Global Reach Review 1

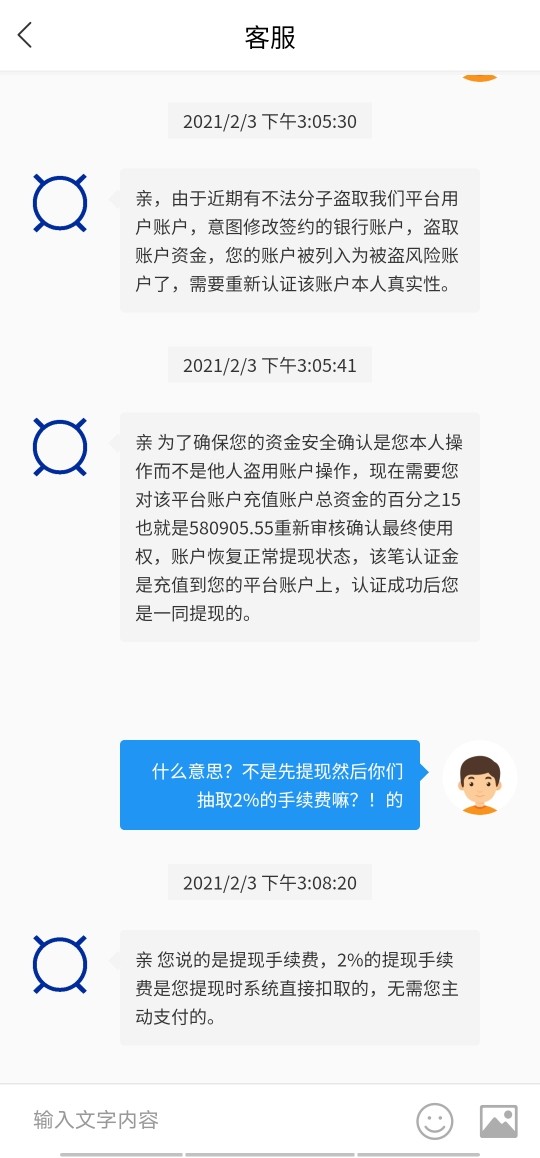

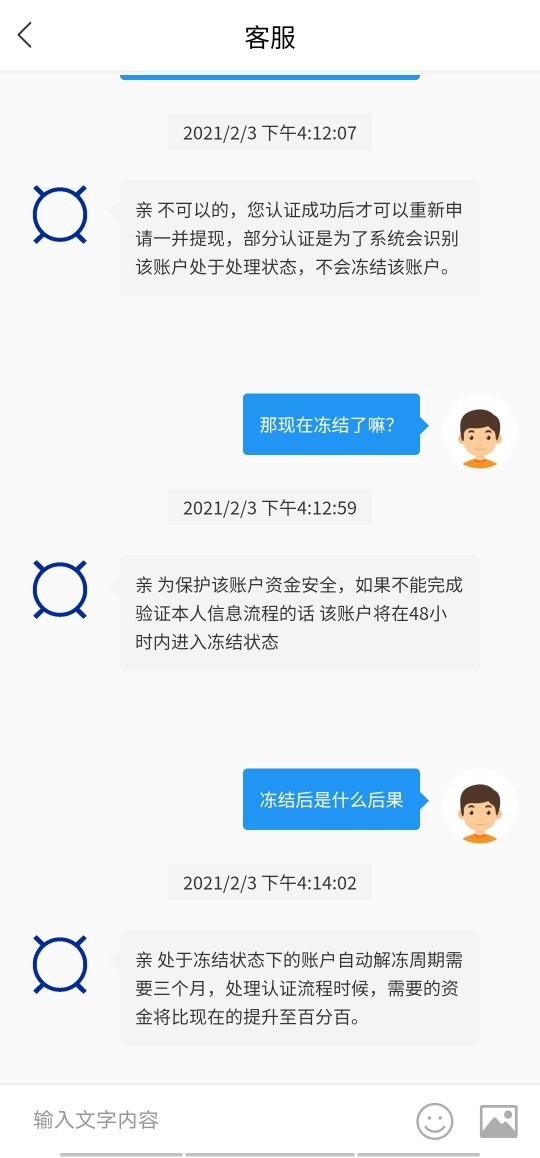

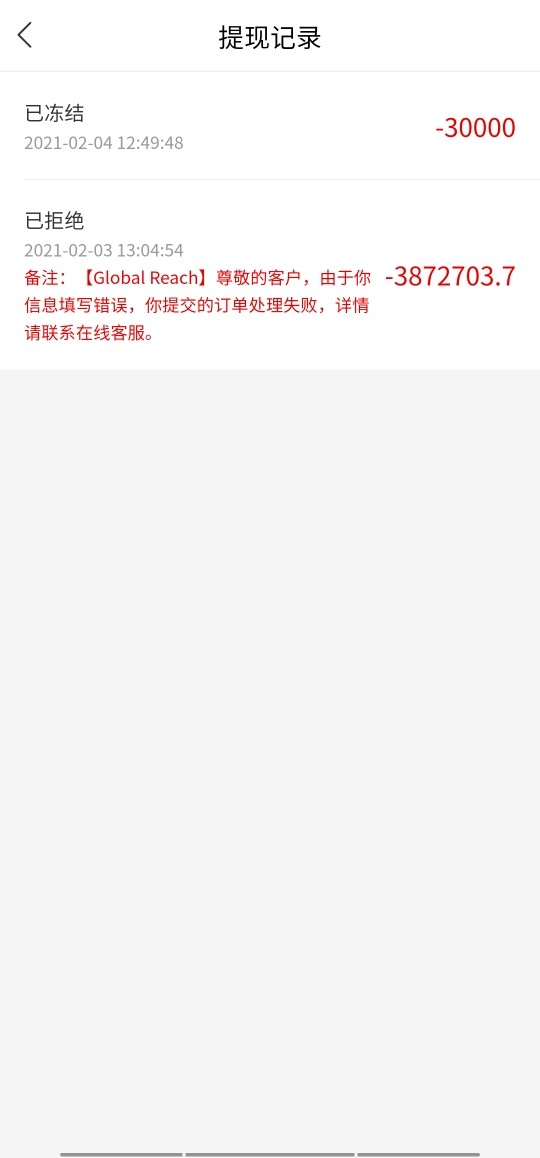

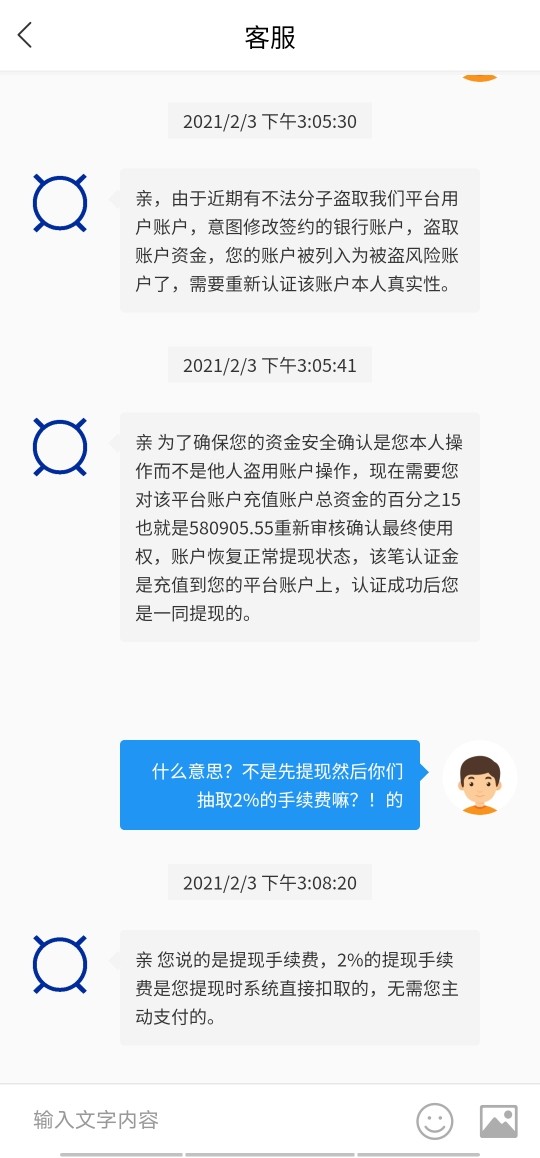

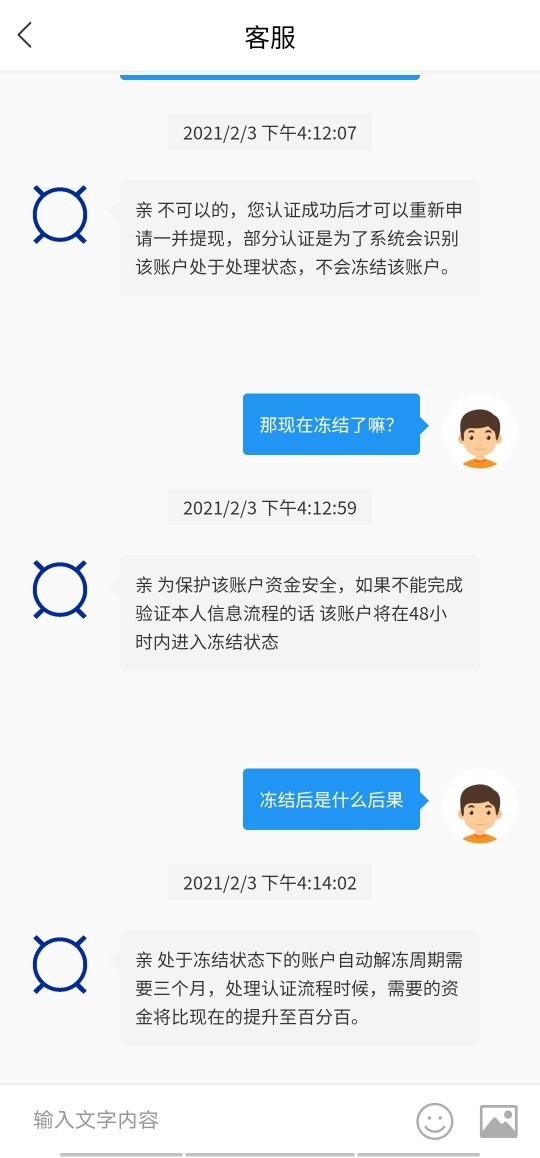

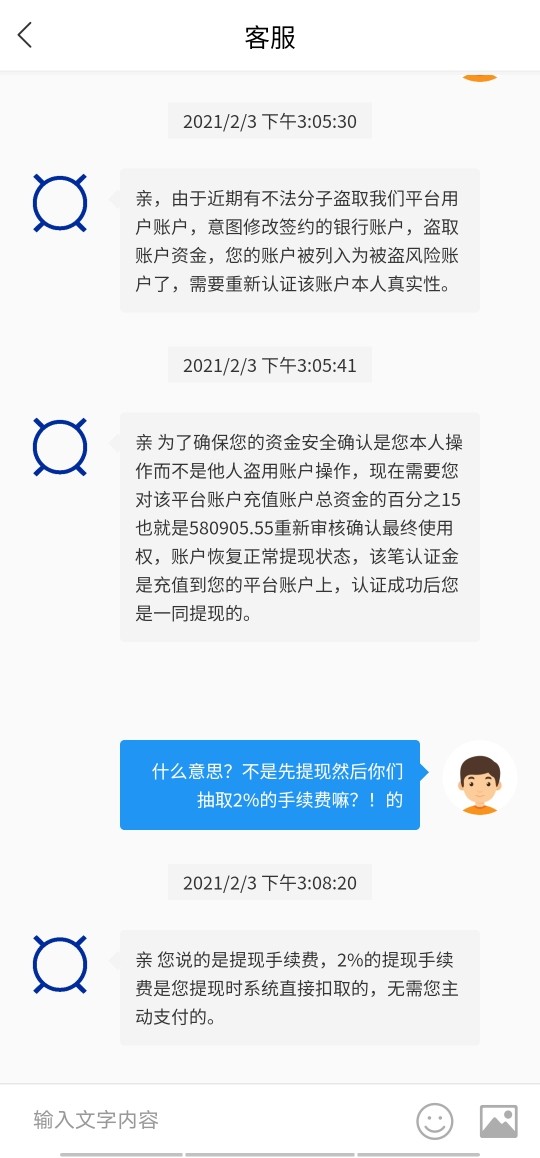

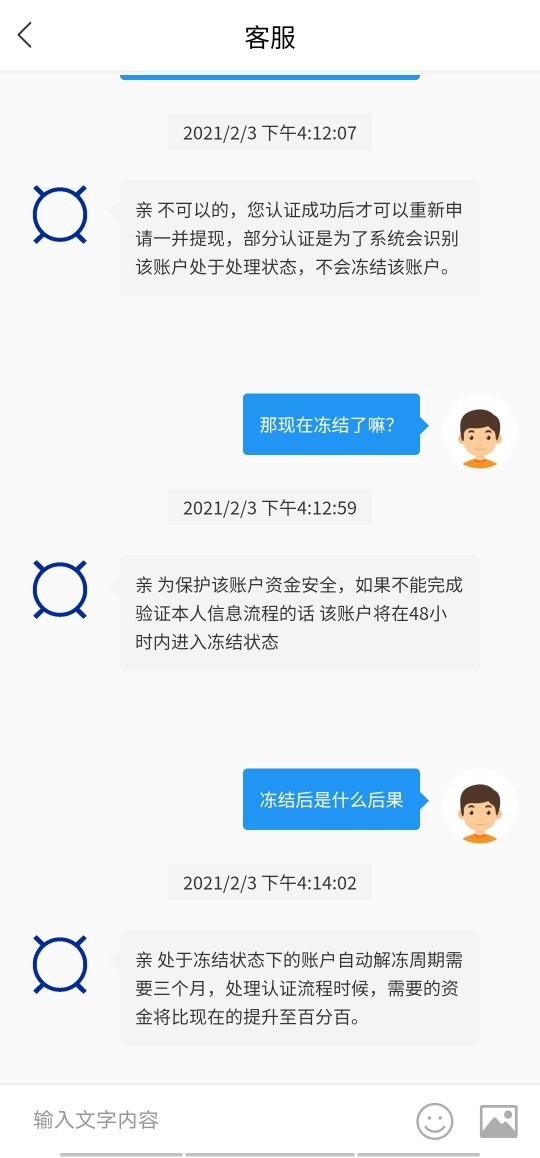

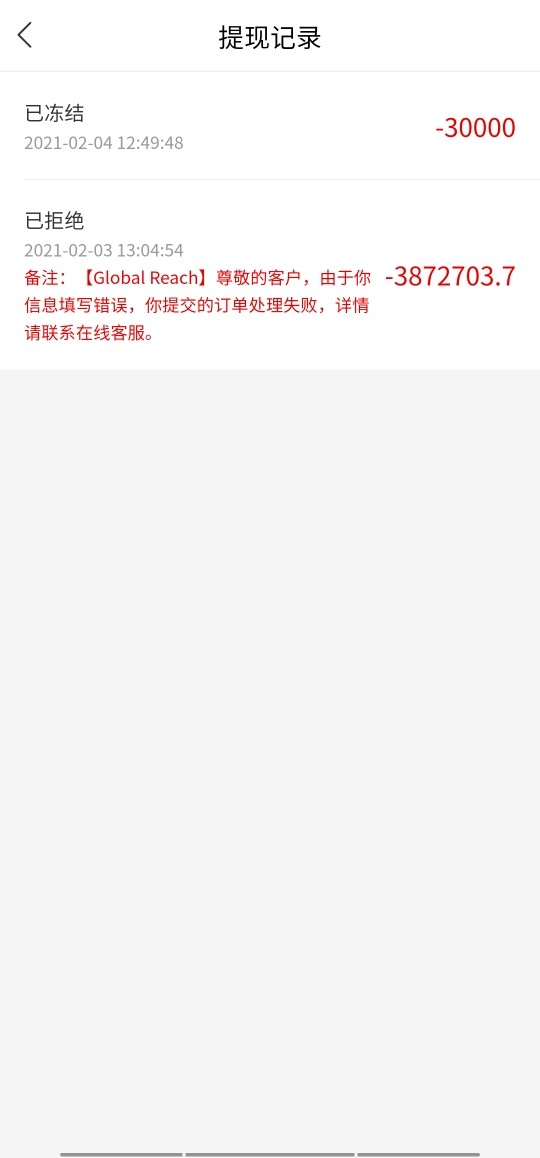

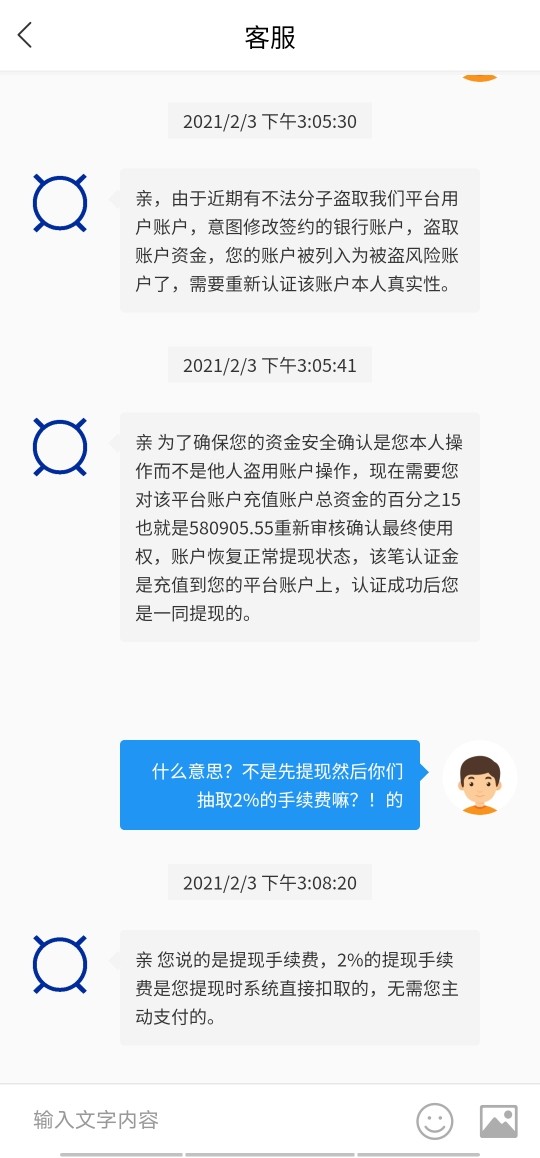

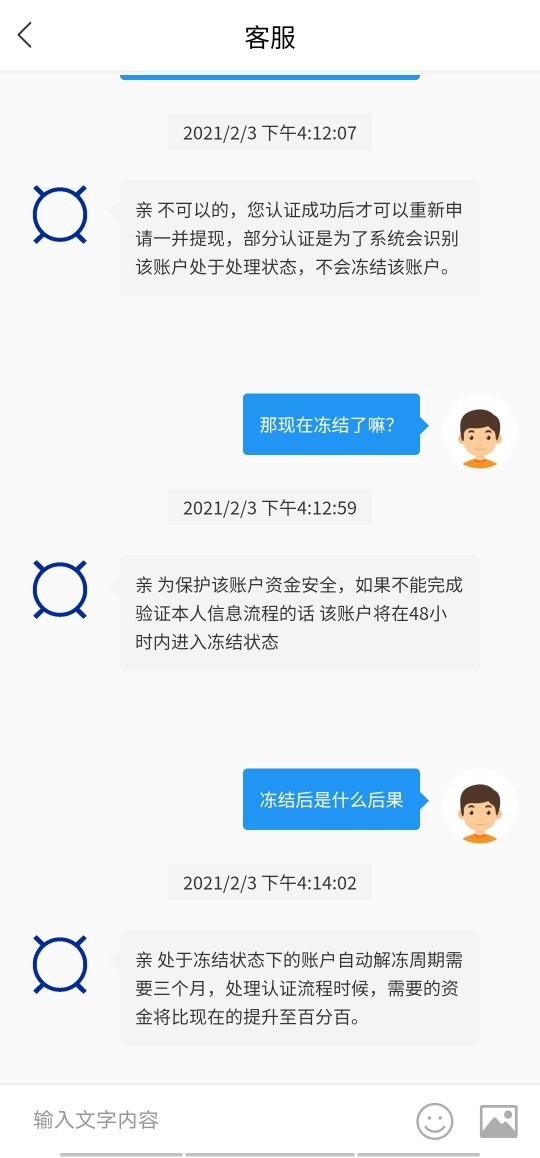

I downloaded Sugram and Global Reach under JiZhuHuiYi’s guidance. I transferred 440,000 RMB to three bank card given by the customer service. I profited 3,872,703 RMB in total while I can’t withdraw funds.

