MBA Trading 2025 Review: Everything You Need to Know

Executive Summary

MBA Trading operates as a forex broker that has attracted significant attention in the trading community. This attention is not always for positive reasons. This mba trading review reveals a platform that presents itself as an educational trading service but faces serious questions regarding its legitimacy and safety. The broker utilizes the popular MetaTrader 4 trading platform. It also offers various technical analysis tools to its users. However, multiple sources have raised concerns about the company's business model. Some reviewers question whether it operates as a pyramid scheme rather than a legitimate forex broker.

The platform appears to target traders seeking educational resources and training opportunities. It positions itself as more than just a traditional brokerage. According to available information, MBA Trading emphasizes its educational component. The company claims to have educators with years of successful trading and teaching experience. However, potential users should exercise extreme caution when considering this broker. The lack of clear regulatory information and negative user feedback regarding safety concerns create significant red flags. The mixed reviews and questionable business practices make this broker unsuitable for most traders. This is particularly true for those seeking a reliable and regulated trading environment.

Important Notice

Due to the absence of specific regulatory information in available sources, users must independently assess the platform's legality and safety before engaging with MBA Trading. This review is based on publicly available information and user feedback. This information may be incomplete or subject to bias. Different jurisdictions may have varying regulations regarding this broker's operations. Traders should verify the broker's regulatory status in their specific region before opening an account. The information presented here should not be considered as financial advice. Potential users are strongly encouraged to conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

MBA Trading presents itself as a forex broker that combines traditional trading services with educational components. The company's business model appears to focus heavily on providing training and educational resources to traders. However, specific details about its founding year and corporate background are not clearly disclosed in available sources. The broker operates in the competitive forex market. It offers trading services for various financial instruments while emphasizing its educational approach to trading.

The platform utilizes MetaTrader 4 as its primary trading software. This software is widely recognized and trusted in the forex industry. According to available information, MBA Trading provides access to forex trading, CFDs, and other financial instruments through this established platform. However, the lack of clear regulatory information raises significant concerns about the broker's legitimacy and oversight. The company's main regulatory status and licensing details are not prominently disclosed. This represents a major red flag for potential traders seeking a secure and compliant trading environment.

This mba trading review highlights the importance of regulatory transparency in the forex industry. MBA Trading's failure to clearly communicate its regulatory status creates uncertainty about trader protection and fund safety.

Regulatory Status: Specific regulatory information is not clearly provided in available sources. This represents a significant concern for potential traders seeking regulatory protection and oversight.

Deposit and Withdrawal Methods: Information about available payment methods and processing procedures is not detailed in accessible sources. This makes it difficult to assess the convenience and security of fund transfers.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in the available information. This prevents potential traders from understanding the initial investment requirements.

Bonuses and Promotions: Details about promotional offers, welcome bonuses, or ongoing incentives are not mentioned in the sources reviewed.

Tradeable Assets: The platform offers access to forex markets, CFDs, and other financial instruments through the MetaTrader 4 platform. This provides traders with a range of investment opportunities across different asset classes.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not available in the sources. This makes it impossible to assess the broker's competitiveness in terms of pricing.

Leverage Options: Details about maximum leverage ratios and margin requirements are not specified in the available information.

Platform Options: MBA Trading primarily uses MetaTrader 4. This is a well-established and feature-rich trading platform that offers comprehensive charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Information about countries or regions where services are restricted is not available in the sources.

Customer Support Languages: Specific details about multilingual support options are not mentioned in the available information.

This mba trading review emphasizes the concerning lack of transparency regarding essential trading conditions and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of MBA Trading's account conditions proves challenging due to the limited information available in public sources. Without clear details about account types, minimum deposit requirements, or specific account features, potential traders cannot make informed decisions about whether the broker's offerings align with their trading needs and financial capabilities.

The absence of information regarding account opening procedures, verification requirements, and documentation needed represents a significant transparency issue. Most reputable brokers provide clear, accessible information about their account structures. This includes details about different account tiers and their respective benefits. The lack of such information from MBA Trading raises questions about the broker's commitment to transparency and customer service.

Furthermore, the availability of specialized account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, remains unclear. Professional traders seeking advanced account features or institutional-level services would find it difficult to assess whether MBA Trading can meet their sophisticated requirements.

The evaluation of account conditions in this mba trading review highlights the importance of comprehensive information disclosure. This appears to be lacking in MBA Trading's public communications.

MBA Trading demonstrates strength in its technological offerings by providing access to MetaTrader 4. This is one of the most respected trading platforms in the forex industry. The platform includes essential technical analysis tools, stop-loss order capabilities, and tracking charts that enable traders to conduct comprehensive market analysis and risk management.

The broker emphasizes its educational component. It claims to have educators with years of successful trading and teaching experience. This educational focus could potentially benefit novice traders seeking to develop their trading skills and market understanding. However, the specific nature, quality, and accessibility of these educational resources are not detailed in available sources.

