Acl Technology 2025 Review: Everything You Need to Know

Summary

This Acl Technology review looks at a forex broker that traders consider safe, though it gets a neutral rating overall. The broker stands out for its amazing technical performance, including 0ms average trading speed and zero spread costs, which makes it great for traders who want fast execution and low costs.

Acl Technology seems to focus on traders who value quick trade execution and low trading costs. The broker's technical setup shows strong abilities in fast order processing. This can be important for scalping strategies and high-frequency trading. However, the company doesn't share much about its background, rules it follows, or full service list, so potential users should research carefully before choosing this platform.

The broker's safety rating gives some comfort to traders worried about fund security. The lack of detailed rule information means traders should check current licensing status on their own. Acl Technology appears to be a technically skilled broker with specific strengths in execution speed and cost structure. This makes it potentially good for experienced traders with specific technical needs.

Important Notice

Traders should know that information about Acl Technology's rules and regional differences is not fully detailed in current sources. This may mean there are differences in services, rule oversight, and client protections based on the trader's location and the specific rules under which they would operate.

This review uses available user feedback, technical details, and public information about Acl Technology's services. The evaluation may not cover all parts of the broker's operations, especially recent changes in services, rule developments, or platform updates. Future clients should verify all important information directly with the broker and make sure they follow local financial rules before opening trading accounts.

Rating Framework

Broker Overview

Acl Technology works as a forex broker that focuses on providing fast execution speeds and competitive costs for active traders. While specific details about when the company started and its background are not detailed in available sources, the broker has made its place in the forex trading community with special focus on technical performance abilities.

The broker's business model seems centered around providing rapid trade execution with minimal cost barriers. This is shown by their zero spread cost structure and exceptional 0ms average trading speed. This positioning suggests a focus on serving traders who value execution quality over comprehensive service packages or extensive educational resources.

From a technical standpoint, this Acl Technology review shows that the broker has invested significantly in infrastructure capable of delivering institutional-level execution speeds. The platform's asset classes, specific trading platform types, and comprehensive rule oversight details require further verification directly with the broker. These specifics are not thoroughly documented in currently available public information sources.

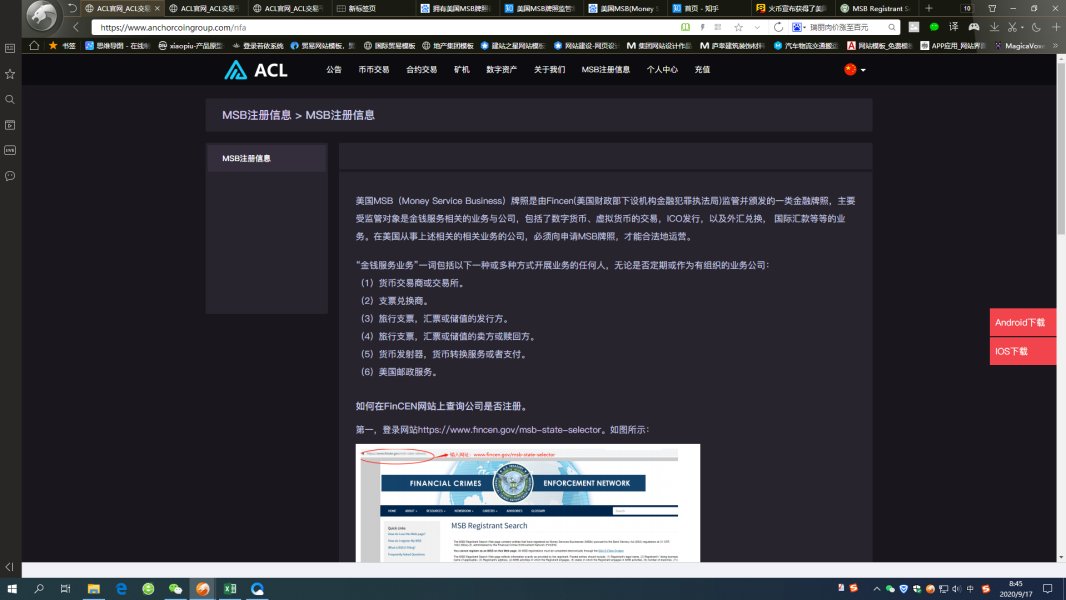

Regulatory Jurisdiction: Specific regulatory information is not detailed in available sources. This requires direct verification with the broker for current licensing status and oversight authorities.

