GTC Markets 2025 Review: Everything You Need to Know

Executive Summary

GTC Markets calls itself a trusted forex broker around the world. It offers advanced trading platforms and competitive spreads across multiple asset classes, making it appealing to many traders. This comprehensive gtc markets review examines a broker that provides trading opportunities in forex, CFDs, precious metals, commodities, stocks, and indices. The platform advertises low spreads, demo account options, and swap-free trading alternatives. However, user feedback presents a mixed picture of the overall trading experience.

The broker targets forex traders, CFD enthusiasts, and investors seeking competitive trading conditions. GTC Markets holds a 3.34 TrustScore based on available user ratings. This score indicates moderate user satisfaction with notable areas of concern that potential clients should consider carefully. Key features include access to advanced trading platforms, multiple asset classes, and competitive pricing structures. Potential traders should carefully evaluate the platform's regulatory standing and user feedback before committing to live trading accounts.

The primary appeal of GTC Markets lies in its diverse asset offerings and advertised low-cost trading environment. This makes it potentially suitable for various trading strategies and experience levels.

Important Notice

Prospective traders should exercise caution when considering GTC Markets. The reason is limited publicly available regulatory information that raises red flags. The absence of clearly stated licensing details raises questions about the broker's oversight and compliance with international financial regulations. This gtc markets review is based on publicly available information and user feedback, and readers should independently verify all claims before opening trading accounts.

Regional regulations vary significantly across different countries and jurisdictions. What may be permissible in one jurisdiction could be restricted in another, creating potential legal issues for traders. Traders are strongly advised to confirm the broker's legal status in their specific location and ensure compliance with local financial regulations before engaging in any trading activities.

Rating Framework

Broker Overview

GTC Markets operates as an international forex and CFD broker. The company emphasizes its global reach and commitment to providing top-tier liquidity to traders worldwide. The company focuses on delivering comprehensive trading solutions across multiple financial markets, positioning itself as a versatile platform for both novice and experienced traders. GTC Markets has built its reputation on offering competitive trading conditions and advanced technological infrastructure.

The broker's business model centers on providing access to diverse financial instruments. It maintains competitive pricing structures that appeal to cost-conscious traders. GTC Markets targets traders seeking exposure to international markets through a single platform, offering the convenience of multi-asset trading without the need for multiple broker relationships. The platform emphasizes its commitment to technological advancement and market access as key selling points.

