Latam FX 2025 Review: Everything You Need to Know

Summary

This latam fx review shows major concerns about the broker's regulatory status and service quality. Latam FX operates in a questionable regulatory environment, with users expressing serious worries about safety and customer support effectiveness. The broker's unclear commission structure and reportedly high spreads create additional challenges for traders seeking transparent and cost-effective trading conditions.

Latam FX positions itself to serve traders interested in Latin American markets, offering forex and CFD products. The lack of transparency regarding key trading conditions raises red flags. User feedback shows considerable differences in experiences, with many expressing dissatisfaction with customer service responsiveness and platform reliability.

The broker's failure to provide clear information about minimum deposits, leverage ratios, and detailed cost structures further undermines trader confidence. Given these factors, this comprehensive evaluation presents a predominantly negative assessment of Latam FX, particularly concerning regulatory clarity and customer support quality. Potential traders should exercise extreme caution when considering this broker, especially given the disputed regulatory status and mixed user testimonials.

Important Notice

Regional Entity Differences: Latam FX's regulatory status may vary significantly across different jurisdictions within Latin America. Traders must carefully verify the specific regulatory framework applicable to their region before engaging with this broker.

The regulatory landscape for forex brokers in Latin American countries can be complex and inconsistent. Review Methodology: This evaluation is based on available user feedback, publicly accessible information, and industry reports. Due to the limited transparency from Latam FX regarding their operations, some information may be subject to updates or corrections.

Traders should conduct independent verification of all claims and regulatory status before making any investment decisions.

Rating Framework

Broker Overview

Latam FX presents itself as a trading platform focused on serving the Latin American market. Specific details about its establishment date and corporate background remain unclear in available documentation. The broker's primary business model centers on providing forex and CFD trading services to clients interested in regional market exposure.

The lack of comprehensive corporate information raises questions about transparency. The platform appears to target traders seeking access to Latin American financial markets, offering what it describes as forex and CFD products. However, the latam fx review process reveals significant gaps in publicly available information about the company's operational history, founding team, and corporate structure.

This lack of transparency contrasts sharply with industry standards where reputable brokers typically provide detailed corporate backgrounds and leadership information. Regarding trading infrastructure, specific details about the trading platforms offered by Latam FX are not clearly specified in available materials. While many brokers in this space typically offer popular platforms like MetaTrader 4 or MetaTrader 5, Latam FX has not provided clear confirmation of their platform offerings.

The asset classes appear to focus on forex pairs and CFD instruments, though detailed product specifications remain undisclosed. Most concerning is the absence of clear regulatory information, as no specific regulatory authority or license numbers are prominently displayed or verified through available sources.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Latam FX operations. This represents a significant concern for potential traders seeking regulated brokers.

Deposit and Withdrawal Methods: Specific information about available funding methods has not been disclosed in accessible materials. This leaves traders uncertain about payment options and processing procedures.

Minimum Deposit Requirements: The broker has not published clear minimum deposit amounts. This makes it difficult for potential clients to understand entry requirements for different account types.

Bonuses and Promotions: No specific promotional offers or bonus structures are detailed in available documentation. This may indicate either absence of such programs or lack of marketing transparency.

Tradeable Assets: The broker indicates availability of forex and CFD products. Detailed specifications about currency pairs, leverage ratios, and available instruments remain undisclosed in public materials.

Cost Structure: Reports suggest the presence of high spreads, though specific numerical values and commission structures are not clearly published. This latam fx review finds the lack of transparent pricing information particularly concerning for cost-conscious traders.

Leverage Ratios: Specific leverage offerings have not been detailed in available information. This leaves traders without clear understanding of available margin requirements and risk parameters.

Platform Options: Trading platform specifications are not clearly outlined in accessible documentation. This creates uncertainty about software capabilities and features.

Geographic Restrictions: Specific regional limitations or service availability details are not prominently disclosed in available materials. Customer Support Languages: Available language support for customer service has not been specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by Latam FX present several concerning gaps that significantly impact the overall trading proposition. Most notably, the broker fails to provide transparent information about account types, their specific features, or the requirements for accessing different service levels.

This lack of clarity makes it extremely difficult for potential traders to make informed decisions about whether the broker's offerings align with their trading needs and capital requirements. The absence of clearly stated minimum deposit requirements represents a fundamental transparency issue. Reputable brokers typically publish detailed account specifications, including entry-level deposits for different account tiers, but this latam fx review finds no such information readily available from Latam FX.

