Elite Strategies 2025 Review: Everything You Need to Know

Executive Summary

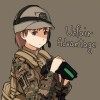

Elite Strategies works as both a forex broker and SEO company in Boca Raton, Florida. The company offers trading services and digital marketing solutions together. This elite strategies review shows a company that gets attention for helping clients build their online presence while giving access to over 45 forex currency pairs and different assets like indices, commodities, oil, gold, silver, and stock CFDs.

The broker stands out by offering the popular MT4 trading platform in Windows and mobile versions. This helps traders who like established and reliable trading environments. Data from Comparably shows Elite Strategies has a strong 92% positive employee rating. This suggests good internal culture and operational standards.

Client testimonials from The Herschthal Practice show the company works well at improving online visibility in about six weeks. Elite Strategies targets traders who want diverse trading products combined with better digital marketing services. This makes it attractive for trading professionals who also need strong online presence management for their businesses.

Important Disclaimers

This elite strategies review uses information from various sources including client testimonials, company culture reports, and trading platform details. Limited regulatory information means traders should do more research about specific regulatory compliance in their areas. The review method uses publicly available information, user feedback, and industry standard assessment criteria.

Different regional entities may work under different regulatory frameworks. Specific terms and conditions may differ based on location and local compliance requirements.

Rating Framework

Broker Overview

Elite Strategies takes a unique approach in the forex brokerage industry by combining traditional trading services with specialized SEO and digital marketing solutions. The company is based in Boca Raton, Florida, and positions itself as more than just a regular forex broker. It offers clients the extra benefit of better online presence management.

This dual-service model attracts trading professionals and businesses that need both market access and digital marketing expertise. The company focuses on providing complete trading services while helping clients improve their search engine rankings and online visibility at the same time. Testimonials from The Herschthal Practice show Elite Strategies increased online presence within a six-week timeframe.

This suggests efficient and effective SEO strategies. The combination of services sets the broker apart from traditional forex-only providers in the competitive brokerage landscape. Elite Strategies provides access to the widely recognized MT4 trading platform in both Windows and mobile versions.

This ensures traders can access markets from various devices and locations. The broker offers an extensive range of trading instruments, including over 45 forex currency pairs alongside indices, commodities, precious metals like gold and silver, oil, and stock CFDs. This diverse asset selection provides traders with multiple opportunities for portfolio diversification and risk management across different market sectors and asset classes.

Regulatory Framework: Available source materials do not provide complete details about specific regulatory oversight or licensing information for Elite Strategies' trading operations.

