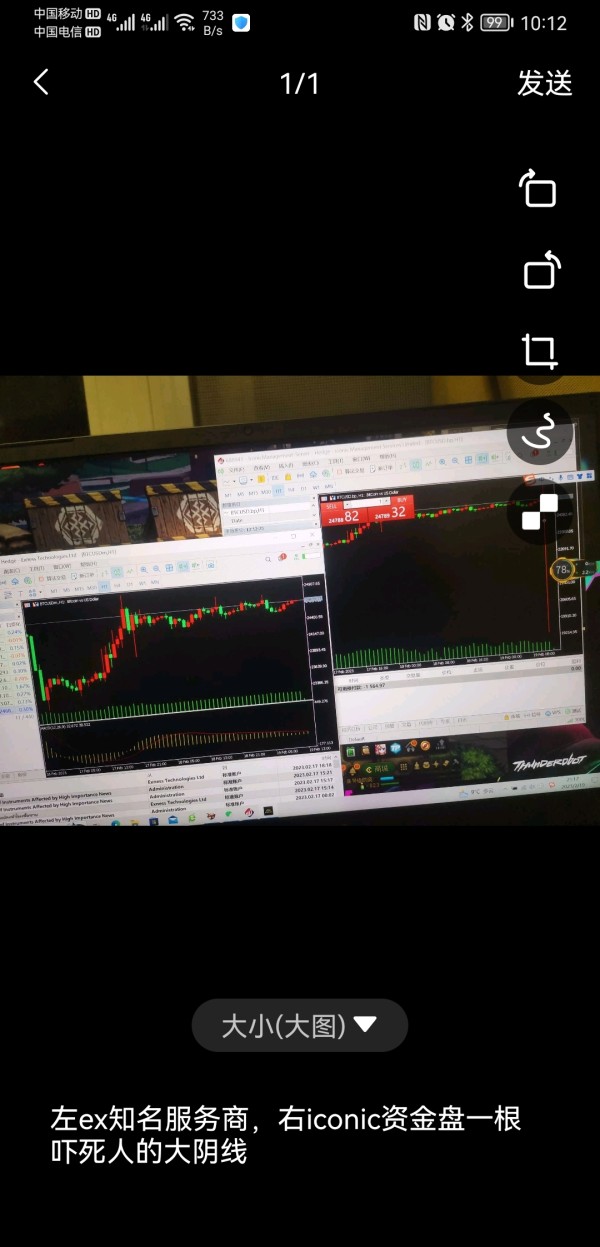

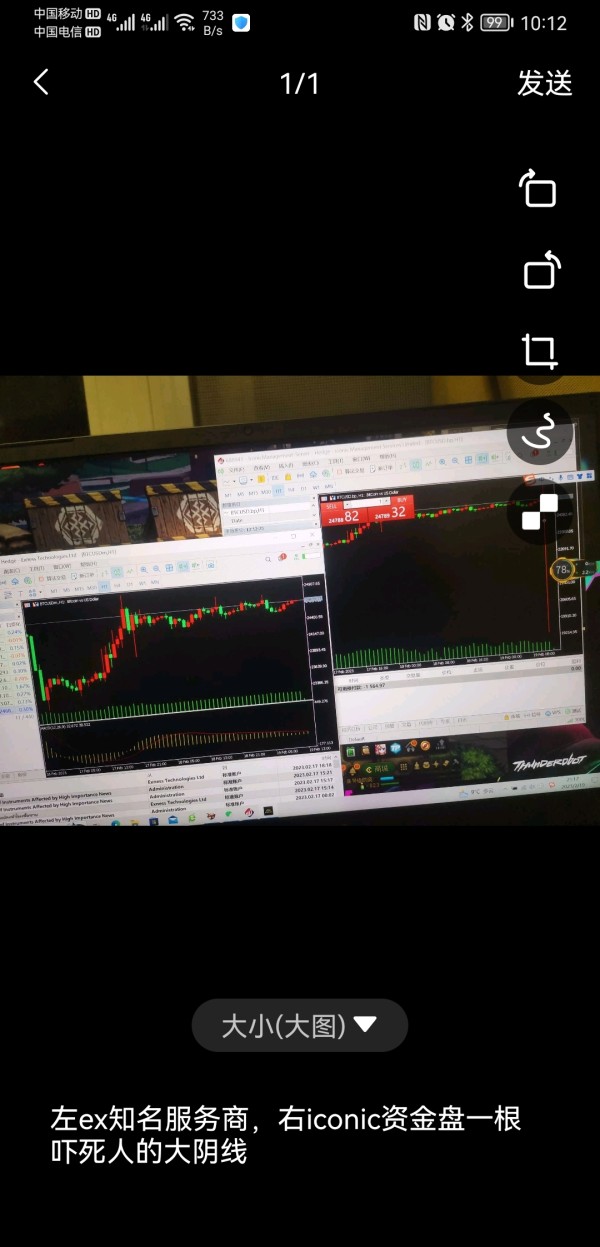

Iconic Management 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive iconic management review provides an in-depth analysis of the brokerage firm's operations and services in 2025. Iconic Management has become a notable player in the forex industry. The company operates across multiple jurisdictions with regulatory oversight from authorities spanning five continents. It demonstrates a commitment to maintaining professional standards and regulatory compliance across its global operations.

According to available employment data, 46% of employees recommend working at the company. The Iconic Management Trainee program receives a solid 4.0 out of 5 rating. These metrics suggest a positive internal culture and structured approach to professional development. The brokerage primarily targets traders seeking practical experience and career growth opportunities within the forex market. It positions itself as a platform for both learning and active trading.

The multi-jurisdictional regulatory framework provides traders with enhanced security and compliance assurance. Specific trading conditions and platform features require further investigation. Based on publicly available information and user feedback, Iconic Management appears to maintain steady operations with a focus on regulatory adherence and employee satisfaction. This makes it a consideration for traders prioritizing regulated environments and professional development opportunities.

Important Notice

Due to Iconic Management's operations across multiple regions and jurisdictions, trading conditions, regulatory requirements, and available services may vary significantly between different geographical locations. Prospective clients should verify the specific regulatory status and trading terms applicable to their region before engaging with the platform.

This review is compiled based on publicly available information, employee reviews, and regulatory disclosures. Given the limited availability of detailed trading specifications in public sources, traders are advised to contact the company directly for comprehensive information about account types, trading conditions, and platform features. The assessment reflects information available at the time of writing. It may be subject to changes in company policies or regulatory requirements.

Rating Framework

Broker Overview

