Bot 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive bot review examines the current landscape of automated trading solutions in 2025. It focuses on the performance and capabilities of various trading bot platforms. Based on available user feedback and market analysis, trading bots have demonstrated significant potential for investors seeking automated trading solutions across multiple asset classes including cryptocurrencies, forex, and stocks.

The standout features of modern trading bots include their 24/7 operational capability. This is particularly valuable in continuously operating markets such as cryptocurrency exchanges. According to InvestingRobots.com, this round-the-clock functionality eliminates the need for manual monitoring and allows traders to capitalize on market opportunities even during off-hours. User satisfaction reports indicate positive experiences with long-term trading strategies. This is particularly true for users implementing bots across four major trading pairs.

The primary target audience for these automated trading solutions consists of investors interested in algorithmic trading approaches. These include those seeking to minimize emotional decision-making in their trading activities, and traders who prefer systematic, data-driven investment strategies. The technology appeals particularly to both novice traders looking for guidance and experienced investors seeking to scale their operations efficiently.

Important Disclaimers

Potential users should be aware that regulatory frameworks for automated trading bots vary significantly across different jurisdictions. Since specific regulatory information was not detailed in available materials, traders must independently verify the compliance status of any bot service in their respective regions before engagement. The regulatory landscape for algorithmic trading continues to evolve. What may be permissible in one jurisdiction could face restrictions in another.

This evaluation is based on available user feedback, industry reports, and publicly accessible information about trading bot performance and capabilities. Readers should conduct their own due diligence and consider consulting with financial advisors before implementing any automated trading strategies.

