Is Iconic Management safe?

Pros

Cons

Is Iconic Management A Scam?

Introduction

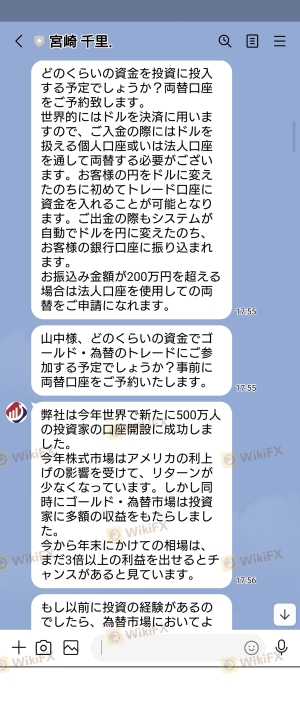

Iconic Management has emerged as a notable player in the foreign exchange (forex) market, positioning itself as an international broker offering multi-asset trading. However, the forex trading landscape is fraught with risks, making it imperative for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. In this article, we will conduct a comprehensive analysis of Iconic Management, focusing on its regulatory standing, company background, trading conditions, customer safety, and user experiences. Our investigation draws upon various online resources, including reviews and regulatory databases, to provide an objective assessment of whether Iconic Management is safe or a potential scam.

Regulation and Legitimacy

One of the most critical aspects of assessing any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Iconic Management claims to be registered with the Companies House in the United Kingdom and the Financial Crimes Enforcement Network (FinCEN) in the U.S. However, neither of these entities is recognized as a legitimate forex regulator.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Companies House | 14285760 | United Kingdom | Verified |

| FinCEN | 31000223110969 | United States | Verified |

| FCA | N/A | United Kingdom | Not Registered |

| NFA | N/A | United States | Unauthorized |

The lack of oversight from reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the National Futures Association (NFA) in the U.S. raises significant concerns about the safety of trading with Iconic Management. The absence of valid regulation indicates that traders' funds may not be protected under any legal framework. Therefore, it is crucial to approach this broker with caution, as its unregulated status suggests that Iconic Management is not safe.

Company Background Investigation

Iconic Management, established in the United Kingdom, presents itself as an independent management firm focused on providing personalized services in the forex trading arena. However, the company's history and ownership structure remain somewhat opaque. There is limited information available regarding its founding members or the management team, making it difficult to assess their expertise and reliability.

The lack of transparency in the company's operational structure raises questions about its credibility. A reputable broker typically provides clear information about its leadership team and their professional backgrounds. In contrast, the uncertainty surrounding Iconic Management's management raises red flags for potential investors. Given these factors, it becomes essential to question whether Iconic Management is safe for traders looking for a trustworthy trading partner.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer can significantly impact a trader's experience and profitability. Iconic Management claims to provide competitive trading conditions, including access to the MetaTrader 5 (MT5) platform. However, the specifics of its fee structure remain unclear, which can be a warning sign for potential clients.

| Fee Type | Iconic Management | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates suggests a lack of transparency in Iconic Management's pricing model. Traders should be wary of any broker that does not clearly disclose its fee structure, as hidden fees can significantly erode profits. Consequently, it is prudent to consider whether Iconic Management is safe based on its ambiguous trading conditions.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Iconic Management claims to implement certain safety measures; however, specific details regarding fund segregation, investor protection, and negative balance protection are lacking. Without robust safety measures in place, traders could be at risk of losing their investments.

