GRIC FX 2025 Review: Everything You Need to Know

Executive Summary

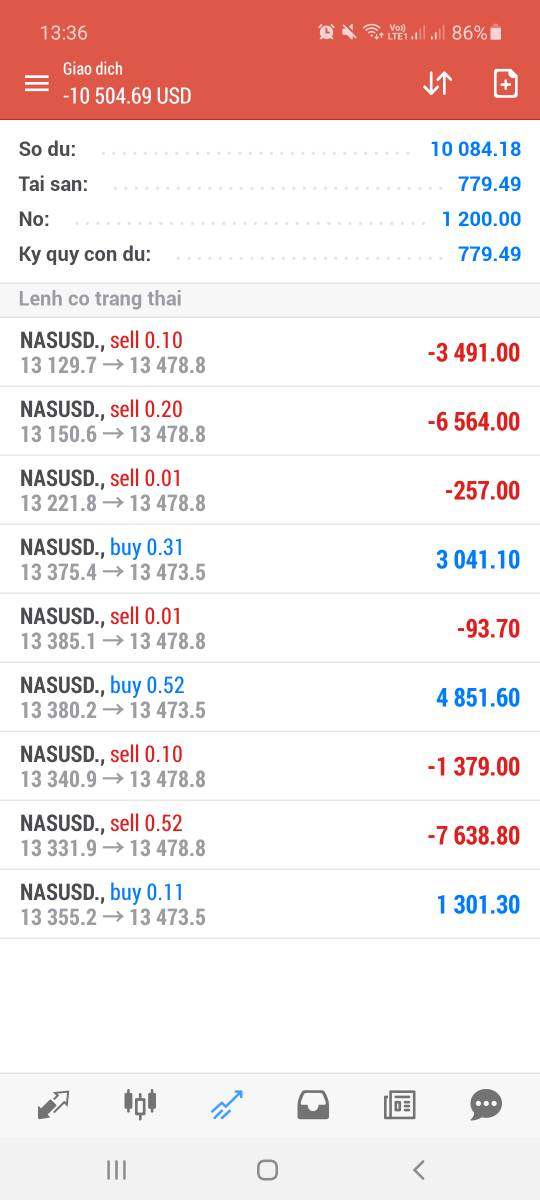

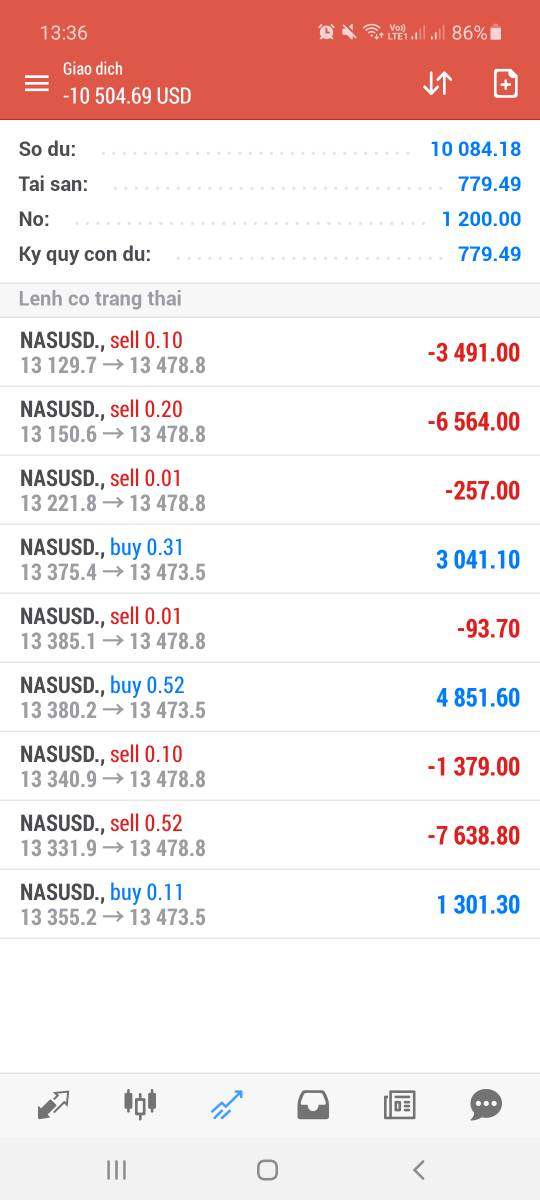

This gric fx review gives you a complete look at GRIC FX, a forex broker that has caught attention in the trading world for troubling reasons. Our review of available data and user feedback shows that GRIC FX performs poorly in many important areas. WikiFX monitoring gives the broker a worrying score of 1.47 out of 10, with user reviews heavily negative - just 1 positive review, 1 neutral review, and 15 complaints from real users.

GRIC FX offers features that might attract traders at first glance. These include leverage up to 1:500 and a minimum deposit of $0, making it accessible to traders with different amounts of money. The broker gives access to multiple types of investments including Forex, CFDs, metals, energies, indices, and cryptocurrencies. But these seeming benefits are greatly outweighed by serious problems with regulation and operations.

The broker targets traders who can handle high risk, especially those wanting high leverage opportunities. However, the lack of proper oversight and many user complaints mean that even risk-tolerant investors should be extremely careful when thinking about this platform.

Important Disclaimers

Regional Entity Differences: GRIC FX operates without proper regulatory permission, as the U.S. Securities and Exchange Commission specifically warns. Investors should know that using this broker may expose them to big legal and financial risks because there is no regulatory protection. The broker's operations lack the oversight that financial service providers typically need, meaning clients have limited options if disputes or issues arise.

Review Methodology: This review uses publicly available information, user feedback, and regulatory warnings. Our analysis does not include direct testing of the platform or first-hand interaction with the broker's services, as the regulatory concerns make such engagement inadvisable for review purposes.

