Is Blazafx safe?

Business

License

Is BlazaFX Safe or a Scam?

Introduction

BlazaFX, also known as Beth Leaster FX, positions itself as an online trading platform offering a variety of services in the forex and commodities markets. In an industry rife with both reputable and dubious brokers, it is crucial for traders to conduct thorough evaluations before committing their funds. The potential for financial loss is significant, especially when dealing with unregulated or poorly regulated brokers. This article aims to assess the safety and legitimacy of BlazaFX by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To achieve this, we will analyze data from various credible sources, including regulatory bodies, customer reviews, and expert assessments. We will also employ a structured evaluation framework to provide a comprehensive overview of whether BlazaFX is safe for trading or if it raises red flags that suggest it may be a scam.

Regulation and Legitimacy

Understanding the regulatory framework under which a broker operates is vital for assessing its legitimacy. Regulatory oversight typically ensures that brokers adhere to strict guidelines designed to protect traders. BlazaFX claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). However, there are significant inconsistencies and concerns regarding the validity of these claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001302684 | Australia | Revoked |

| VFSC | 14663 | Vanuatu | Revoked |

Despite its claims, BlazaFX has faced scrutiny for operating without valid licenses, particularly after the revocation of its VFSC license. This lack of credible regulation raises serious concerns about the broker's legitimacy and the safety of client funds. The absence of oversight from a reputable regulatory body like ASIC or the Financial Conduct Authority (FCA) means that traders have limited recourse in case of disputes or financial mishandling. Therefore, it is imperative to question whether BlazaFX is safe for trading.

Company Background Investigation

BlazaFX was established in 2017 and has since claimed to operate out of Hong Kong with additional offices in Australia and the United States. However, the company's ownership structure and management team remain ambiguous, raising further questions about its transparency and credibility.

The lack of clear information regarding the management team and their professional backgrounds adds to the skepticism surrounding BlazaFX. A reputable broker typically provides detailed information about its leadership, including qualifications and experience in the financial industry. In this case, the absence of such disclosures suggests a lack of accountability and may indicate that BlazaFX is not safe for traders.

Moreover, the company's website is registered under a service that conceals the identity of its owner, which is often a tactic used by fraudulent entities to evade scrutiny. This lack of transparency is a significant red flag, as legitimate brokers are usually upfront about their ownership and operational structure.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. BlazaFX offers various trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the overall fee structure and trading conditions appear to be less favorable when compared to industry standards.

| Fee Type | BlazaFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | From 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Rate Range | Varies | Varies |

While BlazaFX advertises competitive spreads, they are generally higher than those offered by many reputable brokers. Additionally, the lack of clarity regarding commission structures and overnight interest rates adds to the uncertainty surrounding its trading conditions. Traders should be cautious, as hidden fees and unfavorable trading conditions can lead to unexpected financial losses, further questioning whether BlazaFX is safe for trading.

Customer Fund Safety

The safety of customer funds is a paramount concern when evaluating a broker. BlazaFX claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Traders should be particularly wary of the fact that BlazaFX only accepts cryptocurrency deposits, which can complicate withdrawal processes and increase the risk of fund mismanagement. The absence of clear information regarding withdrawal methods further exacerbates concerns about the safety of funds held with BlazaFX. Historical reports indicate that clients have faced significant challenges in withdrawing their funds, leading to allegations of fraud and mismanagement.

In light of these issues, it is crucial to assess whether BlazaFX is safe for trading, especially considering the potential risks involved in using a broker with a questionable regulatory background and inadequate transparency regarding fund safety measures.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews for BlazaFX reveal a troubling pattern of complaints, particularly concerning withdrawal difficulties and lack of transparency in fees and trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

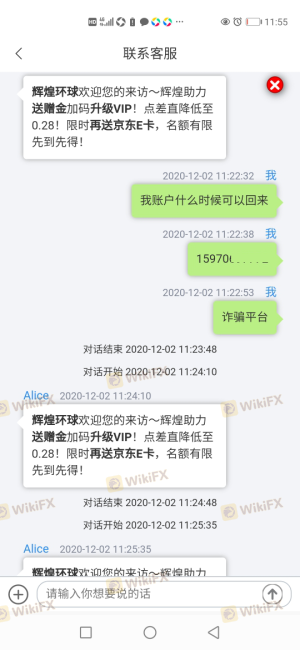

Many users report being unable to access their funds, with some claiming that their accounts were frozen without explanation. Additionally, clients have expressed frustration over the company's slow response to inquiries and complaints. These recurring issues significantly undermine confidence in BlazaFX and suggest that it may not be a trustworthy broker.

For instance, one user reported that they were unable to withdraw their funds for months, leading to financial distress. Such experiences point to a systemic issue within BlazaFX, further questioning whether BlazaFX is safe for traders.

Platform and Execution

The trading platform offered by BlazaFX is the widely used MetaTrader 4 (MT4), known for its user-friendly interface and robust analytical tools. However, the platform's performance and execution quality are critical factors that can impact a trader's experience.

Reports indicate that users have experienced slippage and order rejections, which can severely affect trading outcomes. The lack of transparency regarding execution quality raises concerns about potential manipulation or unfair practices, leading to further skepticism about the safety of trading with BlazaFX.

Risk Assessment

Engaging with BlazaFX comes with a range of risks that potential traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns about accountability. |

| Financial Risk | High | Complaints of withdrawal issues indicate potential fund mismanagement. |

| Transparency Risk | High | Ambiguous company information and hidden fees create uncertainty. |

Given these risks, it is vital for traders to exercise caution when considering BlazaFX as a trading option. Engaging with a broker that lacks proper regulation and transparency can lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that BlazaFX is not safe for trading. The broker's lack of valid regulatory oversight, combined with a history of customer complaints and transparency issues, raises significant red flags. Traders should be particularly cautious when dealing with BlazaFX, as the potential for financial loss is high.

For those seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as ASIC or FCA. Such brokers typically offer better protection for client funds and more transparent trading conditions. Prioritizing safety and transparency is essential for any trader looking to navigate the forex market successfully.

Is Blazafx a scam, or is it legit?

The latest exposure and evaluation content of Blazafx brokers.

Blazafx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Blazafx latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.