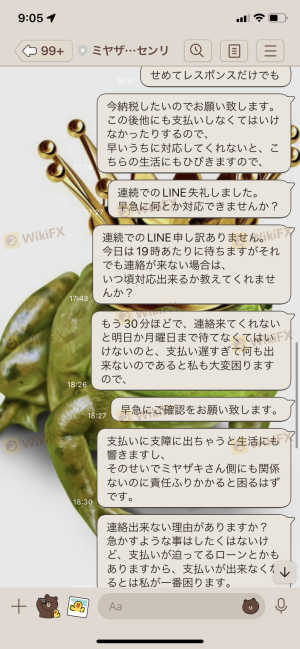

Moreover, the absence of a clear policy regarding the protection of client funds raises concerns about the broker's commitment to safeguarding investors' assets. Historical complaints about withdrawal issues and fund accessibility further exacerbate these concerns. Therefore, it is essential to assess whether Iconic Management is safe for holding and trading funds.

Customer Experience and Complaints

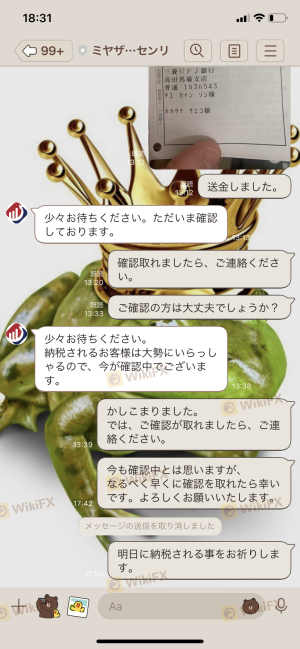

Customer feedback is a vital indicator of a broker's reliability and service quality. Analyzing reviews and user experiences related to Iconic Management reveals a pattern of complaints, primarily concerning withdrawal difficulties and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency | High | Poor |

For instance, numerous users have reported being unable to withdraw their funds, with some alleging that their inquiries went unanswered. These complaints highlight a significant issue with customer service and raise questions about the overall integrity of Iconic Management. Given these reports, it is reasonable to conclude that Iconic Management is not safe for traders seeking reliable support and services.

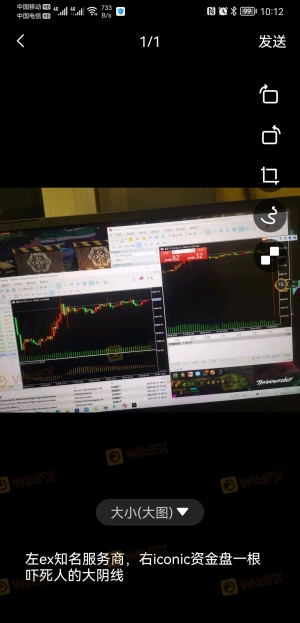

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Iconic Management offers the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, reports of execution delays, slippage, and order rejections have surfaced, indicating potential issues with the broker's trade execution quality.

Traders have expressed concerns about the reliability of order execution, which can significantly impact trading outcomes. Any indication of platform manipulation or execution issues can be detrimental to a trader's success. Thus, it is vital to consider whether Iconic Management is safe based on its platform performance and execution reliability.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Iconic Management is no exception. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about oversight. |

| Financial Risk | High | Lack of transparency in fees can erode profits. |

| Customer Service Risk | Medium | Reports of poor support can affect trading experience. |

| Platform Risk | High | Execution issues may impact trade outcomes. |

Given these risk factors, traders should approach Iconic Management with caution. Implementing risk mitigation strategies, such as only investing what one can afford to lose and diversifying trading activities, can help alleviate some concerns.

Conclusion and Recommendations

In conclusion, the evidence suggests that Iconic Management is not safe for traders. The broker's lack of regulation, opaque company background, ambiguous trading conditions, and negative customer feedback raise significant red flags. Traders should exercise extreme caution and consider alternative, regulated brokers that offer transparent operations and a strong track record.

For those seeking reliable forex trading options, it may be prudent to explore alternatives such as FBS, Swissquote, or FXOpen, which are known for their regulatory compliance and customer support. Ultimately, thorough research and due diligence are essential for ensuring a secure trading experience in the forex market.

Is Iconic Management a scam, or is it legit?

The latest exposure and evaluation content of Iconic Management brokers.

Iconic Management Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Iconic Management latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.