FreshForex 2025 Review: Everything You Need to Know

FreshForex has established itself as a noteworthy player in the forex trading landscape, with a presence since 2004. However, its regulatory status raises concerns among potential traders. This review synthesizes various insights regarding user experiences, expert opinions, and key features associated with FreshForex.

Notice: It is important to note that FreshForex operates through different entities across regions, which can affect regulatory oversight and user experiences. Therefore, potential clients should exercise caution and conduct thorough research before engaging with the platform.

Ratings Overview

How we rate brokers: Our ratings are based on a comprehensive analysis of user feedback, expert evaluations, and factual data regarding each broker's offerings.

Broker Overview

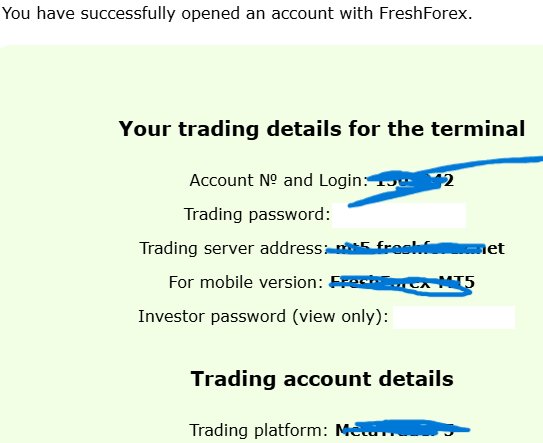

Founded in 2004, FreshForex is operated by Riston Capital Ltd, which is registered in Saint Vincent and the Grenadines. Despite its long-standing presence in the market, FreshForex lacks regulation from major financial authorities like the FCA or ASIC, which raises red flags regarding investor protection. The broker provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and offers a variety of trading instruments, including forex pairs, CFDs on stocks, indices, and commodities.