Iconic Management operates as a forex brokerage firm with a global presence. Specific founding details and company history are not extensively documented in publicly available sources. The company has established operations across multiple continents, suggesting a strategic approach to international market penetration and regulatory compliance. While comprehensive corporate background information remains limited, the firm's regulatory footprint indicates substantial operational scope and commitment to meeting diverse jurisdictional requirements.

The brokerage's business model appears focused on providing forex trading services while maintaining regulatory compliance across various markets. According to available information, Iconic Management emphasizes professional development through structured training programs. This is evidenced by their dedicated trainee program. The company's approach to employee satisfaction and professional growth suggests a long-term vision for building expertise within the organization. This may translate to enhanced service quality for clients.

Regarding regulatory oversight, Iconic Management operates under supervision from regulatory authorities across five continents. This represents one of the most comprehensive regulatory frameworks observed in the industry. This extensive regulatory coverage provides multiple layers of oversight and compliance requirements. It potentially offers enhanced protection for traders operating in different jurisdictions. The multi-continental regulatory structure also suggests the company's commitment to maintaining operational standards across diverse markets and regulatory environments.

Regulatory Jurisdictions: Iconic Management maintains regulatory compliance across five continents. Specific regulatory body names and license numbers are not detailed in available public information. This extensive geographical coverage suggests comprehensive oversight and compliance requirements.

Deposit and Withdrawal Methods: Specific information regarding payment processing options, supported currencies, and transaction methods is not available in reviewed sources. Prospective clients should inquire directly about available funding options.

Minimum Deposit Requirements: Minimum account funding requirements are not specified in publicly available materials. Different account types may have varying minimum deposit thresholds depending on the jurisdiction and account classification.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not documented in accessible sources. Any available promotions would likely vary by region and regulatory requirements.

Available Trading Assets: The range of tradeable instruments, including currency pairs, commodities, indices, or other financial products, is not specified in reviewed materials. Asset availability may differ across jurisdictions based on local regulations.