Global Reach Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I downloaded Sugram and Global Reach under JiZhuHuiYi’s guidance. I transferred 440,000 RMB to three bank card given by the customer service. I profited 3,872,703 RMB in total while I can’t withdraw funds.

Global Reach Partners is a top foreign exchange broker. The company has built a strong reputation in international financial services over many years of operation. This global reach review shows a company that has earned major recognition for excellent customer service. The firm has 644 reviews on Trustpilot that show clients are consistently satisfied with their services. Global Reach Partners operates from London at Woolgate Exchange and focuses on currency transfer services. They serve both corporate and individual clients who need reliable international money transfer solutions.

The broker has earned an expert rating of 4 on FXcompared. This rating shows the company has solid standing in the industry, which reflects years of professional service delivery. Customer feedback always highlights how the company listens to client needs. They also maintain advanced technology for service delivery that keeps pace with modern financial requirements. Global Reach Partners targets businesses and individuals who need reliable currency transfer solutions. The company positions itself as a trusted partner in international financial transactions, building long-term relationships with clients across multiple sectors.

Key strengths include exceptional customer service quality. Clients praise the company's quick responses and strong technical capabilities that support efficient transaction processing. The firm takes a professional approach to client relationships that has earned widespread recognition. Staff members receive particular praise for their reliability and expertise in handling complex international transactions. However, this review notes that detailed information about trading conditions remains limited. Regulatory framework details and specific service offerings also need more public information for complete assessment.

This Global Reach review uses publicly available information and user feedback from various sources. Readers should know that financial services rules and conditions change significantly across different areas where Global Reach operates. The company's presence worldwide means that service terms may differ depending on your location. Regulatory oversight and available features also vary based on where you live and your residency status, which affects what services you can access.