This opacity extends to the account opening process, where potential clients cannot easily understand the documentation requirements, verification procedures, or expected timeframes for account activation. User feedback regarding account conditions shows significant divergence, with some traders reporting confusion about account features and limitations. The lack of detailed information about special account functionalities, such as Islamic accounts, VIP services, or institutional offerings, further diminishes the broker's appeal to sophisticated traders who require specific account features.

Compared to established brokers in the Latin American market, Latam FX's approach to account condition transparency falls well below industry standards.

The trading tools and resources provided by Latam FX receive a mediocre assessment due to limited information about the specific capabilities and quality of their offerings. While the broker mentions providing access to forex and CFD trading, the detailed specifications of trading tools, analytical resources, and research capabilities remain largely undisclosed in available documentation.

Research and analysis resources, which are crucial for informed trading decisions, appear to be inadequately documented or potentially limited in scope. Professional traders typically require access to market analysis, economic calendars, technical indicators, and research reports, but Latam FX has not clearly outlined what analytical support they provide to their clients. Educational resources, another critical component for trader development, are not prominently featured in available materials.

The absence of clear information about webinars, trading guides, market tutorials, or educational content suggests either a limited educational offering or poor marketing of existing resources. Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, remains unclear based on available information. This uncertainty particularly affects traders who rely on automated strategies or require specific technical capabilities for their trading approaches.

User feedback regarding tools and resources is limited, which itself indicates either low engagement with available tools or restricted access to comprehensive trading resources.

Customer Service and Support Analysis (Score: 4/10)

