ac markets limited 2025 Review: Everything You Need To Know

1. Abstract

In this ac markets limited review, we rate AC Markets Limited very poorly. AC Markets Limited started in 2023 and has its main office in China, but it has not gotten approval from any well-known financial regulators. The broker says it offers online forex and CFD trading services. Many users report that this platform might be a scam. The lack of strong regulatory oversight and warnings from global financial watchdogs mean potential traders should be very careful, especially those who want to trade forex and CFDs. This review uses public information and investor comments, and all sources point to serious reliability problems. With few details on account conditions, deposit structures, and transparency, users should avoid this broker, and our ac markets limited review strongly advises against using it due to trust and safety issues.

2. Disclaimer and Methodology

AC Markets Limited works without the needed regulatory approvals in many important areas. The broker does not have a license from the Hong Kong Securities and Futures Commission and other notable regulators, which raises big concerns about legal compliance and investor protection. This review uses publicly available information and user feedback and does not include any insider data. The methodology relies on reliable sources and user reports available as of late 2024, but readers should know that several key operational aspects of the broker remain unclear in the available information. The evaluation reflects the current market state and emphasizes caution, given the potential scam risks widely reported in various independent assessments.

3. Scoring Framework

4. Broker Overview

AC Markets Limited was founded in 2023 and has its headquarters in China. The broker wants to serve online trading fans by giving them access to forex and CFD markets. The firm focuses on executing trades in these asset classes and seeks to take advantage of the high liquidity and dynamic movements in forex and derivatives markets. However, AC Markets Limited's business model has been unclear about its regulatory framework and operational protocols from the very beginning. Many potential clients are skeptical and cautious despite the appealing promise of online trading opportunities.

The broker also supports multiple trading platforms that work with Windows PC, Android, and iPhone devices, which are designed to meet the different needs of modern traders. But AC Markets Limited has not gotten approvals from any well-known financial regulatory bodies. This lack of oversight is a major red flag for potential users who care about safety and regulatory compliance. Our ac markets limited review shows that while the platform provides basic infrastructure for forex and CFD trading, the underlying operational and regulatory problems make it a poor choice for traders who want a secure and reliable trading environment.

Regulatory Regions:

AC Markets Limited has not been approved or watched by any well-known financial regulatory authority such as the FCA. The Hong Kong Securities and Futures Commission also flags the broker as an unlicensed entity. This big regulatory gap is one of the main concerns mentioned in various independent evaluations.