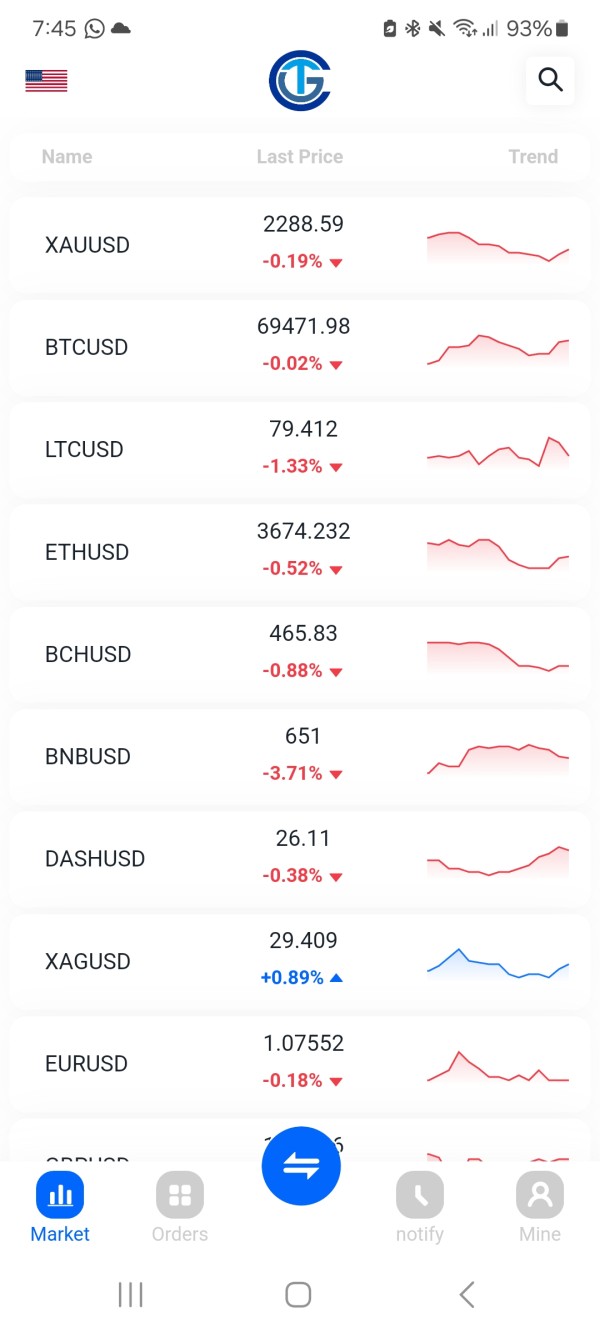

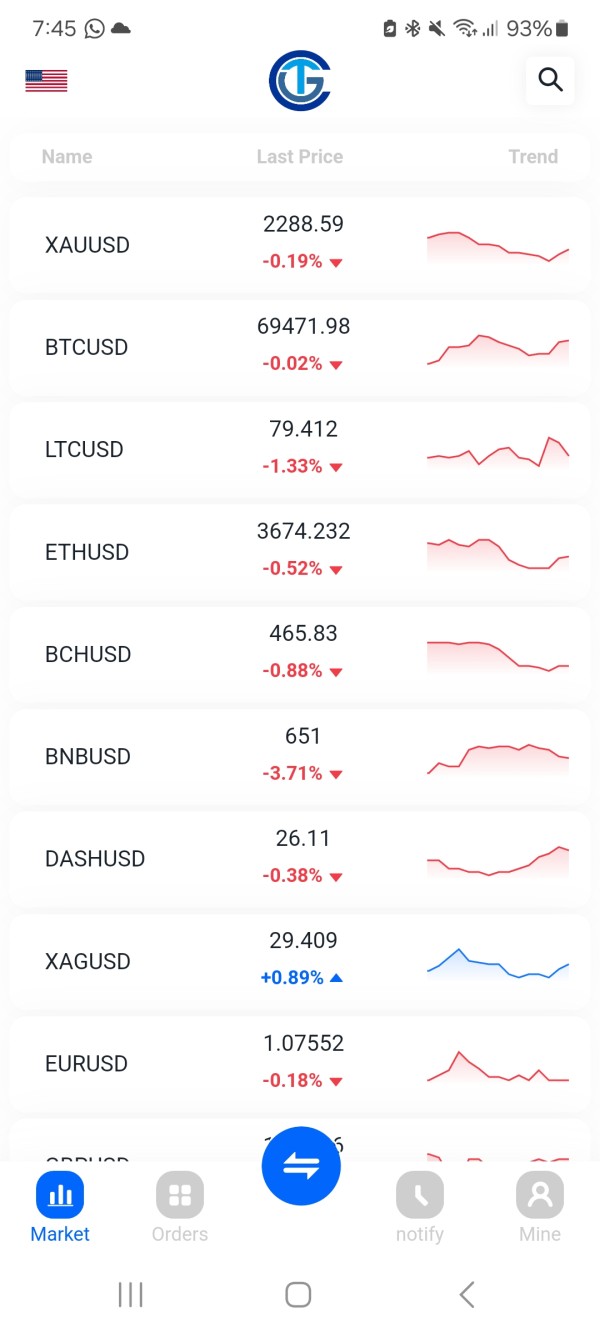

GTCFX serves as the trading platform brand associated with GTC Markets. It provides advanced trading technology designed to meet modern trading demands across various market conditions. The platform supports trading across forex pairs, CFDs, precious metals, commodities, stocks, and indices, offering traders comprehensive market access. This gtc markets review notes that while the broker advertises sophisticated trading infrastructure, the actual user experience varies according to available feedback.

