MSFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the fast-paced world of forex trading, MSFX distinguishes itself by offering a low-cost trading platform and attractive high leverage options. This broker aims to cater to experienced traders who are seeking to maximize their trading potential with minimal fees. However, while the trading conditions appear enticing, there are critical trade-offs that potential clients must consider. Foremost among these is the absence of regulatory oversight, which raises substantial concerns regarding fund safety and the reliability of withdrawals from the platform. As a result, MSFX may be better suited for seasoned traders who are adept at navigating the inherent risks associated with unregulated brokers. In contrast, novice traders and risk-averse investors should approach with caution and perhaps consider alternatives that provide a more secure trading environment.

⚠️ Important Risk Advisory & Verification Steps

Attention Traders! Before considering opening an account with MSFX, it is crucial to understand the potential risks involved. Here are some critical points to consider:

- Risk Signals:

- MSFX operates without oversight from recognized financial regulatory authorities.

- Claims of registration and operational legitimacy may not hold water upon investigation.

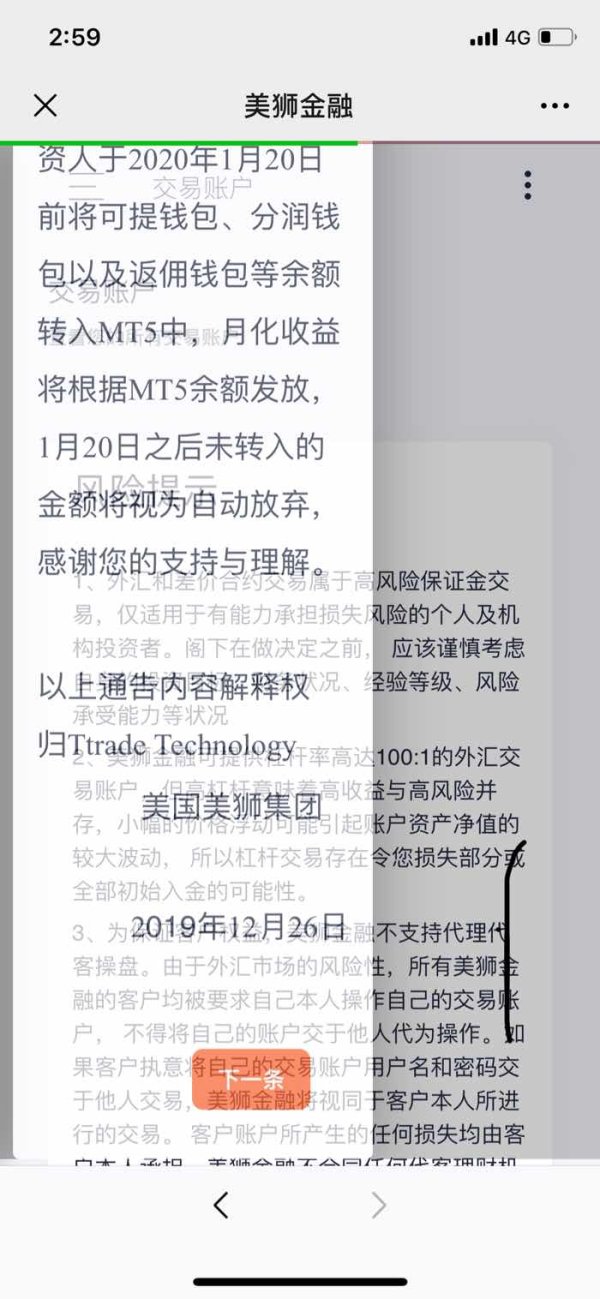

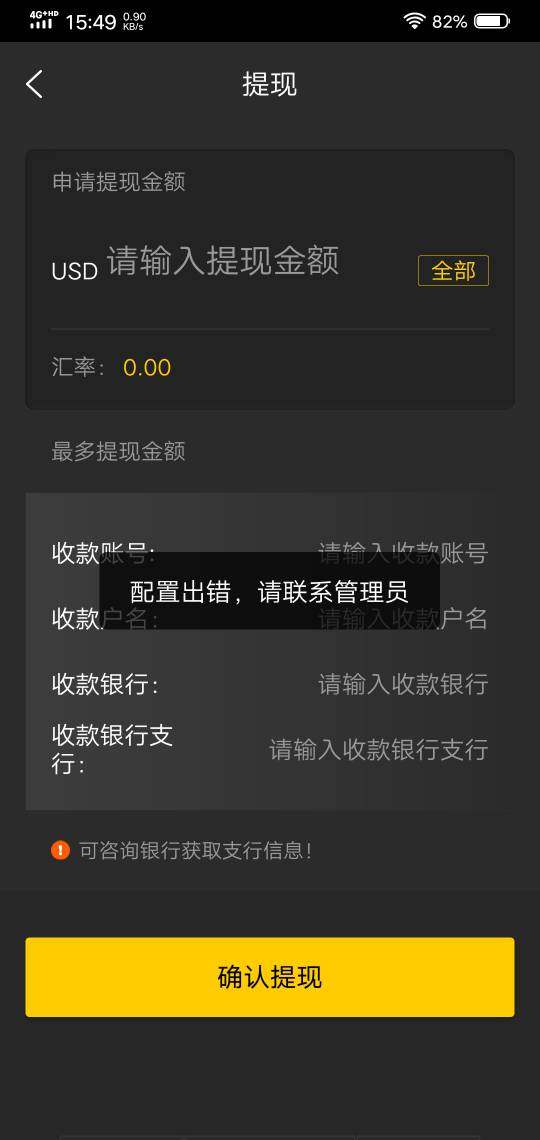

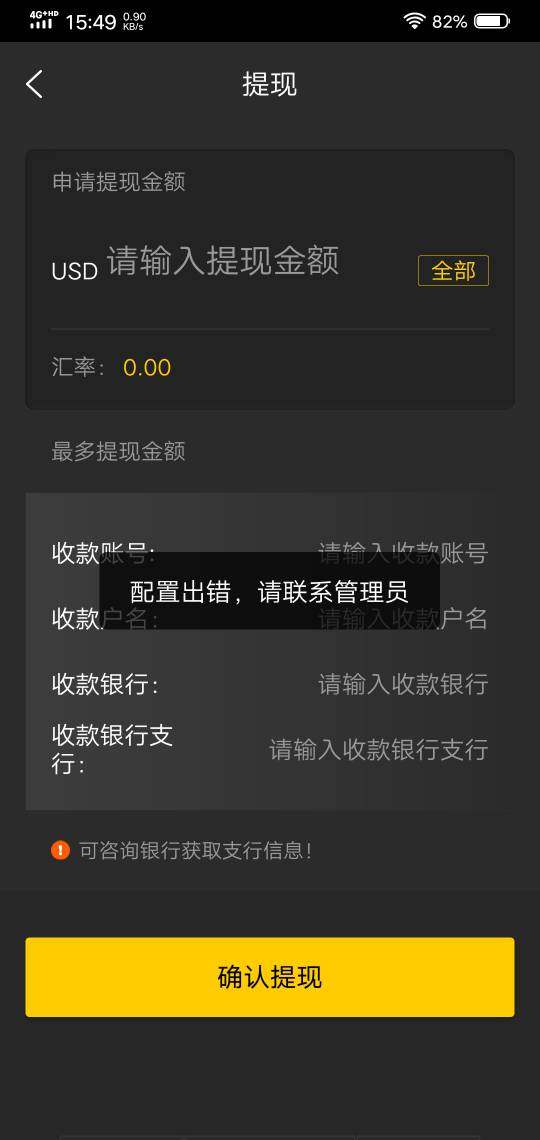

- High withdrawal fees and possible difficulties accessing funds have been reported.

Potential Harms:

- There could be limited recourse if funds are lost, making it crucial to self-verify information regarding the broker.

How to Self-Verify:

- Check Regulatory Agencies: Use sources such as the NFA's BASIC database to confirm the broker's registration status.

- Review User Feedback: Look for reviews on trustworthy financial websites to gauge other traders' experiences.

- Assess Broker Communication: Reach out to the broker with questions and note the responsiveness and professionalism of their support.

- Inspect Physical Addresses: Verify if the broker has a legitimate, verifiable company address through Google Maps.

