Is HEINERCASH safe?

Business

License

Is Heinercash Safe or Scam?

Introduction

Heinercash is a forex broker that has recently attracted attention in the online trading community. Positioned as a platform for trading various financial instruments, including forex, commodities, and cryptocurrencies, it claims to offer competitive trading conditions and a user-friendly interface. However, the importance of conducting thorough due diligence when selecting a forex broker cannot be overstated. Traders must be cautious and evaluate brokers to ensure their legitimacy and reliability, given the prevalence of scams in the forex market.

In this article, we will investigate whether Heinercash is a safe trading option or a potential scam. Our analysis is based on a comprehensive review of various online sources, including regulatory information, company background, trading conditions, customer feedback, and risk assessments. By employing a structured evaluation framework, we aim to provide a balanced and informative overview of Heinercash's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in assessing its safety and legitimacy. A well-regulated broker is typically subject to strict oversight, which helps protect traders from potential fraud or malpractice. In the case of Heinercash, the broker has claimed to be regulated by authorities in Australia (ASIC) and the United States (MSB). However, investigations reveal that these claims are misleading, as the mentioned licenses belong to a now-defunct entity.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Verified |

| MSB | N/A | United States | Not Verified |

The absence of proper regulatory backing raises significant concerns about Heinercash's operations. A lack of regulation means that the broker is not obligated to adhere to industry standards, which can jeopardize the safety of client funds. Furthermore, the historical compliance record of the broker is non-existent, reinforcing the notion that Heinercash may not be a trustworthy option for traders.

Company Background Investigation

Heinercash's company background is another critical area of scrutiny. The broker claims to operate from the United Kingdom, but details about its ownership structure and management team are scarce. The lack of transparency regarding the company's history, including its founding date and significant milestones, casts doubt on its credibility.

Moreover, the management team's professional experience in the financial industry is not disclosed, raising questions about their qualifications and ability to manage a trading platform effectively. The opacity surrounding the company's operations and its failure to provide essential information further contribute to the skepticism surrounding Heinercash.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders to gauge the potential costs and risks involved. Heinercash advertises various trading instruments and claims to provide competitive spreads and commissions. However, the actual trading conditions may not align with these claims.

Trading Costs Comparison Table

| Cost Type | Heinercash | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves facing unexpected costs, which could significantly impact their profitability. It is essential for traders to be aware of any unusual fee policies that may exist within the broker's framework.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Heinercash's approach to fund security is unclear, raising alarms about the safety of deposited funds. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection.

Unfortunately, Heinercash has not provided any information regarding these critical safety measures. The absence of such policies suggests that traders' funds may not be adequately protected, making it risky to engage with this broker. Furthermore, any historical incidents related to fund security or disputes involving client withdrawals would further emphasize the need for caution.

Customer Experience and Complaints

Analyzing customer feedback is a valuable way to assess a broker's reputation and reliability. Reviews and testimonials from actual users can reveal common complaints and the broker's responsiveness to issues. In the case of Heinercash, there are numerous reports of withdrawal difficulties and poor customer service.

Complaint Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Non-responsive |

| Unclear Fee Structures | High | Non-responsive |

Typical complaints revolve around the inability to withdraw funds, leading many users to believe they have been scammed. The broker's lack of effective communication and resolution strategies raises further concerns about its legitimacy. With multiple reports of traders feeling deceived, it is essential for potential clients to consider these experiences before engaging with Heinercash.

Platform and Trade Execution

The trading platform's performance and execution quality are vital for a smooth trading experience. Heinercash claims to offer a user-friendly platform, but reviews suggest that the actual performance may not meet expectations. Issues such as slippage and order rejections have been reported, which can negatively affect trading outcomes.

Moreover, the absence of a reputable third-party trading platform, such as MetaTrader 4 or 5, raises questions about the reliability of the broker's trading infrastructure. Traders should be wary of platforms that do not provide transparent execution policies, as this could indicate potential manipulation or unfair practices.

Risk Assessment

Engaging with any broker carries inherent risks, and it is crucial for traders to evaluate these risks before proceeding. In the case of Heinercash, the overall risk profile appears to be high due to the lack of regulation, transparency, and customer satisfaction.

Risk Assessment Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No credible regulatory oversight |

| Fund Security Risk | High | Lack of transparency in fund protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Conditions Risk | High | Unclear and potentially unfavorable fees |

To mitigate these risks, traders should conduct thorough research, consider using a demo account (if available), and avoid depositing significant funds until they are confident in the broker's legitimacy.

Conclusion and Recommendations

In conclusion, the investigation into Heinercash raises significant red flags regarding its safety and reliability. The absence of proper regulation, unclear trading conditions, and numerous customer complaints suggest that this broker may not be a trustworthy option for traders.

For those considering engaging with Heinercash, it is advisable to proceed with extreme caution. If you are looking for safer alternatives, consider brokers that are well-regulated by reputable authorities, have transparent fee structures, and demonstrate a commitment to customer service.

Overall, the question "Is Heinercash safe?" leans towards a negative answer, as the evidence suggests potential risks and concerns that traders should not overlook.

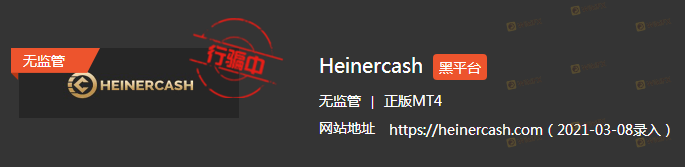

Is HEINERCASH a scam, or is it legit?

The latest exposure and evaluation content of HEINERCASH brokers.

HEINERCASH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HEINERCASH latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.