FxBitCapital 2025 Review: Everything You Need to Know

Executive Summary

FxBitCapital is an unregulated forex broker that presents significant legitimacy and compliance concerns for potential investors. Multiple industry reports show that this broker has been blacklisted and receives mostly negative user reviews across various platforms. The company operates under FXBitCapital Group Ltd and is registered in Saint Vincent and the Grenadines, but it lacks proper regulatory oversight from financial authorities.

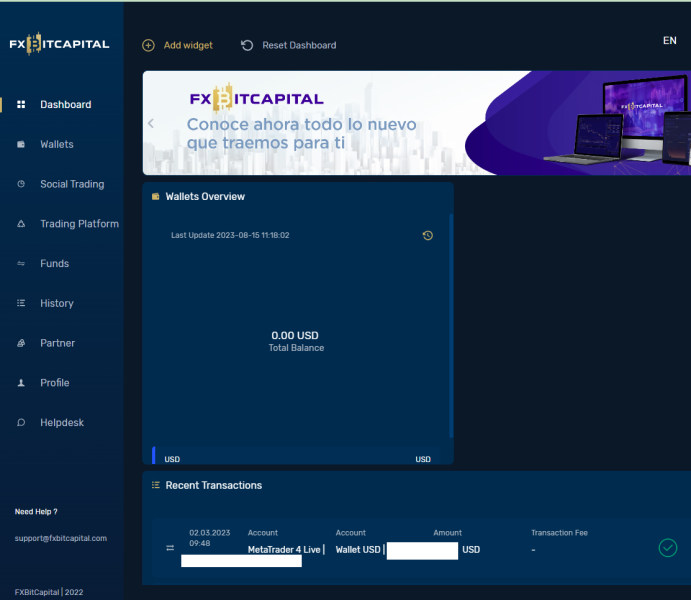

The broker offers some appealing features, including the popular MetaTrader 4 trading platform and access to multiple asset classes. These assets span forex, CFDs, stocks, spot indices, futures, precious metals, and energy commodities. However, these limited advantages are significantly overshadowed by serious regulatory deficiencies and concerning user feedback patterns.

This fxbitcapital review reveals that the platform primarily targets traders seeking diversified investment options. Potential users must exercise extreme caution given the substantial risks involved. The absence of regulatory protection, combined with consistent negative user experiences, makes this broker unsuitable for most retail traders, particularly those prioritizing capital safety and reliable customer service.

Important Notice

Regional Entity Differences: FxBitCapital operates with varying degrees of legitimacy and compliance across different jurisdictions. The broker's registration in Saint Vincent and the Grenadines does not provide the same level of investor protection available in major regulated markets. Traders should be aware that regulatory standards and legal recourse options differ significantly depending on their location.

Review Methodology: This comprehensive evaluation is based on extensive analysis of user feedback, regulatory databases, and publicly available market information. Our assessment incorporates multiple data sources to provide an accurate representation of FxBitCapital's current market standing and operational practices.

Overall Rating Framework

Broker Overview

FxBitCapital operates under FXBitCapital Group Ltd, with its headquarters located in Saint Vincent and the Grenadines. The exact establishment date remains unclear from available sources, but the company has positioned itself as a multi-asset trading provider serving international markets. However, the broker's operational history is marred by regulatory concerns and negative market perception.

The company's business model centers on providing access to global financial markets through online trading platforms. It operates without proper regulatory oversight from recognized financial authorities. This fundamental compliance gap raises serious questions about investor protection and operational transparency.

The broker offers trading services through the MetaTrader 4 platform. This provides access to various asset classes including foreign exchange pairs, contracts for difference, equity instruments, spot market indices, futures contracts, precious metals, and energy commodities. Despite claiming to serve clients across 180 countries, FxBitCapital lacks the regulatory credentials typically required for legitimate international brokerage operations. This fxbitcapital review emphasizes the importance of understanding these operational limitations before considering any investment decisions.