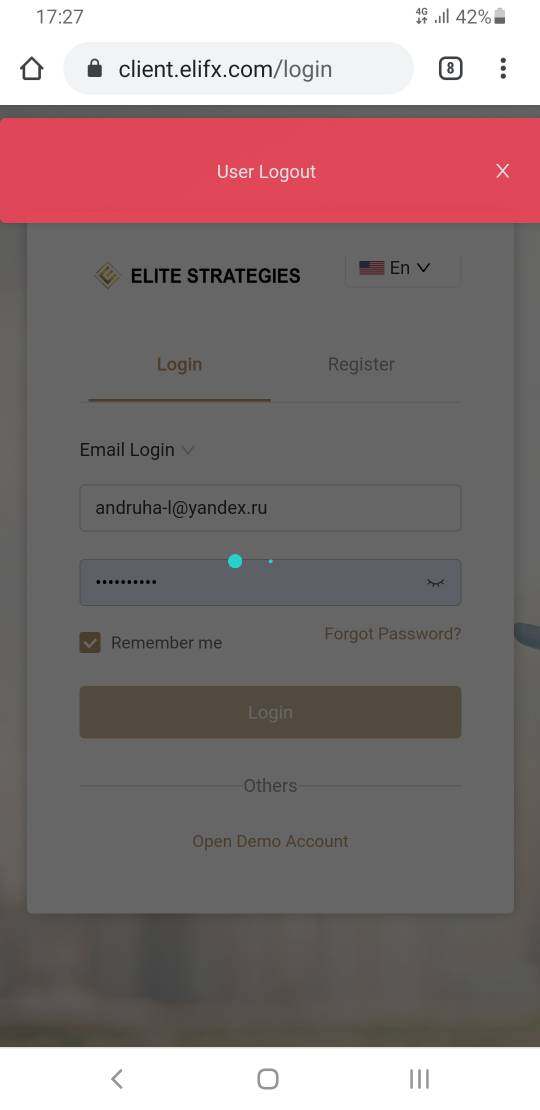

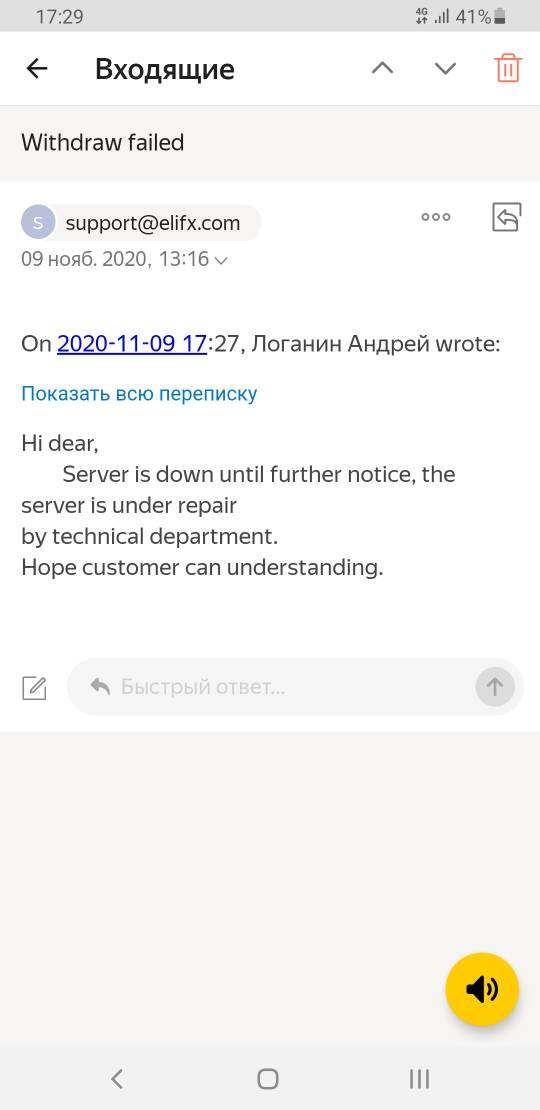

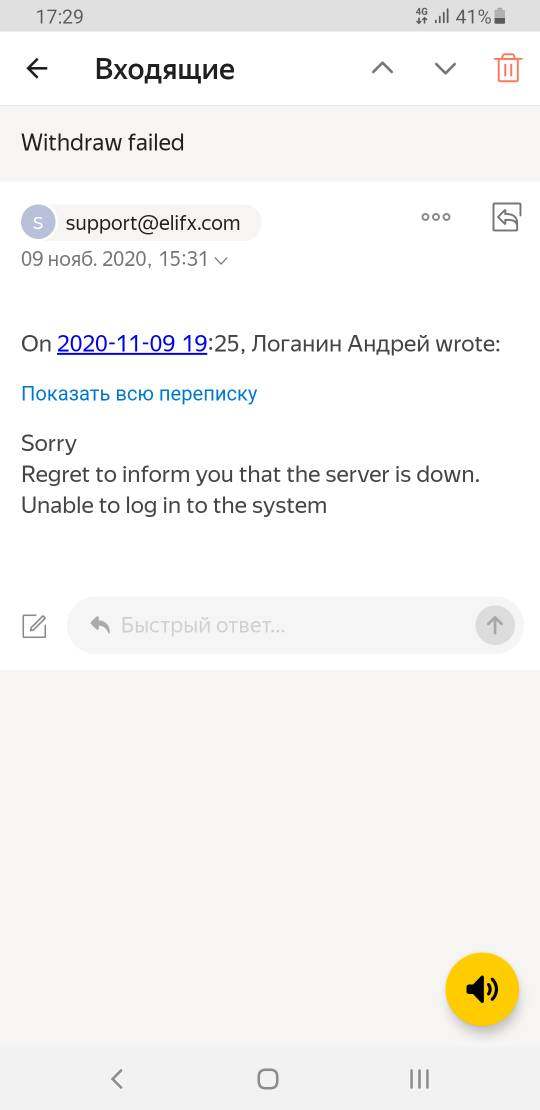

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and fees for deposits and withdrawals is not detailed in available source materials.

Minimum Deposit Requirements: The exact minimum deposit amounts required to open trading accounts with Elite Strategies are not specified in accessible documentation.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not outlined in available source materials.

Trading Assets: Elite Strategies offers a complete selection of over 45 forex currency pairs, providing access to major, minor, and exotic currency combinations. The broker also provides trading opportunities in indices, commodities, oil, gold, silver, and stock CFDs. This creates a diversified trading environment suitable for various trading strategies and risk appetites.