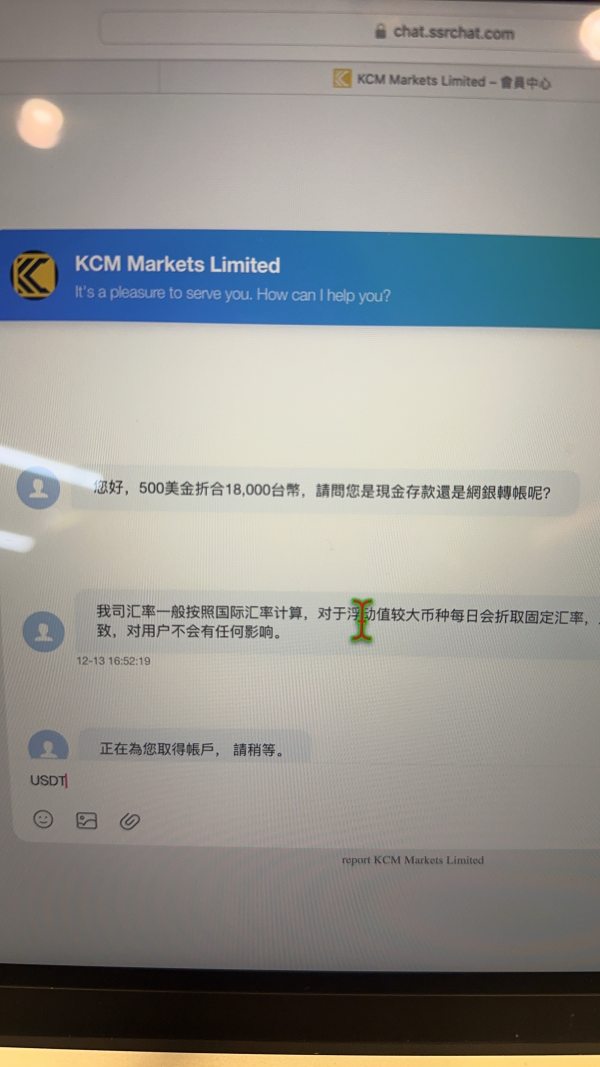

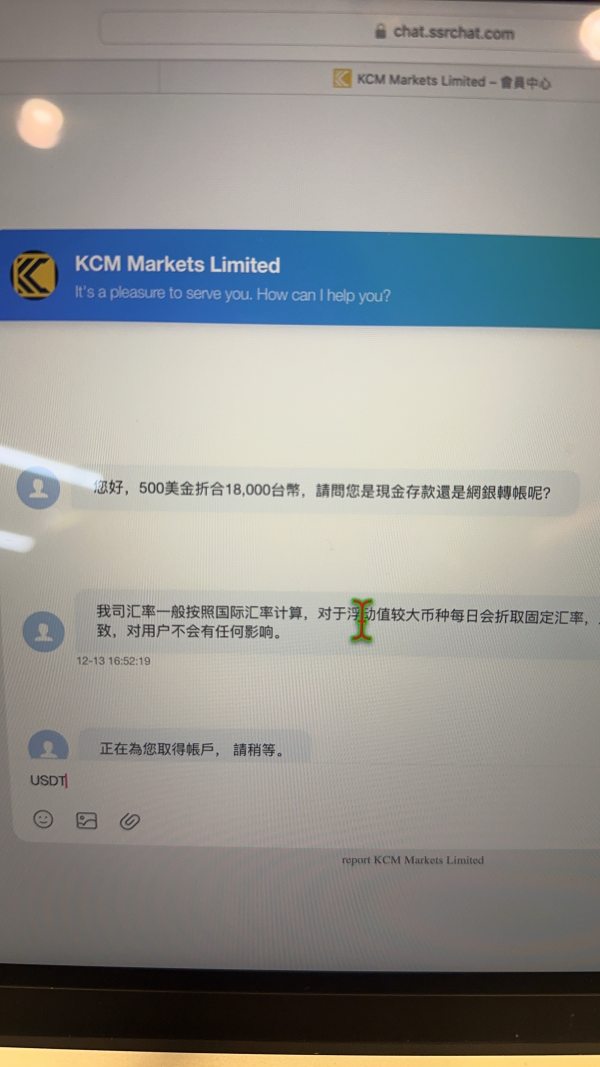

Deposit and Withdrawal Methods:

The available public information does not give any specific details about the deposit and withdrawal methods offered by AC Markets Limited. Potential users should know that the process for transferring funds remains unclear and unverified through independent reports.

Minimum Deposit Requirements:

There is no reliable information on minimum deposit requirements for AC Markets Limited. The absence of this important detail only adds to the overall uncertainty and risk profile of the broker.

Bonus and Promotions:

Our resources have not detailed any bonus or promotional offers connected with AC Markets Limited. Without such incentives disclosed, there is little to attract new customers, aside from the inherent risks of unregulated trading.

Tradable Assets:

AC Markets Limited focuses on offering trades in forex and CFD markets. These asset classes remain the main area of operation for the broker, matching its promise to help high-liquidity trading; however, the lack of additional asset classes further limits options for diversification.

Cost Structure:

The cost structure, including detailed information on spreads, commission fees, and any hidden charges, is notably missing from the published materials. This lack of transparency in pricing models is worrying since it leaves traders without clear insights into the actual cost of trading on the platform.

Leverage Ratios:

Like many other operational details, leverage ratios are not specified in the available documents. Without clear guidelines on allowable leverage, traders cannot measure potential risk exposure before committing funds.

Platform Choices:

AC Markets Limited offers support for multiple platforms, specifically Windows PC, Android, and iPhone applications. This multi-platform approach is meant to serve traders on different devices, yet the actual performance and reliability remain unconfirmed by detailed user feedback.

Regional Restrictions:

There is no specific information available about the existence of regional restrictions imposed by AC Markets Limited. The absence of this information makes it challenging for potential users in certain areas to assess whether they can legally access the platform.

Customer Service Language:

No consistent details are available about the customer service languages supported by AC Markets Limited, which serves as another indicator of the broader lack of transparency and comprehensive operational details.

