Is GTC MARKETS safe?

Business

License

Is GTC Markets Safe or a Scam?

Introduction

GTC Markets is a relatively new player in the forex trading arena, having been established in 2019. Positioned as a broker that offers a range of trading instruments, including forex pairs, indices, cryptocurrencies, crude oil, and gold, GTC Markets aims to attract both novice and experienced traders. However, the forex market is fraught with risks, making it imperative for traders to conduct thorough due diligence before committing their funds to any broker. The importance of evaluating the safety and legitimacy of forex brokers cannot be overstated, as unregulated or poorly regulated firms can expose traders to significant financial risks, including fraud and loss of funds.

This article aims to provide a comprehensive analysis of GTC Markets, exploring its regulatory status, company background, trading conditions, client fund safety measures, customer experiences, and overall risk assessment. By synthesizing information from various sources, including user reviews and regulatory databases, this article will help traders determine whether GTC Markets is a safe trading environment or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical aspect that directly impacts its safety and legitimacy. GTC Markets operates without a valid regulatory license, which raises significant concerns regarding its trustworthiness. The absence of oversight from a recognized financial authority means that the broker is not subject to stringent regulations that protect traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation indicates that GTC Markets does not adhere to the same standards of accountability and transparency required of regulated brokers. This unregulated status increases the likelihood of unethical practices, such as fund mismanagement and withdrawal difficulties. Historical compliance records are non-existent, further complicating the evaluation of GTC Markets' reliability. Given these factors, it is essential for potential clients to approach GTC Markets with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

GTC Markets, registered in the United Kingdom, has been operational for approximately five years. However, details regarding its ownership structure and management team remain vague. The lack of transparency surrounding the company's leadership raises concerns about its operational integrity. A broker's management team plays a crucial role in determining its credibility, and without clear information on the qualifications and experience of the individuals at the helm, it becomes challenging to assess the broker's reliability.

Furthermore, the company's history is marked by a lack of verifiable achievements or milestones that would typically establish a broker's reputation in the industry. The absence of a well-defined corporate structure and the lack of publicly available information about its operations contribute to an overall perception of opacity. This raises red flags for potential investors, as brokers with unclear backgrounds often operate in ways that may not align with industry best practices.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is paramount. GTC Markets offers various account types, including standard, ECN, premium, and pro accounts, with a minimum deposit requirement of $50. However, the absence of clear information regarding spreads, commissions, and other trading costs raises concerns about potential hidden fees.

| Fee Type | GTC Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0 pips | 0.1 - 0.5 pips |

| Commission Structure | Unknown | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

The spread starting from 0 pips appears attractive at first glance; however, the lack of transparency regarding commission structures and other fees may lead to unexpected costs that can erode trading profits. Additionally, the absence of detailed information on overnight interest rates may hinder traders' ability to make informed decisions.

Traders should also be wary of any unusual fee policies that could affect their overall trading experience. The lack of clarity surrounding GTC Markets' fee structure is a significant drawback, potentially leading to dissatisfaction among clients who may find themselves burdened by unexpected charges.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. GTC Markets' unregulated status raises significant questions about its fund safety measures. Regulated brokers are typically required to maintain client funds in segregated accounts, ensuring that traders' money is protected in case of insolvency. However, GTC Markets does not provide clear information regarding its fund management practices.

Moreover, the absence of investor protection schemes, which are often mandated by regulatory authorities, leaves clients vulnerable in the event of financial mismanagement. The lack of negative balance protection further exacerbates the risk, as traders could potentially lose more than their initial investment. Historical issues related to fund safety or disputes have not been disclosed, making it difficult to assess the broker's track record in this regard.

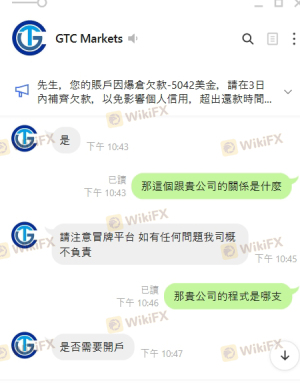

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Reviews of GTC Markets reveal a mixed bag of experiences, with many traders expressing frustration over withdrawal difficulties and lack of responsive customer support. These issues are particularly concerning, as they can significantly impact a trader's overall experience and confidence in the broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Customer Support | Medium | Unresolved queries |

| Transparency Concerns | High | No clear answers |

Typical complaints include long waiting times for withdrawals and a perceived lack of transparency regarding account management. These issues suggest that GTC Markets may not prioritize customer service, which is critical for maintaining trust in the forex trading environment. Notably, several traders have reported difficulties in retrieving their funds, a situation that can lead to significant financial distress.

Platform and Execution

The trading platform is a critical component of the trading experience. GTC Markets offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, user reviews indicate that the platform's performance can be inconsistent, with reports of slippage and execution delays during volatile market conditions.

Traders have raised concerns about the potential for order manipulation, particularly in times of high volatility. Instances of rejected orders and delayed executions have been reported, which could undermine the trading experience and lead to financial losses. The overall reliability of the trading platform is crucial, and any signs of manipulation or poor execution quality must be taken seriously.

Risk Assessment

Trading with GTC Markets presents a range of risks that potential clients should carefully consider. The absence of regulation, combined with a lack of transparency regarding fees and fund safety, contributes to an elevated risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Financial Risk | High | Lack of fund segregation and investor protection. |

| Operational Risk | Medium | Potential for execution issues and order manipulation. |

To mitigate these risks, traders should consider using only a small portion of their capital when trading with GTC Markets and should remain vigilant regarding their account management. Additionally, seeking alternative brokers with robust regulatory oversight may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, GTC Markets raises several red flags that warrant caution. The lack of regulation, coupled with unclear trading conditions and a history of customer complaints, suggests that this broker may not be a safe choice for traders. While GTC Markets offers attractive trading features, the underlying risks associated with its unregulated status and questionable customer service practices make it a potentially hazardous option.

For traders seeking a reliable forex broker, it is advisable to consider well-regulated alternatives with proven track records in customer service and fund safety. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks and transparent trading conditions, making them more trustworthy options for forex trading.

Ultimately, the decision to trade with GTC Markets should be made with careful consideration of the risks involved, and traders are encouraged to conduct thorough research before proceeding.

Is GTC MARKETS a scam, or is it legit?

The latest exposure and evaluation content of GTC MARKETS brokers.

GTC MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTC MARKETS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.