Detailed Insights

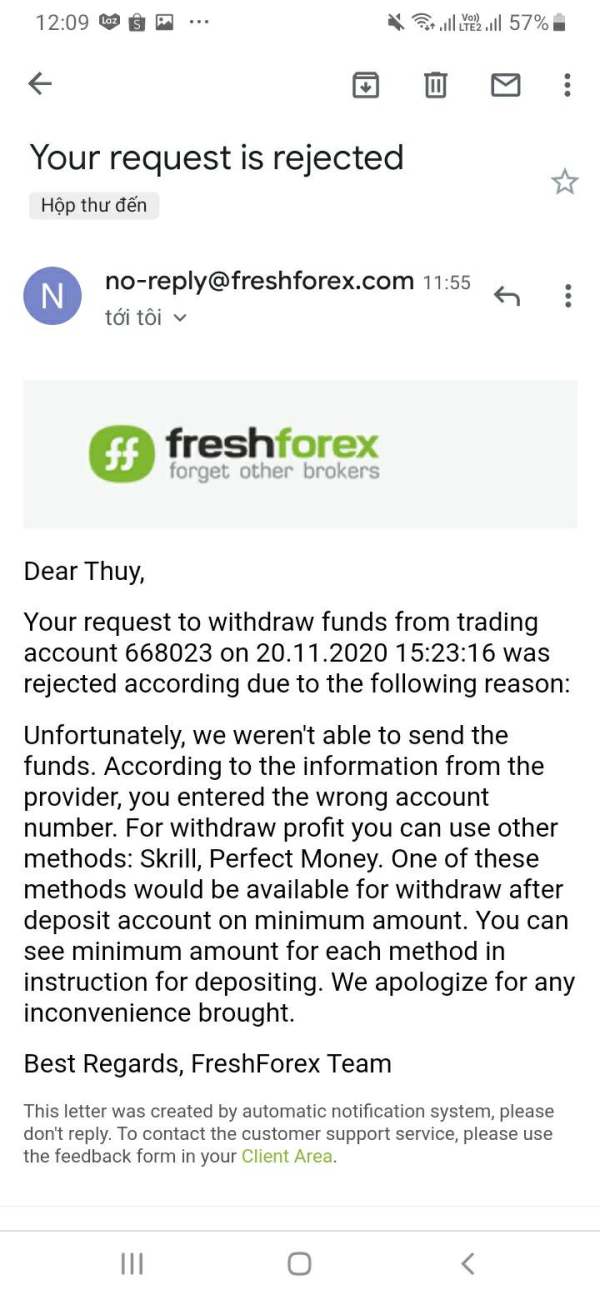

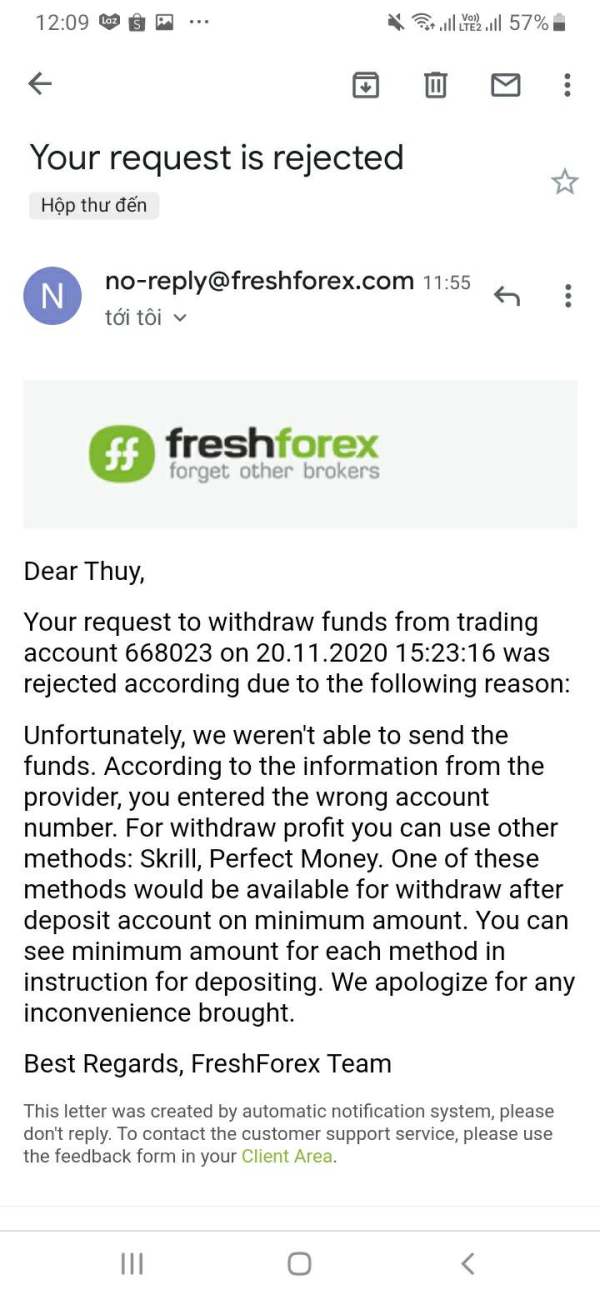

Regulatory Regions: FreshForex operates without stringent regulatory oversight, primarily under the self-regulation of the CRFIN. This absence of reputable regulation is a significant concern, as it implies a higher risk for traders regarding the safety of their funds (source).

Deposit/Withdrawal Currencies: The broker supports various currencies for deposits and withdrawals, including USD, EUR, and RUB. Additionally, it accepts cryptocurrencies like Bitcoin and Tether, which provides flexibility for users (source).