The technical analysis tools provided through the MetaTrader 4 platform include standard indicators, charting capabilities, and analytical functions that are essential for informed trading decisions. These tools enable traders to perform technical analysis, identify market trends, and develop trading strategies based on historical price data and market patterns.

However, information about additional research resources, market analysis reports, daily briefings, or automated trading support remains limited. The absence of detailed information about the broker's research capabilities and supplementary tools makes it difficult to fully assess the comprehensive value proposition offered to traders.

Customer Service and Support Analysis

Customer service quality appears to be a point of contention based on available user feedback. Mixed reviews suggest inconsistent service delivery. Some users have reported negative experiences with customer support. This indicates potential issues with response quality, problem resolution, or overall service satisfaction.

The specific customer service channels available to traders are not clearly detailed in accessible sources. These channels include phone support, live chat, email assistance, or help desk ticketing systems. This lack of transparency regarding support options makes it difficult for potential traders to understand how they can access assistance when needed.

Response times for customer inquiries and the availability of support during different trading sessions remain unclear. Given the 24-hour nature of forex markets, traders typically require access to customer support during extended hours. This is particularly important during active trading periods across different time zones.

The quality of multilingual support and the availability of customer service representatives who can assist traders in their native languages is not specified. For international traders, language support can be crucial for effective communication and problem resolution. This is especially true when dealing with account issues or technical difficulties.

Trading Experience Analysis

The trading experience assessment focuses primarily on the MetaTrader 4 platform. MBA Trading utilizes this as its main trading interface. MetaTrader 4 is widely recognized for its stability, comprehensive functionality, and user-friendly design. This suggests that the basic trading experience should meet industry standards for platform reliability and feature availability.

However, specific information about order execution quality is not available in the sources reviewed. This includes execution speeds, slippage rates, and fill quality. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-volatility market conditions where execution quality significantly impacts trading results.

The platform's stability during peak trading hours and its performance during major market events are not documented in available sources. Traders require consistent platform performance to execute their trading strategies effectively. Any technical issues or downtime can result in significant financial losses.

Mobile trading capabilities and the quality of mobile applications for iOS and Android devices are not detailed in the available information. In today's trading environment, mobile accessibility is essential for traders who need to monitor and manage their positions while away from their primary trading stations.

This mba trading review emphasizes that while the underlying MetaTrader 4 platform is robust, the specific implementation and performance by MBA Trading cannot be fully assessed due to limited available data.