Regulatory Status: FxBitCapital is registered in Saint Vincent and the Grenadines but operates without supervision from the Financial Services Authority or other recognized regulatory bodies. This unregulated status significantly increases investment risks and reduces legal recourse options for traders.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available sources. This raises transparency concerns for potential users.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts in publicly available materials. This makes it difficult for traders to assess account accessibility and entry barriers.

Promotional Offerings: Current bonus structures, promotional campaigns, and incentive programs are not clearly outlined in available documentation. This suggests limited marketing transparency.

Tradeable Assets: The platform provides access to multiple asset categories including forex currency pairs, CFD instruments, stock market securities, spot indices, futures contracts, precious metals trading, and energy commodity markets. This offers reasonable diversification opportunities.

Cost Structure: Detailed information regarding spreads, commission rates, overnight fees, and other trading costs remains undisclosed in available sources. This prevents accurate cost analysis for potential users.

Leverage Options: Specific leverage ratios and margin requirements are not clearly specified in accessible materials. This creates uncertainty about trading terms and risk management parameters.

Platform Selection: The broker primarily offers MetaTrader 4, providing users with access to various technical indicators, charting tools, and automated trading capabilities. Additional platform options are not mentioned.

Geographic Restrictions: While claiming to serve 180 countries, specific regional limitations and compliance requirements are not detailed in available sources.

Customer Support Languages: Information regarding multilingual support options and communication channels is not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