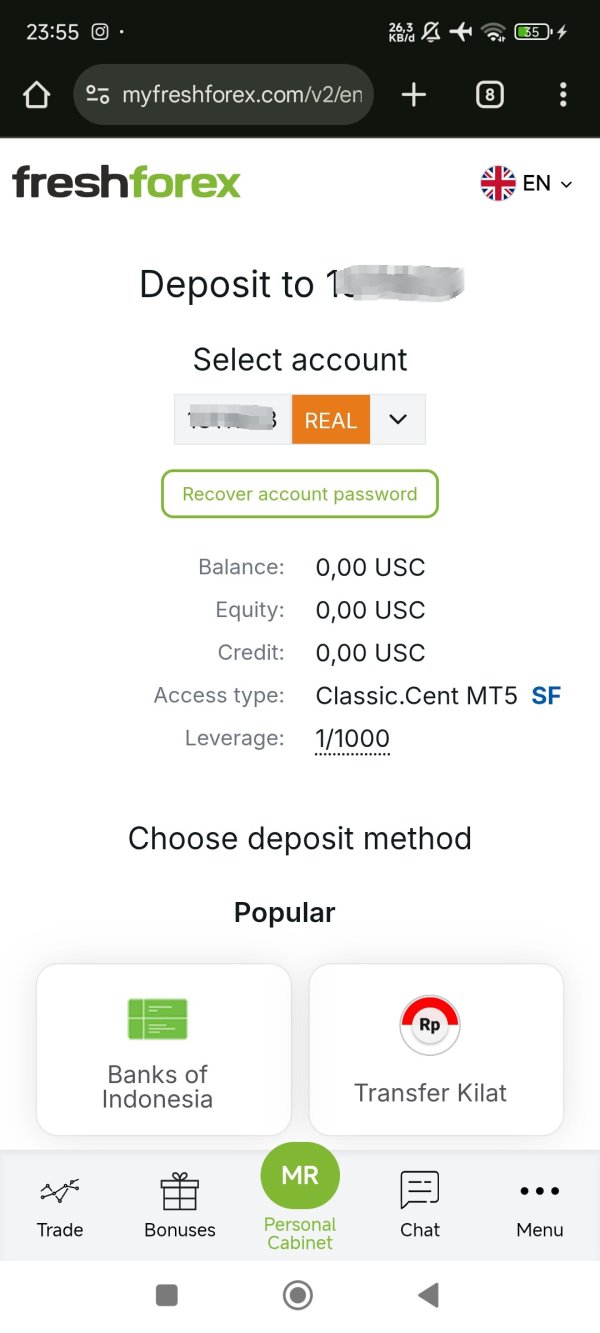

Minimum Deposit: FreshForex has a low minimum deposit requirement, with some accounts requiring as little as $1 to start trading. However, the recommended minimum deposit for more optimal trading conditions is around $200 for the classic account (source).