Rating Framework

Broker Overview

Company Background and Positioning

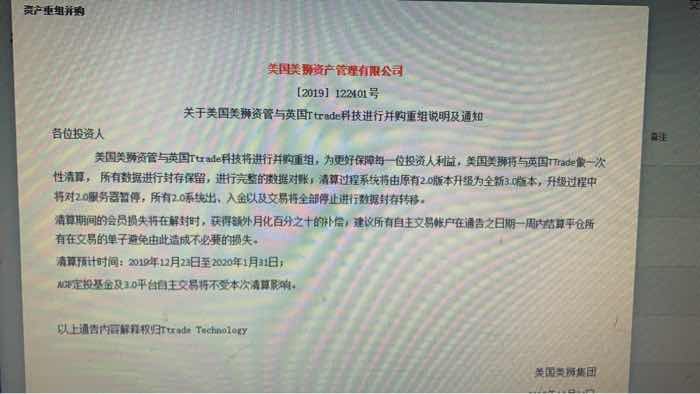

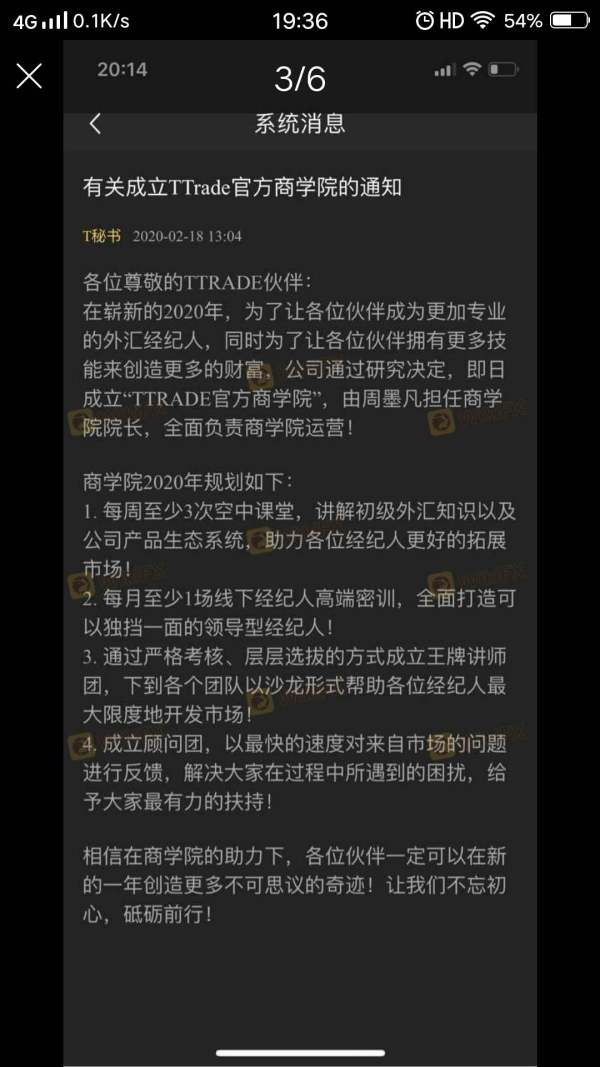

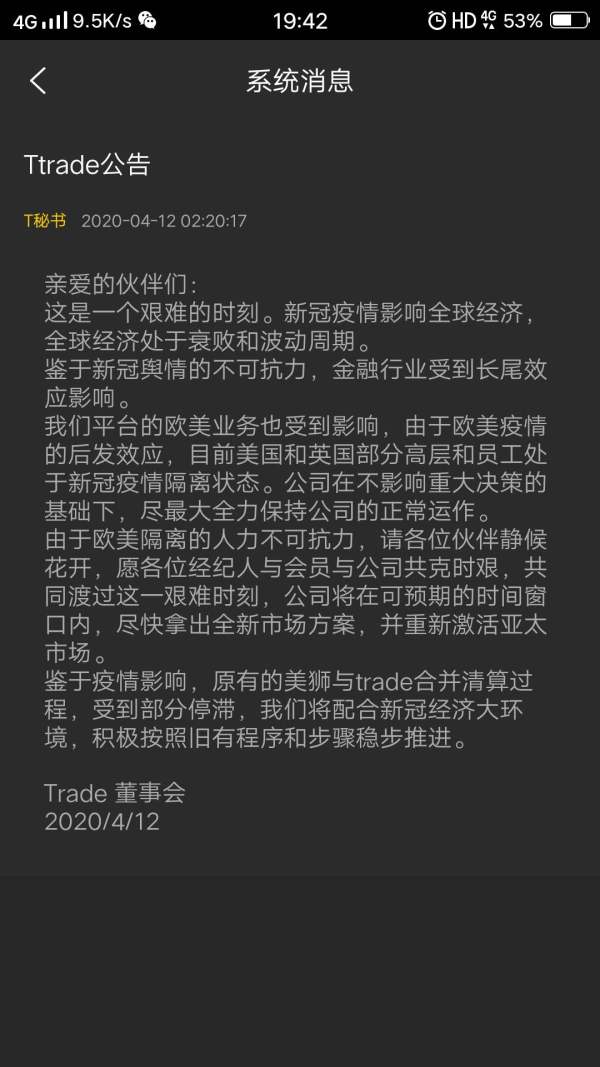

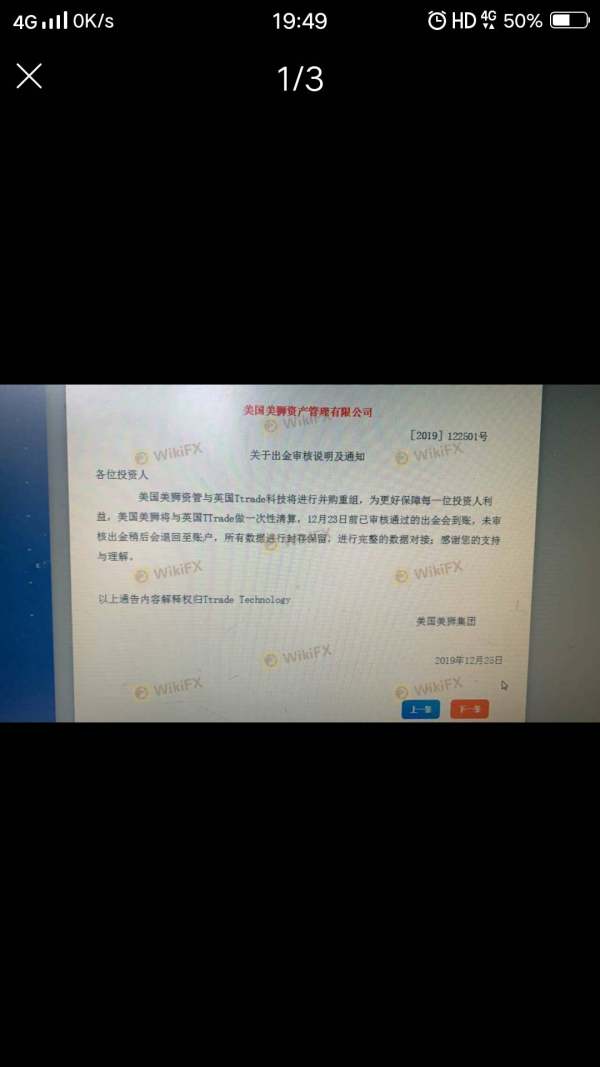

Founded in 2020, MSFX is embodied by the operational entity, Realms Tech Private Limited, which claims to be headquartered in Seychelles. However, it has come under scrutiny as multiple sources indicate that MSFX is not regulated by any recognized financial authority. The implication here is concerning; without regulatory oversight, the broker's operations lack the safeguards typically afforded to traders dealing with regulated entities. This absence of transparency raises questions about the legitimacy of MSFX's claims regarding global operations and quality service.

Core Business Overview

MSFX primarily focuses on forex trading, offering a range of assets, including cryptocurrencies, indices, and commodities. The broker promotes itself as a one-stop trading platform providing cutting-edge tools on popular trading interfaces like MT4 and MT5. However, reports indicate that MSFX does not provide demo trading accounts, which raises red flags for inexperienced traders eager to practice before committing real funds. The brokers claims regarding its liquidity provider, Alpha Trade Pty Ltd, have also been met with skepticism due to the negative reputation surrounding unregulated brokers in this space.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

MSFX operates in a nebulous regulatory environment. The cornerstone of trust for any trading platform stems from the existence of a supervisory body that can offer oversight. However, the findings regarding MSFX indicate major inconsistencies in their licensing claims.

Analysis of Regulatory Information Conflicts:

The absence of credible licensing from major regulatory bodies such as the Seychelles Financial Services Authority raises immediate concerns. Across multiple reviews, it is noted that “real msfx” is associated with misleading registration claims that place investor funds at high risk.

User Self-Verification Guide:

To ensure engagement with a legitimate broker, traders should:

Use Official Regulatory Websites: Consult databases like the NFA's BASIC to verify if MSFX is listed.

Search for Independent Reviews: Look for trading forums and credible review sites to determine user satisfaction and operational history.

Contact Customer Support: Assess the availability and responsiveness of customer service via phone or chat features.

Check Company Registration: Ensure a legitimate business address exists and explore it via satellite views for authenticity.