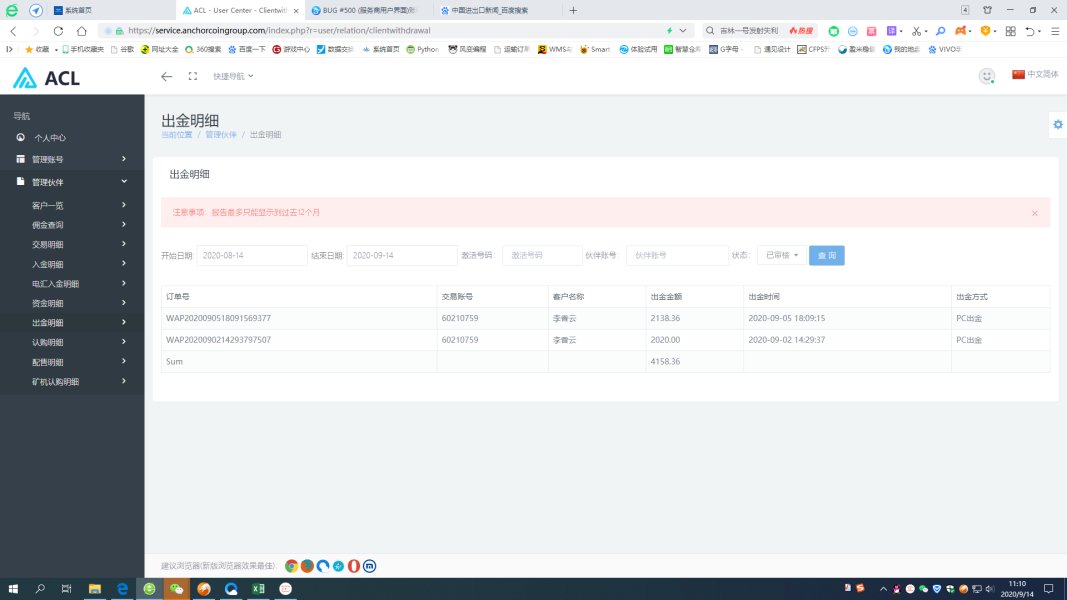

Deposit and Withdrawal Methods: Available sources do not provide comprehensive details about supported payment methods, processing times, or associated fees for funding and withdrawal operations.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not specified in available documentation. This suggests potential flexibility or tier-based structures.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in accessible sources. This indicates either absence of such offers or limited public disclosure.

Tradeable Assets: The range of available instruments, including forex pairs, commodities, indices, and other asset classes, requires direct confirmation with the broker. Specifics are not comprehensively documented.

Cost Structure: The broker offers zero spread costs according to available data. However, commission structures, overnight fees, and other potential charges are not detailed in current sources, making comprehensive cost analysis challenging.

Leverage Options: Available leverage ratios for different asset classes and account types are not specified in accessible documentation. This requires direct inquiry for accurate information.

Platform Selection: Specific trading platforms offered, including proprietary solutions or third-party integrations like MetaTrader, are not detailed in available sources.

Geographic Restrictions: Regional availability and any country-specific limitations are not comprehensively outlined in current documentation.

Customer Support Languages: Available language options for customer service interactions are not specified in accessible sources.

This Acl Technology review highlights the need for direct communication with the broker to obtain comprehensive details about service specifics and operational parameters.

Account Conditions Analysis

The evaluation of Acl Technology's account conditions reveals significant information gaps that impact the comprehensive assessment of their service offerings. Available sources do not provide detailed specifications about the variety of account types offered, their respective features, or the minimum deposit requirements for different tier levels. This lack of transparency makes it challenging for potential clients to understand the entry requirements and account-specific benefits.