Cost Structure: Information regarding spreads, commissions, overnight fees, and other trading costs is not available in public sources. Fee structures typically vary based on account type and trading volume in this iconic management review.

Leverage Ratios: Maximum leverage offerings and margin requirements are not detailed in available information. Leverage limits would be subject to local regulatory restrictions in each operational jurisdiction.

Trading Platform Options: Specific trading platforms, mobile applications, or proprietary software offerings are not documented in reviewed sources. Platform availability may vary by region and account type.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not detailed in accessible materials. Geographic limitations would depend on local regulations and licensing agreements.

Customer Support Languages: Available languages for customer service and support are not specified in reviewed sources. Multi-jurisdictional operations suggest multilingual capabilities.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Iconic Management's account conditions faces limitations due to insufficient publicly available information regarding specific account types, their features, and associated requirements. Without detailed documentation of account tiers, minimum deposit requirements, or special account functionalities, it becomes challenging to provide a comprehensive assessment of how the brokerage structures its client offerings.

Industry standards typically include multiple account types catering to different trader profiles. These range from beginner-friendly accounts with lower minimum deposits to professional accounts with enhanced features and reduced costs. However, specific details about Iconic Management's account hierarchy are not disclosed in available sources. The account opening process, verification requirements, and timeline for account activation also remain undocumented.

Given the company's multi-jurisdictional regulatory framework, it's reasonable to expect that account conditions may vary significantly between regions to comply with local regulatory requirements. Some jurisdictions mandate specific account protections, segregation requirements, or leverage limitations that would directly impact account terms. Without access to jurisdiction-specific account documentation, this iconic management review cannot provide definitive guidance on account suitability for different trader types or geographic locations.

The assessment of trading tools and resources offered by Iconic Management is constrained by the lack of detailed information in publicly available sources. Modern forex brokerages typically provide comprehensive suites of trading tools, including technical analysis software, economic calendars, market research, and educational resources. However, specific details about Iconic Management's tool offerings are not documented in reviewed materials.

Educational resources represent a critical component of broker evaluation. This is particularly important given the company's emphasis on professional development as evidenced by their trainee program structure. The 4.0/5 rating for the Iconic Management Trainee program suggests some level of structured educational content. The specific nature, scope, and accessibility of these resources to regular trading clients remains unclear.

Research and analysis capabilities, automated trading support, and third-party integrations are standard expectations in the contemporary forex brokerage landscape. Without specific information about chart packages, signal services, or analytical tools, it's difficult to assess how Iconic Management positions itself relative to industry standards. The multi-continental regulatory presence suggests operational sophistication that would typically correlate with comprehensive tool offerings. This remains speculative without concrete documentation.