This comprehensive ac markets limited review reveals significant gaps and uncertainties in service details that contribute to the overall perception of high risk for traders.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The analysis of account conditions for AC Markets Limited shows a series of significant challenges for potential traders. From the available information, there is no clear outline about the types of accounts offered, the different features of each account, or the specific details on spreads, commissions, or minimum deposit requirements. This lack of clarity severely hurts consumer confidence. Users have not been given any information on account opening processes, including any special features such as Islamic accounts or other variants designed to serve specific trading needs. In most well-regulated brokers, transparency in account conditions is a key aspect that helps build trust and ensures customer satisfaction. However, in the case of AC Markets Limited, this critical information is simply missing. There is no explanation of how the account conditions compare with industry standards or how they might be optimized for the trader's risk profile. This problem is clearly troubling, especially when considering the high standards necessary for safe and secure trading. As repeated in our ac markets limited review, these gaps in information contribute directly to the extremely low rating for account conditions.

In evaluating the tools and resources provided by AC Markets Limited, we note that the broker offers a basic set of trading tools, mainly centered on the forex and CFD markets. The platform gives access to fundamental trading instruments and supports multiple trading channels through Windows PC, Android, and iPhone applications. However, the range of analytical and research resources is very limited. There is little to no information about educational materials meant to help traders understand and navigate the complexities of forex and CFD trading. Moreover, the platform does not appear to provide advanced automated trading systems or cutting-edge tools that can offer a competitive edge. When compared to industry standards where comprehensive research and educational resources are a given, the current offerings at AC Markets Limited fall short. This limited toolset, coupled with the absence of expert analysis or interactive features, makes it challenging for traders to perform thorough market analysis or to implement more sophisticated trading strategies. In summary, while the availability of multiple trading platforms is a positive, it does not make up for the overall lack of supportive resources and detailed trading tools.