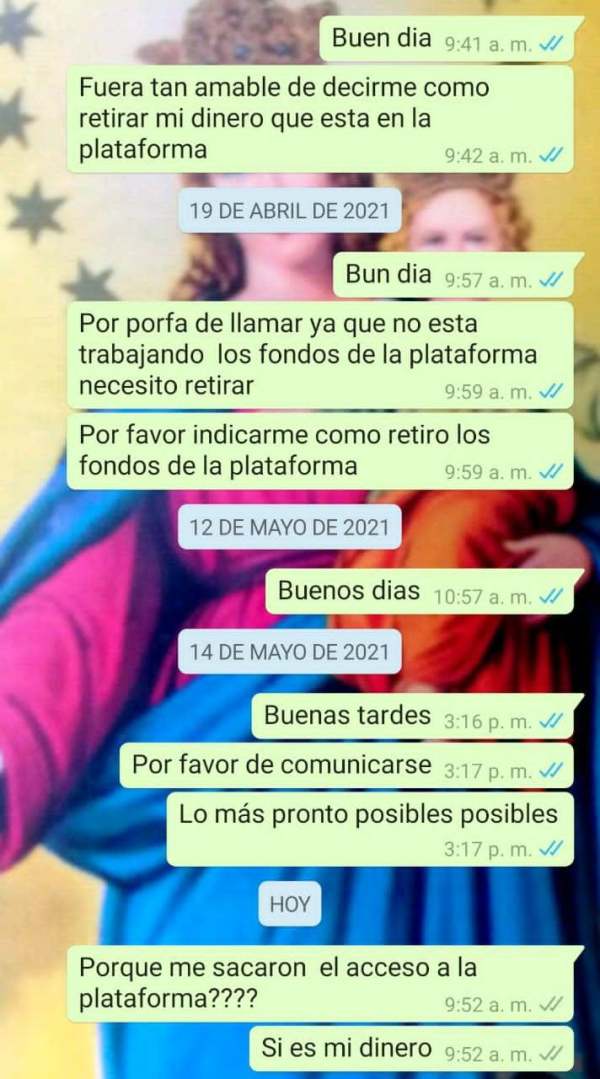

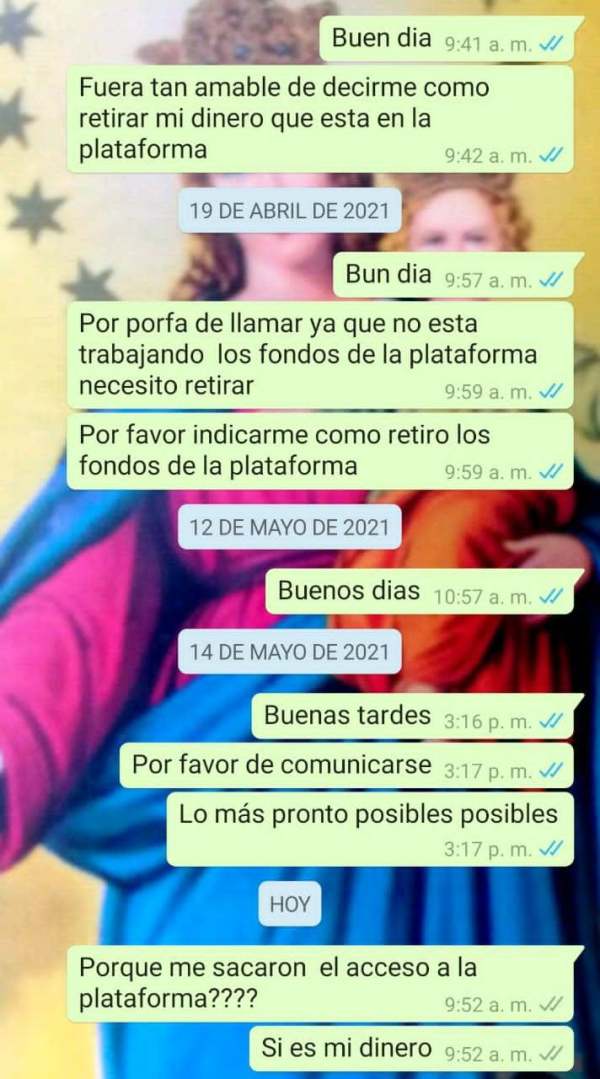

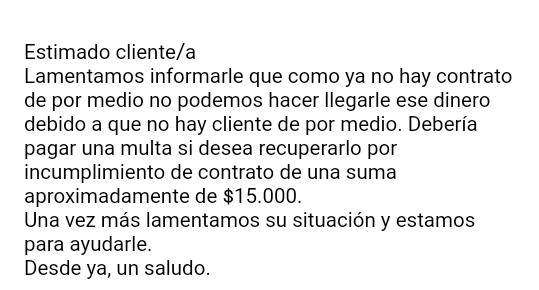

Customer service quality emerges as a significant weakness in this latam fx review, with user feedback consistently highlighting concerns about support responsiveness and effectiveness. The specific customer service channels available to traders are not clearly documented, creating uncertainty about how clients can access help when needed.

Response times appear to be a particular pain point, with user reports suggesting extended waiting periods for issue resolution. This is particularly problematic in the fast-paced forex trading environment where timely support can be crucial for resolving urgent trading-related issues or technical problems. Service quality concerns extend beyond response times to include the effectiveness of problem resolution.

User testimonials indicate frustration with the level of expertise and helpfulness provided by customer support representatives, suggesting potential gaps in staff training or resource allocation for customer service operations. The availability of multilingual support, which would be expected for a broker serving the diverse Latin American market, is not clearly specified in available documentation. This represents a missed opportunity for a broker positioning itself to serve Spanish and Portuguese-speaking traders across the region.

Documentation does not clearly specify customer service hours or availability, leaving traders uncertain about when they can expect to receive assistance.

Trading Experience Analysis (Score: 5/10)

The trading experience with Latam FX presents mixed signals, with some concerning elements that impact overall usability and satisfaction. Platform stability and speed, critical factors for successful trading execution, have received mixed feedback from users, with some reporting technical issues that could potentially affect trading performance.

Order execution quality remains unclear due to limited available data about slippage rates, execution speeds, and order fill quality. The absence of detailed performance metrics makes it difficult for traders to assess whether the broker can provide the execution quality required for their trading strategies, particularly for scalping or high-frequency trading approaches. Platform functionality appears to be a question mark, as specific details about trading platform features, charting capabilities, and analytical tools are not comprehensively documented.

This latam fx review finds the lack of detailed platform information concerning, especially given the importance of robust trading software for professional traders. Mobile trading experience, increasingly important for modern traders who require flexibility and mobility, is not clearly addressed in available documentation. The absence of clear information about mobile app capabilities or mobile-optimized trading solutions represents a significant gap in the modern trading experience.

The reported presence of high spreads significantly impacts the overall trading environment, potentially making trading more expensive and reducing profitability for active traders.