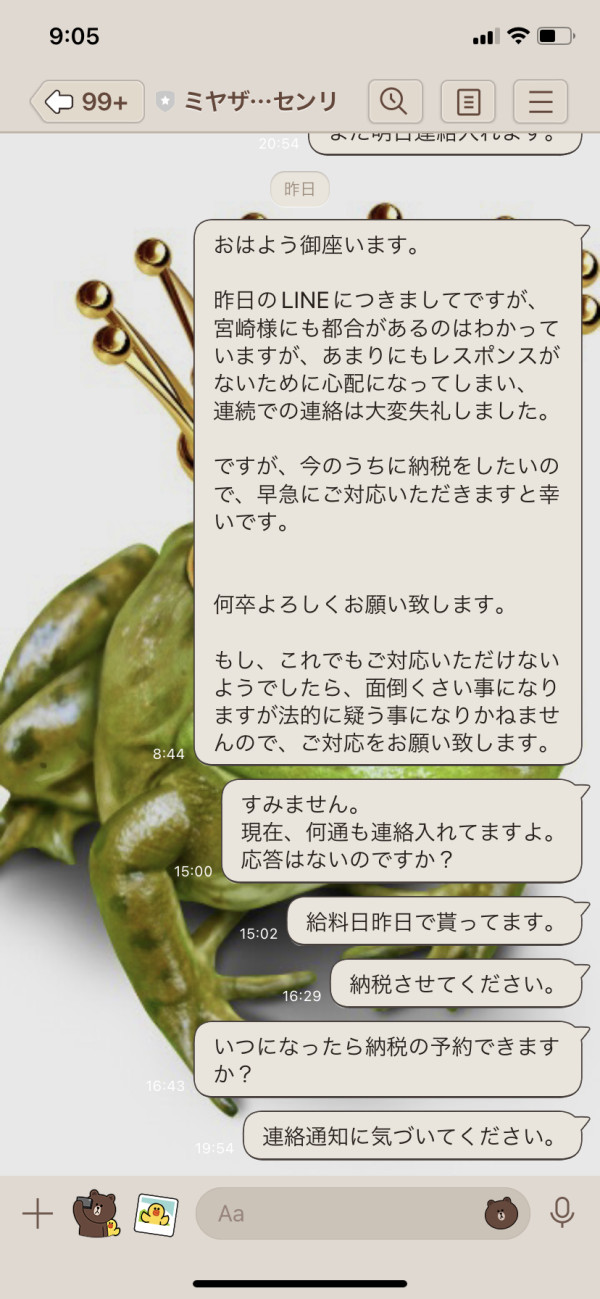

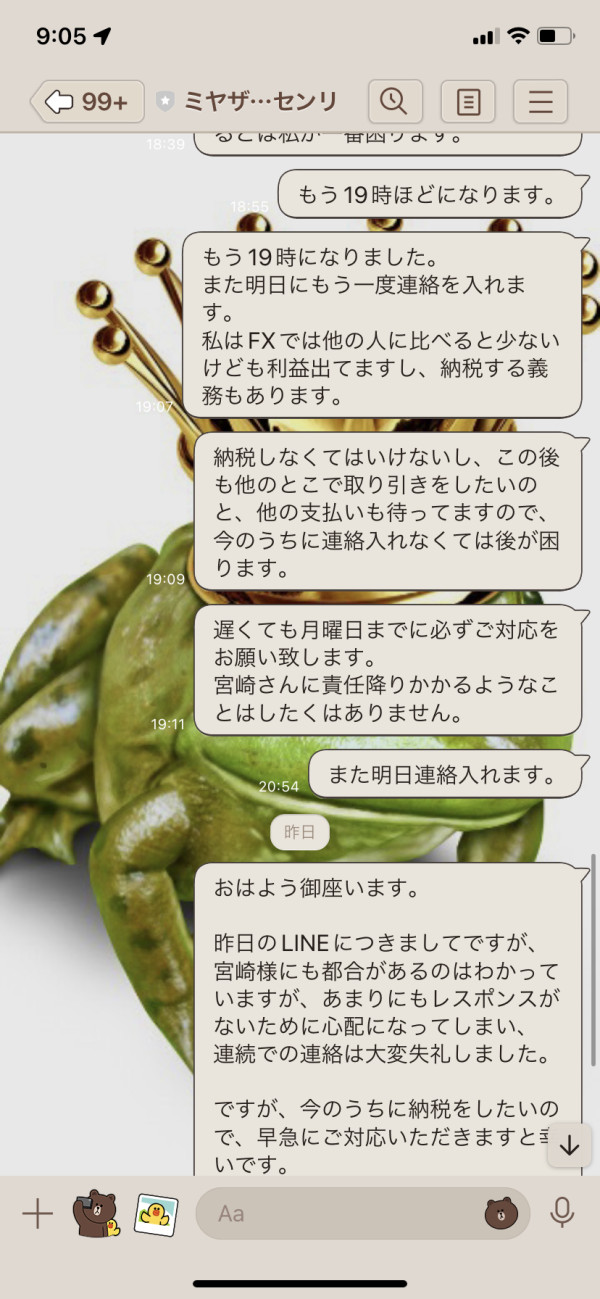

Customer Service and Support Analysis

Customer service evaluation for Iconic Management faces significant limitations due to the absence of detailed information about support channels, response times, and service quality metrics in publicly available sources. The 46% employee recommendation rate provides some indirect insight into internal company culture. This may correlate with customer-facing service quality, though this connection remains speculative.

Multi-jurisdictional operations typically require robust customer support infrastructure to address diverse regulatory requirements, time zones, and language preferences. Given Iconic Management's presence across five continents, one would expect comprehensive support capabilities. These would include multiple communication channels and extended operating hours. However, specific details about live chat availability, phone support, email response times, or ticket systems are not documented.