Regulatory Information: Available sources do not provide specific details about GTC Markets' regulatory oversight or licensing jurisdictions. This represents a significant concern for potential traders seeking regulated broker relationships.

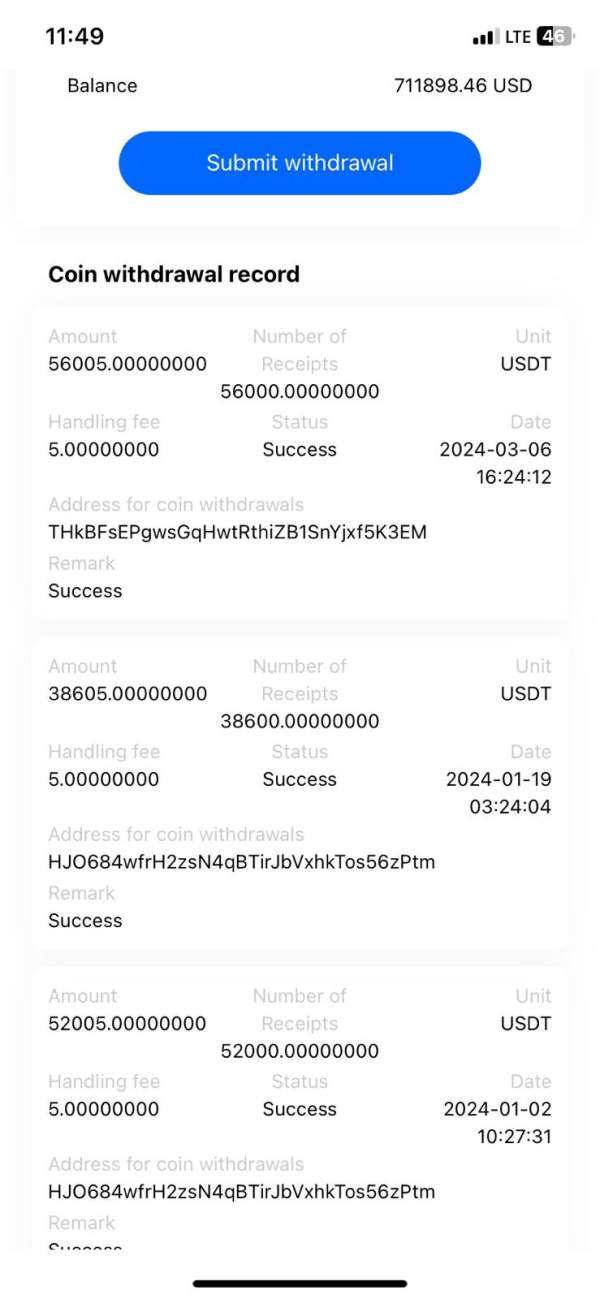

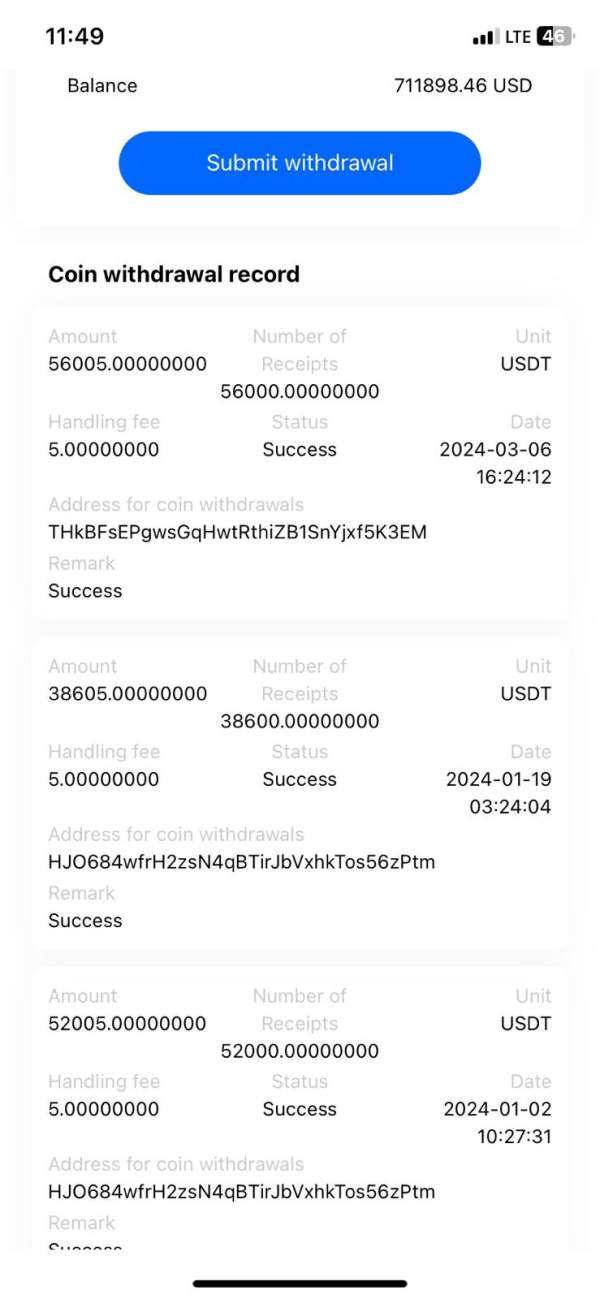

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. Traders require direct inquiry with the broker to obtain this crucial information.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in publicly available information.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available sources. Traders should inquire about any ongoing campaigns directly with the broker to learn about potential incentives.

Tradeable Assets: GTC Markets offers access to forex currency pairs, CFDs on various underlying assets, precious metals including gold and silver, commodities, individual stocks, and major market indices. This provides comprehensive market exposure for diverse trading strategies.

Cost Structure: The broker advertises low spreads as a key competitive advantage. However, specific commission structures and additional trading costs require clarification through direct contact with the company.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available public information.

Platform Options: GTCFX provides the primary trading platform. It is described as offering advanced trading capabilities and modern interface design for enhanced user experience.

Geographic Restrictions: Specific information about restricted jurisdictions and regional limitations is not available in current sources.

Customer Support Languages: The range of supported languages for customer service is not specified in available documentation.

This gtc markets review emphasizes the need for traders to conduct thorough due diligence. The limited publicly available information about key trading conditions and regulatory status creates uncertainty for potential clients.

Account Conditions Analysis

The account conditions offered by GTC Markets present a mixed picture. This is due to limited publicly available information about specific account types and their requirements. Without detailed information about minimum deposit amounts, account tiers, or specific features associated with different account levels, potential traders face uncertainty about what to expect when opening accounts.

The absence of clear information about account opening procedures creates challenges for traders. Verification requirements and documentation needed for different account types remain unclear to prospective clients. Professional traders typically require detailed information about account conditions to make informed decisions about broker selection.

Special account features such as Islamic accounts for Muslim traders remain unclear. VIP accounts for high-volume traders and demo accounts with specific terms and conditions are not clearly detailed in available sources. This lack of transparency regarding account structures makes it difficult to assess how well GTC Markets serves different trader demographics and trading styles.

The verification process and account funding requirements remain unclear without direct contact with the broker. Any restrictions on trading activities based on account type are also not specified in available information. This gtc markets review notes that the limited transparency regarding account conditions may deter traders who prefer comprehensive information before committing to a broker relationship.

GTC Markets advertises advanced trading platforms through its GTCFX brand. However, specific details about trading tools, analytical resources, and educational materials are not comprehensively documented in available sources. The platform's technological capabilities appear to focus on providing market access rather than extensive analytical tools or educational resources.

