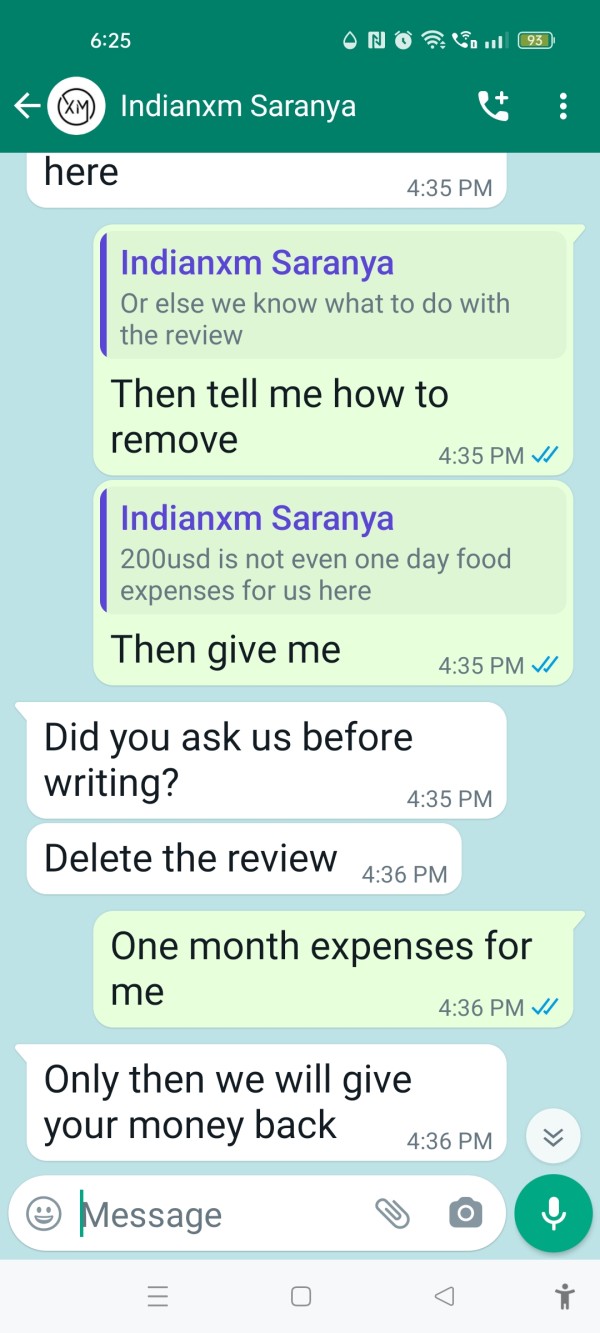

Multiple independent sources have flagged IndianXM as a potential scam operation. These represent serious warnings from industry watchdogs and review platforms that monitor broker legitimacy. These warnings suggest patterns of behavior or operational practices that raise red flags about the broker's intentions and ability to provide legitimate trading services. The absence of regulatory oversight means that traders would have extremely limited recourse in case of disputes, fund recovery issues, or operational problems.

Fund safety measures, including client money segregation, deposit protection schemes, and financial compensation arrangements, are not documented or verified through regulatory filings. Legitimate brokers typically maintain client funds in segregated accounts with established financial institutions and provide clear information about fund protection measures. IndianXM's practices in this critical area remain unknown and unverified.

The broker's transparency regarding company ownership, financial statements, operational licenses, and corporate governance is notably lacking. This further undermines confidence in its legitimacy and operational integrity. User feedback consistently supports concerns about the broker's trustworthiness and operational practices.

User Experience Analysis

User experience with IndianXM has been consistently negative across multiple review platforms and industry monitoring sources. Widespread feedback indicates serious concerns about the broker's service quality and operational practices. Overall user satisfaction appears significantly below industry standards, with multiple sources warning potential traders about engaging with this broker due to suspected fraudulent activities and poor service delivery.

Interface design and platform usability information is not well-documented in available sources. The lack of detailed platform specifications suggests potential limitations in user experience design and functionality. Professional forex trading platforms typically feature intuitive interfaces, customizable layouts, and efficient navigation systems. IndianXM's capabilities in these areas remain unclear and potentially problematic based on user feedback patterns.

Registration and account verification processes are not clearly detailed. This may indicate either inadequate onboarding procedures or deliberately opaque account opening requirements. Legitimate brokers typically provide clear guidance about account opening steps, required documentation, and verification timelines. IndianXM's approach to client onboarding appears less transparent than industry standards.

Common user complaints center around the broker's overall legitimacy and service quality. Specific operational issues, platform problems, or customer service failures are not comprehensively documented in available feedback. The consistent pattern of negative reviews and scam warnings suggests systematic problems with the broker's operations rather than isolated service issues.

Traders seeking safe and reliable forex trading platforms should consider regulated alternatives that provide transparent operations, comprehensive user support, and proper regulatory oversight to ensure positive trading experiences and fund security.

Conclusion

This comprehensive indianxm review reveals significant concerns that make IndianXM unsuitable for traders prioritizing safety, transparency, and regulatory protection. The broker's complete absence of regulatory approval from recognized financial authorities, combined with widespread warnings from industry sources flagging it as a potential scam operation, creates an unacceptable risk environment for serious forex traders.

While IndianXM claims to offer multiple trading instruments and 24-hour customer support, these potential advantages are fundamentally undermined by the lack of regulatory oversight and consistently negative user feedback. The broker's limited transparency regarding account conditions, trading costs, platform specifications, and fund safety measures further reinforces concerns about its legitimacy and operational standards.

Traders seeking reliable forex trading services should prioritize regulated brokers that provide comprehensive transparency, verified fund protection measures, and proper regulatory oversight to ensure safe and professional trading experiences.