Account opening procedures, verification requirements, and the timeframe for account activation are not detailed in accessible documentation. This absence of procedural clarity may indicate either a streamlined process or insufficient public disclosure of operational specifics. The availability of specialized account features, such as Islamic accounts for Shariah-compliant trading, professional account designations, or institutional account offerings, remains unspecified in current sources.

Without comprehensive account condition details, this Acl Technology review cannot provide definitive guidance on whether the broker's account structures align with different trader profiles and capital requirements. Prospective clients should directly contact the broker to obtain detailed account specifications. This includes any tier-based benefits, account maintenance requirements, and specific terms and conditions that may apply to different account categories.

The limited availability of account condition information suggests that Acl Technology may operate with more personalized account setup procedures. This requires direct consultation to determine appropriate account configurations for individual trading needs and regulatory compliance requirements.

The assessment of Acl Technology's tools and resources reveals a significant information gap in available documentation. Current sources do not provide comprehensive details about the trading tools, analytical resources, or educational materials offered to clients. This absence of information makes it challenging to evaluate the broker's commitment to supporting trader development and providing comprehensive market analysis capabilities.

Research and analysis resources, including market commentary, technical analysis tools, economic calendars, and fundamental analysis materials, are not detailed in accessible sources. The availability of advanced charting capabilities, custom indicators, or proprietary analytical tools remains unspecified. This limits the ability to assess the platform's analytical depth.

Educational resources such as webinars, trading tutorials, market education materials, or mentorship programs are not documented in current sources. This gap suggests either limited educational offerings or insufficient public disclosure of available learning resources. For traders seeking comprehensive educational support, this represents a significant consideration in broker selection.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, or API access for custom trading solutions, is not detailed in available information. The absence of these specifications makes it difficult for traders interested in automated strategies to assess platform suitability.

The limited information about tools and resources in this Acl Technology review indicates that prospective clients should directly inquire about available analytical tools, educational resources, and platform capabilities. This ensures alignment with their trading requirements and development needs.

Customer Service and Support Analysis

Customer service evaluation for Acl Technology reveals mixed indicators based on available information. The documented staff rating of 3.6 out of 5 suggests moderate satisfaction levels among users, indicating room for improvement in service quality and responsiveness. This rating provides some insight into the overall customer experience, though it lacks context about specific service areas or resolution capabilities.

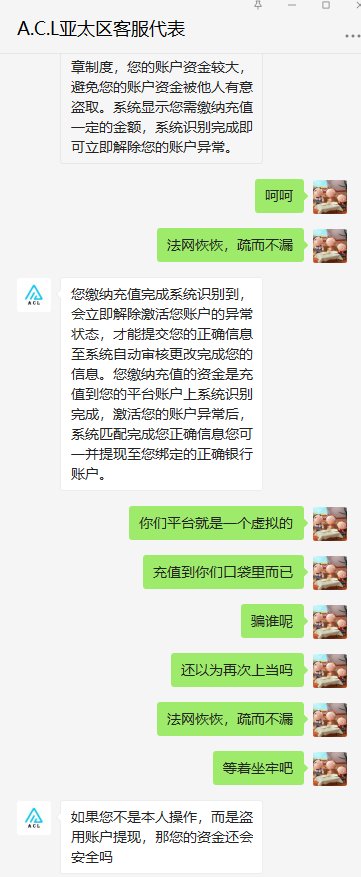

Available sources do not provide comprehensive details about customer support channels, including whether the broker offers live chat, telephone support, email assistance, or ticket-based systems. The absence of specific contact methods and availability hours makes it difficult for potential clients to understand how they can access support when needed.

Response time metrics, which are crucial for active traders requiring immediate assistance, are not documented in accessible sources. The lack of service level agreements or response time commitments represents a transparency gap. This may concern traders who prioritize reliable customer support access.

Multilingual support capabilities are not specified in current documentation, potentially limiting accessibility for international clients. The geographic coverage of customer support and any regional variations in service quality remain unclear from available information.

Problem resolution processes, escalation procedures, and the availability of dedicated account management for different client categories are not detailed in accessible sources. This Acl Technology review emphasizes the importance of directly verifying customer support capabilities and service standards before committing to the platform. This is particularly important for traders who anticipate requiring regular assistance or have specific support requirements.