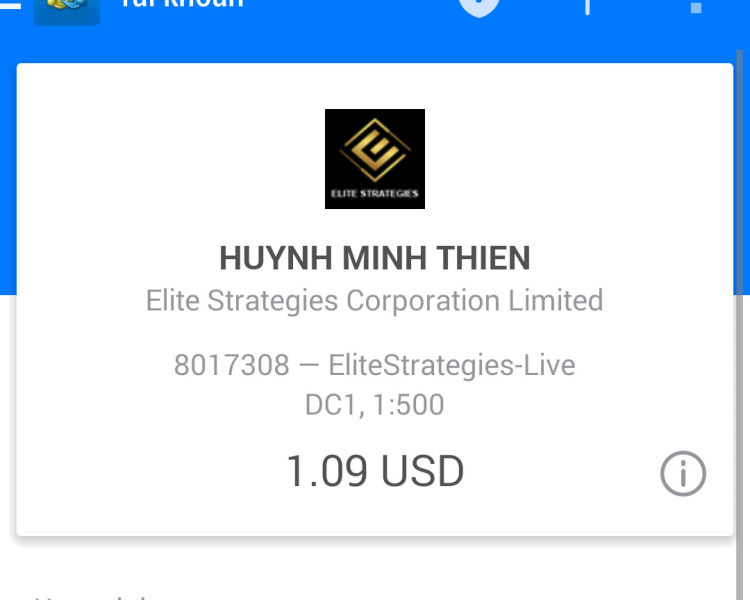

Cost Structure: Specific information about spreads, commissions, swap rates, and other trading costs is not detailed in available source materials for this elite strategies review.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible documentation.

Platform Options: The broker provides access to the MetaTrader 4 platform in both Windows desktop and mobile versions. This ensures compatibility across different operating systems and devices.

Geographic Restrictions: Specific information about countries or regions where services may be restricted is not detailed in available source materials.

Customer Support Languages: Available languages for customer support services are not specified in accessible documentation.

Account Conditions Analysis

The specific account conditions offered by Elite Strategies need further investigation as detailed information about account types, minimum deposit requirements, and account-specific features are not outlined in available source materials. Traditional forex brokers typically offer multiple account tiers designed to accommodate different trader experience levels and capital commitments. These range from basic accounts for beginners to premium accounts for high-volume traders.

Account opening procedures, verification requirements, and timeline expectations are not detailed in accessible documentation. Most reputable brokers implement Know Your Customer and Anti-Money Laundering procedures that require identity verification, proof of address, and sometimes income verification. This depends on account type and deposit amounts.

Special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions, managed accounts, or institutional account options are not specifically mentioned in available source materials. The absence of detailed account condition information in this elite strategies review suggests potential clients should directly contact the broker for complete account specification details.

Account funding options, withdrawal procedures, and processing times would typically be important considerations for traders evaluating account conditions. These specifics are not detailed in accessible documentation.

Elite Strategies shows strength in its platform and tool offerings by providing access to the widely respected MetaTrader 4 platform in both Windows desktop and mobile versions. MT4 remains one of the most popular trading platforms in the forex industry due to its robust charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and user-friendly interface design.

The broker's asset selection represents a significant strength, offering over 45 forex currency pairs alongside diverse instruments including indices, commodities, oil, gold, silver, and stock CFDs. This complete instrument selection enables traders to implement diversification strategies across multiple asset classes and market sectors. It potentially reduces portfolio risk through correlation management.

However, available source materials do not provide detailed information about additional research resources, market analysis tools, economic calendars, or educational materials that might be available to traders. Many competitive brokers enhance their platform offerings with proprietary research, daily market commentary, webinars, and educational content designed to support trader development and decision-making processes.

Automated trading capabilities through MT4's Expert Advisor functionality would typically be available. Specific details about custom EA development support, strategy optimization tools, or algorithmic trading resources are not outlined in accessible documentation for this elite strategies review.

Customer Service and Support Analysis

Customer service quality and support infrastructure details are not covered in available source materials, representing a significant information gap in this evaluation. However, client testimonials from The Herschthal Practice indicate positive experiences with responsiveness, specifically noting that Elite Strategies "responds quickly to my needs." This suggests at least some level of effective customer communication.

The testimonial evidence suggests that the company maintains professional standards in client relationship management with particular emphasis on delivering results within promised timeframes. The six-week timeline mentioned for achieving improved online presence indicates structured project management and regular client communication during service delivery.