The evaluation here reflects information available when this review was written. It may not cover all aspects of the broker's services since companies regularly update their offerings and policies. Potential clients should verify current terms and conditions directly with Global Reach Partners before making financial commitments. They should also confirm regulatory status in their specific jurisdiction to ensure compliance with local requirements. This assessment uses industry standards and user experiences as its foundation. However, it cannot guarantee completeness of all available information about the company's current services and policies.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | Not Rated | Specific account terms and conditions not detailed in available sources |

| Tools and Resources | Not Rated | Information about trading tools and analytical resources not provided |

| Customer Service | 8/10 | Strong client testimonials highlighting responsive service and technical expertise |

| Trading Experience | Not Rated | Detailed trading platform performance data not available in source materials |

| Trust and Reliability | Not Rated | Regulatory information not comprehensively detailed in accessible sources |

| User Experience | Not Rated | Comprehensive user interface and platform usability data not specified |

Global Reach Partners operates from its London headquarters at 2nd Floor, Woolgate Exchange, 25 Basinghall Street. The company has established itself as a major player in foreign exchange and currency transfer services through consistent performance and client satisfaction. Global Reach Partners has built a reputation for delivering comprehensive financial services to corporate entities and individual clients. They focus on serving clients who need reliable international money transfer solutions for various business and personal purposes. While available sources do not specify the exact founding date, the firm has shown consistent growth over its operational period. Client satisfaction levels have remained high throughout the company's development, indicating stable service quality and professional management.

The business model focuses primarily on foreign exchange services and currency transfers. Global Reach Partners serves as an intermediary for clients requiring international financial transactions, providing expertise and technology to facilitate smooth cross-border payments. This global reach review shows that the company has positioned itself strategically to address growing demand for efficient cross-border payment solutions. The global economy becomes more interconnected each year, creating increased opportunities for international financial service providers like Global Reach Partners.

Platform technology and asset offerings need more detailed information from direct sources. Specific details about trading platforms and available financial instruments are not fully covered in source materials, requiring direct inquiry for complete information. Information about primary regulatory authorities overseeing the company's operations also requires verification with the firm. The company's operational structure appears designed to accommodate diverse client needs across multiple jurisdictions. However, specific regulatory frameworks governing different regional operations need individual confirmation to ensure compliance with local requirements.

Regulatory Framework: Specific regulatory authorities and jurisdictions governing Global Reach Partners' operations are not detailed in available source materials. Prospective clients should verify current regulatory status directly with the company to ensure compliance with their local requirements.

Deposit and Withdrawal Methods: Information about available funding methods is not specified in accessible sources. Processing times and associated fees for deposits and withdrawals also require direct inquiry with the company for current details.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types or services are not detailed in available information. Clients should contact Global Reach Partners directly to learn about current minimum requirements for their specific needs.

Promotional Offers: Details about current bonus structures are not provided in source materials reviewed. Promotional campaigns or special offers also require direct verification with the company for current availability and terms.

Tradeable Assets: The company specializes in foreign exchange and currency transfers. However, comprehensive information about specific currency pairs is not detailed in available sources, requiring direct inquiry for complete asset listings.

Cost Structure: Specific information about spreads requires direct inquiry with Global Reach Partners. This global reach review found limited publicly available pricing details for commissions, fees, and other trading costs that clients typically need for decision-making.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible source materials. Clients should verify current leverage policies directly with the company to understand available options for their trading needs.

Platform Selection: Details about available trading platforms are not comprehensively covered in available sources. Software options and technological infrastructure information also require direct verification with Global Reach Partners for current specifications.

Geographic Restrictions: Information about service availability in specific countries or regions is not detailed in materials reviewed. Clients should confirm service availability in their jurisdiction directly with the company before proceeding.

Customer Support Languages: Customer service quality receives high ratings from clients. However, specific language support options are not listed in available sources and require direct inquiry for current language capabilities.

The evaluation of Global Reach Partners' account conditions faces limitations due to insufficient publicly available information. Specific account types and their respective features are not detailed in source materials examined for this review. This global reach review cannot provide detailed analysis of minimum deposit requirements without more comprehensive source information. Account tier structures or specialized account offerings also need direct verification with the company for accurate details.

Standard industry practice suggests that currency transfer services typically offer different service levels. These levels usually depend on transaction volumes and client types, providing flexibility for various customer needs. However, Global Reach Partners' specific account categorization system is not detailed in accessible sources. The absence of clear information about account opening procedures represents a significant gap for potential clients who need this information for planning purposes.

Required documentation and verification timelines are also not specified in available materials. Specialized account features need direct inquiry, such as corporate accounts with enhanced transaction limits or individual accounts with specific benefits for personal use. Information about Islamic-compliant account options is not provided in source materials. Other specialized religious or regulatory accommodations also require direct verification with the company for availability and terms.

The company's London-based operations suggest adherence to UK financial services standards. However, specific account protection measures require direct verification with the firm for current policies and coverage details. Segregation policies and insurance coverage details also need confirmation directly from Global Reach Partners. This limitation affects comprehensive assessment of account conditions that potential clients typically require for informed decision-making about their financial service provider.