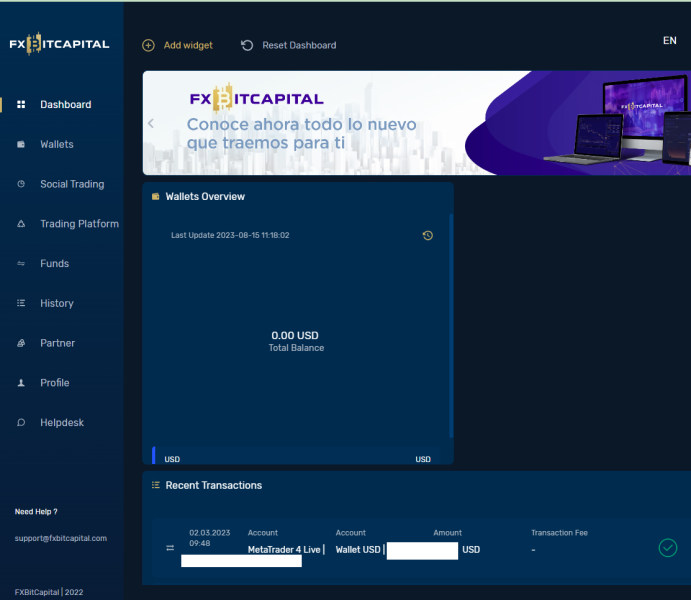

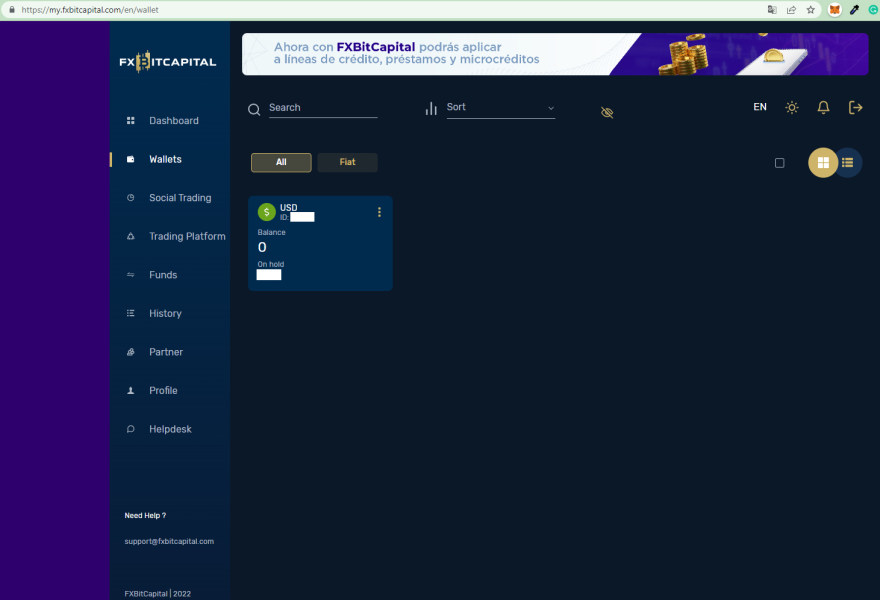

FxBitCapital's account conditions receive an extremely low rating due to significant transparency deficiencies and negative user experiences. The broker fails to provide clear information about account types, their respective features, or specific terms and conditions that would allow traders to make informed decisions.

The absence of disclosed minimum deposit requirements creates uncertainty for potential clients trying to assess account accessibility. This lack of transparency extends to spread information, commission structures, and leverage terms, which are fundamental considerations for any serious trader. Available user feedback shows that clients have expressed frustration with unclear account terms and unexpected conditions that were not properly disclosed during the registration process.

The account opening process appears problematic based on user reports. Clients cite difficulties in verification procedures and unclear documentation requirements. The broker also fails to mention specialized account options such as Islamic accounts for Muslim traders, suggesting limited accommodation for diverse client needs.

This fxbitcapital review finds that the broker's approach to account conditions falls far short of industry standards. This is particularly true when compared to regulated competitors who provide transparent, detailed account information and clear terms of service.

FxBitCapital receives a moderate rating for tools and resources, primarily based on its provision of the MetaTrader 4 platform. MT4 is widely recognized and appreciated by traders worldwide. MT4 offers comprehensive charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors.

However, the broker's offering appears limited beyond the basic MT4 functionality. Available sources do not mention additional proprietary tools, advanced research capabilities, or comprehensive educational resources that would enhance the trading experience. The absence of detailed information about market analysis, economic calendars, or trading signals suggests a basic service offering.

User feedback indicates mixed experiences with the platform's performance. Some traders report technical issues and stability concerns. The lack of mentioned alternative platforms or mobile-specific applications may limit trading flexibility for users who prefer different interfaces or trading on-the-go.

Educational resources appear insufficient. There is no clear indication of webinars, tutorials, or comprehensive learning materials that would support both novice and experienced traders in developing their skills and market knowledge.

Customer Service Analysis (Score: 3/10)

Customer service represents one of FxBitCapital's most significant weaknesses. Predominantly negative user feedback highlights serious deficiencies in support quality and responsiveness. Available reports consistently indicate poor customer service experiences, with users citing inadequate response times and ineffective problem resolution.

The broker's customer support infrastructure appears insufficient to handle client inquiries effectively. Users report difficulties in reaching support representatives and receiving satisfactory responses to their concerns. Contact methods and availability hours are not clearly specified in available materials, suggesting limited accessibility for international clients across different time zones.

Language support capabilities remain unclear. This could pose significant barriers for non-English speaking clients seeking assistance. The absence of comprehensive FAQ sections or self-service resources appears to compound support limitations, forcing users to rely entirely on direct contact methods that may be unreliable.