Rating Framework

Broker Overview

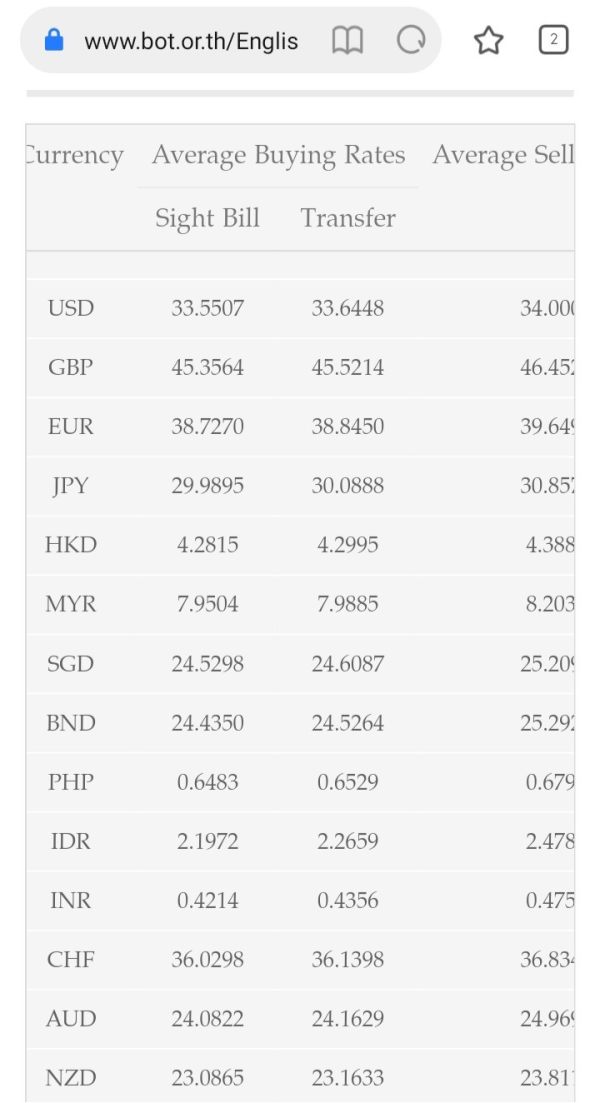

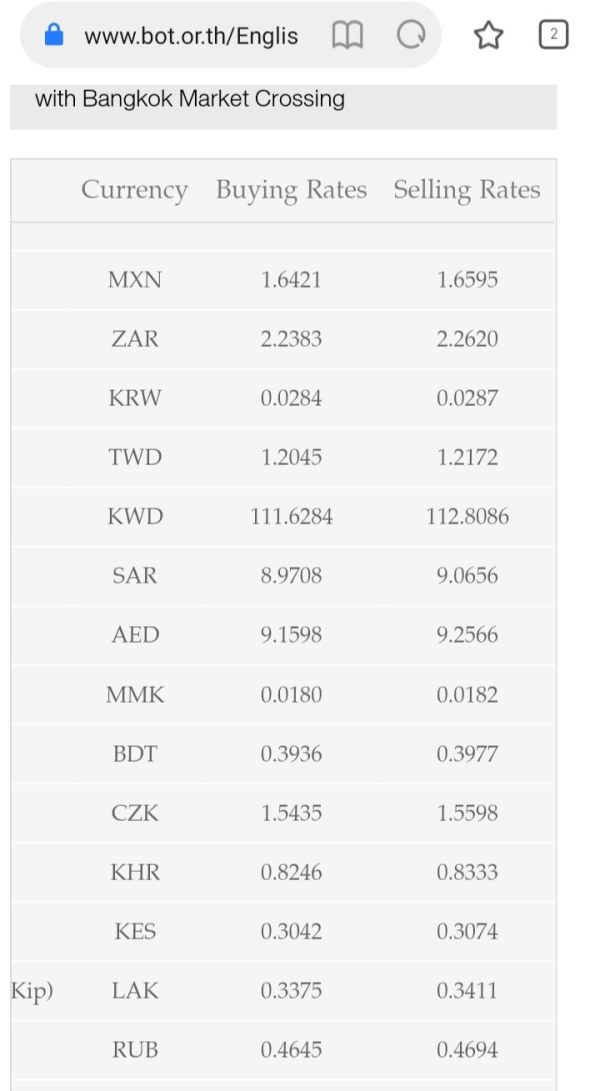

The modern trading bot ecosystem encompasses various automated trading solutions designed to operate across multiple asset classes. According to industry reports, these platforms utilize sophisticated algorithms to analyze market trends, process vast amounts of data, and execute trades without human intervention. The primary business model revolves around providing automated trading capabilities for cryptocurrencies, forex markets, and traditional stock exchanges.

As noted by Varyence's chief technology officer Jason Hishmeh, these programs function as tireless market participants that "run 24 hours a day, analyzing market trends, processing data and executing trades, all without the need for a coffee break." This continuous operation model represents a fundamental shift from traditional trading approaches. It offers users the ability to maintain market presence even during periods when manual monitoring would be impractical.

The trading bot industry has expanded to serve various market segments, operating on traditional stock exchanges like NASDAQ and the New York Stock Exchange. It also operates on foreign currency exchanges, commodities markets for assets like gold and oil, and derivatives exchanges including options and futures trading platforms. This broad market coverage allows users to diversify their automated trading strategies across multiple asset classes and geographical markets.

Regulatory Coverage: Specific regulatory jurisdictions and compliance details were not comprehensively outlined in available source materials. This requires users to independently verify regulatory status in their respective regions.