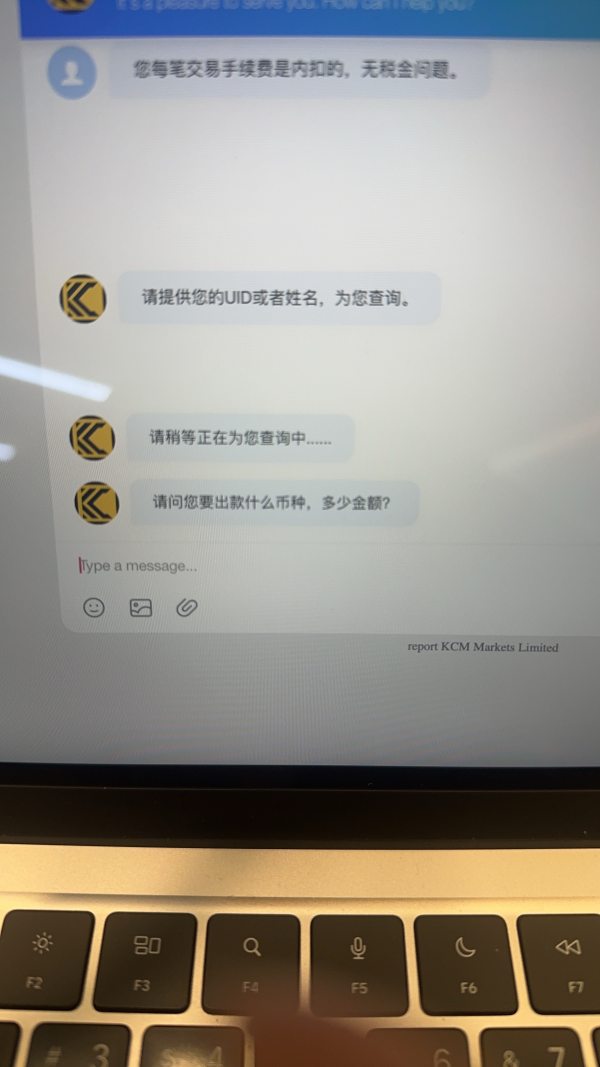

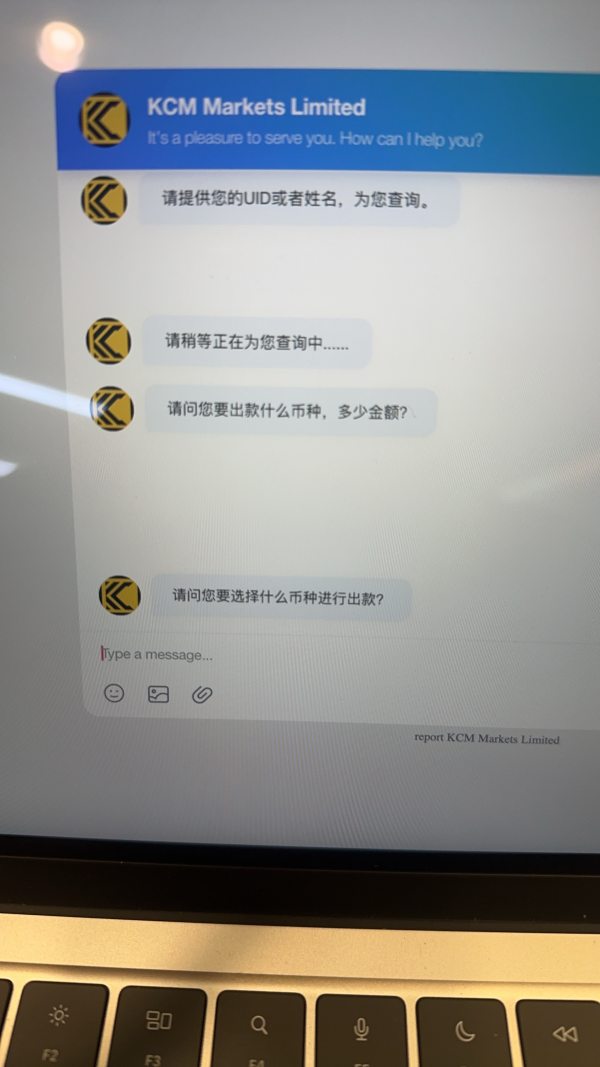

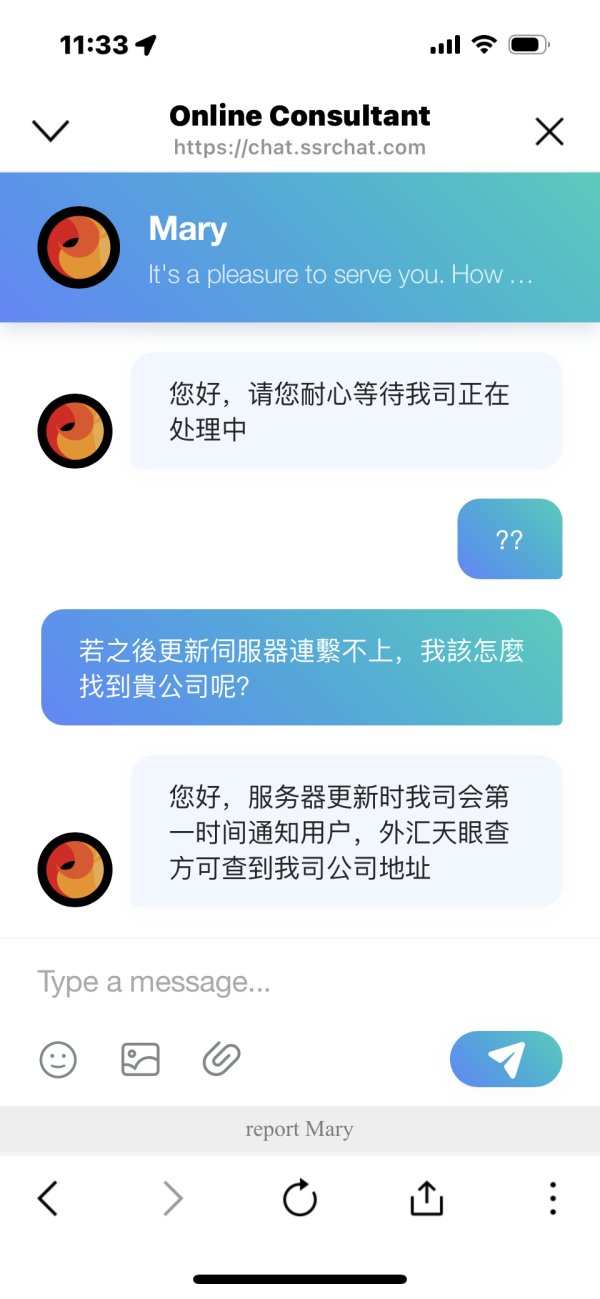

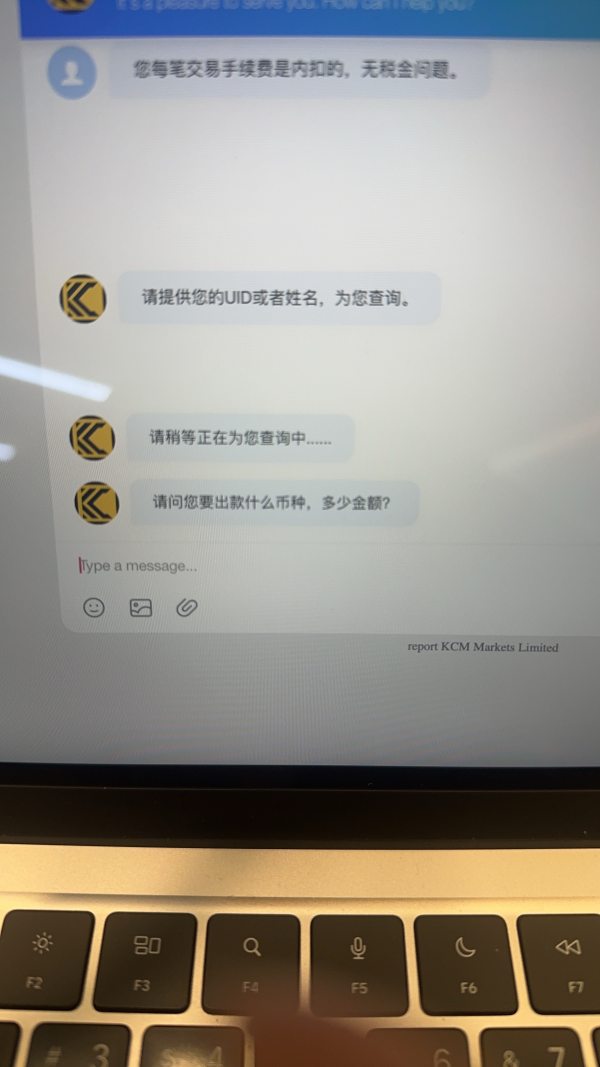

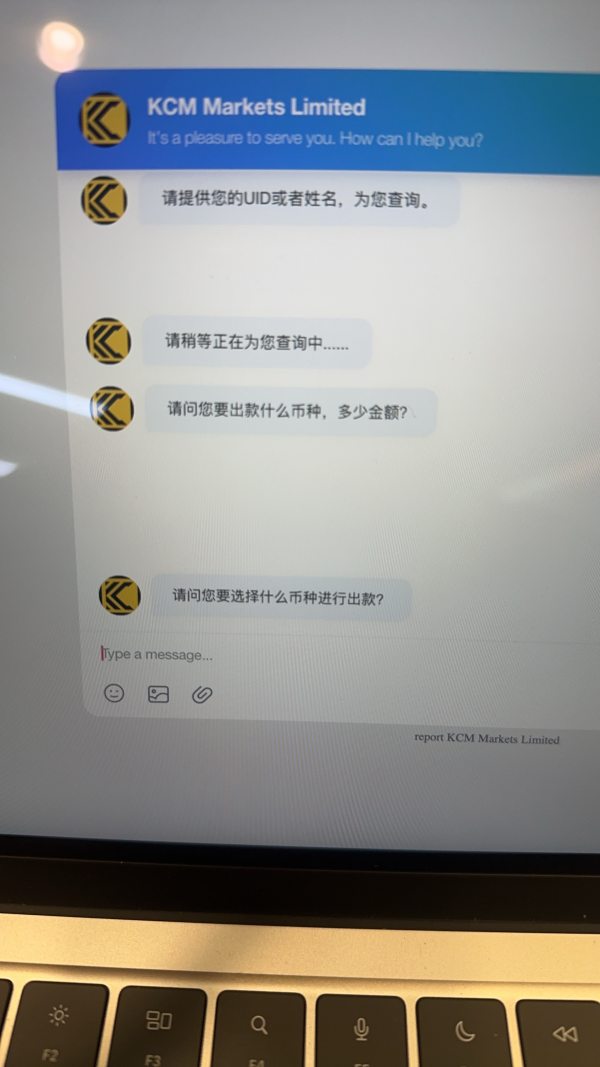

6.3 Customer Service and Support Analysis

The customer service and support provided by AC Markets Limited have received very negative feedback. Users have often reported issues that include delayed response times and insufficient help when encountering problems. The lack of detailed information about the support channels further complicates the overall picture. For example, there is no clear outline of whether support is available 24/7 or if multiple languages are offered to accommodate an international client base. Various user comments have flagged not only the quality of customer service but have also raised concerns about potential scam-related practices, which severely affect the platform's credibility. The absence of transparent service-level agreements or documented problem resolution processes only deepens the uncertainty. Given these issues, potential traders are advised to exercise extreme caution. The negative experiences shared by users emphasize that even if the trading tools or platforms function properly, inadequate support can leave customers vulnerable in critical moments. Overall, the gap in reliable and responsive customer service significantly contributes to the low score in this evaluation, and this is a key factor in the broader cautionary stance advised in our review.

6.4 Trading Experience Analysis

The overall trading experience with AC Markets Limited is disappointing due to several critical shortcomings. First, while the platform does support multiple devices—namely Windows PC, Android, and iPhone—the depth of functionality and stability remains largely undocumented. There is no evidence of robust order execution systems or real-time trade management tools that are essential for effective forex and CFD trading. Additionally, despite the platform's promise to help smooth trading operations, there is a notable lack of detailed user feedback or performance