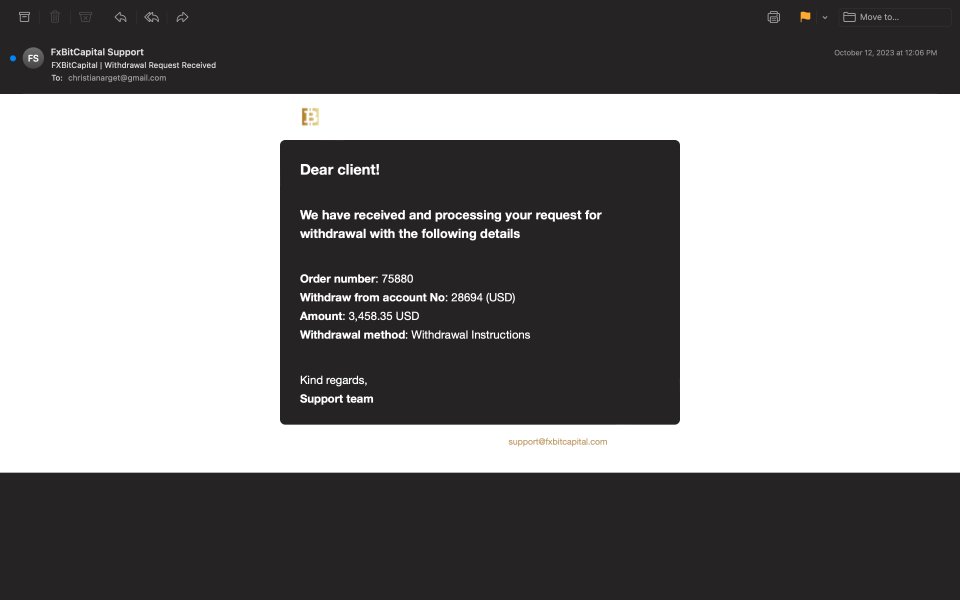

Multiple user reports indicate concerning patterns regarding fund withdrawal assistance and account-related inquiries. Clients express frustration about unresolved issues and inadequate support during critical situations requiring immediate attention.

Trading Experience Analysis (Score: 4/10)

The trading experience with FxBitCapital receives a below-average rating due to various performance and reliability concerns reported by users. The MetaTrader 4 platform provides familiar functionality, but user feedback suggests implementation issues that affect overall trading quality.

Platform stability appears problematic according to user reports. Traders cite connection issues and system interruptions that can impact trading activities. Order execution quality remains questionable, with insufficient information about slippage rates, execution speeds, and price accuracy during volatile market conditions.

The technical functionality of charts and indicators appears adequate through MT4. However, users report concerns about data accuracy and real-time price feeds. Mobile trading experience information is limited, making it difficult to assess the broker's mobile platform capabilities and performance.

Trading environment transparency is lacking. There is insufficient information about liquidity providers, spread consistency, and market depth. This fxbitcapital review notes that the absence of detailed execution statistics and performance metrics makes it challenging for traders to assess the quality of the trading environment compared to regulated alternatives.

Trustworthiness Analysis (Score: 1/10)

FxBitCapital receives the lowest possible trustworthiness rating due to its unregulated status and inclusion on industry blacklists. The broker operates without oversight from recognized financial regulators, eliminating crucial investor protections and legal safeguards that legitimate brokers provide.

The company's registration in Saint Vincent and the Grenadines does not constitute proper financial regulation. This jurisdiction lacks stringent oversight requirements for forex brokers. This regulatory gap means clients have limited recourse in case of disputes or operational issues.

Industry reputation is severely compromised. Multiple sources indicate blacklist status and warn potential investors about associated risks. The absence of segregated client fund protection, deposit insurance, or regulatory compensation schemes significantly increases the risk of capital loss.

Company transparency is minimal. There is limited disclosure about corporate structure, financial statements, or operational procedures. The lack of verifiable track record and absence of third-party auditing further undermines credibility and trustworthiness among potential clients.

User Experience Analysis (Score: 3/10)