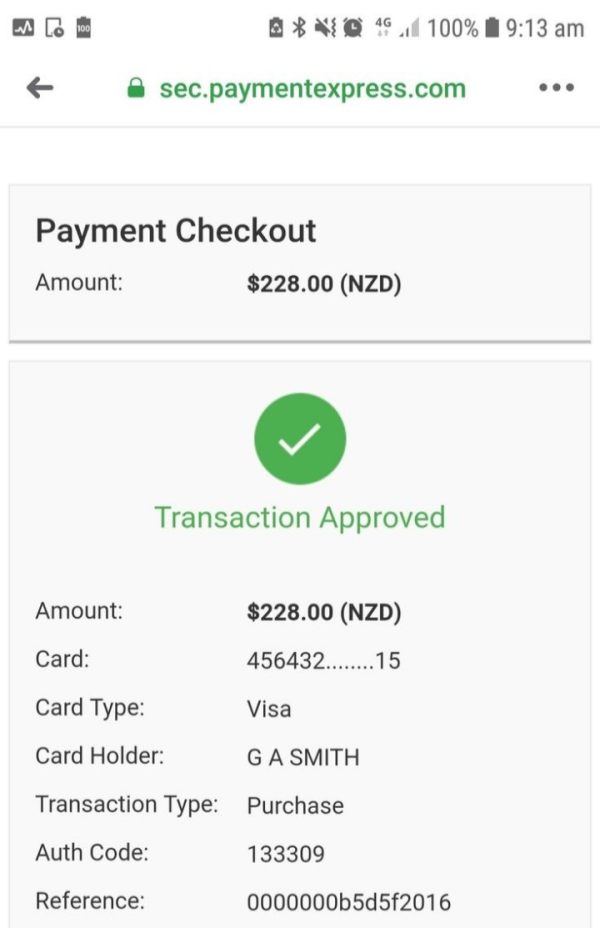

Deposit and Withdrawal Methods: Funding mechanisms and withdrawal processes were not detailed in the reviewed materials. This indicates a need for direct platform inquiry regarding payment options.

Minimum Deposit Requirements: Entry-level investment thresholds were not specified in available documentation. This suggests varying requirements across different bot platforms.

Promotional Offerings: Bonus structures and promotional incentives were not detailed in the source materials reviewed for this bot review.

Tradeable Assets: The platforms support automated trading across cryptocurrencies, forex currency pairs, traditional stocks, commodities including gold and oil, and derivatives such as options and futures contracts.

Cost Structure: According to InvestingRobots.com, users should expect various fee structures that might include subscription costs, trading fees, or performance-based charges. However, specific pricing details were not comprehensively outlined.

Leverage Options: Leverage ratios and margin requirements were not specified in available materials. This requires direct platform consultation for specific terms.

Platform Selection: Specific trading platform integrations and software options were not detailed in reviewed sources.

Geographic Restrictions: Regional availability limitations were not comprehensively addressed in available materials.

Customer Support Languages: Multi-language support options were not specified in the reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis

The specific account structures and conditions offered by trading bot platforms were not comprehensively detailed in available source materials. This represents a significant information gap for this bot review. Account terms typically include crucial details such as minimum balance requirements, account types available to different user categories, and special features that might benefit specific trading strategies.

Without detailed account condition information, potential users cannot adequately assess whether the platform structures align with their trading capital availability and investment goals. The absence of information regarding account opening procedures, verification requirements, and any special account features such as Islamic-compliant options limits the ability to provide a comprehensive evaluation of this crucial aspect.

Industry standards typically include various account tiers designed to accommodate different experience levels and capital commitments. The lack of specific information about account conditions in available materials suggests that interested users would need to contact platforms directly to understand the full scope of account options and requirements.

The evaluation of account conditions remains incomplete due to insufficient detailed information in reviewed sources. This prevents a thorough assessment of how these platforms structure their client relationships and account management approaches.

The trading bot ecosystem demonstrates strong capabilities in automated trading tools and technological resources. According to available reports, platforms offer comprehensive suites including AI chatbots for customer interaction, specialized crypto trading bots for digital asset markets, and forex trading robots designed for currency market operations.

The 24/7 operational capability represents a significant technological advantage, particularly in cryptocurrency markets that operate continuously without traditional market closures. This round-the-clock functionality allows users to maintain consistent market presence and capitalize on opportunities that might occur during off-hours when manual trading would be impractical.

The integration of artificial intelligence in both customer service and trading execution demonstrates the platforms' commitment to leveraging advanced technology for improved user experiences. AI chatbots can provide immediate responses to user inquiries. Meanwhile, AI-powered trading algorithms can process vast amounts of market data to identify potential trading opportunities.

However, specific details regarding research and analysis resources, educational materials, and advanced trading tools were not comprehensively covered in available materials. The absence of detailed information about backtesting capabilities, strategy customization options, and performance analytics tools limits the complete assessment of the platforms' resource offerings.

Customer Service and Support Analysis

Customer service capabilities and support structures were not extensively detailed in the available source materials. This creates a significant evaluation gap for potential users. Effective customer support is crucial for trading bot platforms, particularly given the technical complexity of automated trading systems and the need for prompt assistance when technical issues arise.