Research and analysis resources are crucial for informed trading decisions. These resources are not detailed in publicly available information about GTC Markets. Modern traders typically expect access to market analysis, economic calendars, news feeds, and technical analysis tools as standard platform features. The absence of detailed information about these resources makes it challenging to evaluate the platform's suitability for traders who rely heavily on analytical tools.

Educational resources such as webinars, trading guides, video tutorials, or market commentary are not specifically mentioned in available sources. For novice traders, the availability and quality of educational materials often influence broker selection decisions significantly. The lack of information about learning resources may indicate limited support for trader development and skill building.

Automated trading support remains undocumented in available sources. This includes Expert Advisor compatibility, API access, and algorithmic trading capabilities that advanced traders often require. Advanced traders often require these features for implementing sophisticated trading strategies, and the absence of clear information about automation support may limit the platform's appeal to this trader segment.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker evaluation. However, specific information about GTC Markets' support infrastructure is limited in available sources. The broker provides contact information including phone support at +971 800 667788 and email support at support@gtcfx.com, indicating basic communication channels.

Response times for customer inquiries significantly impact trader satisfaction. These response times are not documented in available user feedback or broker specifications. Modern traders expect prompt responses to technical issues, account questions, and trading-related concerns, particularly during active trading hours when time-sensitive issues may arise.

Service quality assessments based on user experiences are not comprehensively available. This makes it difficult to evaluate how effectively GTC Markets resolves customer issues or handles account-related requests. The 3.34 TrustScore suggests moderate user satisfaction, though specific service-related feedback is not detailed.

Multilingual support capabilities are essential for international brokers serving diverse client bases. These capabilities are not specified in available information about GTC Markets. Traders operating in non-English speaking regions typically require customer support in their native languages for effective communication about complex trading or account issues.

Support availability hours are not documented in available sources. This includes weekend and holiday coverage information that may concern traders operating in different time zones or those who trade outside standard business hours.

Trading Experience Analysis

The trading experience offered by GTC Markets centers around its GTCFX platform. The platform is described as providing advanced trading capabilities for modern traders. However, user feedback suggests mixed experiences with platform performance and overall trading conditions. The advertised low spreads represent a positive aspect of the trading environment, potentially reducing transaction costs for active traders.

Platform stability and execution speed are critical factors for successful trading. These aspects receive varied feedback from users who have tested the system. Some traders report satisfactory performance while others express concerns about platform reliability during high-volatility market conditions. The lack of comprehensive performance data makes it challenging to objectively assess platform quality.

Order execution quality is not documented in available sources. This includes slippage rates and fill speeds that professional traders need to evaluate. Professional traders require reliable order execution to implement their strategies effectively, and the absence of detailed execution statistics may concern traders who prioritize execution quality over other factors.

Mobile trading capabilities are increasingly important for modern traders. These traders require market access while away from desktop computers, but such capabilities are not specifically detailed in available information. The quality and functionality of mobile trading applications significantly impact overall user experience.

The trading environment's competitiveness is enhanced by advertised low spreads. However, it may be offset by other factors not clearly documented in available sources. This gtc markets review notes that comprehensive trading experience evaluation requires more detailed information than currently available through public sources.