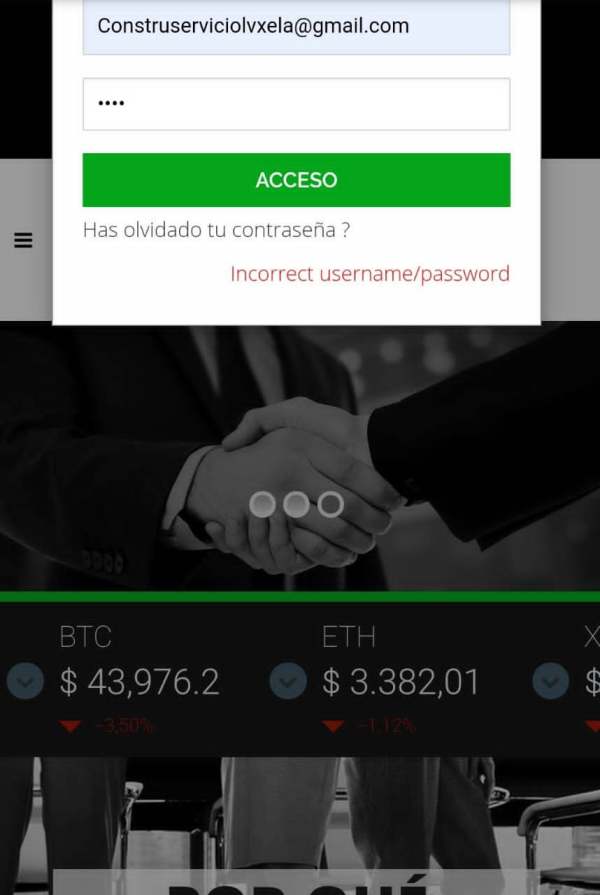

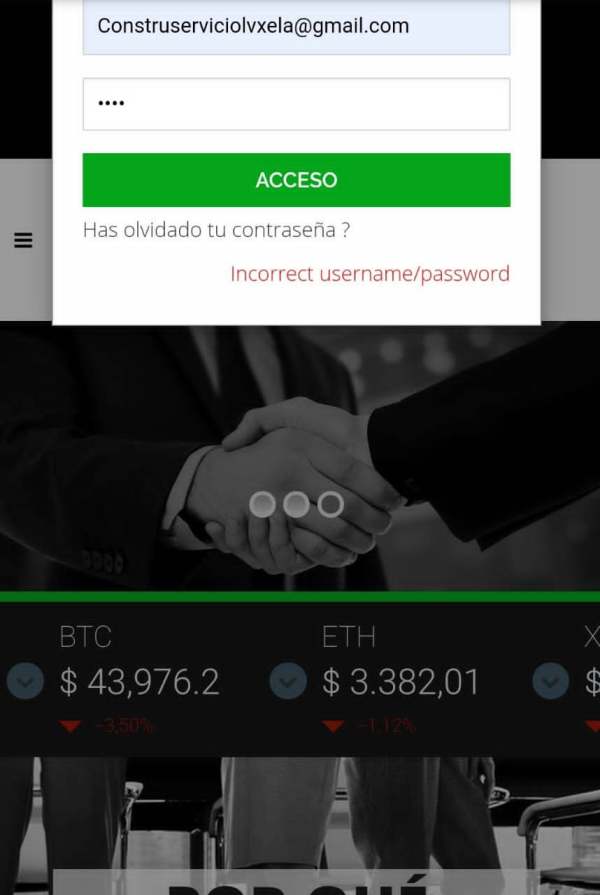

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent the most concerning aspects of Latam FX's operations, earning the lowest rating in this comprehensive evaluation. The regulatory status remains disputed and unclear, with no clearly verified regulatory authority providing oversight of the broker's operations.