Assessment of Global Reach Partners' trading tools and analytical resources encounters significant limitations. Insufficient detailed information in available sources prevents comprehensive evaluation of the company's technological offerings. The technological advancement mentioned in customer testimonials suggests sophisticated systems that support efficient service delivery. However, specific tool descriptions are not provided in accessible materials, requiring direct inquiry for detailed information about available resources.

Research and analytical resources that typically support foreign exchange decision-making are not detailed in source materials reviewed. This includes market analysis tools that help clients make informed decisions about currency transactions. Economic calendars, technical analysis tools, and real-time data feeds are also not specified in available information. These resources are often expected from professional foreign exchange service providers, making their availability an important consideration for potential clients.

Educational resources are increasingly important for client development and market understanding. However, these resources are not specifically mentioned in available sources, creating an information gap about the company's commitment to client education. Information about webinars is not provided in accessible materials. Tutorials, market insights, and educational materials also represent areas requiring direct verification with Global Reach Partners for current availability and quality.

Automated trading capabilities are not addressed in materials examined for this review. Algorithmic trading support and API access for institutional clients also need direct inquiry for availability and specifications. These features are often crucial for sophisticated users requiring programmatic access to foreign exchange services, particularly for high-volume corporate clients with complex transaction needs.

Customer feedback indicates technological sophistication in service delivery. However, the specific nature of these technological advantages remains unclear without more detailed source information about the company's systems and capabilities. This limitation affects comprehensive assessment of the company's technological infrastructure and client-facing tools that support efficient transaction processing and customer service delivery.

Global Reach Partners demonstrates exceptional performance in customer service delivery. The company earns an 8/10 rating based on consistent positive client feedback that highlights professional service quality. Customer testimonials specifically highlight the company's commitment to listening to client needs and understanding their unique requirements. They also maintain technologically advanced service delivery systems that support efficient communication and transaction processing for clients across different time zones and regions.

Client reviews consistently praise individual staff members for their reliability and expertise. They also commend positive working relationships that develop over time between clients and service representatives. One notable testimonial states that customer service is "impeccable" and emphasizes the company's responsiveness to client requirements. The technological advancement mentioned by clients suggests efficient communication systems that facilitate smooth interactions. Streamlined service delivery processes also contribute to overall client satisfaction with the company's professional approach to customer service.

The quality of service extends beyond basic transaction processing to include personalized attention. Professional relationship management also plays a key role in client satisfaction, as evidenced by positive testimonials. Clients specifically commend staff members for their hard work and reliability in handling complex international transactions. They also praise positive attitudes that create comfortable working relationships, indicating a company culture focused on client satisfaction and professional excellence in all interactions.

However, specific details about customer service channels require direct verification with the company. Availability hours, response time guarantees, and multilingual support capabilities are not detailed in available sources, creating information gaps for potential clients. Information about 24/7 support is not provided in accessible materials. Live chat options and dedicated account management services also represent areas requiring direct inquiry with Global Reach Partners for current availability and service specifications.

Despite these information limitations, consistently positive client feedback justifies the strong rating in this category. Specific testimonials about service quality reflect genuine client satisfaction with Global Reach Partners' customer service approach, demonstrating the company's commitment to maintaining high standards in client relationship management and professional service delivery across all customer interactions.

The evaluation of Global Reach Partners' trading experience faces significant constraints. Limited specific information about platform performance is available in source materials, preventing comprehensive assessment of the trading environment. Customer testimonials reference technological advancement in service delivery systems. However, detailed platform specifications are not provided in accessible sources, requiring direct inquiry for complete information about trading capabilities and system performance.

Platform stability and execution speed metrics are crucial for foreign exchange operations. However, these technical specifications are not detailed in accessible materials, creating information gaps for potential clients who need this data for decision-making. Information about order execution models requires clarification through direct inquiry with the company. Whether Global Reach Partners operates as a market maker or provides direct market access also needs verification for clients who have specific execution preferences.

User interface design cannot be assessed comprehensively based on available sources. Platform functionality and feature completeness also require direct evaluation or inquiry with the company for detailed specifications. The absence of information about charting capabilities limits this global reach review's ability to evaluate the complete trading experience. Order types, risk management tools, and trading automation features also need direct verification for availability and functionality specifications.

Mobile platform capabilities are increasingly important for modern foreign exchange users. However, these features are not addressed in source materials, creating uncertainty about mobile access options for clients. Information about mobile app availability is not provided in accessible sources. Functionality and performance across different devices and operating systems also require direct inquiry with Global Reach Partners for current specifications and compatibility information.

The trading environment's competitiveness cannot be evaluated without more detailed information. Factors such as spreads significantly impact overall trading costs but remain unspecified in available sources, requiring direct inquiry for current pricing. Slippage, requotes, and execution transparency also affect the trading experience. These technical aspects need verification directly with the company to provide clients with accurate information about trading conditions and cost structures.