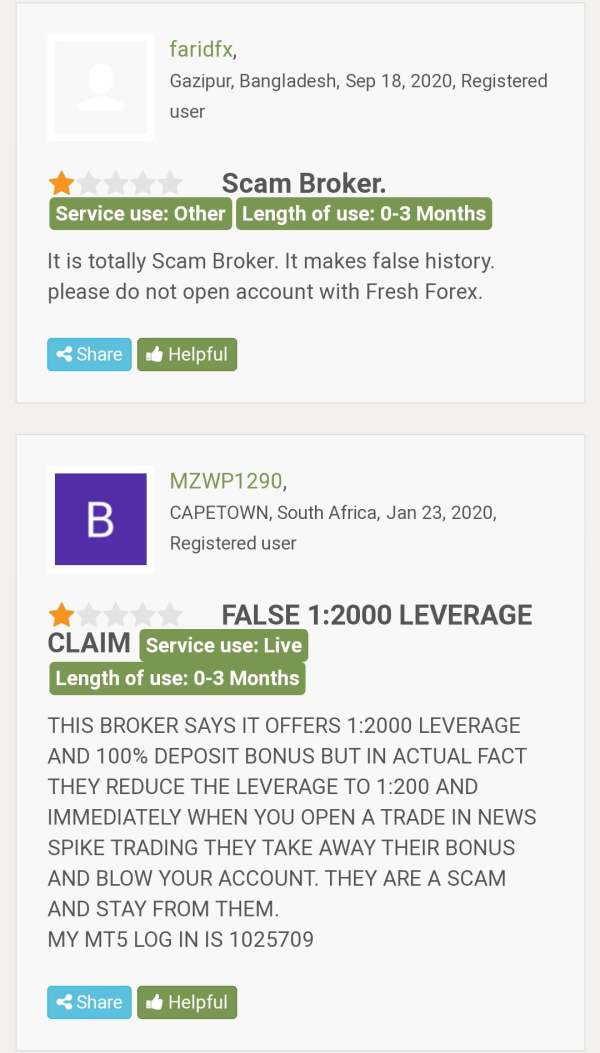

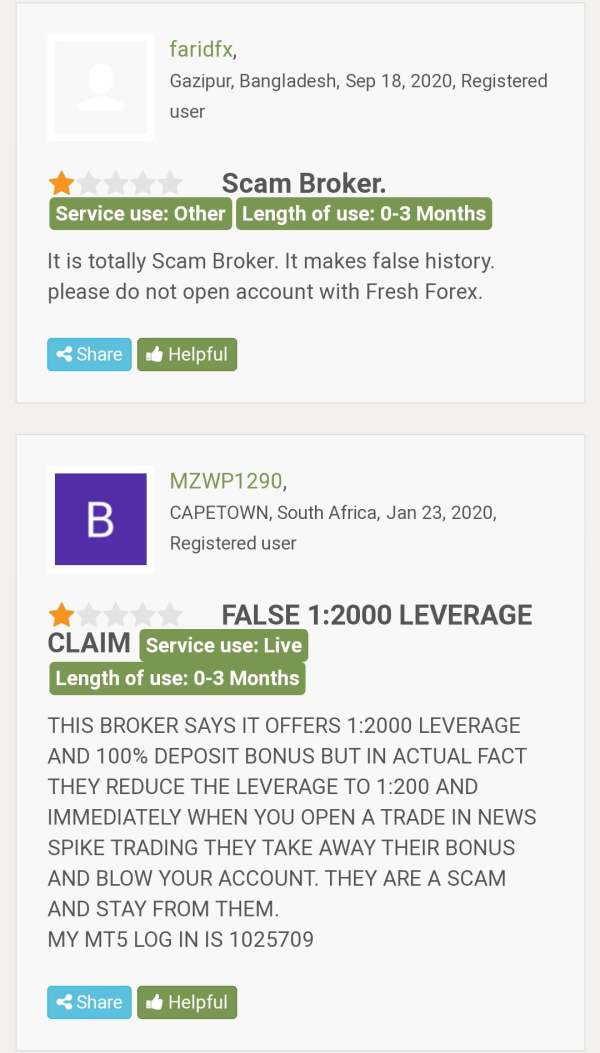

Bonuses/Promotions: The broker offers various promotional bonuses, including a 300% first deposit bonus and a 101% drawdown bonus. However, these bonuses often come with stringent trading volume requirements that may be hard to meet, which has led to some dissatisfaction among users (source).

Tradeable Asset Classes: FreshForex provides a diverse range of assets for trading, including 49 forex pairs, 13 precious metals, and 114 stocks. However, it lacks a comprehensive offering in cryptocurrencies, which may limit trading opportunities for some users (source).

Costs (Spreads, Fees, Commissions): The spreads vary by account type, with fixed spreads starting from 2 pips for classic accounts and floating spreads from 0.9 pips for market pro accounts. The ECN account offers spreads as low as 0.0 pips, but it incurs a commission of $1.90 per lot. Overall, the fee structure is competitive, but users should be aware of potential withdrawal fees (source).