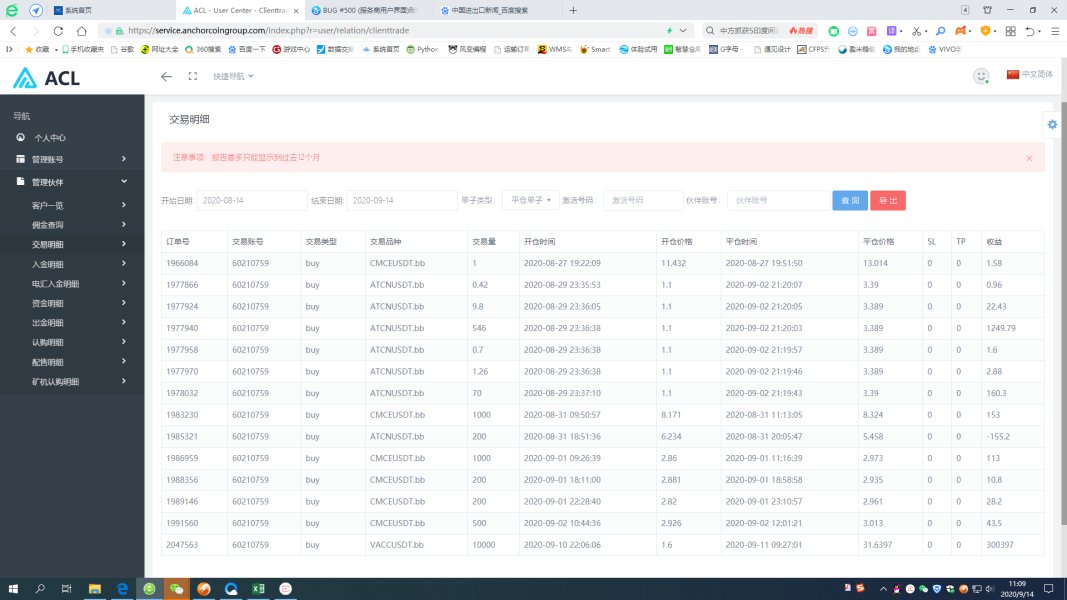

Trading Experience Analysis

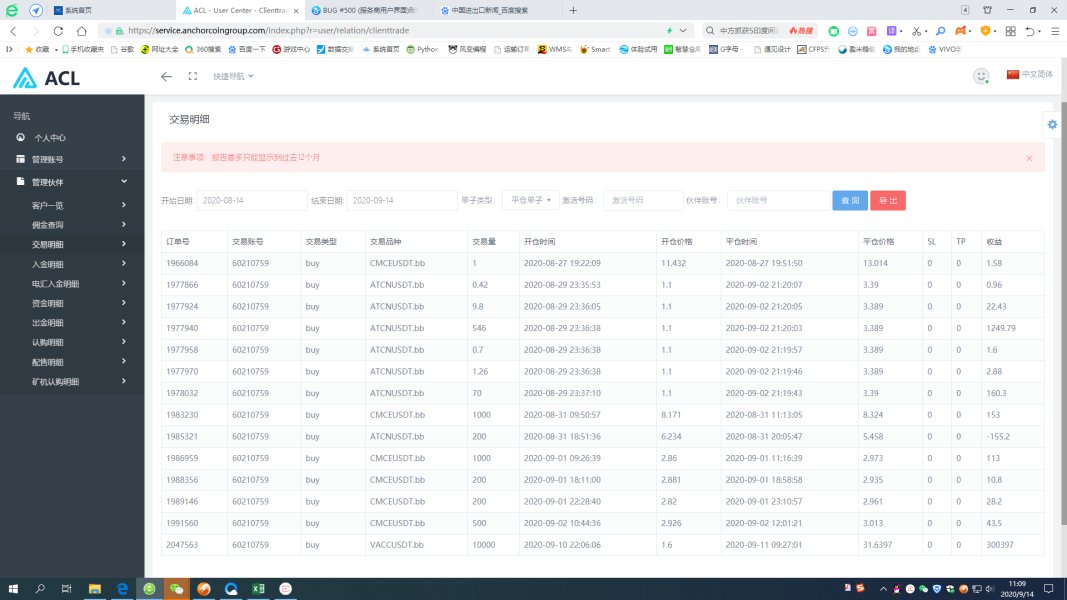

The trading experience evaluation reveals Acl Technology's strongest performance area, with impressive technical capabilities that distinguish it from many competitors. The documented average trading speed of 0ms represents exceptional execution performance. This indicates sophisticated infrastructure capable of processing orders with minimal latency. This technical achievement is particularly valuable for scalping strategies, high-frequency trading, and situations where execution speed directly impacts profitability.

The zero spread cost structure provides significant cost advantages for active traders, potentially reducing trading expenses considerably compared to brokers with traditional spread-based pricing models. However, the absence of detailed commission structure information means traders cannot calculate total trading costs comprehensively without additional clarification from the broker.

Platform stability metrics, uptime statistics, and system reliability data are not comprehensively documented in available sources. While the exceptional speed metrics suggest robust technical infrastructure, comprehensive platform performance data would strengthen confidence in system reliability during high-volatility periods or peak trading sessions.

Order execution quality beyond speed metrics, including slippage rates, rejection rates, and requote frequency, requires additional verification. Mobile trading experience, cross-platform synchronization, and the availability of advanced order types are not detailed in accessible documentation.

This Acl Technology review highlights the broker's clear strength in execution speed and cost efficiency, making it potentially attractive for traders prioritizing these technical aspects. However, comprehensive trading experience evaluation requires additional information about platform features, reliability metrics, and advanced trading capabilities. These should be verified directly with the broker.