The assessment of Global Reach Partners' trustworthiness encounters limitations. Insufficient specific regulatory and compliance information in available sources prevents comprehensive evaluation of the company's regulatory standing. The company's London base suggests operation within the UK regulatory framework, which provides certain protections for clients. However, specific regulatory authorizations and oversight details are not comprehensively provided in accessible materials, requiring direct verification for complete regulatory information.

Fund security measures are crucial for client confidence. However, client money segregation policies and deposit protection schemes are not detailed in accessible materials, creating information gaps about protective measures. These factors require direct verification with the company to obtain specific information about how client funds are protected. Insurance coverage and regulatory safeguards also need confirmation directly from Global Reach Partners for current policies and protection levels.

Corporate transparency regarding ownership structure is not detailed in available sources. Financial backing and operational history information also requires direct inquiry for comprehensive background information about the company's stability and resources. While the company maintains a professional presence and receives positive client feedback, comprehensive background information needs verification. Detailed corporate structure and financial strength indicators require direct assessment or inquiry with Global Reach Partners.

Industry reputation indicators show positive signs for Global Reach Partners. FXcompared provides an expert rating of 4, suggesting recognition within professional circles and industry acknowledgment of service quality. However, detailed analysis from regulatory bodies is not available in source materials reviewed. Industry association ratings and independent rating agency assessments also require direct verification for comprehensive reputation analysis.

The handling of negative incidents cannot be evaluated based on available information. Dispute resolution procedures and regulatory compliance history also remain unspecified in accessible sources, limiting comprehensive reliability evaluation. These factors typically contribute significantly to overall trust assessment for financial service providers. However, they require direct inquiry or independent research to obtain current information about the company's track record and dispute resolution capabilities.

User experience evaluation for Global Reach Partners shows positive indicators through customer service feedback. Client testimonials suggest overall satisfaction with service delivery and professional interaction quality that meets or exceeds client expectations. However, comprehensive platform usability information is limited in available sources, preventing detailed assessment of the complete user experience from initial contact through ongoing service delivery.

Interface design and platform usability details are not specified in accessible materials. This prevents detailed assessment of navigation ease and feature accessibility for users with different technical skill levels. Visual design quality also requires direct evaluation or inquiry with the company for current specifications. The technological advancement mentioned by clients suggests sophisticated systems that support efficient user interactions. However, specific user interface characteristics remain unclear without more detailed information about platform design and functionality.

Registration and account verification processes are not detailed in available sources. Information about required documentation is not specified, creating uncertainty for potential clients about onboarding requirements. Verification timelines and onboarding procedures also require direct inquiry for current specifications. These factors significantly impact initial user experience and client satisfaction during the account setup process, making them important considerations for potential clients.

Funding operation experiences need more detailed information for comprehensive assessment. Deposit and withdrawal procedures are not described in accessible materials, preventing evaluation of process efficiency and user-friendliness. Processing times and user interface quality for financial transactions also require direct verification. These operational aspects significantly influence overall user satisfaction with the service provider, particularly for clients who conduct frequent transactions or have time-sensitive transfer requirements.

Customer testimonials indicate positive experiences with staff interactions and service responsiveness. However, comprehensive user experience assessment requires more detailed information about platform functionality that is not fully detailed in available sources. Process efficiency and overall service delivery systems also need direct evaluation or inquiry for complete assessment. While positive feedback suggests satisfactory user experiences, detailed platform and process information would provide more comprehensive insight into the complete user journey.

This Global Reach Partners review reveals a company with strong customer service capabilities. The firm has built positive client relationships over time, earning recognition for its professional approach and technological advancement in service delivery. Global Reach Partners' London-based operations and focus on currency transfer services position it as a credible option for international financial transactions. The company serves businesses and individuals who require reliable support for cross-border payment needs, building long-term relationships with clients across various sectors.

The company appears well-suited for clients who prioritize personalized service over comprehensive trading platform features. Corporate clients and individuals seeking straightforward currency transfer solutions may find Global Reach Partners' service-focused approach particularly valuable for their needs. The firm's emphasis on professional relationships and responsive customer service creates an environment that supports ongoing client satisfaction and trust in international financial transactions.

However, limited publicly available information about specific trading conditions represents a significant consideration for potential clients. Regulatory details and platform features also need direct verification, creating information gaps that require additional research before making service decisions. While customer service excellence is well-documented through client testimonials, comprehensive evaluation requires direct consultation with the company. Clients should obtain detailed information about services, costs, and operational terms directly from Global Reach Partners to make fully informed decisions about their international financial service needs.

FX Broker Capital Trading Markets Review