Available documentation does not specify customer support channels such as live chat, telephone support, email support, or help desk ticket systems. Support availability hours, weekend coverage, and holiday support schedules are not detailed in accessible materials. Multi-language support capabilities, which are often important for international brokers, are not specified in available source materials.

Response time expectations, escalation procedures for complex issues, and support quality metrics are not outlined in accessible documentation. The 92% positive employee rating from Comparably data suggests strong internal culture, which often correlates with better customer service delivery. Direct customer service satisfaction metrics are not available.

Trading Experience Analysis

Trading experience evaluation is limited by the absence of specific performance metrics, execution quality data, or detailed user feedback about platform functionality in available source materials. The provision of MT4 platform access suggests traders would have access to standard features including real-time pricing, advanced charting, technical indicators, and order management tools that are characteristic of this established platform.

Platform stability and execution speed metrics are not detailed in accessible documentation. The choice to offer MT4 suggests recognition of trader preferences for proven, reliable trading infrastructure. Mobile platform functionality through MT4 mobile would typically provide essential trading capabilities for traders requiring market access while away from desktop environments.

Order execution quality, including fill rates, slippage statistics, and rejection rates, are not specified in available source materials. These metrics are typically important considerations for active traders, particularly those employing scalping or high-frequency trading strategies that require consistent, fast execution.

Trading environment details such as dealing desk versus no dealing desk execution, market maker versus ECN model, and liquidity provider relationships are not outlined in accessible documentation for this elite strategies review. Such information would typically influence trading costs and execution quality expectations.

