assetsfx 2025 Review: Everything You Need to Know

Abstract

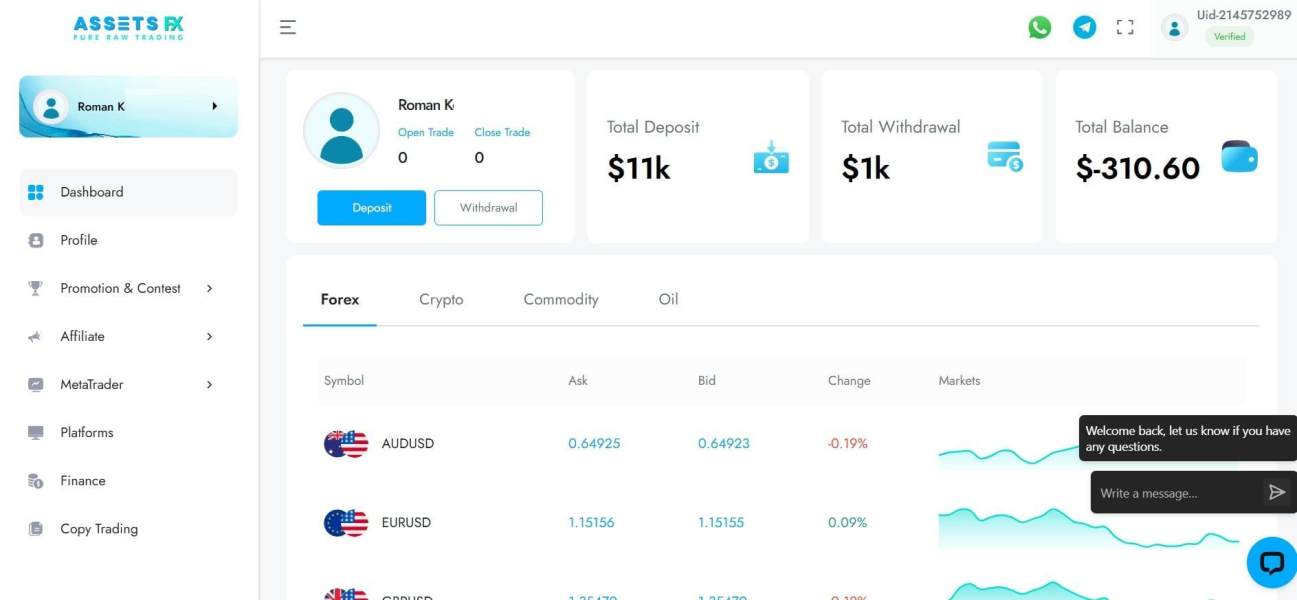

AssetsFX started in 2013. The company has made a name for itself in the busy foreign exchange market by offering very low spreads and small commission fees. Some customers complain about trust problems and unclear rules, but most users give positive feedback about this broker. The assetsfx review shows the broker's new cashback reward program and different account types made especially for skilled traders. Clients like how the company focuses on fast trade completion and good prices. These features have helped keep users happy over time. But people thinking about using this broker should carefully check the risks that come with unclear regulatory details. This review uses complete market data and many user stories to show the real trading experience, even though people have mixed opinions about customer support and trust. In short, AssetsFX offers attractive low-cost trading and advanced features, but traders should think about all factors before choosing this platform.

Notice

AssetsFX does not clearly name any regulatory authorities that watch over its work. Because of this, traders should be careful and check the possible risks when trading with this broker. This review includes analysis based on direct user feedback and combined market information from many sources. The evaluation looks at different parts of the platform's performance, including account conditions, trading tools, customer service, overall experience, and trust level. Different sources have reported different views on some parts, especially about regulatory oversight and how fast customer support responds. So potential clients should look for more information and stay aware of the uncertainties when dealing with companies that work across different regions.

Scoring Framework

Broker Overview

AssetsFX started in 2013. It is a forex broker that offers both ECN and STP business models, working mainly with experienced traders who want competitive trading conditions. The broker has made itself different by giving very low spreads and small commission fees. AssetsFX focuses on reducing trading costs and has been able to attract a loyal group of skilled traders. Many users praise the new cashback rewards program and the wide range of account types available, but there are also worries about regulatory transparency and trustworthiness. Despite these problems, many clients say they want to keep using the platform because it is cost-efficient and has strong execution quality.

AssetsFX also supports a complete set of trading platforms. The broker gives both MetaTrader 4 and MetaTrader 5 platforms, plus mobile and web-based solutions, making sure that traders can access the market how they want. The available asset classes include forex, cryptocurrencies, and major indices, so it works for many different trading strategies. But details about the specific regulatory authority are not given, leaving some parts of operations unclear. The assetsfx review always points to the broker's good use of cutting-edge technology and many asset options, helping traders stay flexible in volatile market conditions.

AssetsFX has not given specific details about its regulatory oversight when it comes to regulation. Therefore, the broker remains unaccredited by any major regulatory body. This lack of clear oversight means that traders should check the risks on their own before starting trade activities.