Rating Framework

Broker Overview

GRIC FX started in 2019 and operates from the United States, calling itself a provider of diverse financial trading services. The company claims to offer access to multiple types of investments through its trading platform, targeting both new and experienced traders who want exposure to global financial markets. However, the broker's history has been marked by regulatory warnings and user complaints that raise serious questions about whether it is legitimate and reliable.

Even though it has been operating for several years, GRIC FX has failed to get proper regulatory permission from relevant financial authorities. The U.S. Securities and Exchange Commission has specifically issued warnings about the broker's operations, showing that it lacks the necessary licensing to provide financial services. This regulatory gap represents a basic flaw in the broker's business model and creates big risks for potential clients.

The broker's business model focuses on providing access to Forex trading, contracts for difference (CFDs), precious metals, energy commodities, stock indices, and cryptocurrency trading. While this diverse offering might look attractive to traders seeking variety, the lack of regulatory oversight means that clients have no guarantee of fair trading conditions, proper fund separation, or ways to resolve disputes. This gric fx review emphasizes how important regulatory compliance is in choosing a broker, an area where GRIC FX falls far short of industry standards.

Regulatory Status: GRIC FX operates without permission from recognized financial regulatory bodies. The U.S. Securities and Exchange Commission has issued specific warnings about the broker's unauthorized operations, showing major compliance failures.