The quality of customer service often reflects a company's overall operational maturity and client focus. While the positive employee feedback suggests internal satisfaction, the translation of this satisfaction to customer-facing service quality requires direct client feedback. This information is not available in reviewed sources. Professional development emphasis through the trainee program may indicate investment in staff quality. This could potentially benefit customer service delivery.

Trading Experience Analysis

The evaluation of trading experience with Iconic Management is significantly limited by the absence of specific information about platform performance, execution quality, and technical capabilities in available sources. Trading experience encompasses multiple factors including platform stability, order execution speed, slippage rates, and overall technical reliability. None of these are documented in reviewed materials.

Platform functionality and user interface design play crucial roles in trader satisfaction and performance. Modern traders expect sophisticated charting capabilities, customizable interfaces, and reliable mobile access. However, specific details about Iconic Management's platform offerings are not available for assessment in this iconic management review. This includes whether they use proprietary or third-party solutions.

The multi-jurisdictional regulatory framework suggests operational complexity that could either enhance or complicate the trading experience, depending on implementation quality. Different regulatory requirements across jurisdictions might result in varying platform features or execution policies for clients in different regions. Without concrete user feedback or platform specifications, it's impossible to assess how these regulatory complexities impact the actual trading experience.

Trust and Reliability Analysis

Iconic Management demonstrates strong credentials in trust and reliability through its extensive regulatory framework spanning five continents. This multi-jurisdictional regulatory presence represents one of the most comprehensive oversight structures observed in the forex industry. It suggests significant commitment to compliance and operational transparency. The breadth of regulatory coverage indicates the company has successfully met diverse regulatory requirements across multiple markets.

Regulatory supervision provides essential investor protections including fund segregation requirements, capital adequacy standards, and operational oversight. The presence of regulatory authorities from five continents suggests that Iconic Management operates under multiple sets of compliance requirements. This potentially offers enhanced protection for traders in different jurisdictions. This regulatory diversity also indicates the company's willingness to invest in compliance infrastructure necessary for multi-market operations.

The company's regulatory standing appears to be maintained without documented negative regulatory actions or significant compliance issues in available sources. However, the absence of detailed public information about specific regulatory licenses, capital adequacy ratios, or fund segregation practices limits the depth of trust assessment possible. The regulatory framework provides a strong foundation for trust. Additional transparency regarding specific compliance measures would enhance the overall trust evaluation.

User Experience Analysis

User experience assessment for Iconic Management reveals mixed indicators based on available information. The 46% employee recommendation rate provides insight into internal satisfaction levels. This may correlate with overall organizational quality and customer-facing service delivery. While this percentage indicates room for improvement, it suggests a baseline level of employee satisfaction that could translate to reasonable service quality.

The Iconic Management Trainee program's 4.0/5 rating demonstrates the company's capability to deliver structured, well-regarded professional development programs. This rating suggests competency in program design and delivery. It may extend to customer onboarding, education, and support services. The focus on professional development indicates an organizational culture that values learning and growth. This could potentially benefit client experience.

However, specific user interface design, platform usability, registration processes, and fund management experiences are not documented in available sources. The multi-jurisdictional nature of operations may create complexity in user experience. Different regions might have varying procedures, platform features, or service levels based on local regulatory requirements. Without direct client feedback or detailed platform information, comprehensive user experience evaluation remains limited.

Conclusion

Based on available information, Iconic Management presents a mixed profile with notable strengths in regulatory compliance and professional development, balanced against significant information gaps regarding specific trading conditions and service offerings. The brokerage's most compelling feature is its extensive regulatory framework across five continents. This demonstrates substantial commitment to compliance and operational oversight. This regulatory breadth provides a strong foundation for trader confidence and suggests serious operational infrastructure.

The company appears well-suited for traders who prioritize regulatory oversight and are seeking opportunities for professional development within the forex industry. The positive trainee program rating and moderate employee satisfaction levels indicate organizational competency in structured program delivery and professional growth support. However, traders focused on specific trading conditions, platform features, or cost structures may find the limited public information insufficient for informed decision-making.

The primary limitations of this evaluation stem from the absence of detailed trading specifications, platform information, and comprehensive user feedback in publicly available sources. Prospective clients should conduct direct inquiries with the company to obtain specific information about account types, trading costs, platform capabilities, and regional service variations before making trading decisions.