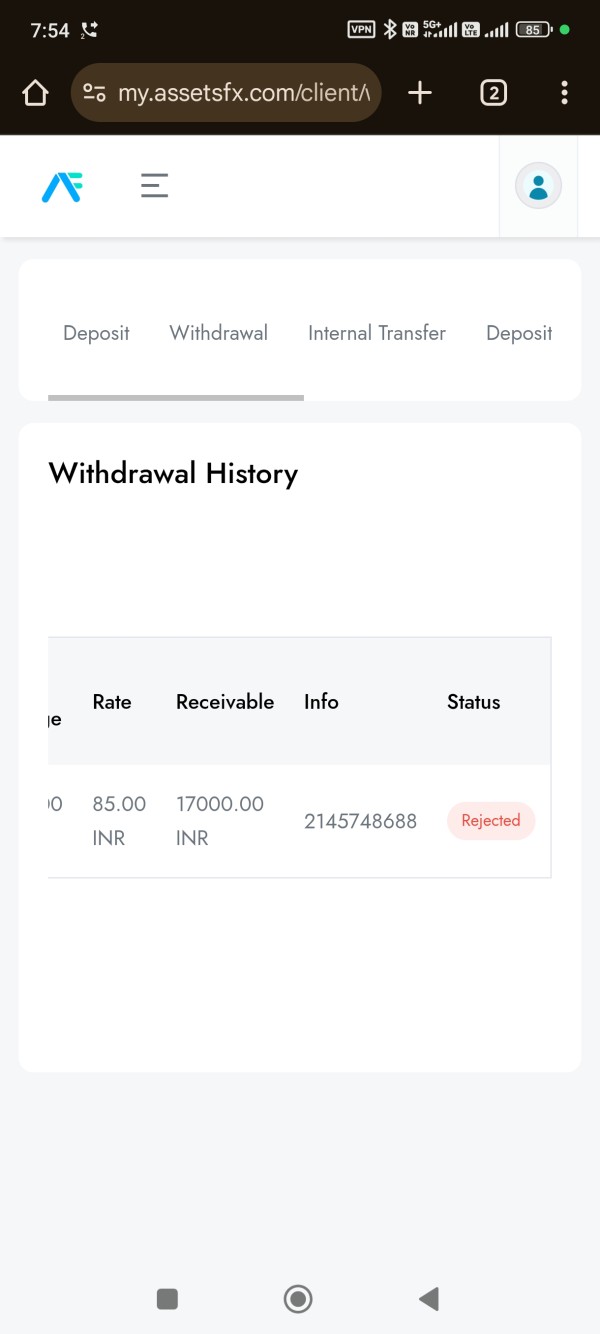

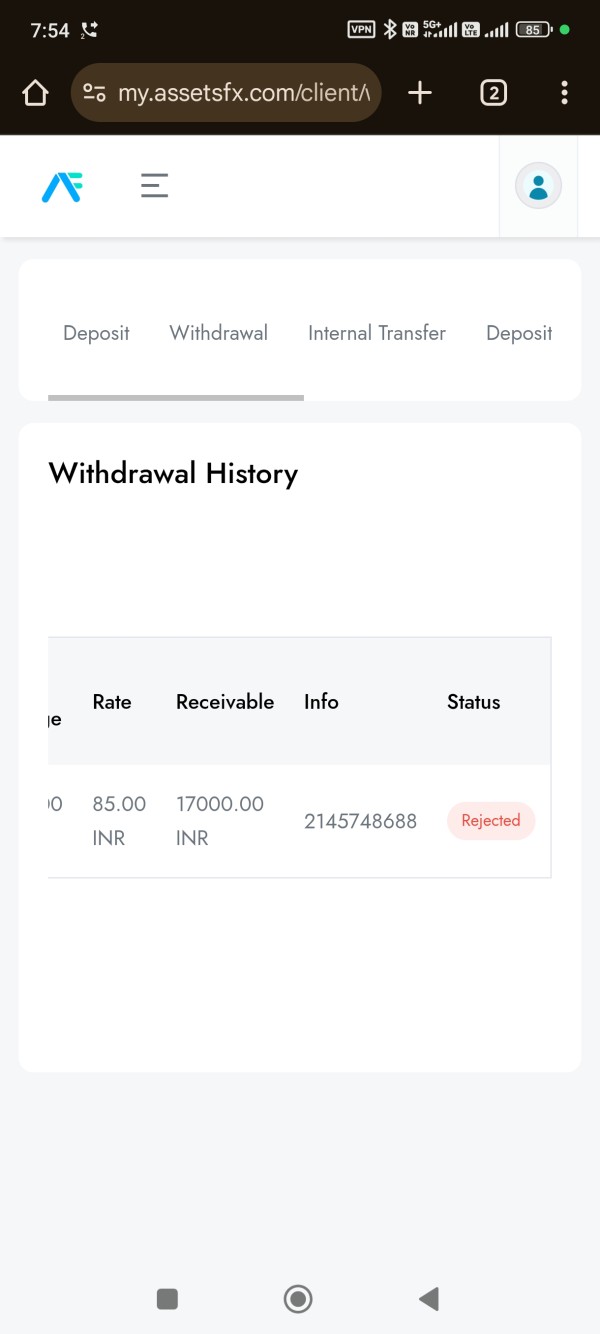

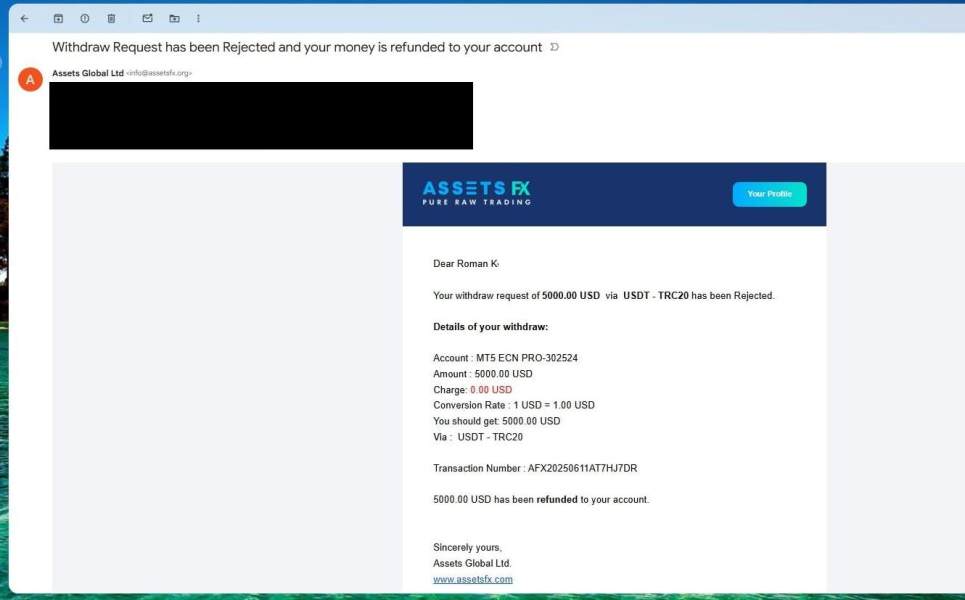

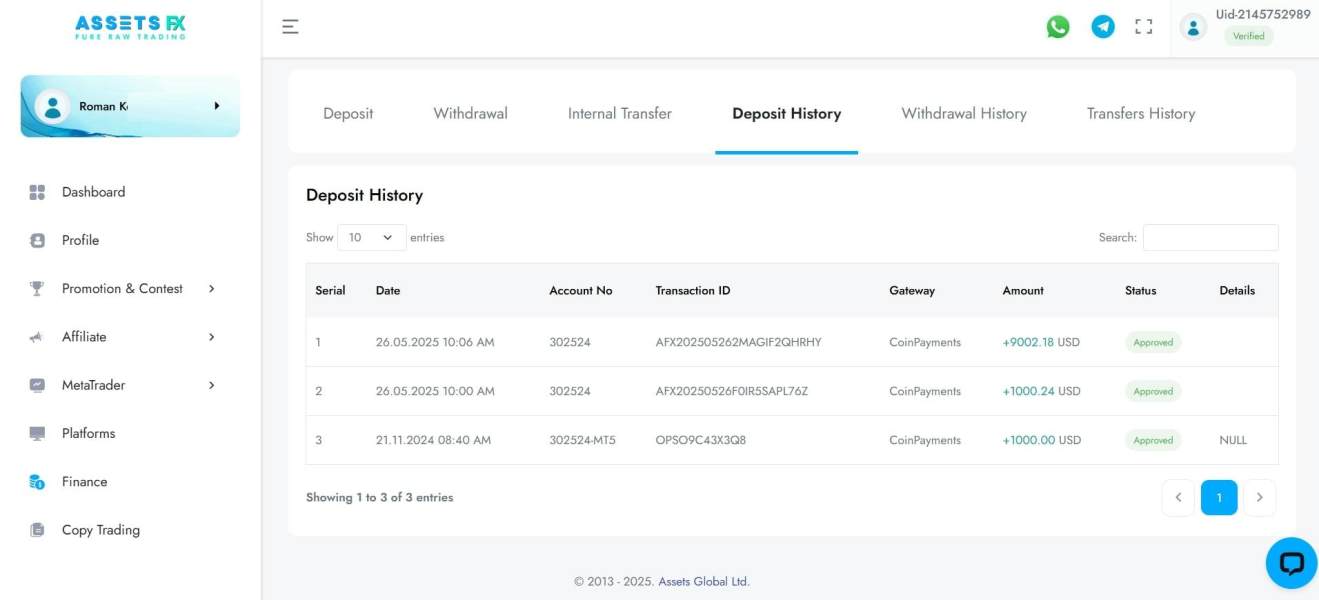

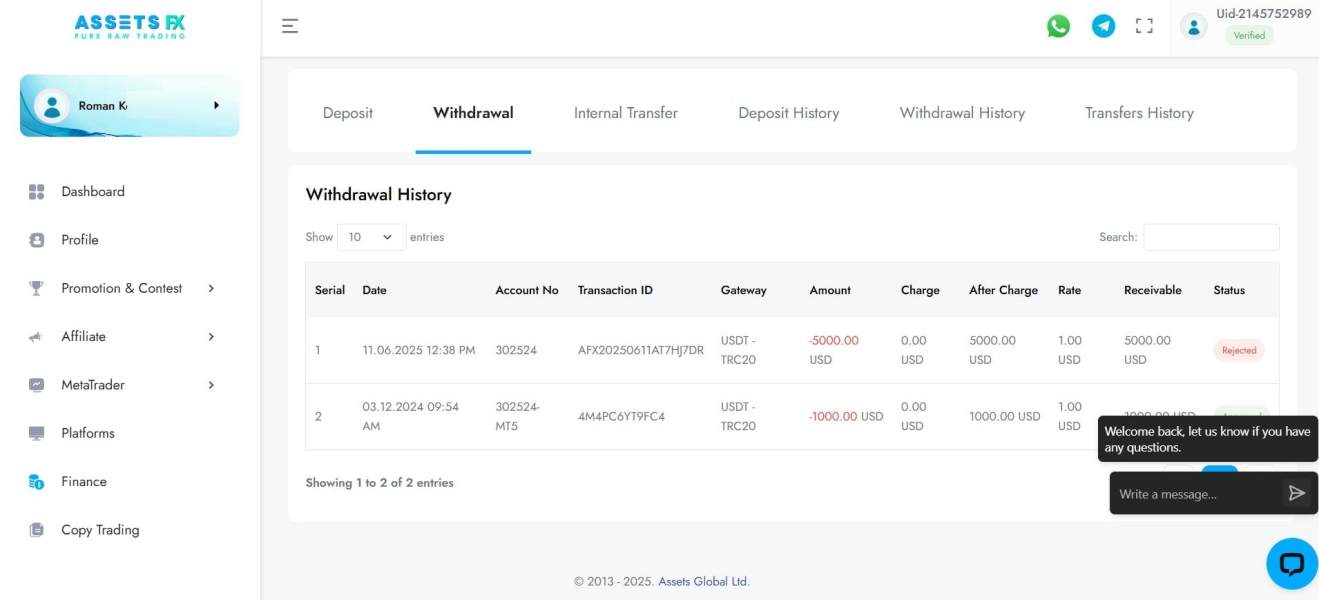

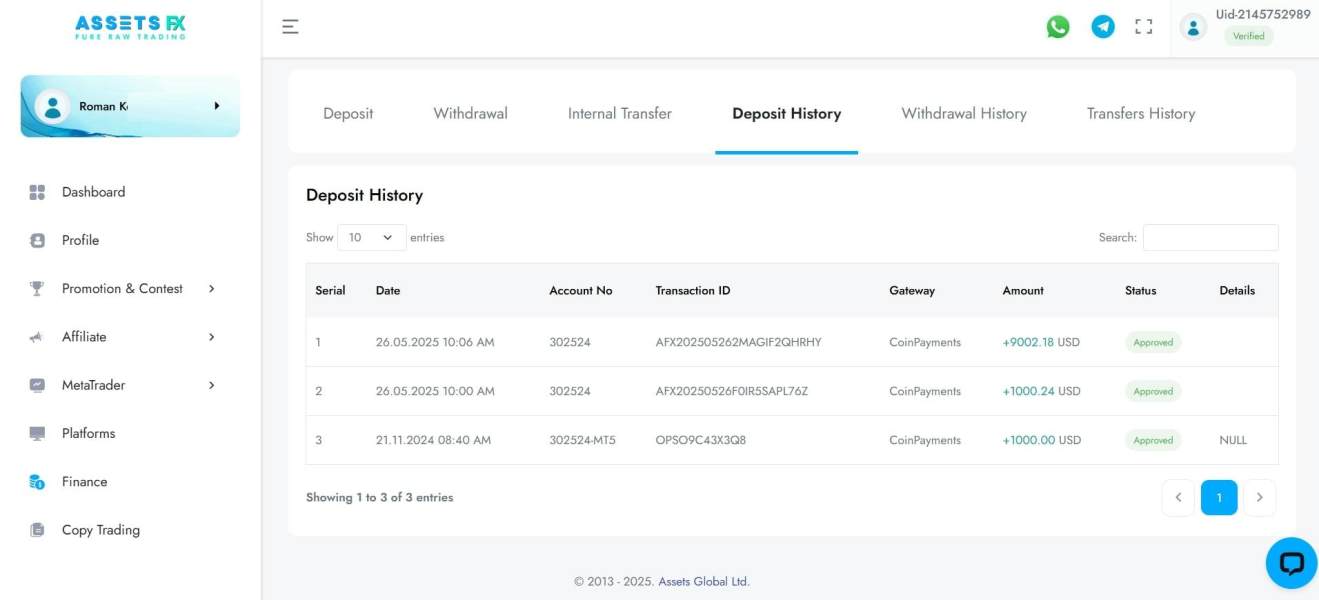

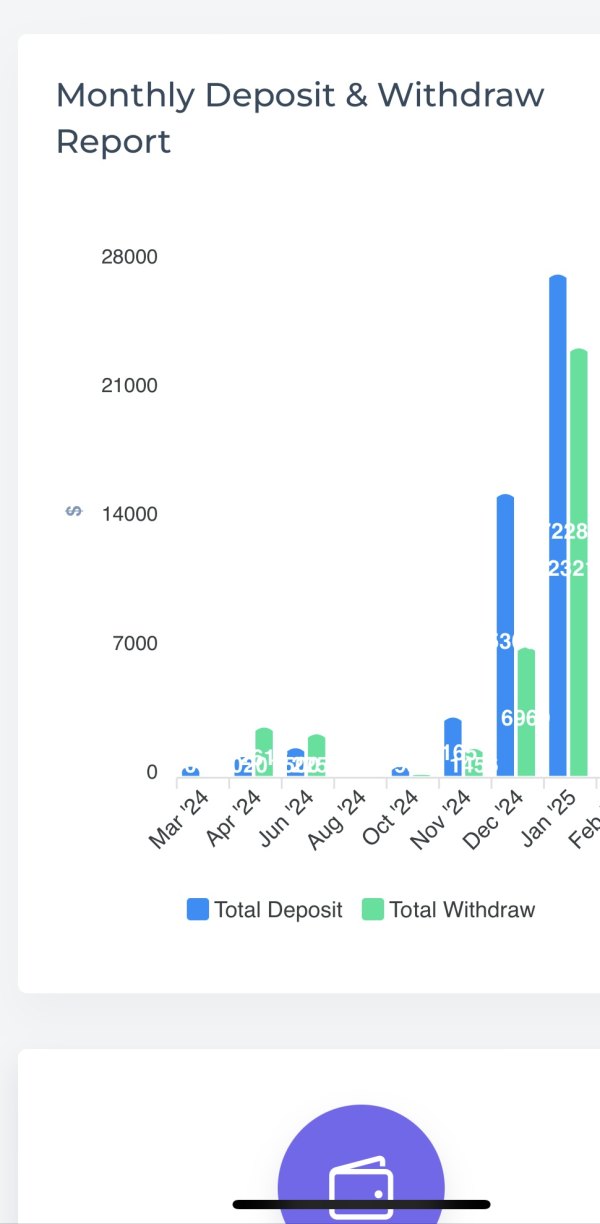

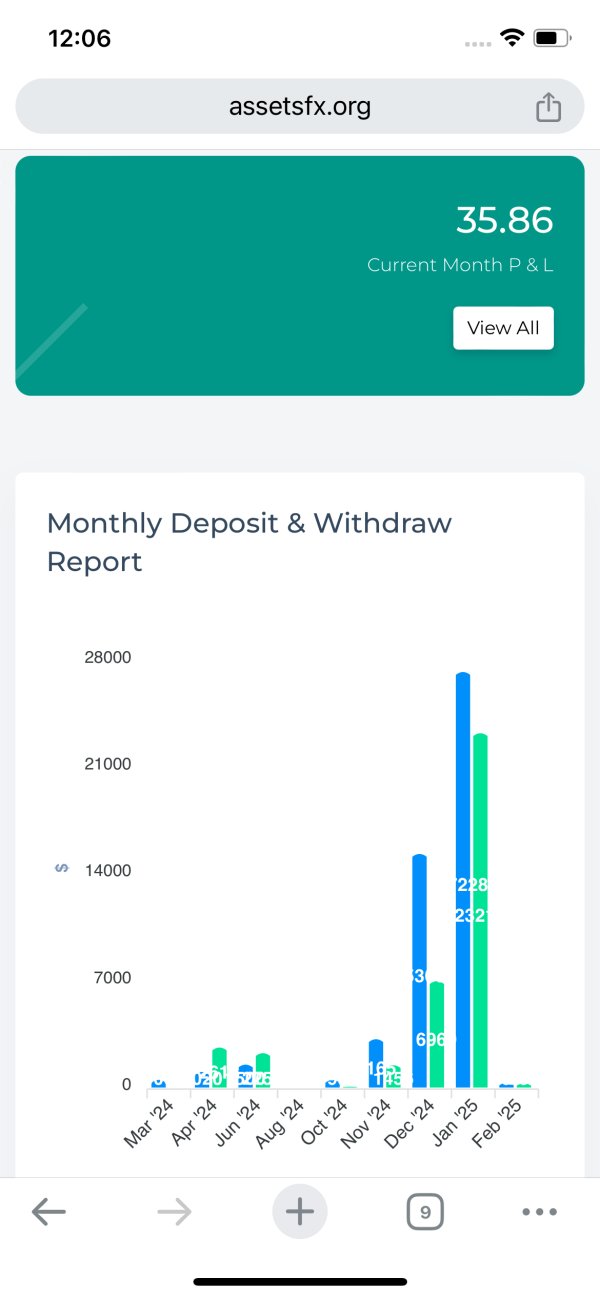

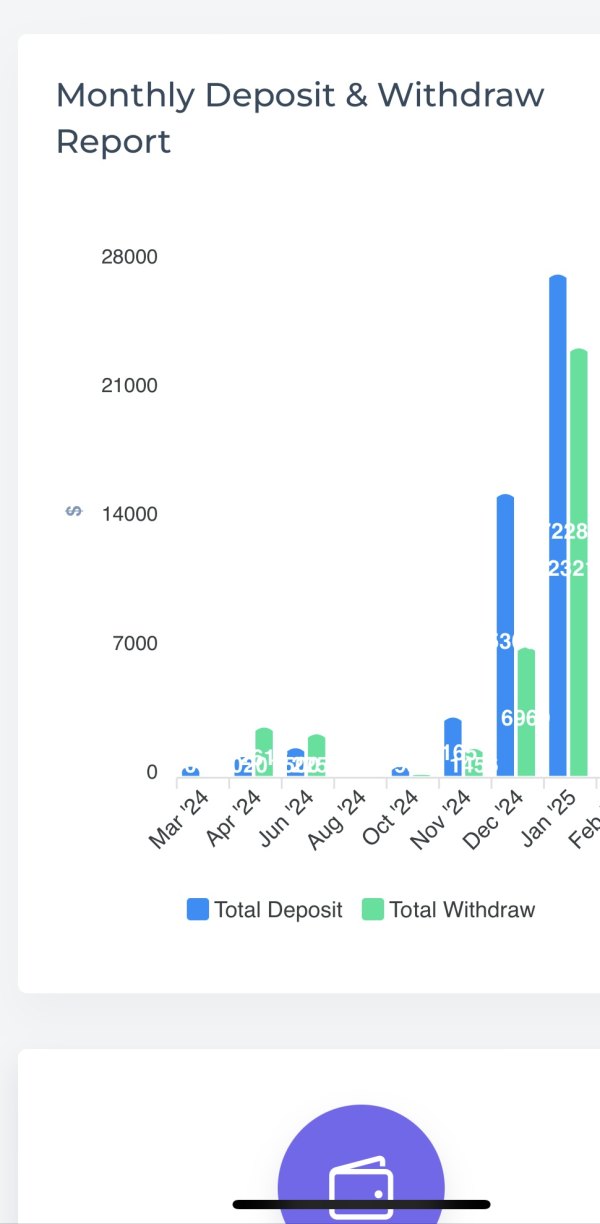

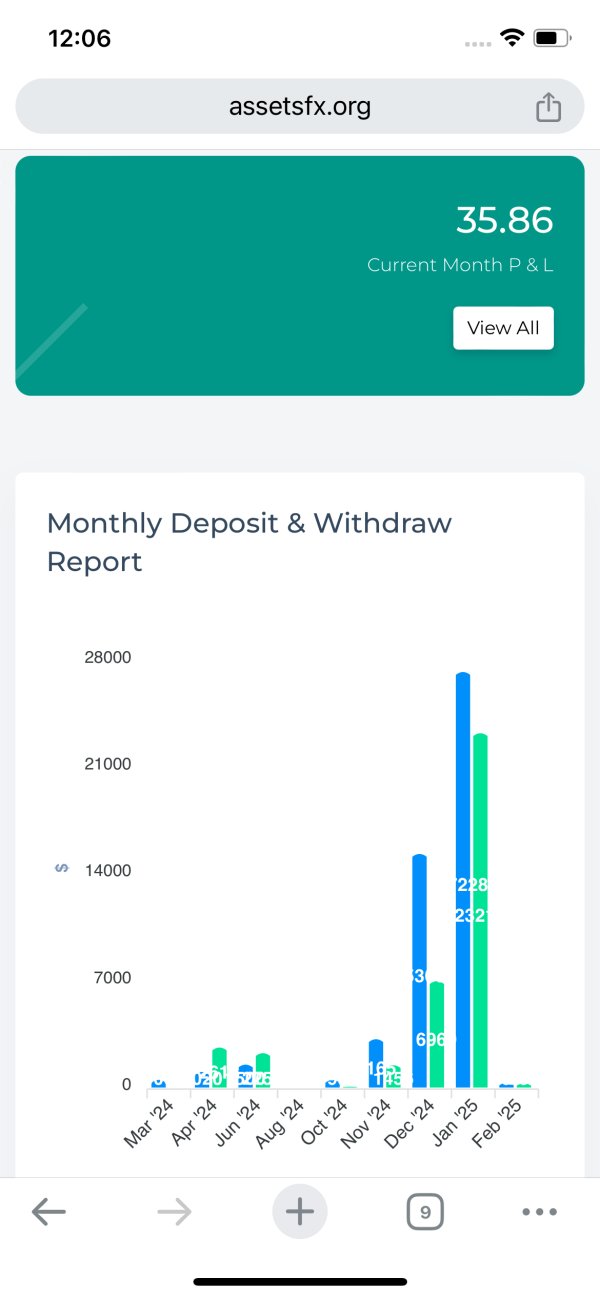

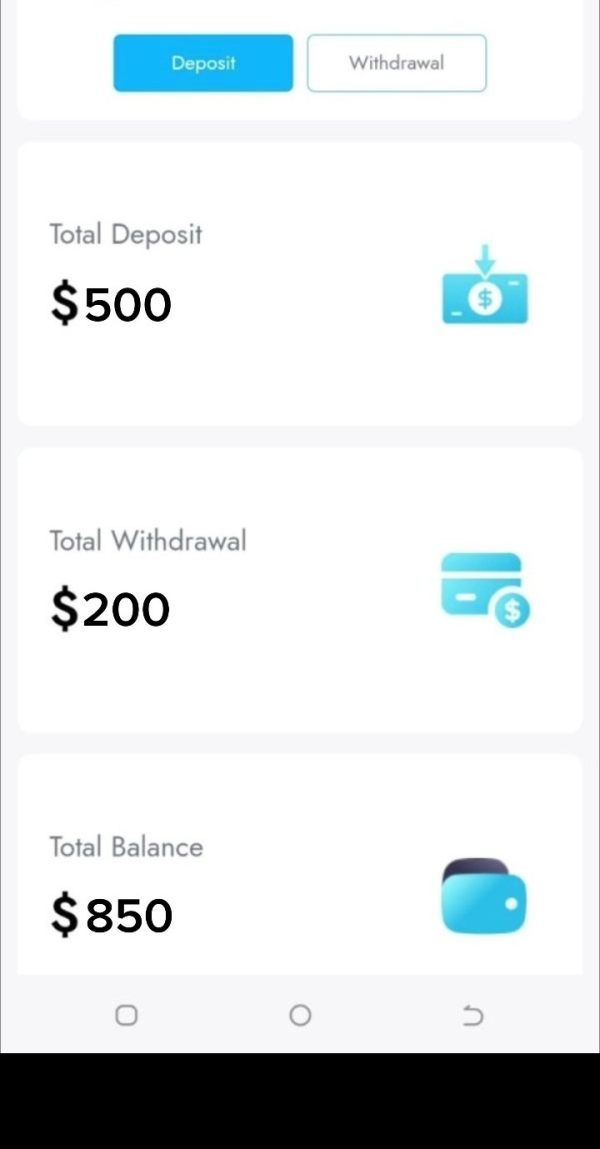

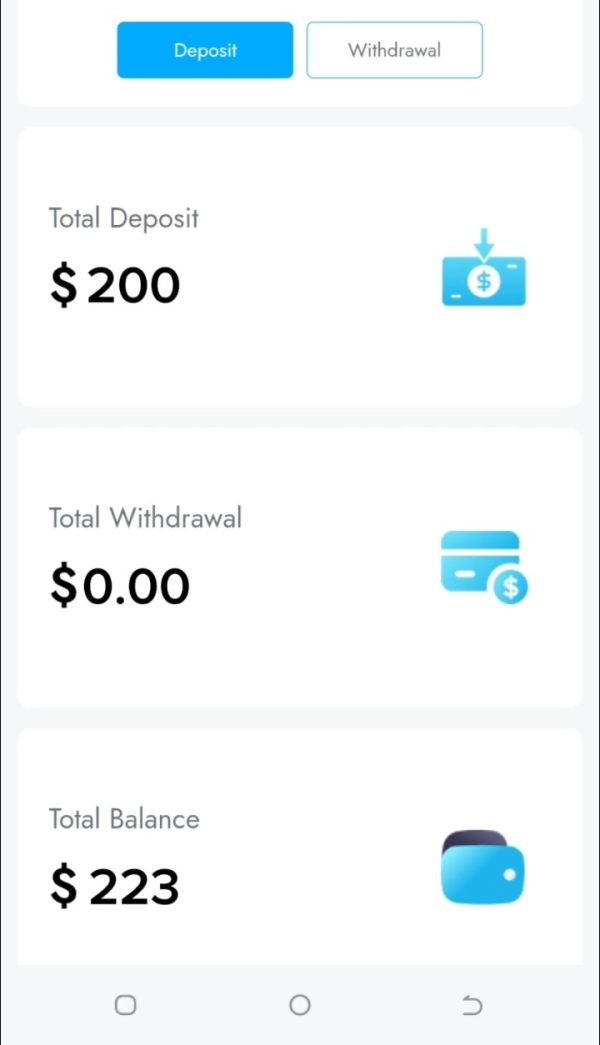

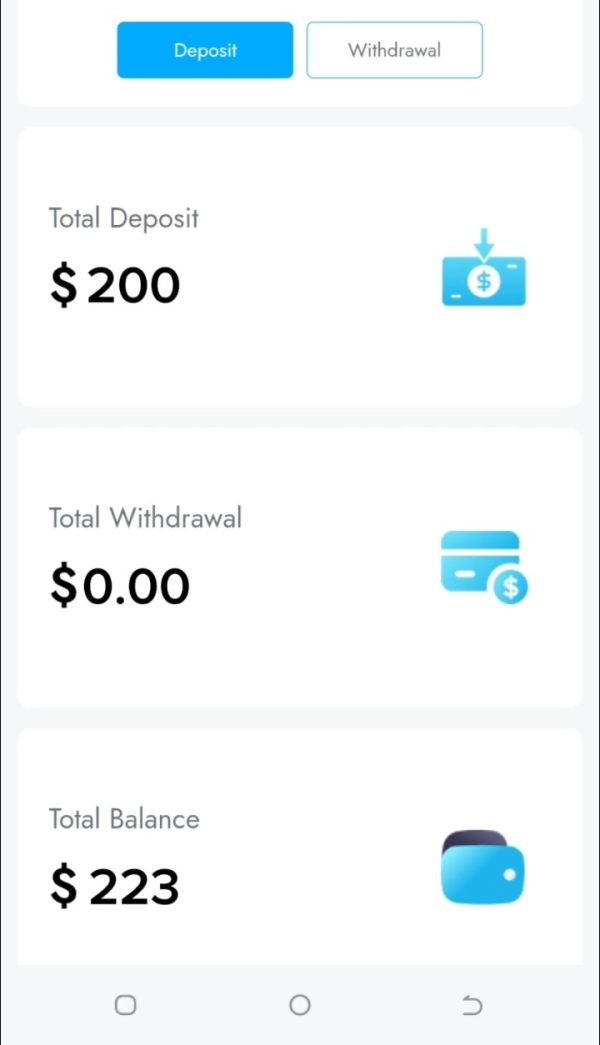

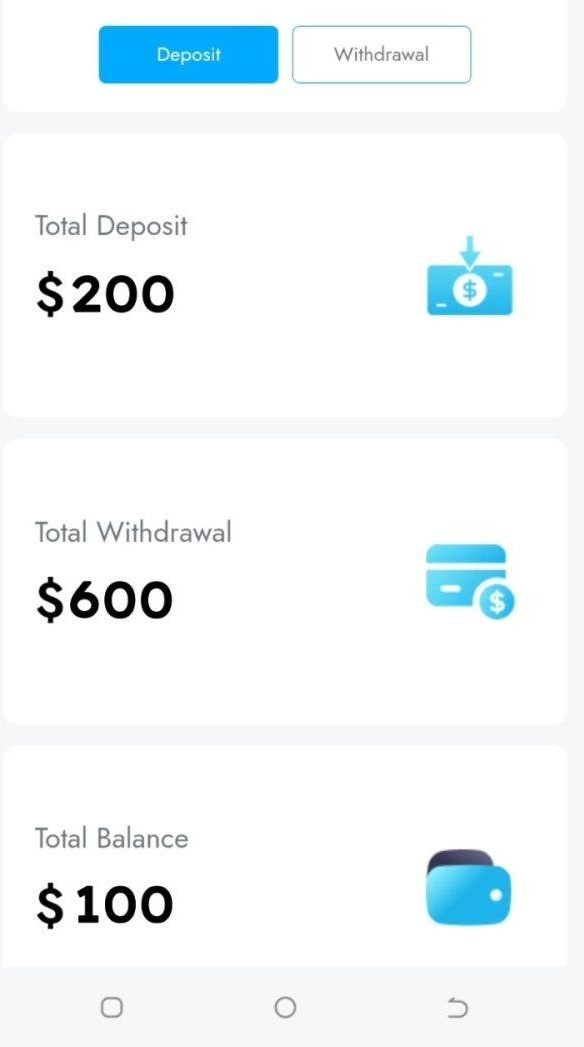

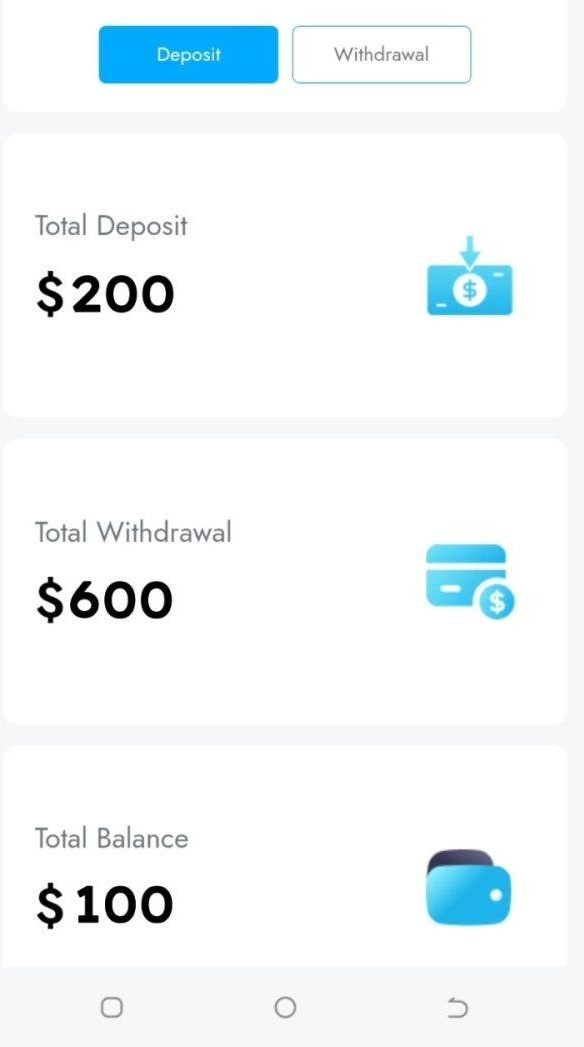

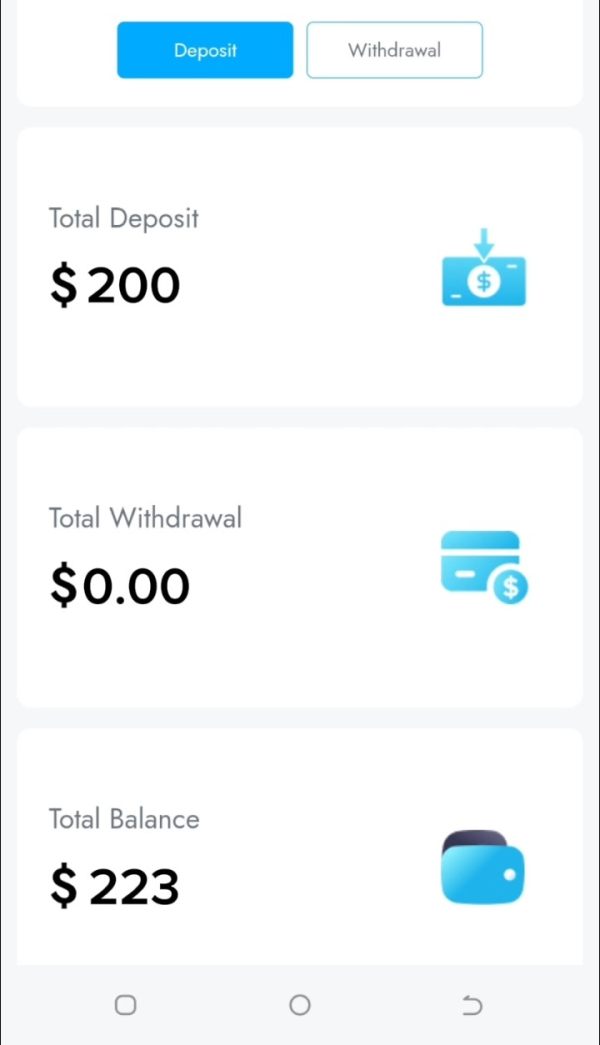

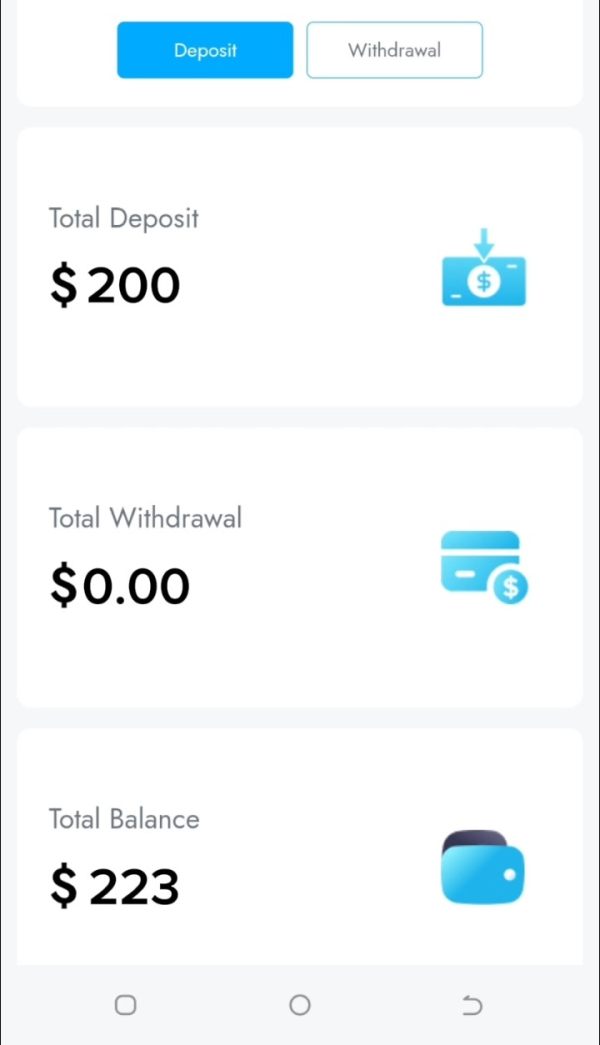

AssetsFX's available options for deposit and withdrawal methods are not clearly detailed in the available materials. There is no complete breakdown of payment systems, leaving potential customers with limited insights into processing times or transaction fees.

