Is Mirae AF safe?

Business

License

Is Mirae AF Safe or Scam?

Introduction

Mirae AF has emerged as a prominent player in the forex market, attracting traders with its diverse offerings and competitive trading conditions. However, the influx of new brokers in the forex industry necessitates a cautious approach for traders. With the potential for scams and fraudulent activities, it is crucial for investors to thoroughly evaluate the credibility and safety of their chosen brokers. This article aims to investigate whether Mirae AF is a safe trading platform or a potential scam by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory landscape is a fundamental aspect of any forex broker's credibility. Mirae AF's regulatory status raises concerns, as it lacks valid regulatory information and does not appear to be registered with any recognized financial authority. The absence of oversight can expose traders to significant risks, including potential fraud and loss of funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | No Valid Regulation |

The lack of regulation is a significant red flag. Regulatory bodies are essential for ensuring that brokers adhere to strict operational standards, protecting clients' interests and funds. Without such oversight, traders may find themselves vulnerable to unethical practices. Moreover, historical compliance issues or any past regulatory actions against the broker can further indicate the level of risk involved. In this case, Mirae AF's lack of regulation and oversight leads to serious concerns about its legitimacy.

Company Background Investigation

Mirae AF's history and ownership structure play a vital role in assessing its trustworthiness. Established recently, the broker lacks a long-standing reputation in the industry, which can be a warning sign for potential investors. A thorough examination of the management team reveals limited information about their professional backgrounds and expertise in the financial sector.

Transparency is another critical factor; the broker's website does not provide sufficient information regarding its operational history, ownership, or team members. This lack of clarity can create an atmosphere of distrust among potential clients. A credible broker typically offers comprehensive information about its history, management, and operational practices, allowing traders to make informed decisions.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is crucial. Mirae AF presents a competitive fee structure, but the absence of detailed information regarding its pricing policies raises questions.

| Fee Type | Mirae AF | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of transparency regarding spreads, commissions, and overnight interest rates can lead to unexpected costs for traders. Additionally, any unusual or hidden fees can significantly impact profitability. Traders should be wary of brokers that do not clearly outline their fee structures, as this can indicate potential attempts to obscure costs that may arise during trading.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Mirae AFs approach to fund safety is unclear, with no information provided about fund segregation or investor protection measures.

The absence of a clear policy regarding fund safety can be alarming for potential clients. Reputable brokers typically implement strict measures to protect client funds, including segregating client accounts from operational funds and providing negative balance protection. The lack of such disclosures from Mirae AF raises serious concerns about the safety of client investments.

Customer Experience and Complaints

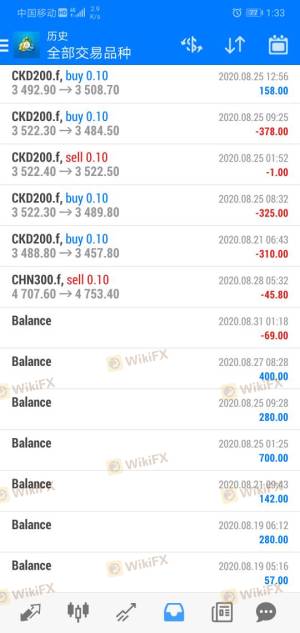

Customer feedback is a valuable resource for assessing a broker's reliability. While there may be some positive reviews, a closer examination reveals a pattern of complaints, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Fair |

Typical complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. These issues can significantly affect the trading experience and raise concerns about the broker's operational integrity. For instance, some users have reported long delays in processing withdrawals, which can be particularly distressing for traders needing quick access to their funds.

Platform and Execution

The trading platform's performance and execution quality are critical factors for traders. While Mirae AF may offer a standard trading platform, user experiences indicate potential issues with execution quality, including slippage and order rejections.

Traders have reported instances of poor execution, where orders are not filled at the expected prices, leading to losses. Such issues can be indicative of underlying platform manipulation or technical limitations. A reliable broker should provide a robust trading platform with minimal slippage and high execution reliability to ensure a fair trading environment.

Risk Assessment

Utilizing Mirae AF comes with inherent risks that potential traders should consider. The absence of regulation, unclear trading conditions, and customer complaints contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and regulation. |

| Financial Risk | High | Unclear fee structures and fund safety measures. |

| Operational Risk | Medium | Issues with execution quality and customer service. |

To mitigate these risks, traders should conduct thorough research, consider alternative brokers with robust regulatory oversight, and ensure they understand the trading conditions before committing their funds.

Conclusion and Recommendations

In conclusion, the investigation into Mirae AF raises significant concerns regarding its safety and legitimacy. The lack of regulation, unclear trading conditions, and a pattern of customer complaints suggest that this broker may not be a safe choice for traders.

Is Mirae AF safe? The evidence indicates that potential investors should exercise extreme caution. For traders seeking reliable options, it is advisable to consider established brokers with strong regulatory backing and transparent operational practices. Alternatives such as well-regarded platforms with proven track records may offer a safer trading environment.

In summary, while Mirae AF may present attractive features, the risks associated with trading through this broker warrant careful consideration and a thorough evaluation of safer alternatives.

Is Mirae AF a scam, or is it legit?

The latest exposure and evaluation content of Mirae AF brokers.

Mirae AF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mirae AF latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.