data that can verify the system's reliability. For instance, potential delays, order slippage, or technical glitches are concerns that have not been properly addressed by the broker. Mobile trading, though available, does not seem to have been fine-tuned for a seamless user experience, thereby hurting its overall appeal. Furthermore, there are no clear guidelines or metrics provided to evaluate the liquidity and cost-effectiveness of trades on the platform. In light of these issues, our ac markets limited review underscores that the trading experience is significantly compromised, rendering the platform unsuitable for traders who demand a high level of stability and precision in their trading operations.

6.5 Trust Analysis

Trust is an essential pillar in the evaluation of any brokerage, and in the case of AC Markets Limited, the trust factor is alarmingly low. The most obvious issue is the broker's lack of regulatory oversight; it has not been approved by any reputable financial regulatory authority such as the FCA or equivalent bodies in critical jurisdictions. This absence of regulation raises immediate concerns about the safety of client funds and the integrity of the trading environment. Additionally, multiple independent sources and user reports have flagged the broker as potentially operating with fraudulent intent, a sentiment that reflects poorly on its industry reputation. The lack of information on protective measures, such as segregated accounts for client funds or robust risk management protocols, further contributes to the skepticism surrounding the broker. There are no verifiable third-party audits or certifications to enhance transparency, leaving traders with little confidence in the company's operational ethics. Consequently, the persistent negative sentiment among users—who frequently warn of scam risks—serves as a critical indicator that any engagement with the platform is full of risk. This trust deficit is central to our evaluation and results in assigning a minimal score for this crucial dimension.

6.6 User Experience Analysis

