FinX Brokers 2025 Review: Everything You Need to Know

Executive Summary

This FinX Brokers review shows major problems with how the broker works and follows rules. FinX Brokers says it helps people trade forex, but our research finds serious warning signs that investors need to think about carefully. The broker has big problems following trading rules and many customers have complained, especially about trouble taking out their money and bad customer service.

FinX Brokers has mostly bad reviews from users, proven complaints about people not being able to withdraw their funds, and questionable legal status. The platform does let you practice trading with demo accounts, but users seem to have many problems with how things work. People who like forex trading are the main customers, but you should be very careful because of all the documented problems.

Based on what we found and what users say, FinX Brokers has several serious problems that make traders lose confidence and feel unhappy. The broker's customer support only works limited hours from Monday to Friday, 08:00-17:00, which might not help international clients in different time zones well enough.

Important Disclaimers

FinX Brokers must follow different rules depending on which country you're in, and the standards can be different based on local laws. Traders need to check if the broker is legally allowed to operate in their area before using the platform.

This review uses information that anyone can find and feedback from users that we collected from different places. What we found might not show what all users experience, and each person's trading experience could be different. Changes in markets, new rules, and platform updates might make this review less accurate over time.

Rating Framework

Broker Overview

FinX Brokers works as a forex trading company, but we don't know exactly when it started or who founded it based on available information. The company focuses on giving forex trading services to regular investors, but it doesn't clearly explain its history and how the company is organized. Not having clear founding information makes us worry about whether the broker is honest and follows good business practices.

The broker seems to focus mainly on forex trading services, but we don't have much information about other types of investments and trading tools. FinX Brokers offers basic trading features with demo accounts that let future traders test the platform before using real money, according to what we found. But there's not much information about specific trading platforms, technology, and advanced trading tools, which suggests the service might not be fully developed.

This FinX Brokers review shows big gaps in basic information about how the company operates, which usually means either poor honesty or limited presence in the market. Good and trustworthy brokers usually give complete information about their company background, legal status, and what services they offer.

Regulatory Jurisdiction: We can't find clear information about which government agencies watch over FinX Brokers, which makes us very worried about whether the broker follows rules and has proper oversight.

Deposit and Withdrawal Methods: Available information doesn't tell us which payment methods FinX Brokers accepts, but user complaints suggest big problems with processing withdrawals and getting access to funds.

Minimum Deposit Requirements: We don't have details about how much money you need to start trading, making it hard for potential traders to understand what they need to begin.

Promotional Offers: There's no specific information about bonuses, special deals, or trading rewards available right now.

Tradable Assets: FinX Brokers mainly focuses on forex trading, but we don't know the complete list of available currency pairs and other trading options.

Cost Structure: We don't have detailed information about spreads, fees, overnight charges, and other trading costs, which makes it very hard for traders to see if the platform offers good value.

Leverage Options: We can't find information about specific leverage amounts and margin requirements in available sources.

Platform Selection: There's no information about which trading platforms they use, whether they made their own or use popular ones like MetaTrader.

This FinX Brokers review shows major information gaps that good brokers would normally provide easily.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

