Founded in 2009, UC Trader has established its presence primarily in Germany, operating from München. Despite over a decade in the market, it has not secured regulatory status with reputable financial authorities, attracting considerable scrutiny from potential investors. The lack of endorsement from recognized regulators raises questions about the brokers operational integrity and investor safety.

UC Trader provides access to various financial instruments such as Forex, CFDs, commodities, and indices. However, the absence of established trading platforms like MetaTrader 4 and 5 limits the variety of tools available to traders accustomed to these industry standards. The web-based interface allows customization and offers a suite of tools, but feedback has pointed out that it falls short of facilitating a seamless trading experience.

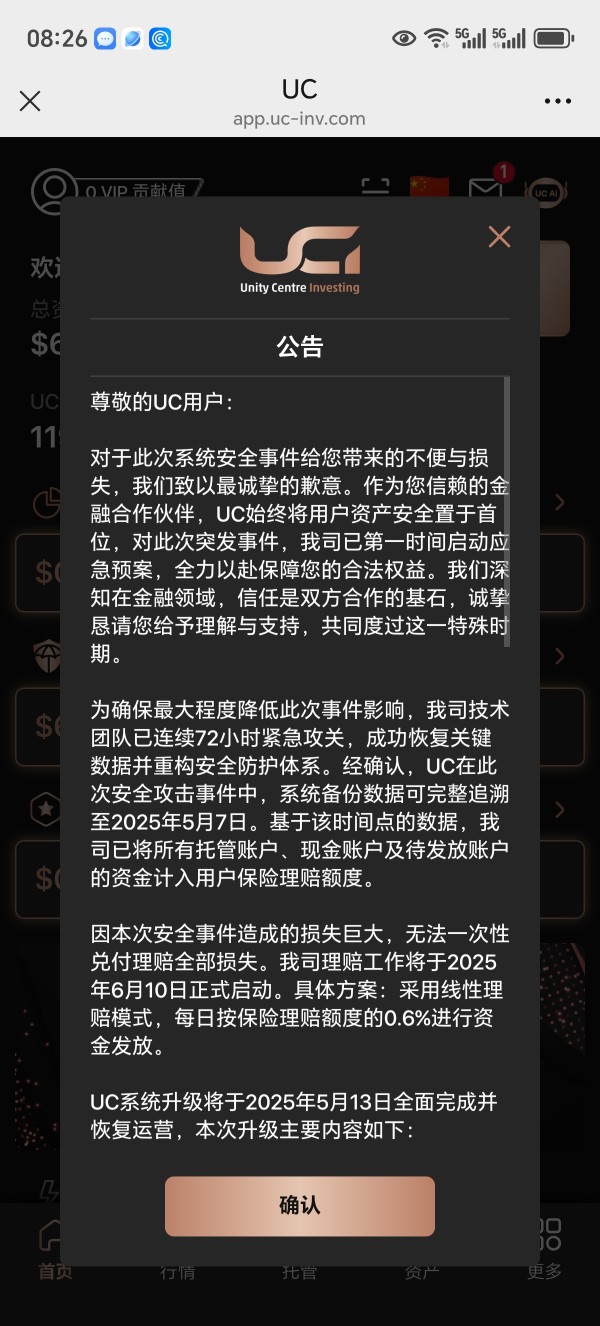

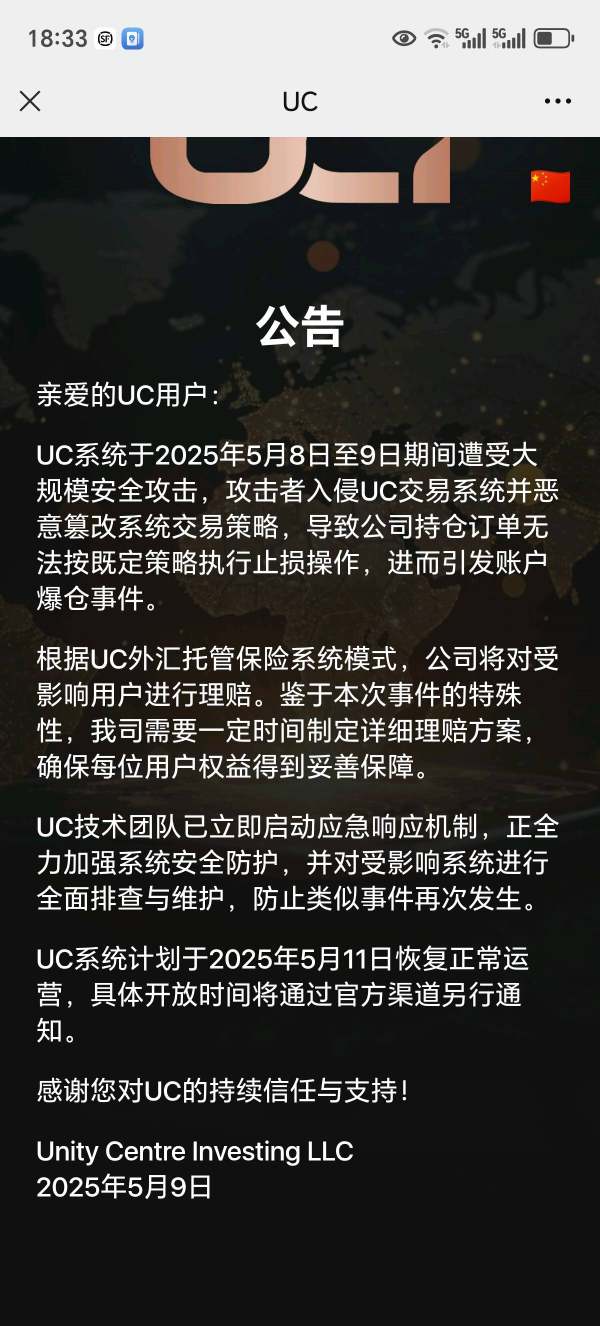

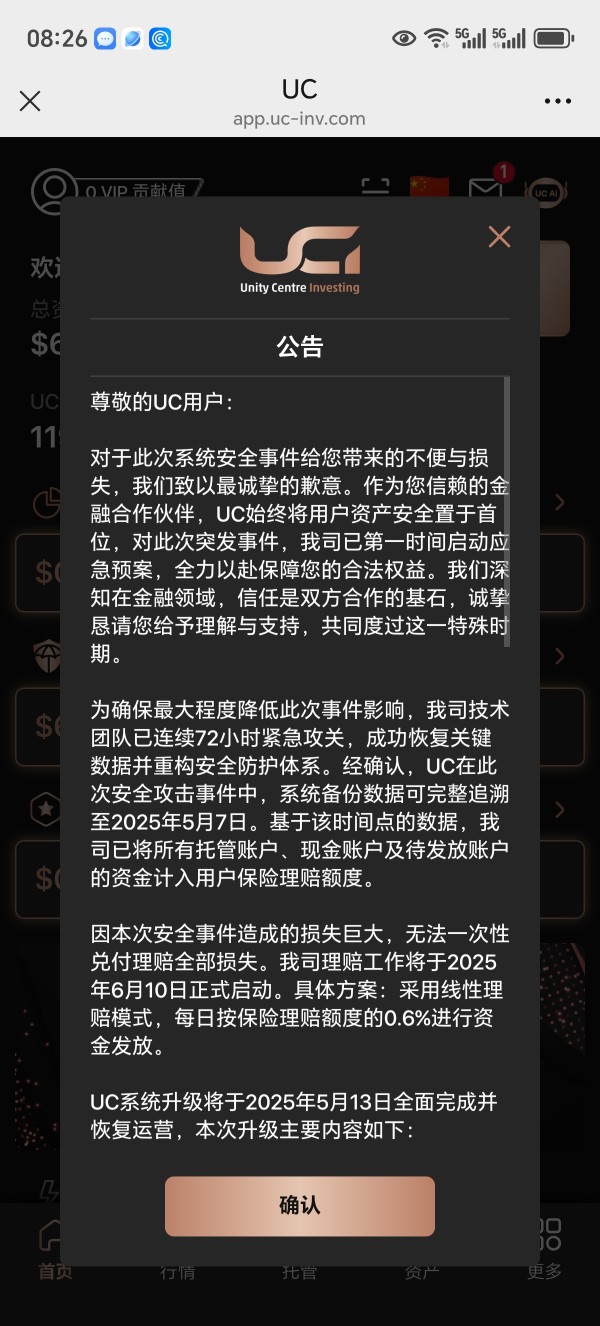

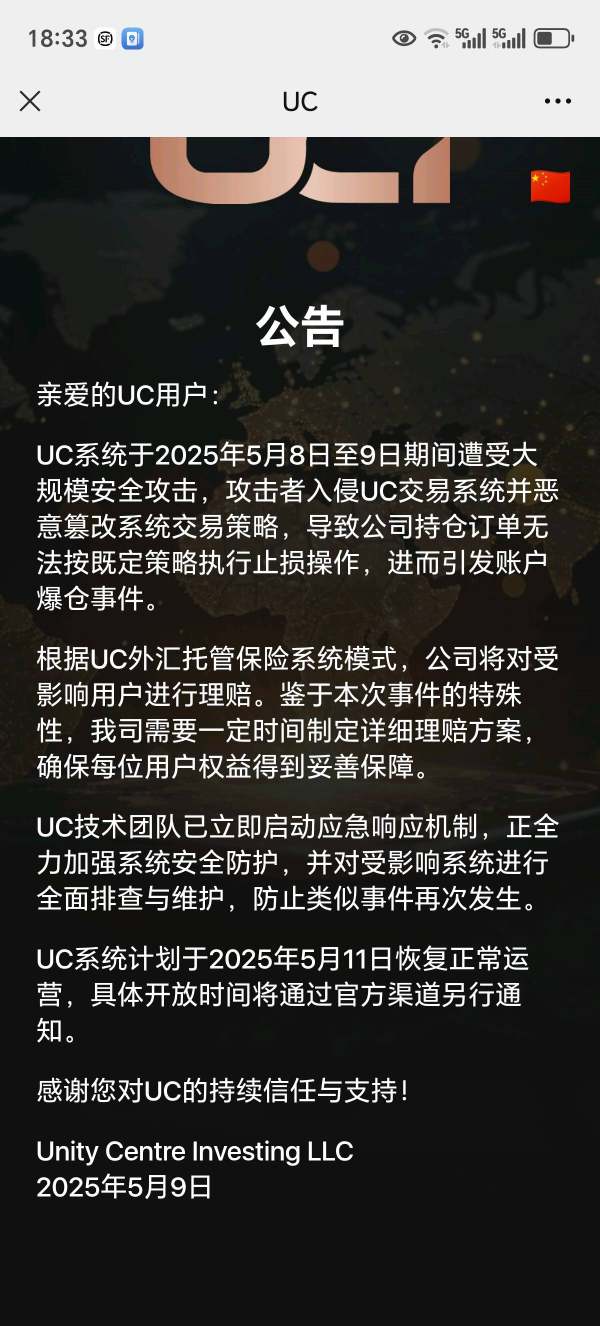

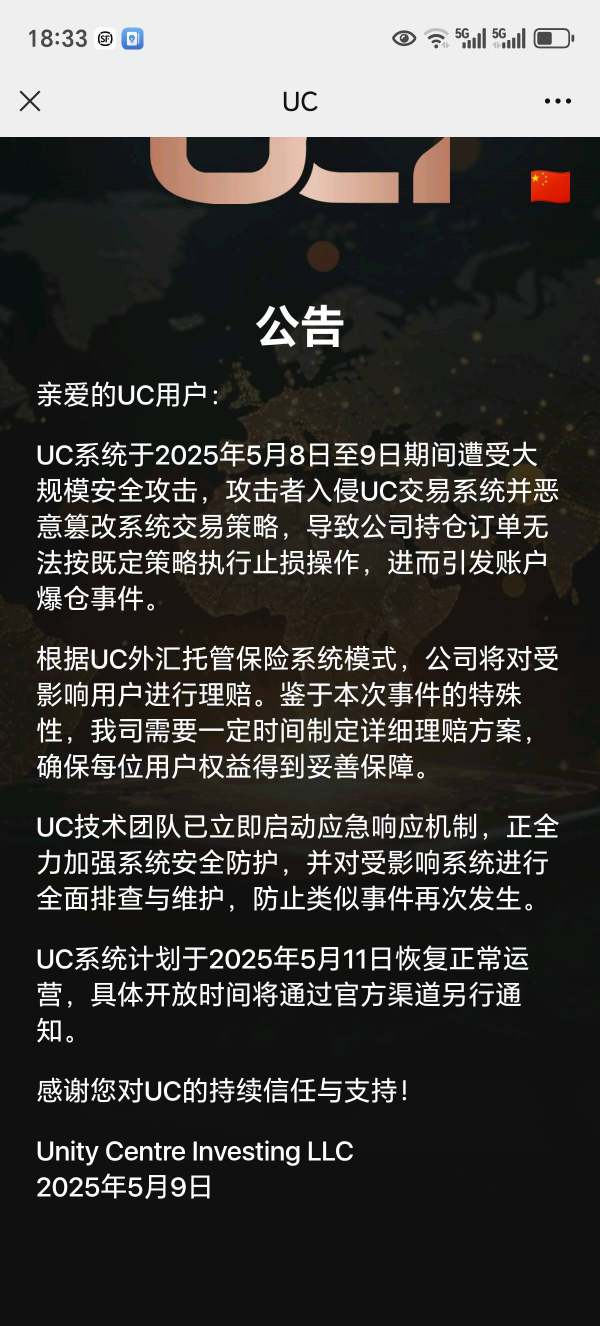

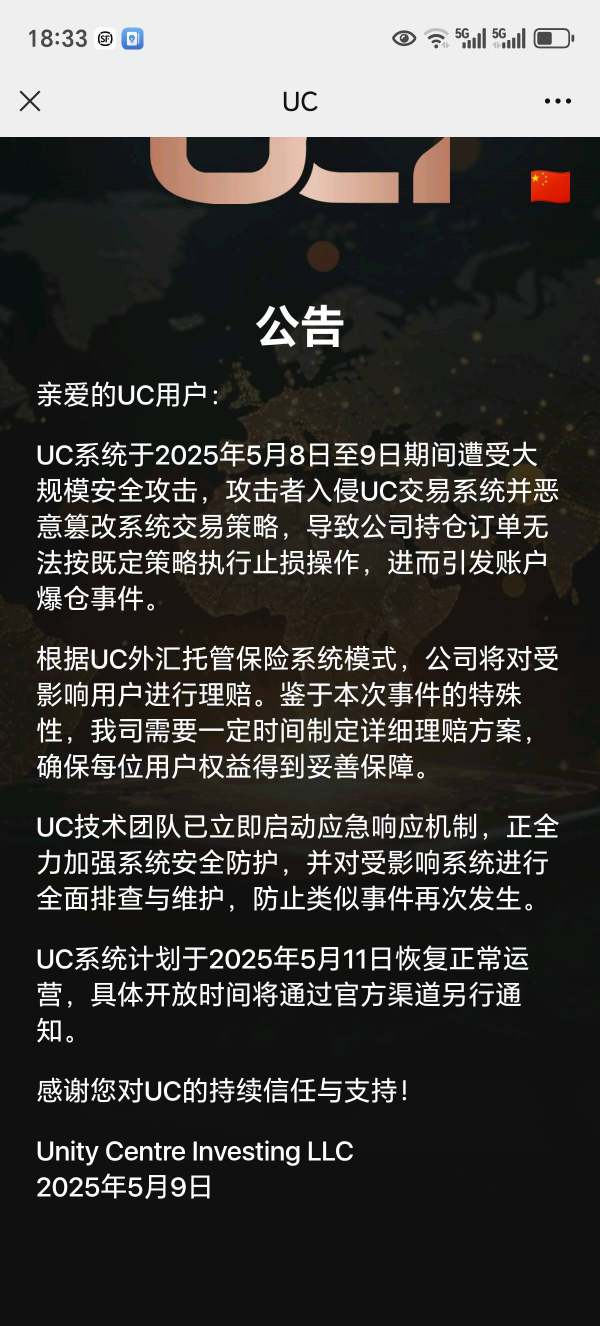

The lack of regulatory oversight for UC Trader casts doubt on the overall trustworthiness of the platform. It has no licenses or valid regulatory information, which raises significant concerns regarding investor protection.

- Check for Regulatory Status: Consult regulatory bodies for licensing information.

- Analyze User Reviews: Review feedback from other users on established forums.