Trust and Reliability Analysis

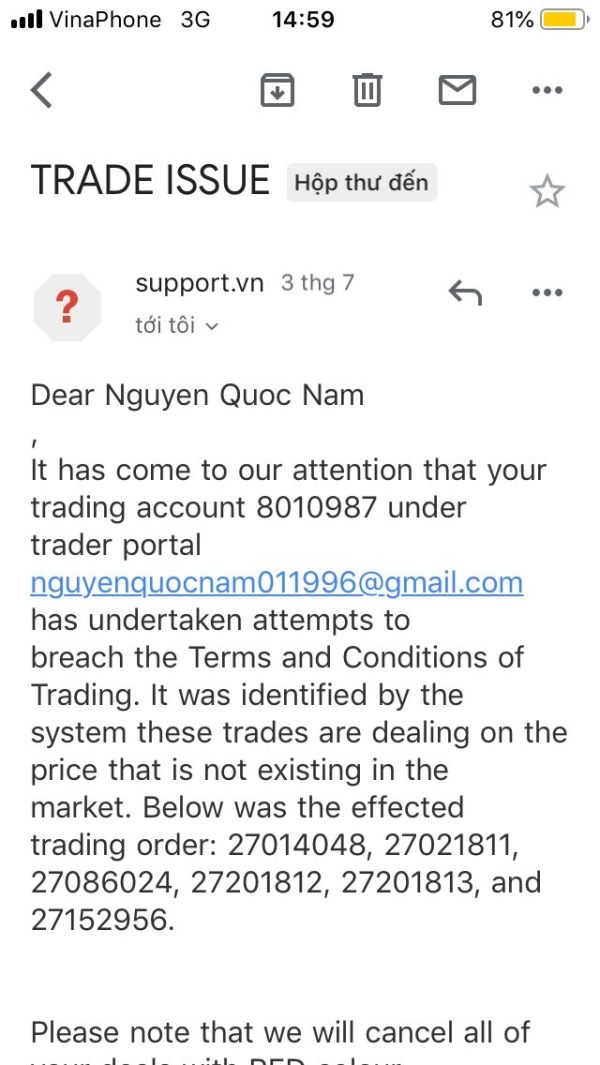

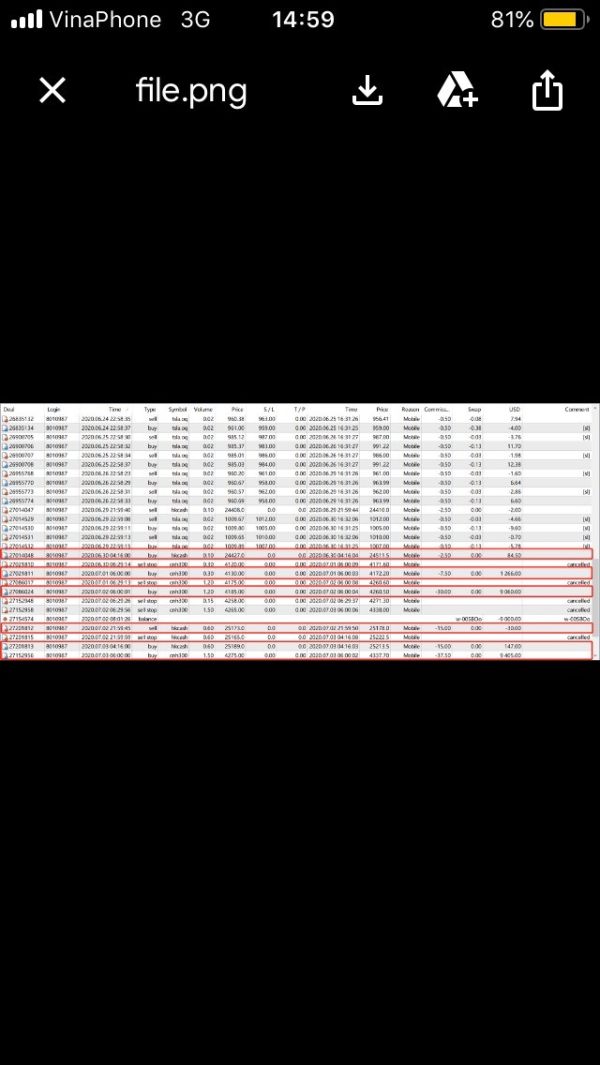

Trust and reliability assessment is significantly limited by the absence of detailed regulatory information in available source materials. Regulatory oversight represents a fundamental component of broker evaluation, as it provides framework for client fund protection, operational standards, and dispute resolution mechanisms.

The company's dual focus on forex trading and SEO services, while potentially beneficial for clients requiring both services, may raise questions about operational focus and resource allocation between these different business lines. However, the positive employee rating of 92% from Comparably suggests strong internal operational standards and potentially stable business management.

Client testimonials, particularly the detailed feedback from The Herschthal Practice, indicate successful service delivery and professional relationship management. The testimonial specifically mentions improvement after "years of working with a few poor quality companies," suggesting Elite Strategies was able to deliver where competitors had failed.

Fund safety measures, segregated account protocols, and client money protection schemes are not detailed in available source materials. These protections are typically mandated by regulatory authorities and represent crucial considerations for trader fund security. The absence of specific regulatory information in this elite strategies review creates uncertainty about these important protections.

User Experience Analysis

Complete user experience evaluation is limited by the absence of detailed user feedback and satisfaction metrics in available source materials. However, the available testimonial from The Herschthal Practice provides insight into at least one client's positive experience, particularly highlighting rapid results achievement and improved online presence within six weeks of engagement.

The testimonial indicates satisfaction with both service delivery and ongoing support, with specific mention of quick response times to client needs. This suggests effective communication protocols and client relationship management, though broader user satisfaction data is not available for complete analysis.

Interface design and platform usability would primarily relate to the MT4 platform experience, which benefits from widespread industry adoption and extensive user familiarity. However, broker-specific customizations, additional tools, or proprietary interfaces are not detailed in accessible documentation.

Registration and account opening procedures are not described in available source materials. The 92% positive employee rating suggests internal processes are likely well-structured and professional. Account verification timelines, documentation requirements, and onboarding support are not specified in accessible materials.

The combination of trading services with SEO capabilities may appeal to specific user segments, particularly trading professionals or financial advisors who require both market access and digital marketing support for their business operations. Detailed user demographic analysis is not available in this elite strategies review.

Conclusion

Elite Strategies presents an interesting proposition in the forex brokerage landscape by combining traditional trading services with specialized SEO and digital marketing capabilities. The broker shows strengths in platform selection through MT4 provision and asset diversity with over 45 forex pairs plus additional instruments across multiple asset classes. The 92% positive employee rating and positive client testimonials suggest professional operational standards and effective service delivery.

However, this evaluation is significantly limited by the absence of crucial information including specific regulatory details, account conditions, cost structures, and complete user feedback. Potential clients should conduct additional due diligence to obtain detailed information about regulatory compliance, trading costs, and specific terms and conditions.

Elite Strategies appears most suitable for traders seeking diversified trading opportunities combined with digital marketing support, particularly those operating trading-related businesses requiring enhanced online presence. The broker's unique service combination may provide value for clients needing both trading access and SEO services. Traditional forex-focused traders may require additional information to fully evaluate the trading proposition.