Trust and Safety Analysis

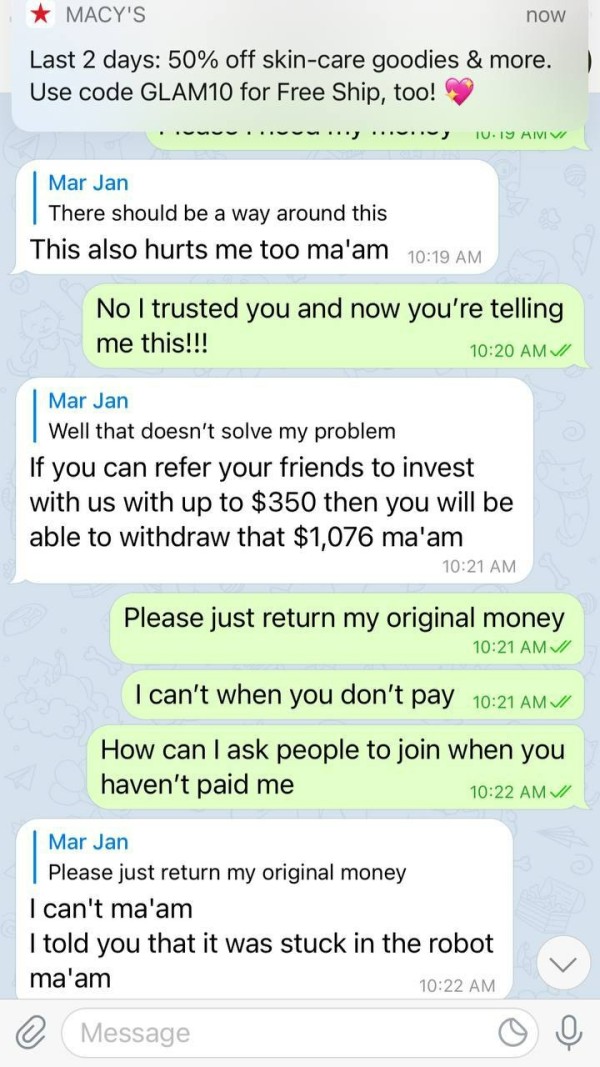

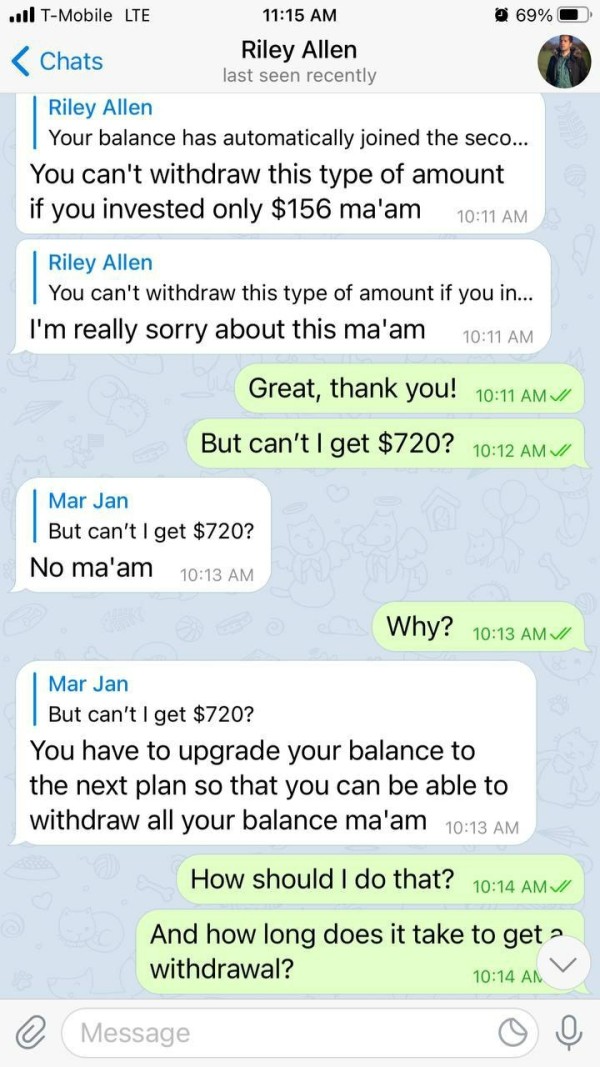

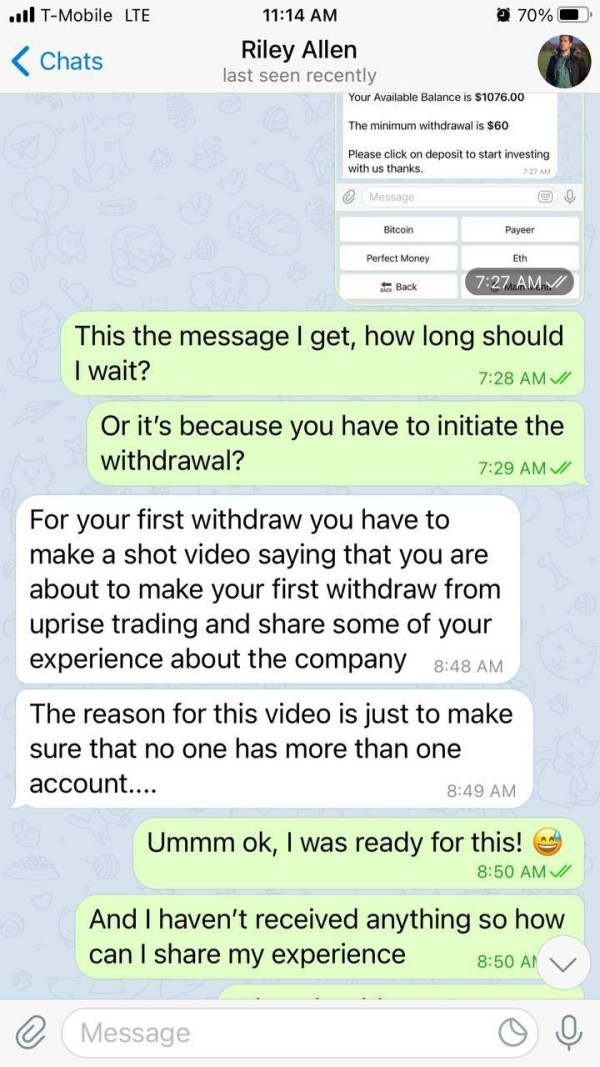

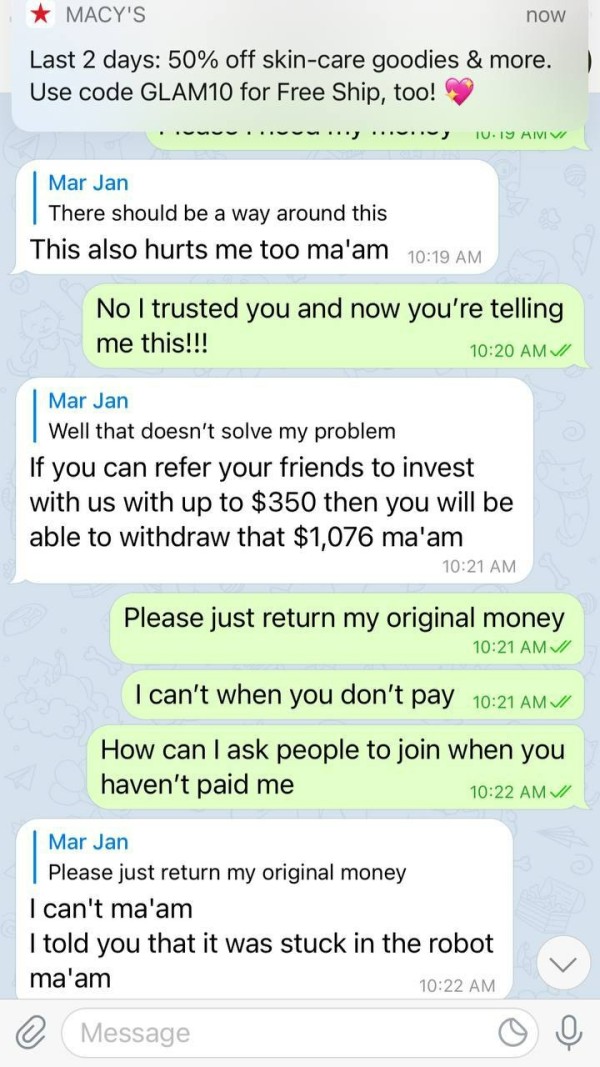

Trust and safety represent the most concerning aspects of MBA Trading's operations. Multiple sources raise serious questions about the broker's legitimacy and business model. Allegations suggest that MBA Trading may operate as a pyramid scheme rather than a legitimate forex broker. These allegations create significant red flags that potential traders cannot ignore.

The absence of clear regulatory information represents a fundamental trust issue in an industry where regulatory oversight is essential for trader protection. Reputable forex brokers typically prominently display their regulatory licenses, registration numbers, and oversight authorities. This demonstrates their commitment to compliance and customer protection.

Fund safety measures are not detailed in available sources. These include segregated client accounts, investor compensation schemes, and third-party fund custodianship. These protections are standard practice among regulated brokers and are crucial for ensuring that client funds remain secure and separate from the broker's operational capital.

The broker's transparency regarding its corporate structure, ownership, and financial backing remains unclear. Traders typically seek assurance about their broker's financial stability and corporate governance. This is particularly important when depositing significant amounts for trading purposes. The lack of such information creates uncertainty about the company's reliability and long-term viability.

Industry reputation and third-party evaluations suggest significant concerns about MBA Trading's legitimacy. Various sources question the safety and reliability of the platform for serious forex trading activities.

User Experience Analysis

User experience feedback reveals a mixed picture. Some positive comments about the educational aspects of the platform are balanced against serious concerns about safety and legitimacy. The diversity of user opinions suggests that experiences may vary significantly depending on individual expectations and engagement levels with the platform.