Trust and Safety Analysis

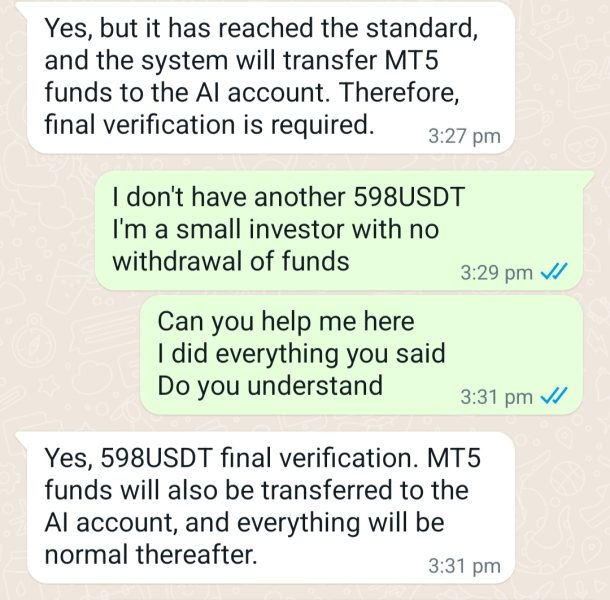

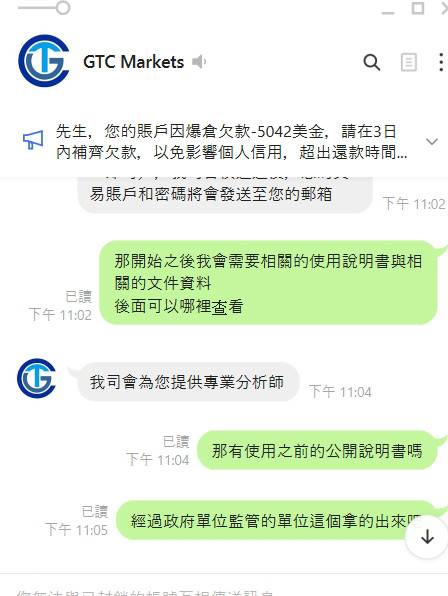

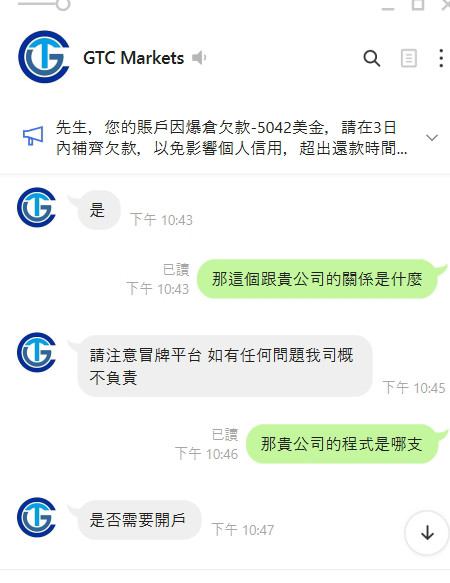

Trust and safety considerations present significant concerns in this GTC Markets evaluation. The concerns arise due to limited regulatory information and transparency issues that affect trader confidence. The absence of clearly stated regulatory oversight from recognized financial authorities raises questions about investor protection and fund security measures.

Regulatory credentials from established authorities are not documented in available sources. These authorities include the FCA, ASIC, CySEC, and other recognized regulators that provide crucial oversight. Regulatory oversight provides crucial investor protections including segregated client funds, compensation schemes, and operational oversight that many traders consider essential when selecting brokers.

Fund security measures are not detailed in publicly available information. These measures include client money segregation, bank partnerships, and insurance coverage that protect trader investments. Professional traders typically require assurance that their deposited funds are protected through appropriate safeguarding measures and regulatory frameworks.

Company transparency regarding ownership structure, operational history, and business practices is limited. This limitation is based on available sources that provide insufficient detail about company background. Transparency builds trust between brokers and clients, and the lack of detailed company information may concern traders who prefer comprehensive due diligence before establishing broker relationships.

Industry reputation and third-party assessments are not extensively documented. However, user feedback suggests concerns about legitimacy among some traders who have researched the company. The mixed user reviews and questions about regulatory status contribute to uncertainty about the broker's overall trustworthiness.

User Experience Analysis

User experience with GTC Markets presents a complex picture. This complexity is based on the available 3.34 TrustScore, indicating moderate satisfaction levels with notable areas of concern. This rating suggests that while some users find value in the platform's offerings, others experience significant issues that impact their overall satisfaction.

