Fxcg 2025 Review: Everything You Need to Know

Fxcg, a brokerage operated by Capstone Global Markets LLC, has garnered significant attention in the forex trading community. However, the overall sentiment towards this broker is largely negative, with numerous user complaints and warnings about its legitimacy. Key features of Fxcg include its use of the popular MetaTrader 4 platform and a wide range of trading instruments, but serious concerns about regulatory compliance and user experiences persist.

Note: It is crucial to consider that Fxcg operates through multiple entities across different jurisdictions, which complicates its regulatory status and raises questions about its credibility. This review aggregates various sources to provide a fair and accurate assessment of Fxcg.

Ratings Overview

How We Rate Brokers: Our ratings are based on a combination of user feedback, expert analysis, and factual data regarding the broker's operations.

Broker Overview

Fxcg was established in 2012 and is registered in Saint Vincent and the Grenadines. The broker claims to offer a user-friendly trading experience through the MetaTrader 4 platform, which is widely recognized in the trading community. Fxcg provides access to various asset classes, including forex, commodities, and indices, but lacks significant offerings in cryptocurrencies and stocks.

The regulatory landscape for Fxcg is murky, with claims of oversight by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA). However, evidence suggests that these claims may not hold up under scrutiny, as many sources indicate that Fxcg operates without proper regulation.

Detailed Analysis

-

Regulatory Areas: Fxcg operates primarily from Saint Vincent and the Grenadines, a jurisdiction known for having lax regulatory oversight, making it a hotspot for unregulated brokers. While Fxcg claims to be regulated by ASIC and CIMA, investigations reveal inconsistencies in its licensing, leading to widespread skepticism about its legitimacy.

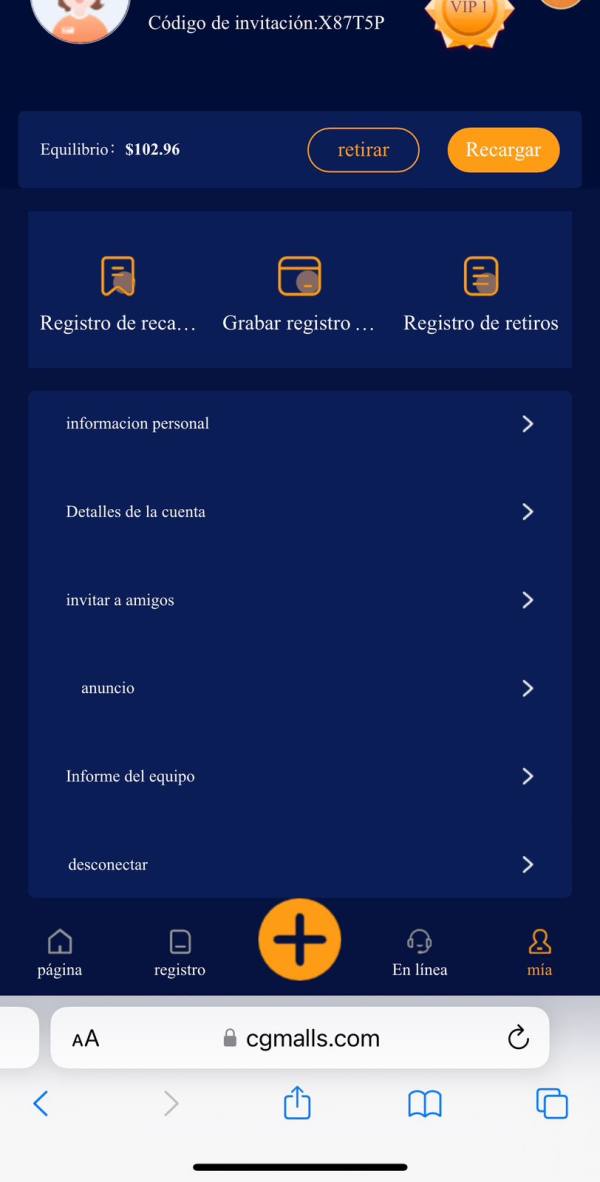

Deposit/Withdrawal Methods: Fxcg accepts various funding methods, including credit/debit cards, wire transfers, and China UnionPay. The minimum deposit requirement is set at $100, which is relatively standard. However, users have reported issues with withdrawals, often citing delays and unexpected fees, raising concerns about the broker's transparency.

Minimum Deposit: The minimum deposit to open an account with Fxcg is generally reported to be around $100, a figure that aligns with many other brokers in the industry. However, the lack of a demo account may deter potential users from testing the platform before committing funds.