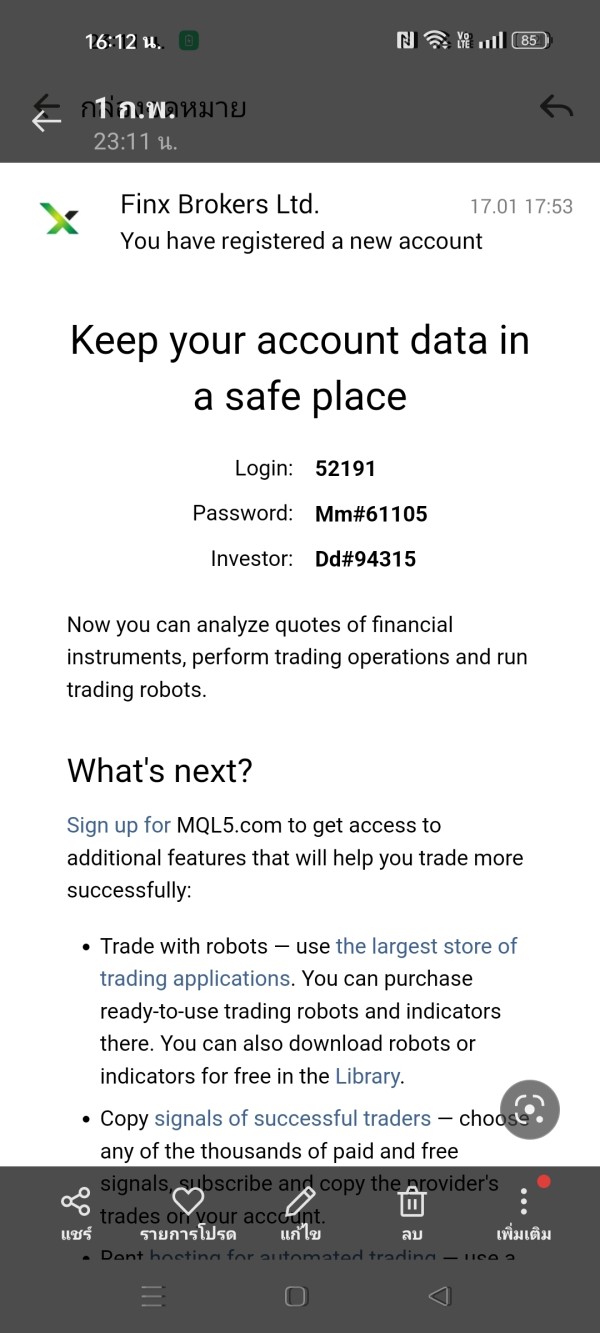

FinX Brokers gets a poor rating for account conditions because there's not enough clear information and documentation. We can't find details about what types of accounts are available, how much money you need to start, or what special features different account levels have. This lack of clarity makes it very hard for potential traders to understand what they can expect from the service.

The process for opening an account isn't explained well, which makes us worry about how honest the broker is about its operations. Good brokers usually give clear information about account types, including standard accounts, premium accounts, and special accounts like Islamic accounts for Muslim traders. Not having this information suggests either poor marketing or limited services.

User feedback shows big problems with managing accounts, especially with taking out money and getting into accounts. These problems directly affect how useful accounts are and show major operational failures. The documented withdrawal problems suggest that even if you can open accounts easily, getting your money out might be very difficult.

This FinX Brokers review emphasizes that not having detailed account information, plus user complaints about fund access, creates uncertainty that experienced traders usually stay away from.

FinX Brokers gets a below-average rating for tools and resources mainly because of limited documented offerings and lack of complete trading support materials. The platform does offer demo accounts, which is good for new traders who want to practice before risking real money. But we're not sure about advanced trading tools, analysis resources, and educational materials.

Not having detailed information about research abilities, market analysis tools, and technical indicators suggests the platform might lack the advanced resources that active traders usually need. Modern forex brokers generally provide complete charting tools, economic calendars, market news, and analysis resources to help people make smart trading decisions.

Educational resources beyond demo accounts aren't well-documented, which makes the platform less appealing to new traders who need learning materials and guidance. Not having information about automated trading support also suggests limited compatibility with expert advisors and computer trading strategies.

User feedback doesn't give much commentary on tool quality or how effective resources are, which might mean either limited use or minimal availability of advanced features.

Customer Service and Support Analysis (6/10)

Customer service gets an average rating based on limited hours and documented accessibility problems. FinX Brokers provides customer support Monday through Friday from 08:00 to 17:00, which is standard business hours but might not help international traders in different time zones well enough. This limited availability could create problems for traders who need help outside standard hours.

The broker offers contact through phone and email, providing basic ways to communicate for customer questions. But we don't have information about response times and service quality, making it hard to judge how effective customer support interactions are.