The minimum deposit requirement is also not clearly stated in the provided information. This might suggest a flexible but somewhat unclear policy for new account setup.

The bonus and promotional structure stands out with its new cashback reward plan. This incentive is made to reward active traders with a rebate on trading commissions. The exact figures and conditions are not specified, but the promotional strategy is considered a big draw for high-frequency traders.

AssetsFX offers many different tradable assets. These include major currency pairs, select cryptocurrencies, and key financial indices. This variety helps traders diversify their portfolios, though specific instruments and trading conditions remain partly unspecified.

AssetsFX boasts competitive low spreads and commissions on the cost structure front. Users have consistently reported low trading costs as a major advantage, even though precise numerical values regarding spreads and fees have not been made widely available.

The leverage offered by the broker is another area where detailed figures are absent. This leaves the exact risk metrics to be inferred from broader user experiences rather than concrete data.

Platform selection is strong, with support for desktop, mobile, and web platforms via MT4 and MT5. This makes sure that traders have access to advanced trading tools and a consistent experience no matter what device they use.

There is no clear mention of regional restrictions. This implies that the service may be available to traders in many markets, though users should check any potential limitations based on their jurisdiction on their own.

Customer support language details are not fully explained. While the platform likely supports several languages, specific information about available languages or support hours is missing.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

AssetsFX offers many account types made to work with different trading styles and preferences. The variety in account options is a key feature that lets experienced traders choose between different setups tailored to specific strategies. There are several account types available, but important details such as minimum deposit requirements remain unspecified, which can leave new traders uncertain about the initial financial commitment. The process for account opening is mentioned in general terms, though specifics about documentation requirements and verification processes are not explained. Some users have reported that despite the range of accounts, additional features such as an Islamic account are not clearly mentioned. In the assetsfx review, positive remarks often focus on the competitive spreads and low commissions, which help traders reduce overall trading costs. But when compared with other brokers who offer detailed account setups and clear minimum deposit information, AssetsFX falls short in giving full transparency. This gap in information is concerning for risk-averse traders who place significant emphasis on clear account conditions before onboarding.

AssetsFX supports many trading platforms including MetaTrader 4 and MetaTrader 5. These are highly regarded for their strong features and reliability. These platforms give advanced charting tools, technical indicators, and automated trading capabilities essential for experienced traders. The variety in platform options lets traders select a platform that best matches their trading style, whether they prefer desktop-based platforms or mobile solutions. Despite the strong emphasis on platform quality, there is a noticeable lack of emphasis on additional research and analysis tools, such as proprietary market research or complete educational resources. Users have noted that while the trading tools are very effective for executing trades, there is room for improvement in offering market insights and technical analyses that are readily accessible on the platform. The assetsfx review consistently highlights this modern trading setup as a significant advantage, yet the absence of detailed educational content means that novice traders might need to seek external resources. Overall, the strengths of the trading tools lie in their reliability, speed, and advanced functionality, which contribute positively to the overall trading environment provided by AssetsFX.