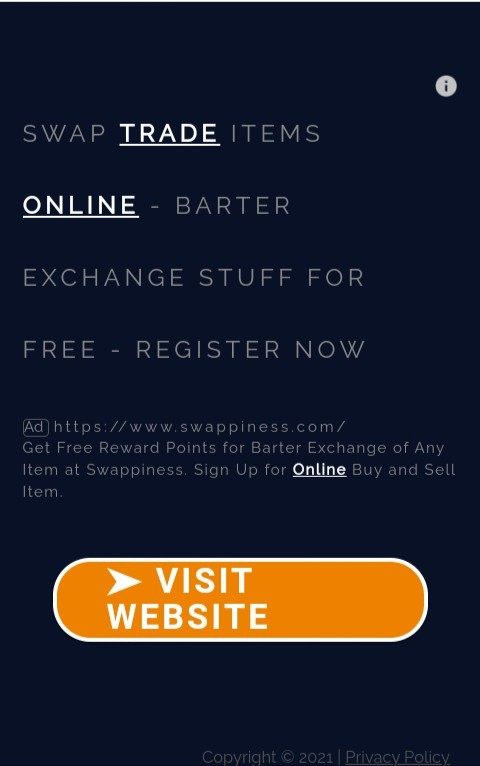

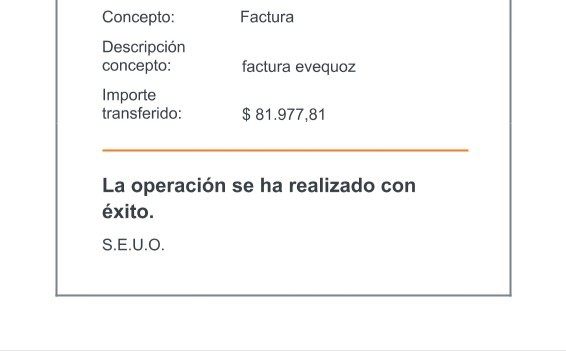

This regulatory ambiguity creates substantial risk for traders who prioritize safety and regulatory protection. Fund safety measures, including client fund segregation, deposit insurance, and financial safeguards, are not clearly documented or verified through available sources. The absence of transparent information about how client funds are protected represents a fundamental concern for any trading relationship.

Company transparency issues extend beyond regulatory status to include limited disclosure about corporate structure, financial reporting, and operational oversight. Reputable brokers typically provide detailed information about their corporate governance, financial stability, and regulatory compliance, but this information appears to be lacking for Latam FX. Industry reputation and recognition through awards, certifications, or positive regulatory feedback are not evident in available documentation.

The absence of third-party validation or industry recognition further undermines confidence in the broker's credibility and operational standards. User trust feedback consistently reflects concerns about safety and security, with multiple reports expressing worry about the broker's reliability and regulatory standing.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with Latam FX shows significant divergence, with experiences ranging from neutral to notably negative. The polarized feedback suggests inconsistent service delivery and potentially problematic operational practices that affect user satisfaction and retention.

Interface design and usability information is limited in available documentation, making it difficult to assess the quality of the user interface and overall platform experience. Modern traders expect intuitive, responsive, and feature-rich interfaces, but the lack of detailed information about Latam FX's interface quality represents a concerning gap. Registration and verification processes are not clearly outlined in accessible materials, potentially creating confusion for new users attempting to open accounts.

The absence of clear guidance about required documentation, verification timeframes, and account activation procedures contributes to a suboptimal onboarding experience. Fund operation experiences, including deposit and withdrawal processes, are not well-documented in available user feedback, though the general pattern of user concerns suggests potential issues with financial transactions and processing times. Common user complaints center around safety concerns and inadequate customer support, reflecting the broader issues identified in other evaluation categories.

The consistency of these concerns across multiple feedback sources suggests systemic issues rather than isolated incidents. The broker appears to target traders interested in Latin American markets, but the execution of this positioning seems to fall short of user expectations, particularly regarding transparency, regulatory clarity, and service quality.

Conclusion

This comprehensive latam fx review reveals significant concerns that lead to an overall negative assessment of the broker's offerings and operational standards. The disputed regulatory status and consistently problematic user feedback create substantial red flags for potential traders considering this platform.

Latam FX may appeal to traders specifically interested in Latin American market exposure, but the numerous transparency issues, regulatory concerns, and service quality problems make it a risky choice that requires extreme caution. The broker's failure to provide clear information about fundamental trading conditions, combined with user reports of poor customer support, creates an environment unsuitable for serious trading activities. The primary advantages appear limited to the availability of forex and CFD products with a Latin American focus, while the disadvantages significantly outweigh any potential benefits.

Key concerns include unclear regulatory oversight, inadequate customer support, high spreads, and overall lack of transparency that fails to meet modern broker standards.