The user experience of AC Markets Limited is damaged by several significant problems. Feedback collected from various sources consistently highlights that most users are advised to avoid the platform altogether. The primary concerns revolve around an unclear registration and verification process, with little to no guidance provided on the steps required to access trading functionalities. Additionally, many users report general dissatisfaction with the ease-of-use of the interface, where the design and navigation offer limited intuitive functionality compared to industry-leading platforms. Complexities in managing funds have also been cited by clients who struggle with the unclear deposit and withdrawal instructions. Overall, the operational aspects—ranging from registration to day-to-day fund management—lack the streamlined efficiency that is essential for a positive user experience. Repeated warnings from the community further solidify the perspective that potential clients should be wary of using this platform. The cumulative effect of these shortcomings is a low overall satisfaction rate, making it clear that AC Markets Limited fails to provide an environment that is conducive to secure, efficient trading. This negative sentiment is a core reason behind our exceedingly low user experience score in this comprehensive evaluation.

7. Conclusion

In conclusion, AC Markets Limited is not recommended for any trader seeking a safe and reliable trading experience. The absence of regulation, combined with numerous red flags—including unverified account conditions, inadequate customer support, and an overall negative user sentiment—creates a risk profile that is simply too high. The platform's weaknesses far outweigh any potential benefits offered by its multi-platform support for forex and CFD trading. Potential users, regardless of experience level, would be better served exploring alternatives that are fully compliant with regulatory standards and have a proven track record of safeguarding client interests. Our ac markets limited review ultimately advises caution and a low level of confidence in engaging with this broker.