The availability of AI chatbots suggests some level of automated customer support capability, potentially providing immediate responses to common inquiries and basic technical questions. However, the extent of human support availability, response times for complex issues, and the overall quality of customer service interactions were not specified in reviewed materials.

Critical customer service elements such as available communication channels, support hours, and escalation procedures for urgent issues were not detailed. The absence of information regarding multi-language support capabilities also limits assessment of the platforms' ability to serve international user bases effectively.

Without specific user testimonials regarding customer service experiences or detailed information about support team expertise, this aspect of the platforms remains inadequately evaluated. Users considering these platforms would need to independently assess customer service quality through direct interaction or seek additional user feedback sources.

Trading Experience Analysis

The overall trading experience encompasses platform stability, execution speed, user interface design, and mobile accessibility - areas that were not comprehensively detailed in available source materials. However, user feedback indicates satisfaction with long-term trading strategies, particularly for automated systems managing four major trading pairs.

The bot review process reveals that platforms operate across multiple exchanges and market types, suggesting robust connectivity and execution capabilities. The ability to function continuously in 24/7 markets like cryptocurrency trading indicates strong technical infrastructure designed to handle consistent operational demands.

Platform functionality and user interface design details were not extensively covered in reviewed materials, limiting assessment of ease of use, customization options, and overall user experience quality. Mobile trading capabilities, which are increasingly important for modern traders, were also not specifically addressed in available sources.

The absence of specific performance metrics such as execution speeds, slippage rates, and platform uptime statistics prevents comprehensive evaluation of trading experience quality. Users would need to rely on trial periods or direct platform testing to assess these crucial performance aspects.

Trust and Security Analysis

Trust and security represent critical evaluation criteria for any trading platform, particularly for automated systems that operate with limited human oversight. Unfortunately, specific regulatory information, security measures, and compliance details were not comprehensively outlined in available source materials. This creates significant evaluation challenges.

The absence of detailed regulatory licensing information prevents assessment of the platforms' compliance with financial services regulations in various jurisdictions. This regulatory uncertainty could impact user confidence and legal protections available to traders using these automated systems.

Security measures such as fund protection protocols, data encryption standards, and cybersecurity frameworks were not detailed in reviewed materials. Given the increasing importance of cybersecurity in financial services, the lack of specific security information represents a notable evaluation gap.

Company transparency regarding ownership, financial backing, and operational history was also not extensively covered in available sources. Without this fundamental information, users cannot adequately assess the stability and reliability of the organizations behind these trading bot platforms.

User Experience Analysis

User experience evaluation shows positive indicators based on available feedback, with users expressing satisfaction regarding long-term trading bot performance across four major trading pairs. This suggests that the platforms deliver on their core promise of effective automated trading execution for users implementing longer-term strategies.

The target user profile appears well-defined, focusing on investors interested in systematic, automated trading approaches. This clear positioning helps potential users understand whether these platforms align with their trading philosophy and investment goals. The technology particularly appeals to traders seeking to minimize emotional decision-making and those wanting to maintain consistent market presence.

User interface design, registration processes, and account verification procedures were not extensively detailed in available materials, limiting comprehensive user experience assessment. The ease of initial setup and ongoing platform navigation are crucial factors for user satisfaction that require additional evaluation.

The balance between automation and user control, customization options for trading strategies, and the learning curve for new users were not specifically addressed in reviewed sources. These factors significantly impact overall user experience and long-term platform satisfaction.

Conclusion

Based on available information and user feedback, trading bot platforms demonstrate strong potential for investors seeking automated trading solutions, particularly those interested in maintaining 24/7 market presence across multiple asset classes. The positive user satisfaction reports, especially regarding long-term trading strategies, indicate that these platforms can effectively serve their target market of automation-focused traders.

However, the evaluation reveals significant information gaps regarding regulatory compliance, detailed account conditions, and comprehensive security measures. These missing elements represent important considerations for potential users who must independently verify regulatory status and platform reliability in their respective jurisdictions.

The platforms appear most suitable for investors comfortable with automated trading approaches, those seeking to scale their trading operations, and traders interested in systematic, data-driven investment strategies across cryptocurrency, forex, and traditional stock markets.