Trust and Safety Analysis

The trust and safety evaluation for Acl Technology presents a mixed assessment based on available information. The broker has been rated as safe within the forex trading community, providing some reassurance regarding fund security and operational integrity. However, the lack of specific regulatory details in accessible sources creates transparency concerns that require careful consideration.

Regulatory oversight information, including specific licensing authorities, regulatory numbers, and compliance frameworks, is not comprehensively documented in available sources. This absence of detailed regulatory information makes it challenging to verify the level of client protection and regulatory oversight. This applies to different geographic regions and client categories.

Fund safety measures, including segregated account policies, deposit insurance coverage, and client money protection protocols, are not detailed in accessible documentation. These aspects are crucial for trader confidence and should be verified directly with the broker. This ensures adequate fund protection measures are in place.

Company transparency regarding ownership structure, financial statements, and operational history is limited in available sources. The absence of comprehensive corporate disclosure may concern traders who prioritize transparency and corporate accountability in their broker selection process.

Industry reputation indicators, third-party assessments, and any regulatory actions or compliance issues are not detailed in current sources. The overall safety rating provides positive indication, but comprehensive due diligence requires additional verification of regulatory standing and compliance history.

This trust and safety analysis emphasizes the importance of direct verification of regulatory status, fund protection measures, and compliance frameworks before committing funds. This ensures adequate client protection and regulatory oversight.