Interface design and platform usability are not comprehensively reviewed in available user feedback. The advanced platform claims suggest modern design principles that should enhance user experience. User interface quality significantly impacts trading efficiency and overall satisfaction, particularly for traders who spend considerable time on the platform.

Registration and account verification processes are not detailed in available user experiences. This leaves questions about onboarding efficiency and documentation requirements that new clients must navigate. Streamlined account opening procedures typically enhance user satisfaction, while complex or lengthy verification processes may frustrate new clients.

Fund management experiences are not documented in available user feedback. These experiences include deposit and withdrawal procedures, processing times, and associated fees that affect daily operations. These operational aspects significantly impact overall user satisfaction and platform usability for active traders.

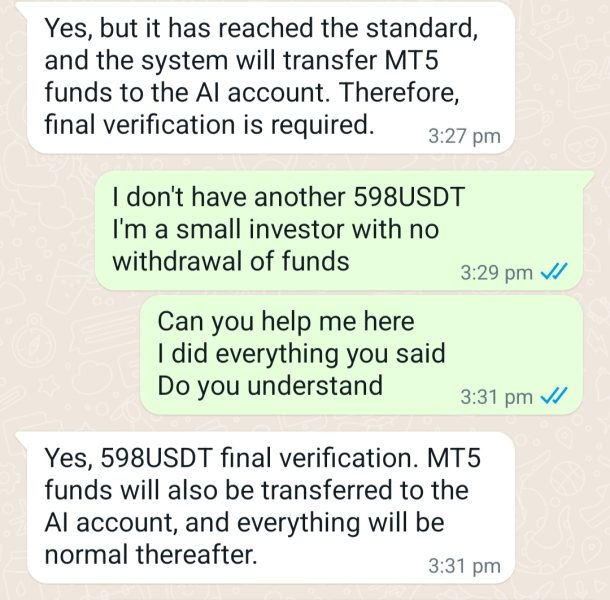

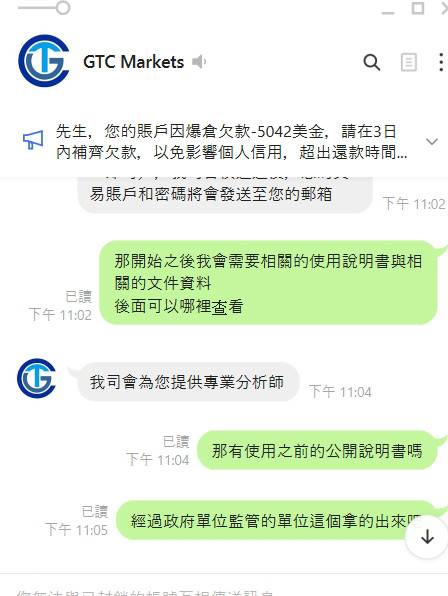

Common user complaints appear to center around legitimacy concerns and questions about the broker's regulatory status. This information comes from available feedback that highlights user skepticism. Some users express skepticism about the platform's authenticity, which may indicate underlying issues with communication, transparency, or service delivery that affect user confidence in the broker's operations.

Conclusion

GTC Markets presents itself as a global forex and CFD broker offering competitive spreads and diverse asset classes through its GTCFX platform. However, this comprehensive evaluation reveals significant information gaps and transparency concerns that potential traders should carefully consider before making any commitments. While the broker advertises advanced trading technology and low-cost trading conditions, the limited regulatory information and mixed user feedback suggest caution is warranted.

The platform may suit traders seeking access to multiple asset classes and competitive pricing structures. This applies provided they are comfortable with the regulatory uncertainty and limited transparency about key operational aspects. However, traders prioritizing regulatory oversight, comprehensive customer protection, and transparent business practices may find better alternatives in the current market.

The primary concerns identified include insufficient regulatory information, limited transparency about account conditions and fees, and mixed user experiences. These factors raise questions about service quality and legitimacy that cannot be ignored. These factors combine to create an uncertain trading environment that may not meet the standards expected by professional traders or those seeking secure, regulated broker relationships.