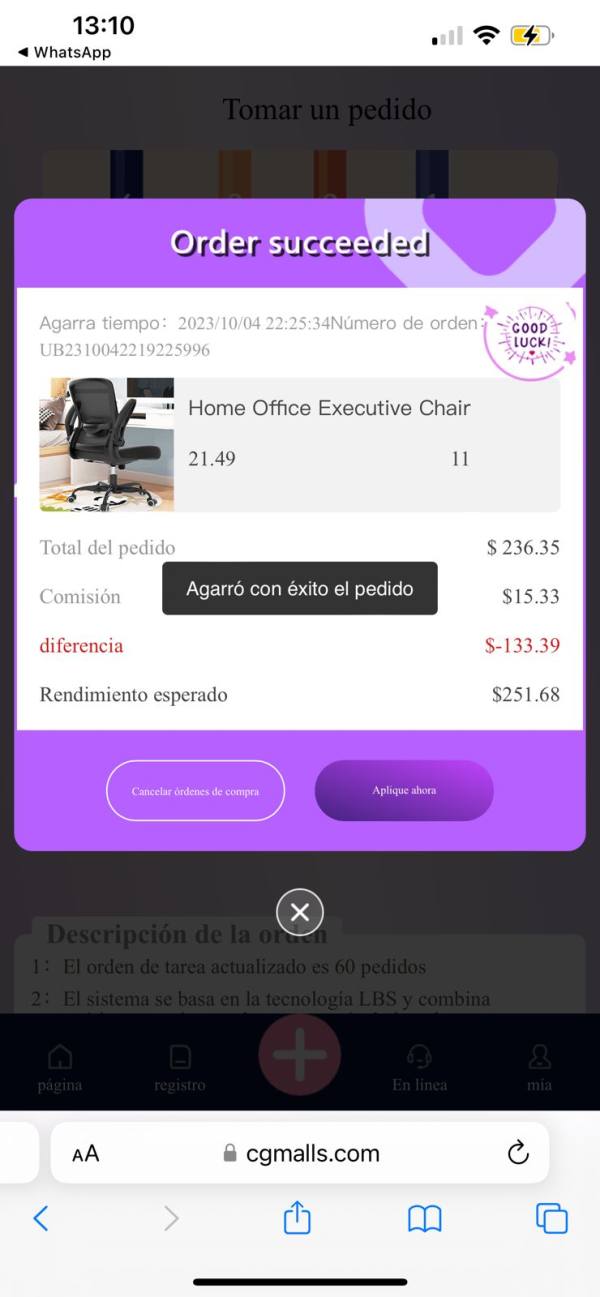

Bonuses/Promotions: Fxcg offers a welcome bonus of up to $2,000, which can be enticing for new traders. However, such bonuses often come with stringent withdrawal conditions that can complicate the process of accessing funds, a common red flag in the industry.

Tradeable Asset Classes: The broker provides access to over 35 forex pairs, commodities like gold and oil, and indices. However, the absence of cryptocurrencies and a limited range of stock trading options may deter traders looking for diverse investment opportunities.

Costs (Spreads, Fees, Commissions): Fxcg advertises competitive spreads starting from 0 pips, but the actual trading conditions are often not as favorable in practice. Users have reported spreads that can reach as high as 1.6 pips for common pairs like EUR/USD, along with commissions of $2 to $4 per lot, which can eat into potential profits.

Leverage: Fxcg offers leverage of up to 1:500, which is significantly higher than what is typically allowed by regulated brokers in more stringent jurisdictions. While high leverage can amplify profits, it also increases the risk of substantial losses, making it a double-edged sword for traders.

Allowed Trading Platforms: Fxcg primarily operates on the MetaTrader 4 platform, which is known for its robustness and user-friendly interface. However, the broker has faced criticism for not providing access to its own trading terminal, leading to further dissatisfaction among users.

Restricted Regions: Fxcg claims to restrict its services to certain countries, including the United States and several European nations. However, user reviews suggest that traders from these regions may still be able to access the platform, raising questions about the broker's compliance with regulatory standards.

Available Customer Support Languages: Fxcg offers customer support primarily in English, with options to contact them via live chat, email, and phone. However, many users have reported unresponsive customer service, which can be particularly frustrating when dealing with withdrawal issues.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: Users have expressed dissatisfaction with the account types available, which are limited in features and flexibility. The lack of a demo account further complicates the onboarding process.

Tools and Resources: While Fxcg offers the widely used MetaTrader 4 platform, the absence of educational resources or advanced trading tools limits its appeal, especially for novice traders.

Customer Service and Support: Numerous complaints highlight the broker's poor customer service, with many users reporting long response times and unhelpful support when issues arise.

Trading Setup (Experience): The trading experience is marred by reports of high spreads and withdrawal difficulties, which can significantly impact a trader's profitability and overall satisfaction.

Trustworthiness: The lack of clear regulatory oversight and numerous user complaints contribute to a low trust rating for Fxcg, making it a risky choice for potential investors.

User Experience: Overall user experiences have been largely negative, with many traders voicing concerns about the broker's transparency and reliability.

In conclusion, the Fxcg review indicates that potential traders should exercise extreme caution when considering this broker. The combination of regulatory ambiguities, user complaints, and a lack of transparency raises significant red flags. It is advisable for traders to explore more reputable and regulated alternatives to ensure a safer trading experience.