User Experience Analysis

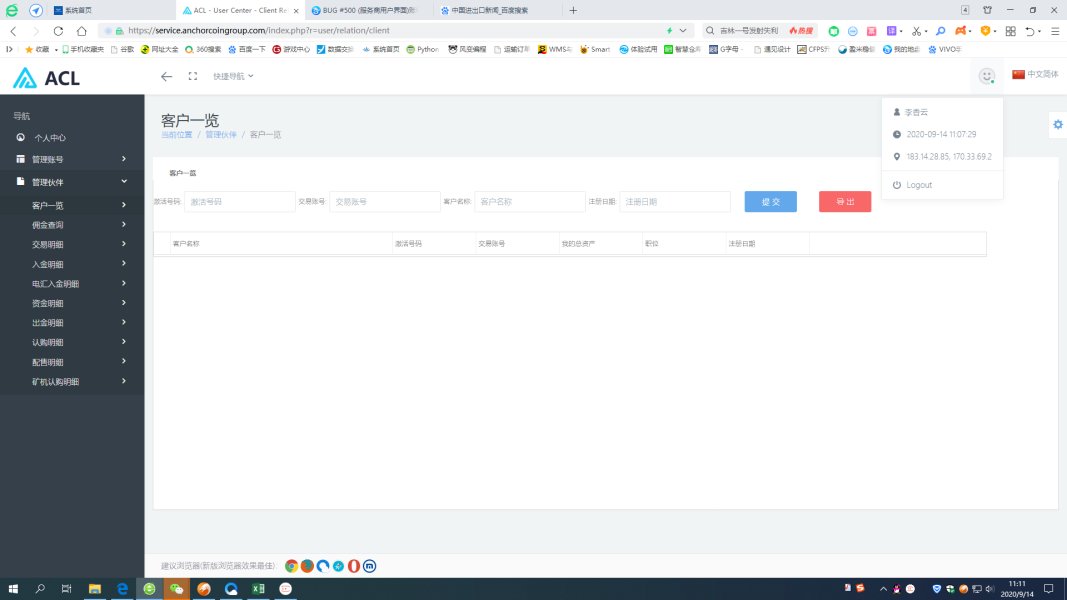

User experience evaluation for Acl Technology indicates moderate satisfaction levels based on the documented employee rating of 3.6 out of 5. This rating suggests that while the broker provides functional services, there may be areas requiring improvement to achieve higher user satisfaction and retention rates.

Interface design quality, platform usability, and navigation efficiency are not detailed in available sources, making it challenging to assess the overall user experience from a design and functionality perspective. The absence of specific user interface feedback limits understanding of how intuitive and user-friendly the platform may be for traders with different experience levels.

Registration and account verification processes are not comprehensively documented, including timeframes, required documentation, and any potential complications users might encounter during onboarding. Streamlined onboarding processes are increasingly important for user satisfaction and initial platform adoption.