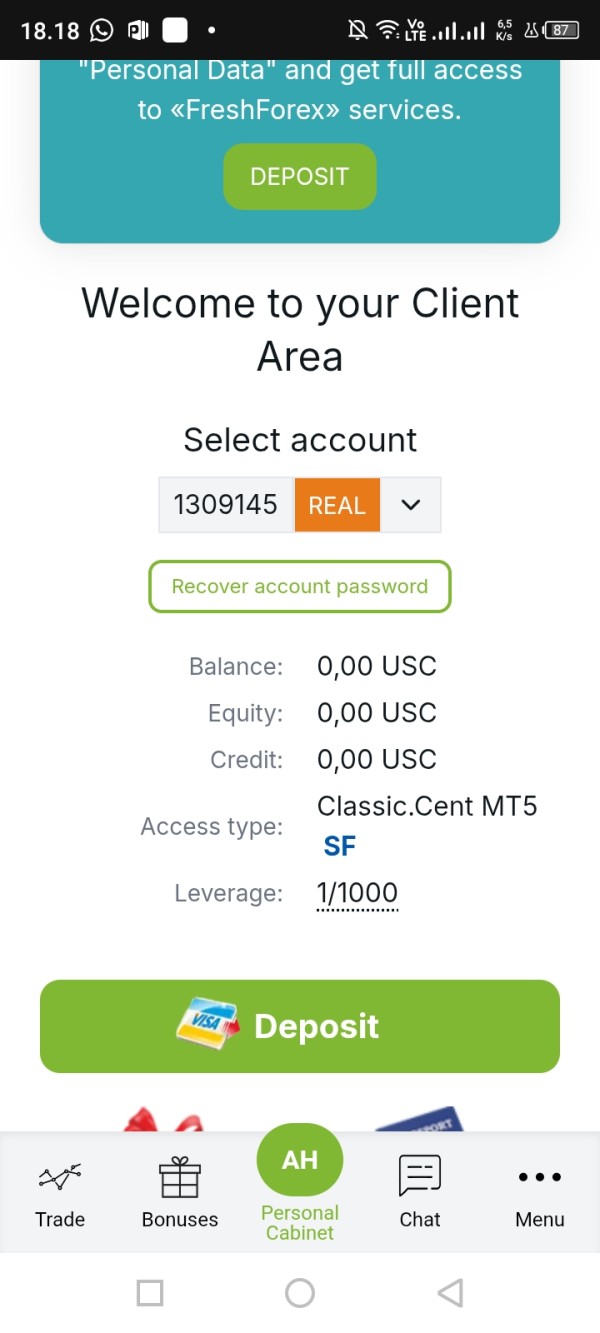

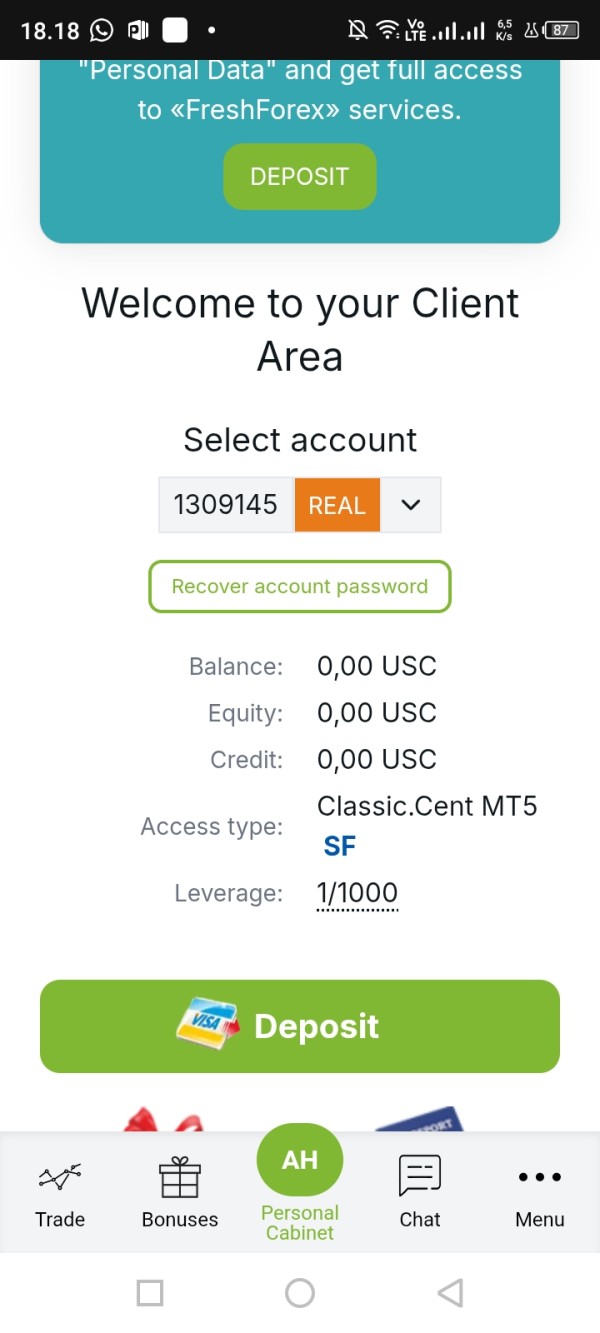

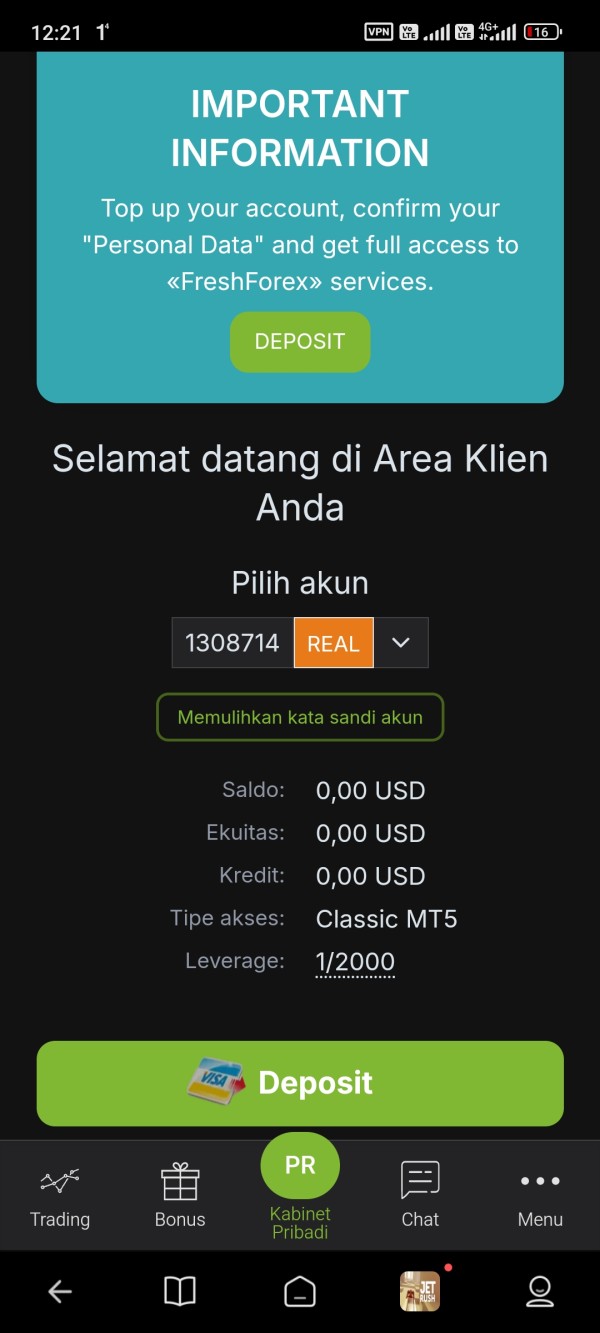

Leverage: FreshForex offers high leverage options, up to 1:2000, which can be appealing to experienced traders. However, this high leverage also increases the risk of significant losses, and caution is advised (source).

Allowed Trading Platforms: Traders can utilize both MT4 and MT5 platforms, which are well-regarded for their user-friendly interface and extensive analytical tools. However, the broker does not offer proprietary trading software, which may be a drawback for some users (source).

Restricted Regions: FreshForex does not accept clients from several countries, including the United States, United Kingdom, and North Korea, which may limit its global reach (source).

Available Customer Support Languages: The broker provides customer support in multiple languages, including English, Russian, and Arabic. However, the quality of support has been criticized, with some users reporting slow response times (source).

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions (Score: 6.5): FreshForex offers various account types catering to different trading styles, but the lack of tier-one regulation is a significant drawback.

Tools and Resources (Score: 7.0): The availability of MT4 and MT5 platforms is a strong point, along with educational resources, but the outdated research tools could be improved.

Customer Service and Support (Score: 6.0): Customer service operates 24/5 but has received mixed reviews regarding response times and effectiveness.

Trading Setup (Experience) (Score: 7.5): The trading experience is generally positive, with fast execution and competitive spreads, but users should be cautious of high leverage.

Trustworthiness (Score: 4.0): The absence of reputable regulation raises concerns about the safety of funds and overall trustworthiness.

User Experience (Score: 6.5): The user interface is functional, but some users have reported issues with navigation and usability.

In summary, while FreshForex offers several attractive features, including low minimum deposits and a variety of trading instruments, its lack of robust regulatory oversight and mixed user experiences suggest that potential traders should proceed with caution. Always conduct thorough research and consider your risk tolerance before engaging with any broker.