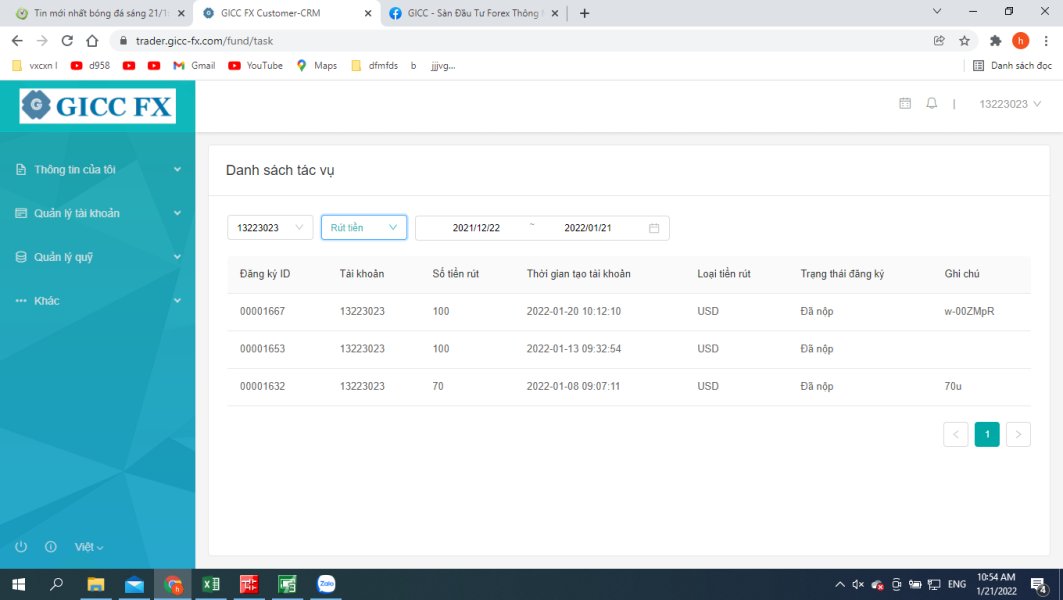

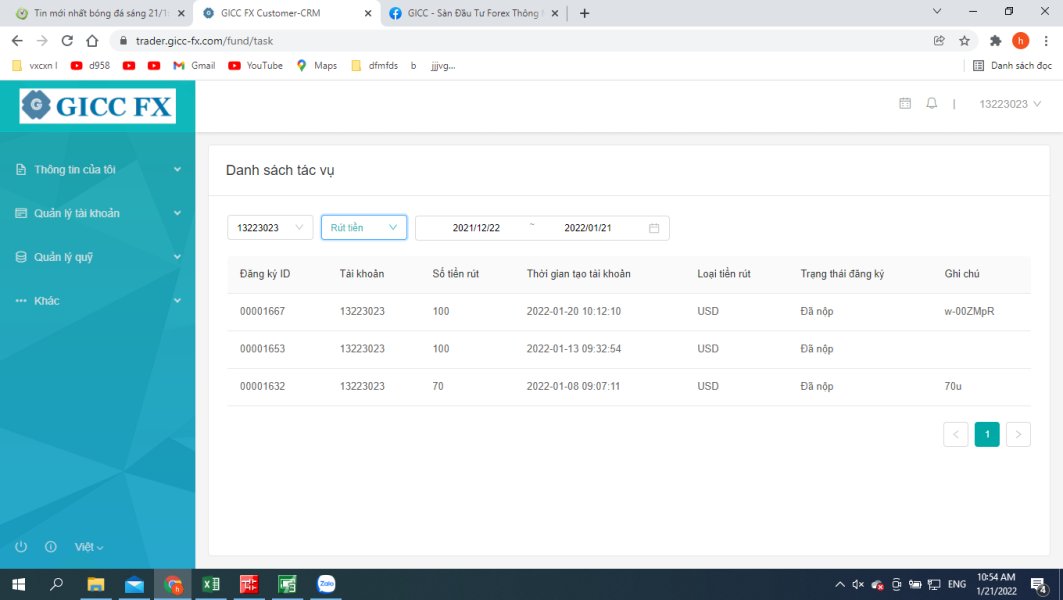

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources, which itself represents a transparency concern for potential clients.

Minimum Deposit Requirements: The broker advertises a minimum deposit of $0, which may seem attractive but raises questions about the broker's revenue model and whether it can operate sustainably.