User feedback shows negative experiences with customer service, especially about withdrawal questions and solving problems. These complaints suggest that while you can contact them, the quality and effectiveness of support might not meet trader expectations or solve operational issues well enough.

Not having live chat support, complete FAQ sections, or support in multiple languages further limits the customer service compared to industry standards.

Trading Experience Analysis (3/10)

The trading experience with FinX Brokers gets a poor rating mainly because of documented user complaints about basic operational problems. We don't have information about platform stability and execution speed, but user feedback suggests big problems with core trading functions, especially withdrawal processing.

Order execution quality seems compromised based on user reports of difficulties accessing funds and completing transactions. These problems directly affect the basic trading experience and create uncertainty that undermines trader confidence. Reliable execution is essential for forex trading, and any documented problems in this area show serious operational failures.

The platform's functionality and completeness remain unclear because of limited documentation, but not having detailed information about advanced trading features suggests a possibly basic offering. We don't know about mobile trading abilities and cross-platform compatibility, which might limit trading flexibility for modern traders.

User feedback consistently shows negative experiences, especially about withdrawal processes and fund accessibility. These basic operational problems significantly hurt the overall trading experience and show major warning signs for potential users.

This FinX Brokers review emphasizes that trading experience problems, especially withdrawal difficulties, show critical issues that can affect trader success and satisfaction.

Trust and Reliability Analysis (2/10)

Trust and reliability get the lowest rating because of significant regulatory compliance concerns and documented customer complaints. FinX Brokers faces regulatory compliance problems that raise serious questions about whether it operates legally and meets oversight standards. Not having clear regulatory information makes these concerns even worse.

Fund safety measures and client protection rules aren't well-documented, which creates uncertainty about how trader funds are handled and protected. Good brokers usually provide detailed information about separated accounts, regulatory compliance, and client fund protection measures.

Company transparency is notably lacking, with not enough information about corporate structure, operational history, and regulatory standing. This lack of openness contrasts sharply with industry standards where established brokers provide complete corporate information and regulatory documentation.

The broker's industry reputation seems significantly damaged by documented customer complaints and negative user feedback. These problems suggest systematic operational problems that affect multiple users rather than isolated incidents.

Third-party evaluations and regulatory verification information aren't easy to find, further limiting the ability to assess the broker's legitimacy and operational standards.

User Experience Analysis (3/10)

Overall user satisfaction with FinX Brokers seems poor based on mostly negative feedback and documented operational problems. User complaints consistently highlight withdrawal difficulties, poor customer service, and operational challenges that significantly affect the trading experience.

We don't have good information about interface design and platform usability, but the lack of positive user feedback suggests potential problems with platform functionality and user-friendliness. Modern traders expect easy-to-use interfaces and smooth operational experiences, and any problems in these areas directly affect satisfaction.

The registration and verification process details aren't clearly specified, but user complaints about account management and fund access suggest potential problems with these basic procedures. Account funding and withdrawal experiences seem particularly problematic based on documented user feedback.

Common user complaints focus on withdrawal difficulties and poor customer service responsiveness, showing systematic problems that affect multiple users. These problems suggest operational failures that affect the core user experience and trader satisfaction.

The target users for FinX Brokers seem to be forex trading enthusiasts, but the documented problems make the platform unsuitable for traders seeking reliable and professional trading conditions.

Conclusion

This comprehensive FinX Brokers review reveals significant concerns that potential traders must carefully consider. The broker's overall evaluation is negative, particularly regarding withdrawal processing, customer service quality, and regulatory compliance. While the platform might appeal to people interested in forex trading, extreme caution is advised given the documented operational problems.

The main disadvantages include withdrawal difficulties, limited customer support hours, regulatory compliance concerns, and mostly negative user feedback. These problems show basic operational failures that can significantly affect trading success and fund security. Not having clear advantages or positive features further limits the platform's appeal compared to established alternatives.

Potential users should thoroughly research regulatory compliance in their specific area and consider alternative brokers with stronger operational track records and clearer regulatory standing before engaging with FinX Brokers.