Interface design and ease of use are primarily determined by the MetaTrader 4 platform. This generally provides a professional and intuitive trading environment. However, any customizations or modifications made by MBA Trading to the standard platform interface are not detailed in available sources.

Registration and account verification processes are not clearly documented. This makes it difficult for potential users to understand the onboarding experience and timeline for account activation. Streamlined registration processes are important for user satisfaction. Robust verification procedures are essential for regulatory compliance and security.

User complaints appear to focus on concerns about the broker's business model and safety rather than specific technical or platform-related issues. This pattern of feedback suggests that the primary user experience concerns relate to trust and legitimacy rather than day-to-day trading functionality.

The target user profile appears to be traders interested in educational resources and training opportunities. However, the mixed feedback suggests that even these users should carefully consider the potential risks associated with the platform.

Conclusion

This comprehensive mba trading review reveals significant concerns about the broker's safety, legitimacy, and regulatory compliance that far outweigh any potential benefits from its educational offerings or technical tools. While MBA Trading provides access to the reliable MetaTrader 4 platform and claims to offer educational resources, the allegations of pyramid scheme operations and the absence of clear regulatory oversight create unacceptable risks for most traders.

The broker may appeal to individuals specifically seeking trading education and training opportunities. However, even these users should exercise extreme caution and thoroughly investigate the platform's legitimacy before engaging with its services. The lack of transparency regarding essential information such as regulatory status, account conditions, and corporate structure represents fundamental red flags that cannot be overlooked.

The main advantages include access to established trading technology and educational focus. The significant disadvantages encompass safety concerns, regulatory uncertainty, and questionable business practices. For traders seeking a reliable, regulated, and transparent forex broker, MBA Trading does not meet the basic standards expected in today's competitive and regulated forex industry.