Is IndianXM safe?

Business

License

Is IndianXM A Scam?

Introduction

IndianXM is a forex broker that has recently gained attention in the trading community. Positioned as a platform for trading contracts for difference (CFDs) on various financial instruments, including forex, stocks, commodities, and cryptocurrencies, IndianXM aims to cater to both novice and experienced traders. However, the legitimacy of this broker has come under scrutiny, prompting traders to exercise caution when evaluating their options. Given the high stakes involved in forex trading, it is crucial for traders to thoroughly assess the credibility and safety of any broker before committing their funds.

This article investigates whether IndianXM is a safe trading platform or a potential scam. Our evaluation is based on a comprehensive review of available data, including regulatory status, company background, trading conditions, customer feedback, and security measures. By employing a structured framework, we aim to provide a balanced and informative analysis of IndianXM, helping traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific standards and practices designed to protect investors. IndianXM claims to be regulated by multiple authorities, but the validity of these claims is questionable.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Seychelles FSA | Not Available | Seychelles | Unverified |

| Israel Securities Authority | 812646574 | Israel | Unverified |

| ASIC | Not Available | Australia | Unverified |

| CySEC | Not Available | Cyprus | Unverified |

Despite its claims, multiple sources indicate that IndianXM is not listed under the regulatory bodies it purports to be associated with. The absence of verifiable information raises significant concerns about its legitimacy. A lack of regulation means that traders have no legal recourse if issues arise, making it highly risky to trust this broker with funds. The overall regulatory quality appears weak, and historical compliance records are non-existent, further adding to the skepticism surrounding IndianXM.

Company Background Investigation

Understanding a broker's company background is essential for assessing its trustworthiness. IndianXM's history is relatively short, having registered its official website in June 2023. The broker claims to offer a wide range of trading services, but there is limited information available regarding its ownership structure and management team.

The absence of transparency regarding the company's history, ownership, and operational practices is a red flag. Reliable brokers typically provide detailed information about their founders and management teams, along with their professional backgrounds. IndianXM's lack of such disclosures raises questions about its commitment to transparency and accountability, making it difficult for potential clients to trust the broker.

Furthermore, the company's website exhibits signs of poor maintenance, such as non-functional links and a lack of substantial content. This lack of professionalism may indicate underlying issues within the organization and further supports the notion that IndianXM may not be a legitimate broker.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's success. IndianXM states that it provides competitive trading conditions, but a closer examination reveals some concerning aspects of its fee structure.

| Fee Type | IndianXM | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While IndianXM claims to offer no commissions on trades, the spreads appear to be wider than the industry average. Additionally, the broker's overnight interest rates are reportedly high, which could significantly impact traders who hold positions overnight. Such fee structures can erode profits, making it essential for traders to be aware of these costs before engaging with the platform.

The potential for hidden fees or unfavorable trading conditions further emphasizes the need for caution when considering IndianXM. Traders should always read the fine print and ensure they fully understand the costs associated with trading on any platform.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. IndianXM's claims regarding fund security measures warrant careful scrutiny. The broker asserts that it employs various security measures, but the lack of transparency makes it difficult to ascertain the effectiveness of these measures.

Key aspects of fund security include fund segregation, investor protection, and negative balance protection. IndianXM has not provided clear information regarding these policies, leaving traders vulnerable to potential risks. Without robust investor protection schemes in place, traders may find themselves at risk of losing their funds without any recourse.

Additionally, historical incidents of fund safety issues or disputes could further complicate matters. A broker's track record in this area is crucial for building trust, and IndianXM's lack of a documented history raises concerns about its commitment to safeguarding client assets.

Customer Experience and Complaints

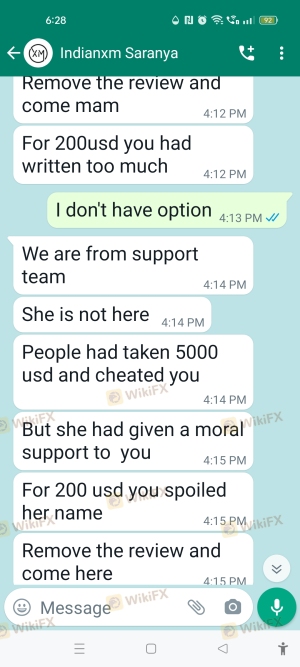

Analyzing customer feedback can provide valuable insights into a broker's reliability. However, reports regarding IndianXM indicate a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, poor customer service responsiveness, and a lack of transparency in operations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Unresolved |

| Transparency Concerns | High | No Response |

Several users have reported frustrations with the withdrawal process, often citing delays or outright refusals. This raises significant red flags about the broker's operational integrity. Moreover, the company's responses to complaints appear to be slow or inadequate, further diminishing trust among current and potential clients.

One notable case involved a trader who attempted to withdraw funds after a profitable trading period but faced multiple obstacles, including excessive fees and account restrictions. This situation highlights the potential risks associated with trading on IndianXM and serves as a cautionary tale for prospective users.

Platform and Execution

The trading platform's performance is critical for a successful trading experience. IndianXM claims to offer a robust trading platform, but user reviews suggest otherwise. Traders have reported issues related to platform stability, order execution quality, and instances of slippage.

The execution quality is particularly concerning, with reports of high slippage during volatile market conditions. Such issues can lead to significant financial losses, especially for traders employing scalping or high-frequency trading strategies. Additionally, the platform's user interface has been criticized for being less intuitive compared to competitors, making it challenging for new traders to navigate effectively.

Risk Assessment

Using IndianXM presents various risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation |

| Fund Security Risk | High | Unclear fund protection measures |

| Execution Risk | Medium | Reports of slippage and execution delays |

| Customer Service Risk | High | Poor responsiveness to complaints |

To mitigate these risks, traders should consider employing strict risk management strategies. This includes setting clear stop-loss orders, diversifying their trading portfolios, and ensuring they do not invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that IndianXM raises significant red flags regarding its legitimacy and safety. The lack of verifiable regulation, poor customer feedback, and questionable trading conditions indicate that traders should exercise extreme caution when considering this broker.

For those seeking reliable alternatives, it is advisable to explore well-regulated brokers with a proven track record of transparency and customer satisfaction. Options such as XM Group, which is regulated by multiple tier-1 authorities, may offer a more secure trading environment.

In summary, while IndianXM may present itself as a viable trading option, the potential risks and concerns highlighted in this analysis warrant a careful approach. Traders should prioritize safety and reliability in their choice of brokers to protect their investments effectively.

Is IndianXM a scam, or is it legit?

The latest exposure and evaluation content of IndianXM brokers.

IndianXM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IndianXM latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.