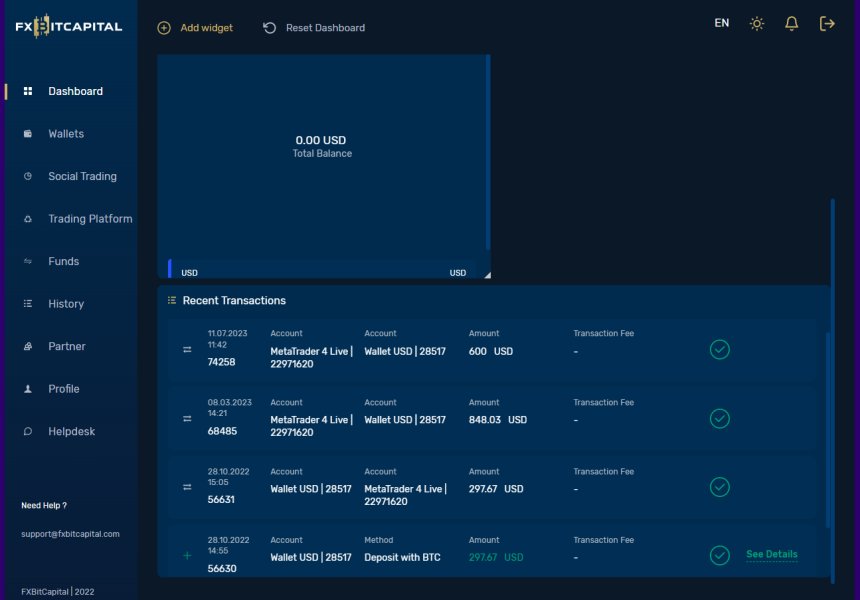

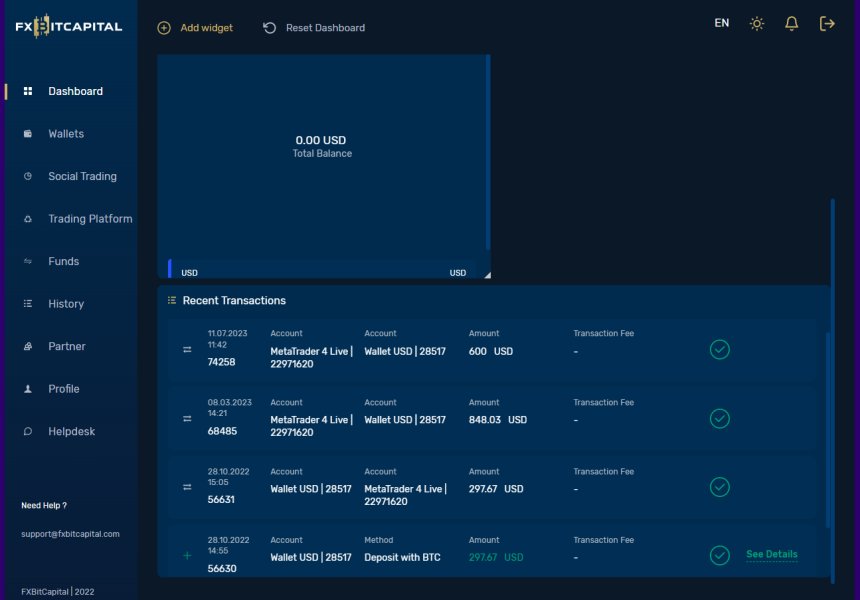

Overall user satisfaction with FxBitCapital is predominantly negative based on available feedback and reviews. Users consistently report disappointing experiences across multiple aspects of the service, from initial registration through ongoing trading activities.

Interface design and usability information is limited. The MT4 platform provides a familiar environment for experienced traders. However, user reports suggest that the broker's implementation may have issues that affect the standard MT4 experience.

Registration and verification processes appear problematic according to user feedback. Clients report unclear requirements and extended processing times. Fund management experiences are particularly concerning, with users citing difficulties in deposit and withdrawal procedures.

Common user complaints center around poor customer service, platform reliability issues, and concerns about fund security. The pattern of negative feedback suggests systemic issues with the broker's operational approach and client relationship management. Users frequently express regret about choosing this broker and recommend seeking regulated alternatives for safer trading experiences.

Conclusion

FxBitCapital presents significant risks as an unregulated forex broker with consistently negative user feedback and questionable operational practices. This comprehensive evaluation reveals fundamental deficiencies in regulatory compliance, customer service, and overall reliability that make it unsuitable for most retail traders.

The broker may only be appropriate for highly experienced traders with thorough understanding of unregulated market risks and substantial risk tolerance. However, even sophisticated investors would benefit from choosing regulated alternatives that provide better protection and service quality.

The primary advantage of diverse trading assets is heavily outweighed by critical disadvantages. These include lack of regulatory oversight, poor customer support, platform reliability concerns, and consistently negative user experiences. Potential investors should exercise extreme caution and consider regulated alternatives that offer superior protection and service standards.