Industry Reputation and Summary:

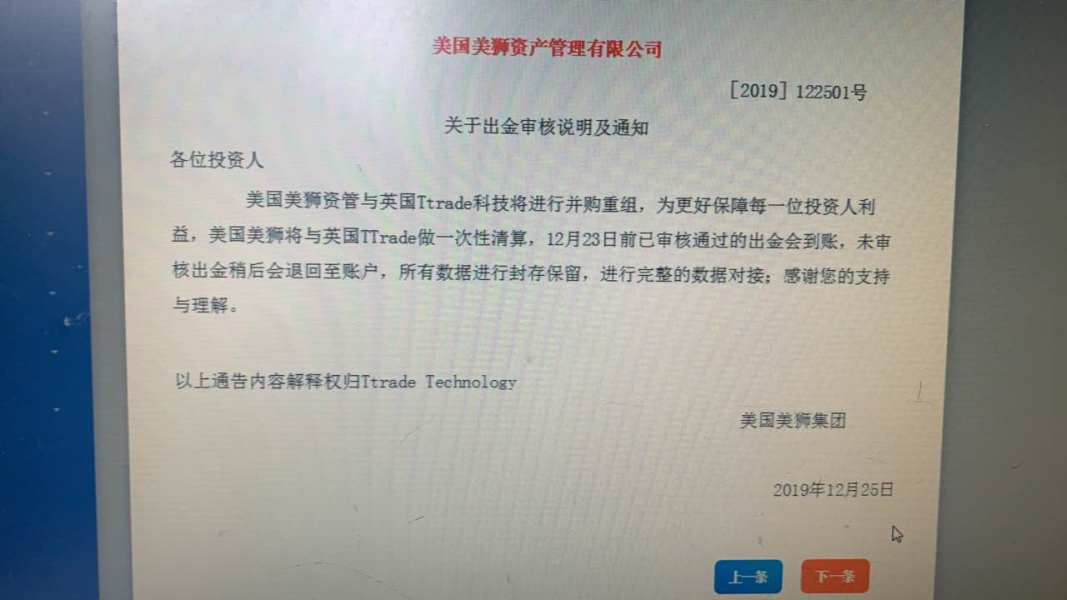

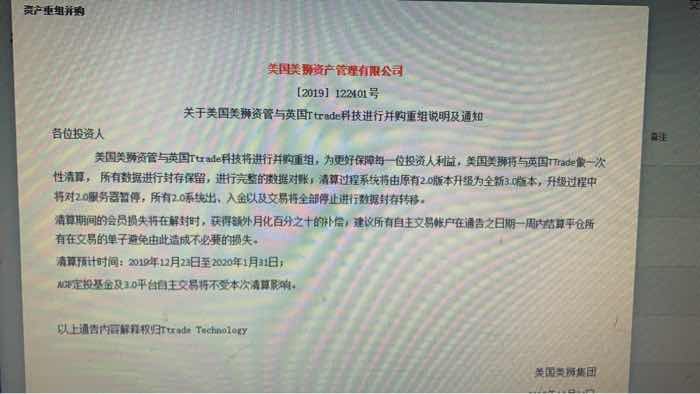

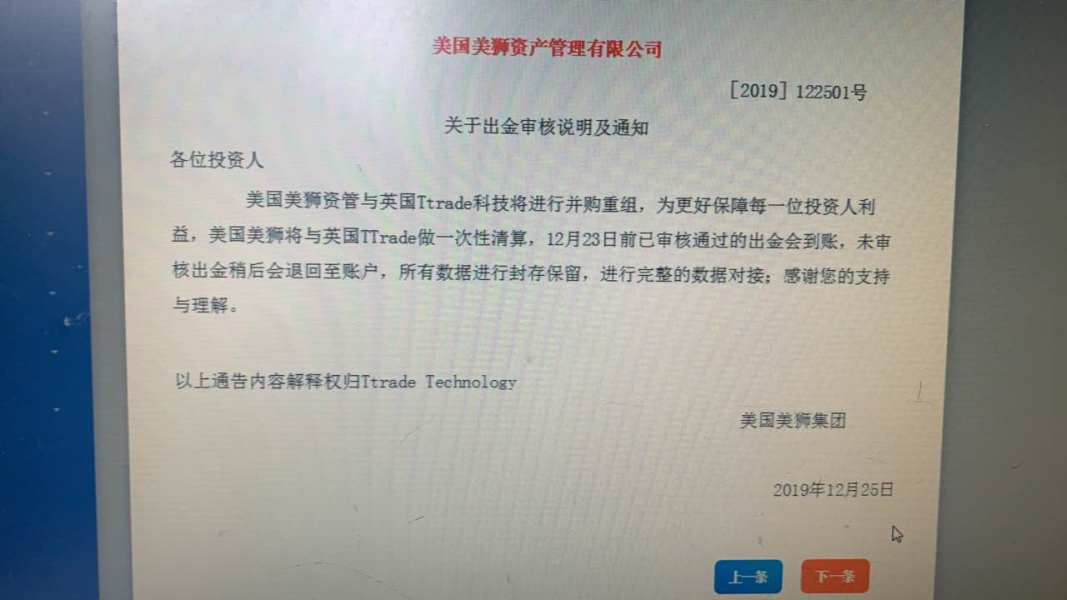

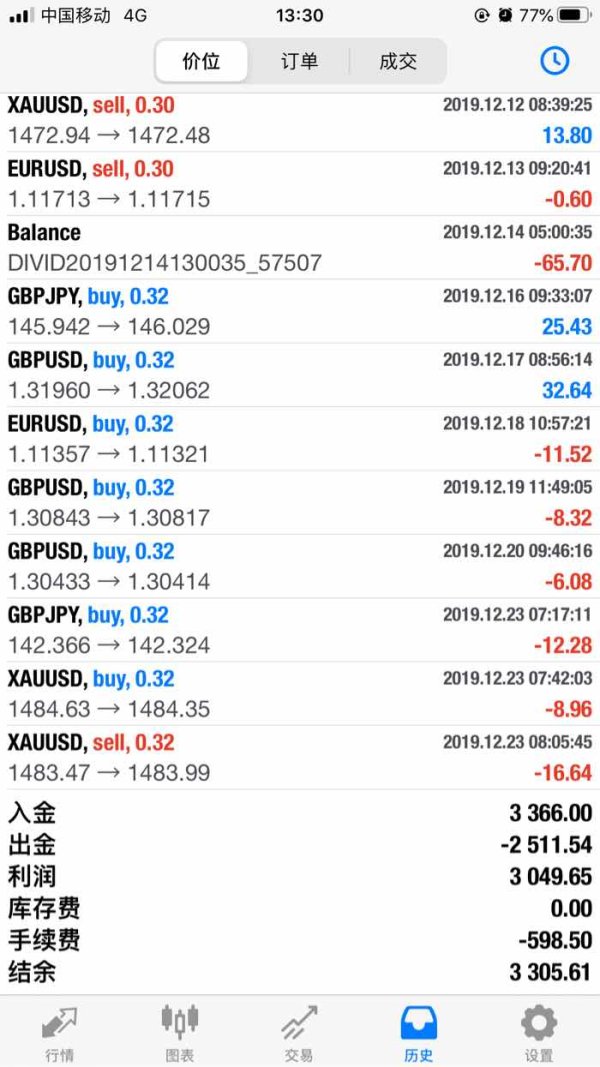

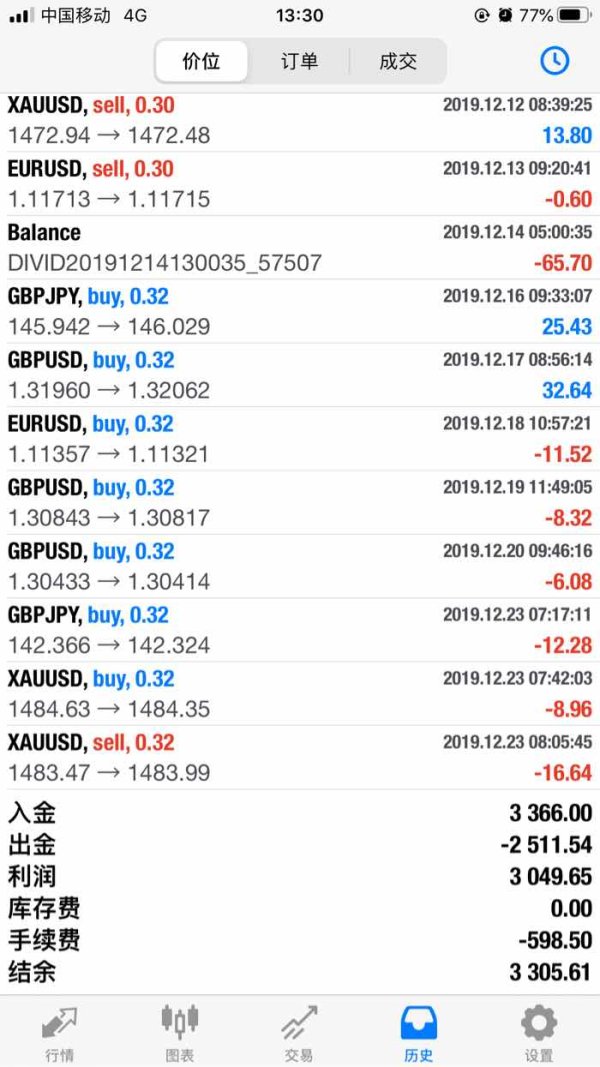

Feedback collected from various trading communities consistently highlights substantial issues with fund withdrawals and overall trustworthiness. One user summarized concerns succinctly in the following:

"I had problems withdrawing funds, and the support team was nearly non-existent."