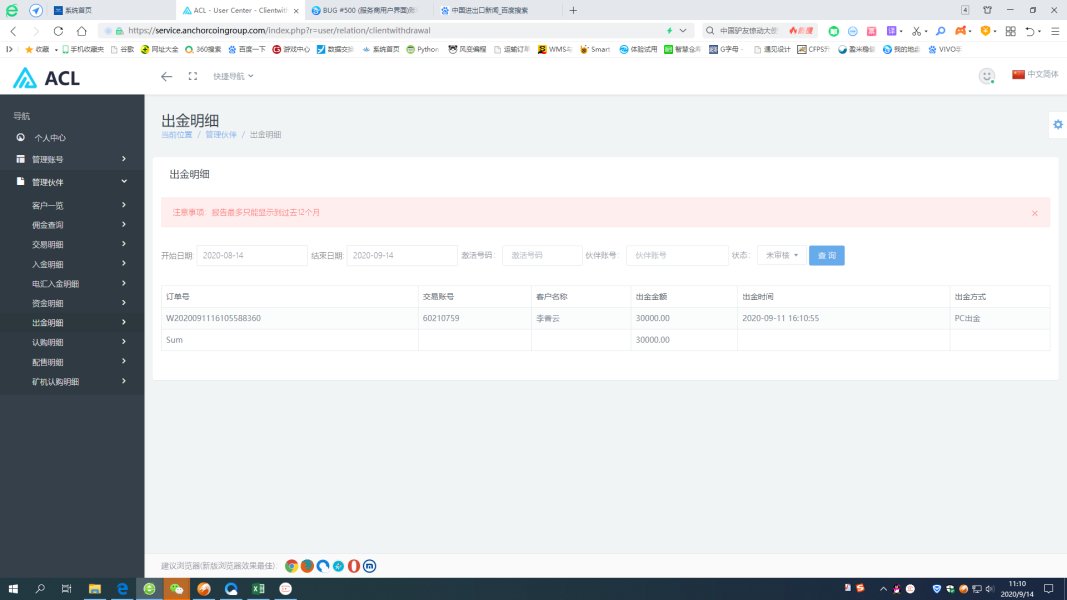

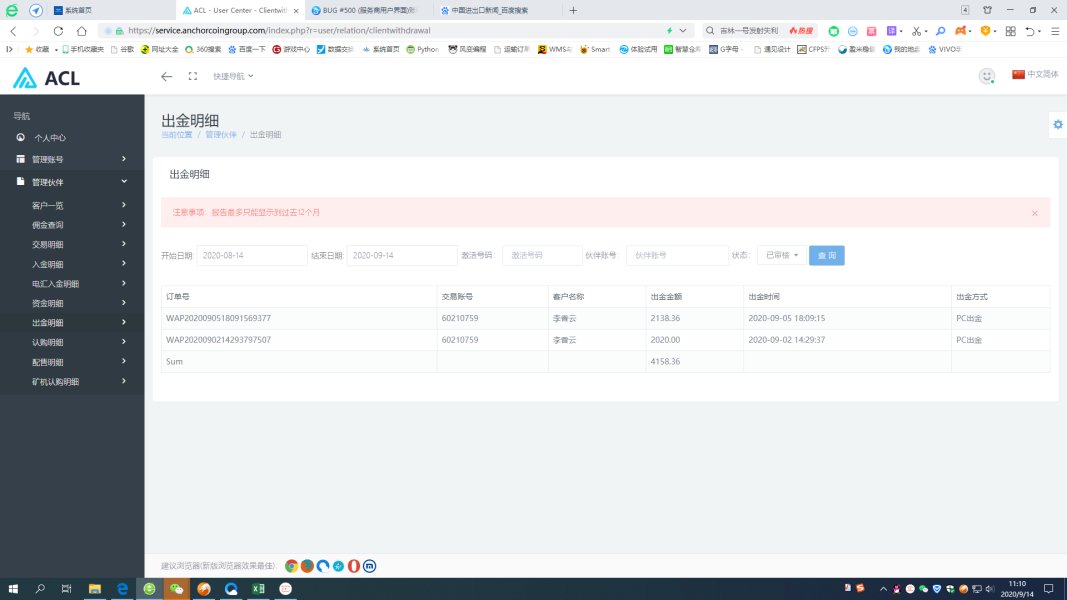

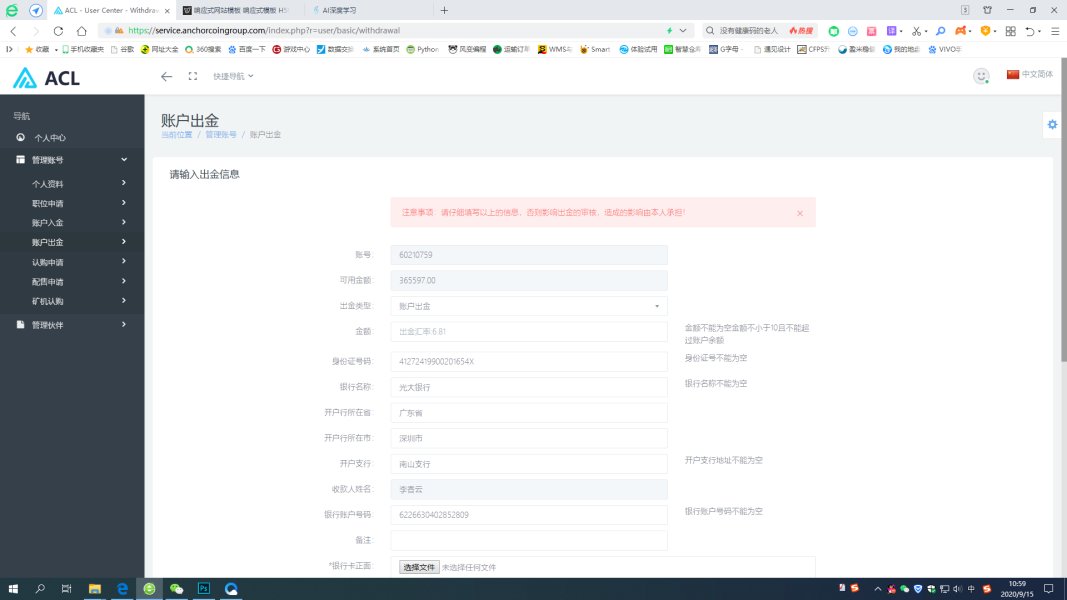

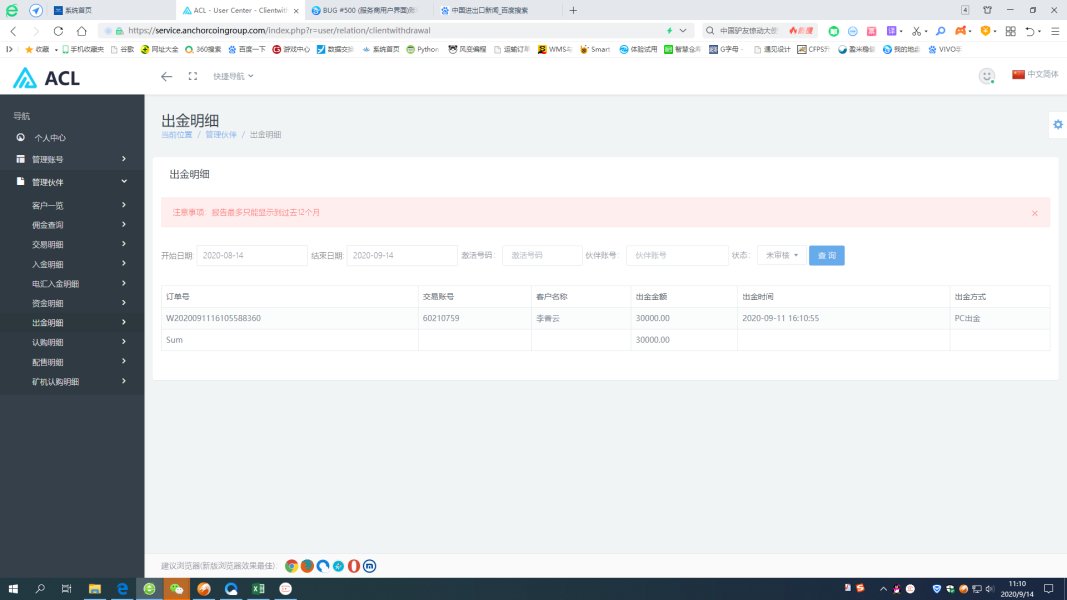

Fund operation experiences, including deposit and withdrawal processes, processing times, and any user-reported issues, are not detailed in accessible sources. These operational aspects significantly impact overall user satisfaction and should be verified through direct inquiry or user community feedback.

Common user complaints, frequently reported issues, and the broker's responsiveness to user feedback are not documented in available sources. Understanding typical user concerns would provide valuable insight into potential experience limitations and areas where the broker might need improvement.

The moderate satisfaction rating in this Acl Technology review suggests that while the broker provides functional services, prospective users should carefully evaluate whether the platform meets their specific requirements and expectations. This is particularly important regarding user interface quality, operational efficiency, and overall service experience.

Conclusion

This comprehensive Acl Technology review reveals a forex broker with notable technical strengths but limited transparency in several key areas. The broker demonstrates exceptional performance in execution speed and cost efficiency, making it potentially attractive for traders who prioritize these technical aspects. However, the significant information gaps regarding regulatory oversight, comprehensive service offerings, and detailed operational procedures require careful consideration.

Acl Technology appears most suitable for experienced traders who value rapid execution speeds and minimal spread costs, particularly those employing scalping strategies or high-frequency trading approaches. The broker's technical infrastructure capabilities suggest institutional-level execution quality that can benefit active trading strategies.

The main advantages include exceptional 0ms trading speeds and zero spread costs, providing significant technical and cost benefits for qualifying trading strategies. However, the disadvantages include limited transparency regarding regulatory status, insufficient details about comprehensive service offerings, and moderate user satisfaction ratings that suggest room for improvement in overall service quality.

Prospective clients should conduct thorough due diligence, directly verify regulatory status and service specifications, and ensure that the broker's focused approach aligns with their specific trading requirements and risk tolerance levels.