Is ACL TECHNOLOGY safe?

Pros

Cons

Is Acl Technology Safe or Scam?

Introduction

Acl Technology is a forex broker based in the United Kingdom, offering a range of financial products and services. As the foreign exchange market continues to grow, traders are increasingly drawn to various brokers, including Acl Technology, in search of favorable trading conditions and opportunities. However, the influx of new brokers also raises concerns about the legitimacy and safety of these platforms. Traders must exercise caution when assessing forex brokers to avoid potential scams and ensure their investments are secure. This article aims to provide a comprehensive evaluation of Acl Technology, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Our investigation employs a multi-faceted approach, analyzing data from credible sources, user reviews, and regulatory disclosures. By systematically examining these aspects, we seek to determine whether Acl Technology is a safe trading option or if it raises red flags that warrant concern.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in assessing its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps protect traders' interests and ensures compliance with industry standards. In the case of Acl Technology, it operates without valid regulatory licenses, which is a significant concern for potential clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | United Kingdom | Unverified |

The absence of regulation can expose traders to higher risks, including potential fraud and misappropriation of funds. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK provide oversight to ensure that brokers adhere to strict guidelines. Without such oversight, Acl Technology's operations are considered high-risk, as there is no guarantee of transparency or accountability.

Furthermore, the lack of historical compliance records raises questions about the broker's legitimacy. Traders should be wary of engaging with a broker that operates outside the bounds of regulatory oversight, as this could lead to significant financial losses.

Company Background Investigation

Acl Technology Co., Ltd. was incorporated in February 2020, and its registered office is located in London. However, the company was dissolved in August 2021, which raises serious questions about its operational history and stability. The brief existence of the company, coupled with its dissolution, indicates a lack of longevity and reliability in the forex market.

The management team behind Acl Technology remains largely undisclosed, which further diminishes the broker's credibility. A transparent broker typically provides information about its leadership team, including their professional backgrounds and qualifications. The absence of such information can lead to suspicions about the broker's intentions and operational practices.

In terms of transparency, Acl Technology has not demonstrated a commitment to open communication with its clients. The lack of clear information regarding its ownership structure and management team can be a red flag for potential investors, indicating that the broker may not prioritize client interests.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall attractiveness. Acl Technology presents a range of trading products, including forex, CFDs, and commodities. However, the absence of regulatory oversight raises concerns about the fairness and transparency of its trading conditions.

The fee structure of Acl Technology appears to be competitive; however, traders should be cautious of any hidden fees or unusual policies that may not be immediately apparent.

| Fee Type | Acl Technology | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | High | 2% - 5% |

While the spread may seem competitive, the high overnight interest rates could significantly impact long-term trading strategies. Traders should carefully evaluate whether the potential costs associated with holding positions overnight align with their trading goals.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Acl Technology's lack of regulatory oversight raises significant questions about its measures for safeguarding client funds. Regulated brokers typically implement strict protocols for fund segregation, ensuring that client funds are held in separate accounts from the broker's operational funds.

Unfortunately, Acl Technology has not provided clear information regarding its fund safety measures, which is concerning. The absence of investor protection schemes and negative balance protection policies further exacerbates the risks associated with trading on this platform.

Historically, there have been no reported incidents of fund security breaches; however, the lack of transparency in Acl Technology's operations makes it difficult to assess the overall safety of client funds.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating a broker's reputation and reliability. Reviews of Acl Technology reveal mixed experiences among users. While some traders report satisfactory experiences, others have raised concerns regarding customer service quality and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Unresponsive |

| Poor Customer Support | High | Inconsistent |

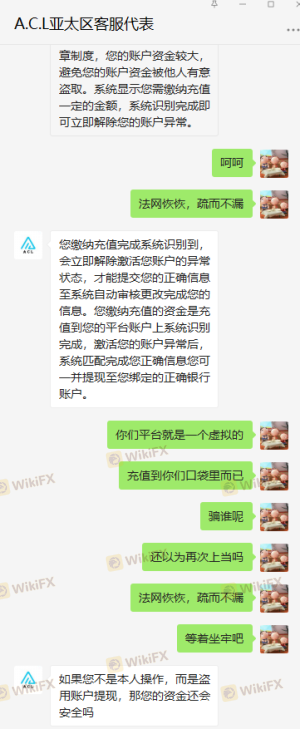

Common complaints include difficulties with withdrawals, lack of transparency regarding fees, and poor customer support. These issues can significantly affect a trader's experience and may deter potential clients from engaging with the platform.

For instance, one user reported a frustrating experience attempting to withdraw funds, citing a lack of communication from the support team. This type of feedback raises concerns about the overall reliability of Acl Technology and its commitment to customer satisfaction.

Platform and Trade Execution

The trading platform provided by Acl Technology is essential for evaluating its usability and performance. The broker offers access to popular platforms like MetaTrader 4 and MetaTrader 5, which are known for their user-friendly interfaces and robust trading features. However, the overall performance of the platform, including execution speed and reliability, remains a critical factor.

Users have reported mixed experiences regarding order execution quality. Instances of slippage and rejected orders have been noted, which can adversely impact trading strategies, especially for those who rely on precise execution.

Moreover, any signs of platform manipulation, such as frequent disconnections during high volatility periods, should raise concerns about the broker's integrity. Traders should be vigilant and consider these factors when evaluating whether Acl Technology is safe for trading.

Risk Assessment

Engaging with Acl Technology comes with inherent risks, primarily due to its lack of regulation and transparency. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid licenses or oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund security measures. |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness. |

| Trading Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, traders should conduct thorough research before engaging with Acl Technology. It may be prudent to start with a small investment and closely monitor the broker's performance and reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Acl Technology raises several red flags that potential traders should consider. The lack of regulatory oversight, coupled with a brief operational history and mixed customer experiences, indicates a higher level of risk. While some traders may find attractive trading conditions, the overall safety of Acl Technology remains questionable.

For traders seeking a reliable forex broker, it is advisable to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight, transparent operations, and positive user feedback should be prioritized to ensure a safer trading environment.

In summary, while Acl Technology may offer some appealing features, the potential risks associated with trading on this platform cannot be overlooked. Traders are encouraged to conduct their due diligence and consider safer, more reputable options in the forex market.

Is ACL TECHNOLOGY a scam, or is it legit?

The latest exposure and evaluation content of ACL TECHNOLOGY brokers.

ACL TECHNOLOGY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACL TECHNOLOGY latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.