2.6.3 Customer Service and Support Analysis

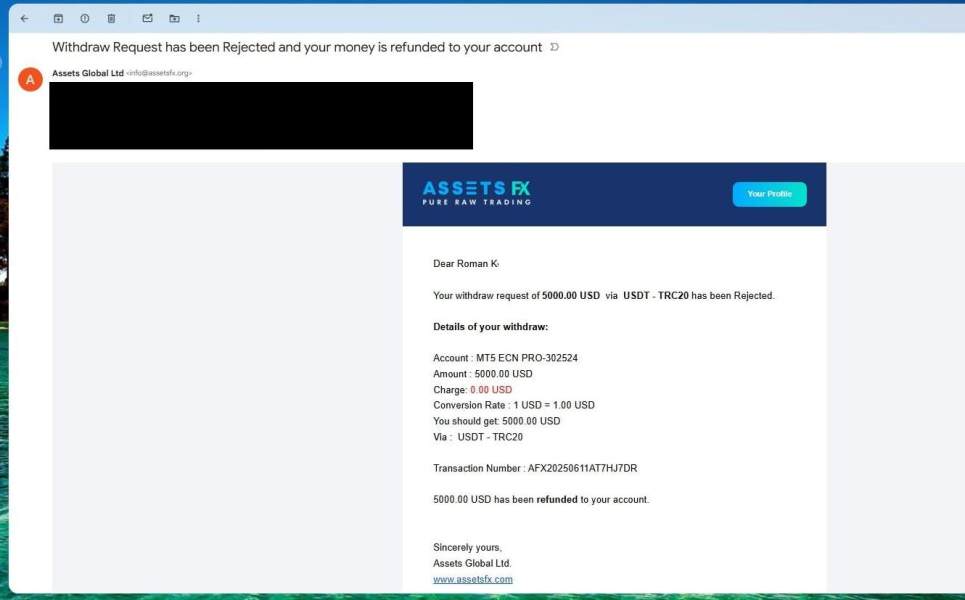

Customer service remains one of the less consistent parts of the AssetsFX offering. Feedback from various users suggests that while the broker tries to provide multiple channels for support, the quality and responsiveness of these channels can vary significantly. Some traders have experienced delays in response times and expressed dissatisfaction with the ability of support staff to resolve issues promptly. The lack of detailed information about the available support channels, such as live chat specifics or dedicated support phone lines, further complicates the issue. Also, there is no clear information on whether support is offered in multiple languages or the extent of service coverage during non-peak hours. Such inconsistencies in customer care negatively impact the overall trading experience and have contributed to some users questioning the broker's reliability. In several assetsfx review reports, the recurring theme is an expectation for a higher standard of service, particularly when dealing with complex account issues or transaction disputes. The reported examples of inadequate support responses have fueled concerns about potential delays during critical trading situations. In summary, while the technical trading infrastructure is strong, the customer service component appears to need significant improvement in responsiveness and quality clarity.

2.6.4 Trading Experience Analysis

The trading experience on AssetsFX is generally seen as positive by many experienced traders. This is particularly due to the platform's speed and low trading costs. Rapid execution of orders is frequently cited as one of the main advantages, enabling users to capitalize on fleeting market opportunities without encountering significant delays. The infrastructure supporting the MetaTrader platforms is strong, ensuring that major technical indicators and analytical tools run smoothly, thus providing a seamless trading environment. Also, the low spreads and minimal commission fees contribute to an overall cost-effective trading experience, enabling traders to maximize their returns over time. But there have been occasional reports of order execution inconsistencies, though such instances are rare. The assetsfx review emphasizes that while most users report a largely satisfactory trading environment, there remain areas where further improvements could be made, such as enhancing the mobile platform experience and providing more in-depth customization options. Overall, the positive aspects of the trading experience—including reliable order execution and competitive pricing—typically outweigh the few negative remarks, making AssetsFX a viable option for those prioritizing efficiency and cost in their trading activities.

2.6.5 Trust Analysis

Trust remains a big concern for potential clients considering AssetsFX. The broker has faced several customer complaints, some even hinting at scams or fraudulent practices, which substantially affect its trust rating. One of the key factors contributing to these concerns is the absence of clearly defined regulatory oversight—no specific regulatory bodies have been identified to assure clients regarding the security and transparency of their funds. Even though AssetsFX touts ultra-low trading costs through low spreads and commissions, the lack of explicit information on protective measures for client funds raises doubts among risk-averse traders. Industry experts and various reports have pointed out that a transparent regulatory framework is crucial for fostering client trust. In multiple assetsfx review articles, the broker's handling of negative events and the slow resolution of disputed issues have further compounded the skepticism. Without strong, independent oversight, even the most competitive trading conditions may not be enough to reassure clients. In summary, while there are many favorable factors related to pricing and trading efficiency, the notable deficiencies in regulatory clarity and incident resolution processes severely undermine overall trust in the broker.

2.6.6 User Experience Analysis

User experience with AssetsFX presents a mixed picture characterized by high satisfaction in cost efficiency and speed, counterbalanced by concerns over transparency and customer support. The overall design of the trading platforms is functional and offers necessary analytical tools, contributing to a generally positive interface and ease of navigation for experienced traders. But the registration and account verification processes have been described as somewhat unclear, with limited documentation provided about specific steps or timelines. Operational issues such as delays in withdrawal processing and unclear instructions regarding funding methods have also been noted by some users. The feedback in several assetsfx review reports indicates that while many traders are content with the efficient execution and low trading costs, the downside lies in the occasional complexity of navigating account features and lack of detailed educational support. Also, the presence of customer service issues marginally detracts from the overall user experience, suggesting that while the trading environment itself is strong, improvements in communication and transparency could further elevate user satisfaction. Enhancing these areas may particularly benefit newer traders who may rely more heavily on guided support during their onboarding process.

Conclusion

In summary, AssetsFX emerges as a broker notable for its ultra-low spreads, minimal commission fees, and advanced trading platforms. This makes it especially attractive to experienced traders who prioritize cost efficiency. But the absence of clear regulatory information and recurring customer service issues cast a shadow on its overall reliability. The assetsfx review points to solid trading conditions and technological strengths, yet also highlights significant concerns regarding trust and transparency. Traders who can navigate these uncertainties and are willing to conduct thorough due diligence may find AssetsFX a competitive option. Ultimately, the broker is best suited for those who value low trading costs while remaining vigilant about potential operational shortcomings and regulatory ambiguities.