- Research Company History: Investigate operational history and any past issues with regulatory compliance.

- Assess Transparency: Evaluate the clarity of the broker's terms and conditions.

- Engage with Customer Service: Contact support to probe directly about operational procedures and policies.

Industry Reputation and Summary

Feedback suggests that UC Trader has garnered a negative reputation concerning fund withdrawals and hidden fees, reinforcing the need for cautious trading. Users have emphasized the importance of due diligence and self-verification when engaging with such unregulated platforms.

Trading Costs Analysis

Advantages in Commissions

One aspect where UC Trader shines is in its commission structure. Traders benefit from competitive commission rates that can be appealing for high-frequency traders and those looking to capitalize on minute price movements.

The "Traps" of Non-Trading Fees

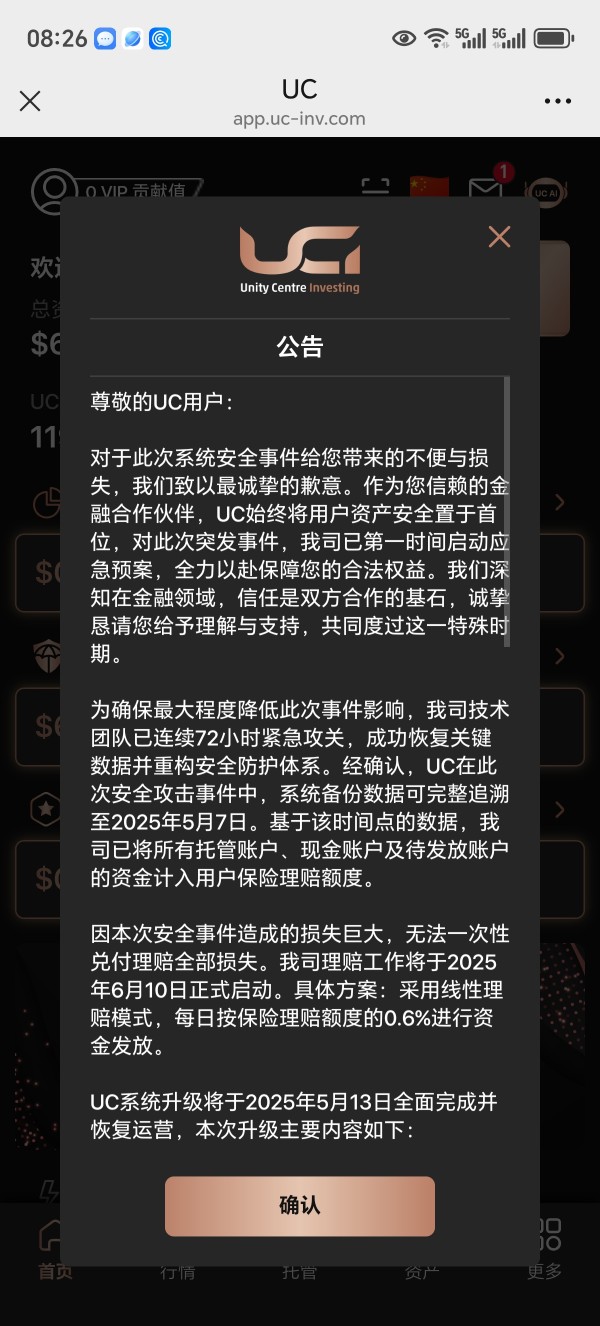

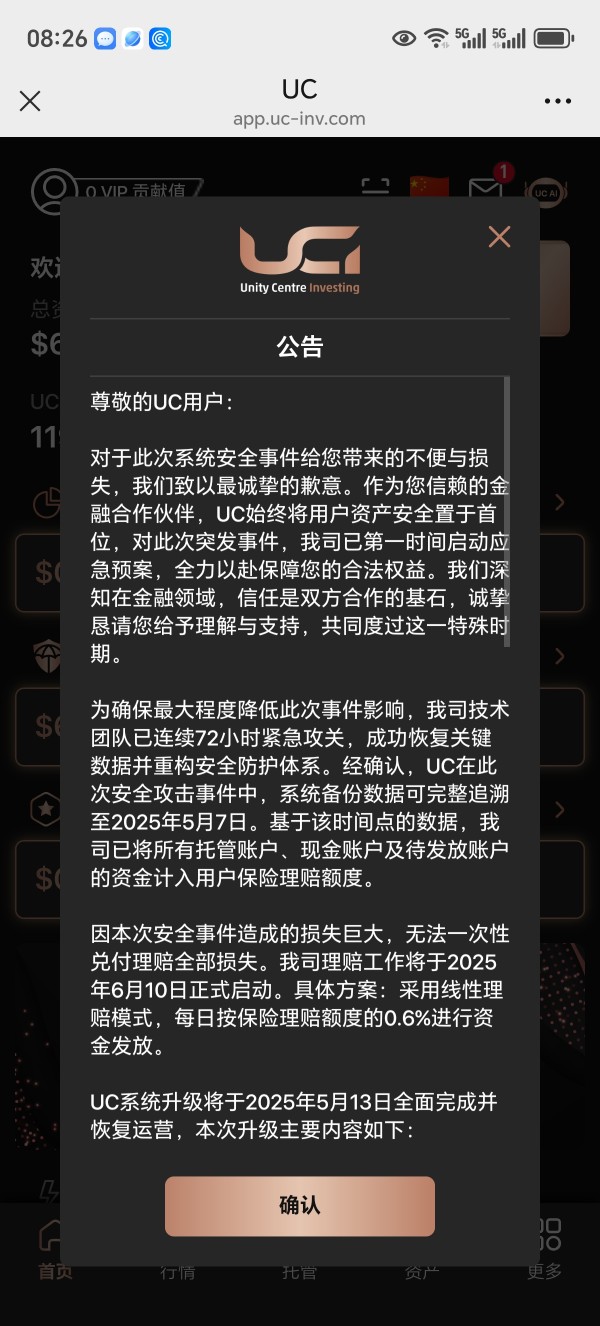

However, users have expressed frustration regarding $30 withdrawal fees that can significantly eat into profits. Furthermore, many grievances point towards undisclosed costs that can arise unexpectedly.

“I tried to withdraw $100 and was charged a hidden fee of $30, which was unacceptable.”

Cost Structure Summary

For experienced traders, low commissions may provide a significant advantage. However, those less familiar with fee structures could find that hidden costs negate any initial savings—demonstrating a clear trade-off.

UC Trader provides a customizable web-based platform, which lacks compatibility with popular tools such as MT4 and MT5. This gap can inconvenience traders who are accustomed to the robust analyses offered by such platforms.

The web platform includes basic charting and analytical tools. While these tools serve to facilitate trade, reviews indicate they do not match the depth and functionality found in leading trading software.