Bonus and Promotional Offers: Available information does not specify current bonus or promotional programs, suggesting either absence of such offerings or poor communication of available incentives.

Available Trading Assets: GRIC FX provides access to six main asset categories: foreign exchange pairs, contracts for difference, precious metals, energy commodities, stock market indices, and cryptocurrency instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available in public sources, representing a significant transparency issue for potential clients.

Leverage Options: The broker offers maximum leverage of 1:500, which while attractive to some traders, represents extremely high risk, particularly in an unregulated environment.

Trading Platform Options: Specific trading platform information is not detailed in available sources, making it difficult to assess the technological infrastructure supporting client trades.

Geographic Restrictions: Information about geographic restrictions or service limitations is not specified in available documentation.

Customer Support Languages: Available customer service languages are not detailed in accessible information sources.

This gric fx review notes that the lack of detailed information about basic operational aspects represents a significant red flag for potential clients seeking transparency and reliability.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

GRIC FX's account conditions present a mixed picture that looks good at first but shows concerning gaps when you look closer. The broker's most notable feature is its $0 minimum deposit requirement, which theoretically makes trading accessible to people with limited money. This low barrier to entry might appeal to new traders or those wanting to test the platform without a big initial investment.

However, the seeming advantage of no minimum deposit is severely hurt by the lack of detailed information about account types and their specific features. Available sources do not provide clear descriptions of different account levels, their benefits, or any special features that might make service levels different. This lack of transparency makes it impossible for potential clients to make informed decisions about which account type might best suit their trading needs.

The account opening process details are not clearly documented in available sources, raising questions about verification procedures, documentation requirements, and how long onboarding takes. Professional traders typically need clear information about account setup procedures, but GRIC FX's documentation appears to lack this essential detail.

Furthermore, there is no mention of specialized account options such as Islamic accounts for clients requiring Sharia-compliant trading conditions, or institutional accounts for larger traders. This limited account diversity suggests that GRIC FX may not adequately serve the varied needs of different trader segments.

User feedback about account conditions has been mostly negative, with traders expressing concerns about the overall account management experience. The combination of limited information availability and negative user experiences significantly impacts the rating for this category. This gric fx review emphasizes that while low minimum deposits can be attractive, they lose value when not supported by comprehensive account features and reliable service delivery.

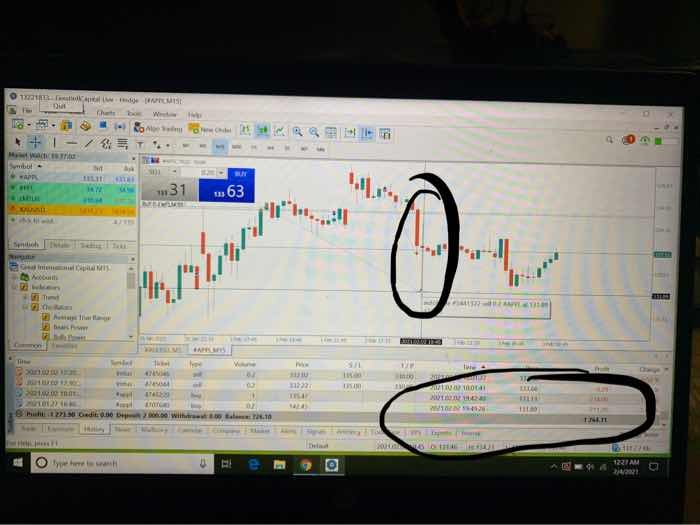

The trading tools and resources offered by GRIC FX represent one of the broker's weakest areas, with available information suggesting a significant lack of essential trading infrastructure. Professional forex trading requires access to comprehensive analytical tools, market research, and educational resources, areas where GRIC FX appears to fall short of industry standards.