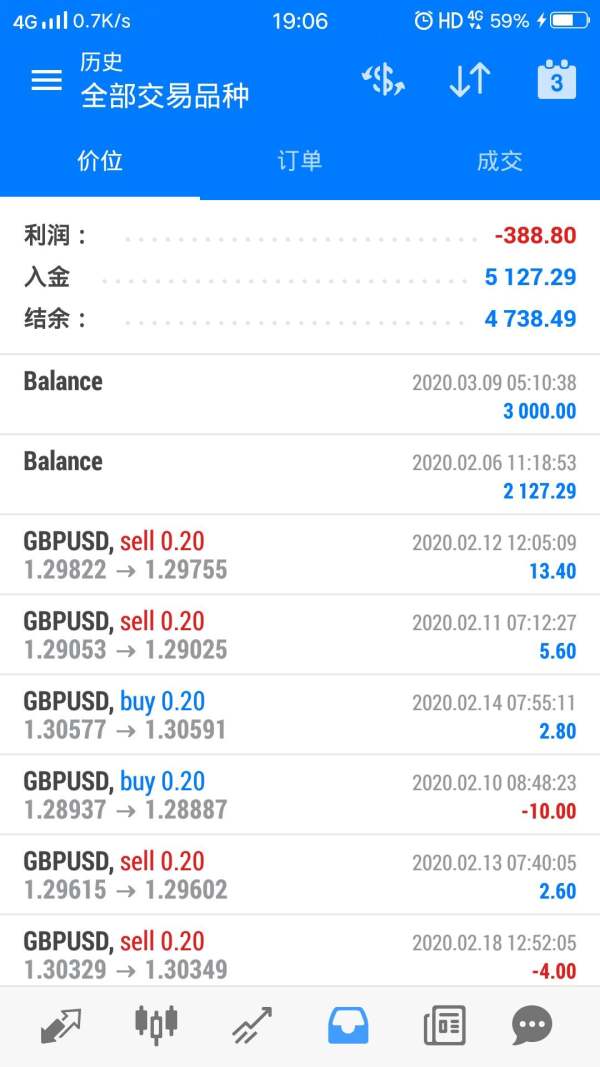

Trading Costs Analysis

With trading costs being a primary consideration for many traders, MSFX provides an enticing low-commission structure. However, the allure of such low costs must be viewed with caution.

Advantages in Commissions:

MSFX advertises competitive trading commissions, particularly with spreads allegedly starting from as low as 0.0 pips for certain account types. This structure appeals especially to high-frequency traders looking to minimize trading costs.

The "Traps" of Non-Trading Fees:

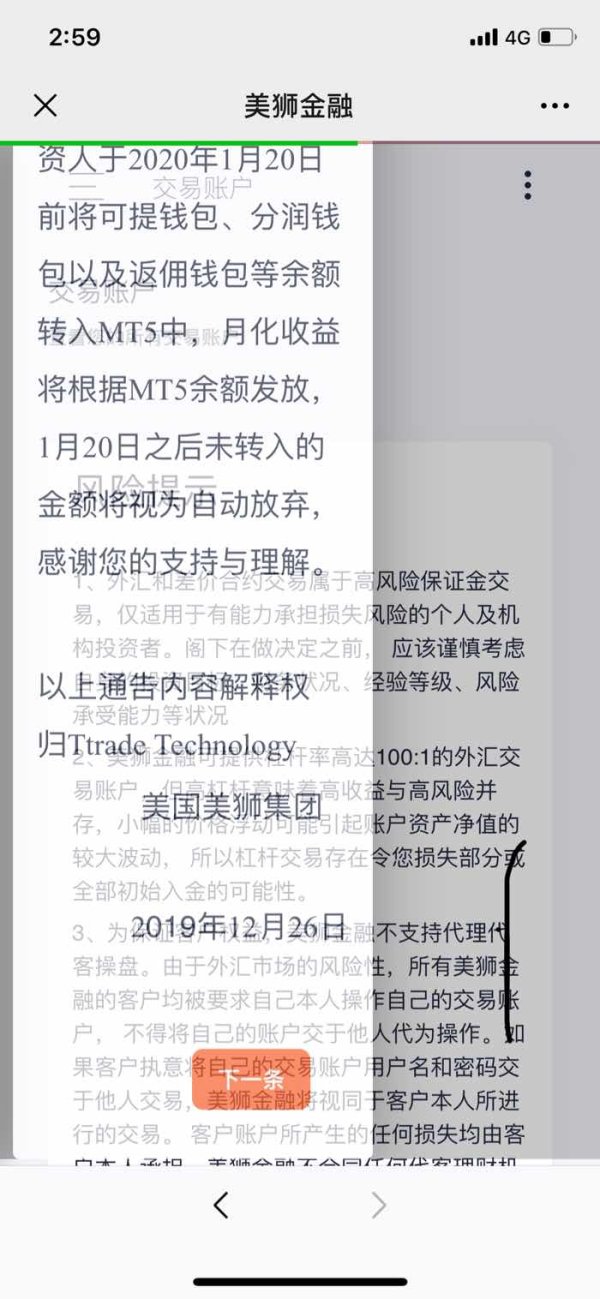

Despite attractive commission rates, users have voiced concerns regarding withdrawal fees:

"I tried to withdraw my earnings, but they charged me $30. It felt like a penalty for taking my money out."

High withdrawal fees alongside unclear terms can cancel out the benefits from low trading commissions.

- Cost Structure Summary:

Overall, while MSFX appears to offer favorable trading conditions on the surface, prospective traders should weigh these costs closely against potential hidden fees which could erode profitability.

The platforms offered by MSFX are critical to the overall trading experience.

Platform Diversity:

MSFX supports both MT4 and MT5 platforms, known for their extensive features and flexible trading capabilities. This inclusion caters to a broad spectrum of traders, from beginners to professionals seeking robust tools for technical analysis.

Quality of Tools and Resources:

User experience with charting tools and analytics available on these platforms remains a mixed bag. Many users appreciate the familiarity and user interface of MT platforms but report insufficient educational resources directly from MSFX.

Platform Experience Summary:

Overall feedback reflects a degree of satisfaction among users familiar with MT platforms, but some express disappointment in the lack of tailored resources that the broker should ideally offer.

User Experience Analysis

User experience can make or break a trading relationship.

General Feedback on Usability:

MSFX's interface is generally user-friendly for those accustomed to forex trading. However, there are reports of frustrating experiences when responded to by customer service.

Issues Reported:

Users mention instances of slow support and unclear responses to critical inquiries, which can negatively impact their trading performance.

Final Consideration:

The brokerage needs to enhance its customer engagement to bolster user experience and foster greater trust.

Customer Support Analysis

Customer support plays an integral role in a trader's success.

Available Communication Channels:

While MSFX provides various channels for communication, feedback indicates inconsistencies in responsiveness. Traders report prolonged waiting times which exacerbate stress during trading hours.

Effectiveness of Support:

Service reviews are polarized, with some users satisfied with the support received, while others express frustration with slow service response.

Room for Improvement:

Enhancing availability and effectiveness of customer support would likely improve overall user sentiment.

Account Conditions Analysis

Understanding account conditions is essential for traders of all levels.

Types of Accounts Offered:

MSFX offers two account types: an ECN account that requires a minimum deposit of $1 with commission costs, and a standard account which charges only spread alongside its exceptionally high maximum leverage of 1:1000.

KYC Verification Challenges:

Requirements for KYC verification create an additional barrier for some prospective clients. Efficient processing of account setups prioritizing user convenience could make a significant difference.

Conclusion:

While flexible account options exist, the associated risks and high leverage can lead to substantial losses without proper risk management.

Conclusion

In summary, MSFX presents a compelling proposition for experienced traders seeking low-cost trading platforms and flexible leverage. However, the risks associated with unregulated services cannot be ignored. The absence of regulatory oversight raises significant concerns regarding fund safety, withdrawal accessibility, and overall trustworthiness. Novice traders must tread cautiously, ensuring they conduct thorough due diligence before engaging with MSFX. In a landscape littered with both opportunities and pitfalls, understanding the full spectrum of risks and benefits is essential for any successful trading venture. Always remember to verify the legitimacy of any broker before making a commitment.