Overall, the user experience is mixed, with some users finding the platform functional, while others have called out for improved accessibility and variety.

“The interface feels outdated compared to what is available in the market today.”

User Experience Analysis

Overall User Feedback

User experiences range widely but lean toward the negative, particularly in regards to withdrawal issues and hidden fees that can hinder a seamless trading experience. Many traders have expressed concerns with accessing funds once deposited.

Analysis of User-Friendly Features

While the platform tries to provide user-friendly features, the lack of transparency in how fees are charged has led to user dissatisfaction.

Customer Support Analysis

Support Channels

UC Trader's support features a phone line and an email address for inquiries, but user reviews have reported slow response times and unhelpfulness.

User Feedback on Support Interactions

Users have cited experiences indicating a lackluster support system, with many reporting that their inquiries went unanswered or were met with generic responses.

Account Conditions Analysis

Flexibility and Accessibility

One of the critical complaints revolves around withdrawal limitations. Users have faced significant issues with getting funds out of their accounts, contributing to a negative overall experience.

Summary of Account Conditions

Due to the persistent issues with fund access and the lack of regulatory oversight, the overall conditions under which UC Trader operates can be considered restrictive and risky for investors.

Conclusion

In summary, while UC Trader offers an array of trading possibilities, the significant risks associated with unregulated operations and the presence of hidden costs suggest that it is better suited for experienced traders prepared to manage those risks. For beginners or those averse to risk, UC Trader may represent more of a potential trap rather than an opportunity. Interested traders should conduct thorough due diligence before entering this environment, constantly weighing the substantial risks involved.