Available sources do not detail the specific trading tools provided to clients, which is concerning given that modern forex trading relies heavily on technical analysis capabilities, charting software, and real-time market data. The absence of clear information about available indicators, drawing tools, or analytical features suggests that the broker may not provide the sophisticated tools that serious traders require for effective market analysis.

Research and market analysis resources appear to be notably absent from GRIC FX's offerings. Professional traders typically rely on daily market commentary, economic calendars, fundamental analysis reports, and expert insights to inform their trading decisions. The lack of mention of such resources in available documentation suggests that clients may need to find this critical information on their own, adding complexity and cost to their trading activities.

Educational resources, which are essential for trader development and platform familiarization, are not detailed in available sources. This absence is particularly concerning for new traders who rely on broker-provided education to develop their skills and understanding of market dynamics.

Automated trading support, including expert advisors (EAs) and algorithmic trading capabilities, is not mentioned in available information. This represents a significant limitation for traders who rely on automated strategies or want to implement systematic trading approaches.

User feedback consistently highlights the inadequacy of available tools and resources, with traders expressing frustration about the limited functionality and poor quality of provided features. The combination of limited tool availability and negative user experiences justifies the low rating in this critical category.

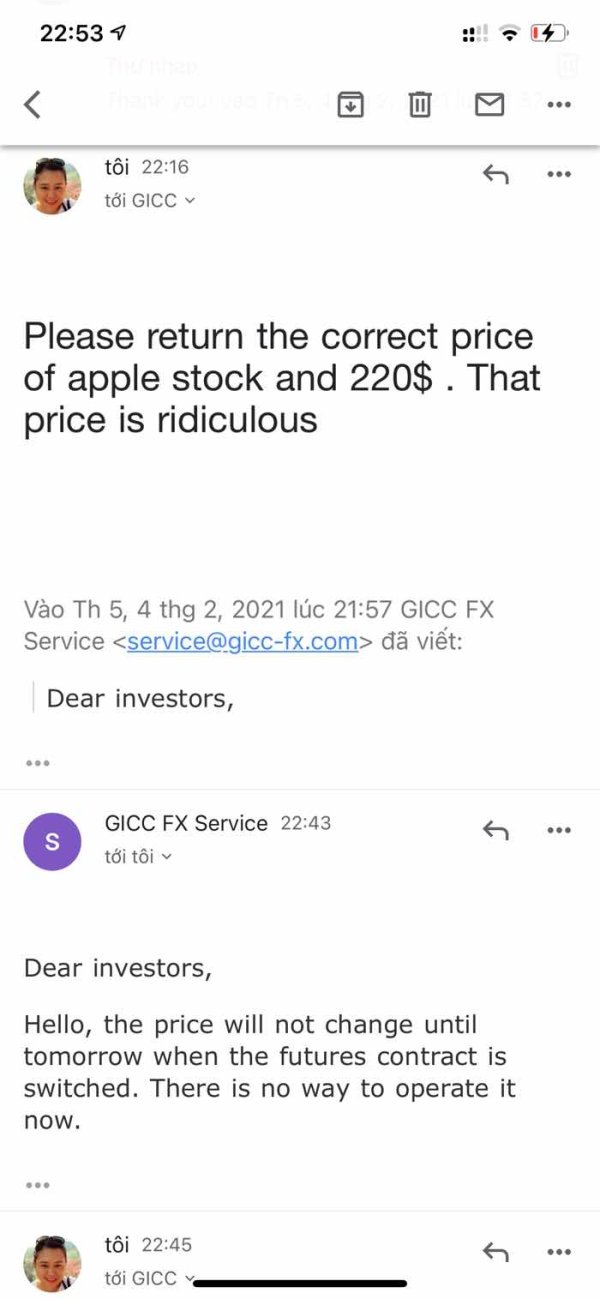

Customer Service and Support Analysis (2/10)

Customer service represents one of GRIC FX's most problematic areas, with user feedback and complaint data painting a concerning picture of support quality and responsiveness. The broker's customer service performance is particularly troubl